Professional Documents

Culture Documents

GST Functional OSP Flow Phase2

Uploaded by

vishav_20003214Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST Functional OSP Flow Phase2

Uploaded by

vishav_20003214Copyright:

Available Formats

Pre-Release Document

Oracle Financials for India (OFI)

Goods and Services Tax (GST) -

Outside Processing (OSP)

Author: Chandra Shekhar

Creation Date: 14-Feb-2017

Last Updated: 02-Mar-2017

Document Ref:

Version: 1A

Organization: Oracle India Private Limited.

OFI-GST OSP Functional Flow 1

Document Control

Change Record

2

1

Date Author Versio Change Reference

n

02-Mar-17 Chandra Shekhar 1A Initial document

Reviewers

Name Position

Rajnish Kumar Director, Tax Development

V S Baburaj Director, Product Strategy

Audience

Name Position

12.1 & 12.2 Implementation team

12.1 & 12.2 Customers

OFI-GST OSP Functional Flow 2

Table of Contents

Goods and Services Tax (GST) - ............................................................................................................ 1

Outside Processing (OSP) ........................................................................................................................ 1

Document Control .................................................................................................................................. 2

1. Introduction.......................................................................................................................................... 4

2. Scope ................................................................................................................................................... 4

3. Definitions ............................................................................................................................................ 5

4. Overview .............................................................................................................................................. 6

5. Setups .................................................................................................................................................. 6

6. Outside Processing Transactions .................................................................................................... 8

7. Call to Action: .................................................................................................................................... 21

OFI-GST OSP Functional Flow 3

1. Introduction

GST is the most significant indirect tax reform in the history of India.

The "Constitution (122nd Amendment) Bill, 2014" was introduced in the Lok Sabha (House of People) by

Finance Minister Arun Jaitley on 19-Dec-2014, and passed by the House on 6-May-2015. In the Raja

Sabha (Council of States), the bill was referred to a Select Committee on 14-May-2015. The Select

Committee of the Rajya Sabha submitted its report on the bill on 22-Jul-2015. The bill was passed by the

Rajya Sabha on 3-Aug-2016, and the amended bill was passed by the Lok Sabha on 8-Aug-2016.

The bill needs to get ratified at least by 15 state assemblies, which is a mandatory pre-requisite for rolling

out the GST regime in India.

The main objective of GST implementation is to transform India into a uniform market by breaking the

current fiscal barrier between states and facilitate a uniform tax levied on goods and services across the

country.

2. Scope

This paper is intended for an audience familiar with Oracle Financials for India and seeking an insight

into how the functionality of Outside Processing is built to cover the statutory requirement in India as

per GST Law

Note : The current content has been compiled in reference to the frozen scope of the Phase-2

deliverables (Ref: OFI-GST Phase-2 Deliverables.docx).

The scope of this paper is limited to the basic set up and Transaction flow

OFI-GST OSP Functional Flow 4

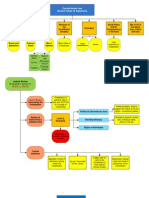

GST Structure

GST

CGST SGST IGST

(Intrastate (Intrastate (Interstate, Imports &

transactions) Transactions) Exports)

3. Definitions

1. JOB Work :;The term Job work is defined in section 2(62) of Model GST law as undertaking

any treatment or process by a person on goods belonging to another registered taxable person

and the expression Job Worker shall be constructed accordingly

Job work is understood as the processing or working on goods supplier by the principal so as to

complete a part or whole of the process. The work may be the initial process, intermediate

process ,assembly ,packing or any other completion process. The goods sent for job work maybe

raw material, components parts , semi finished goods and even finished goods. The resultant

goods could also be a variation of the same or the complete product .Example of common job

works are slitting, machining, welding, painting, electroplating, power coating etc.

2. OSP: Outside Processing (OSP) is subcontracting process where certain operations in process

routing are performed by the sub-contractor and process as an integral part of the manufacturing

process. The outside processing feature of Financial For India provided the functionality of

tracking the goods send to sub-contractor for Job Work.

OFI-GST OSP Functional Flow 5

4. Overview

The main objective of this document is to help understand the procedure to be followed so to map the

Customer requirements in reference to the Goods and Services tax (GST) Job Work as per section

2(62) of Model GST law

In GST , the taxable event would only be supply of goods and supply of service. The goods supplied by

principal supplier to job worker would be supply of goods chargeable of CGST/SGST in case of intra state

job work and IGST , in case of inter-state job work

There would be a requirement of document evidence for claiming a credit of GST

4.1 Major Features :

Followings are major features would be provided in GST

1. OSP challan can be created based on only Purchase Order

2. Manual OSP chalan can be generated in the case of staggered dispatch ,this will be generated

against a primary challan

3. You have a option of cancelling OSP challan to overcome user errors, however system will allow

to cancelling the challan if the material is not yet received

4. You can generate Original, Duplicate Challan in case where the challan is lost

5. System allow sending excess material for outside process and tracking the return

5. Setups

5.1 For Outside processing transaction ,following setup are required in GST

to complete OSP

Define Tax Calendar

Define the Regime and attach the Tax Calendar

Define Tax Type

Define Tax Rate

Define Tax Category

Item Classification

First Party Registration

Third Party Registration

OFI-GST OSP Functional Flow 6

5.1.1 Define Common Configuration :

Once the above setups are completed .it is required to configure Common Configuration

(N) Oracle Financial Of India > Tax Configuration > Common Configuration

i)Based on flag Allow dispatch quantity to exceed original quantity enable in this form

,system allow to dispatch more than original quantity while creating the primary challan

ii)OSP Return Days helps in setting threshold for tracking the material ,if the goods are not

received within 365 days .

OFI-GST OSP Functional Flow 7

5.1.2 Define Document Sequencing :

This setup is required to generate the Form Challan Number while creating the challan

based on Purchase Order and Manual Challan

(N) Oracle Financial Of India > Tax Configuration > Document Sequencing

6. Outside Processing Transactions

6.1 Core Application Functional flow :

Standard Oracle Application support Outside Procession Operation in Oracle

Work in Process (WIP) module ,You will be able to monitor the movement of

goods to the sub-contractor in Oracle Financial Of India Module

Bill of Material needs to be created for the assembly in BOM module and a Job

should be created for the Assembly on Oracle Work in Process (WIP) module.

When the Job is released and component is moved to queue of OSP

operation, a requisition gets created in Purchasing module. Submit Requisition

import to create the Requisition . Using requisition you can create a Purchase

Order using auto create and approve the PO. When you receive material it is

directly update in WIP Operations.

OFI-GST OSP Functional Flow 8

Please note: There are multiple way to creating a Purchasing document based

on sourcing rule

6.2 Outside Processing Transaction flow in GST

Under Oracle Financial of India following additional steps or process are involved

1. You need to navigate to Outside Processing Screen and verify the details populated ,

update the quantity you wish to dispatch and approve the dispatch. Form (Challan)

number will be generated

2. OSP Dispatch forms are crated on the basis of BOM component defined for the item being

subcontracted. In case the issue of material to the sub-contractor is in a staggered manner

(item or quantity ).Manaul Challan can be used for the subsequent dispatches. Each

dispatch in manual challan generates a new challan number

3. Receive the item against the Purchase Order or Release ; Return quantity in OSP Challan

will get updated .

6.2.1 Outside Processing Dispatch

Using this form the user can find out the dispatch form for a Purchase Order (PO) and the

same can be approved.

Dispatch approved in this form is Primary form for a particular OSP PO. System creates the

challan form comprising the entire WIP component required for the specific WIP operations

attached to OSP PO in Outside Processing Details. If the WIP operation is the first

Operations, only the components are to be dispatched to the Sub Contractor

If the WIP operation is the second or higher, the intermediate assembly of earlier

operations only with the components required for current operation need to be dispatched

to the Sub Contractor. Hence additional item line with the PO OSP item is created in OSP

dispatch form for such OSP Purchase Orders.

