Professional Documents

Culture Documents

FIN 410 Chapter 11 Money Markets Review

Uploaded by

nikowawa0 ratings0% found this document useful (0 votes)

9 views2 pagesThis document contains a chapter review for FIN 410 taught by Dr. Hatem Akeel in the Fall 2017 semester. It includes questions about why different entities use money markets and what types of money market instruments exist. It also provides two example problems - the first calculating the discount rate and annualized investment rate for a 182-day Treasury bill, and the second calculating the maturity dates for commercial paper given its price and stated discount rates.

Original Description:

fr

Original Title

Ch 11 Review

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a chapter review for FIN 410 taught by Dr. Hatem Akeel in the Fall 2017 semester. It includes questions about why different entities use money markets and what types of money market instruments exist. It also provides two example problems - the first calculating the discount rate and annualized investment rate for a 182-day Treasury bill, and the second calculating the maturity dates for commercial paper given its price and stated discount rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesFIN 410 Chapter 11 Money Markets Review

Uploaded by

nikowawaThis document contains a chapter review for FIN 410 taught by Dr. Hatem Akeel in the Fall 2017 semester. It includes questions about why different entities use money markets and what types of money market instruments exist. It also provides two example problems - the first calculating the discount rate and annualized investment rate for a 182-day Treasury bill, and the second calculating the maturity dates for commercial paper given its price and stated discount rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

FIN 410 - Fall 2017

Instructor: Dr.Hatem Akeel

Chapter 11 Review

1. Why does the U.S. Government use the money markets?

2. Why do businesses use the money markets?

3. Why do banks not eliminate the need for money markets?

4. Who issues commercial paper and for what purpose?

5. Why are banker’s acceptances so popular for international transactions?

Who Participates in the Money Markets?

U.S. Treasury Department

Federal Reserve System

Commercial Banks

Businesses

Investment and Securities Firms

Individuals

What are Money Market Instruments?

Treasury Bills

Federal Funds

Repurchase Agreements

Negotiable Certificates of Deposit

Commercial Paper

Banker’s Acceptances

Eurodollars

1.What would be your discount rate % and our annualized investment rate % on the purchase of a 182

day Treasury bill for $4,925 that pays $5,000 at maturity?

$5,000 −$4,925 360

Discount Rate ⇓= × = 0.02967 = 2.967%

$5,000 182

$5,000 − $4,925 365

Investment Rate ⇓= × = 0.03054 = 3.054%

$4,925 182

2. The price of $8,000 face value commercial paper is $7,930. If the discount rate is 4%, when will

the paper mature? If the annualized investment rate % is 4%, when will the paper mature?

[($8,000 − $7,930) / $8,000)] × (360 / N ) = 0.04

($70 / $8,000) × (360 / N ) = 0.04

($0.00875) × (360 / N ) = 0.04

(360 / N ) = 0.04 × (1/ $0.00875)

(360 / N ) = 4.571429

N = 78.75 = 79days

[($8,000 − $7,930) /($7,930)] × (365 / N ) = 0.04

($70 / $7,930) × (365 / N ) = 0.04

(365 / N ) = 0.04 × (1/ 0.008827)

365 / N = 4.53155

N = 80.55 = 81days

You might also like

- The Money Markets: Quantitative ProblemsDocument4 pagesThe Money Markets: Quantitative ProblemsMai AnhNo ratings yet

- Solution Manual For Financial Markets and Institutions 7th Edition by MishkinDocument10 pagesSolution Manual For Financial Markets and Institutions 7th Edition by MishkinKennethOrrmsqiNo ratings yet

- Replace Your Salary by Investing: Save More, Invest Smart and Maximise Your MoneyFrom EverandReplace Your Salary by Investing: Save More, Invest Smart and Maximise Your MoneyRating: 3.5 out of 5 stars3.5/5 (2)

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimNo ratings yet

- First Time Investor: Your Guide to Investing in the Australian Stock MarketFrom EverandFirst Time Investor: Your Guide to Investing in the Australian Stock MarketNo ratings yet

- Power of Dividend GrowthDocument2 pagesPower of Dividend Growthag rNo ratings yet

- The Magic of Income Investing 2: Your Household Runs on Income: Financial Freedom, #149From EverandThe Magic of Income Investing 2: Your Household Runs on Income: Financial Freedom, #149No ratings yet

- Why Market Value Should Not Equal Book ValueDocument6 pagesWhy Market Value Should Not Equal Book ValueErieyca ErieyNo ratings yet

- Chapter 4: Bond and Stock Valuation: Answers To End of Chapter QuestionsDocument10 pagesChapter 4: Bond and Stock Valuation: Answers To End of Chapter QuestionsAn HoàiNo ratings yet

- Financial Literacy-Middle School 13-PresenationDocument31 pagesFinancial Literacy-Middle School 13-PresenationRodel floresNo ratings yet

- A. Simple-Compound-Math of Money-ODL PDFDocument30 pagesA. Simple-Compound-Math of Money-ODL PDFcassandraNo ratings yet

- Bank Management 8Th Edition Koch Solutions Manual Full Chapter PDFDocument31 pagesBank Management 8Th Edition Koch Solutions Manual Full Chapter PDFBenjaminWeissazqe100% (10)

- Bank Management 8th Edition Koch Solutions ManualDocument10 pagesBank Management 8th Edition Koch Solutions Manualphoebeky78zbbz100% (26)

- Revison CF 13.07.2023 (All)Document116 pagesRevison CF 13.07.2023 (All)seyon sithamparanathanNo ratings yet

- Finance ProblemsDocument5 pagesFinance Problemsstannis69420No ratings yet

- Mathematics in The Modern World Lesson 1 2 FinalsDocument31 pagesMathematics in The Modern World Lesson 1 2 FinalsYumeko LeeNo ratings yet

- Present Value - Extra Topic Chapt 9 12 AdvDocument5 pagesPresent Value - Extra Topic Chapt 9 12 AdvlokNo ratings yet

- Vol-3 A Must Know Before You Start Trading ForexDocument11 pagesVol-3 A Must Know Before You Start Trading Forexsenad1981No ratings yet

- What Characteristics Define The Money Markets?Document8 pagesWhat Characteristics Define The Money Markets?habiba ahmedNo ratings yet

- A9R72l78x 11wze8t Ax0Document11 pagesA9R72l78x 11wze8t Ax0elisaNo ratings yet

- Vol-3-A Must Know Before You Start Trading ForexDocument11 pagesVol-3-A Must Know Before You Start Trading ForexanNo ratings yet

- Simple and Compound InterestDocument8 pagesSimple and Compound InterestMari Carreon TulioNo ratings yet

- Buying and Selling SecuritiesDocument6 pagesBuying and Selling SecuritiesChaituNo ratings yet

- Finance and StockmarketDocument37 pagesFinance and StockmarketmorireNo ratings yet

- TVM Practice Problems SolutionsDocument3 pagesTVM Practice Problems SolutionsEmirī PhoonNo ratings yet

- Capital Equipment List: Item Per Unit Quantity TotalDocument11 pagesCapital Equipment List: Item Per Unit Quantity TotalMichelle ClarkeNo ratings yet

- Simple Interest Calculator With Regular Deposits - WithdrawalsDocument9 pagesSimple Interest Calculator With Regular Deposits - Withdrawalsrajchavan528567No ratings yet

- TVM - Time Value of Money ConceptsDocument10 pagesTVM - Time Value of Money ConceptskartalNo ratings yet

- 01 Inflation and Investment AppraisalDocument7 pages01 Inflation and Investment AppraisalayeshaNo ratings yet

- CF Tutorial 11 - SolutionsDocument5 pagesCF Tutorial 11 - SolutionschewNo ratings yet

- Money WI E: Reward YourselfDocument63 pagesMoney WI E: Reward YourselfGrwltygrNo ratings yet

- ABM11 Business Mathematics Q1 W8Document12 pagesABM11 Business Mathematics Q1 W8Archimedes Arvie GarciaNo ratings yet

- Investment Portfolio ManagementDocument82 pagesInvestment Portfolio Management21-51804No ratings yet

