Professional Documents

Culture Documents

P46: Employee Without A Form P45: Section One

P46: Employee Without A Form P45: Section One

Uploaded by

alecs_the_lionOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P46: Employee Without A Form P45: Section One

P46: Employee Without A Form P45: Section One

Uploaded by

alecs_the_lionCopyright:

Available Formats

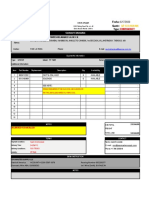

P46: Employee without a form P45

Section one To be completed by the employee

Your employer will need this information if you don’t have a form P45 from your previous employer. Your employer may ask you

to complete this form or provide the same information in another format. If you later receive your P45, hand it to your present

employer. Use capital letters when completing this form.

Your details

National Insurance number Date of birth DD MM YYYY

This is very important in getting your tax and benefits right

Title – enter MR, MRS, MISS, MS or other title Address

House or flat number

Surname

Rest of address including house name or flat name

First name(s)

Postcode

Gender. Enter 'X' in the appropriate box

Male Female

Your present circumstances Student Loans (advanced in the UK)

Read all the following statements carefully and enter 'X' If you left a course of UK Higher Education before last

in the one box that applies to you. 6 April and received your first UK Student Loan

A – This is my first job since last 6 April and instalment on or after 1 September 1998 and you have

I have not been receiving taxable Jobseeker's not fully repaid your Student Loan, enter 'X' in box D.

Allowance, Employment and Support Allowance (Do not enter ‘X’ in box D if you are repaying your UK

or taxable Incapacity Benefit or a state or Student Loan by agreement with the UK Student Loans

occupational pension.

A Company to make monthly payments through

your bank or building society account.)

D

OR

B – This is now my only job, but since last 6 April

I have had another job, or have received

Signature and date

taxable Jobseeker's Allowance,

I confirm that this information is correct

Employment and Support Allowance or

taxable Incapacity Benefit. I do not receive Signature

a state or occupational pension.

B

OR

C – I have another job or receive a state or

occupational pension.

C

Date DD MM YYYY

2 0

P46 Page 1 HMRC 01/11

Section two To be completed by the employer

Almost all employers must file employee starter information online at www.hmrc.gov.uk/online

Guidance for employers who must file online can be found at www.businesslink.gov.uk/payingnewemployees

Employers exempt from filing online should send this form to their HM Revenue & Customs office on the first payday. Guidance

can be found in the E13 Employer Helpbook Day to day payroll.

Employee's details

Date employment started DD MM YYYY Works/payroll number and department or branch (if any)

Job title

Employer's details

Employer PAYE reference Address

Office number Reference number Building number

/

Rest of address

Employer name

Postcode

Tax code used

If you do not know the tax code to use or the current National Insurance contributions (NICs)

lower earnings limit, go to www.businesslink.gov.uk/payeratesandthresholds

Enter 'X' in the appropriate box

Box A Tax code used

Emergency code on a cumulative basis

A

If Week 1 or

Month 1 applies,

Box B enter 'X' in this box

Emergency code on a non-cumulative

Week 1/Month 1 basis

B

Box C

Code BR unless employee fails to

complete section one then code 0T

Week 1/Month 1 basis

C

For employees who complete Box A or Box B starter notification is not needed until their earnings reach the NICs

lower earnings limit.

Page 2

You might also like

- Anglo PersianDocument11 pagesAnglo Persianeghl89No ratings yet

- Rental - Lease Agreement PDFDocument6 pagesRental - Lease Agreement PDFMiles Makinmoves Moreals100% (1)

- Direct Deposit Enrollment Form: Account Information AmountDocument1 pageDirect Deposit Enrollment Form: Account Information AmountClifton WilsonNo ratings yet

- Dave Ramsey Chapter 4 - DebtDocument4 pagesDave Ramsey Chapter 4 - DebtGene'sNo ratings yet

- State of Georgia G-4 PDFDocument2 pagesState of Georgia G-4 PDFJames BoyerNo ratings yet

- Addendum To Contract of Sale (Chase) 12122011 WEB-1417029181Document10 pagesAddendum To Contract of Sale (Chase) 12122011 WEB-1417029181Gleb SterrNo ratings yet

- Firm Profile FormatDocument13 pagesFirm Profile FormatSURANA1973No ratings yet

- Notice of Conditional Acceptance 2Document4 pagesNotice of Conditional Acceptance 2Akil Bey100% (3)

- P 46Document2 pagesP 46Charlotte JamesNo ratings yet

- Staff - p45Document4 pagesStaff - p45velorutionNo ratings yet

- LicenseDocument6 pagesLicenseRazvannusNo ratings yet

- CC Form (WPO)Document1 pageCC Form (WPO)Nancy SparlingNo ratings yet

- Lucky Tiger Casino Card Authentication: XX XXXXDocument1 pageLucky Tiger Casino Card Authentication: XX XXXXบ่จัก ดอกNo ratings yet

- F 941Document4 pagesF 941gopaljiiNo ratings yet

- Secured Card ApplicationDocument1 pageSecured Card Applicationahren gabrielNo ratings yet

- Tax Return 2018-19Document18 pagesTax Return 2018-19Kasam ANo ratings yet

- BMO World Elite Mastercard Benefits Guide enDocument11 pagesBMO World Elite Mastercard Benefits Guide enTonyNo ratings yet

- Better Covid ThingDocument4 pagesBetter Covid ThingAuguste RiedlNo ratings yet

- What Is Aadhaar KYC Know e KYC For Aadhaar CardDocument3 pagesWhat Is Aadhaar KYC Know e KYC For Aadhaar CardHARSHNo ratings yet

- 2018 EldDocument3 pages2018 Eldmuhammad afiqNo ratings yet

- ProblemC ch05Document5 pagesProblemC ch05Adan FakihNo ratings yet

- Mr. Ashok 4375 XXXX XXXX 2004 H No 17/255, Tharanatha Hospital, Anantapur Road, Behind MRF ShowroomDocument3 pagesMr. Ashok 4375 XXXX XXXX 2004 H No 17/255, Tharanatha Hospital, Anantapur Road, Behind MRF ShowroomAshok KumarNo ratings yet

- Vba-26-1880-Are VA Certificate of Eligability ApplicationDocument2 pagesVba-26-1880-Are VA Certificate of Eligability ApplicationJohnnie L. MockNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- 2023 Tax Return ZaireDocument14 pages2023 Tax Return ZairepatovoidNo ratings yet

- 2008 Mark and Stephanie Madoff Foundation 990Document60 pages2008 Mark and Stephanie Madoff Foundation 990jpeppardNo ratings yet

- Tax Return 2016Document18 pagesTax Return 2016kezia dugdale0% (1)

- AZ Argan Ventures LTDDocument20 pagesAZ Argan Ventures LTDBarangaySanLuisNo ratings yet

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- COMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24Document350 pagesCOMERICA INC /NEW/ 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- Au Pairs WWW - Irs.gov/pub/irs-Pdf/f1040nre PDFDocument1 pageAu Pairs WWW - Irs.gov/pub/irs-Pdf/f1040nre PDFMaru Aguirre ArizmendiNo ratings yet

- View Completed FormsDocument10 pagesView Completed FormsRui FariaNo ratings yet

- Chapter 5 - Tax PayableDocument36 pagesChapter 5 - Tax PayableRyan YangNo ratings yet

- Bin 2 Xbox Gold, 4 NETFLIX + 2 Play Store + 2 PAYPAL, Spotify 100Document2 pagesBin 2 Xbox Gold, 4 NETFLIX + 2 Play Store + 2 PAYPAL, Spotify 100alonsoNo ratings yet

- VAC Form New FeesDocument3 pagesVAC Form New FeesLiano GuerraNo ratings yet

- TTH3G9SDocument77 pagesTTH3G9SRobert SmithNo ratings yet

- Fall 2023 - Tax ProjectDocument4 pagesFall 2023 - Tax Projectacwriters123No ratings yet

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument6 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterWomen Cup2No ratings yet

- Your National Insurance Number: About This FormDocument4 pagesYour National Insurance Number: About This FormTatyana TerziyskaNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- QT-133-2020-MX Gavsa RT 760e PDFDocument1 pageQT-133-2020-MX Gavsa RT 760e PDFraulNo ratings yet

- 1420 Form For Applicants PDFDocument21 pages1420 Form For Applicants PDFsarangowaNo ratings yet

- GST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFDocument78 pagesGST - Tax Invoice, Debit or Credit Notes, Returns, Payment of Tax PDFSapna MalikNo ratings yet

- US Internal Revenue Service: f1040nr - 2004Document5 pagesUS Internal Revenue Service: f1040nr - 2004IRSNo ratings yet

- New JErsey Resident Return NJ-1040Document68 pagesNew JErsey Resident Return NJ-1040Stephen HallickNo ratings yet

- What Is Unemployment?Document8 pagesWhat Is Unemployment?Arsema ShimekitNo ratings yet

- Aaron Berg w2Document2 pagesAaron Berg w2kevin kuhnNo ratings yet

- Https WWW - Dol.state - Ga.us WS4-MW5 CicsDocument4 pagesHttps WWW - Dol.state - Ga.us WS4-MW5 CicsDaniel MinnickNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument11 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJazella IlejayNo ratings yet

