Professional Documents

Culture Documents

1404 - Tax

Uploaded by

rietzhel220 ratings0% found this document useful (0 votes)

143 views5 pagesTAX1404

Original Title

1404 - TAX

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTAX1404

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

143 views5 pages1404 - Tax

Uploaded by

rietzhel22TAX1404

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

AGAMATA

eert

CPA REVIEW

FINAL INCOME TAX

“Home of Topnotch Professionals” KNOWLEDGE

ENGINEERS/ REVIEWERS

R. B. Banggawan

_ REVIEW NOTES

PHILIPPINE INCOME TAX SCHEME

An identified gross income will be subject to tax as follows:

pny anbtnsw!

identified item of gross income

i

‘

'

1

‘

1

!

Exception Tes! = :

i q

Final Withholding Tax Taxable at Spal Galnaea 4

(Certain passive either (Certain capital gains |

income only) only) 5

t

4

:

fl

1

1

:

t

1

1

1

t

1

1

Regular Income Tax

Individuals: Progressive Taxation (5-32%)

Corporations: Proportional Taxation (30%)

Cateh-all for all item of gross income not subject to final tax and capital gains tax

Final tax and capital gains tax are the exceptions rule in the taxation of gross income. If an item of

gross Income is subject to, or is exempted from, final tax or capital gains tax, it is no longer subject to

regular tax,

ok

Ue cpa review www.certscollege.org www.revieweronline com

AX.0-1404.Final Income Tax.RN

PINAL WITHHOLDING TAX

Pinal withholding tax is imposed to certain passive income. Refer to HO04,1 for the tist. Under the final

withholding tax system, the taxpayer actually shoulders the tax but it is the income payor who

withholds and pays the tax. The amount of tax withheld is final. The taxpayer has no more

Fesponsibility to file an income tax return for the passive income covered subject to final withholding

tix

Nature of Final Income Tax on Certain Passive Income:

L. The final taxes on the passive income are restrictive in application. They are applicable only on

the items of passive income that are expressly listed by the NIRC.

Final taxes are withheld at source by the income payor; hence, the income received by the

taxpayer is net of the final tax, The income taxpayer therefore need not file a return for the

Passive income.

1, Final taxes apply only on specified passive income by the law earned in the Philippines.

Final Withholding Tax vs. Creditable/Expanded Witholding Tax

‘The income payor withhold a percentage ef the income,

Serves to avoid cash flow problems to taxpayers by collecting at the moment cash is available.

Differences:

Income tax withheld Full

Certain passive income

Only portion

Certain passive income

and regular income

income payor and the

taxpayer

Required

Coverage

Who remits the tax Income payor

“Necessity for a consolidated returm None

a -

WwWw.reviewer-online.com uc cpa review

wiww.certscollege.org

L

uc cpa review

‘MULTE CHOICE QUESTIONS (21 7s Gal

Which is not subject to final tax?

A. Gain on sale of shares of stock directly to buyer

B. Royaities from musical composition

C. Capital gain on sale of real property classified as capital asset

D. Share ofa partner in the distributive net income after tax of a business partnership

Which is subject to final tax?

A. Share of the distribute net income of a general professional partnership

B. Winnings not exceeding P10,000

C. Prizes not exceeding P10,000

D. Interest income from foreign bank deposits

‘Which of the following passive income is taxed on an annual and net basis?

‘A. Capital gain on sale of domestic stocks directly to buyer

B. Capital gain on sale of domestic stocks through the Philippine Stock Exchange

©. Capital gain on sale of real property classified as capital asset

D. Capital gain on sale of real property classified as ordinary asset

Capital gain on the sale of which capital asset below is éaActusively presumed

A. Real property used in business C. Personal property not used in business

8. _ Real property not used in business D. Personal property used in business

The passive Income that is subject to a two-tiered final tax structure is

A. Capital gain on sale of stocks of & resident foreign corporation directly to buyer

B. Capital gain on the sale of capital interest in a partnership

CC.” Capital gain on sale of sale of real property not used in business

D. Capital gain on the sale of stocks of a domestic corporation directly to buyer

Which is taxed at the lowest final tax rate among the following passive income?

A. Interest income received fiom a depositary bank under the expanded foreign currency

deposit system received by a resident citizen

B. Cash dividend from a domestic corporation

. Royalties from books and other literary works

D. Interest income from long-term deposit with maturity of over five years

All of the following are subject to 7 14% final tax on interest on FCDU Deposit, except

A. Resident citizen D. Domestic corporation

B.. Non-resident citizen E. Resident corporation

C. Resident alien

Dividends received by which of the following is not subject to dividend tax?

