Professional Documents

Culture Documents

Intercompany Transaction - Inventory Dengan Unrealized Profit (Persediaan Akhir)

Intercompany Transaction - Inventory Dengan Unrealized Profit (Persediaan Akhir)

Uploaded by

Inas Salsabila UrbachOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intercompany Transaction - Inventory Dengan Unrealized Profit (Persediaan Akhir)

Intercompany Transaction - Inventory Dengan Unrealized Profit (Persediaan Akhir)

Uploaded by

Inas Salsabila UrbachCopyright:

Available Formats

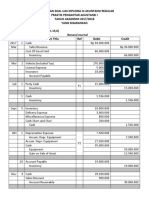

INTERCOMPANY TRANSACTION - INVENTORY

DENGAN UNREALIZED PROFIT (PERSEDIAAN AKHIR)

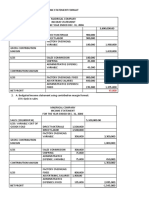

Reporting Consolidated

Financial Statement

PT.P afiliate of PT.S

PT.L-1 PT.P PT.S PT.L-2

$ 30.000 $ 36.000 $ 37.500

$ 6.000

Elimination of Intercompany

profit and Unrealized Profit

ILUSTRASI:

B SELAMA TH 2012:

PT.S MEMBELI PERSEDIAAN PADA PT.P SEHARGA $ 36,000

HARGA POKOK PERSEDIAAN PD PT.P TERCATAT $ 30,000

PT.S MENJUAL PERSEDIAAN TSB KE PELANGGAN $ 37,500

PT.S MENJUAL KE PIHAK LAIN DGN PERSED AKHIR $ 6,000

JURNAL TRANSAKSI ANTAR PERUSAHAAN:

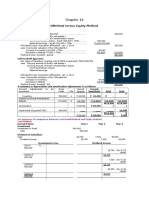

1 DI PT.P: Rumus UnRealized Profit=

PERSEDIAAN (Inventory) 30,000

UTG DAG (Account Payable) 30,000 = P.Ak x (ICS-COS)

ICS

PTG DAG (Account Receivable) 36,000 atau

PENJUALAN (Sale) 36,000 = P/Ak - P/Ak

(ICS/COS)

HPP (Cost of Sale) 30,000

PERSEDIAAN 30,000 ICS=Inter Company 36,000

Sale

2 DI PT.S:

PERSEDIAAN (Inventory) 36,000 Ending Inventory= 6,000

UTG DAG (Account Payable) 36,000

Margin -ICS=(36.000-30.000) = 6,000

PTG DAG (Account Receivable) 37,500 Unrealized profit= 1,000

PENJUALAN (Sale) 37,500 5,000

1.20

HPP (Cost of Sale) 30,000 (6.000/36.000 x 6.000) =

PERSEDIAAN 30,000 atau

6,000

6.000 -

36000/30.000

CATATAN:

1 DISISAKAN SEBAGAI PERSEDIAAN AKHIR PER 31/12/12 SEBESAR = $ 6,000

2 JADI HP PERSEDIAAN TDK TERCATAT SEBESAR $ 36.000 MELAINKA $ 30,000

3 UNREALIZED PROFIT =6.000/36.000X(36.000-30.000) $ 1,000

(ATAU=6.000-6000/(36.000:30.000)

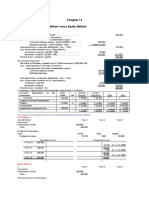

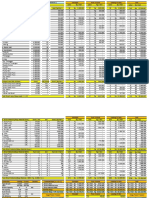

ELIMINASI DLM KERTAS KERJA KONSOLIDASI:

PT.P PT.S(100%) ELIMINASI KONSOLI

R/L: D K DASI

PENJUALAN 36,000 37,500 1 36,000 37,500

HPP 30,000 30,000 2 1,000 1 36,000 25,000

LABA KOTOR 12,500

NERACA:

PERSEDIAAN 6,000 2 1,000 5,000

JURNAL ELIMINASI INTERCOMPANY TRANSACTION-PERSEDIAAN

Sale 36,000 ICS 2012

Cost of Sale 36,000

Cost of Sale 1,000 URP-2012

Inventory 1,000

You might also like

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-15Document31 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-15allysa amping100% (1)

- Prior PeriodDocument14 pagesPrior PeriodHarvey Dienne Quiambao100% (6)

- Week 5 Activity (ANSWER)Document9 pagesWeek 5 Activity (ANSWER)Christine Kaye Damolo100% (2)

- Solution Manual Advanced Accounting by Guerrero Peralta Chapter 2 PDFDocument24 pagesSolution Manual Advanced Accounting by Guerrero Peralta Chapter 2 PDFAndry John PerialdeNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-16Document82 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-16Kate Alvarez75% (4)

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document89 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16Mckenzie100% (1)

- Chapter 2 Partnership OperationsDocument26 pagesChapter 2 Partnership OperationsKianJohnCentenoTuricoNo ratings yet

- Perida and Rhoda Answer KeyDocument5 pagesPerida and Rhoda Answer KeyApril NaidaNo ratings yet

- P13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Document3 pagesP13.3 General Journal A Date Account Titles Ref Dr. Cr. Aug-01 Cash (2.000 X 0,70) Sep-01 Cash (2.000 X 8)Friska AvriliaNo ratings yet

- Umipig AbbyMarileth Interim2Document3 pagesUmipig AbbyMarileth Interim2abbyyyyy.mariNo ratings yet