- Health Insurance Forms 1Document1 pageHealth Insurance Forms 1api-453439542No ratings yet

- Date Description Type Amount Available: Debit Account TransactionsDocument4 pagesDate Description Type Amount Available: Debit Account TransactionsClifton WilsonNo ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- View PDF FormDocument1 pageView PDF FormKathryn NightwineNo ratings yet

- G AcoerDocument1 pageG AcoerChris MedicaNo ratings yet

- Dec-23 UpdatedDocument10 pagesDec-23 UpdatedMuhammad UsmanNo ratings yet

- US Internal Revenue Service: F1040a - 1991Document2 pagesUS Internal Revenue Service: F1040a - 1991IRSNo ratings yet

- rc1 15eDocument5 pagesrc1 15erouzbeh1797No ratings yet

- Mart1552 21i FCDocument23 pagesMart1552 21i FCOlga M.No ratings yet

- 2023 Tax Return: Prepared ByDocument14 pages2023 Tax Return: Prepared BypatovoidNo ratings yet

- O o o o O: ReceivedDocument10 pagesO o o o O: ReceivedCalWonkNo ratings yet

- Activity Example 1040 TaxDocument2 pagesActivity Example 1040 TaxKevin ÁlvarezNo ratings yet

- Transfer ReceiptDocument1 pageTransfer ReceiptEzekiel EgwenikeNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- 05 CurrencySwapsDocument40 pages05 CurrencySwapsVenkat NaguriNo ratings yet

- Business Organisations and Agency PDFDocument250 pagesBusiness Organisations and Agency PDFalexops5No ratings yet

- Boney Hector D'cruz (Am - Ar.u3com08013) - Final ProjectDocument63 pagesBoney Hector D'cruz (Am - Ar.u3com08013) - Final ProjectShinu ChandradasNo ratings yet

- Acc TestDocument17 pagesAcc TestNeha KalraNo ratings yet

- ITC Annual ReportDocument19 pagesITC Annual Reportanks0909No ratings yet

- Comparative Equity Analysis of Pharma StocksDocument91 pagesComparative Equity Analysis of Pharma StocksVenkat50% (4)

- Reference Guide To MortgagesDocument28 pagesReference Guide To MortgagesRussell GaoNo ratings yet

- Andhra Pradesh Records of Rights in Land and Pattadar Pass Books PDFDocument15 pagesAndhra Pradesh Records of Rights in Land and Pattadar Pass Books PDFLatest Laws TeamNo ratings yet

- Simple and Compound InterestDocument8 pagesSimple and Compound InterestMari Carreon TulioNo ratings yet

- The Satyam CaseDocument40 pagesThe Satyam CaseManinder SinghNo ratings yet

- Topic 4 - Current Liabilities Sample ProblemsDocument8 pagesTopic 4 - Current Liabilities Sample ProblemsHazel Jane EsclamadaNo ratings yet

- Trans SumateraDocument24 pagesTrans SumateraEka Sukma Aditya100% (1)

- Taxation Law 2 (TaxRevDocument61 pagesTaxation Law 2 (TaxRevCrnc NavidadNo ratings yet

- Advanced Financial ManagementDocument23 pagesAdvanced Financial ManagementDhaval Lagwankar75% (4)

- SAP Standard BI Content ExtractorsDocument74 pagesSAP Standard BI Content Extractorsnira5050No ratings yet

- Assignment - Commercial LawDocument15 pagesAssignment - Commercial LawNURKHAIRUNNISANo ratings yet

- Currency ConvertibilityDocument17 pagesCurrency ConvertibilityRehna Mohammed AliNo ratings yet

- Certificate of MembershipDocument2 pagesCertificate of MembershipJaime BerryNo ratings yet

- Comparative Analysis of Demat Services of Broking FirmsDocument48 pagesComparative Analysis of Demat Services of Broking FirmsdraviNo ratings yet

- June, 2016.ethiopiaDocument60 pagesJune, 2016.ethiopiasamuel debebeNo ratings yet

- Seno vs. PestolanteDocument1 pageSeno vs. PestolantejamimaiNo ratings yet

- Hodges v. SalasDocument7 pagesHodges v. SalasPea ChubNo ratings yet

- Case Digest (My Part) 2.5.2012Document3 pagesCase Digest (My Part) 2.5.2012xx_stripped52No ratings yet

- DCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveDocument4 pagesDCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveanjugaduNo ratings yet

- Hero - Honda DataDocument9 pagesHero - Honda Datarakesh9006No ratings yet