Professional Documents

Culture Documents

General Discussion Absorption Costing Variable Costing: Fixed

Uploaded by

Hassan KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Discussion Absorption Costing Variable Costing: Fixed

Uploaded by

Hassan KhanCopyright:

Available Formats

13/6/20 Product Cost Period Cost

General Discussion

Absorption Costing Variable Costing Variable Costing

Direct Matrerial Marginal Costing

Direct Labour Direct Costing

Product Cost Manufacturing OverhProduct Cost EPS

Variable RS.5 / shar

Fixed Suppose there is 60% Pay

Selling expenses Period Cost How much they are gonn

Period Cost Administrative expenses Rs.3 / share

In absorption costing the cost of ending inventory is deffereed to the next period

Current ratio preferered is 2:1

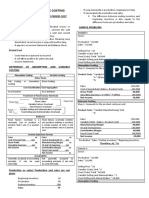

Question: There were 20,000 units produced and 18,000 units were sold. The following cost was incurred. Each unit was s

Rs. / unit

Direct mate 150 Required: 1. Calcuate the total per unit Product cost by using

Direct labo 90 i. Absorption Costing Rs.295

FOH ii. Variable Costing

Variab 30 2. Calcuate the total per unit Period cost by using

Selling & 15 3. Prepare an Income statement by Absorption and Variable costing

Fixed expenses ANSWER: Calculation of Product Cost

ManufactuRs.500,000 AbsorptionVariable Costing

Selling & Rs. 350,000 Direct Mate 150 150

DL 90 90

FOH

Varia 30 30

Fixed 25 -----------

295 270

Period Cost per Unit AbsorptionVariable

Manufacturing O/H 25

Sellling & Admin Expenses

Variable 15 15

Fixed 19.5 19.5

34.5 59.5

3 ABC Company

Income statement _ Absorption Costing

For the period ended …………

Sales 18,000 * 400 7,200,000

Less: Cost of goods Sold

Beginning Inventory 0

Add: Cost of goo 20,000 * 2 5,900,000

Cost of goods availabl5,900,000

less: Ending Inv 2,000 * 29 590,000

Cost of goods sold 5,310,000

Gross Margin 1,890,000

Less: Selling & Administartive expenses

Vasriable 18,000 * 1 270,000

Fixed 350,000

Total expense 620,000

Net profit 1,270,000

ABC Company

Income statement _ VContribution Format

For the period ended …………

Sales 18,000 * 400 7,200,000 Manufacturing concern

Less: All variable expenses Non-manufacturing or merchandisin

Variable Cost of goods sold Service organizartions

Beginning Inventory 0

Add:Cost of goods ma20,000 * 2 5,400,000 50,000

Cost of goods avail. For use 5,400,000

Les: Ending Inventory2,000 * 27 540,000

Cost of goods s 4,860,000 If Ending inventory * F/M

Add: Variable Selling 18,000 * 1 270,000 2,000 * Rs.25

Total variable expense 5,130,000 Rs.50,000

Contribution Margin 2,070,000

Less: Fixed expense

Manufacturing 500,000

Selling & Admin. 350,000

Total Fixed expense 850,000

Net profit 1,220,000

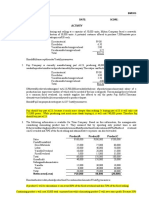

General Discussion

Variable Costing

Marginal Costing

Direct Costing

Net Income / TCSO

Divided and Retained earning

Suppose there is 60% Payout ratio

How much they are gonna paid as dividend

Rs.3 / share

s incurred. Each unit was sold for Rs.400. it's a merchandising concern.

ption and Variable costing methods.

uring concern

ufacturing or merchandising

ganizartions

Reconciliation

If Ending inventory * F/M/O/H/Unit

2,000 * Rs.25

You might also like

- Information For Decision MakingDocument33 pagesInformation For Decision Makingwambualucas74No ratings yet

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- Calculating full product cost and profit under absorption and variable costingDocument49 pagesCalculating full product cost and profit under absorption and variable costingrajeshaisdu009No ratings yet

- Variable Costing ConceptsDocument10 pagesVariable Costing Conceptsrodell pabloNo ratings yet

- Managerial Accounting Chapter 8 & 9 SolutionsDocument8 pagesManagerial Accounting Chapter 8 & 9 SolutionsJotham NyanjeNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Niti MarginalDocument19 pagesNiti MarginalNitichandra IngleNo ratings yet

- Absorption Costing For STDocument6 pagesAbsorption Costing For STDEREJENo ratings yet