The PO OSP item description could be provided in such way to identify with intermediate

Assembly. This is specific workaround to meet the GST requirement. Its not a mandatory

to dispatch all the component or their full quantities in the Primary form itself. If the

dispatches are done in a staggered manner, the first batch could be dispatched through the

Primary form. Subsequent dispatches could be done through the Manual OSP Dispatch

(N) Oracle Financial Of India > Transactions > Outside Processing

OFI-GST OSP Functional Flow 9

This form is used to create the challan based on PO number and you can query this form

using PO number or Vendor name or From Number and From Date

Field Description Type Action Description

PO Number Optional EDIT HELP PICK Select PO Number

from LOV to find and

review or approve

dispatch/receipt

Vendor Name Optional EDIT HELP PICK Select the vendor

name from LOV to

find and review the

dispatch for that

vendor

From Date Optional EDIT HELP PICK Select From Date

from LOV to find and

Review the dispatch

OFI-GST OSP Functional Flow 10

This screen is challan details form where you can validate the component item details that

will be use for outside processing.

Field Description Type Action Description

Organization Defaulted Enter Organization name

will be defaulted as

PO Number

Location Defaulted Enter Location will be also

defaulted form PO

Form Number Display only System generated

form number will be

displayed after the

completion and

approval of dispatch

From Date Display Only By default this will be

current date

Supplier Name Defaulted Enter PO supplier name

will be defaulted

Max Day Permitted Display only Display only This filed will have

default value from

Common

Configuration setup

Receive upto Display only This will be the cutoff

date for receiving

OFI-GST OSP Functional Flow 11

back the OSP

material from the

delivery date from

the vendor

Line Level

Job Name Defaulted Enter Job name associated

with PO gets default

here

Assembly Display only Assembly attached to

Job will be displayed

here

Description Display only Description of

Assembly attached to

job

Item Required Enter Component item gets

default as per

released Job

Description Display only Description of BOM

item will display here

Unit of Measure Unit of Measure of

the item being

dispatched . Primary

UOM of the item shall

be defaulted

.However other UOM

could be used if the

UOM conversion is

defined for item

HSN CODE Display Only

SAC CODE Display only

Original Quantity Display Only This is required

quantity of BOM

component

Dispatched Quantity Display Only This is total dispatch

quantity for this

challan

Form Dispatch Qty Required Enter Item quantity which

you want to dispatch

for outside

OFI-GST OSP Functional Flow 12

processing

Item Rate Display only List price in item

definition will be

defaulted in this field.

This can be updated

as per the valuation

of OSP item

Dispatch Value Display only Dispatch value=

Dispatch quantity *

item rate

Processing Nature Display only This will default from

Operation description

of OSP operation

from the related Job

and this can be

edited if required.

Return Qty Display only Return quantity filed

gets updated once

the receipt is done of

OSP item

Return Value Display only Return Value =

Return quantity *item

rate

After entering data on primary challan click on View Taxes to validate the tax details on

challan form gets default as per tax attached to PO

OFI-GST OSP Functional Flow 13

Now, click on Approve Dispatch button to approve the challan then form number will be

generated automatically for future reference

6.2.2 Enter Manual Outside Processing Dispatch

This form can be used to create a manual challan for sending a material for Outside

processing .Manual challan can be created based on an OSP PO.

When the Manual challan is being created based on OSP PO, the system checks for the

dispatched quantity in the Primary Form .An entry is allowed in the Manual challan form

only if the full quantity is not dispatched through the Primary form. System does not allow

dispatching any additional material against the PO in excess of the materials required for

the discrete job linked to OSP PO item line.

(N) Oracle Financial Of India > Transactions > Outside Processing

Manual button gets enable only for those PO against that Primary challan is dispatched for

partial quantity.