A. Resident individual C. Resident corporation

8, General professional partnership D. Non-resident foreign corporation

www.certscollege.org

2

www. reviewer-online.com.

9

—

404.Final Income Ta:

i i i Its of

Ambiong Bank of Baguio started operation in 1995 with the following information on resul

operation and dividend declarations.

Year — Netincome Dividends declared

1996 P_ 500,000 E

1997 1,500,000 a

1998 2,000,000 ~

1999 1,000,000 7

2000 2,500,000 P 6,500,000

ee . 1

How much tax must have been paid in the 2000 dividend Ss Ban! oe

‘A, P650,000 8, P390,000 Paso,

i tition is generally taxable -

The prizes on the foliowing award or compet i ' bi

A ie echo competition sponsored by an organization sanctioned by the Philippi

Olympic Committee. F

B. “Most Charitable Person of the Year”

“Nobel Prize Winner”

D, Pageant competition

i 2 Sbjoad by a resident citizen is subject to

e foreign cutrency deposits made abfoa

Interest income from foreigi ebiratle

D. regular tax

‘A, 20% final tax

B, 74% final tax

Royalties on musical composition is subject to

A, 20% final tax

B, 10% final tax

C/0% finial tax

D. regular tax

The interest inéome on long’t

ee 1 of P300,000

Armando is a partner ine business partnership. At the end of 2010, he peste abt a

profit sharing on the after tax income of the partnership inclusiveiof F120,

's profit sharing,

managing partner. Compute the amount final tax to. be withheld from Armando’s pro! 8

a. (paz.o00 c, P30,000

8, P18,000 Pane

ional

Assuming the same information above except that the partnership is a general professio

partnership, compute the. final tax to be withheld?

turn; which is

Final taxes are genétally withheld at source and does not require an income tax ret

an exception ;

A. Pinal tax on interest income from deposit

{Final tax on royalties ’

Pinal tax on capital gain on’sale of domestic shares of stock directly to buye

Ab. fi nk on dividends

uc cpa review

www. reviewer-online.com

wwiw.certscollege.org

Whith of the following is not subject to 20% final tax?

| Interest income on long-term deposit of domestic corporation

| Interest income on foreign toans

{Interest income from money market placements or trust funds

(Lotto winnings

(oinpute the total amount of income subject to fifial tax:

Yield from deposit substitute

P 10,000

Interest income from bonds of a domestic corporation 23,000

\roperty dividend declared by a foreign corporation 40,000

stock dividend declared by a domestic corporation 50,000

Compensation income, net of P10,000 withholding tax 80,000

trize on “Search for Mr. Sexy Body” 15,000

oyalties from books 24,000

interest income on personal foans granted to a friend 8,000

Salaries from a general professional partnership 30,000

Salaries from a business partnership 20,000

A. P89,000 8. P99,000 €. P49,000 D. P69,000

19, Determine the total amotint of income tax withheld

inconte during the year:

Interest on Peso bank deposit e P 90,000

Royalties 36,000

Dividends 63,000

Share In the distributive income of ajéint venture 72,000

A. 46,000 B, P53,000 © Ss. ©. P38,700 D. P46, 500

12% annual interest every January 1. If Kevin disposed of this investment directly to buyer on

December 31, 2008'at 102, how much is'the total final tax due?

As. P24,000 B. P25,000 €)P1,000 D. PO

On January 1, 2005, Helen invested P1,000,000 to RCBC Commercial Bank’:

pre-terminated her investment on July 1, 2008. How much is thi

of Helens investment?

A. P9,000; P1,066,000

C. P18,750; P1,056,250

B. P63,000; P1,012,000

D. P30,000; P1,345,000

°2. How much final tax is withheld in the interest income paid by the bank on Janiiaty 1) 2006?

AS~'PO B. P18,000 C. P30,000 D. P7,500

uc cpa review www.certscollege.org

TAX.0-1404.Final Income Tax.MC

if thé taxpayer received the following passive

OnJanuary 1, 2008, Kevin purchased 1,000 P1,000 face value bonds of a tlomestic corporation at

face value, The bonds were datéd January 1, 2007 and mature on January 1, 2011, The bonds pay

s S-year, tax-free time

Geposit. The long-term deposit pays 15% annual interest every January 1. In need of cash, Helen

e final tax due and the proceeds

Wwww.reviewer-online.com

24, Assuming the same information in the problem above, except that the investment was mad

domestic corporation, how much final tax is withheld in the year of pre-termination and the

proceeds to the corporation?

A. P'15,000; P1,060,000

B, 45,000; P1,030,000

C. P18,750; P1,056,250

D. P30,000; P1,345,000

20. Wenito Mojica invested in an 8-year long-term deposit in Rizal Commercial Banking Corporation

mounting to P2,000,000 paying 10% interest semi-annually. How much is the final tax tobe

withheld by Rizal Commercial Banking Corporation if Benito Mojica pre-terminated his

(nvestinent at the just after the end of the third year?

A 00 €. 30,000

6. 72,000 D.P120,000

21. What if Benito Mojica pre-terminates it just after the end of the fifth year?

ea) . P50,000

B, 972,000 D. P200,000

22. Benedict rendered advisory services to Alexander in connection'With the latter’s tax compliance

from May 2, to July 2, 2006. In July 2, 2006, Alexandeppaid him a note with a face value of

P100,000 payable a year after, The same note could b@discounted at the bank for 15% at the

time of receipt. How much compensation income and interest income is to be included in gross

Income?

A, P85,000; PO

6. P100,000; P15,000

C. P85,000; P7,500

0, P2100,000; PO

24 Andromeda, a non-resident alien, rendered professional services to Philippine company, a

domestic corporation. The total consultancy fees agreed were P1,000,000. How much should

Philippine company withhold?

A, P1100,000 8. P200;000 C, P250,000 D.PO

24, Androme

Andromeda earned P100,000 interest income. How much final tax should Metro Pilipino Bank

withhold?

A, PO 8, P20,000

C. P25,000 D. P 30,000

25, Assuming the same information in the preceding problem except that Andromeda is a non-

resident corporation. How much final tax is to be withheld?

A PO B. P20,000 C. P25,000

D,P 30,000

@ non-resident alien, invests in the 60-day Peso time deposit of Metro Pilipino Bank.

TAX.O-1404. Final Income Tax.MC

7). Sunrise Bank, a non-resident foreign bank, has substantial foreign currency deposit at the FCDU

unit of Banco italiano, a resident foreign bank, totaling $5,000,000. Total interest credited to

Sunrise Bank was $600,000 equivalent to P28,800,000 at the time of payment. How much is the

final tax on the interest received by Sunrise Bank?

A. P10,080,000 B. P5,760,000 C. P2,880,000 D. Exempt

28. The Gambling World, Inc, a foreign corporation, Inc. has been trying. its luck with the Philippine

Charity Sweepstakes lotto. It spent P800,000 for losing PCSO lotto tickets. Luckily, one ticket

costing P10 won the P218,000,000 Superlotto 6/49 draw on July 24, 2007. How much is the ‘

deductible expense and the taxable amount of winnings?

A. P40; P47,999,990 C. P800,000; PO

B. 800,000; P47,999,990 D. PO; PO

29. Which statement is incorrect?

A. Prize results from an effort.

B. Winning results from transaction dependent upon chance,

C. Prizes is subject to either regular tax or final tax.

D. Winnings from the Philippines is always subject to final tax’

30. The system of tax compliance wherein the employees dgés not have to make computations nor

file an income tax return at the end of the year.

A. Final withholding tax scheme

B. Creditable withholding tax scheme

C. Substituted Filing of Tax Returns

/ D. Self-Assessment Method

31. The substituted Filing of Tax Return ig Applicable where (choose the exception)

A. The employee earns pure comperisation income

8, The employee has only one employer

C. The tax withheld by the’employer is correct

D. The employee is also engaged in the exercise of a profession

32. Creditable withholding tax rates shall not be less than but not more than

A, 5%; 20% C. 1%; 32%

B. 1%; 20% D. 2%; 15%

33. Which is subject to final withholding taxes?

A. Interest on loans of by banks

B. Prizes from abroad

C. Dividends from foreign corporations

D, Book royalties

34. Which is subject to creditable withholding taxes?

20, Andromeda, a non-resident alien, deposited $100,000 in the FCDU unit of Universal Bank, a A, Rentincome

resident foreign bank. During the period, Andromeda earned $1,000 total interest. The relevant B. Dividends from domestic corporations

‘exchange rate between the Peso and the Dollar was P50:$1. How much final tax should Metro C. Winnings from PCSO

Pilipino Bank withhold? D. Interest income from long-term deposits by corporations .

_°50,000 B. P100,000 €. P125,000 D.PO 7

www reviewer-online.com www.certscollege.org

uc cpa review

Hic cpa review www reviewer-online.com

a

TAX.0-1404.Final Income Tax.MC

———— ee

35. The return for final withholding tax by withholding agent shall be filed not later than

A. 20 days from the close of each calendar quarter

B, 25 days from the close of each calendar quarter

C23 days from the close of each calendar quarter Co

D, 60 days from the close of each calendar quarter

36. The return for creditable withholding tax by withholding agent shall be filed not later than

A. the first day of the month following the close of the quarter during which withholding was

made

B. the 15 day of the month following the cldge of the quarter during which withholding was

made

C. the 25" day of the month cee the close of the quarter during which withholding was

made

D. the last day of the month following the close of the quarter during which withholding was

made (

CPA ere Y

Davao City © Cebu City © Manila e Pampanga e Dubai, UAE

Davao City

2" Floor Lourdes Bldg., Lapulapu St. Agdao, Davao City

‘m (082) 3041374 / 2214337] www.certs

certscpareview@amail,com| TLOVECERTS@groups. fac 1m,

Cebu City

UC CPA Review Center

Sanciangko St., Cebu City

‘ (032) 255-777 Loc. 122

Manila ¥

Carl Balita Review Center

2F Catmen Bildg,, Espatia Ave., Cor G. Tolentino St, Sampaloc, Manila

‘@ (02) 7354098 / 09228335089 / 09175626676

wwew.caribalitareviewcenter.com

Pampanga

‘System-Plus College Foundation

McArthur Highway, Balibago, Angeles City

‘3 09178035381 | certsnampanaa

ae ge

2" Foor Lourdes tidg,, Lapulapu St. Agdzo, Davao Cty

@ (082) 3041374{ wwnw.reviewer-online.com

support@reviewer-online.com | www.fokeclassroom.com i

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Booking Voucher - EnglishDocument1 pageBooking Voucher - Englishrietzhel22No ratings yet

- LlawDocument2 pagesLlawrietzhel22No ratings yet

- Laborlaw - PH: Work ConditionsDocument2 pagesLaborlaw - PH: Work Conditionsrietzhel22No ratings yet

- Bit CoinDocument3 pagesBit Coinrietzhel22No ratings yet

- Booking Voucher - KoreanDocument1 pageBooking Voucher - Koreanrietzhel22No ratings yet

- MS.O-1408 Cash and Marketable Securities ManagementDocument1 pageMS.O-1408 Cash and Marketable Securities Managementrietzhel22No ratings yet

- Organizational ChartDocument3 pagesOrganizational Chartrietzhel22No ratings yet

- Company N: Employee HandbookDocument18 pagesCompany N: Employee HandbookronsarmientoNo ratings yet

- Memo Break TimeDocument1 pageMemo Break Timerietzhel22100% (1)

- 1409 - TaxDocument10 pages1409 - Taxrietzhel22No ratings yet

- 03 Correction of Error - CTDIDocument15 pages03 Correction of Error - CTDIrubydelacruzNo ratings yet

- Laborlaw - PH: Work ConditionsDocument2 pagesLaborlaw - PH: Work Conditionsrietzhel22No ratings yet

- Chap 1Document80 pagesChap 1rietzhel22No ratings yet

- 1401 - TaxDocument9 pages1401 - Taxrietzhel22No ratings yet

- AP 5902Q Liabs Supporting NotesDocument2 pagesAP 5902Q Liabs Supporting NotesEmms Adelaine TulaganNo ratings yet

- 1403 - TaxDocument9 pages1403 - Taxrietzhel22No ratings yet

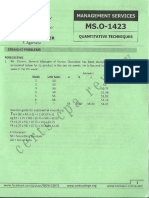

- 1423 - MasDocument18 pages1423 - Masrietzhel22No ratings yet

- PA1.O.1408 Property, Plant and Equipment-AcquisitionDocument1 pagePA1.O.1408 Property, Plant and Equipment-Acquisitionrietzhel22No ratings yet

- VP For CommDocument4 pagesVP For Commrietzhel22No ratings yet

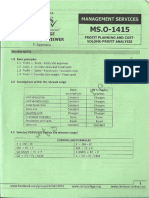

- 1415 - MasDocument13 pages1415 - Masrietzhel22No ratings yet

- 04 Exempt Sales of Goods, Properties and Services PDFDocument19 pages04 Exempt Sales of Goods, Properties and Services PDFrietzhel22No ratings yet

- Thesis Apa FormatDocument5 pagesThesis Apa Formatrietzhel22No ratings yet

- 01 Introduction To Consumption TaxesDocument14 pages01 Introduction To Consumption Taxesrietzhel22No ratings yet

- REL OF APA - 1st PartDocument4 pagesREL OF APA - 1st Partrietzhel22No ratings yet

- Team Building WaiverDocument1 pageTeam Building Waiverrietzhel22No ratings yet

- Lea Accountancy Days RealDocument4 pagesLea Accountancy Days Realrietzhel22No ratings yet

- Academic EventsDocument8 pagesAcademic Eventsrietzhel22No ratings yet

- FinanceDocument6 pagesFinancerietzhel22No ratings yet

- EndorsementDocument1 pageEndorsementrietzhel22No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)