- Absorption Costing vs. Variable CostinggDocument11 pagesAbsorption Costing vs. Variable CostinggGwyneth Ü ElipanioNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing Decisionschintan desaiNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- Week 2 - One Direction SolutionDocument2 pagesWeek 2 - One Direction SolutionrahimNo ratings yet

- Variable costing key conceptsDocument21 pagesVariable costing key conceptsMary Rose GonzalesNo ratings yet

- Session Objectives:: Methods of Costing?Document15 pagesSession Objectives:: Methods of Costing?Sachin YadavNo ratings yet

- 1G CVP ANALYSIS EXCEL SCDocument49 pages1G CVP ANALYSIS EXCEL SCAlmirah H. AliNo ratings yet

- Costing Systems - Lessons ExamplesDocument15 pagesCosting Systems - Lessons ExamplesNicolasNo ratings yet

- Responsibility Accounting P-3Document3 pagesResponsibility Accounting P-3Ferb CruzadaNo ratings yet

- Variable vs. Absorption CostingDocument21 pagesVariable vs. Absorption Costingsgulay117No ratings yet

- Module 5 AssignmentDocument5 pagesModule 5 AssignmentMayNo ratings yet

- Problem Unit 4Document7 pagesProblem Unit 4meenasaratha100% (1)

- Marginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5Document5 pagesMarginal Costing .. Feb 2020: Q. 1 Denton Company (Rupees in '000') 20x4 20x5신두No ratings yet

- Marginal and Absorption CostingDocument15 pagesMarginal and Absorption CostingCollins AbereNo ratings yet

- ABSORPTION VS VARIABLE COSTINGDocument3 pagesABSORPTION VS VARIABLE COSTINGDhona Mae FidelNo ratings yet

- Variable and Absorption CostingDocument21 pagesVariable and Absorption Costingbrabz rayNo ratings yet

- Basic Cost Accounting DefinitionsDocument8 pagesBasic Cost Accounting Definitionsbritonkariuki97No ratings yet

- BFD Class NotesDocument20 pagesBFD Class NotesAnas KhanNo ratings yet

- Chapter 2 Marginal CostingDocument21 pagesChapter 2 Marginal CostingLan Nhi NguyenNo ratings yet

- Week 67 and 9 Absorption Costing Vs Marginal Costing Costing MethodDocument31 pagesWeek 67 and 9 Absorption Costing Vs Marginal Costing Costing MethodMai LyNo ratings yet

- 107-W7-8-Variable cost-chp05-STDocument48 pages107-W7-8-Variable cost-chp05-STmargaret mariaNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- Week 3 Absorption VariableDocument21 pagesWeek 3 Absorption VariableHallie KuronumaNo ratings yet

- Break Even Point Fixed Cost/ Contribution Per UnitDocument11 pagesBreak Even Point Fixed Cost/ Contribution Per UnitKushagra VarmaNo ratings yet

- Lecture 5Document39 pagesLecture 5Shixi ZhuNo ratings yet

- Variable and Absorption Costing Problems Without SolutionsDocument4 pagesVariable and Absorption Costing Problems Without SolutionsMeca CorpuzNo ratings yet

- Marginal Costing and Absorption Costing ComparedDocument32 pagesMarginal Costing and Absorption Costing Compareddunks metaNo ratings yet

- Marginal Costing PDFDocument16 pagesMarginal Costing PDFaditiNo ratings yet

- Absorption Costing vs. Variable Costing GDocument11 pagesAbsorption Costing vs. Variable Costing GYamaapNo ratings yet

- Exercises Absorption and Variable CostingPAUL ANTHONY DE JESUSDocument4 pagesExercises Absorption and Variable CostingPAUL ANTHONY DE JESUSMeng DanNo ratings yet

- Chapter 2 and 3 Standard Costing & Fundamentals of Variance AnalysisDocument23 pagesChapter 2 and 3 Standard Costing & Fundamentals of Variance AnalysisFidelina CastroNo ratings yet

- Tutorial 4 SolutionsDocument14 pagesTutorial 4 Solutionss11186706No ratings yet

- Variable Costing Tool for ManagementDocument33 pagesVariable Costing Tool for Management1793 Taherul IslamNo ratings yet

- Week 5 Tutorial Solutions for Unit 4 Costing MethodsDocument10 pagesWeek 5 Tutorial Solutions for Unit 4 Costing MethodsSheenam SinghNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Calculating Average Inventory, Payables and Receivables PeriodsDocument10 pagesCalculating Average Inventory, Payables and Receivables PeriodssajedulNo ratings yet

- Acccob3 HW2Document24 pagesAcccob3 HW2Reshawn Kimi SantosNo ratings yet

- Flexible Budgets Provide Better Performance MeasurementDocument27 pagesFlexible Budgets Provide Better Performance Measurementsolomon adamuNo ratings yet

- Aa025 Tutorial Answer Topic 7 AcmcDocument28 pagesAa025 Tutorial Answer Topic 7 Acmccjeipin123No ratings yet

- Differential Costing Practice Exercises (Part 2Document2 pagesDifferential Costing Practice Exercises (Part 2Jan Christopher CabadingNo ratings yet

- Segment Reporting and Performance EvaluationDocument23 pagesSegment Reporting and Performance EvaluationiqbalrzzNo ratings yet

- Manufacturing Account NotesDocument7 pagesManufacturing Account Notesdayna davisNo ratings yet

- Accounting Act6Document2 pagesAccounting Act6Eren YeagerNo ratings yet

- Absorption and Variable CostingDocument5 pagesAbsorption and Variable CostingKIM RAGANo ratings yet

- UntitledDocument15 pagesUntitledPawan Ramesh PadhyeNo ratings yet

- Solved Prblem of Budget PDFDocument9 pagesSolved Prblem of Budget PDFSweta PandeyNo ratings yet

- Calculating Break-Even Point and Profits for Variable CostsDocument9 pagesCalculating Break-Even Point and Profits for Variable CostsSweta PandeyNo ratings yet

- CAMELBACK COMMUNICATIONS REVAMPS COSTING SYSTEMDocument23 pagesCAMELBACK COMMUNICATIONS REVAMPS COSTING SYSTEMVidya Sagar Ch100% (2)

- Variable & Absorption Costing LectureDocument11 pagesVariable & Absorption Costing LectureElisha Dhowry PascualNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- 13-8-20 Season 10Document4 pages13-8-20 Season 10Hassan KhanNo ratings yet

- 27-6-20 Season 5Document6 pages27-6-20 Season 5Hassan KhanNo ratings yet

- 30-05-20, Session 1Document2 pages30-05-20, Session 1Hassan KhanNo ratings yet

- 18-7-20 Season 8Document9 pages18-7-20 Season 8Hassan KhanNo ratings yet

- Class Timings: Thursday at 8pm OnwardsDocument2 pagesClass Timings: Thursday at 8pm OnwardsHassan KhanNo ratings yet

- Relevent Cost / Factors For Decision MakingDocument4 pagesRelevent Cost / Factors For Decision MakingHassan KhanNo ratings yet

- Class Timings: Thursday at 8pm OnwardsDocument2 pagesClass Timings: Thursday at 8pm OnwardsHassan KhanNo ratings yet

- 8-8-20 Season 9Document4 pages8-8-20 Season 9Hassan KhanNo ratings yet

- Special Orders: Decision: To Accept or Reject This OfferDocument2 pagesSpecial Orders: Decision: To Accept or Reject This OfferHassan KhanNo ratings yet

- 6-6-20, Session 2Document5 pages6-6-20, Session 2Hassan KhanNo ratings yet

- 13-8-20 Season 10Document4 pages13-8-20 Season 10Hassan KhanNo ratings yet

- 8-8-20 Season 9Document4 pages8-8-20 Season 9Hassan KhanNo ratings yet

- General Discussion Absorption Costing Variable Costing: FixedDocument4 pagesGeneral Discussion Absorption Costing Variable Costing: FixedHassan KhanNo ratings yet

- 27-6-20 Season 5Document6 pages27-6-20 Season 5Hassan KhanNo ratings yet

- 18-7-20 Season 8Document9 pages18-7-20 Season 8Hassan KhanNo ratings yet

- Relevent Cost / Factors For Decision MakingDocument4 pagesRelevent Cost / Factors For Decision MakingHassan KhanNo ratings yet

- WhatsApp Worksheet NODocument1 pageWhatsApp Worksheet NOHassan KhanNo ratings yet

- 30-05-20, Session 1Document2 pages30-05-20, Session 1Hassan KhanNo ratings yet

- 6-6-20, Session 2Document5 pages6-6-20, Session 2Hassan KhanNo ratings yet

- Intermediate 24 Feb AssignmentDocument2 pagesIntermediate 24 Feb AssignmentHassan KhanNo ratings yet

- Special Orders: Decision: To Accept or Reject This OfferDocument2 pagesSpecial Orders: Decision: To Accept or Reject This OfferHassan KhanNo ratings yet

- WhatsApp Worksheet N1Document1 pageWhatsApp Worksheet N1Hassan KhanNo ratings yet

- How To Say Dates in Chinese: Class AssignmentDocument2 pagesHow To Say Dates in Chinese: Class AssignmentHassan KhanNo ratings yet

