Professional Documents

Culture Documents

Investement and Protfolio Management: Total No. of Pages: 1

Investement and Protfolio Management: Total No. of Pages: 1

Uploaded by

Umang Modi0 ratings0% found this document useful (0 votes)

7 views1 pageInvestment Portfolio Management Question Paper for Annamalai University Dec-2012

Original Title

IPMNew Dec2012

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvestment Portfolio Management Question Paper for Annamalai University Dec-2012

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageInvestement and Protfolio Management: Total No. of Pages: 1

Investement and Protfolio Management: Total No. of Pages: 1

Uploaded by

Umang ModiInvestment Portfolio Management Question Paper for Annamalai University Dec-2012

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

Total No.

of Pages: 1

Register Number: 6479

Name of the Candidate:

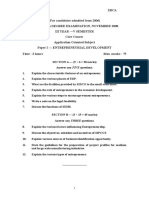

M.Com (Accounting and Finance) DEGREE EXAMINATION 2012

(FIRST YEAR)

(PAPER-III)

130. INVESTEMENT AND PROTFOLIO MANAGEMENT

December) Maximum: 100 Marks (Time: 3 Hours

SECTION-A

Answer any FIVE Questions (58=40)

All questions carry equal marks

1. Define the term Investments as it relates to securities investment.

2. What is financial risk? Briefly explain.

3. Briefly explain the various sources of investment information.

4. What are the limitations of charts?

5. How is a fundamental analysis useful to a prospective investor?

6. What are the important characteristics of growth shares?

7. Explain the advantages of bargain hunting.

8. What are formula plans? How do they help in portfolio revision?

SECTION-B

Answer any THREE Questions (320=60)

All questions carry equal marks

9. Explain the different stages of industry life cycle.

10. Explain the functions of stock market.

11. Describe the advantages and (limitations of technical analysis)

12. What are defensive shares? Discuss its various characteristics.

13. What do you understand by DCA? Explain the Guidelines for using DCA.

---------------------

You might also like

- Questions For Master Exam Strategic Management 3 2Document7 pagesQuestions For Master Exam Strategic Management 3 2_dinash100% (8)

- Eat That FrogDocument35 pagesEat That FrogUmang Modi100% (1)

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

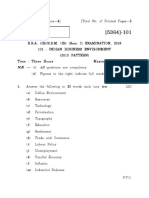

- (Accounting and Finance) : Total No. of Pages: 1Document1 page(Accounting and Finance) : Total No. of Pages: 1Umang ModiNo ratings yet

- May 2011Document19 pagesMay 2011raviudeshi14No ratings yet

- M.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem EntDocument1 pageM.B.A. Degree Examination, May 2015 (Financial Management) : 250: Investm Ent, Security and Portfolio M Anagem EntRavi KrishnanNo ratings yet

- Seat No.: All Questions Are CompulsoryDocument19 pagesSeat No.: All Questions Are CompulsoryNishant PatilNo ratings yet

- MODEL I SAPM - 1,2,3 UnitsDocument2 pagesMODEL I SAPM - 1,2,3 UnitsSabha PathyNo ratings yet

- Btech Apm 6 Sem Industrial Management 2010Document4 pagesBtech Apm 6 Sem Industrial Management 2010Soumya BeraNo ratings yet

- Answer Any ONE Question.: Section - CDocument2 pagesAnswer Any ONE Question.: Section - CRavi KrishnanNo ratings yet

- M.B.A. Degree Examination, May 2015 (International Business)Document1 pageM.B.A. Degree Examination, May 2015 (International Business)Shaik TousifNo ratings yet

- QP CODE: 18103380: Third SemesterDocument2 pagesQP CODE: 18103380: Third SemesterOnline Class, CAS KPLYNo ratings yet

- 17E00312 Investment & Portfolio ManagementDocument4 pages17E00312 Investment & Portfolio ManagementBeedam BalajiNo ratings yet

- A2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75Document2 pagesA2318 ECA44 (For Candidates Admitted From 2008) Ii Year - Iv Semester Major Paper Xvii - Financial Markets and Services Time: 3 Hours Max. Marks: 75kaviyaNo ratings yet

- Instruction: Answers Should Written in English OnlyDocument2 pagesInstruction: Answers Should Written in English OnlyLishanthNo ratings yet

- Sapm 2Document3 pagesSapm 2Mythili KarthikeyanNo ratings yet

- APril 17Document102 pagesAPril 17Shubham KulalNo ratings yet

- International Business Management QPDocument26 pagesInternational Business Management QPAashutosh PandeyNo ratings yet

- Time: 3 Hours Total Marks: 100Document81 pagesTime: 3 Hours Total Marks: 100geetanjali vermaNo ratings yet

- 895EBCADocument1 page895EBCAkaviyaNo ratings yet

- MBA (International Business)Document52 pagesMBA (International Business)Nazhia KhanNo ratings yet

- M.B.A. Degree Examination, May 2015 (Financial Management) : 240: M Anagem Ent of Funds and AssetsDocument1 pageM.B.A. Degree Examination, May 2015 (Financial Management) : 240: M Anagem Ent of Funds and AssetsRavi KrishnanNo ratings yet

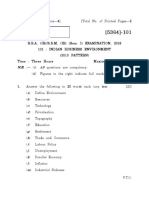

- M.B.A. Degree Examination, May 2015: (Human Resource Management)Document1 pageM.B.A. Degree Examination, May 2015: (Human Resource Management)Ravi KrishnanNo ratings yet

- Anu Mba 3 Years Final Year Question Paper June 2010Document41 pagesAnu Mba 3 Years Final Year Question Paper June 2010gauravNo ratings yet

