Professional Documents

Culture Documents

Market Update 020710

Uploaded by

wsocOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Update 020710

Uploaded by

wsocCopyright:

Available Formats

Market Update 02/07/10

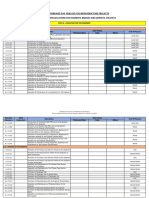

Daily CBOT in A$/mt 28/04/2008 - 12/08/2010 (CHG)

Price

Line, QWc1, Last Trade(Last) AUD

02/07/2010, 209.19 MTU

350

Note the sharp spike in the 340

CBOT wheat value in A$/mt 330

320

310

300

290

280

270

260

250

240

230

220

210

209.190

200

190

.123

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Au

Q2 2008 Q3 2008 Q4 2008 Q1 2009 Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 10

[Delayed]

CBOT Wheat ‐ In the past two day’s we have seen the CBOT wheat market rally above 40c/bu (or US$14.70/mt), thanks to

the revised acreage planting for corn (off 1million acreas) and lower than anticipated corn stocks. Hence, wheat has rallied

on the coat tail of corn which presents an opportunity for new crop marketing. There was no significant news that

suggested that wheat should have rallied given that the US report was in fact bearish for wheat. This along with the sharp

fall in the AUD over the past two days has led to a sharp rally in the new crop wheat swap value as represnted in the chart

above.

Will the international wheat market continue to rally – well, this is anyones guess, although along with the current

excessive world wheat stocks and current production profile (although slightly revised down with production concerns in

Canada, Europe and the Eastern blocks) one would expect the CBOT wheat market to be restricted trading to much higher

with the current burdensome supply of wheat world wide.

Calcs for PNW Export Parity

CBOT Wheat 5.21 Dec

FOB Basis - US PNW -0.18 Z

Wheat FOB US PNW 5.03

SWW Wheat FOB PNW 185.00 US$/mt

Freight US to Japan - Panamax 35.00 Dec/Jan

Wheat C&F Japan - Panamax 220.00

Freight Aust.Japan- Panamax 22.00 Dec/Jan

Equivalent Value FOB Australia-US$/mt 198.00 Dec/Jan

Exchange Rate A$/US$ 0.85 Dec

Equivalent Value FOB Australia 233.85

Equivalent Value "Track" Spread 28.50

Equivalent Value Track Australia 205.35 Dec

Advance Trading Australia | Special One Grain 1

Australian Wheat Export Parity – The Australian new crop APH wheat value has risen on the back of the recent rally in the

CBOT market. Assuming the US SWW wheat PNW (Pacific North West) is trading at US$185/mt (see table above), the

implied export parity (the implied minimal price for APW wheat) for APW sold out of Australia for Dec 2010 is

A$205.35/mt. With the local market currently trading at $218/mt, there is currently a domestic $13/mt premium to export

parity (difference between $205 (export Parity) and $218 (current APW track price)).

The market is suggesting an opportunity for selling new crop wheat with the current spike in the wheat market. The

current rally in the CBOT futures, softening A$ and slight basis premium in the domestic new crop wheat market all points

to a selling opportunity. If we also assume a small carryover stock increase this year in Australia, domestic cash prices can

come under pressure if we see a plus 22mmt wheat crop. This analysis is also supported with the Australian Meteorologist

suggesting a “La Nina” event on the East Coast of Australia. More rain, more grain?

Special One Grain has just released its ECP No:2 which seems timely given the recent market movements in the past week.

Growers wishing to take full advantage of the market rally please complete the expression of interest and fax back to head

office on 02 68281249 ASAP.

GENERAL ADVICE WARNING

Please note that any advice given by ADVANCE staff is deemed to be GENERAL advice, as the information or advice given does not take into account your particular objectives, financial situation or needs.

Therefore at all times you should consider the appropriateness of the advice before you act further.

ATA Disclaimer: The market commentary is prepared by an external source believed to be reliable. Advance Trading Australia cannot and does not warrant the accuracy, completeness, timeliness, non-

infringement, merchantability or fitness for a particular purpose of any information contained in the market commentary. Nothing in the market commentary should be regarded as trading advice of any kind

whatsoever. This data is provided for information purposes only and is not intended to be used for specific trading strategies without consulting Advance Trading Australia. All information is based upon data

that is believed to be reliable, but its accuracy is not guaranteed.

Copyright 2010 Advance Trading Australia. 36c Fitzmaurice St Wagga Wagga NSW 2650. Reproduction in any form without the expressed written consent of Advance Trading Australia is strictly forbidden.

This data is provided for information purposes only and is not intended to be used for specific trading strategies without consulting Advance Trading Australia. No guarantee of any kind is implied or possible

where projections of future conditions are attempted. Past results are no indication of future performance. All information is based upon data that is believed to be reliable, but it accuracy is not guaranteed.