- IF Question BankDocument4 pagesIF Question BankshlakaNo ratings yet

- Money WiseDocument62 pagesMoney Wisejei liNo ratings yet

- Full Download Personal Finance Canadian 4th Edition Madura Solutions ManualDocument35 pagesFull Download Personal Finance Canadian 4th Edition Madura Solutions Manualsavidaoicc6100% (34)

- Beauty Salon 1Document24 pagesBeauty Salon 1Danny SolvanNo ratings yet

- Full Download Fundamentals of Investments Valuation and Management 7th Edition Jordan Solutions ManualDocument36 pagesFull Download Fundamentals of Investments Valuation and Management 7th Edition Jordan Solutions Manualtapergodildqvfd100% (36)

- 4 ForexDocument80 pages4 Forexnayar alamNo ratings yet

- FM Unit 2 Lecture - Financial Statement Analysis - 2020Document51 pagesFM Unit 2 Lecture - Financial Statement Analysis - 2020Tanice WhyteNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Tugas Kelompok 1Document6 pagesTugas Kelompok 1Bought By UsNo ratings yet

- Chapter 5 Part 1Document6 pagesChapter 5 Part 1das23dasdaNo ratings yet

- The Effect of Inflation On Cash Flows: Year Cash Received Deflation Factor Deflated ValueDocument168 pagesThe Effect of Inflation On Cash Flows: Year Cash Received Deflation Factor Deflated ValuePREX WEXNo ratings yet

- Pratik Jagati Question BankDocument420 pagesPratik Jagati Question BankRoshan PoudelNo ratings yet

- What's The Use of It?Document41 pagesWhat's The Use of It?UdieokfchwNo ratings yet

- On The Purchase of 91-Day T-Bill, If The Face Value Is $3,000 and Purchase Price Is $2,900. (1QP)Document8 pagesOn The Purchase of 91-Day T-Bill, If The Face Value Is $3,000 and Purchase Price Is $2,900. (1QP)I IvaNo ratings yet

- What's More: Quarter 2 - Module 4: Simple and General AnnuitiesDocument4 pagesWhat's More: Quarter 2 - Module 4: Simple and General AnnuitiesChelsea NicoleNo ratings yet

- D 485 A 21 Eff 73 e 155Document8 pagesD 485 A 21 Eff 73 e 155Rica PulongbaritNo ratings yet

- PS7 Primera ParteDocument5 pagesPS7 Primera PartethomasNo ratings yet

- Mathematics of Investment Reviewer FinalsDocument20 pagesMathematics of Investment Reviewer FinalsDawn VersatilityNo ratings yet

- 5 6161346545657577683 PDFDocument6 pages5 6161346545657577683 PDFShivam GoyalNo ratings yet

- 5 6161346545657577683 PDFDocument6 pages5 6161346545657577683 PDFShivam GoyalNo ratings yet

- Finance ExamplesDocument15 pagesFinance ExamplescherifsambNo ratings yet

- Intermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 2 SolutionsDocument8 pagesIntermediate Accounting II (ACCT 342/542) Winter, 2014 Exam 2 SolutionsTzuyu TchaikovskyNo ratings yet

- Discussion 2 Time Value of Money ApplicationDocument2 pagesDiscussion 2 Time Value of Money ApplicationAyat fatimaNo ratings yet

- Business Plan Workbook How TODocument19 pagesBusiness Plan Workbook How TOpopye007No ratings yet

- Advnced Excel Skills D2Document185 pagesAdvnced Excel Skills D2Monir HosenNo ratings yet

- Chapter 8 Strategic ManagementDocument6 pagesChapter 8 Strategic ManagementnikowawaNo ratings yet

- Economics: General QuestionsDocument2 pagesEconomics: General QuestionsnikowawaNo ratings yet

- TN 48 Sun MicrosystemsDocument31 pagesTN 48 Sun Microsystemsnikowawa100% (1)

- FormulationDocument14 pagesFormulationAl AminNo ratings yet

- Electronic Book Resource ListDocument9 pagesElectronic Book Resource ListnikowawaNo ratings yet

- Recruitment PrintableDocument15 pagesRecruitment PrintableAnonymous C5sDarONo ratings yet

- What Is An E-Contract: Through The InternetDocument3 pagesWhat Is An E-Contract: Through The InternetnikowawaNo ratings yet

- PG Apps Training HandoutsDocument9 pagesPG Apps Training HandoutsnikowawaNo ratings yet

- Functions and Forms of BankingDocument5 pagesFunctions and Forms of Bankingمحمد أحمد عبدالوهاب محمدNo ratings yet

- Lecture 1 - Accounting in The Czech RepublicDocument12 pagesLecture 1 - Accounting in The Czech RepublicUmar SulemanNo ratings yet

- NCL Mis AdministratorDocument3 pagesNCL Mis AdministratornikowawaNo ratings yet

- CDC UP Training Plan TemplateDocument11 pagesCDC UP Training Plan TemplatenikowawaNo ratings yet

- Introduction To Multivariate Regression AnalysisDocument7 pagesIntroduction To Multivariate Regression AnalysisnikowawaNo ratings yet

- Chapter 1: Introduction To Management Information SystemsDocument14 pagesChapter 1: Introduction To Management Information SystemsvinuoviyanNo ratings yet

- Gatech-Opns MGMT SylDocument7 pagesGatech-Opns MGMT SylstudioshahNo ratings yet

- ABI-301 Lecture Note No. 1Document6 pagesABI-301 Lecture Note No. 1Aderaw GashayieNo ratings yet

- Management Flow Diagram: DirectorDocument18 pagesManagement Flow Diagram: DirectornikowawaNo ratings yet

- Hybrid Syllabus: MBA 500: Essentials of Business ManagementDocument10 pagesHybrid Syllabus: MBA 500: Essentials of Business ManagementnikowawaNo ratings yet

- Evolving Sustain AblyDocument22 pagesEvolving Sustain AblyHenry DongNo ratings yet

- Information Systems and Performance An AnalyticalDocument11 pagesInformation Systems and Performance An AnalyticalnikowawaNo ratings yet

- Smart Cities: As Enablers of Sustainable Development: A European ChallengeDocument3 pagesSmart Cities: As Enablers of Sustainable Development: A European ChallengenikowawaNo ratings yet

- Information Systems For Business and BeyondDocument20 pagesInformation Systems For Business and BeyondnikowawaNo ratings yet

- Defining Smart Sustainable CitiesDocument71 pagesDefining Smart Sustainable CitiesnikowawaNo ratings yet

- CSR Disclosure Banking Sector Saudi ArabiaDocument20 pagesCSR Disclosure Banking Sector Saudi ArabianikowawaNo ratings yet

- Budget Template Guide for Effective Program FundingDocument2 pagesBudget Template Guide for Effective Program FundingnikowawaNo ratings yet

- Monthly Expenses: Sample Budgeting WorksheetDocument2 pagesMonthly Expenses: Sample Budgeting WorksheetnikowawaNo ratings yet

- Ford Case (2990)Document8 pagesFord Case (2990)nikowawaNo ratings yet

- Budget WorksheetDocument2 pagesBudget WorksheetnikowawaNo ratings yet

- Standard Document: Short Form Agreement For Services: Notes and Instructions For UseDocument20 pagesStandard Document: Short Form Agreement For Services: Notes and Instructions For UsenikowawaNo ratings yet

- Chapter 23 Capital Structure: Learning ObjectivesDocument19 pagesChapter 23 Capital Structure: Learning ObjectivesnikowawaNo ratings yet

- PA System Design GuideDocument68 pagesPA System Design GuideBob Pierce100% (1)

- McDonald's Resources OverviewDocument5 pagesMcDonald's Resources OverviewPrarthana RaiNo ratings yet

- 7 1 15Document103 pages7 1 15Gaurish ChoudhuryNo ratings yet

- SITRAIN Training Course FeesDocument2 pagesSITRAIN Training Course FeesSead ArifagićNo ratings yet

- Siebel Course ContentsDocument2 pagesSiebel Course ContentsChiranjeeviChNo ratings yet

- Nil 20210313Document32 pagesNil 20210313Ambrosia NeldonNo ratings yet

- How-To Configure Mailbox Auto Remediation For Office 365 On Cisco SecurityDocument13 pagesHow-To Configure Mailbox Auto Remediation For Office 365 On Cisco SecurityCark86No ratings yet

