Professional Documents

Culture Documents

Terminal Value: Prepared by - Dheeraj Vaidya, CFA, FRM

Terminal Value: Prepared by - Dheeraj Vaidya, CFA, FRM

Uploaded by

NarendraSinha0 ratings0% found this document useful (0 votes)

0 views3 pagesTerminal Value Calculator

Original Title

Terminal Value

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTerminal Value Calculator

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views3 pagesTerminal Value: Prepared by - Dheeraj Vaidya, CFA, FRM

Terminal Value: Prepared by - Dheeraj Vaidya, CFA, FRM

Uploaded by

NarendraSinhaTerminal Value Calculator

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 3

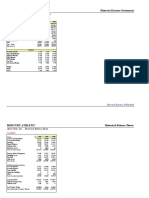

Terminal Value

Prepared by - Dheeraj Vaidya, CFA, FRM

email - dheeraj@wallstreetmojo.com

websites: www.wallstreetmojo.com www.educorporatebridge.com

Historical Foreca

Free Cash Flow to Firm 2010 2011 2012 2013 2014

EBIT $32 $38 $48 $50 $55

Free Cash Flow to Firm

EBIT x (1-t) $22 $27 $34 $35 $39

Add: Depreciation $30 $30 $30 $31 $33

Less: Capex $15 $30 $30 $32 $34

Less: Change in working capital $7 $6 $3 $3

FCFF $20 $27 $31 $34

Assumptions

WACC 10%

Growth Rate 4%

Present Value of Explicit FCFF $161

1) Perpetuity Growth method 2014

0

Present Value of Explicit FCFF $561

2) Exit Multiple method 2014

0

Present Value of Explicit FCFF $547

Share Price Calculations

Present Value of Explicit FCFF 161 23%

Present value of Terminal Value 547 77%

Total Enterprise Value 708

(-) Debt 100

(+) Cash 50

Equity Value 658

# of Shares 100

Share Price $6.58

Forecasts

2015 2016 2017 2018

$62 $68 $75 $82

$43 $48 $53 $57

$36 $38 $41 $44

$37 $39 $42 $45

$3 $4 $4 $4

$39 $43 $48 $52

2015 2016 2017 2018

0 0 0 904

2015 2016 2017 2018

0 0 0 881

You might also like

- Revised ModelDocument27 pagesRevised ModelAnonymous 0CbF7xaNo ratings yet

- Business Valuation GuideDocument13 pagesBusiness Valuation GuideSODDEYNo ratings yet

- LBO Analysis CompletedDocument9 pagesLBO Analysis CompletedVenkatesh NatarajanNo ratings yet

- Lbo DCF ModelDocument38 pagesLbo DCF ModelBobbyNicholsNo ratings yet

- 06 06 Football Field Walmart Model Valuation BeforeDocument47 pages06 06 Football Field Walmart Model Valuation BeforeIndrama Purba0% (1)

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- FCFF Vs FCFE Valuation ModelDocument5 pagesFCFF Vs FCFE Valuation Modelksivakumar09No ratings yet

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- ProjectDocument24 pagesProjectAayat R. AL KhlafNo ratings yet

- Neptune Model CompleteDocument23 pagesNeptune Model CompleteChar_TonyNo ratings yet

- FM16 Ch25 Tool KitDocument35 pagesFM16 Ch25 Tool KitAdamNo ratings yet

- 20.06.26 Nano II Model - SentDocument309 pages20.06.26 Nano II Model - SentAdrian KurniaNo ratings yet

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLNo ratings yet

- Discount Factor TemplateDocument5 pagesDiscount Factor TemplateRashan Jida Reshan100% (1)

- 1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesDocument46 pages1 2 3 4 5 6 7 8 9 File Name: C:/Courses/Course Materials/3 Templates and Exercises M&A Models/LBO Shell - Xls Colour CodesfdallacasaNo ratings yet

- Box IPO Financial ModelDocument42 pagesBox IPO Financial ModelVinNo ratings yet

- Bond ValuationDocument17 pagesBond ValuationMatthew RyanNo ratings yet

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellNo ratings yet

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- 4-35 Model ProblemDocument18 pages4-35 Model Problemcherishwisdom_997598100% (1)

- Alibaba IPO Financial Model WallstreetMojoDocument52 pagesAlibaba IPO Financial Model WallstreetMojoJulian HutabaratNo ratings yet

- Fitch Special Report US Private Equity Overview October 2010Document19 pagesFitch Special Report US Private Equity Overview October 2010izi25No ratings yet

- NISM WorkbookDocument380 pagesNISM WorkbookcheetivenkatNo ratings yet

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Document18 pages1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNo ratings yet

- JMBM Hotel Acquisition ChecklistDocument25 pagesJMBM Hotel Acquisition ChecklistSODDEYNo ratings yet

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- M&a Case Study SolutionDocument3 pagesM&a Case Study SolutionSoufiane EddianiNo ratings yet

