Professional Documents

Culture Documents

FORM NO. 12C (See Rule 26B) Form For Sending Particulars of Income Under Section 192 - 2B

FORM NO. 12C (See Rule 26B) Form For Sending Particulars of Income Under Section 192 - 2B

Uploaded by

SeemaSambargiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORM NO. 12C (See Rule 26B) Form For Sending Particulars of Income Under Section 192 - 2B

FORM NO. 12C (See Rule 26B) Form For Sending Particulars of Income Under Section 192 - 2B

Uploaded by

SeemaSambargiCopyright:

Available Formats

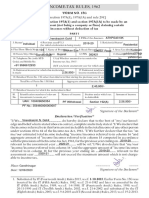

FORM NO.

12C

[See rule 26B]

Form for sending particulars of income under section 192 (2B) for the year ending 31st March, 19

1. Name and address of the employee

2. Permanent Account Number

3. Residential Status

4. Particulars of income under any head of income other than

“Salaries” (not being loss under any such head other than the

loss under the head “Income from house property”)

received in the financial year

(i) Income from house property Rs. .

(in case of loss, enclose computation thereof )

(ii) Profits and gains of business or profession Rs. .

(iii)Capital gains Rs. .

(iv) Income from other sources

(a) Dividends Rs. .

(b) Interest Rs. .

(c) Other income Rs. .

(specify) Total Rs. .

5. Aggregate of sub-items (I) to (v) of item 4

6. Tax deducted at source [enclosed certificate(s) issued under

section 203]

Place .

Date . Signature of the employer

Verification

I, , do hereby declare that what is stated above is

true to the best of my knowledge and belief.

Verified today, day of 19 .

Place .

Date . Signature of the employer

You might also like

- Notification 88 2023Document4 pagesNotification 88 2023sarvagya.mishra448No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Form 12CDocument2 pagesForm 12CAllahBaksh100% (2)

- Declaration FormDocument1 pageDeclaration FormDattatraya ParleNo ratings yet

- Form 12C PDFDocument1 pageForm 12C PDFKanishka MandalNo ratings yet

- Form 12C PDFDocument1 pageForm 12C PDFNithya RahulNo ratings yet

- Form 12CDocument1 pageForm 12CSrinivasa Rao TNo ratings yet

- Form 12BBDocument6 pagesForm 12BBmoin.m.baigNo ratings yet

- Loss On House PropertyDocument1 pageLoss On House PropertyVarun KumarNo ratings yet

- Annexure III&IIIA-Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA-Form12C&ComputationSheetBhooma Shayan100% (1)

- Annexure III&IIIA Form12C&ComputationSheetDocument2 pagesAnnexure III&IIIA Form12C&ComputationSheetkalpNo ratings yet

- Other IncomeDocument2 pagesOther IncomeSandeep ReddyNo ratings yet

- It Form 12BBDocument4 pagesIt Form 12BBBunty JeeNo ratings yet

- Form 12CDocument1 pageForm 12Csadiqsein01No ratings yet

- FRE Form12CDocument1 pageFRE Form12Cappsectesting3No ratings yet

- VerificationDocument1 pageVerificationRaghunath DhandapaniNo ratings yet

- Form 12 CDocument1 pageForm 12 CSireeshaVeluruNo ratings yet

- FormDocument2 pagesFormGyanendra GautamNo ratings yet

- Form NoDocument1 pageForm Nomurali_mohan_5No ratings yet

- Income-Tax Rules, 1962Document3 pagesIncome-Tax Rules, 1962Akarsh ReghunathNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFtpchoNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFvizay237_430788222No ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFvizay237_430788222No ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSunnyGouravNo ratings yet

- Ministry of Finance (Department of Revenue)Document24 pagesMinistry of Finance (Department of Revenue)grameshchandraNo ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- FORM12C2Document1 pageFORM12C2Sudha SNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeNo ratings yet

- Form 16 For The AY 2017-18Document4 pagesForm 16 For The AY 2017-18Suman HalderNo ratings yet

- FORM 12C (Let Out Property)Document1 pageFORM 12C (Let Out Property)Sureshkumar MauryaNo ratings yet

- ACC 203 Taxation in NepalDocument9 pagesACC 203 Taxation in NepalSophiya PrabinNo ratings yet

- Form 23ac: Form For Filing Balance Sheet and Other Documents With The RegistrarDocument7 pagesForm 23ac: Form For Filing Balance Sheet and Other Documents With The Registrarcoolavi066628No ratings yet

- Form 23BDocument2 pagesForm 23BnavanitguptaNo ratings yet

- Form 23ACDocument6 pagesForm 23ACNikkhil GuptaaNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Chapter No.1 Basic Concepts: (A) Income-Tax Act, 1961 (B) Income-Tax Rules, 1962Document48 pagesChapter No.1 Basic Concepts: (A) Income-Tax Act, 1961 (B) Income-Tax Rules, 1962Rohit BadgujarNo ratings yet

- Amendment in TDS RulesDocument3 pagesAmendment in TDS RulesjohnsuthaNo ratings yet

- Form No 15GDocument2 pagesForm No 15Gnarendra1968No ratings yet

- ITR-A Released - Wef - 01.11.2022Document2 pagesITR-A Released - Wef - 01.11.2022sai charanNo ratings yet

- Rayat Educational & Research TrustDocument2 pagesRayat Educational & Research Trustvijay_2594No ratings yet

- 15G PDFDocument2 pages15G PDFSudhendu ChauhanNo ratings yet

- Form 3CDDocument8 pagesForm 3CDmahi jainNo ratings yet

- Income Tax DepartmentDocument6 pagesIncome Tax DepartmentRajasekar SivaguruvelNo ratings yet

- How To Fill-Up ITR Using EBIRForm - 2022 - v1Document10 pagesHow To Fill-Up ITR Using EBIRForm - 2022 - v1Michael PantonillaNo ratings yet

- Paymentof Bonus ActDocument2 pagesPaymentof Bonus ActSrinivasan .MNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- IT FormDocument8 pagesIT Formapi-3829020No ratings yet

- Form IV - Annual ReturnDocument2 pagesForm IV - Annual Returnhdpanchal86No ratings yet

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilNo ratings yet

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- ITR62 Form 15 CADocument5 pagesITR62 Form 15 CAMohit47No ratings yet

- 1089 Form68Document3 pages1089 Form68vigneshNo ratings yet

- INCOME TAX MASTER FILEDocument28 pagesINCOME TAX MASTER FILEDIVYA RANINo ratings yet

- Taxation of IncomeDocument10 pagesTaxation of IncomeDavis Deo KagisaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet