Professional Documents

Culture Documents

Fcffvsfcfe

Fcffvsfcfe

Uploaded by

greg0 ratings0% found this document useful (0 votes)

6 views2 pagesqqq

Original Title

fcffvsfcfe

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentqqq

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesFcffvsfcfe

Fcffvsfcfe

Uploaded by

gregqqq

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 2

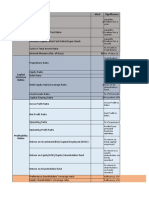

Inputs

Earnings before interest and taxes = 100

Expected growth for next 5 years = 10%

Expected growth after year 5 = 5%

Tax rate = 40%

Debt ratio for the firm = 20%

Cost of equity = 12%

Pre-tax cost of debt = 7%

Return on capital in high growth= 12%

Return on capital in stable growth = 10%

0 1 2 3 4 5 Terminal Year

Expected Growth rate 10% 10% 10% 10% 10% 5%

Reinvestment rate 83.33% 83.33% 83.33% 83.33% 83.33% 50.0%

EBIT $ 100.00 $ 110.00 $ 121.00 $ 133.10 $ $ 146.41 161.05 $ 169.10

Taxes $ 44.00 $ 48.40 $ 53.24 $ $ 58.56 64.42 $ 67.64

EBIT(1-t) $ 66.00 $ 72.60 $ 79.86 $ $ 87.85 96.63 $ 101.46

- Reinvestment $ 55.00 $ 60.50 $ 66.55 $ $ 73.21 80.53 $ 50.73

FCFF $ 11.00 $ 12.10 $ 13.31 $ $ 14.64 16.11 $ 50.73

Terminal Value $ 932.56

Present Value $ 9.96 $ 9.92 $ 9.88 $ 9.84 $ 577.40

Value of Firm = $ 617.01 $ 670.42 728.314002 791.039984 858.983558 $ 932.56 ! This is the present value o

Value of Equity = $ 493.61 ! Equity as % of value starting in each year; year 2

Value of Debt = $ 123.40 ! Debt as % of value

EBIT $ 100.00 $ 110.00 $ 121.00 $ 133.10 $ 146.41 $ 161.05 $ 169.10

Interest Exp $ 8.64 $ 9.39 $ 10.20 $ 11.07 $ 12.03 $ 13.06

EBT $ 101.36 $ 111.61 $ 122.90 $ 135.34 $ 149.03 $ 156.05

Taxes $ 40.54 $ 44.65 $ 49.16 $ 54.13 $ 59.61 $ 62.42

Net Income $ 60.82 $ 66.97 $ 73.74 $ 81.20 $ 89.42 $ 93.63

- Reinvestment $ 55.00 $ 60.50 $ 66.55 $ 73.21 $ 80.53 $ 50.73

+ New Debt Issued $ 10.68 $ 11.58 $ 12.55 $ 13.59 $ 14.71 $ 9.33

FCFE $ 16.50 $ 18.05 $ 19.74 $ 21.58 $ 23.60 $ 52.22

Terminal Value of Equity $ 746.05

Present Value $ 14.73 $ 14.39 $ 14.05 $ 13.72 $ 436.72

Value of Equity = $ 493.61

Capital Structure

Debt at end of year $ 123.40 $ 134.08 $ 145.66 $ 158.21 $ 171.80 $ 186.51 $ 195.84

Cost of Equity 12.00% 12% 12.00% 12.00% 12.00% 12.00%

Pre-tax Cost of Debt 7.00% 7% 7.00% 7.00% 7.00% 7.00%

After-tax Cost of Debt 4.20% 4% 4.20% 4.20% 4.20% 4.20%

Cost of Capital 10.44% 10.44% 10.44% 10.44% 10.44% 10.44%

Terminal Year

! This is the present value of the cash flows to the firm

starting in each year; year 2, year 3

! This is the new debt issued each year

! This is 30% of each year's firm value

! Computed using a 70% Equity; 30% Debt

ratio.