- Faqir Chand Gulati v. Uppal Agencies Pvt. Ltd. principles housing constructionDocument5 pagesFaqir Chand Gulati v. Uppal Agencies Pvt. Ltd. principles housing constructionArnav LekharaNo ratings yet

- Describing Companies and JobsDocument9 pagesDescribing Companies and JobsJuan Manuel VillarealNo ratings yet

- R13 Oracle SCM Maintenance (EAM) Cloud Features SummaryDocument17 pagesR13 Oracle SCM Maintenance (EAM) Cloud Features SummarySrinivasa Rao AsuruNo ratings yet

- Lecture 1 and 2 Summary: Material Flow, Cargo Classification, Packaging, Warehousing and Material HandlingDocument9 pagesLecture 1 and 2 Summary: Material Flow, Cargo Classification, Packaging, Warehousing and Material HandlingAdyashaNo ratings yet

- Calculating Marginal Revenue From A Linear Dema... - Chegg - Com97Document4 pagesCalculating Marginal Revenue From A Linear Dema... - Chegg - Com97BLESSEDNo ratings yet

- Abbott Diagnostics Cell Dyn Emerald Operating Manual PDFDocument298 pagesAbbott Diagnostics Cell Dyn Emerald Operating Manual PDFAhmedMoussa0% (1)

- MAS - Runthrough NotesDocument3 pagesMAS - Runthrough NotesMae LaglivaNo ratings yet

- ZMP19278 - Fragata Uniao - Mil-Tek 102HD PDFDocument6 pagesZMP19278 - Fragata Uniao - Mil-Tek 102HD PDFLeandro_BarjonasNo ratings yet

- Is the US Stock Market in a Bubble? Signs to Watch ForDocument2 pagesIs the US Stock Market in a Bubble? Signs to Watch ForLeslie LammersNo ratings yet

- JD 0001 - General ManagerDocument2 pagesJD 0001 - General ManagerAigene PinedaNo ratings yet

- Promis-E V8i User GuideDocument828 pagesPromis-E V8i User Guideyongcv100% (4)

- Short Selling Comes Under Fire - AgainDocument1 pageShort Selling Comes Under Fire - AgainSUNLINo ratings yet

- Republic Act No. 7942Document42 pagesRepublic Act No. 7942Paul John Page PachecoNo ratings yet

- E-Commerce, Competitive Advantage and Business Performance of Banyuwangi Small and Medium-Sized EnterprisesDocument5 pagesE-Commerce, Competitive Advantage and Business Performance of Banyuwangi Small and Medium-Sized Enterprisesdewi auryaningrumNo ratings yet

- Consumer Behavior 12th Edition Schiffman Test BankDocument31 pagesConsumer Behavior 12th Edition Schiffman Test Bankrowanbridgetuls3100% (24)

- GTP&DWG of - Earthing Pipe& Earth RodDocument6 pagesGTP&DWG of - Earthing Pipe& Earth RodabhishekNo ratings yet

- Reflection on Experiences and Organizational Behavior Concepts Learned this SemesterDocument6 pagesReflection on Experiences and Organizational Behavior Concepts Learned this SemesterVaneet SinglaNo ratings yet

- Sana Mansoor Patel: Patelsana820Document3 pagesSana Mansoor Patel: Patelsana820Zoya KhanNo ratings yet

- BST 12 KVS Study Material 2024Document77 pagesBST 12 KVS Study Material 2024Parth AgrawalNo ratings yet

- Sales and Marketing Channel Management (M3) : Course ObjectiveDocument37 pagesSales and Marketing Channel Management (M3) : Course ObjectiveDhanek NathNo ratings yet

- 1000 Stocks - 7b48eDocument3 pages1000 Stocks - 7b48eAshok DewanganNo ratings yet

- Customer-Centricity in Retail BankingDocument17 pagesCustomer-Centricity in Retail BankingMadalina PopescuNo ratings yet

- Po 4701558619Document2 pagesPo 4701558619Roger Sebastian Rosas AlzamoraNo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

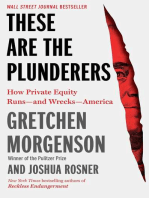

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)