Professional Documents

Culture Documents

Economic Selection Criteria PDF

Economic Selection Criteria PDF

Uploaded by

Mohamed Arbi Ben YounesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Economic Selection Criteria PDF

Economic Selection Criteria PDF

Uploaded by

Mohamed Arbi Ben YounesCopyright:

Available Formats

E CONOMIC P ROJECT

S ELECTION C RITRIA

September 2015 Hisham Haridy, PMP, PMI-RMP

ECONOMIC PROJECT SELECTION CRITERIA

CAPITAL BUDGETING

Project managers are often called upon to be active participants during the

benefit-to-cost analysis of project selection. It is highly unlikely that companies

will approve a project where the costs exceed the benefits.

Benefits can be measured in either financial or nonfinancial terms.

The process of identifying the financial benefits is called capital budgeting,

which may be defined as the decision-making process by which organizations

evaluate projects that include the purchase of major fixed assets such as

buildings, machinery, and equipment.

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

CAPITAL BUDGETING

Sophisticated capital budgeting techniques take into consideration depreciation

schedules, tax information, and cash flow.

The following are economic models for selecting a project:

1) Present value

2) Net present value

3) Internal rate of return

4) Payback period

5) Benefit-cost ratio.

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

1. Present Value (PV):

The value today of future cash flows.

This is the method of determining today’s value of future money.

FV

PV =

Where:

(1+i)n

PV: Present Value

FV: Future Value

i : Interest rate

n: number of time periods

Example

What is the present value of $300,000 received three years from now if we expect the interest

rate to be 10 percent?

300000

PV = = $225,394

(1+0.1)3

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

2. Net Present Value (NPV)

The sum of the present value of all income and expenditures of a project. (> 0 is ok).

It is the present value of the total benefits (income or revenue) minus the costs over many

time periods.

NPV= PV (all cash inflows) – PV (all cash outflows)

FV

NPV= ∑ - Initial investment

(1+k+i)n

Where:

k: Annual inflation rate

Example

You have two projects to choose from. Project A will take three years to complete and has an

NPV of $45,000. Project B will take six years to complete and has an NPV of $85,000. Which

one would you prefer?

Project “B”

Key selection: Maximum NPV

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Example

Cash flow as follow with interest 10%.

NPV?

Time Income / Present Value of Income at Present Value of Cost at

Costs

Period Revenue 10% Interest Rate 10% Interest Rate

0 0 0 200 200

1 50 45 100 91

2 100 83 0 0

3 300 225 0 0

Total 353 291

NPV= 353 - 291 = $ 62

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

3. Internal Rate of Return (IRR)

The determination of the discount rate at the point of NPV = 0

The rate (read it as "interest rate") at which the project inflows (revenues) and project

outflows (costs) are equal.

Calculating IRR is complex and requires the aid of a computer.

FV

0= ∑ - Initial investment

(1+k+i)n

Where:

i: Rate of return

Example

You have two projects to choose from; Project A with an IRR of 21 percent will be

completed in 4 years or Project B with an IRR of 15 percent will be completed in one year.

Which one would you prefer?

Project “A”

Although the project B has a smaller duration than project A does not

matter because time is already taken into account in IRR calculations

Key selection: Greatest IRR

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

4. Payback Period

The payback period is the length of time required to recover an initial investment through

cash flows generated from the investment.

The shorter the time period, the better the investment opportunity.

Payback period is the least precise of all capital budgeting methods because the calculations

are in dollars and not adjusted for the time value of money.

Initial Investment

Payback Period=

(Annual cash inflows)

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Example

A project costs $100,000 to implement and has annual net cash inflows of $25,000.

100,000

Payback Period= = 4 years

25,000

Example

Project A has an investment of $ 500,000 and payback period of 3 years. Project B has an

investment of $ 300,000 and payback period of 5 years. Using the payback period criteria,

which project will you select?

Project “A”

Key selection: Lowest Payback period

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Example

Years 0 1 2 3 4

Cash flow -1000 500 400 300 100

Net Cash flow -1000 -500 -100 200 300

Payback period = 2.33 years

Example

Years 0 1 2 3 4

Cash flow -1000 100 300 400 600

Net Cash flow -1000 -900 -600 -200 400

Payback period = 3.33 years

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

5. Benefit Cost Ratio (BCR)

A comparison of revenue to costs. Greater than 1 is good.

Benefits (or Payback or Revenue)

BCR=

Costs

BCR of > 1 means that benefits (i.e. expected revenue) is greater than the cost. Hence it

is beneficial to do the project.