OFI-GST OSP Functional Flow 14

Field Description Type Action Description

PO Number Required Pick Select PO number

form LOV, if the

primary challan is

already created

against the PO then

only system will allow

to create manual

challan

Vendor Name Optional Select the Vendor

name for whom the

challan is going to be

created

After pressing the Manual button the following challan form will be opened and user can

enter the data as per their requirement of challan

The screen layout and it feature are described for ready reference

Filed Description Type Action Description

Organization Defaulted Enter Organization will be

defaulted from

OFI-GST OSP Functional Flow 15

Purchase Order

Location Defaulted Enter Location will be

defaulted from

Purchase Order

Form Number Display Only System generated

Form Number will be

displayed after the

completion and

approval of

transactions

Form Date Display Only By default this will be

current date

Supplier Name Defaulted PO supplier name

will be defaulted here

Max Days Permitted Display Only This filed will have

default value from

Common

Configuration setup

Receive upto Display only This will be the cutoff

date for receiving

back the OSP

material from the

delivery date from

the vendor

Primary Form Display Form number of

Number Primary dispatch

created against the

PO

Line level

Job Name Enter Job name associated

with PO will be

defaulted here, user

will have an option to

select the Job name

Assembly Display only Assembly for the

above Job name will

be displayed here

Description Display only Description of

assembly item will be

OFI-GST OSP Functional Flow 16

displayed here

Item Required ENTER The user needs to

select the BOM

component item from

LOV

Description Display Only Description of item

will be displayed here

UOM Display Only Unit of Measure for

the item being

dispatched. Primary

UOM of the item

shall be defaulted

,However other

UOMs could be used

if UOM conversion is

define for the item

HSN CODE Display only

SAC CODE Display only

Original Quantity Display only This is required

quantity of BOM

component

Dispatched Quantity Display only This is total

dispatched quantity

of item till date

Form Dispatch Qty Enter Item quantity which

you want to dispatch

for outside

processing.

Item Rate Display only List price in item

definition will be

defaulted in this field.

This can be updated

as per the valuation

of OSP item

Dispatch Value Display only Dispatch value=

Dispatch quantity *

item rate

Processing Nature Display only This will default from

Operation description

of OSP operation

OFI-GST OSP Functional Flow 17

from the related Job

and this can be

edited if required.

Return Qty Display only Return quantity filed

gets updated once

the receipt is done of

OSP item

Return Value Display only Return Value =

Return quantity *item

rate

6.2.3 Print Control Challan

This feature enables you to control printing of challan, it would restrict repeated print of a

challan. Control over printing of Duplicated would be controlled and Duplicate challan would

be marked as such. In case where the print could not be generated due to Printer errors,

authorized user can generate an original print

Records in challan form would be populated on Approval of a Purchase Order (PO) with

line Type as Outside Processing. The user would check the accuracy of the records and

approve the dispatch and not the Form Number . On approval a record would be populated

on Print Control Challan form .the Original in this form would be set to Yes and the value

in the Duplicate filed would be set to No

After approval, you would navigate to India Local Purchasing >Oracle Purchasing >

Report> Run, Submit India Outside Processing challan report. The Form Numbers From

and From Numbers To fields would display only the unprinted Challans i.e challans with

either the Original or Duplicate status set to Yes .On Printing the Challan ,the value in

the Original field would be set to No. At this stage, both Original and Duplicate fields

can be updated.

(N) Oracle Financial Of India > Transactions > OSP Print Challan

OFI-GST OSP Functional Flow 18

Organization Name:

You can select the Organizations. The List of Values (LOV) for all other fields would be

based on value selected in this filed and this is mandatory filed

Location:

You can select the Location, that is attached to Organization

Fin Year:

The LOV of this filed would list the Fin Year ( Fin year would be determine based on tax

calendar pass at Regime level )

Vendor Name:

The LOV for this parameter would display the Suppliers with OSP Transactions

PO Number:

The LOV of this filed would display the Purchase Order with OSP items created for the

selected Organization, Location and Fin Year. This would be restricted based on the value

selected in the Vendor Name filed

Form Number:

The LOV for this filed would display the Form Number created for the selected

Organization, Location, Fin Year.

After clicking find button .Challan Print Control lines form will be opened and you can enter

the data as per the notes given below.

OFI-GST OSP Functional Flow 19

PO Number:

This filed would display the Purchase Order based on which the Form Number has been

generated.

Form Number:

This filed would display the Challan Form Number

Vendor Name:

This field would display the Supplier Name for which the Form has been generated

Original:

The Check box would be enabled when the Challan is dispatched. Once the challan is

printed the check would be removed .However, you can check this to Print as Original

Challan , This cannot be checked if the Duplicate field is checked .

Duplicate:

You can check Duplicate check box to print duplicate challans, once the challan is printed

the check would be removed .However, you can check this to Print to Duplicatechallan.

This field cannot be checked if the Original filed is checked.

OFI-GST OSP Functional Flow 20

7 - Summary:

The above document will provide the following benefits to the user:

Required setup to achieve Outside Processing Functionality in GST

Challan crated based on Purchase Order

Manual Chalan Creation

Print the Challan details

7. Call to Action:

Please do the OSP setup according to the above documentation and perform the outside processing

This is not the final document and we will incorporate further changed in this document according to your

queries and Business requirement

You can also refer the document in GST Info Center (Documentation Tab) released as part of Phase 1

and Phase 2 deliverables

E-Business Suite Release 12: India Goods and Service Tax (GST) Info Center (Doc ID 2176820.2)

OFI-GST OSP Functional Flow 21

You might also like

- BOMA - Office Building Standard Methods of Measurement AppendixDocument41 pagesBOMA - Office Building Standard Methods of Measurement Appendixxavest100% (7)

- Con Law Flow ChartsDocument6 pagesCon Law Flow Chartsbiferguson100% (48)

- Lawsuit Filed Against Western Iowa Tech Community College Over J-1 Visa ProgramDocument35 pagesLawsuit Filed Against Western Iowa Tech Community College Over J-1 Visa ProgramKatie Copple100% (2)

- GST List of PatchesDocument13 pagesGST List of PatchesdurairajNo ratings yet

- OFI GST Tax Interface Functional DocumentDocument29 pagesOFI GST Tax Interface Functional DocumentrahuldisyNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2012 IP-Copyright SapaloDocument31 pages2012 IP-Copyright Sapaloazuka_devil66674850% (1)

- Ksa Driving MCQ TestDocument16 pagesKsa Driving MCQ Testashok_04meNo ratings yet

- Criminal Law I Finals ReviewerDocument287 pagesCriminal Law I Finals ReviewerRache Gutierrez95% (19)

- EBS GST Infrastructure ScopeDocument15 pagesEBS GST Infrastructure ScopeRana7540No ratings yet

- Handling Outside Processing in Oracle Apps with India LocalizationDocument18 pagesHandling Outside Processing in Oracle Apps with India LocalizationnehOshi08No ratings yet

- OFI GST ISupplier Functional DocumentDocument27 pagesOFI GST ISupplier Functional Documentsubhani1211No ratings yet

- OFI GST – Assets IntegrationDocument19 pagesOFI GST – Assets IntegrationMadhusudhan Reddy VangaNo ratings yet

- GST Tax Interface Phase2Document23 pagesGST Tax Interface Phase2rajkumar100% (1)

- OFI - GST - BOE Functional Flow PDFDocument48 pagesOFI - GST - BOE Functional Flow PDFshrikantNo ratings yet

- OFI GST Functional Tax Computation For P2P Phase1Document73 pagesOFI GST Functional Tax Computation For P2P Phase1rajkumarNo ratings yet

- Reconciliation Between Inventory Valuation & Subledger Postings (R12) For OPM CostingDocument44 pagesReconciliation Between Inventory Valuation & Subledger Postings (R12) For OPM Costinghaitham ibrahem mohmed100% (1)

- In Memory Management OPMDocument35 pagesIn Memory Management OPMKarthikeya BandaruNo ratings yet

- Oracles RMCSDocument34 pagesOracles RMCSsharas77No ratings yet

- Acme Pick Slip Md050 DraftDocument16 pagesAcme Pick Slip Md050 Draftqkhan2000No ratings yet

- OFI GST BOE Functional DocumentDocument49 pagesOFI GST BOE Functional Documentzaheer ahamadNo ratings yet

- OPM Resource Cost-Overheads-Component - Class-PeriodsDocument12 pagesOPM Resource Cost-Overheads-Component - Class-PeriodsAhmedNo ratings yet

- Ebs Enterprise Command Center Quick Start GuideDocument6 pagesEbs Enterprise Command Center Quick Start GuidearavindaNo ratings yet

- How To Cancel/ Restart The Cost Manager:: More Create Blog Sign inDocument4 pagesHow To Cancel/ Restart The Cost Manager:: More Create Blog Sign inRahul AgarwalNo ratings yet

- Drop Shipment Back Order and Back To Back Order in OMDocument5 pagesDrop Shipment Back Order and Back To Back Order in OMGuru PrasadNo ratings yet

- 8958 Production Scheduling PP TDocument29 pages8958 Production Scheduling PP Tarajesh07No ratings yet

- OPM - Quality MGMT - R12Document68 pagesOPM - Quality MGMT - R12duygu100% (1)

- COA Technical GuidelinesDocument17 pagesCOA Technical Guidelinesvarachartered283No ratings yet

- Accounting Entires For Oracle Apps R12Document27 pagesAccounting Entires For Oracle Apps R12Vimalakkannan GopalNo ratings yet

- Oracle EBS - Fusion SCP Cloud Integration Automation Whitepaper FinalDocument12 pagesOracle EBS - Fusion SCP Cloud Integration Automation Whitepaper FinalMohamed MahmoudNo ratings yet

- Ora ErrorsDocument2,186 pagesOra ErrorsdexatroNo ratings yet

- OPM Batch APIDocument22 pagesOPM Batch APIKarthikeya Bandaru100% (2)

- Global Forecasting: ASCP FundamentalsDocument18 pagesGlobal Forecasting: ASCP FundamentalspavanNo ratings yet

- Oracle Fusion - MFG OMDocument25 pagesOracle Fusion - MFG OMSrinivasa Rao AsuruNo ratings yet

- Sentham - Kannan PsDocument6 pagesSentham - Kannan PsKarunya KannanNo ratings yet

- MFG OPM Advisor Webcast 2016 0105Document61 pagesMFG OPM Advisor Webcast 2016 0105Steffi StevenNo ratings yet

- Shipping Ship Method Freight Charges Oracle AppsDocument12 pagesShipping Ship Method Freight Charges Oracle AppsRamesh GarikapatiNo ratings yet

- Back To Back Promising - Fusion Gop Supply Planning PDFDocument11 pagesBack To Back Promising - Fusion Gop Supply Planning PDFJorge DeaThrider VazquezNo ratings yet

- Web AdiDocument61 pagesWeb AdiSurendra BabuNo ratings yet

- Oracle LCMDocument33 pagesOracle LCMtsurendarNo ratings yet

- Project Manufacturing Setup and TransactionsDocument36 pagesProject Manufacturing Setup and TransactionsSreeharsha SNo ratings yet

- eAM Project ManufacturingDocument22 pageseAM Project ManufacturingPramodh KumarNo ratings yet

- BR100Ainv Inventory Application SetupDocument51 pagesBR100Ainv Inventory Application Setupselva pmscreativeNo ratings yet

- Exam 1z0-1024: Oracle Cost ManagementDocument3 pagesExam 1z0-1024: Oracle Cost Managementdreamsky702243No ratings yet

- Gme - Osp PDFDocument148 pagesGme - Osp PDFseenuyarasiNo ratings yet

- Md120 Cats Hr005 Benco Out InterfaceDocument6 pagesMd120 Cats Hr005 Benco Out Interfacelingesh6bNo ratings yet

- How To Make API WIPDocument2 pagesHow To Make API WIPHeriNo ratings yet

- R12 OPM Quality PDFDocument440 pagesR12 OPM Quality PDFjvidyalaNo ratings yet

- Update Physical Inventory CountsDocument8 pagesUpdate Physical Inventory CountsAkashNo ratings yet

- Cost SIG May 2012 Cost Rollup v3Document97 pagesCost SIG May 2012 Cost Rollup v3Rimsha KiranNo ratings yet

- Fbdi Vs AdfdiDocument2 pagesFbdi Vs AdfdivijayakumarjNo ratings yet

- OPM Migration Reference Guide Release 11i To Release 12 1Document40 pagesOPM Migration Reference Guide Release 11i To Release 12 1Sanjeeva RokkalaNo ratings yet

- Oracle PSDocument39 pagesOracle PSSribidya MishraNo ratings yet

- Some Important Tables Joins in Oracle Apps WIP, BOM, InVDocument4 pagesSome Important Tables Joins in Oracle Apps WIP, BOM, InVSudha KrishnaNo ratings yet

- OFI GST Process Claim Functional DocumentDocument22 pagesOFI GST Process Claim Functional Documentlkalidas1998No ratings yet

- OFI-GST - Functional Tax Computation For O2C - Phase1Document56 pagesOFI-GST - Functional Tax Computation For O2C - Phase1Rana7540100% (3)

- OFI GST Integration for AP, AR and WMSDocument8 pagesOFI GST Integration for AP, AR and WMSchandrawakarNo ratings yet

- Ebs GST Transition 1jul17Document6 pagesEbs GST Transition 1jul17rajkumarNo ratings yet

- 5OFI GST Functional P2P Flow Phase1 PDFDocument57 pages5OFI GST Functional P2P Flow Phase1 PDFlkalidas1998No ratings yet

- OFI GST Functional TDS Configuration Phase2Document26 pagesOFI GST Functional TDS Configuration Phase2rajkumarNo ratings yet

- Oracle Financials for India (OFI) Bill of Entry (BOE) Functional FlowDocument53 pagesOracle Financials for India (OFI) Bill of Entry (BOE) Functional FlowLaxmidhara NayakNo ratings yet

- Oracle Financials GST SettlementDocument32 pagesOracle Financials GST SettlementSrinivas KovvurNo ratings yet

- OFI Tax DefaultingDocument68 pagesOFI Tax DefaultingRajat SNo ratings yet

- GST Functional TDS Configuration Phase2Document26 pagesGST Functional TDS Configuration Phase2Venkata Ramana50% (4)

- OFI GST E-Invoicing Functionality1Document24 pagesOFI GST E-Invoicing Functionality1Rajesh KumarNo ratings yet

- Oracle Developer - Build Forms I - Volume 2 - Student GuideDocument342 pagesOracle Developer - Build Forms I - Volume 2 - Student GuideTrurlScribdNo ratings yet

- SQL 1 - Volume IIIDocument40 pagesSQL 1 - Volume IIIvishav_20003214No ratings yet

- Oracle Developer - Build Forms I - Volume 2 - Student GuideDocument342 pagesOracle Developer - Build Forms I - Volume 2 - Student GuideTrurlScribdNo ratings yet

- Anurag SagarDocument254 pagesAnurag Sagarvimal329967% (3)

- I K 46303029Document1 pageI K 46303029vishav_20003214No ratings yet

- HIL-Mangli Phase VIII Focal Point Ludhiana (Mangli) 141010 IndiaDocument1 pageHIL-Mangli Phase VIII Focal Point Ludhiana (Mangli) 141010 Indiavishav_20003214No ratings yet

- Oracle Apps Accounts Payables FunctionalityDocument60 pagesOracle Apps Accounts Payables FunctionalitySra1$93% (15)

- Oracle WIPDocument195 pagesOracle WIPzeeshan7850% (2)

