Professional Documents

Culture Documents

Chapter No.06 Company Analysis and Stock Valuation

Uploaded by

Blue Stone0 ratings0% found this document useful (0 votes)

19 views40 pagesOriginal Title

Chapter No.06 Company Analysis and Stock Valuation

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views40 pagesChapter No.06 Company Analysis and Stock Valuation

Uploaded by

Blue StoneCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 40

Chapter 06 –

Company Analysis and

Stock Valuation

Company Analysis and Stock

Valuation

• After analyzing the economy and stock markets for

several countries, you have decided to invest some

portion of your portfolio in common stocks

• After analyzing various industries, you have

identified those industries that appear to offer

above-average risk-adjusted performance over your

investment horizon

• Which are the best companies?

• Are they overpriced?

Company Analysis and Stock

Valuation

• Good companies are not necessarily good

investments

• Compare the intrinsic value of a stock to its

market value

• Stock of a great company may be overpriced

• Stock of a growth company may not be growth

stock

Growth Companies

• Growth companies have historically been

defined as companies that consistently

experience above-average increases in sales

and earnings

• Financial theorists define a growth company

as one with management and opportunities

that yield rates of return greater than the

firm’s required rate of return

Growth Stocks

• Growth stocks are not necessarily shares in

growth companies

• A growth stock has a higher rate of return

than other stocks with similar risk

• Superior risk-adjusted rate of return occurs

because of market undervaluation compared

to other stocks

Defensive Companies and Stocks

• Defensive companies’ future earnings are

more likely to withstand an economic

downturn

• Low business risk

• Not excessive financial risk

• Stocks with low or negative systematic risk

Company Analysis

• Industry competitive environment

• SWOT analysis

• Present value of cash flows

• Relative valuation ratio techniques

Competitive Forces

• Current rivalry

• Threat of new entrants

• Potential substitutes

• Bargaining power of suppliers

• Bargaining power of buyers

Porter's Competitive Strategies

• Low-Cost Strategy

– The firm seeks to be the low-cost

producer, and hence the cost leader in its

industry

• Differentiation Strategy

– firm positions itself as unique in the

industry

SWOT Analysis

• Examination of a firm’s:

– Strengths

– Weaknesses

– Opportunities

– Threats

SWOT Analysis

• Examination of a firm’s:

– Strengths INTERNAL ANALYSIS

– Weaknesses

– Opportunities

– Threats

SWOT Analysis

• Examination of a firm’s:

– Strengths

– Weaknesses

– Opportunities

EXTERNAL ANALYSIS

– Threats

Estimating Intrinsic Value

A. Present value of cash flows (PVCF)

– 1. Present value of dividends (DDM)

– 2. Present value of free cash flow to equity (FCFE)

– 3. Present value of free cash flow (FCFF)

Present Value of Dividends

• Simplifying assumptions help in estimating

present value of future dividends

• Assumption of constant growth rate

Intrinsic Value = D1/(k-g)

D1= D0(1+g)

Example

• You will recall that the model also required that k > g (the

required rate of return is larger than the expected growth

rate), which is not true in this case because k = 9.0 percent

and g = 13 percent

• Therefore, the analyst must employ a two- or three-stage

growth model. Because of the fairly large difference

between the current growth rate of 13 percent and the

long-run constant growth rate of 8 percent,

• It seems reasonable to use a three-stage growth model,

which includes a gradual transition period.

• Therefore, beginning with 2002 when

dividends were expected to be $0.15, the

future dividend payments will be as follows

(the growth rate is in parentheses):

YEAR HIGH-GROWTH YEAR DECLINING-

PERIOD GROWTH PERIOD

2003 (13%) 0.17 2010 (12%) 0.39

2004 (13%) 0.19 2011 (11%) 0.43

2005 (13%) 0.21 2012 (10%) 0.47

2006 (13%) 0.24 2013 (9%) 0.51

2007 (13%) 0.27 2014 (8%) 0.55

2008 (13%) 0.31

2009 (13%) 0.35

Constant Growth Period:

•P 2014 = 0.55 (1.08) = $59

0.9-0.8

1. Present value of high-growth

period dividends $1.20

2. Present value of declining-growth

period dividends 1.00

3. Present value of constant-growth

period dividends 20.91

Total present value of dividends $23.11

Required Rate of Return Estimate

• Nominal risk-free interest rate

• Risk premium

• Market-based risk estimated from the firm’s

characteristic line using regression

Required Rate of Return Estimate

• Nominal risk-free interest rate

• Risk premium

• Market-based risk estimated from the firm’s

characteristic line using regression

R s to ck E(RFR) sto ck [ E(R mark et ) E(RFR)]

EXAMPLE

• Given Hitech’s beta of 1.75 and a risk-free

rate of 7 percent, what is the expected rate

of return assuming

a. a 15 percent market return?

b. a 10 percent market return?