Example

Project A has an investment of $ 500,000 and BCR of 2.5 Project B has an investment of $

300,000 and BCR of 1.5 Using the Benefit Cost Ratio criteria, which project will you select?

Project “A”

Although the project B has a smaller investment than project A will not impact the selection

Key selection: Greatest BCR

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

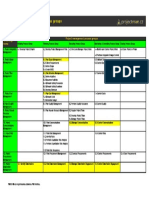

Exercise:

Time Period Project “A” Project “B” Selection

NPV $ 95,000 $ 75,000 A

IRR 13 % 17 % B

Payback Period 16 months 21 months A

Benefit : Cost ratio 2.79 1.3 A

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Sunk Cost

The cost that has already been incurred – therefore cannot be avoided going forward.

Example

Project A had initial budget of $ 1,000 out of which $ 800 has already been spent. To

complete project A, we will need additional $ 500. Another Project B will require $ 1200

for completion. Which project do you want to select?

Project “A”

$ 800 spent in project A i.e it is sunk cost – hence should be ignored. So, at this point of

time,

Cost of completing project A = $ 500

Cost of completing project B = $ 1200

Key selection: Ignore the sunk costs “because they have already been incurred and cannot be avoided”

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Opportunity Cost

The opportunity given up by selecting one project over another.

The cost of passing up the next best choice when making a decision.

Once the best option is decided, the Opportunity cost of not doing the other next option is

determined – this is used to calculate opportunity cost.

Example

You have two projects to choose from: Project A with an NPV of $45,000 or Project B with

an NPV of $85,000. What is the opportunity cost of selecting project B?

Project “$45,000”

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Economic Value Added (EVA)

This concept is concerned with whether the project returns to the company more value

than it costs.

The amount of added value the project produces for the company's shareholders above

the cost of financing the project

EVA= Net Operating profit after tax - Capital charge

Working Capital

The amount of money the company has available to invest, including investment in

projects.

Net Working Capital = Current assets - Current liabilities for an organization.

PROJECT COST MANAGEMENT September 2015

ECONOMIC PROJECT SELECTION CRITERIA

Depreciation

Large assets (e.g., equipment) purchased by a company lose value over time.

There are two forms of depreciation:

1. Straight Line Depreciation

2. Accelerated Depreciation

Accelerated depreciation depreciates faster than straight line.

Straight Line Depreciation Accelerated Depreciation

The same amount of depreciation is taken There are two forms:

each year. 1. Double Declining Balance

2. Sum of the Years Digits

Example: A $1,000 item with a 10-year Example: A $1,000 item with a 10-year useful life

useful life and no salvage value (how much and no salvage value (how much the item is worth at

the item is worth at the end of its life) the end of its life)

Would be depreciated at $100 per year. Would be depreciated at $180 the first year, $150 the

second, $130 the next, etc.

PROJECT COST MANAGEMENT September 2015

You might also like

- Repossession ChecklistDocument5 pagesRepossession ChecklistDipak Ranjan MukherjeeNo ratings yet

- Common Law Copyright NoticeDocument4 pagesCommon Law Copyright NoticeAnonymous nYwWYS3ntV60% (5)

- Total Quality Management: Mechanical Engineering Technology MET - 523TQMDocument24 pagesTotal Quality Management: Mechanical Engineering Technology MET - 523TQMsubhan sibghatNo ratings yet

- Analysis of Pipe NetworksDocument14 pagesAnalysis of Pipe NetworksAhmad Sana100% (2)

- Overview of 49 Processes From PMBOK Guide PDFDocument11 pagesOverview of 49 Processes From PMBOK Guide PDFIndustrial Engineering Services Sri LankaNo ratings yet

- Project Work Plan TemplateDocument2 pagesProject Work Plan TemplateAndrew ArimNo ratings yet

- KraDocument1 pageKralass navarroNo ratings yet

- RMP - Integration and Very Important QuestionsDocument89 pagesRMP - Integration and Very Important QuestionsAhmed EL-desokeyNo ratings yet

- Unblocking BottlenecksDocument3 pagesUnblocking BottlenecksMaggie GonzalesNo ratings yet

- Lean Six Sigma: DMAIC Model By: Manufacturing Practice LabDocument17 pagesLean Six Sigma: DMAIC Model By: Manufacturing Practice LabLean Six Sigma TrainingNo ratings yet

- Phase Gate Review ReportDocument4 pagesPhase Gate Review ReportDavid PhoaNo ratings yet

- Scheduling Tool Procurement: Joseph M. Rivard Phase 2 - Contract Selection Dr. Antonio Prensa October 15, 2010Document14 pagesScheduling Tool Procurement: Joseph M. Rivard Phase 2 - Contract Selection Dr. Antonio Prensa October 15, 2010jojolax36No ratings yet

- Project ManagementDocument158 pagesProject Managementratnesh737No ratings yet

- Risk ManagementDocument17 pagesRisk ManagementMatthew SibandaNo ratings yet

- Recalled Questions - Promotion Test For Scale II To IIIDocument8 pagesRecalled Questions - Promotion Test For Scale II To IIIcandeva2007No ratings yet

- Are We Doing Well SlidesDocument10 pagesAre We Doing Well SlidessahajNo ratings yet

- PM620 Unit 4 DBDocument3 pagesPM620 Unit 4 DBmikeNo ratings yet

- Part1 Define - GBDocument38 pagesPart1 Define - GBNitesh GoyalNo ratings yet

- PMP ExamDocument18 pagesPMP ExamSamir Hegishte50% (2)

- How To Calculate Sigma Level For A ProcessDocument9 pagesHow To Calculate Sigma Level For A ProcessmaherkamelNo ratings yet

- Improving Bank Call Centre Operations Using Six Sigma: Rahul GautamDocument8 pagesImproving Bank Call Centre Operations Using Six Sigma: Rahul Gautamsajeeby100% (1)

- Film PrioritizationDocument7 pagesFilm PrioritizationPrashanthi Priyanka ReddyNo ratings yet

- Unit 4 IpDocument7 pagesUnit 4 IpJohannah MunozNo ratings yet

- Phase 4 - Project Management Financial Assessments Value in Using PERT, Risk Matrices, and Earned Value Management Memo Joseph M. Rivard Professor: Dr. Gonzalez PM620-1003B-01 September 10, 2010Document5 pagesPhase 4 - Project Management Financial Assessments Value in Using PERT, Risk Matrices, and Earned Value Management Memo Joseph M. Rivard Professor: Dr. Gonzalez PM620-1003B-01 September 10, 2010jojolax36No ratings yet

- Case PresentationDocument22 pagesCase PresentationMustafa MahmoodNo ratings yet

- Variable Flow and Volume Refrigerant System: Market FactorsDocument2 pagesVariable Flow and Volume Refrigerant System: Market FactorsamrezzatNo ratings yet

- Lesson 3 - PMP - Prep - Project Management - V3Document28 pagesLesson 3 - PMP - Prep - Project Management - V3pranjal92pandeyNo ratings yet

- Quality Cost: by Dr. Lawrence WongDocument23 pagesQuality Cost: by Dr. Lawrence WongAtif Ahmad KhanNo ratings yet

- List of Free SimulatorsDocument1 pageList of Free SimulatorsUmar MunawarNo ratings yet

- Sipoc: Document The Top Level Process Steps in Any Process For A Product or ServiceDocument7 pagesSipoc: Document The Top Level Process Steps in Any Process For A Product or ServicetonyNo ratings yet

- Shapiro CHAPTER 5 SolutionsDocument11 pagesShapiro CHAPTER 5 Solutionsjimmy_chou13140% (1)

- Navarro VS SolidumDocument2 pagesNavarro VS Solidumjovani emaNo ratings yet

- Risk Management - Communication PlanDocument6 pagesRisk Management - Communication PlanirviNo ratings yet

- HA CEDAC Workshop INDO Kaizen PartDocument16 pagesHA CEDAC Workshop INDO Kaizen PartHardi BanuareaNo ratings yet

- Lesson 8 - CAPM Prep Quality Management V2Document42 pagesLesson 8 - CAPM Prep Quality Management V2Kamran Anjum100% (1)

- Six Sigma Analyse Phase: BITS PilaniDocument33 pagesSix Sigma Analyse Phase: BITS PilaniFUNTV5100% (1)

- Sales Final CasesDocument42 pagesSales Final CasesMeldz VerzanoNo ratings yet

- Scope Management PlanDocument4 pagesScope Management Planalireza ghoreyshiNo ratings yet

- Six SigmaTraining OfferingDocument16 pagesSix SigmaTraining OfferingAshitosh BabarNo ratings yet

- Copy of Broiler FinancialsDocument5 pagesCopy of Broiler Financialskevior2No ratings yet

- PMP Case StudyDocument2 pagesPMP Case StudyShanker SAPNo ratings yet

- Lean Six Sigma CrosswordDocument1 pageLean Six Sigma CrosswordexamplecgNo ratings yet

- Formato PdcaDocument1 pageFormato PdcaManuel MaresNo ratings yet

- CSQP Section 3 SlidesDocument156 pagesCSQP Section 3 SlidesIsmehen TrabelsiNo ratings yet

- PM Tricks Classroom Workbook Ed9 R1 20180920 - ProtecciónDocument194 pagesPM Tricks Classroom Workbook Ed9 R1 20180920 - ProteccióncrangelNo ratings yet

- Current State of Quality in The Automotive Industry: Scott Gray Director, Quality Products and Services, AIAGDocument26 pagesCurrent State of Quality in The Automotive Industry: Scott Gray Director, Quality Products and Services, AIAGSelvaraj SNo ratings yet

- Pmi Acp DemoDocument6 pagesPmi Acp DemoKhang TruongNo ratings yet

- Cause-And-Effect Diagram: Why Implement Cost of Quality (COQ) ?Document3 pagesCause-And-Effect Diagram: Why Implement Cost of Quality (COQ) ?Doren Joy BatucanNo ratings yet

- 04 The Six Sigma MethodologyDocument53 pages04 The Six Sigma Methodologychteo1976No ratings yet

- PMP ITTO Process Chart PMBOK Guide 6th Edition-1aDocument14 pagesPMP ITTO Process Chart PMBOK Guide 6th Edition-1aSyed SadiqNo ratings yet

- PMP QuestionsDocument3 pagesPMP QuestionsHosam YassinNo ratings yet

- Kano Model TemplateDocument3,059 pagesKano Model TemplateNicol Huarca ChoqueNo ratings yet

- Lean Project Management PrinciplesDocument6 pagesLean Project Management PrinciplessantosoNo ratings yet

- ASQ Test4prep CSSBB v2021!04!27 by Henry 116qDocument51 pagesASQ Test4prep CSSBB v2021!04!27 by Henry 116qSyed Danish AlamNo ratings yet

- Capm QuestionsDocument6 pagesCapm QuestionsyenNo ratings yet

- 8a Quiz QC Tool 2 Check SheetDocument2 pages8a Quiz QC Tool 2 Check SheetJose Ortega0% (1)

- Chapter 4 & 5 (The Foundation of Project MGT)Document29 pagesChapter 4 & 5 (The Foundation of Project MGT)Belayneh MekonnenNo ratings yet

- Asset-V1 TUMx+QPLS1x+2T2018+type@asset+block@SixSigma Process-Improvement Methods ToolsDocument85 pagesAsset-V1 TUMx+QPLS1x+2T2018+type@asset+block@SixSigma Process-Improvement Methods ToolsAmar MohammedNo ratings yet

- The Foundations of PM - Chapter 1Document47 pagesThe Foundations of PM - Chapter 1Belayneh MekonnenNo ratings yet

- Lean and Environmental Sustainability in ConstructionDocument2 pagesLean and Environmental Sustainability in ConstructionRedzwan NazlyNo ratings yet

- Professional Practice 434: Six SigmaDocument19 pagesProfessional Practice 434: Six SigmaWen Ming LauNo ratings yet

- Quiz Submissions - Quiz 3 - Chapter 6Document5 pagesQuiz Submissions - Quiz 3 - Chapter 6charlesNo ratings yet

- Project Management Process GroupsDocument1 pageProject Management Process GroupsMuhammad NadeemNo ratings yet

- ASQ 23case-Study-Siemens-VdoDocument4 pagesASQ 23case-Study-Siemens-VdoSubhashNo ratings yet

- CAPSTONE OverviewDocument17 pagesCAPSTONE OverviewChahat JauraNo ratings yet

- Amway Lean Office Hdi 2Document30 pagesAmway Lean Office Hdi 2Ignacio Guerra100% (1)

- Overproduction MUDADocument1 pageOverproduction MUDARaza HasanNo ratings yet

- 7 QC ToolsDocument31 pages7 QC ToolsSohel GavandiNo ratings yet

- Quality: To Meet Product or Service Specifications and ExpectationsDocument13 pagesQuality: To Meet Product or Service Specifications and ExpectationsmaelikahNo ratings yet

- Project Management Office PMO A Complete Guide - 2020 EditionFrom EverandProject Management Office PMO A Complete Guide - 2020 EditionNo ratings yet

- Task 3 Final Draft Potable Water Distribution System Plan Analysis Section 4 Development of Water System ModelDocument5 pagesTask 3 Final Draft Potable Water Distribution System Plan Analysis Section 4 Development of Water System ModelamrezzatNo ratings yet

- ArcGIS Pro Essential Workflows Course ContentsDocument9 pagesArcGIS Pro Essential Workflows Course ContentsamrezzatNo ratings yet

- Figure B.1 Commissioning Process Flow Chart.: ASHRAE Guideline 0-2005 23Document1 pageFigure B.1 Commissioning Process Flow Chart.: ASHRAE Guideline 0-2005 23amrezzatNo ratings yet

- RoutledgeHandbooks Chapter03Document19 pagesRoutledgeHandbooks Chapter03amrezzatNo ratings yet

- Water Programme Reading ListDocument8 pagesWater Programme Reading ListamrezzatNo ratings yet

- Samsung Refrigerator 14 FT, 2 Doors, RT422ARL PDFDocument5 pagesSamsung Refrigerator 14 FT, 2 Doors, RT422ARL PDFamrezzatNo ratings yet

- SOBEK 2.14.001 New FeaturesDocument10 pagesSOBEK 2.14.001 New FeaturesamrezzatNo ratings yet

- Pipe NetworkDocument20 pagesPipe Networkamrezzat100% (1)

- B PipeNetworksDocument4 pagesB PipeNetworksamrezzatNo ratings yet

- AQAP - FittingsDocument4 pagesAQAP - FittingsamrezzatNo ratings yet

- Tan vs. Valdehueza Facts: Jardenil vs. Solas - Art. 1956 - CalinisanDocument8 pagesTan vs. Valdehueza Facts: Jardenil vs. Solas - Art. 1956 - CalinisannikkimaxinevaldezNo ratings yet

- Minister Outlines MOE's Plans For Holistic Education - Singapore NewsDocument7 pagesMinister Outlines MOE's Plans For Holistic Education - Singapore NewsIvanNo ratings yet

- Executive Summary: NPA Management in State Bank of IndiaDocument62 pagesExecutive Summary: NPA Management in State Bank of IndiaFurkhan Ahmed SamNo ratings yet

- Compilation of Test ACC106 For StudentsDocument15 pagesCompilation of Test ACC106 For StudentsKamarul Adha0% (1)

- PNB Vs - Spouses ManaloDocument9 pagesPNB Vs - Spouses ManaloKent Wilson Orbase AndalesNo ratings yet

- DSP ML Tax Saver Fund - Application FormDocument2 pagesDSP ML Tax Saver Fund - Application Formdrashti.investments1614No ratings yet

- Caprock Trade and Finance LLCDocument3 pagesCaprock Trade and Finance LLCDaniel Reis NandovaNo ratings yet

- Glaski V Boa Final AppendixDocument195 pagesGlaski V Boa Final AppendixraphinologyNo ratings yet

- G.R. No. 193453 Spouses Hojas v. Philippine Amanah BankDocument6 pagesG.R. No. 193453 Spouses Hojas v. Philippine Amanah BankmehNo ratings yet

- Financial Accounting Journal Entries and Accounting Cycle Study Guide PDFDocument10 pagesFinancial Accounting Journal Entries and Accounting Cycle Study Guide PDFshaankkNo ratings yet

- Republic Vs Dela RamaDocument5 pagesRepublic Vs Dela RamaaldinNo ratings yet

- Introduction To Banking Sector & SbiDocument106 pagesIntroduction To Banking Sector & Sbiaparajitha lalasaNo ratings yet

- PT Askrindo President Director Speech FinalDocument4 pagesPT Askrindo President Director Speech Finalrizky ibnuNo ratings yet

- Assignment No. 1: Course Name: "Financial Reporting and Disclosure" Submitted byDocument7 pagesAssignment No. 1: Course Name: "Financial Reporting and Disclosure" Submitted byMUHAMMAD UMARNo ratings yet

- Bank and NBFCDocument21 pagesBank and NBFCManika AggarwalNo ratings yet

- Nobel Prize in Literature: About The Poet: Rabindranath TagoreDocument20 pagesNobel Prize in Literature: About The Poet: Rabindranath TagoreADITYANo ratings yet

- LTD Digest Pool 5pdf PDFDocument13 pagesLTD Digest Pool 5pdf PDFColeenNo ratings yet

- Auto Loan at HDFCDocument65 pagesAuto Loan at HDFCMohsin Khan100% (1)

- Problem Set 2 Solution 2021Document8 pagesProblem Set 2 Solution 2021Pratyush GoelNo ratings yet

- Equity Research Report HDFC BankDocument4 pagesEquity Research Report HDFC BankNikhil KumarNo ratings yet

- UpcaDocument60 pagesUpcaapi-308243995No ratings yet

- Here Are The 10 Oldest Companies in India That Are Still Going Strong - The Economic TimesDocument7 pagesHere Are The 10 Oldest Companies in India That Are Still Going Strong - The Economic TimesvssrikalyanNo ratings yet