- CostingDocument6 pagesCostingLove IslamNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Art Niensted Greg Bolen Krista Sayler Total Salary Allowance Interest Allowance 1Document1 pageArt Niensted Greg Bolen Krista Sayler Total Salary Allowance Interest Allowance 1Carmela Kate FernandezNo ratings yet

- P12 2aDocument1 pageP12 2aCarmela Kate FernandezNo ratings yet

- Partnership Operations Solution GuideDocument26 pagesPartnership Operations Solution GuideRachel GreenNo ratings yet

- CASE 1 - LO1 A.) Heaven Company Income Statement For The Year Ended December 31, 2019 (Document13 pagesCASE 1 - LO1 A.) Heaven Company Income Statement For The Year Ended December 31, 2019 (Dhitami KhairunnisaNo ratings yet

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDocument4 pagesLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzNo ratings yet

- Solution Chapter 16Document90 pagesSolution Chapter 16Frances Chariz YbioNo ratings yet

- 7-3 PT Pandu Dan PT SadewaDocument2 pages7-3 PT Pandu Dan PT SadewaTeam 1No ratings yet

- Chapter 24 CVP - Break Even AnalysisDocument58 pagesChapter 24 CVP - Break Even AnalysisShehryar Abdul SattarNo ratings yet

- 2018-04-24 BOQ Soil Improvement Blok HDocument1 page2018-04-24 BOQ Soil Improvement Blok HM Reza Fatchul HaritsNo ratings yet

- SOLUTIONS To FAR FINAL PREDocument6 pagesSOLUTIONS To FAR FINAL PRELezyl UntalanNo ratings yet

- Kunci - Menyusun Lap. Keuangan - P1Document15 pagesKunci - Menyusun Lap. Keuangan - P1Arief Budi SetiawanNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part A)John Carlos DoringoNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 3 (2022)Document76 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 3 (2022)Mazikeen DeckerNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 16Document90 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 16MckenzieNo ratings yet

- Problem 1 Dream Co. and Theater CoDocument4 pagesProblem 1 Dream Co. and Theater CoskyNo ratings yet

- RoncalA EA2 VariableCostingDocument4 pagesRoncalA EA2 VariableCostingDrei Galanta RoncalNo ratings yet

- Simulasi Penggajihan Dan Bonus CleanerDocument5 pagesSimulasi Penggajihan Dan Bonus Cleanerfahmiwahono.bsc03No ratings yet

- RoncalA EA2 JobOrderCostingDocument4 pagesRoncalA EA2 JobOrderCostingDrei Galanta RoncalNo ratings yet

- Chapter 2 Partnership OperationsDocument24 pagesChapter 2 Partnership OperationsChelsy SantosNo ratings yet

- Installment SalesDocument6 pagesInstallment SalesJeramae M. artNo ratings yet

- Project Orderslip Mori Lt35 Ranggada Re02Document5 pagesProject Orderslip Mori Lt35 Ranggada Re02Arland AsraNo ratings yet

- A. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Document10 pagesA. Goodwill, 12/31/20x6 (P330,000 - P19,300) P 310,700 B. FV of NCI, 12/31/20x6Love FreddyNo ratings yet

- NotesDocument9 pagesNotesKristine AncunaNo ratings yet

- Accounts Homework SolutionsDocument67 pagesAccounts Homework SolutionsKunal BhansaliNo ratings yet

- Intercompany Profit Transactions - InventoriesDocument25 pagesIntercompany Profit Transactions - InventoriesRevina DewiNo ratings yet

- Chapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Document1 pageChapter 15 Afar Solman (Dayag 2015ed) - Prob 1 & 2Ma Teresa B. CerezoNo ratings yet

- Activity 1 Man. Acct.Document2 pagesActivity 1 Man. Acct.Aia Sophia SindacNo ratings yet

- C3&4Document4 pagesC3&4Joana MarieNo ratings yet

- Liquidation LectureDocument6 pagesLiquidation LectureGarp BarrocaNo ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- Atillo, Portfolio 3 - Bsa 314Document7 pagesAtillo, Portfolio 3 - Bsa 314Jeth MahusayNo ratings yet

- Chapter No: 3: GoodwillDocument29 pagesChapter No: 3: GoodwillDurga Prasad NallaNo ratings yet

- Chapter 2 Partnership Operationsdoc PDF FreeDocument25 pagesChapter 2 Partnership Operationsdoc PDF Freemaria evangelistaNo ratings yet

- Cash inDocument27 pagesCash inAnisa NANo ratings yet

- BAb V Buku Bu IInDocument6 pagesBAb V Buku Bu IInAditya Agung SatrioNo ratings yet

- Ratio AnalysisDocument56 pagesRatio AnalysissrinivasNo ratings yet

- Chapter 18 Answer KeyDocument9 pagesChapter 18 Answer KeyNCT100% (1)

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part M)John Carlos DoringoNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- Kuis Pertemuan 3 AKLDocument6 pagesKuis Pertemuan 3 AKLDeby KartikaNo ratings yet

- Contribution Margin Income Statement FormatDocument2 pagesContribution Margin Income Statement FormatMarilou GabayaNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationGeraldine MayoNo ratings yet

- Chapter 1Document21 pagesChapter 1marieieiemNo ratings yet

- Harga Pokok Produksi (Crusher Ke Load JT)Document2 pagesHarga Pokok Produksi (Crusher Ke Load JT)mrmmsamut gatal22No ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet