0% found this document useful (0 votes)

2K views3 pagesIAS 16 Overview: Property, Plant, Equipment

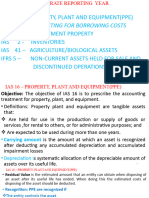

This document summarizes the key aspects of IAS 16 regarding accounting for property, plant, and equipment. IAS 16 aims to prescribe the accounting treatment for property, plant, and equipment. It covers recognition, initial measurement at cost, subsequent measurement using either the cost or revaluation model, depreciation, and disclosure requirements. Major points include initially recognizing assets at cost, allowing the cost or revaluation models, requiring regular revaluations if using the revaluation model, and specifying depreciation and impairment accounting as well as disclosure of useful lives, carrying amounts and reconciliations.

Uploaded by

Jhonalyn ZonioCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views3 pagesIAS 16 Overview: Property, Plant, Equipment

This document summarizes the key aspects of IAS 16 regarding accounting for property, plant, and equipment. IAS 16 aims to prescribe the accounting treatment for property, plant, and equipment. It covers recognition, initial measurement at cost, subsequent measurement using either the cost or revaluation model, depreciation, and disclosure requirements. Major points include initially recognizing assets at cost, allowing the cost or revaluation models, requiring regular revaluations if using the revaluation model, and specifying depreciation and impairment accounting as well as disclosure of useful lives, carrying amounts and reconciliations.

Uploaded by

Jhonalyn ZonioCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Summary of IAS 16