You might also like

- Electricity Bill Calculator Template ExcelDocument5 pagesElectricity Bill Calculator Template ExcelPro Resources0% (2)

- Corpfin HW 7Document2 pagesCorpfin HW 7notanaccount0% (1)

- Accounting Cycle of A Merchandising BusinessDocument54 pagesAccounting Cycle of A Merchandising BusinessKim Flores100% (1)

- MACR - Module 5 - Valuation in M&ADocument43 pagesMACR - Module 5 - Valuation in M&AManjunath RameshNo ratings yet

- FirmmultDocument2 pagesFirmmultPro ResourcesNo ratings yet

- Employee Shift Schedule Generator in ExcelDocument20 pagesEmployee Shift Schedule Generator in ExcelPro ResourcesNo ratings yet

- Eva Vs RoceDocument5 pagesEva Vs RoceNuno LouriselaNo ratings yet

- Constitutional Foundation of Secularism by Subramanian SwamyDocument73 pagesConstitutional Foundation of Secularism by Subramanian SwamySanatan DharmaNo ratings yet

- 9 Analisis Strategi Dan PilihanDocument54 pages9 Analisis Strategi Dan PilihanAngel Franda PutriNo ratings yet

- Quantitative Strategic Planning Matrix (QSPM) - PAMDocument2 pagesQuantitative Strategic Planning Matrix (QSPM) - PAMmayephmal.No ratings yet

- Investing Is An Art Not A ScienceDocument4 pagesInvesting Is An Art Not A SciencemeetwithsanjayNo ratings yet

- How To Generate Stock IdeasDocument5 pagesHow To Generate Stock IdeasKannanNo ratings yet

- APA Style Format Daftar Pustaka PDFDocument4 pagesAPA Style Format Daftar Pustaka PDFfilantropiNo ratings yet

- 13th Motilal Oswal Wealth Creation StudyDocument48 pages13th Motilal Oswal Wealth Creation StudySwamiNo ratings yet

- The 23 Winning Investment HabitsDocument3 pagesThe 23 Winning Investment HabitsbiscodylNo ratings yet

- Ambit Good and Clean India PMSDocument22 pagesAmbit Good and Clean India PMSAnkurNo ratings yet

- Graham & Doddsville Spring 2011 NewsletterDocument27 pagesGraham & Doddsville Spring 2011 NewsletterOld School ValueNo ratings yet

- Eka Setifani AfrianahDocument135 pagesEka Setifani Afrianahmirtha aulia salfaNo ratings yet

- Consultant Career Path 2021: January 2021Document13 pagesConsultant Career Path 2021: January 2021ASAD RAHMANNo ratings yet

- Rakesh JhunjhunwalaDocument11 pagesRakesh Jhunjhunwalachinmay 1001No ratings yet

- Value Investing Grapich NovelDocument16 pagesValue Investing Grapich NovelSebastian Zwph100% (1)

- FIL Stock MarketDocument41 pagesFIL Stock Marketrekha_kumariNo ratings yet

- 06-Valuation & Cash Flow AnalysisDocument7 pages06-Valuation & Cash Flow AnalysisPooja RatraNo ratings yet

- 24 Micro-Cap Multibagger Stocks To Buy Now PDFDocument11 pages24 Micro-Cap Multibagger Stocks To Buy Now PDFPravin YeluriNo ratings yet

- EV To EBIT Valuation SpreadsheetDocument2 pagesEV To EBIT Valuation SpreadsheetHoang HaNo ratings yet

- The Psychology of Ethics in The Finance and Investment IndustryDocument104 pagesThe Psychology of Ethics in The Finance and Investment IndustryChad EL SaleebyNo ratings yet

- MSFT 10yr OSV Stock Valuation SpreadsheetDocument15 pagesMSFT 10yr OSV Stock Valuation SpreadsheetOld School ValueNo ratings yet

- How To Screen Stocks: Be A Wise Investor and Not A Day TraderDocument67 pagesHow To Screen Stocks: Be A Wise Investor and Not A Day Traderppate100% (1)

- Financial Statements, Cash Flow, and TaxesDocument27 pagesFinancial Statements, Cash Flow, and Taxeszohaib25No ratings yet

- How To Become Rich and Happy: by Prasenjit Kumar PaulDocument22 pagesHow To Become Rich and Happy: by Prasenjit Kumar PaulSatish KumarNo ratings yet

- Islamic Social Finance Report 2015 PDFDocument164 pagesIslamic Social Finance Report 2015 PDFkalipucangNo ratings yet

- Top Funds Have Increased Stake in This Real Estate Company!Document45 pagesTop Funds Have Increased Stake in This Real Estate Company!Poonam AggarwalNo ratings yet

- Resumen Valuation MckinseyDocument11 pagesResumen Valuation MckinseycarlosvallejoNo ratings yet

- Line-Item Analysis of Earnings QualityDocument137 pagesLine-Item Analysis of Earnings QualityGrace Priscilla SiahaanNo ratings yet

- Success in Investment 10 03Document36 pagesSuccess in Investment 10 03JOHN MYKLUSCH100% (1)

- Applied Corporate Finance: Aswath Damodaran For Material Specific To This Package, Go ToDocument72 pagesApplied Corporate Finance: Aswath Damodaran For Material Specific To This Package, Go TomeidianizaNo ratings yet

- Ratio AnalysisDocument26 pagesRatio AnalysisDeep KrishnaNo ratings yet

- Fs - Blog-Charlie Munger On Getting Rich Wisdom Focus Fake Knowledge and MoreDocument7 pagesFs - Blog-Charlie Munger On Getting Rich Wisdom Focus Fake Knowledge and MorebambambholeNo ratings yet

- Understand Earnings QualityDocument175 pagesUnderstand Earnings QualityVu LichNo ratings yet

- Basant Maheshwari Delights PMS Investors With Hefty Gains. He Also Reveals Strategy For Finding Multibagger StocksDocument9 pagesBasant Maheshwari Delights PMS Investors With Hefty Gains. He Also Reveals Strategy For Finding Multibagger StockspravinyNo ratings yet

- Discounted Cash Flow ModelDocument21 pagesDiscounted Cash Flow Modelvaibhavsachdeva0326No ratings yet

- Value Investing - A Presentation by Prof Sanjay BakshiDocument22 pagesValue Investing - A Presentation by Prof Sanjay BakshisubrataberaNo ratings yet

- Free Cash Flow ValuationDocument46 pagesFree Cash Flow ValuationLayNo ratings yet

- Intrinsic Value PDFDocument7 pagesIntrinsic Value PDFChrisNo ratings yet

- Fcffsimpleginzu ITCDocument62 pagesFcffsimpleginzu ITCPravin AwalkondeNo ratings yet

- NRI Investments in IndiaDocument3 pagesNRI Investments in IndiaRahul BediNo ratings yet

- Exam 1 Study Guide S15Document1 pageExam 1 Study Guide S15Jack JacintoNo ratings yet

- Chapter 8 Profit Maximization &cmptitive SupplyDocument92 pagesChapter 8 Profit Maximization &cmptitive Supplysridhar7892No ratings yet

- Anatomy of The Small-Cap AnomalyDocument22 pagesAnatomy of The Small-Cap AnomalyPKNo ratings yet

- My Journey Dec2020Document28 pagesMy Journey Dec2020sunil unnithan100% (1)

- Overconfidence Under Reaction BuffettDocument43 pagesOverconfidence Under Reaction BuffettDevan PramuragaNo ratings yet

- Investing in Frontier MarketsDocument44 pagesInvesting in Frontier MarketsGus ChehayebNo ratings yet

- Annual Report 2014Document115 pagesAnnual Report 2014paNo ratings yet

- Managing The OD Process: Sethu Baburaj PGP13131Document9 pagesManaging The OD Process: Sethu Baburaj PGP13131mysticsensesNo ratings yet

- Jae Jun's Top 10 Stock Valuation Ratios: Owner EarningsDocument3 pagesJae Jun's Top 10 Stock Valuation Ratios: Owner EarningsAtanas KosturkovNo ratings yet

- Stock AnalysisDocument5 pagesStock AnalysisArun Kumar GoyalNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- High GrowthDocument30 pagesHigh GrowthAbhinav PandeyNo ratings yet

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikNo ratings yet

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- Apple TTMDocument25 pagesApple TTMQuofi SeliNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Apple Case StudyDocument2 pagesApple Case StudyPrakhar MorchhaleNo ratings yet

- Measuring Economic Value Added (EVA)Document4 pagesMeasuring Economic Value Added (EVA)Paulo NascimentoNo ratings yet

- LiqdiscDocument4 pagesLiqdiscPro ResourcesNo ratings yet

- Free Business Analysiss TemplateDocument8 pagesFree Business Analysiss TemplatePro ResourcesNo ratings yet

- Financial Forecast Template ExcelDocument43 pagesFinancial Forecast Template ExcelPro Resources100% (1)

- Fcffsimpleginzu 2014Document54 pagesFcffsimpleginzu 2014Pro Resources100% (1)

- FCFFSTDocument10 pagesFCFFSTapi-3701114No ratings yet

- FcfestDocument5 pagesFcfestPro ResourcesNo ratings yet

- Excel Invoice Numbers TutorialDocument5 pagesExcel Invoice Numbers TutorialPro ResourcesNo ratings yet