Present Value of

Free Cash Flow to Equity

FCFE =

Net Income

+ Depreciation Expense

- Capital Expenditures

- in Working Capital

- Principal Debt Repayments

+ New Debt Issues

Present Value of

Free Cash Flow to Equity

FCFE = FCFE1

Net Income Value

+ Depreciation Expense k g FCFE

- Capital Expenditures

- in Working Capital

- Principal Debt Repayments

+ New Debt Issues

Present Value of

Free Cash Flow to Equity

FCFE1

Value

k g FCFE

FCFE = the expected free cash flow in period 1

k = the required rate of return on equity for the firm

gFCFE = the expected constant growth rate of free cash

flow to equity for the firm

Example

• it is estimated that in 2003 the FCFE will be about $200 million

and the FCFF (free cash flow to the firm) will be about $250

million. Such volatility makes it appropriate to use the

conservative 13 percent growth rate going forward after 2003.

Therefore, the following example again uses a three-stage

growth model with characteristics similar to the dividend

growth model.

• g1 = 13 percent for the six years after 2003

• g2 = a constantly declining growth rate to 8 percent over five

years

• K = 9 percent cost of equity

• The specific estimates of annual FCFE, beginning with the

actual estimated value of $200 million in 2003, are as follows:

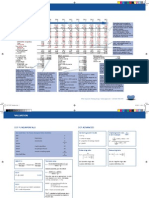

HIGH-GROWTH PERIOD DECLINING-GROWTH PERIOD

YEAR GROWTH YEAR GROWTH

$ MILLION PV @ 9% $ MILLION PV @ 9%

2003 — 200 183 2010 (12%) 465 233

2004 (13%) 226 190 2011 (11%) 517 238

2005 (13%) 255 197 2012 (10%) 568 240

2006 (13%) 288 204 2013 (9%) 619 240

2007 (13%) 325 211 2014 (8%) 669 238

2008 (13%) 368 219 Total 1,189

2009 (13%) 416 228

Total 1,432

Price 2014 = 669(1.08)/ 0.09-.08 = 72,300

Price at 2003 at 9% = $25,703

The total value of the stock is the sum of

the three present value streams discounted

at 9 percent:

$ MILLION

1. Present value of high-growth cash flows 1,432

2. Present value of declining-growth cash flows 1,189

3. Present value of constant-growth cash flows 25,703

Total present value of FCFE $28,324

Present Value of

Operating Free Cash Flow

Discount the firm’s operating free cash flow

to the firm (FCFF) at the firm’s weighted

average cost of capital (WACC) rather than

its cost of equity

FCFF = EBIT (1-Tax Rate)

+ Depreciation Expense - Capital Spending

- in Working Capital - in other assets

Present Value of

Operating Free Cash Flow

FCFF1

Firm Value

WACC g FCFF

Oper . FCF1

or

WACC g OFCF

Present Value of

Operating Free Cash Flow

FCFF1

Firm Value

WACC g FCFF

Oper . FCF1

or

WACC g OFCF

Where: FCFF1 = the free cash flow in period 1

Oper. FCF1 = the firm’s operating free cash flow in period 1

WACC = the firm’s weighted average cost of capital

gFCFF = the firm’s constant infinite growth rate of free cash flow

gOFCF = the constant infinite growth rate of operating free cash flow

Example

• Therefore, the following demonstration will employ the

three-stage growth model with growth duration

assumptions similar to the prior examples. Given these

inputs for recent growth and the firm’s WACC, the growth

estimates for a three stage growth model are

• g1 = 13 percent for six years

• g2 = a constantly declining rate to 7 percent over six

years.

The specific estimates for future OFCF (or FCFF) are as

follows, beginning from the 2003 value of $250 million.

HIGH-GROWTH PERIOD DECLINING-GROWTH PERIOD

GROWTH PV @ GROWTH PV @

YEAR RATE FCFF 8% YEAR RATE FCFF 8%

2003 — 250 231 2010 (12%) 583 315

2004 (13%) 282 242 2011 (11%) 647 324

2005 (13%) 319 253 2012 (10%) 712 330

2006 (13%) 361 265 2013 (9%) 776 333

2007 (13%) 408 278 2014 (8%) 838 333

2008 (13%) 461 291 2015 (7%) 897 330

2009 (13%) 520 303 Total $1,965

Total $1,863

P 2015 = 897 (1.07) / .08 - .07 $96,000

PV @ 8% = $ 32654

Thus, the total value of the firm is:

$ MILLION

1. Present value of high-growth cash flows $1,863

2. Present value of declining-growth cash flows 1,965

3. Present value of constant-growth cash flows 32,654

Total present value of operating FCF (FCFF) $36,482

Problem No.01

At year-end 1991, the Wall Street consensus was

that Philip Morris’ earnings and dividends would

grow at 20 percent for five years after which

growth would fall to a market-like 7 percent.

Analysts also projected a required rate of return of

10 percent for the U.S. equity market. a. Current

Dividend on year end is $ 65 per share

Required: Using the multistage dividend discount

model, calculate the intrinsic value of Philip Morris

stock at year-end 1991.

Problem No.02

TABLE 14

VALUATION INFORMATION: DECEMBER 1997

QuickBrush SmileWhite

Beta 1.35 1.15

Market price $45.00 $30.00

Intrinsic value $63.00 ?

Annual dividend per share $1.72

• Notes:

• Risk-free rate 4.50%

• Expected market return 14.50%

• Janet Ludlow’s firm requires all its analysts to use a two-stage

dividend discount model (DDM) and the capital asset pricing model

(CAPM) to value stocks. Using the CAPM and DDM, Ludlow has

valued QuickBrush Company at $63 per share. She now must value

SmileWhite Corporation.

• a. Calculate the required rate of return for SmileWhite using the

information in Table 14 and the CAPM. Show your work. [6 minutes]

Ludlow estimates the following EPS and dividend growth rates for

SmileWhite:

– First 3 years: 12 percent per year

– Years thereafter: 9 percent per year

• b. Estimate the intrinsic value of SmileWhite using the data from

Table 14 and the two stage DDM. Show your work. [12 minutes]

• c. Recommend QuickBrush or SmileWhite stock for purchase by

comparing each company’s intrinsic value with its current market

price. Show your work.

Problem No.03

End of Year

1 $ -0-

2 Lease receipts 15,000

3 Lease receipts 25,000

3 Sale proceeds $100,000

PRESENT VALUE OF $1

Period 6% 8% 10% 12%

1 0.943 0.926 0.909 0.893

2 0.890 0.857 0.826 0.797

3 0.840 0.794 0.751 0.712

4 0.792 0.735 0.683 0.636

5 0.747 0.681 0.621 0.567

• Your client is considering the purchase of $100,000 in

common stock, which pays no dividends and will

appreciate in market value by 10 percent per year. At the

same time, the client is considering an opportunity to

invest $100,000 in a lease obligation that will provide the

annual year-end cash flows listed in Table 1. Assume that

each investment will be sold at the end of three years and

that you are given no additional information.

• Required:

• Calculate the present value of each of the two investments

assuming a 10 percent discount rate, and state which one

will provide the higher return over the three-year period.

Use the data in Table 1, and show your calculations.

Problem No.04

• Abbey Naylor, CFA, has been directed by Carroll to

determine the value of Sundanci’s stock using the free cash

flow to equity (FCFE) model. Naylor believes that Sundanci’s

FCFE will grow at 27 percent for two years and 13 percent

thereafter. Capital expenditures, depreciation, and working

capital are all expected to increase proportionately with FCFE.

a. Calculate the amount of FCFE per share for the year 2000,

using the data from Table 17. Show your work. [6 minutes]

b. Calculate the current value of a share of Sundanci stock based

on the two-stage FCFE model using required rate of return at

16%. Show your work. [8 minutes]

TABLE 17

SUNDANCI ACTUAL 1999 AND 2000 FINANCIAL STATEMENTS FOR

FISCAL YEARS ENDING MAY 31 ($ MILLION, EXCEPT PER-SHARE

DATA)