Advance Trading Australia | Special One Grain 2

You might also like

- Sample Business ProposalDocument10 pagesSample Business Proposalvladimir_kolessov100% (8)

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Document103 pages2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- Net Zero Energy Buildings PDFDocument195 pagesNet Zero Energy Buildings PDFAnamaria StranzNo ratings yet

- 26 Sheet Gate DetailsDocument1 page26 Sheet Gate DetailsFun Ton100% (1)

- The 99 Names of AllahDocument43 pagesThe 99 Names of Allahapi-3739778100% (6)

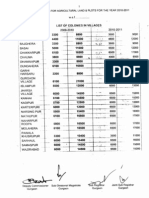

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDocument15 pagesCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Belt and Road InitiativeDocument17 pagesBelt and Road Initiativetahi69100% (2)

- Transition CurveDocument1 pageTransition CurveFaisal TehseenNo ratings yet

- PLANDocument1 pagePLANbasurah abdullNo ratings yet

- Graph Paper1Document5 pagesGraph Paper1vijayabhaskar19722145No ratings yet

- Graph Paper1Document5 pagesGraph Paper1vijayabhaskar19722145No ratings yet

- Cacao From ICCODocument16 pagesCacao From ICCORam KnowlesNo ratings yet

- Plan View at Tos - El +104.000: Sheet 1 of 1Document1 pagePlan View at Tos - El +104.000: Sheet 1 of 1D7mey XNo ratings yet

- Office: PT - Manunggal TrikarsaDocument1 pageOffice: PT - Manunggal TrikarsaPvc Panel Upton SemarangNo ratings yet

- Star S2 St-Brochure March2019 WebDocument3 pagesStar S2 St-Brochure March2019 WebMandla RebirthNo ratings yet

- SOG Newsletter 170810 - 2Document2 pagesSOG Newsletter 170810 - 2wsocNo ratings yet

- Stock Market ReactionDocument3 pagesStock Market ReactionDwitiya MukhopadhyayNo ratings yet

- S02 - MM-#42 Columns Details - R02Document1 pageS02 - MM-#42 Columns Details - R02Mohd SiddiqNo ratings yet

- TMC-BHGE-NovaLT - Gas Turbine - BrochureDocument17 pagesTMC-BHGE-NovaLT - Gas Turbine - Brochurechimmy chinNo ratings yet

- DeckDocument1 pageDeckKiki FadilahNo ratings yet

- Damacrest School LTD STR (Kamangu) 3Document1 pageDamacrest School LTD STR (Kamangu) 3HarryNo ratings yet

- Dializado Serie HDocument1 pageDializado Serie HMiriam SanchezNo ratings yet

- PW 065 PW 120 PW 102: Extra Top BarsDocument1 pagePW 065 PW 120 PW 102: Extra Top BarsHossam AbdelazizNo ratings yet

- Produced by An Autodesk Educational ProductDocument1 pageProduced by An Autodesk Educational Productshakhoof jobaNo ratings yet

- Stacked Coloumn Chart Free PowerPoint Template WDDocument6 pagesStacked Coloumn Chart Free PowerPoint Template WDVixto IvoryNo ratings yet

- Stacked Column Powerpoint Template: Product ProductDocument6 pagesStacked Column Powerpoint Template: Product ProductVixto IvoryNo ratings yet

- Ground Floor 3076 First Floor 3412 Stair 148 Total 6636 FTSQ With Out ElevationDocument2 pagesGround Floor 3076 First Floor 3412 Stair 148 Total 6636 FTSQ With Out ElevationMAN ENGINEERINGNo ratings yet

- EC - Item 03 - World Cocoa EconomyDocument7 pagesEC - Item 03 - World Cocoa EconomyArnaud KUCZINANo ratings yet

- Pressed PDFDocument2 pagesPressed PDFFrankNo ratings yet

- Contoh KlinikDocument1 pageContoh KlinikRiza JabarNo ratings yet

- Legend of Building Services: Sewage Pipe Cold Water S.P C.WDocument1 pageLegend of Building Services: Sewage Pipe Cold Water S.P C.WAlin NegarăNo ratings yet

- BMWDocument1 pageBMWWawan R YusufNo ratings yet

- BG-#5 Column Pos.Document1 pageBG-#5 Column Pos.Mohd SiddiqNo ratings yet

- Blacl Swan Capital, Currency Currents 12.11.10Document11 pagesBlacl Swan Capital, Currency Currents 12.11.10jockxyzNo ratings yet

- What Animal Is It? Count by 10s To Complete The PictureDocument1 pageWhat Animal Is It? Count by 10s To Complete The PictureAplus MaterialsNo ratings yet

- Conference On The Trends and Future Prospects - EC-Item 08Document2 pagesConference On The Trends and Future Prospects - EC-Item 08Ricardo Vera TorresNo ratings yet

- Suzi's Weight and BMI ChartDocument1 pageSuzi's Weight and BMI ChartreimsmNo ratings yet

- RPL365 - TD - ARC - UGT - FPL0 - 01-Under Ground Tank-Plan, SectionsDocument1 pageRPL365 - TD - ARC - UGT - FPL0 - 01-Under Ground Tank-Plan, SectionsSAHANANo ratings yet

- Produced by An Autodesk Educational ProductDocument1 pageProduced by An Autodesk Educational ProductMouhi MouhaNo ratings yet

- A3 Kolor 2Document1 pageA3 Kolor 2dami20022412No ratings yet

- El53300-Psb BDocument7 pagesEl53300-Psb BWahyu WidartoNo ratings yet

- Ardhi Project Denah & LuasanDocument4 pagesArdhi Project Denah & LuasanLutfi Bayu AjiNo ratings yet

- Basic 20 ScaldasalvietteDocument1 pageBasic 20 ScaldasalviettebogodavidNo ratings yet

- PWHEAMTUSDMDocument3 pagesPWHEAMTUSDMLinh TranNo ratings yet

- Chassis Jaw 1300 x300Document1 pageChassis Jaw 1300 x300Ardi NalNo ratings yet

- Denah Layout Konsep 01.09.23Document1 pageDenah Layout Konsep 01.09.23albaihaqiNo ratings yet

- B-1 / B-2 B-3 B-4 B-4A: Base Plate ScheduleDocument1 pageB-1 / B-2 B-3 B-4 B-4A: Base Plate Scheduleleizel dacuNo ratings yet

- Ground Floor 3076 First Floor 3412 Stair 148 Total 6636 FTSQ With Out ElevationDocument1 pageGround Floor 3076 First Floor 3412 Stair 148 Total 6636 FTSQ With Out ElevationMAN ENGINEERINGNo ratings yet

- Designing Silicon Carbide (Sic) Based DC Fast Charging System: Key Challenges, Design Considerations, and Building ValidationDocument31 pagesDesigning Silicon Carbide (Sic) Based DC Fast Charging System: Key Challenges, Design Considerations, and Building Validationtakaca40No ratings yet

- Hydraulic Caliper Disc Brakes SF Series: Pintsch BubenzerDocument6 pagesHydraulic Caliper Disc Brakes SF Series: Pintsch BubenzeryoyoNo ratings yet

- Produced by An Autodesk Educational ProductDocument1 pageProduced by An Autodesk Educational Productshakhoof jobaNo ratings yet

- Sectiune Biserica: Master TMLCDocument1 pageSectiune Biserica: Master TMLCAlexandru ȚigănușNo ratings yet

- 6behailu Alt 22023Document1 page6behailu Alt 22023gelfeto gebreNo ratings yet

- Sheet - A105 - SETOUT PLANDocument1 pageSheet - A105 - SETOUT PLANyoonas aliNo ratings yet

- West Gojjam Zone High CourtDocument1 pageWest Gojjam Zone High CourtSisay AlamirewNo ratings yet

- UntitledDocument1 pageUntitledMeet JaniNo ratings yet

- Pintsch Bubenzer - de Disk Brake SFDocument6 pagesPintsch Bubenzer - de Disk Brake SFgugNo ratings yet

- Second Floor Beams Top Tie BeamsDocument1 pageSecond Floor Beams Top Tie Beamsሳምሶን ወርቁNo ratings yet

- Sectiunu Funda A3 F7 R4D - 20Document1 pageSectiunu Funda A3 F7 R4D - 20Dani Serban0% (1)

- McDonald RD AreaDocument1 pageMcDonald RD Areasamuelraymond337No ratings yet

- Draft by Niswar: Coldbin Asphalt Drum/CementDocument1 pageDraft by Niswar: Coldbin Asphalt Drum/CementNiswar MiftahNo ratings yet

- Ab STR 111 B124Document1 pageAb STR 111 B124arainzada807No ratings yet

- RUMAH LAYOUT ALT.2 01.09.23-ModelDocument1 pageRUMAH LAYOUT ALT.2 01.09.23-ModelalbaihaqiNo ratings yet

- Centru de Conferinte: Gspublisherengine 0.5.100.100Document1 pageCentru de Conferinte: Gspublisherengine 0.5.100.100AnnIttNo ratings yet

- The Specialist 18 Aug 2010Document1 pageThe Specialist 18 Aug 2010wsocNo ratings yet

- The Specialist 17 Aug 2010Document1 pageThe Specialist 17 Aug 2010wsocNo ratings yet

- Specialist Crop Insurance Update 240810Document1 pageSpecialist Crop Insurance Update 240810wsocNo ratings yet

