Professional Documents

Culture Documents

Ankush - Gupta - Financial Management and Valuation - MBA - DBF - DEC - 2020 - Word File

Uploaded by

Ankush GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ankush - Gupta - Financial Management and Valuation - MBA - DBF - DEC - 2020 - Word File

Uploaded by

Ankush GuptaCopyright:

Available Formats

JGU Id. No.

_____________

End-term Examination

MBA-DFB – C2

Financial Management and Valuation

MAXIMUM MARKS: 50 TIME: 7 Days

Answer: 1

The model was used to complete the valuation, which necessitated the reconstruction of the

financial statements as well as the computation of significant financial indicators like net

operating profit after tax (NOPAT) and free cash flow to the business. Following the method,

an appraisal of the value of the business was performed.

With the use of the following formula, one may calculate NOPAT: In its simplest form,

NOPAT stands for net income before taxes (EBIT minus taxable income).

NOPAT is added to the increase in CAPEX and the increase in current assets to calculate

FCFF.

During the whole of the first stage, which is also referred to as the fast growth phase, it was

determined whether or not it was necessary to provide an explicit prediction of the stage's

unlevered free cash flows. The reason for this is that both the company's sales and earnings

have been on the increase recently.

In addition, the findings of the second stage of calculations show that, when seen from a more

holistic perspective, the increase has reached a level of stability. In actual practise, the

equation that is employed is as follows:

The sum total of a firm's current operating income and its anticipated capital expenditures is

what determines the value of that corporation.

PV stands for present value.

TV = Terminal value

FCFF, which stands for flows of freely accessible currency

Both the two-stage model and the three-stage model predict the occurrence of a developing

phase and a stable phase, which is one similarity between the two models. In parallel with

these two phases, another phase known as the transitional one takes place. There is a pause

that occurs between the period of rapid expansion and the phase of stable growth.

End-term Examination –Fall’2022, JGBS Page 1

The valuation of the company taking into account three distinct phases of expansion: an early

stage characterised by rapid expansion, an intermediate stage characterised by contracting

expansion, and a concluding stage characterised by uninterrupted expansion.

Assumptions

• It is presumed that the company is now through an exceptionally rapid expansion phase.

• It is anticipated that this tremendous increase will continue for an initial time period that

has to be indicated.

• The growth rate will slow down in a linear fashion throughout the time of transition to a

stable growth rate.

• The link between expenditures on capital assets and depreciation is dynamic, shifting in

response to changes in the pace of economic growth.

General inputs:

Current Earnings ₹ 11,342.00

Current Dividends ₹ 4,300.00

Current Capital Spending ₹ 3,167.00

Current Depreciation ₹ 3,522.00

Current Revenues ₹ 1,60,341.00

Working Capital ₹ 34,872.00

Chg. Working Capital ₹ 1,195.00

It is estimated that this project's growth phase will last for four years. Free cash flow would

rise by 10% annually. To determine free cash flow, the proper formula was used.

The corporation made a profit of Rs 1,60,341.00 crores last year after paying out costs of Rs

486.00 crores in interest.

When running the model, a 30% tax rate was used as an assumption.

A 5% annual growth rate is assumed during the four-year transit period, but no adjustments

are made to capital expenditures, depreciation, or working capital.

Following are some methods for estimating the worth of the business: Value = Free Cash

Flow + Share Price + Interest Deferral Taxes

Discounted cash flow, or DCF, is a topic that will be covered in the subsequent video. DCF

relies heavily on an idea called economic value added (EVA).

It is based on the IRR of a corporation. An investment's return is the total amount invested

less the initial investment and any transaction costs. You also noted that NOPLAT is

calculated differently in the EPM model than in the two-stage and three-stage DCF models.

Formula for Calculating ROIC: NPV + NOPLAT You may figure out your ROI by using the

Capital Spent formula.

