Professional Documents

Culture Documents

Chapter 6 Bonus Material Amortization Schedule

Uploaded by

Setenay GelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6 Bonus Material Amortization Schedule

Uploaded by

Setenay GelCopyright:

Available Formats

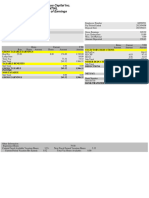

Chapter 6 bonus material

Amortization schedule

The “amortization schedule” approach to separating interest from principal payments:

In several different accounting topics (installment sales, long-term receivables, bond accounting, lease

accounting) we require that annuity payments be split between the principle/compounding portion and the

interest portion of the payment.

Why? Because the principal/compounding amount typically impacts a permanent account and the

interest portion typically impacts a temporary account.

How the “amortization schedule” approach works (it is always the same basic format!).You start with a

blank table that has the following headings (this is an EXCELlent place to use your spreadsheet skills):

Date Payment amount Interest portion Principal portion Principal balance

(1) (2) (3) (4)

(1) The payment amount in this schedule is almost always fixed (it is based on a contract) and doesn’t

change over the life of the schedule.

(2) The interest portion is calculated as: Appropriate interest rate * beginning Principal balance.

(3) The principal portion is calculated as: Payment amount – Interest portion.

(4) The principal balance is calculated as: beginning Principal balance – current principal portion.

Example: let’s use an installment sale schedule as an example since that is the first topic we’ll come across

that uses this schedule

Suppose that you make a $50,000 installment sale in which you will receive 10 equal payments at the end

of each year for 10 years. The appropriate interest rate has been determined to be 15%. Complete a

schedule showing the interest and principal payments received under this sale.

Step 1:

Step 2: Now we can complete the schedule (The numbers correspond to the columns above):

(1) the Payment amount is _______________ for each of the 10 years.

(2) the interest portion for the first year is: ________________________ . This is how much interest

income we will recognize for the first year.

(3) the principal portion for the first year is: _________________________. This is the reduction in the

receivable for the first year .

(4) the new principal balance after the first payment will be : _______________.

(Think about this - even though you received $______, most of it was interest so the principal balance

really didn't go down much -- this is the same way your car payments or home mortgages work - even

though you make pretty big payments, the payoff balance only decreases a tiny bit in the early months)

(5) the interest portion for the second year is: YOU FIGURE IT OUT

Over the life of the schedule, the principal balance will go to –0-. Try a few lines. (Look at the completed

schedule in Chapter ___ to see if you did it correctly!)

You might also like

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Compound InterestDocument14 pagesCompound InterestIan Butera Lopez100% (2)

- AnnuityDocument6 pagesAnnuityGokul NathNo ratings yet

- Accounting and Audit For Financial Sector: Unit - 1 Understanding Bank Interest and It's CalculationsDocument19 pagesAccounting and Audit For Financial Sector: Unit - 1 Understanding Bank Interest and It's CalculationsTanay ShahNo ratings yet

- Amortization Schedule - WikipediaDocument8 pagesAmortization Schedule - Wikipediapuput075100% (2)

- Amortization: ObjectivesDocument10 pagesAmortization: ObjectivesLara Lewis AchillesNo ratings yet

- Basic 5Document2 pagesBasic 5Venky DNo ratings yet

- Example Amortization ScheduleDocument3 pagesExample Amortization SchedulePankil R ShahNo ratings yet

- EC09Document18 pagesEC09Junaid YNo ratings yet

- Advanced Bond ConceptsDocument32 pagesAdvanced Bond ConceptsJohn SmithNo ratings yet

- Amortization Activity SheetDocument5 pagesAmortization Activity SheetFernanda FerreiraNo ratings yet

- 05 FA-I CHAPTER FIVEand FOURDocument33 pages05 FA-I CHAPTER FIVEand FOURHistory and EventNo ratings yet

- Bond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)Document9 pagesBond Concepts: Bond Pricing: Ihtisham Abdul Malik (Department of Management Sciences)ammar123No ratings yet

- Premium Discount Par: Understanding The Time Value of MoneyDocument5 pagesPremium Discount Par: Understanding The Time Value of Moneyvaibhavc87No ratings yet

- Premium Discount Par: Understanding The Time Value of MoneyDocument5 pagesPremium Discount Par: Understanding The Time Value of Moneyvaibhavc87No ratings yet

- Using Solver For Financial PlanningDocument4 pagesUsing Solver For Financial PlanningAmna JupićNo ratings yet

- Accounting For Bonds PayableDocument10 pagesAccounting For Bonds PayableAdeel Ur Rehman GorayaNo ratings yet

- Fin Model Class5 Debt Schedule SlidesDocument10 pagesFin Model Class5 Debt Schedule SlidesGel viraNo ratings yet

- A Time Value of Money Primer: by David B. Hamm, MBA, CPA For Finance and Quantitative Methods ModulesDocument28 pagesA Time Value of Money Primer: by David B. Hamm, MBA, CPA For Finance and Quantitative Methods ModulesMSA-ACCA100% (2)

- Monte Carlo - Cash Budget Models Outline and CorrelationsDocument13 pagesMonte Carlo - Cash Budget Models Outline and CorrelationsphanhailongNo ratings yet

- Capital Investment Analysis and Project Assessment: PurdueDocument12 pagesCapital Investment Analysis and Project Assessment: PurdueFAKHAN88No ratings yet

- Final MortgageDocument5 pagesFinal Mortgageapi-301270815No ratings yet

- Rates and Time Value of Money - Basic Tools of Finance-19-10-20Document16 pagesRates and Time Value of Money - Basic Tools of Finance-19-10-20Zewen HENo ratings yet

- M1050mortgagelab 1Document5 pagesM1050mortgagelab 1api-302779278No ratings yet

- Fa-I Chapter FiveDocument33 pagesFa-I Chapter FiveHussen AbdulkadirNo ratings yet

- Lesson 4 - Finantial and Investment OperationsDocument10 pagesLesson 4 - Finantial and Investment OperationsYoussef Charif 2No ratings yet

- Financial Math With Calculators and ExcellDocument22 pagesFinancial Math With Calculators and ExcellJulio JoséNo ratings yet

- Accounting ExplainedDocument69 pagesAccounting ExplainedGeetaNo ratings yet

- Mortgage Project 1Document5 pagesMortgage Project 1api-284831231No ratings yet

- Lesson 03a Understanding MoneyDocument29 pagesLesson 03a Understanding MoneyVjion BeloNo ratings yet

- 2nd-Q - Week-1-BF-Amortization - JOSEPH AURELLODocument13 pages2nd-Q - Week-1-BF-Amortization - JOSEPH AURELLOFairly May LaysonNo ratings yet

- Project 2Document5 pagesProject 2api-246579738No ratings yet

- Unit 3 TVM Live SessionDocument43 pagesUnit 3 TVM Live Sessionkimj22614No ratings yet

- 2 General Annuity DiscussionDocument8 pages2 General Annuity Discussionmusic niNo ratings yet

- Math1050 - MortgagelabDocument5 pagesMath1050 - Mortgagelabapi-424955946No ratings yet

- 2 FIN10002 Chapter1 2015 PDFDocument90 pages2 FIN10002 Chapter1 2015 PDFAnna XiNo ratings yet

- Ch. 1-Simple Interest & Simple Discount: TopicsDocument20 pagesCh. 1-Simple Interest & Simple Discount: TopicsOCEANWATERSEANo ratings yet

- Investment FormulasDocument14 pagesInvestment Formulasgatete samNo ratings yet

- Advanced Bond ConceptsDocument8 pagesAdvanced Bond ConceptsEllaine OlimberioNo ratings yet

- Answer 1.: Straight Line DepreciationDocument11 pagesAnswer 1.: Straight Line DepreciationDanish ShaikhNo ratings yet

- MEC210 - Lecture 04 - 241Document32 pagesMEC210 - Lecture 04 - 241Mina NasserNo ratings yet

- Bonds Payable - ExplanationDocument37 pagesBonds Payable - ExplanationRuby Dela CruzNo ratings yet

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- 449b11 - Lecture 05 EEDocument30 pages449b11 - Lecture 05 EEMuhammad SalmanNo ratings yet

- C1 D1 Doc Tech 2Document4 pagesC1 D1 Doc Tech 2Anggi Gayatri SetiawanNo ratings yet

- Easy LBODocument7 pagesEasy LBOmikeNo ratings yet

- Chapter 4 - Time Value of MoneyDocument46 pagesChapter 4 - Time Value of MoneyAubrey AlvarezNo ratings yet

- Capital Budgeting: Present ValueDocument15 pagesCapital Budgeting: Present ValueNoorunnishaNo ratings yet

- Original 1436552353 VICTORIA ProjectDocument12 pagesOriginal 1436552353 VICTORIA ProjectShashank SharanNo ratings yet

- Math 1050 Mortgage Project: Show Work HereDocument5 pagesMath 1050 Mortgage Project: Show Work Hereapi-302479969No ratings yet

- Loan AmortizationDocument14 pagesLoan AmortizationPoorvajaNo ratings yet

- Week 012-Module Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Document8 pagesWeek 012-Module Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Jieann BalicocoNo ratings yet

- Week 012-Module Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Document8 pagesWeek 012-Module Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 002Jieann BalicocoNo ratings yet