- SOG Newsletter 170810 - 2Document2 pagesSOG Newsletter 170810 - 2wsocNo ratings yet

- Cash Price Report 090810Document1 pageCash Price Report 090810wsocNo ratings yet

- Cash Price Report 030810Document1 pageCash Price Report 030810wsocNo ratings yet

- Cash Price Report 060810Document1 pageCash Price Report 060810wsocNo ratings yet

- Section3 AOF Standards 200910Document70 pagesSection3 AOF Standards 200910wsocNo ratings yet

- CashPriceReport290710 2Document1 pageCashPriceReport290710 2wsocNo ratings yet

- Cash Price Report 290710Document1 pageCash Price Report 290710wsocNo ratings yet

- Specialist 20 July 2010Document1 pageSpecialist 20 July 2010wsocNo ratings yet

- Specialist 20 July 2010Document2 pagesSpecialist 20 July 2010wsocNo ratings yet

- Specialist 8 July 2010Document1 pageSpecialist 8 July 2010wsocNo ratings yet

- ECP2 FlyerDocument2 pagesECP2 FlyerwsocNo ratings yet

- Specialist 19 May 2010Document1 pageSpecialist 19 May 2010wsocNo ratings yet

- GTA Contract No 3 Grower Terms Apr09Document1 pageGTA Contract No 3 Grower Terms Apr09wsocNo ratings yet

- SOG Newsletter 4 100326Document2 pagesSOG Newsletter 4 100326wsocNo ratings yet

- Specialist 13 Nov 09 - 0Document1 pageSpecialist 13 Nov 09 - 0wsocNo ratings yet

- Commodity Vendor DeclarationDocument1 pageCommodity Vendor DeclarationwsocNo ratings yet

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDocument14 pagesLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaNo ratings yet

- De Mgginimis Benefit in The PhilippinesDocument3 pagesDe Mgginimis Benefit in The PhilippinesSlardarRadralsNo ratings yet

- Coconut Oil Refiners Association, Inc. vs. TorresDocument38 pagesCoconut Oil Refiners Association, Inc. vs. TorresPia SottoNo ratings yet

- India'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelDocument10 pagesIndia'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelAnonymous cRMw8feac8No ratings yet

- Fire Service Resource GuideDocument45 pagesFire Service Resource GuidegarytxNo ratings yet

- Exim BankDocument79 pagesExim Banklaxmi sambre0% (1)

- NaftaDocument18 pagesNaftaShabla MohamedNo ratings yet

- Kennedy 11 Day Pre GeneralDocument16 pagesKennedy 11 Day Pre GeneralRiverheadLOCALNo ratings yet

- What Is Zoning?Document6 pagesWhat Is Zoning?M-NCPPCNo ratings yet

- PT Berau Coal: Head O CeDocument4 pagesPT Berau Coal: Head O CekresnakresnotNo ratings yet

- The Making of A Global World 1Document6 pagesThe Making of A Global World 1SujitnkbpsNo ratings yet

- Indian Contract ActDocument8 pagesIndian Contract ActManish SinghNo ratings yet

- Involvement of Major StakeholdersDocument4 pagesInvolvement of Major StakeholdersDe Luna BlesNo ratings yet

- International Financial Management 8th Edition Eun Test BankDocument38 pagesInternational Financial Management 8th Edition Eun Test BankPatrickLawsontwygq100% (15)

- HQ01 - General Principles of TaxationDocument14 pagesHQ01 - General Principles of TaxationJimmyChao100% (1)

- Oil Opportunities in SudanDocument16 pagesOil Opportunities in SudanEssam Eldin Metwally AhmedNo ratings yet

- MBBcurrent 564548147990 2022-12-31 PDFDocument10 pagesMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinNo ratings yet

- DX210WDocument13 pagesDX210WScanner Camiones CáceresNo ratings yet

- Paul Romer: Ideas, Nonrivalry, and Endogenous GrowthDocument4 pagesPaul Romer: Ideas, Nonrivalry, and Endogenous GrowthJuan Pablo ÁlvarezNo ratings yet

- Measure of Eco WelfareDocument7 pagesMeasure of Eco WelfareRUDRESH SINGHNo ratings yet

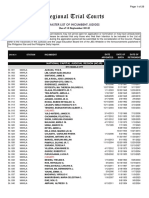

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaNo ratings yet

- Approaches To Industrial RelationsDocument39 pagesApproaches To Industrial Relationslovebassi86% (14)

- Presentation On " ": Human Resource Practices OF BRAC BANKDocument14 pagesPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziNo ratings yet

- July 07THDocument16 pagesJuly 07THYashwanth yashuNo ratings yet

- PDC Yanque FinalDocument106 pagesPDC Yanque FinalNilo Cruz Cuentas100% (3)