Professional Documents

Culture Documents

Measuring and Improving Internal Business Processes Answer To End of Chapter Exercises

Uploaded by

Jay BrockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Measuring and Improving Internal Business Processes Answer To End of Chapter Exercises

Uploaded by

Jay BrockCopyright:

Available Formats

1

Chapter 22

Measuring and Improving Internal Business Processes

Answer to End of Chapter Exercises

Q 22.1

A B

selling price 37 39

variable cost 15 12

contribution 22 27

Time required A B

units 100 60

time per unit process 1 15 20

time per unit process 2 15 10

Total hours

Total time process 1 (hours) 25 20 45

Total time process 2 (hours) 25 10 35

Time available is 40 hours so there is a constraint on process 1 but not on process 2.

i) Variable and full cost and profit per unit of each product:

A B

Selling price per unit 37.0 39.0

Variable cost 15.0 12.0

Full cost* 19.5 19.5

Total cost per unit 34.5 31.5

Profit per unit 2.5 7.5

* Labour cost of each process is 360 hours for a 40 hour shift = 9 an hour. The overhead is 30 per hour and so

total overheads are 39 per hour. Since each product requires 30 minutes processing the overhead cost per unit is

19.50

ii) Based on profit per unit, product B would be manufactured first, followed by product A.

The constraint process is process 1.

Time in

process 1

Product units (hours) Cumulative time

B 60 20 20

A 80 20 40

60 units of product B would be manufactured plus 80 units of product A.

iii) The optimum production plan will be based on maximising the contribution per limiting factor

A B

Selling price per unit 37 39

Variable cost 15 12

Contribution per unit 22 27

time in constraint area (process 1) 15 mins 20 mins

Contribution per hour in process 1 88 81

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

2

ii) Based on contribution per limiting factor, product A would be manufactured first, followed by product B.

The constraint process is process 1.

Product units time Cumulative time

A 100 25 20

B 45 15 40

Profit at this volume of activity

A B Total

Selling price per unit 37 39

Variable cost 15 12

Contribution per unit 22 27

Number of units sold 100 45

Contribution 2200 1215 3415

Total labour cost 720

Overhead (30 per hour for 80 hours) 2400

Profit 295

iv) The organisation might consider ways of eliminating the constraint on process 1. Since it is not possible

to manufacture sufficient units of product B, there is a lost contribution of 27 per unit or 81 an hour.

Method of increasing throughput through process 1 should be investigated or additional hours should be

worked in process 1.

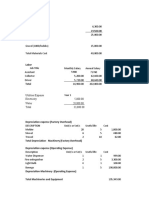

Q 22.2

Traditional system 3 = 13.8%

3 + .67+ 2 + 16

2 = 26.3%

JIT system 2 + .1 + .5 + 5

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

3

Q 22.3

20X6 20X7

Prevention '000 '000 % '000 '000 %

Employee training 100 120

Preventative maintenance 80 70

Quality circles 100 120

Sub-total 280 6.5% 310 6.9%

Appraisal

Inspecting raw materials 80 70

inspecting w-i-p

inspecting finished goods 70 90

Field testing 90 80

sub-total 240 5.6% 240 5.3%

Internal failure

Scrap cost 100 120

Rework

Lost time 80 75

Disposal costs 130 90

Sub-total 310 7.2% 285 6.3%

External failure

Product recall

Warranty 180 160

Contribution from lost sales

180 4.2% 160 3.6%

Total 1010 23.5% 995 22.1%

Sales 4,300 4500

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

4

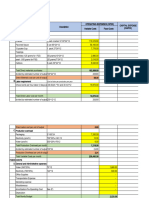

Q 22.4

Cost of quality for Arlington Ltd 2007

'000 '000 %

Prevention

Employee training 200.0

sub-total 200.0 4.0%

Appraisal

Inspecting raw materials 25.0

inspecting w-i-p 87.5

inspecting finished goods 87.5

Field testing 50.0

sub-total 250.0 5.0%

Internal failure

Rework 50.0

Scrap cost 112.5

Sub-total 162.5 3.3%

External failure

Product recall 400

Warranty 100.0

Contribution from lost sales 200.0 700.0 14.0%

Total 1312.5 26.3%

Sales 5,000.0

Workings

50

Selling price per unit 30

Variable cost per unit 20

Contribution per unit

Lost sales (units) 10,000

Lost contribution 200,000

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

5

Q 22.5

i) Product A Product B

Material cost 65.00 35.00 (variable cost in short-term)

labour and overhead 52.08 30.42

Full cost 117.08 65.42

Sales price 130.00 70.00

Profit per unit 12.92 4.58

i) Product A Product B

Sales price 130 70

Material cost 65 35

Throughput 65 35

Time spent on products

Minutes

Time for product A Machining Polishing assembly Total

component X (2 units) 20 40

component Y 15 40

Total for product 35 80 10 = 125 @ 25 per hour = 52.1

Minutes

Time for product B Machining Polishing assembly Total

component Y 15 40

component Z 8 0

Total for product 23 40 10 = 73 mins @ 25 per hour = 30.4

ii) Production plan that maximises profit per product will be the one that maximises throughput (sales minus

material cost).

First it is necessary to identify whether there is a constraint

No of No. of No. of

Units units of X units of Y units of Z

Product A 40 80 40

Product B 30 30 30

Total number of

components 80 70 30

Time required: Minutes Hours

machining 800 1050 240 2090 34.8

polishing 1600 2800 4400 73.3

assembly 700 700 11.7

Maximum hours available is 40 hours so there is a constraint on polishing or assembly time, so

need to maximise throughput per time in polishing.

i) Product A Product B

Sales price 130 70

Material cost 65 35

Throughput 65 35

Time in polishing (minutes) 80 40

Contribution per bottleneck minute 0.8125 0.875

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

6

Therefore the optimum production plant that maximises profits per week will occur if all of product B is first

produced and then as much as possible of product A.

Units Polishing time Time remaining

Product B 30 1200 minutes 1200 minutes

Product A 15 1200 minutes 0

Optimum production plan is 30 units of Product B and 15 units of product A.

iii) This is the optimum production plan given assumptions such as the constraint on time available in the

polishing department of 40 hours.

iv) The theory of constraints indicates a need to continuously the constraints in the system and act to

eliminate these constraints.

Q 22.6

(a) How much of the total costs in 20X/8 is value-added, non-value added, or difficult

to classify on that basis?

Answer -

Value added %

Interviewing clients to identify training requirements for agreed future

courses 10

Delivering courses 25

Writing course material 25

Non value added %

Proof reading and correcting errors found in the course material 10

Filing and general administration 20

Difficult to classify

Research for potential new areas requiring training courses 10

(b) If non-value added time could be reduced by 50% what would be the impact on the

operating profit of the bank?

Answer -

It depends

i) Can the non-value added time be changed into value added time and if so how can this be

valued?

ii) If the reduction is achieved through cost cutting then the saving would be potentially 50% x

30% = 15%. It is not clear what costs could be saved however. Presumably salary costs could be

saved but not it is questionable how much of other costs could be saved. 15% x 250,000 =

37,500.

(c) How has the analysis helped the management of South Stone Bank.

Answer

It clarifies how time is being spent. Some information is likely to be better than none. Questions

could be asked about why 30% of time is spent on filing and general administration; what

research for new areas requiring training courses is taking place; why is 25% of time in writing

courses , are these new courses or rewriting old courses

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

7

Q 22.7 Advise the management of Siegmund Ltd on how they might improve the measurement

and performance of their internal business processes.

Internal business processes will cover innovation processes, operations and post sale service.

Time is also a crucial attribute for Siegmund Ltd and the length of the manufacturing cycle

time is a cause of concern.

Process improvement:

Siegmund may consider the potential use of a number of process improvement approaches:

- TQM; Kaizen costing; Business process re-engineering; changing plant layout to a JIT system

from a batch production system; identifying and eliminating constraints using the theory of

constraints; inter-organisational systems (improving linkages with customers and suppliers).

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- How To Manage Multiple ProjectsDocument4 pagesHow To Manage Multiple ProjectsFariha Saeed100% (1)

- Safety Management PlanDocument66 pagesSafety Management Planlokoru james100% (1)

- Chapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Week 10 - Competency Based Performance Management System - MSDM BK - Kelompok 1Document28 pagesWeek 10 - Competency Based Performance Management System - MSDM BK - Kelompok 1Fitri YaniNo ratings yet

- ISO 19011-2018 Terms and DefinitionsDocument4 pagesISO 19011-2018 Terms and DefinitionsredaNo ratings yet

- Production PlanningDocument4 pagesProduction PlanningShankar ChowdhuryNo ratings yet

- Camelback CommunicationsDocument9 pagesCamelback Communicationsvir1672100% (1)

- Chapter 1 2 Cost Accounting and Control by de Leon 2019Document10 pagesChapter 1 2 Cost Accounting and Control by de Leon 2019Accounting Files50% (2)

- Camelback Cost Management AnalysisDocument23 pagesCamelback Cost Management AnalysisVidya Sagar Ch100% (2)

- Project Management For Environmental, Construction and Manufacturing Engineers PDFDocument257 pagesProject Management For Environmental, Construction and Manufacturing Engineers PDFCarl WilliamsNo ratings yet

- Chapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- WGP Chemical Company Case StudyDocument4 pagesWGP Chemical Company Case StudyFolakemi Lawal56% (16)

- TQM Class NotesDocument12 pagesTQM Class NotesMOHAMMED ALI CHOWDHURY100% (4)

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- Strategic Framework For CRM - Payne and Frow - JM '05 PDFDocument11 pagesStrategic Framework For CRM - Payne and Frow - JM '05 PDFMaria ZakirNo ratings yet

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionDocument21 pagesIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockNo ratings yet

- QuestionsDocument8 pagesQuestionsZavyarNo ratings yet

- Pricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesDocument2 pagesPricing and Costing in A Competitive Environment Answers To End of Chapter ExercisesJay BrockNo ratings yet

- F2.1 Management Accounting - Answ J2022Document20 pagesF2.1 Management Accounting - Answ J2022NKURUNZIZA FrancoisNo ratings yet

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- End Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattDocument14 pagesEnd Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattShivani TannuNo ratings yet

- Cost Accounting Level 3/series 3 2008 (Code 3016)Document18 pagesCost Accounting Level 3/series 3 2008 (Code 3016)Hein Linn Kyaw100% (3)

- Week 4 - Seminar 3 Trimake Solution A) and B) OnlyDocument3 pagesWeek 4 - Seminar 3 Trimake Solution A) and B) Onlychina xiNo ratings yet

- Decision MakingDocument5 pagesDecision Makingconstruction omanNo ratings yet

- Afm 311 A - 2013Document8 pagesAfm 311 A - 2013Dolly VongweNo ratings yet

- CMA Individual Assignment Manu M EPGPKC06054Document6 pagesCMA Individual Assignment Manu M EPGPKC06054CH NAIRNo ratings yet

- Given: March: Quantity ScheduleDocument10 pagesGiven: March: Quantity ScheduleVon Andrei MedinaNo ratings yet

- BACT 302 Activity Based CostingDocument25 pagesBACT 302 Activity Based CostingLetsah BrightNo ratings yet

- Management Accounting - AC2097-2018 Answers To Homework Questions Total: 118 PagesDocument118 pagesManagement Accounting - AC2097-2018 Answers To Homework Questions Total: 118 Pagesduong duong100% (1)

- Costing In-Class ActivitiesDocument10 pagesCosting In-Class ActivitiesTrần NghĩaNo ratings yet

- ABCD Product Mix Example (Part I Data Sheet) : Producton Plan and Gross ProfitDocument5 pagesABCD Product Mix Example (Part I Data Sheet) : Producton Plan and Gross Profitgosaye desalegnNo ratings yet

- SINGH007 Ans Homework Lec 14 To 21Document47 pagesSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiNo ratings yet

- 3acc0809 Introduction To Management Accounting Tutorial 7: (ACCA, F5, BPP)Document2 pages3acc0809 Introduction To Management Accounting Tutorial 7: (ACCA, F5, BPP)Sarah RanduNo ratings yet

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- Multiple Choice: Basadre, Jessa G. Bsa 3 Yr. Managerial Accounting Assignment No. 1Document4 pagesMultiple Choice: Basadre, Jessa G. Bsa 3 Yr. Managerial Accounting Assignment No. 1Jessa BasadreNo ratings yet

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vii (UNIT-V)Document7 pagesSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vii (UNIT-V)Jaya BharneNo ratings yet

- Costing Systems ExercisesDocument10 pagesCosting Systems ExercisesRosele CabañelezNo ratings yet

- Process CostingDocument4 pagesProcess Costingsus meetaNo ratings yet

- Maria 081947Document4 pagesMaria 081947Clay MaaliwNo ratings yet

- Process Costing: Bba-Ii Unit-V by DR - Vikas Sharma Assistant ProfessorDocument31 pagesProcess Costing: Bba-Ii Unit-V by DR - Vikas Sharma Assistant ProfessoranjaliNo ratings yet

- 12914sugg Pe2 gp2 1Document33 pages12914sugg Pe2 gp2 1harshrathore17579No ratings yet

- Assignment - Due 02 April 24Document3 pagesAssignment - Due 02 April 24rnghitewaNo ratings yet

- CCCAC Chapter 3Document10 pagesCCCAC Chapter 3rochelle lagmayNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Homework 1 of AccountingDocument3 pagesHomework 1 of AccountingZulfi AnnurNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Relevant Cost (Seatwork)Document5 pagesRelevant Cost (Seatwork)Gianna KyleneNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- ACC20020 Management - Accounting Exam - 17-18Document13 pagesACC20020 Management - Accounting Exam - 17-18Anonymous qRU8qVNo ratings yet

- Zegu Cac 414 Practice QuestionsDocument9 pagesZegu Cac 414 Practice Questionsloise zvizvaiNo ratings yet

- Full Cost of Product Per Unit 170Document5 pagesFull Cost of Product Per Unit 170Shafaq ZafarNo ratings yet

- VARGAS Homework 1Document10 pagesVARGAS Homework 1Pamela Keith VargasNo ratings yet

- COST 1 Deleon PDFDocument86 pagesCOST 1 Deleon PDFMeeni MeeyNo ratings yet

- Acccob3 HW3Document20 pagesAcccob3 HW3Reshawn Kimi SantosNo ratings yet

- Sabit FSDocument8 pagesSabit FSMilagrosa VillasNo ratings yet

- Best Financial Forecast FinalDocument13 pagesBest Financial Forecast Finalitsmethird.26No ratings yet

- 4 2005 Jun QDocument9 pages4 2005 Jun Qapi-19836745No ratings yet

- Chapter 4-Exercises-Managerial AccountingDocument3 pagesChapter 4-Exercises-Managerial AccountingSheila Mae LiraNo ratings yet

- Acct602 Managerial AccountingDocument8 pagesAcct602 Managerial AccountingHaroon KhurshidNo ratings yet

- MGT Accounting, Intermideiate-SolutionsDocument31 pagesMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZINo ratings yet

- Cases On Activity Based Costing SystemDocument6 pagesCases On Activity Based Costing SystemEnusah PeterNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- Assignment V - Short Run Decision MakingDocument3 pagesAssignment V - Short Run Decision Makinganurag raoNo ratings yet

- General Discussion Absorption Costing Variable Costing: FixedDocument4 pagesGeneral Discussion Absorption Costing Variable Costing: FixedHassan KhanNo ratings yet

- Productivity Measurement and ControlDocument31 pagesProductivity Measurement and ControlAbegail BacolodNo ratings yet

- Chapter 1-3Document21 pagesChapter 1-3Alexsandra GarciaNo ratings yet

- Bab 8 Costing by Product and Joint ProductDocument5 pagesBab 8 Costing by Product and Joint ProductAntonius Sugi Suhartono100% (1)

- Chapters 1 3Document112 pagesChapters 1 3julygg0710No ratings yet

- Poll Question 3 - ABCDocument1 pagePoll Question 3 - ABCMary Ann NatividadNo ratings yet

- Solution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsDocument25 pagesSolution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsJay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document55 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document23 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Chapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Document18 pagesChapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Document32 pagesChapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Control in Divisionalized Organizations Answer To End of Chapter ExercisesDocument6 pagesControl in Divisionalized Organizations Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Document36 pagesChapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Strategy and Control System Design Answer To End of Chapter ExercisesDocument5 pagesStrategy and Control System Design Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesDocument6 pagesPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Internal Appraisal of The Organization Answer To End of Chapter ExercisesDocument5 pagesInternal Appraisal of The Organization Answer To End of Chapter ExercisesJay BrockNo ratings yet

- CH23 PDFDocument5 pagesCH23 PDFJay BrockNo ratings yet

- Budgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesDocument2 pagesBudgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Funding The Business Answer To End of Chapter ExercisesDocument2 pagesFunding The Business Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Accounting and Strategic Analysis Answer To End of Chapter ExercisesDocument6 pagesAccounting and Strategic Analysis Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDDocument7 pagesIdentifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDJay BrockNo ratings yet

- Traditional Approaches To Full Costing Answers To End of Chapter ExercisesDocument4 pagesTraditional Approaches To Full Costing Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Standard Costing and Manufacturing Methods Answer To End of Chapter ExercisesDocument5 pagesStandard Costing and Manufacturing Methods Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesDocument4 pagesStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Budgetary Control Systems Answer To End of Chapter ExercisesDocument3 pagesBudgetary Control Systems Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Further Decision-Making Problems Answers To End of Chapter ExercisesDocument6 pagesFurther Decision-Making Problems Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- Case On: Building Customer Satisfaction, Value, and RetentionDocument23 pagesCase On: Building Customer Satisfaction, Value, and RetentionShimekit LegeseNo ratings yet

- Auto PO and ERSDocument14 pagesAuto PO and ERSVaraprasad ReddyNo ratings yet

- IT-210 Final Project TemplateDocument10 pagesIT-210 Final Project Templatemalaysiastuart0% (2)

- IBA Company Profile BirdnestDocument7 pagesIBA Company Profile BirdnestQc BPSNo ratings yet

- Green HRMDocument7 pagesGreen HRMpdaagarwal100% (1)

- 102 Strategy: Case Discussion NotesDocument3 pages102 Strategy: Case Discussion NotesYashrajsing LuckkanaNo ratings yet

- Executive Director: Job DescriptionDocument2 pagesExecutive Director: Job DescriptionjanahiramNo ratings yet

- LBSIM PPT 2julyDocument15 pagesLBSIM PPT 2julySaurabh PrabhakarNo ratings yet

- HatilDocument29 pagesHatilmd. nazmul100% (1)

- Gearing Up For A Pharmacovigilance Audit Using A Risk Based ApproachDocument2 pagesGearing Up For A Pharmacovigilance Audit Using A Risk Based ApproachVijay Venkatraman Janarthanan100% (1)

- ICFAI Competitive Strategy - Discussion Topic 2Document2 pagesICFAI Competitive Strategy - Discussion Topic 2Venku BabuNo ratings yet

- Chemistry PDFDocument25 pagesChemistry PDFVictor CantuárioNo ratings yet

- M1Topic2 The Role of The Project Manager NEWDocument10 pagesM1Topic2 The Role of The Project Manager NEWMelisa May Ocampo AmpiloquioNo ratings yet

- Chapter One Operation Management Designs, Operates, and Improves Productive Systems-Systems ForDocument12 pagesChapter One Operation Management Designs, Operates, and Improves Productive Systems-Systems ForwubeNo ratings yet

- CV SakhawatDocument3 pagesCV SakhawatHossain SakhawatNo ratings yet

- 'NEXtCARE Corporate Profile 4Document1 page'NEXtCARE Corporate Profile 4Rajesh PotluriNo ratings yet

- Management Development: A Strategic Initiative: by Lin Grensing-PophalDocument4 pagesManagement Development: A Strategic Initiative: by Lin Grensing-PophalharshnikaNo ratings yet

- Faculty of Higher Education: This Cover Sheet Must Be Submitted With Your AssignmentDocument7 pagesFaculty of Higher Education: This Cover Sheet Must Be Submitted With Your AssignmentDivya JoshiNo ratings yet

- Mis - QuizDocument7 pagesMis - Quizalpanagupta22No ratings yet

- Final PaperDocument2 pagesFinal Paperliu920619No ratings yet

- Club Sixty Ninth Summarized Business PlanDocument4 pagesClub Sixty Ninth Summarized Business PlanJohn Michael PascuaNo ratings yet