- BAV Model v4.7Document26 pagesBAV Model v4.7jess236No ratings yet

- 01 09 Inventory Changes Cash DebtDocument4 pages01 09 Inventory Changes Cash DebtShikharNo ratings yet

- 72Ho-Singer Model V3Document28 pages72Ho-Singer Model V3aqwaNo ratings yet

- Merger Model PP Allocation BeforeDocument100 pagesMerger Model PP Allocation BeforePaulo NascimentoNo ratings yet

- Case 1 SwanDavisDocument4 pagesCase 1 SwanDavissilly_rabbit0% (1)

- Valuation Cash Flow A Teaching NoteDocument5 pagesValuation Cash Flow A Teaching NotesarahmohanNo ratings yet

- Kellogg: Balance SheetDocument14 pagesKellogg: Balance SheetSubhajit KarmakarNo ratings yet

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- 04 Atlassian 3 Statement Model CompletedDocument18 pages04 Atlassian 3 Statement Model CompletedYusuf RaharjaNo ratings yet

- Worldwide Paper DCFDocument16 pagesWorldwide Paper DCFLaila SchaferNo ratings yet

- Wal-Mart Stores, Inc. - Summary of Financial Statements: Historical Projected 2012 RevenueDocument18 pagesWal-Mart Stores, Inc. - Summary of Financial Statements: Historical Projected 2012 RevenueRakshana SrikanthNo ratings yet

- Simple LBO ModelDocument14 pagesSimple LBO ModelSucameloNo ratings yet

- McDonald's (MCD) - Earnings Quality ReportDocument1 pageMcDonald's (MCD) - Earnings Quality ReportInstant AnalystNo ratings yet

- Qatar National Bank April 2011Document6 pagesQatar National Bank April 2011Michael KiddNo ratings yet

- 333893Document12 pages333893Char MonNo ratings yet

- Blank Financial ModelDocument109 pagesBlank Financial Modelrising_above100% (1)

- F Wall Street 4-MSFT-Analysis (2010) 20100817Document1 pageF Wall Street 4-MSFT-Analysis (2010) 20100817smith_raNo ratings yet

- SBICAPS - Model Test 2Document34 pagesSBICAPS - Model Test 2rishav digga0% (1)

- Ch03 P15 Build A ModelDocument2 pagesCh03 P15 Build A Model03020380% (1)

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- 72 11 NAV Part 4 Share Prices AfterDocument75 pages72 11 NAV Part 4 Share Prices Aftercfang_2005No ratings yet

- Company ValuationDocument68 pagesCompany ValuationXinyi SunNo ratings yet

- Synopsis of Many LandsDocument6 pagesSynopsis of Many Landsraj shekarNo ratings yet

- Ch04 Tool KitDocument80 pagesCh04 Tool KitAdamNo ratings yet

- 107 23 Uber ValuationDocument34 pages107 23 Uber Valuationram persadNo ratings yet

- WSP Terminal Value VFDocument5 pagesWSP Terminal Value VFShane BrooksNo ratings yet

- 8-Security-Valuation 2Document29 pages8-Security-Valuation 2saadullah98.sk.skNo ratings yet

- WSP Levered DCF Model VFDocument5 pagesWSP Levered DCF Model VFBlahNo ratings yet

- Chapter No.06 Company Analysis and Stock ValuationDocument40 pagesChapter No.06 Company Analysis and Stock ValuationBlue StoneNo ratings yet

- How To Complete Mira 601 PDFDocument10 pagesHow To Complete Mira 601 PDFSODDEYNo ratings yet

- Income Tax Act English 20200119Document72 pagesIncome Tax Act English 20200119SODDEYNo ratings yet

- Remittance Tax Guide: MIRA R833Document14 pagesRemittance Tax Guide: MIRA R833SODDEYNo ratings yet

- Equity Value Vs Enterprise Value - Wall Street MojoDocument10 pagesEquity Value Vs Enterprise Value - Wall Street MojoSODDEYNo ratings yet

- CWM Detailed Course CurriculumDocument113 pagesCWM Detailed Course CurriculumSODDEYNo ratings yet

- Natio Onal S Stock Excha Ange O F India A Limite ED: Commo Odities Mark Ket ModuleDocument1 pageNatio Onal S Stock Excha Ange O F India A Limite ED: Commo Odities Mark Ket ModuleSODDEYNo ratings yet

- MIRA 906 - MRTGS Remittance RequestDocument2 pagesMIRA 906 - MRTGS Remittance RequestSODDEYNo ratings yet

- CFP - SuggestedSolutions - RPEBDocument6 pagesCFP - SuggestedSolutions - RPEBSODDEYNo ratings yet

- CFP - Sample Paper TPEPDocument9 pagesCFP - Sample Paper TPEPSODDEYNo ratings yet

- IFRS in TourismDocument17 pagesIFRS in TourismSODDEYNo ratings yet