1999 2000

Income Statement

Revenue $474 $598

Depreciation 20 23

Other operating costs 368 460

Income before taxes 86 115

Taxes 26 35

Net income 60 80

Dividends 18 24

Earnings per share $0.714 $0.952

Dividend per share $0.214 $0.286

Common shares outstanding

(millions) 84.0 84.0

Balance Sheet

Current assets $201 $326

Net property, plant and equipment 474 489

Total assets 675 815

Current liabilities 57 141

Long-term debt 0 0

Total liabilities 57 141

Shareholders’ equity 618 674

Total liabilities and equity 675 815

Capital expenditures 34 38

You might also like

- Addl Notes - FCFF Model PDFDocument17 pagesAddl Notes - FCFF Model PDFRoyLadiasanNo ratings yet

- Valuation of Financial AssetsDocument47 pagesValuation of Financial AssetsprashantkumbhaniNo ratings yet

- Refined de PamphilisDocument83 pagesRefined de PamphilisMudit GargNo ratings yet

- Free Cash Flow and Its UsesDocument22 pagesFree Cash Flow and Its UsesAnand Deshpande67% (3)

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Cost of CapitalDocument31 pagesCost of CapitalMariam JahanzebNo ratings yet

- DCF AswathDocument91 pagesDCF AswathDaniel ReddyNo ratings yet

- Valuation of FirmDocument13 pagesValuation of FirmLalitNo ratings yet

- American Vanguard Corporation (Security AnaylisisDocument18 pagesAmerican Vanguard Corporation (Security AnaylisisMehmet SahinNo ratings yet

- Lecture 36Document27 pagesLecture 36palwasha jiNo ratings yet

- Bank ValuationsDocument20 pagesBank ValuationsHenry So E DiarkoNo ratings yet

- Fins3625 Week 4 Lecture SlidesDocument24 pagesFins3625 Week 4 Lecture SlidesjoannamanngoNo ratings yet

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetNo ratings yet

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Document33 pagesValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasNo ratings yet

- Ch. 13 - 13ed Corporate Valuation - MasterDocument56 pagesCh. 13 - 13ed Corporate Valuation - MasterBudiman SutantoNo ratings yet

- Why Dividends Differ from FCFEDocument34 pagesWhy Dividends Differ from FCFENikhil ChitaliaNo ratings yet

- Session 9 and 10 M&a PGDM 2023Document22 pagesSession 9 and 10 M&a PGDM 2023ArchismanNo ratings yet

- Valuation of Preferred and Common StockDocument77 pagesValuation of Preferred and Common StockRazvan Dan0% (1)

- Chapter 19: Financial Statement AnalysisDocument11 pagesChapter 19: Financial Statement AnalysisSilviu TrebuianNo ratings yet

- Discounted Cash Flow ValuationDocument45 pagesDiscounted Cash Flow Valuationnotes 1No ratings yet

- Cost of CapitalDocument37 pagesCost of Capitalrajthakre81No ratings yet

- AFA - Earnings Drivers EtcDocument24 pagesAFA - Earnings Drivers EtcHYUN JUNG KIMNo ratings yet

- FT12 - Day 6 - SSV - GKR - 06062021Document81 pagesFT12 - Day 6 - SSV - GKR - 06062021AnshulNo ratings yet

- Free Cash Flow To Equity Valuation Model For Coca ColaDocument5 pagesFree Cash Flow To Equity Valuation Model For Coca Colaafridi65No ratings yet

- Pln-Cmams - MERGER AND ACQUISITION PART 2Document31 pagesPln-Cmams - MERGER AND ACQUISITION PART 2dwi suhartantoNo ratings yet

- Lecture 9 M17EFA - Company Valuation 2 1Document48 pagesLecture 9 M17EFA - Company Valuation 2 1822407No ratings yet

- "Basic Petroleum Economy": PetrovietnamDocument48 pages"Basic Petroleum Economy": PetrovietnamPhạm ThaoNo ratings yet

- Earnings Persistence and Valuation MethodsDocument31 pagesEarnings Persistence and Valuation MethodsKhushbooNo ratings yet

