Professional Documents

Culture Documents

Rates of Estate Tax If Net Taxable Estate Is Over But Not Over Tax Shall Be Plus of The Excess Over

Uploaded by

Kj Banal0 ratings0% found this document useful (0 votes)

17 views1 pageTAX

Original Title

Tax table

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTAX

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views1 pageRates of Estate Tax If Net Taxable Estate Is Over But Not Over Tax Shall Be Plus of The Excess Over

Uploaded by

Kj BanalTAX

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

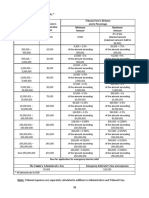

Rates of Estate Tax

If net taxable Of the excess

But not over Tax shall be Plus

estate is over over

P 200,000 Exempt

P 200,000 500,000 0 5% P 200,000

500,000 2,000,000 15,000 8% 500,000

2,000,000 5,000,000 135,000 11% 2,000,000

5,000,000 10,000,000 465,000 15% 5,000,000

10,000,000 And over 1,215,000 20% 10,000,000

Rates of Donor’s Tax

If net gift is Of the excess

But not over Tax shall be Plus

over over

P 100,000 Exempt

P 100,000 200,000 0 2% P 100,000

200,000 500,000 2,000 4% 200,000

500,000 1,000,000 14,000 6% 500,000

1,000,000 3,000,000 44,000 8% 1,000,000

3,000,000 5,000,000 204,000 10% 3,000,000

5,000,000 10,000,000 404,000 12% 5,000,000

10,000,000 And over 1,004,000 15% 10,000,000

You might also like

- Estate Tax TableDocument1 pageEstate Tax TableJulietGuirnaldoNo ratings yet

- Tax TableDocument2 pagesTax TableKlaters BokuNo ratings yet

- Estate TaxDocument7 pagesEstate TaxSirci RamNo ratings yet

- Tax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Document6 pagesTax Particulars National Internal Revenue Code of 1997 R. A. No. 10963Natsu DragneelNo ratings yet

- DIAC CostsDocument1 pageDIAC CostsKB TranslationNo ratings yet

- DIAC Table of Fees and CostsDocument1 pageDIAC Table of Fees and CostsMohamed A.HanafyNo ratings yet

- Jorg R. MenesesDocument3 pagesJorg R. MenesesKevin JugaoNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document25 pagesTax Changes You Need To Know Under RA 10963Charry BaximenNo ratings yet

- Tax 2020Document1 pageTax 2020Afreen MasoodNo ratings yet

- Tax TablesDocument1 pageTax TablesEmman NepacenaNo ratings yet

- Caf 6 PT EsDocument58 pagesCaf 6 PT EsSyeda ItratNo ratings yet

- Caf 6 PT Es PDFDocument58 pagesCaf 6 PT Es PDFSyeda ItratNo ratings yet

- Iligan City - Seminar On TRAIn Law For Students - 05 03 18Document195 pagesIligan City - Seminar On TRAIn Law For Students - 05 03 18Lorainne AjocNo ratings yet

- Comparison Train Law and NircDocument37 pagesComparison Train Law and Nircczabina fatima delica89% (19)

- Withholding Tax For 2020-21Document2 pagesWithholding Tax For 2020-21Rana InamNo ratings yet

- Tax Card For Tax Year 2020Document1 pageTax Card For Tax Year 2020zohaib shahNo ratings yet

- Chapter 5 Net Taxable Estate and Estate TaxDocument1 pageChapter 5 Net Taxable Estate and Estate TaxClaire BarbaNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- TRAIN (Changes) ???? Pages 1, 4, 7, 8Document4 pagesTRAIN (Changes) ???? Pages 1, 4, 7, 8blackmail1No ratings yet

- (Train) : Taxchanges U Need To KnowDocument27 pages(Train) : Taxchanges U Need To KnowNoel DomingoNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- Individual Income Taxation - IllustrationsDocument24 pagesIndividual Income Taxation - IllustrationsCharity Lumactod AlangcasNo ratings yet

- ESTATEDocument12 pagesESTATEVangie AntonioNo ratings yet

- Chapter 2Document17 pagesChapter 2ISLAM KHALED ZSCNo ratings yet

- Index For Estate TaxDocument16 pagesIndex For Estate TaxRonan PunzalanNo ratings yet

- Tax Rates For Individuals: Fast Moving Consumer GoodsDocument1 pageTax Rates For Individuals: Fast Moving Consumer GoodsHakim JanNo ratings yet

- House Bill 5636 - Package 1Document63 pagesHouse Bill 5636 - Package 1Denise MarambaNo ratings yet

- Calculate New Salary Tax by ShajarDocument2 pagesCalculate New Salary Tax by Shajarshajar-abbasNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather SaleemMalikKamranAsifNo ratings yet

- Estate Tax Bir WebsiteDocument14 pagesEstate Tax Bir WebsiteCharlotte MalgapoNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document20 pagesTax Changes You Need To Know Under RA 10963Rosanno DavidNo ratings yet

- Income TaxationDocument2 pagesIncome TaxationPaulene PabloNo ratings yet

- Taxation 2 (Maika Notes)Document30 pagesTaxation 2 (Maika Notes)Maria Acepcion DelfinNo ratings yet

- Old Tax Law Vs Train Law Tax PH Lessons - CompressDocument7 pagesOld Tax Law Vs Train Law Tax PH Lessons - CompressRonron De ChavezNo ratings yet

- Tax Card For Tax Year 2021 (TSP)Document1 pageTax Card For Tax Year 2021 (TSP)Muhammad Usama SheikhNo ratings yet

- Income Tax WHT Rates Card 2016-17Document8 pagesIncome Tax WHT Rates Card 2016-17Sami SattiNo ratings yet

- Tax Card 2021Document1 pageTax Card 2021MA AttariNo ratings yet

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

- Donor'S Tax: BIR Form 1800Document4 pagesDonor'S Tax: BIR Form 1800JAYAR MENDZNo ratings yet

- Tax QuizDocument2 pagesTax QuizMJ ArazasNo ratings yet

- Estate Tax Description: BIR Form 1801Document5 pagesEstate Tax Description: BIR Form 1801Razz LimpiadaNo ratings yet

- 19040400095- Nguyễn Hữu Phú- Lab03 Model Design 21092020Document5 pages19040400095- Nguyễn Hữu Phú- Lab03 Model Design 21092020Viem AnhNo ratings yet

- Graduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Document3 pagesGraduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Jecah May R. RiegoNo ratings yet

- Ra10963: Tax Reform For Acceleration and Inclusion Law (Train)Document6 pagesRa10963: Tax Reform For Acceleration and Inclusion Law (Train)fantasighNo ratings yet

- Tax Card 2020-21Document2 pagesTax Card 2020-21Lahore TaxationsNo ratings yet

- WorkingDocument4 pagesWorkingHaresh RajputNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- 4 5B Taxation of Individuals Graduated RatesDocument9 pages4 5B Taxation of Individuals Graduated RatesArgie DeguzmanNo ratings yet

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDocument7 pagesAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakNo ratings yet

- Income Tax Card Tax Year 2015Document3 pagesIncome Tax Card Tax Year 2015Sardar Shahid KhanNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiAnubhav KumarNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Estate and Trusts Solution - in Our TrustDocument6 pagesEstate and Trusts Solution - in Our TrustNoella Mae 01 GavinoNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSarang AgrawalNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiNirav TailorNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiVishalNo ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSACHIN REVEKARNo ratings yet

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Sleep, Consciousness and DreamDocument57 pagesSleep, Consciousness and DreamKj BanalNo ratings yet

- IntelligenceDocument27 pagesIntelligenceKj BanalNo ratings yet

- Cognitive, Social and Insightful Learning & MemoryDocument25 pagesCognitive, Social and Insightful Learning & MemoryKj BanalNo ratings yet

- Exceptional MemoryDocument12 pagesExceptional MemoryKj BanalNo ratings yet

- Classical and Operant Conditioning: Lorna A. Onda BSA-221Document42 pagesClassical and Operant Conditioning: Lorna A. Onda BSA-221Kj Banal100% (1)

- Learning: Stages, Laws, Styles, and TheoriesDocument24 pagesLearning: Stages, Laws, Styles, and TheoriesKj BanalNo ratings yet

- Chapter 3Document40 pagesChapter 3Kj BanalNo ratings yet

- Customer Delight Survey SampleDocument1 pageCustomer Delight Survey SampleKj BanalNo ratings yet

- Context Flow Diagram: 0 Account Details CashDocument1 pageContext Flow Diagram: 0 Account Details CashKj BanalNo ratings yet

- Man As WorkerDocument12 pagesMan As WorkerKj Banal100% (1)

- Organ SystemDocument22 pagesOrgan SystemKj BanalNo ratings yet

- Corp Liquidation - QuizDocument5 pagesCorp Liquidation - QuizKj Banal0% (1)

- Cognitive, Social and Insightful Learning & MemoryDocument25 pagesCognitive, Social and Insightful Learning & MemoryKj BanalNo ratings yet

- Net Gift and Donor's TaxDocument16 pagesNet Gift and Donor's TaxKj Banal100% (2)

- FinmanDocument2 pagesFinmanKj BanalNo ratings yet

- Ass. in EnglishDocument6 pagesAss. in EnglishKj BanalNo ratings yet

- Exceptional MemoryDocument12 pagesExceptional MemoryKj BanalNo ratings yet

- Cognitive, Social and Insightful Learning & MemoryDocument25 pagesCognitive, Social and Insightful Learning & MemoryKj BanalNo ratings yet

- NeurotransmittersDocument22 pagesNeurotransmittersKj Banal100% (1)

- Final ReviewDocument37 pagesFinal ReviewKj BanalNo ratings yet

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- Advanced Accounting 11e Test Bank PDFDocument15 pagesAdvanced Accounting 11e Test Bank PDFKj Banal100% (1)

- Exceptional MemoryDocument12 pagesExceptional MemoryKj BanalNo ratings yet

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)

- DONOR S Tax Multiple Choice Question 1Document13 pagesDONOR S Tax Multiple Choice Question 1Kj Banal80% (5)