- Gnanamani College of Technology: Ba5012 Security Analysis and Portfolio ManagementDocument2 pagesGnanamani College of Technology: Ba5012 Security Analysis and Portfolio ManagementSabha PathyNo ratings yet

- M.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial FinanciingDocument2 pagesM.B.A. Degree Examination - 2011: 230. Financial Analysis and Industrial FinanciingRavi KrishnanNo ratings yet

- Full Marks: 80 Times: 3 Hours.: Answer Any Five Questions. All Questions Carry Equal MarksDocument5 pagesFull Marks: 80 Times: 3 Hours.: Answer Any Five Questions. All Questions Carry Equal Marksdhananjaykumar684No ratings yet

- Maharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementDocument5 pagesMaharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementJyoti SinghNo ratings yet

- Fy Bba Ib 2018Document18 pagesFy Bba Ib 2018Nishant PatilNo ratings yet

- April 18Document99 pagesApril 18Shubham KulalNo ratings yet

- GB July 2004Document2 pagesGB July 2004achuaswathyNo ratings yet

- New 3rd Semester English (MCO-03,07,15, IBO-02) PDFDocument6 pagesNew 3rd Semester English (MCO-03,07,15, IBO-02) PDFAkash Peter MishraNo ratings yet

- Mba (Bank MGT.)Document32 pagesMba (Bank MGT.)Sneha Angre0% (1)

- MADocument67 pagesMAfarooqkhan888No ratings yet

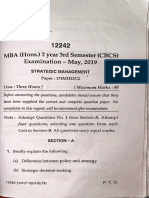

- 2019 Mba 3rd Sem Mba Question PapersDocument9 pages2019 Mba 3rd Sem Mba Question Paperssauravnagpal309No ratings yet

- Business Studies EngDocument2 pagesBusiness Studies EngPrasad C MNo ratings yet

- Model Question Pape1Document5 pagesModel Question Pape1Vijay SinghNo ratings yet

- Business Studies March 2007 EngDocument2 pagesBusiness Studies March 2007 EngPrasad C MNo ratings yet

- Quest 8557Document1 pageQuest 8557Nandita MitraNo ratings yet

- DBA7103Document22 pagesDBA7103Ankit AgarwalNo ratings yet

- P/id 77801/PMBSBDocument21 pagesP/id 77801/PMBSBBrian BurchNo ratings yet

- 1st Sem PapersDocument66 pages1st Sem PapersJanvi 86 sec.BNo ratings yet

- PGDIPR Assignments 2013Document10 pagesPGDIPR Assignments 2013shrikantmsdNo ratings yet

- Bba 702Document2 pagesBba 702api-3782519No ratings yet

- Jaya College of Arts and Science Department of ManagDocument1 pageJaya College of Arts and Science Department of ManagMythili KarthikeyanNo ratings yet

- KKKKDocument2 pagesKKKKGURJARNo ratings yet

- Uka Tarsadia UniversityDocument1 pageUka Tarsadia UniversityDivyesh G GamitNo ratings yet

- B. Com Question 2023Document3 pagesB. Com Question 2023Senthil KumarNo ratings yet

- MTTM 005 Previous Year Question Papers by IgnouassignmentguruDocument45 pagesMTTM 005 Previous Year Question Papers by IgnouassignmentguruReshma RNo ratings yet

- Mba (NS)Document39 pagesMba (NS)Naveen Kumar PagadalaNo ratings yet

- Karnataka Second PUC Business Studies Question PaperDocument2 pagesKarnataka Second PUC Business Studies Question PaperSaifulla Baig75% (4)

- Mba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDocument9 pagesMba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDeep Narayan RamNo ratings yet

- New BookDocument6 pagesNew Bookmuzammil04786No ratings yet

- Collabration Programme M.com EnglishDocument13 pagesCollabration Programme M.com EnglishAmit YadavNo ratings yet

- BBA Retail 3rd Semester - BRL-105,106,107,108, BEVAE-181Document8 pagesBBA Retail 3rd Semester - BRL-105,106,107,108, BEVAE-181sudhirkonojiya1234No ratings yet

- Bachelor of Business Administration (BBA) in Retailing II YearDocument8 pagesBachelor of Business Administration (BBA) in Retailing II YearManpreet KaurNo ratings yet

- M.B.A. Degree Examination - 2011: 220. International FinanceDocument1 pageM.B.A. Degree Examination - 2011: 220. International FinanceRavi KrishnanNo ratings yet

- Quality Money Management: Process Engineering and Best Practices for Systematic Trading and InvestmentFrom EverandQuality Money Management: Process Engineering and Best Practices for Systematic Trading and InvestmentRating: 3 out of 5 stars3/5 (1)

- The Investing Oasis: Contrarian Treasure in the Capital Markets DesertFrom EverandThe Investing Oasis: Contrarian Treasure in the Capital Markets DesertNo ratings yet

- How to Prepare Business Cases: An essential guide for accountantsFrom EverandHow to Prepare Business Cases: An essential guide for accountantsNo ratings yet

- (Accounting and Finance) : Total No. of Pages: 1Document1 page(Accounting and Finance) : Total No. of Pages: 1Umang ModiNo ratings yet

- Declaration: I Hereby Declare That All Given Information Are Best of My Knowledge. Date: Signature Place: New Delhi XxxyyyzzzDocument1 pageDeclaration: I Hereby Declare That All Given Information Are Best of My Knowledge. Date: Signature Place: New Delhi XxxyyyzzzUmang ModiNo ratings yet

- Confirmation LetterDocument1 pageConfirmation LetterUmang ModiNo ratings yet