- Ankush - Gupta - Financial Management and Valuation - MBA - DBF - DEC - 2020 - Word FileDocument8 pagesAnkush - Gupta - Financial Management and Valuation - MBA - DBF - DEC - 2020 - Word FileAnkush GuptaNo ratings yet

- Lecture 5 (Valuation)Document17 pagesLecture 5 (Valuation)Kamrul HudaNo ratings yet

- Chapter 9 Capital Budgeting Decision LectureDocument9 pagesChapter 9 Capital Budgeting Decision LectureAia GarciaNo ratings yet

- VebitdaDocument24 pagesVebitdaAndr EiNo ratings yet

- 8-Security-Valuation 2Document29 pages8-Security-Valuation 2saadullah98.sk.skNo ratings yet

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Document10 pages3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- Cash Flow Estimation and Risk AnalysisDocument55 pagesCash Flow Estimation and Risk AnalysisgridlockdxNo ratings yet

- Business Valuation 1Document19 pagesBusiness Valuation 1Temmy AdegboyeNo ratings yet

- Capital StructureDocument22 pagesCapital StructureBhanu sharmaNo ratings yet

- Analysis of Financial StatementsDocument54 pagesAnalysis of Financial StatementsBabasab Patil (Karrisatte)No ratings yet

- Financial Leverage Du Pont Analysis &growth RateDocument34 pagesFinancial Leverage Du Pont Analysis &growth Rateahmad jamalNo ratings yet

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- Week 3: Lecture Slides: DCF - Earnings and Terminal Value Chapter 10 and 12Document21 pagesWeek 3: Lecture Slides: DCF - Earnings and Terminal Value Chapter 10 and 12joannamanngoNo ratings yet

- II. The Two-Stage FCFE ModelDocument7 pagesII. The Two-Stage FCFE ModelzZl3Ul2NNINGZzNo ratings yet

- Set 4. Details For FCFE Model - TaggedDocument15 pagesSet 4. Details For FCFE Model - TaggedAryan SholapureNo ratings yet

- CApital Structure and LeverageDocument33 pagesCApital Structure and LeverageMD Rifat ZahirNo ratings yet

- Value DriversDocument28 pagesValue DriversAbhishek SachdevaNo ratings yet

- Cost of Capital: © 2003 The Mcgraw-Hill Companies, Inc. All Rights ReservedDocument36 pagesCost of Capital: © 2003 The Mcgraw-Hill Companies, Inc. All Rights ReservedNusratJahanHeabaNo ratings yet

- Capital BudgetingDocument23 pagesCapital BudgetingchanfunyanNo ratings yet

- Discounted Cash FlowDocument12 pagesDiscounted Cash FlowViv BhagatNo ratings yet

- Analysis of Financial Statements 1-10-19Document28 pagesAnalysis of Financial Statements 1-10-19Shehzad QureshiNo ratings yet

- Intrinsic Valuation: The Constant Growth ModelDocument4 pagesIntrinsic Valuation: The Constant Growth ModelChulbul PandeyNo ratings yet

- Chap 4 Stock and Equity Valuation RevisedDocument49 pagesChap 4 Stock and Equity Valuation RevisedHABTAMU TULU100% (1)

- Sampa VideoDocument18 pagesSampa Videomilan979No ratings yet

- Cost of CapitalDocument31 pagesCost of CapitaldevNo ratings yet

- Principles of Corporate ValuationDocument14 pagesPrinciples of Corporate ValuationSubhrodeep DasNo ratings yet

- DCF FCFF ValuationDocument0 pagesDCF FCFF ValuationSneha SatyamoorthyNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Anti CorruptionDocument10 pagesAnti CorruptionBlue StoneNo ratings yet

- Mid Term PaperDocument4 pagesMid Term PaperBlue StoneNo ratings yet

- Analysis of Financial Statements: Chapter No.07Document56 pagesAnalysis of Financial Statements: Chapter No.07Blue StoneNo ratings yet

- ECP Directives For KP and PunjabDocument3 pagesECP Directives For KP and PunjabBlue StoneNo ratings yet

- RibaDocument50 pagesRibafarhan israrNo ratings yet

- Ats TestDocument7 pagesAts TestBlue StoneNo ratings yet

- Chapter No.08 The Analysis and Valuation of Bonds - STDocument13 pagesChapter No.08 The Analysis and Valuation of Bonds - STBlue StoneNo ratings yet