End-term Examination –Fall’2022, JGBS Page 2

In addition, I learned about capital charge, or the cost a company must bear in order to make

a profit on the money it first invested. You may write it out like this:

To calculate capital expenditures, subtract the cost of maintenance from the total amount

invested.

Money made in the economy equals Not OPLA + money invested.

Enterprise Value = Net Present Value + Initial Invested Capital was provided as a formula for

determining the total worth of a business.

Loss Potential (PV) Plus Overall Loss Potential (PV) (EP)

Value at Expiration (VE) = Value in the Present (TV)

Value at Present Time Equals NPV.

The accounting for value approach originates in the equity book value. This figure is

equivalent to book equity plus any returns in excess of projections.

We also figured out how to calculate the net profit after subtracting the cost of capital.

You found that the accounting for value framework allows for the value of a share to be

calculated using either the residual earnings technique or the dividend method. You picked up

this knowledge along the way.

The residual earnings method takes into account all of the following factors when

establishing a stock price:

RE = BN + PV describes ER. Benefits that are expected to be realised in the future have a

value greater than zero right now. By the end of the day, earnings had risen to at least two.

Calculating the worth of a stock based on dividends requires the usage of the following

formula:

The formula for determining dividend value is as follows: Present Dividend Value (PV) times

Share Value (SV) raised to the power of two plus Book Value (PV) raised to the power of

two plus (PV). Salary workers' net salary at the conclusion of the pay period

PV = Total Assets in the Present (TA)

Based on what has been said, it is clear that DV is equivalent to dividend value.

Whether or not the strategy is used, the total value of the stock remains the same.

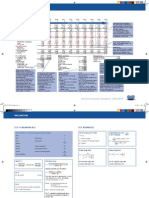

The output of the model has been pasted below :

End-term Examination –Fall’2022, JGBS Page 3

Output from the program

Initial High Growth

Phase

Cost of Equity = 13.05%

Current Earnings = 11,342.00

Proportion of Debt: 15.00%

Capital Spending (DR)=

Proportion of Debt: 15.00%

Working Capital (DR)=

Current Earnings per 11,342.00

share=

(Capital Spending - -301.75

Depreciation)*(1-DR)

Change in Working 1,015.75

Capital * (1-DR)

Current FCFE 10,628.00

Growth Rate in Earnings

per share - Initial High

Growth phase

Growth Weight

Rate

Historical Growth = 0.00% 0.00%

Outside Estimates = 10.00% 100.00%

Fundamental Growth = 0.00% 0.00%

Weighted Average 10.00%

Growth Rate in capital

spending, depreciation

and working capital

High Transition Stable Growth

Growth period

Growth rate in capital 10.00% Earnings g 5.00%

spending =

Growth rate in 10.00% Earnings g 5.00%

depreciation =

Growth rate in revenues 10.00% Earnings g 5.00%

=

Working Capital as 21.75% (in percent)

percent of revenues =

The dividends for the

high growth phase are

shown below (upto 10

years)

Year 1 2 3 4

Earnings 12,476.20 13,723.82 15,096.20 16,605.82

End-term Examination –Fall’2022, JGBS Page 4

(CapEx- -331.93 -365.12 -401.63 -441.79

Depreciation)*(1-DR)

Chg. Working Capital 2,964.12 3,260.53 3,586.59 3,945.24

*(1-DR)

FCFE 9,844.01 10,828.41 11,911.25 13,102.37

Present Value 8,707.66 8,472.73 8,244.14 8,021.72

Transition period (upto

ten years)

Year 5 6 7 8

Growth Rate 8.75% 7.50% 6.25% 5.00%

Cumulated Growth 8.75% 16.91% 24.21% 30.42%

Earnings 18,058.83 19,413.24 20,626.57 21,657.90

(CapEx- -480.45 -516.48 -548.76 -576.20

Depreciation)*(1-DR)

Chg. Working Capital 3,797.30 3,539.62 3,170.91 2,695.28

*(1-DR)

FCFE 14,741.98 16,390.10 18,004.42 19,538.83

Beta 1.1 1.1 1.1 1.1

Cost of Equity 13.05% 13.05% 13.05% 13.05%

Present Value 7,983.68 7,851.60 7,629.31 7,323.76

End-of-Life Index 0 0 0 1

Stable Growth Phase

Growth Rate in Stable 5.00%

Phase =

FCFE in terminal year = 25,913.15

Cost of Equity in Stable 13.05%

Phase =

Price at the end of 3,21,902.45

growth phase =

Present Value of FCFE 33,446.25

in high growth phase =

Present Value of FCFE 30,788.35

in transition phase =

Present Value of 1,20,659.01

Terminal Price =

Value of the firm = 1,84,893.60

End-term Examination –Fall’2022, JGBS Page 5

Answer 2:

Analysis of Liquidity Positions of the companies

The liquidity position of the companies is calculated with the help of financial ratios,

such as

Net working capital

Current ratio, and

Quick ratio,

Step one in any liquidity study should be determining the company's net working

capital. What separates a company's current assets from its current obligations is its

net working capital. The formula for calculating net working capital is as follows:

Current Assets less Current Liabilities.

The second part of a company's liquidity study is to determine its current ratio. The

current ratio indicates the extent to which a company's assets cover its short-term debt

commitments. To be "current," a time frame typically has to be less than a year.

Here's the formula:

The current ratio is the current assets divided by the current liabilities.

The quick ratio is the last component of a company's liquidity examination. When

evaluating liquidity, the quick ratio is stricter than the current ratio. Determines

whether or not the firm can pay its short-term debt commitments without liquidating

any of its current assets. Because you have to go out and locate a buyer for your

inventory, it is the least liquid of all your present assets. In a sluggish economy, it

might be difficult to find a buyer. Therefore, businesses want to avoid liquidating

stock to pay off their short-term debt. You may write it out like this:

The Quick Ratio is defined as the ratio of current assets to current liabilities, less the

value of inventories.

Note:

Companies for analysis: MRF LTD, VISHNU CHEMICALS, FOCUS LIGHTING

& FIXTURE LTD, MALU PAPER MILLS & MARUTI SUZUKI INDIA

Each sum is denoted in crores.

Used Formula are as under: (Net Working Capital = Current Assets - Current

Liabilities), (Current Ratio = Current Assets/Current Liabilities) and (Quick

Ratio = Current Assets-Inventory/Current Liabilities).

End-term Examination –Fall’2022, JGBS Page 6

Analysis of companies one by one:

MRF LTD

The Madras Rubber Factory (often abbreviated as MRF or MRF Tyres) is the

biggest tyre maker in India and operates as an Indian multinational

corporation. Its main office is located in the Indian city of Chennai in the state

of Tamil Nadu. Tires, treads, tubes, conveyor belts, paints, and toys are just a

few of the many rubber items that this firm produces. The MRF Pace

Foundation and the MRF Institute for Driver Development (MIDD) are two of

MRF's charitable initiatives in Chennai. The company’s net working capital,

quick ratio and current ratio are in a very good position; all are above the

margin of standards.

VISHNU CHEMICALS:

Sodium dichromate, potassium dichromate, basic chromium sulphate, and

yellow sodium sulphate are only a few of the chrome compounds that Vishnu

Chemicals Ltd produces. The firm offers a wide variety of chemicals and

nutritional supplements, such as sodium dichromate dihydrate, basic

chromium sulphate, chromic acid, sodium sulphate, potassium dichromate,

sodium saccharin, menadione, and menadione nicotinamide bisulfited (44%).

Since the company's liabilities exceeded its assets, its working capital was a

negative 33.97 crores. In subsequent years, the company was able to raise its

working capital, and by the 2021-22 fiscal year, it had 42.70 crores. In

addition to being above the threshold of 1, all of the current ratios for all five

years are also above the threshold of 1, but the quick ratios are all below the

threshold of 1 throughout. It is assumed in these notes that the business is an

"inventory-based" one, meaning that it places a higher priority on stock than

on other forms of liquid assets.

FOCUS LIGHTING & FIXTURE LTD

Focus Lighting and Fixtures Limited manufacture and sells LED lights.

Trading and Manufacturing are Company segments. The Company delivers

retail, office, residential, hospitality, and infrastructure lighting. It offers ALP,

ARRAY, ARRAY PRO, BOOM, DIONE COVE, ELITE, EOS, JOY,

MAGNUS, NEO, NIX, NOVA, PERDU, RAY M, S SPOT, VARIO, and

XTRA-M. Its ALPs are M, L, M, and L. ARRAY PRO 4X SL C T, SL B T,

and P its products. Cabinet lights include TRIO POST, SOLO, ARC SHELF,

and ARC. XTRA M, FLEX M, FX, and MT are its XTRA-M products. The

company uses lighting systems, cabinet lights, pendants, recessed, semi-

recessed, surface, and track. Because the company's working capital, current

ratios, and quick ratios were all positive and above the margin in all the fiscal

years, the company experienced a living with wings during these periods. If

you take a look at the line graphs of the corporation, you'll see that it has the

form of a heartbeat graph. The company is stepping up its status higher

MALU PAPER MILLS:

End-term Examination –Fall’2022, JGBS Page 7

Malu Paper Mills Limited in India is responsible for the production of paper.

The primary activities of the firm are the manufacture of Kraft paper as well as

newsprint. Within the city of Nagpur, which is located in Central India, the

firm has developed three paper mills. As of the 31st of March in 2011, the

capacity for the yearly manufacture of paper by the Company was 19,800

tonnes. For the year that ended on March 31, 2011, Unit I produced

12,085.982 metric tonnes of paper, Unit II produced 19,790.405 metric tonnes

of Kraft paper, Unit III produced 25,245.524 metric tonnes of newspaper and

8,443.757 metric tonnes of writing and printing, and Unit IV produced

8,443.757 metric tonnes of writing and printing. Malu Group's parent firm is

referred to here as Firm. On the basis of what has been seen, the company is in

a precarious situation: the sum of its obligations is more than the value of its

assets, and it has a negative net working capital position. The ratio of

quickening to current is one that is lower than 1. To pay off the company's

debts via the sale of its assets would incur a price that is unfeasibly high. The

company is putting a lot of effort into adjusting by broadening its asset base,

but at the same time, its liabilities are rising. It is obvious that the majority of

their debt is being used to keep the shelves stocked throughout the last five

years, and it is also possible that the earnings are not being used toward

repaying their obligations. Either way, it is evident that the majority of their

debt is being used.

MARUTI SUZUKI INDIA:

The primary focuses of Maruti Suzuki India Limited's (MSIL) business

activities are the production of vehicles, the acquisition of automobiles, and

the retail sale of automotive parts and accessories (automobiles). The

Company's other primary areas of activity are the selling of pre-owned

automobiles, the management of fleets, and automobile financing. The

business provides customers with a wide range of services, including

financing, insurance, authentic accessories and parts, a driving school, and an

auto card. The business's current ratio and quick ratio are both lower than 1,

and the company has a negative working capital. For the fiscal years 2018

through 2020, the company has a negative working capital balance of more

than one thousand crore rupees. During the fiscal year 2021, the net working

capital (NWC) of the corporation was in the green by 2420 crores, but by the

following year, it had fallen back into the red. Despite the fact that the

company's net assets are growing (assets minus inventory), the stock continues

to "go up some days and down other days."

End-term Examination –Fall’2022, JGBS Page 8

You might also like

- II. The Two-Stage FCFE ModelDocument7 pagesII. The Two-Stage FCFE ModelzZl3Ul2NNINGZzNo ratings yet

- FCFE and FCFF Model SessionDocument25 pagesFCFE and FCFF Model SessionABHIJEET BHUNIA MBA 2021-23 (Delhi)No ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Addl Notes - FCFF Model PDFDocument17 pagesAddl Notes - FCFF Model PDFRoyLadiasanNo ratings yet

- Two-Stage FCFF Discount ModelDocument15 pagesTwo-Stage FCFF Discount ModelCarl HsiehNo ratings yet

- FCFF 2 STDocument15 pagesFCFF 2 STSandeep ChowdhuryNo ratings yet

- Ankush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileDocument8 pagesAnkush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileAnkush GuptaNo ratings yet

- Answer Scheme Group Assignment 1Document8 pagesAnswer Scheme Group Assignment 1NurulAdibahNo ratings yet

- Principles of Corporate ValuationDocument14 pagesPrinciples of Corporate ValuationSubhrodeep DasNo ratings yet

- Model PaperDocument19 pagesModel PaperInovacia CraftsNo ratings yet

- Internal Test 4 - CaseDocument8 pagesInternal Test 4 - CasePranita Ghodpage0% (16)

- CV Midterm Exam 1 - Solution GuideDocument11 pagesCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- Corporate Finance: by Shubha GaneshDocument63 pagesCorporate Finance: by Shubha Ganeshdeepikachandru24No ratings yet

- Internal Test 4 CaseDocument14 pagesInternal Test 4 Casefazil shariffNo ratings yet

- COMM 324 A4 SolutionsDocument6 pagesCOMM 324 A4 SolutionsdorianNo ratings yet

- Concept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book ValuesDocument41 pagesConcept Questions: Chapter Five Accrual Accounting and Valuation: Pricing Book Valuesamina_alsayegh50% (2)

- Quiz 1 Practice ProblemsDocument8 pagesQuiz 1 Practice ProblemsUmaid FaisalNo ratings yet

- FCFF 2 STDocument24 pagesFCFF 2 STapi-3701114No ratings yet

- Treasury Management: Capital Structure and Company ValuationDocument47 pagesTreasury Management: Capital Structure and Company ValuationSyed Saad ManzoorNo ratings yet

- Financial Management AssignmentDocument16 pagesFinancial Management AssignmentNishant goyalNo ratings yet

- Capital Budgeting April2021Document28 pagesCapital Budgeting April2021MikhailNo ratings yet

- Chapter No.06 Company Analysis and Stock ValuationDocument40 pagesChapter No.06 Company Analysis and Stock ValuationBlue StoneNo ratings yet

- SEx 5Document44 pagesSEx 5Amir Madani100% (3)

- Session 9 and 10 M&a PGDM 2023Document22 pagesSession 9 and 10 M&a PGDM 2023ArchismanNo ratings yet

- 0.2 Investment Appraisal Part 2Document28 pages0.2 Investment Appraisal Part 2সৈকত হাবীবNo ratings yet

- Practice SetDocument10 pagesPractice Setkaeya alberichNo ratings yet

- DCF FCFF ValuationDocument0 pagesDCF FCFF ValuationSneha SatyamoorthyNo ratings yet

- Quickfix's financial analysisDocument8 pagesQuickfix's financial analysisCheveem Grace EmnaceNo ratings yet

- Accrual Accounting and ValuationDocument49 pagesAccrual Accounting and ValuationSonyaTanSiYing100% (1)

- Free Cash Flow and Its UsesDocument22 pagesFree Cash Flow and Its UsesAnand Deshpande67% (3)

- Cash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationDocument32 pagesCash Accounting, Accrual Accounting, and Discounted Cash Flow ValuationHanh Mai TranNo ratings yet

- Module 3 - Going Concern Asset Based Valuation - DCFDocument5 pagesModule 3 - Going Concern Asset Based Valuation - DCFLiaNo ratings yet

- Advanced Financial Management May 2017 Past Paper and Suggested Answers ViujprDocument19 pagesAdvanced Financial Management May 2017 Past Paper and Suggested Answers ViujprkaragujsNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- DCFDocument37 pagesDCFPiyush SharmaNo ratings yet

- Discounted Cash FlowDocument12 pagesDiscounted Cash FlowViv BhagatNo ratings yet

- AFM AssignmentDocument12 pagesAFM AssignmentRahul SttudNo ratings yet

- Management Control Systems: University Question - AnswersDocument19 pagesManagement Control Systems: University Question - AnswersvaishalikatkadeNo ratings yet

- Investment Appraisal Relevant Cash Flows AnswersDocument8 pagesInvestment Appraisal Relevant Cash Flows AnswersdoannamphuocNo ratings yet

- Two-Stage FCFE Model ValuationDocument14 pagesTwo-Stage FCFE Model ValuationAnkita HandaNo ratings yet

- Analyzing Growth and Sustainable EarningsDocument64 pagesAnalyzing Growth and Sustainable EarningsDeron Lai100% (1)

- Finman - Ytm & Stock ValuationDocument5 pagesFinman - Ytm & Stock ValuationnettenolascoNo ratings yet

- Startup Valuation Guide: September 2018Document42 pagesStartup Valuation Guide: September 2018adsadNo ratings yet

- Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocument56 pagesFull-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- Term Paper - Accounting and FinanceDocument3 pagesTerm Paper - Accounting and FinanceJayNo ratings yet

- Feasibility Study ReportDocument41 pagesFeasibility Study ReportGail IbayNo ratings yet

- ATOMAT1Document16 pagesATOMAT1Akshita ChordiaNo ratings yet

- Chap 4 - Other DCF ModelsDocument35 pagesChap 4 - Other DCF Modelsrafat.jalladNo ratings yet

- ITS - Global Cost of Capital Case Study SolutionDocument8 pagesITS - Global Cost of Capital Case Study Solutionalka murarka100% (3)

- Higrowth Company ValuationDocument33 pagesHigrowth Company ValuationAttabik AwanNo ratings yet

- FM FormulasDocument13 pagesFM Formulassudhir.kochhar3530No ratings yet

- Undervalue (DCF)Document32 pagesUndervalue (DCF)dav3sworldNo ratings yet

- Analyzing Investment Projects with Discounted Cash FlowDocument28 pagesAnalyzing Investment Projects with Discounted Cash FlowJim Briggs100% (1)

- Set 4. Details For FCFE Model - TaggedDocument15 pagesSet 4. Details For FCFE Model - TaggedAryan SholapureNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Cost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelFrom EverandCost Reduction Strategies for the Manufacturing Sector With Application of Microsoft ExcelNo ratings yet

- Financial Management and ValuationDocument2 pagesFinancial Management and ValuationAnkush GuptaNo ratings yet

- Financial Management and ValuationDocument2 pagesFinancial Management and ValuationAnkush GuptaNo ratings yet

- Sweedal Andrandes - Capital Markets - GADocument14 pagesSweedal Andrandes - Capital Markets - GAAnkush GuptaNo ratings yet

- PortfolioDocument7 pagesPortfolioAnkush GuptaNo ratings yet

- Sectorwise Distribution in The PortfolioDocument15 pagesSectorwise Distribution in The PortfolioAnkush GuptaNo ratings yet

- Internship Report of BankDocument41 pagesInternship Report of BankHusnain AwanNo ratings yet

- Abuscom Final Output 4Document3 pagesAbuscom Final Output 4Mac b IBANEZNo ratings yet

- Full Download Financial Accounting 17th Edition Williams Test BankDocument35 pagesFull Download Financial Accounting 17th Edition Williams Test Bankmcalljenaevippro100% (43)

- Financial Statement PreparationDocument9 pagesFinancial Statement PreparationDELFIN, LORENA D.No ratings yet

- Test Bank For Financial Statement Analysis 10th Edition K R SubramanyamDocument26 pagesTest Bank For Financial Statement Analysis 10th Edition K R Subramanyamagnesgrainneo30No ratings yet

- WhiteMonk HEG Equity Research ReportDocument15 pagesWhiteMonk HEG Equity Research ReportGirish Ramachandra100% (1)

- Tim Muller - Healthcare Deal Maker 2023Document3 pagesTim Muller - Healthcare Deal Maker 2023Timothee MullerNo ratings yet

- Abba 2020Document234 pagesAbba 2020Mohamad Bagus SetiawanNo ratings yet

- Cash and Cash EquivalentsDocument33 pagesCash and Cash EquivalentsMerry Julianne DaymielNo ratings yet

- ROCKWOOL Q1 2020 report highlights solid results despite COVID-19 impactDocument13 pagesROCKWOOL Q1 2020 report highlights solid results despite COVID-19 impactvikasaggarwal01No ratings yet

- CA Inter Gr-1 Accounting E-BookDocument200 pagesCA Inter Gr-1 Accounting E-BookShubham KuberkarNo ratings yet

- Term Sheet Negotiations For Trendsetter IncDocument24 pagesTerm Sheet Negotiations For Trendsetter Inc53570076100% (4)

- Kelompok 2 Chapter 6Document12 pagesKelompok 2 Chapter 6ZEN AMALIANo ratings yet

- BilledStatements 7979 27-02-24 22.58Document2 pagesBilledStatements 7979 27-02-24 22.58jagadeshpandu16No ratings yet

- Final Examination Questions Cover Financial, Treasury and Forex ManagementDocument5 pagesFinal Examination Questions Cover Financial, Treasury and Forex ManagementKaran NewatiaNo ratings yet

- Cost Accounting ExamDocument29 pagesCost Accounting ExamErina AusriaNo ratings yet

- Loan Loss Provisions: Rada Eramina, Ni Ketut MuliasariDocument9 pagesLoan Loss Provisions: Rada Eramina, Ni Ketut Muliasarirada eraminaNo ratings yet

- Centurion Foundation Form 990Document16 pagesCenturion Foundation Form 990Rob PortNo ratings yet

- Financial Performance Analysis of Selected Mutual FundsDocument8 pagesFinancial Performance Analysis of Selected Mutual FundsSurya SNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument12 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Module 8 - Inventory EstimationDocument10 pagesModule 8 - Inventory Estimationmarvy AndayaNo ratings yet

- Consolidated Balance Sheet Consolidated Cash Flow Statement: Monday April 1, 2019Document6 pagesConsolidated Balance Sheet Consolidated Cash Flow Statement: Monday April 1, 2019Ekushey TelevisionNo ratings yet

- Fundamentals of Accounting - Issue, Forfeiture and Re-issue of SharesDocument37 pagesFundamentals of Accounting - Issue, Forfeiture and Re-issue of SharesRkenterpriseNo ratings yet

- 11 Standard CostingDocument30 pages11 Standard CostingLalan JaiswalNo ratings yet

- Barwa Real Estate Balance Sheet Particulars Note NoDocument28 pagesBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNo ratings yet

- Audit of LiabilitiesDocument12 pagesAudit of LiabilitiesAcier KozukiNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportZelalem RegasaNo ratings yet

- Fa2 Ch-1 Inventory. Special Valeation FDocument60 pagesFa2 Ch-1 Inventory. Special Valeation FTsi AwekeNo ratings yet

- Hy 2019 Results and Business Update: Presentation For Investors, Analysts & Media Zurich, 22 July 2019Document34 pagesHy 2019 Results and Business Update: Presentation For Investors, Analysts & Media Zurich, 22 July 2019Priyesh DoshiNo ratings yet

- Lesson 19 - Preparation of Capital Statement and Balance SheetDocument6 pagesLesson 19 - Preparation of Capital Statement and Balance SheetMayeng MonayNo ratings yet