- Assignment No 04Document1 pageAssignment No 04Hassan KhanNo ratings yet

- Assignment 2 Months and NumbersDocument1 pageAssignment 2 Months and NumbersHassan KhanNo ratings yet

- Intermediate Chinese - Assignment ConverseDocument2 pagesIntermediate Chinese - Assignment ConverseHassan KhanNo ratings yet

- Assignment 1 CDocument7 pagesAssignment 1 CHassan KhanNo ratings yet

- Assignment 6 VRDocument1 pageAssignment 6 VRHassan KhanNo ratings yet

- AssignementDocument1 pageAssignementHassan KhanNo ratings yet

- House RentDocument4 pagesHouse RentMayurNo ratings yet

- Commercial Bank Account Details For Diamer Bhasha Dam FundDocument1 pageCommercial Bank Account Details For Diamer Bhasha Dam FundTouqeer AslamNo ratings yet

- Evidencia 3Document4 pagesEvidencia 3Yuri KatherineNo ratings yet

- Talent & Performance ManagementDocument2 pagesTalent & Performance Managementdr.svr13No ratings yet

- Complaint (Final)Document31 pagesComplaint (Final)Kirk Yngwie EnriquezNo ratings yet

- Zudio Marketing PlanDocument2 pagesZudio Marketing PlanAmir KhanNo ratings yet

- Final Reaserch-3Document52 pagesFinal Reaserch-3Dereje BelayNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Curriculum VitaeDocument2 pagesCurriculum Vitaeapi-628389548No ratings yet

- Batangas State University Managerial Economics Article Site Author Date PublishedDocument3 pagesBatangas State University Managerial Economics Article Site Author Date PublishedBen TorejaNo ratings yet

- ISO CERTIFIED COMPANYDocument8 pagesISO CERTIFIED COMPANYGaurav RaghuvanshiNo ratings yet

- FISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Document18 pagesFISIP UNJANI Gambar Arsitektur Pengembangan Desain Bagian 2Harlanrizki PraoktaNo ratings yet

- MANGILIMAN, Neil Francel Domingo (Sep 28)Document8 pagesMANGILIMAN, Neil Francel Domingo (Sep 28)Neil Francel D. MangilimanNo ratings yet

- GOPRO Written Case DraftDocument3 pagesGOPRO Written Case DraftBritney BissambharNo ratings yet

- High Low MethodDocument4 pagesHigh Low MethodSamreen LodhiNo ratings yet

- Módulo 22: Pasivos y Patrimonio: Fundación IFRS: Material de Formación Sobre LaDocument64 pagesMódulo 22: Pasivos y Patrimonio: Fundación IFRS: Material de Formación Sobre LaDAYANA ANDREA DAMS MOLINANo ratings yet

- Iqcm 2019 PDFDocument151 pagesIqcm 2019 PDFshivam johri100% (1)

- Response To Child Support Modification and Retroactive Pay.Document7 pagesResponse To Child Support Modification and Retroactive Pay.Lindsay OlahNo ratings yet

- Agency: Classification of Agents On The Basis of Authority On The Basis of Nature of WorkDocument8 pagesAgency: Classification of Agents On The Basis of Authority On The Basis of Nature of WorkATBNo ratings yet

- Accomplishment Report. KrizDocument7 pagesAccomplishment Report. KrizHazel Seguerra BicadaNo ratings yet

- Trade AgreementDocument6 pagesTrade AgreementFRANCIS EDWIN MOJADONo ratings yet

- ELSS Investment ReceiptDocument6 pagesELSS Investment ReceiptKaran MitrooNo ratings yet

- Parfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandDocument21 pagesParfums Cacharel de L'Oréal 1997-2007:: Decoding and Revitalizing A Classic BrandrheaNo ratings yet

- Empowering Others Through DelegationDocument8 pagesEmpowering Others Through DelegationMonique LasolaNo ratings yet

- NPTEL Assign 3 Jan23 Behavioral and Personal FinanceDocument5 pagesNPTEL Assign 3 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Cir VS Transitions OpticalDocument2 pagesCir VS Transitions OpticalDaLe AparejadoNo ratings yet

- Recruting and Selection Sales PersonnelDocument34 pagesRecruting and Selection Sales PersonnelRuach Dak TangNo ratings yet

- Do a SWOT analysis for business ideasDocument4 pagesDo a SWOT analysis for business ideasOliver SyNo ratings yet

- BS en 10250-3Document16 pagesBS en 10250-3butterflyhuahuaNo ratings yet

- Questionnaire SummaryDocument7 pagesQuestionnaire Summaryinfo -ADDMASNo ratings yet