- MA170 Chapter 1Document8 pagesMA170 Chapter 1ishanissantaNo ratings yet

- Present ValueDocument8 pagesPresent ValueFarrukhsgNo ratings yet

- Principal of Money - Time RelationshipsDocument26 pagesPrincipal of Money - Time RelationshipsAli TreeshNo ratings yet

- Problem Set 1Document8 pagesProblem Set 1seeminevaNo ratings yet

- Financial Accounting 1 Unit 8Document27 pagesFinancial Accounting 1 Unit 8Eyael ShimleasNo ratings yet

- Financial Modelling and Analysis Using Microsoft Excel - For Non Finance PersonnelFrom EverandFinancial Modelling and Analysis Using Microsoft Excel - For Non Finance PersonnelNo ratings yet

- UNACEMDocument246 pagesUNACEMAlexandra Guzman BurgaNo ratings yet

- Authoritative Status of Push-Down AccountingDocument9 pagesAuthoritative Status of Push-Down AccountingToni Rose Hernandez LualhatiNo ratings yet

- Project Profile On Petroleum JellyDocument10 pagesProject Profile On Petroleum JellymahahajNo ratings yet

- Price To Earning RatioDocument10 pagesPrice To Earning Ratiopallavi_tikooNo ratings yet

- Chapter 4: Insurance Companies: Insurance: The Agreement Between Two Parties Where One Party Agrees To Take TheDocument25 pagesChapter 4: Insurance Companies: Insurance: The Agreement Between Two Parties Where One Party Agrees To Take TheJahangir AlamNo ratings yet

- Final To Print DraftDocument101 pagesFinal To Print DraftAakanshya SharmaNo ratings yet

- Business Studies Form Four NotesDocument66 pagesBusiness Studies Form Four Notestimothy muyumbiNo ratings yet

- Reviewer: Shareholders Equity (SHE)Document6 pagesReviewer: Shareholders Equity (SHE)Jewela NogasNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument4 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityTin LicoNo ratings yet

- CapStructure Irrelevance Ass4Document26 pagesCapStructure Irrelevance Ass4QUADRI YUSUFNo ratings yet

- IFT CFA Level I Facts and Formula Sheet 2021 - v1.0Document12 pagesIFT CFA Level I Facts and Formula Sheet 2021 - v1.0Tsaone Fox100% (1)

- Manufacturing Account Worked Example Question 4Document5 pagesManufacturing Account Worked Example Question 4Roshan RamkhalawonNo ratings yet

- Due Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSDocument1 pageDue Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSMandira KollaliNo ratings yet

- Accounts Project 1Document27 pagesAccounts Project 1Yashasvi SharmaNo ratings yet

- A 162-Final Exam - AnswerDocument13 pagesA 162-Final Exam - Answerfarika mamatNo ratings yet

- Unit 30: Money Growth And Inflation: Câu Hỏi 4Document6 pagesUnit 30: Money Growth And Inflation: Câu Hỏi 4Minh Châu Tạ ThịNo ratings yet

- Financial Accounting: A Business Process ApproachDocument42 pagesFinancial Accounting: A Business Process ApproachPeterNo ratings yet

- Ge Webcast Presentation 04252023Document19 pagesGe Webcast Presentation 04252023Vinicius NoronhaNo ratings yet

- Japfa Comfeed India Private - R - 25082020Document8 pagesJapfa Comfeed India Private - R - 25082020DarshanNo ratings yet

- SFDM Individual Assignment (LMH)Document8 pagesSFDM Individual Assignment (LMH)Fuhgandu RashydNo ratings yet

- Poa, Chapter 11 AnswersDocument12 pagesPoa, Chapter 11 Answersselena hussainNo ratings yet

- AFM Formula SheetDocument15 pagesAFM Formula Sheetganesh bhaiNo ratings yet

- Costing English Question 14.07.2020Document7 pagesCosting English Question 14.07.2020Prathmesh JambhulkarNo ratings yet

- Chapter 3 Page 1Document67 pagesChapter 3 Page 1MariaNo ratings yet

- AMFI Sample 500 Questions-2Document36 pagesAMFI Sample 500 Questions-2pratiksha24No ratings yet

- Brian Tai - Pay Slip 00002Document1 pageBrian Tai - Pay Slip 00002Brian TaiNo ratings yet

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- Fundamentals of AccountingDocument7 pagesFundamentals of AccountingNoor FatimaNo ratings yet

- PDF Airline Kpi CompressDocument24 pagesPDF Airline Kpi CompressCarlos Jonathan Molina AlarcónNo ratings yet

- Cost Calculation LaundryDocument11 pagesCost Calculation LaundryFahmi RusyadiNo ratings yet