- Himachal Pradesh Subordinate Services Selection Board Hamirpur, District Hamirpur-177001Document9 pagesHimachal Pradesh Subordinate Services Selection Board Hamirpur, District Hamirpur-177001arun_dashing87No ratings yet

- Discoverer Web Training in San Diego-SpreadoutpagesDocument55 pagesDiscoverer Web Training in San Diego-SpreadoutpagesHany IbNo ratings yet

- Erp Wip QueriesDocument3 pagesErp Wip Queriesvishav_20003214No ratings yet

- Toad For Data AnalystsDocument17 pagesToad For Data AnalystsAmit Singh ChauhanNo ratings yet

- Oracle WIPDocument195 pagesOracle WIPzeeshan7850% (2)

- ASI 61 - Accounting for Taxes on IncomeDocument3 pagesASI 61 - Accounting for Taxes on Incomevishav_20003214No ratings yet

- ACT180 Module 1Document3 pagesACT180 Module 1Norlaylah Naga LantongNo ratings yet

- Moises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Document8 pagesMoises Sanchez-Zaragoza, A077 273 744 (BIA July 14, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Amendment of Indian ConstitutionDocument24 pagesAmendment of Indian ConstitutionAnkit AnandNo ratings yet

- Agrarian Reform Measures Require Just CompensationDocument43 pagesAgrarian Reform Measures Require Just CompensationLady Liezl MiguelNo ratings yet

- MLB2K10 360 ManualDocument9 pagesMLB2K10 360 ManualguzjeNo ratings yet

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDocument23 pagesPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaNo ratings yet

- Official Notification For ITBP RecruitmentDocument19 pagesOfficial Notification For ITBP RecruitmentShrishanti Kale100% (1)

- Astrology Case in Supreme Court of IndiaDocument10 pagesAstrology Case in Supreme Court of IndiaramachariNo ratings yet

- Strategic Alliance Vs RadstockDocument2 pagesStrategic Alliance Vs RadstockChristian Jay B. PonsicaNo ratings yet

- Report 4 Garnace Tort DraftDocument34 pagesReport 4 Garnace Tort DraftmilespunzalanNo ratings yet

- Law of Torts & Consumer Protection Act Renaissance Law College NotesDocument76 pagesLaw of Torts & Consumer Protection Act Renaissance Law College NotesAnjana NairNo ratings yet

- HB 5082Document13 pagesHB 5082Abel Dpb18No ratings yet

- Kitzur Shulchan Aruch - Notes 1Document5 pagesKitzur Shulchan Aruch - Notes 1Daville BulmerNo ratings yet

- 2011 Fall Civil Procedure 1 SyllabusDocument8 pages2011 Fall Civil Procedure 1 SyllabusmskeifNo ratings yet

- MIAA v. CADocument1 pageMIAA v. CAJose Raphael JaringaNo ratings yet

- Transcription: RNA Polymerases and General Transcription FactorsDocument77 pagesTranscription: RNA Polymerases and General Transcription FactorsmluluNo ratings yet

- Rights of Unpaid Seller ExplainedDocument21 pagesRights of Unpaid Seller ExplainedAnanya ShuklaNo ratings yet

- Legal Method MCQs February 2021 ExamDocument18 pagesLegal Method MCQs February 2021 ExamI Dhriti INo ratings yet

- September 2014 MailerDocument35 pagesSeptember 2014 MailerBritCitsNo ratings yet

- AIBEPreparatory Materials Book 1Document238 pagesAIBEPreparatory Materials Book 1Venkata Subbaiah ArigelaNo ratings yet

- Mason Vs CA (SCRA)Document4 pagesMason Vs CA (SCRA)Coleen Navarro-RasmussenNo ratings yet

- State v. Kosterow, Ariz. Ct. App. (2017)Document3 pagesState v. Kosterow, Ariz. Ct. App. (2017)Scribd Government DocsNo ratings yet

- 11155e PDFDocument20 pages11155e PDFPeter MundellNo ratings yet