- EFE Matrix Reveals Opportunities for Abasyn University's Global ExpansionDocument7 pagesEFE Matrix Reveals Opportunities for Abasyn University's Global ExpansionBlue StoneNo ratings yet

- FINANCIAL SYSTEM. Lect.4Document3 pagesFINANCIAL SYSTEM. Lect.4Blue StoneNo ratings yet

- FINANCIAL SYSTEM. Lect.2Document6 pagesFINANCIAL SYSTEM. Lect.2Blue StoneNo ratings yet

- FINANCIAL SYSTEM. Lect.5Document3 pagesFINANCIAL SYSTEM. Lect.5Blue StoneNo ratings yet

- FINANCIAL SYSTEM. Lect.3Document4 pagesFINANCIAL SYSTEM. Lect.3Blue StoneNo ratings yet

- Chapter No.05 Securities ValuationDocument28 pagesChapter No.05 Securities ValuationBlue StoneNo ratings yet

- Key Internal Factors Weight Rating StrenghtsDocument4 pagesKey Internal Factors Weight Rating StrenghtsBlue StoneNo ratings yet

- Communication Issues: Assignment/ Quiz Subject: Business EthicsDocument10 pagesCommunication Issues: Assignment/ Quiz Subject: Business EthicsBlue StoneNo ratings yet

- FINANCIAL SYSTEM. Lect.2Document6 pagesFINANCIAL SYSTEM. Lect.2Blue StoneNo ratings yet

- Business Ethics (BA 443) Course Name: Business Ethics Course Code:BA-554 Course Structure:Lectures:3 Credit Hours:3 Prerequisites: None ObjectivesDocument2 pagesBusiness Ethics (BA 443) Course Name: Business Ethics Course Code:BA-554 Course Structure:Lectures:3 Credit Hours:3 Prerequisites: None ObjectivesBlue StoneNo ratings yet

- Corporate Finance MCQDocument11 pagesCorporate Finance MCQsinghsanjNo ratings yet

- Abrar Ahmad Bhatti Lecturer: Government College of Management SciencesDocument1 pageAbrar Ahmad Bhatti Lecturer: Government College of Management SciencesBlue StoneNo ratings yet

- FINANCIAL SYSTEM. Lect.6Document2 pagesFINANCIAL SYSTEM. Lect.6Blue StoneNo ratings yet

- Assignment/ Quiz: Business Ethics: Name: - Roll No: - BBA Term - 7thDocument7 pagesAssignment/ Quiz: Business Ethics: Name: - Roll No: - BBA Term - 7thBlue StoneNo ratings yet

- Financial Statement Analysis: Course ObjectiveDocument1 pageFinancial Statement Analysis: Course ObjectiveBlue StoneNo ratings yet

- Communication Issues: Assignment/ Quiz Subject: Business EthicsDocument10 pagesCommunication Issues: Assignment/ Quiz Subject: Business EthicsBlue StoneNo ratings yet

- Understanding Entrepreneurial Mindset CharacteristicsDocument2 pagesUnderstanding Entrepreneurial Mindset CharacteristicsBlue StoneNo ratings yet

- Assignment/ Quiz: Business Ethics: Name: - Roll No: - BBA Term - 7thDocument7 pagesAssignment/ Quiz: Business Ethics: Name: - Roll No: - BBA Term - 7thBlue StoneNo ratings yet

- What Is The STP Strategies in MarketingDocument2 pagesWhat Is The STP Strategies in MarketingBlue StoneNo ratings yet

- FINANCIAL STATEMENT ANALYSISDocument45 pagesFINANCIAL STATEMENT ANALYSISBlue Stone100% (1)

- 4Ps of MarkettingDocument7 pages4Ps of MarkettingAtishay JainNo ratings yet

- Entrepreneurship Contributions in Developed vs Developing NationsDocument2 pagesEntrepreneurship Contributions in Developed vs Developing NationsBlue StoneNo ratings yet

- BUSI 353 S18 Assignment 6 SOLUTIONDocument4 pagesBUSI 353 S18 Assignment 6 SOLUTIONTanNo ratings yet

- Financial Performance Analysis of Rupali Bank Limited (RBL)Document51 pagesFinancial Performance Analysis of Rupali Bank Limited (RBL)Nahida Sammi jimNo ratings yet