- Dividend Discount Model: AssumptionsDocument36 pagesDividend Discount Model: AssumptionsPro ResourcesNo ratings yet

- ExpandDocument2 pagesExpandPro ResourcesNo ratings yet

- Advanced Data Validation - Switching Between Lists: Cell With Validation Shortlist Full ListDocument4 pagesAdvanced Data Validation - Switching Between Lists: Cell With Validation Shortlist Full ListPro ResourcesNo ratings yet

- EqmultDocument2 pagesEqmultPro ResourcesNo ratings yet

- Valuing Management Options or Warrants When There Is DilutionDocument4 pagesValuing Management Options or Warrants When There Is DilutionPro ResourcesNo ratings yet

- Disbursement Voucher TemplateDocument20 pagesDisbursement Voucher TemplateKren JheaneNo ratings yet

- ProspectusDocument12 pagesProspectusGAURAV PRAJAPATINo ratings yet

- Valerio Scacco PresentationDocument33 pagesValerio Scacco PresentationValerio ScaccoNo ratings yet

- Events After The Reporting PeriodDocument4 pagesEvents After The Reporting PeriodGlen JavellanaNo ratings yet

- Annex G Authority To Transfer Funds To BTR LANDBANKDocument3 pagesAnnex G Authority To Transfer Funds To BTR LANDBANKAldous Ryean GabitananNo ratings yet

- Fundamentals of Valuation: P.V. ViswanathDocument19 pagesFundamentals of Valuation: P.V. ViswanathLewmas UyimisNo ratings yet

- Dba 302 Financial Management Supplementary TestDocument3 pagesDba 302 Financial Management Supplementary Testmulenga lubembaNo ratings yet

- Financial Management: Capital StructureDocument18 pagesFinancial Management: Capital StructureSamiul AzamNo ratings yet

- TAX 667 Topic 8 Tax Planning For CompanyDocument63 pagesTAX 667 Topic 8 Tax Planning For Companyzarif nezukoNo ratings yet

- Exercicios Do Capitulo 4 (Finanças Empresariais)Document3 pagesExercicios Do Capitulo 4 (Finanças Empresariais)Gonçalo AlmeidaNo ratings yet

- Shareholding Pattern As On June 30, 2020Document9 pagesShareholding Pattern As On June 30, 2020Mit AdhvaryuNo ratings yet

- 15 Sample FinalDocument6 pages15 Sample Finaltstation79No ratings yet

- 15 Business CombinationDocument6 pages15 Business CombinationTinNo ratings yet

- Exercise Sheet 2 With SolutionsDocument8 pagesExercise Sheet 2 With SolutionsFlaminiaNo ratings yet

- Business Combinations - ASPEDocument3 pagesBusiness Combinations - ASPEShariful HoqueNo ratings yet

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDocument14 pagesGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlNo ratings yet

- Chapter 16 Problem SolvingDocument3 pagesChapter 16 Problem SolvingWeStan LegendsNo ratings yet

- Set 3Document14 pagesSet 3Prakshi KansalNo ratings yet

- Software Example Index FundsDocument2 pagesSoftware Example Index Fundsapi-241777572No ratings yet

- Share Market Basics - Learn Stock Market Basics in India - Karvy OnlineDocument7 pagesShare Market Basics - Learn Stock Market Basics in India - Karvy Onlinevenki420No ratings yet

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingDocument6 pagesAccounting Vocabulary: Easy-To-Learn English Terms For AccountingRed WaneNo ratings yet

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (3)

- Exercise Questions For Capital Structure (Ans)Document3 pagesExercise Questions For Capital Structure (Ans)Abrar Ahmed KhanNo ratings yet

- Cost of Capital QuizDocument8 pagesCost of Capital Quizalyanna alanoNo ratings yet

- 14 Ms. Dhartiben P. Rami, Dr. Kamini Shah & Prof (DR) Sandip Bhatt PDFDocument6 pages14 Ms. Dhartiben P. Rami, Dr. Kamini Shah & Prof (DR) Sandip Bhatt PDFRajeshNo ratings yet

- F3 Chapter 8Document12 pagesF3 Chapter 8Ali ShahnawazNo ratings yet

- Ch14 Bonds - Intermediate 2Document103 pagesCh14 Bonds - Intermediate 2BLESSEDNo ratings yet