Professional Documents

Culture Documents

28 Advance Tax Interest Calculator

Uploaded by

puran12345678900 ratings0% found this document useful (0 votes)

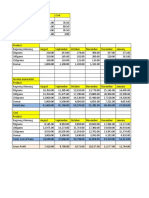

3 views2 pagesThis document contains an advance tax interest calculator for a corporate assessee. It shows the assessee's total tax liability as Rs. 41,273,472 and total TDS of Rs. 1,177,516, leaving an advance tax payable of Rs. 40,095,956. The assessee paid a total advance tax of Rs. 43,600,000 in four installments by the due dates. The calculator also shows interest charged under section 234C of Rs. 918,886 for late payment of advance tax in different quarters, as well as a direct tax refund of Rs. 3,504,044.

Original Description:

advance

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains an advance tax interest calculator for a corporate assessee. It shows the assessee's total tax liability as Rs. 41,273,472 and total TDS of Rs. 1,177,516, leaving an advance tax payable of Rs. 40,095,956. The assessee paid a total advance tax of Rs. 43,600,000 in four installments by the due dates. The calculator also shows interest charged under section 234C of Rs. 918,886 for late payment of advance tax in different quarters, as well as a direct tax refund of Rs. 3,504,044.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pages28 Advance Tax Interest Calculator

Uploaded by

puran1234567890This document contains an advance tax interest calculator for a corporate assessee. It shows the assessee's total tax liability as Rs. 41,273,472 and total TDS of Rs. 1,177,516, leaving an advance tax payable of Rs. 40,095,956. The assessee paid a total advance tax of Rs. 43,600,000 in four installments by the due dates. The calculator also shows interest charged under section 234C of Rs. 918,886 for late payment of advance tax in different quarters, as well as a direct tax refund of Rs. 3,504,044.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Advance Tax Interest Calculator

Assessee Corporate Total Interest U/s 234 C 918,886

Month Of Filling of Return 10 Total Interest U/S 234 B -

Total Tax Liability 41,273,472 Toatl Interest 918,886

TDS 1,177,516 Direct Refund 3,504,044

Total Advance Tax Payable 40,095,956 Net Refund 2,585,158

Advance Tax Paid Amount in Rs.

Up to 15th June 750,000

Up to 15th September 8,000,000

Up to 15th December 5,250,000

Up to 15th March 29,600,000

Total 43,600,000

Self Assessment Paid in Month of Amount in Rs.

March -

April -

May -

June -

July -

August -

September -

October -

November -

December -

Interest U/S 234 C First Quarter 157,932

Interest U/S 234 C Second Quarter 278,795

Interest U/S 234 C Third Quarter 482,159

Interest U/S 234 C Fourth Quarter -

Total 918,886

Interest U/S 234 B April

Interest U/S 234 B May

Interest U/S 234 B June

Interest U/S 234 B July

Interest U/S 234 B August

Interest U/S 234 B September

Interest U/S 234 B October

Interest U/S 234 B November

Interest U/S 234 B December

Total -

You might also like

- Level 4 CocDocument20 pagesLevel 4 Coceferem85% (13)

- SuperbudDocument50 pagesSuperbudapi-4578794210% (1)

- AOM ComplianceDocument8 pagesAOM ComplianceMark Lojero100% (1)

- MP2 Dividend CalculatorDocument12 pagesMP2 Dividend CalculatorJel IbarbiaNo ratings yet

- Managing Money Curriculum: Components of Your Own Budget and Financial PlanDocument33 pagesManaging Money Curriculum: Components of Your Own Budget and Financial PlanJulius PalmaNo ratings yet

- Month Customer Numbers Average Spend (Food) Average Spend (Beverage)Document8 pagesMonth Customer Numbers Average Spend (Food) Average Spend (Beverage)milan shresthaNo ratings yet

- Taller de Ejercicios de PresupuestosDocument11 pagesTaller de Ejercicios de PresupuestosalexNo ratings yet

- BCSDC Inc - Tax ComplianceDocument4 pagesBCSDC Inc - Tax ComplianceCharlesNo ratings yet

- GST 310319Document66 pagesGST 310319Himmy PatwaNo ratings yet

- Tcs Financial ProjectionsDocument6 pagesTcs Financial Projectionsjohnna louella vicedo borjaNo ratings yet

- UtilitiesDocument3 pagesUtilitiesJade GanzanNo ratings yet

- City Manager Financial Report Week Ending Aug 23Document2 pagesCity Manager Financial Report Week Ending Aug 23NewzjunkyNo ratings yet

- SQUACKERSDocument25 pagesSQUACKERSPhilip LarozaNo ratings yet

- SQUACKERSDocument27 pagesSQUACKERSPhilip LarozaNo ratings yet

- Little Sheet1Document12 pagesLittle Sheet1api-427253313No ratings yet

- Finances TemplateDocument7 pagesFinances TemplateSpyros FragopoulosNo ratings yet

- Cash Flow FormDocument10 pagesCash Flow FormYan ErickNo ratings yet

- Rekap Pendapatan Perhari: Tanggal Jumlah Total Disetor Ke Rek JumlahDocument12 pagesRekap Pendapatan Perhari: Tanggal Jumlah Total Disetor Ke Rek JumlahAnonymous PnjvHdNo ratings yet

- Practice Set 1 (Cost Segregation)Document3 pagesPractice Set 1 (Cost Segregation)Ridskiee VivanggNo ratings yet

- SMHI VOUCHERS 2017 - January SMHI VOUCHERS 2017 - February SMHI VOUCHERS 2017 - March SMHI VOUCHERS 2017 - AprilDocument4 pagesSMHI VOUCHERS 2017 - January SMHI VOUCHERS 2017 - February SMHI VOUCHERS 2017 - March SMHI VOUCHERS 2017 - AprilGersey De Los SantosNo ratings yet

- Bati 2015 Month ReportDocument260 pagesBati 2015 Month ReportOsman OsmanNo ratings yet

- City of Watertown Financial Report Nov. 15, 2019Document2 pagesCity of Watertown Financial Report Nov. 15, 2019NewzjunkyNo ratings yet

- Government of Manipur Office of The District Industries Centre, ThoubalDocument2 pagesGovernment of Manipur Office of The District Industries Centre, ThoubalDIC THOUBALNo ratings yet

- Revised - Latihan Cash BudgetDocument8 pagesRevised - Latihan Cash BudgetKhoirul AnamNo ratings yet

- EDCOM Report 2021 Souvenir Program 2Document3 pagesEDCOM Report 2021 Souvenir Program 2Daenarys VeranoNo ratings yet

- Ain20190418028 ModifiedDocument5 pagesAin20190418028 ModifiedNiomi GolraiNo ratings yet

- Tax ClearanceDocument2 pagesTax ClearanceJov CruzNo ratings yet

- EMS3 Payroll FileDocument256 pagesEMS3 Payroll FileJamie RamosNo ratings yet

- Dangcol New SK Monitoring For Year 2024Document9 pagesDangcol New SK Monitoring For Year 2024Katherine Anne SantosNo ratings yet

- January February March April May June July August Septemb Er Novemb Er Decemb ErDocument2 pagesJanuary February March April May June July August Septemb Er Novemb Er Decemb ErLorde WagayenNo ratings yet

- Port Klang Statistics 2020Document2 pagesPort Klang Statistics 2020Syahrul AzminNo ratings yet

- TDS Payment Due Date Every QuarterDocument1 pageTDS Payment Due Date Every QuarterLatha VenugopalNo ratings yet

- Untitled SpreadsheetDocument2 pagesUntitled SpreadsheetOdarpGamingNo ratings yet

- Play and Learn - .: Programs & Schedule of FeesDocument1 pagePlay and Learn - .: Programs & Schedule of FeesDiosy SalcedoNo ratings yet

- Jadwal Pelaksanaan Induk (Cco-01)Document2 pagesJadwal Pelaksanaan Induk (Cco-01)surya bimaNo ratings yet

- Komponen Biaya Kuliah Kampus C JGU 2022 Terbaru2Document4 pagesKomponen Biaya Kuliah Kampus C JGU 2022 Terbaru2SCB LibraryNo ratings yet

- Kasus PT Mitra AbadiDocument3 pagesKasus PT Mitra AbadiKHOLIFATIMNo ratings yet

- Date Description Business ExpensesDocument41 pagesDate Description Business ExpensesMel GenerosoNo ratings yet

- POC ExampleDocument10 pagesPOC ExampleJohnpert ToledoNo ratings yet

- Cce TDocument2 pagesCce TCharish Jane Antonio CarreonNo ratings yet

- WEEK 4 - FNSACC503A - Budgeting - WORKED EXAMPLESDocument10 pagesWEEK 4 - FNSACC503A - Budgeting - WORKED EXAMPLESjenelyn enjambreNo ratings yet

- Tricky Widgets AssumptionsDocument34 pagesTricky Widgets AssumptionsOvidiu NimigeanNo ratings yet

- Laporan BLT Bone LolibuDocument1 pageLaporan BLT Bone LolibuRiski RNo ratings yet

- Assignment QuestionsDocument3 pagesAssignment QuestionsmaheeshNo ratings yet

- Republic of The Philippine6Document3 pagesRepublic of The Philippine6Kenn Rhyan MisolesNo ratings yet

- Month Total Funds Permanent Seasonal Required Requirement S Requirement SDocument2 pagesMonth Total Funds Permanent Seasonal Required Requirement S Requirement SrohanNo ratings yet

- Introduction To Computer SkillsDocument20 pagesIntroduction To Computer SkillsMitali BiswasNo ratings yet

- Camilomadaymen NHSDocument11 pagesCamilomadaymen NHSJamilla MorrisNo ratings yet

- Rivera Roofing Company Balance Date Cash Accounts Receivable Office Supplies Office Equipment Roofing Equipment Accounts Payable Common StockDocument5 pagesRivera Roofing Company Balance Date Cash Accounts Receivable Office Supplies Office Equipment Roofing Equipment Accounts Payable Common StockMuskan ValbaniNo ratings yet

- Las Vegas Stadium Bond AnalysisDocument5 pagesLas Vegas Stadium Bond AnalysisZennie AbrahamNo ratings yet

- 09032022-Sierra Valley Gardens B3-0218Document4 pages09032022-Sierra Valley Gardens B3-0218Ma. Dolores DiñoNo ratings yet

- Strat CostDocument2 pagesStrat CostTINDOY, Darlyn Joyce O.No ratings yet

- Annualization For Alphalist 2017-2020Document18 pagesAnnualization For Alphalist 2017-2020AEC IncorpNo ratings yet

- Personal BudgetDocument12 pagesPersonal Budgetapi-359542106No ratings yet

- IPCRF KRA Adas 2 2020 2021Document14 pagesIPCRF KRA Adas 2 2020 2021Krizza Mae De LeonNo ratings yet

- Economia GeneralDocument2 pagesEconomia GeneralRichard Jonathan Condorena LozaNo ratings yet

- Cce 2Document2 pagesCce 2Charish Jane Antonio CarreonNo ratings yet

- BPDocument6 pagesBPkimberly rose UsoriaNo ratings yet

- Pendapatan Bulan JulyDocument4 pagesPendapatan Bulan JulyDim WasNo ratings yet

- Dianabol (D.20131018.221414Document1 pageDianabol (D.20131018.221414puran1234567890No ratings yet

- ANALYSISTABS Sample Dashboard Sales DataDocument232 pagesANALYSISTABS Sample Dashboard Sales Datapuran1234567890No ratings yet

- Bank of Baroda, Greater Mumbai Zone Meeting of Statutory AuditorsDocument1 pageBank of Baroda, Greater Mumbai Zone Meeting of Statutory Auditorspuran1234567890No ratings yet

- ANALYSIS TABS Creating A New Workbook and Saving ItDocument2 pagesANALYSIS TABS Creating A New Workbook and Saving Itpuran1234567890No ratings yet

- Analysis Tabs Getting Data Using AdoDocument3 pagesAnalysis Tabs Getting Data Using Adopuran1234567890No ratings yet

- Form GST RFD-01: 1. Application For Refund of Tax, Interest, Penalty, Fees or Any Other AmountDocument7 pagesForm GST RFD-01: 1. Application For Refund of Tax, Interest, Penalty, Fees or Any Other Amountpuran1234567890No ratings yet

- Taxguru - In-Features of GSTR1 and Filing of Return of Outward Supply Under GSTDocument2 pagesTaxguru - In-Features of GSTR1 and Filing of Return of Outward Supply Under GSTpuran1234567890No ratings yet

- LLP Agreement Final1Document9 pagesLLP Agreement Final1puran1234567890No ratings yet

- Npa Norms: Income Recognition, Asset Classification and ProvisioningDocument41 pagesNpa Norms: Income Recognition, Asset Classification and Provisioningpuran1234567890No ratings yet