- Resume KPMGDocument1 pageResume KPMGapi-356253047No ratings yet

- Marketing Strategy in Play: Questioning To Create DifferenceDocument16 pagesMarketing Strategy in Play: Questioning To Create DifferenceBusiness Expert PressNo ratings yet

- Gist of FIEO ServicesDocument1 pageGist of FIEO Servicessanjay patraNo ratings yet

- Java SuccessDocument3 pagesJava SuccessAnil Kumar BattulaNo ratings yet

- Foreign Tax Form W-8BEN GuideDocument1 pageForeign Tax Form W-8BEN Guidehector100% (1)

- Grade 11 Module 3Document122 pagesGrade 11 Module 3mhaiibreakerNo ratings yet

- Event Management SystemDocument45 pagesEvent Management SystemJimmy Khan43% (23)

- Annual Compliance Calendar - Companies Act, 2013 LISTED COMPANY - Series 527 PDFDocument13 pagesAnnual Compliance Calendar - Companies Act, 2013 LISTED COMPANY - Series 527 PDFGaurav SharmaNo ratings yet

- Research Rma Format Guide 1Document110 pagesResearch Rma Format Guide 1Nicole Anne PacoNo ratings yet

- FM11 CH 01 Test BankDocument33 pagesFM11 CH 01 Test Banksarah_200285No ratings yet

- Performance For Today and Tomorrow!: - Innovative Casthouse Solutions That PerformDocument2 pagesPerformance For Today and Tomorrow!: - Innovative Casthouse Solutions That PerformDaniel StuparekNo ratings yet

- Wharton Consulting Club Case Book 2019Document201 pagesWharton Consulting Club Case Book 2019guilhermetrinco62% (13)

- Oracle Fusion Middleware Disaster Recovery Solution Using HP EVA StorageDocument29 pagesOracle Fusion Middleware Disaster Recovery Solution Using HP EVA Storagehelmy_mis1594No ratings yet

- Vendor ListDocument3 pagesVendor ListSanjeev SinghNo ratings yet

- Affidavit of Written Initial Universal Commercial Code Financing StatementDocument8 pagesAffidavit of Written Initial Universal Commercial Code Financing StatementKamal Hakim Bey100% (1)

- Personal Assignment - BUS 431 (Business Ethics and Corporate Governance)Document4 pagesPersonal Assignment - BUS 431 (Business Ethics and Corporate Governance)Pius OgundeleNo ratings yet

- On A 365Document4 pagesOn A 365Made EasilyNo ratings yet

- CT SS For Student Apr2019Document5 pagesCT SS For Student Apr2019Nabila RosmizaNo ratings yet

- Gaurav PDFDocument70 pagesGaurav PDFSandesh GajbhiyeNo ratings yet

- A Project Report On: Importance of Human Resource Role During The RecessionDocument43 pagesA Project Report On: Importance of Human Resource Role During The Recessionaurorashiva1No ratings yet

- Chapter 6 BUSINESS PLANDocument28 pagesChapter 6 BUSINESS PLANFRANCYN SIGRID MACALALADNo ratings yet

- Combined Assurance: Overcoming Common ChallengesDocument18 pagesCombined Assurance: Overcoming Common ChallengesWM4scribdNo ratings yet

- ADMS 3920 Assignment #2 Part 2Document40 pagesADMS 3920 Assignment #2 Part 2Jarrett XuNo ratings yet

- Improve Grammar and Build Vocabulary with TENSES PracticeDocument51 pagesImprove Grammar and Build Vocabulary with TENSES PracticeNguyen DreyNo ratings yet

- Ircon International Limited v. Jaiprakash Associates Ltd.Document14 pagesIrcon International Limited v. Jaiprakash Associates Ltd.varsha bansodeNo ratings yet

- ESKIMI Ltd: Mobile Social Network and VAS Provider in Africa and AsiaDocument4 pagesESKIMI Ltd: Mobile Social Network and VAS Provider in Africa and Asiaish ishokNo ratings yet

- Grating Catalog MeiserDocument136 pagesGrating Catalog MeiserAdrian Leonas IonitaNo ratings yet

- DBP v COA: COA Validly Disallowed Productivity Award Despite No Refund OrderDocument2 pagesDBP v COA: COA Validly Disallowed Productivity Award Despite No Refund OrderKathlene JaoNo ratings yet