Professional Documents

Culture Documents

Inland Revenue Department: Form 3

Uploaded by

余日中Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inland Revenue Department: Form 3

Uploaded by

余日中Copyright:

Available Formats

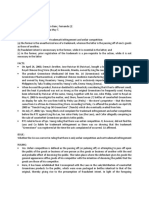

INLAND REVENUE DEPARTMENT

BUSINESS REGISTRATION OFFICE

4/F., REVENUE TOWER

5 GLOUCESTER ROAD, WAN CHAI

HONG KONG

Web site:www.ird.gov.hk

B.R. No. ...................................

FORM 3 [ re g. 6]

BUSINESS REGISTRATION REGULATIONS

Claim for exemption from payment of fee and levy under

section 9 of the Business Registration Ordinance

Name of applicant : ....................................................................................................................................................................................

Address of applicant : ....................................................................................................................................................................................

....................................................................................................................................................................................

....................................................................................................................................................................................

(See B.R. Name of business : ....................................................................................................................................................................................

Certificate)

Address of business : ....................................................................................................................................................................................

....................................................................................................................................................................................

....................................................................................................................................................................................

Average total *sales/receipts of the

business for the past 6 months or,

in the case of a new business, the

estimated average total *sales/

receipts of the business for the first

6 months after commencement : $ ................................................................................ per month

Exemption for year commencing ......................... / ........................ / .......................

(day) (month) (year)

DECLARATION BY APPLICANT

I, the applicant named above, declare as follows—

(a) I am the *proprietor/partner/principal officer of the above described business and I do not carry on business at any

address other than that stated;

(b) I have no business other than the one described above;

(c) the statements contained in this application are true and correct,

and I understand that the above statement of average total sales or receipts (as the case may be) may be investigated by an officer

of the Inland Revenue Department and that I am liable to prosecution if the amount stated is found to be false.

Date: .................................................................................... Signed:.......................................................................................

*Delete as appropriate.

NOTE TO APPLICANTS

Any person found guilty of making a false statement to the Commissioner is liable to a fine at level 2 or imprisonment for

1 year or both (section 15(1)(i) of the Business Registration Ordinance (Cap.310)).

Please also read the ‘Supplementary Notes’.

IRBR61 (10/2010)

本 署 專 用 Approved by: TC703/704

For official use only

Issue UL: TC3733

Application for Exemption from Payment of Business Registration Fee & Levy

Supplementary Notes

Who is Eligible

1. A business carried on by an individual, a partnership, an unincorporated body of persons or a limited company which is not incorporated or

required to be registered under the Companies Ordinance; and

2. Its average monthly turnover does not exceed:

(a) for businesses mainly deriving profits from the sale of services : $10,000;

(b) for other businesses: $30,000; and

3. For the business mentioned in the declaration, a sole proprietor must not carry on another sole-proprietorship business at the same time. In the

case of a partnership business, all its partners must not carry on another partnership business together at the same time. See examples below:

(a) If Mr A carries on two sole proprietorship businesses X and Y at the same time, neither X nor Y is entitled to the exemption.

(b) If Mr A and Mr B carry on two partnership businesses C and D at the same time, neither C nor D is entitled to the exemption.

(c) If Mr A and Mr B carry on a partnership business E and at the same time, Mr A and Mr C carry on another partnership business F, E and F

are not considered to be carried on by the same person.

(d) If Mr A carries on a sole proprietorship business G and at the same time, Mr A and Mr B carry on a partnership business H, G and H are not

considered to be carried on by the same person.

How to Calculate the Average Monthly Turnover (Described as “average total *sales/receipts” in the application form)

4. For an existing business, it is the monthly average of the actual total turnover (i.e. gross income before deducting cost of goods, expenses, salary,

etc.) for the period of six months immediately preceding the date of making the application, e.g.:

Date of making the application 1 July 2017

6 months preceding the application 1 January 2017 to 30 June 2017

Actual total turnover for the above period $96,000

Average monthly turnover $96,000 ÷ 6 = $16,000

5. For a new business, it is the monthly average of the estimated total turnover for the first six months of the commencement of the business, e.g.:

Date of commencement of business 1 July 2017

First 6 months of commencement of business 1 July 2017 to 31 December 2017

Estimated total turnover for the above period $96,000

Average monthly turnover $96,000 ÷ 6 = $16,000

How to Apply

6. The business operator needs to complete and return the duly signed application form (Form 3) (original) to the Business Registration Office,

either by post to P.O. Box 29015 Gloucester Road Post Office, Wan Chai, Hong Kong or in person at 4/F Revenue Tower, 5 Gloucester Road, Wan

Chai, Hong Kong. Please DO NOT send the form to Business Registration Office by fax/email.

7. The business operator may download the application form (Form 3) from IRD web site (www.ird.gov.hk), or obtain it through IRD's 24-hour

Fax-A-Form Service (telephone number: 2598 6001), by post, or in person at the IRD Office.

8. The business operator may apply online via GovHK (www.gov.hk/br). Please visit GovHK for more details.

When to Apply

9. For an existing business, the application for exemption from payment of business registration fee & levy for the coming year must be received by

the Business Registration Office:

• In person or by post – not later than 1 month before the expiry of its current business registration certificate (However, please do not submit

the application earlier than three months before the expiry of the current certificate), e.g.:

Date of expiry of business registration certificate 15 May 2017

Deadline for application for exemption 15 April 2017

• via GovHK – not later than 1 week before the expiry of its current business registration certificate (i.e. 3 more weeks for application), e.g.:

Date of expiry of business registration certificate 15 May 2017

Deadline for application for exemption 8 May 2017

10. For a new business, the application for exemption from payment of business registration fee & levy for the first year must be received by the

Business Registration Office:

• In person or by post – not later than 1 month after the application for business registration, e.g.:

Date of application for registration 15 May 2017

Deadline for application for exemption 15 June 2017

• via GovHK – not later than 7 weeks after the application for business registration (i.e. 3 more weeks for application), e.g.:

Date of application for registration 15 May 2017

Deadline for application for exemption 3 July 2017

Important Notes

11. Notwithstanding any application for exemption from payment, a business operator receiving a notice of demand for payment of business

registration fee & levy must fully settle the amount demanded thereon when due, unless he has received an “exempt business registration

certificate” covering the same validity period as the demand note.

12. Exemption is only granted upon application and for one year ending on the expiry date of the exempt certificate. Fresh application should be

made for each subsequent year in accordance with the exemption conditions and application procedures then in force.

13. If a business has ceased, its business operator must notify the Business Registration Office in writing within one month from the date of cessation

of business.

14. Under the Business Registration Ordinance (Cap 310), changes of business particulars must be notified WITHIN 1 MONTH. Information

disclosed in Form 3 will be accepted as a notification of change under that Ordinance.

Personal Information Collection Statement

It is obligatory for you to supply the personal data as required by this form. If you fail to supply the required data, your application / notification will

not be accepted.

The personal data provided by you will be used for tax and business registration purposes and may be made available for public inspection pursuant to

sections 19 and 19A of the Business Registration Ordinance (Cap. 310) so as to enable any person to ascertain whether a business is registered under that

ordinance and the particulars of the businesses so registered, in accordance with section 19B of that ordinance. The Department may also give some of

such data to other parties authorized by law to receive it. Except where there is an exemption provided under the Personal Data (Privacy) Ordinance

(Cap. 486), you have the right to request access to and correction of your personal data. Such request should be addressed to the Business Registration

Officer at 4/F, Revenue Tower, 5 Gloucester Road, Wan Chai, Hong Kong.

Enquiry

Hotline: 187 8088 Web site: www.ird.gov.hk Business Registration Office, Inland Revenue Department

IRBR168 (9/2017)

You might also like

- GSTIN - Loan Application FormDocument14 pagesGSTIN - Loan Application FormPUSHKAR PATIDARNo ratings yet

- 21 Application Format For Registring As NBFCDocument13 pages21 Application Format For Registring As NBFCDarshak ShahNo ratings yet

- Renewal NoticeDocument7 pagesRenewal NoticeDS SystemsNo ratings yet

- Renew Business Name RegistrationDocument2 pagesRenew Business Name RegistrationSkyview Travel LTD ManagementNo ratings yet

- Business RegistrationDocument26 pagesBusiness RegistrationAudrey Kwao100% (1)

- General Information Sheet for Global Link Technology Industrial Supplies & Services IncDocument11 pagesGeneral Information Sheet for Global Link Technology Industrial Supplies & Services Incmaricel TandangNo ratings yet

- Application Form For The Registration of Importers & ExportersDocument4 pagesApplication Form For The Registration of Importers & ExportersLiveka PrintersNo ratings yet

- (Name of Company) Business PlanDocument10 pages(Name of Company) Business PlanJohn JohnsonNo ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document11 pagesStock Corporation General Instructions:: General Information Sheet (Gis)JHUNELNo ratings yet

- (Company) : Contact: (NAME) (Address) (Address) (City, State Zip) Phone XXX-XXX-XXXX Fax XXX-XXX-XXXX (Email)Document32 pages(Company) : Contact: (NAME) (Address) (Address) (City, State Zip) Phone XXX-XXX-XXXX Fax XXX-XXX-XXXX (Email)James Zachary100% (2)

- TEF Seed Capital UndertakingDocument3 pagesTEF Seed Capital UndertakingUchennaNo ratings yet

- 2019form RevGIS Stock UpdatedDocument10 pages2019form RevGIS Stock UpdatedRonaldo Barleta100% (1)

- NSIC Chick ListDocument5 pagesNSIC Chick ListVRS MANPOWER AND SECURITY SERVICE PVT LTDNo ratings yet

- Upgrading application for contractorsDocument16 pagesUpgrading application for contractorsElisha WankogereNo ratings yet

- Equipme Plant Hire CREDIT APPDocument12 pagesEquipme Plant Hire CREDIT APPtapiwanaishe maunduNo ratings yet

- Tax PrathmendraDocument15 pagesTax PrathmendraBittu HidkoNo ratings yet

- GIS PartnertshipDocument12 pagesGIS PartnertshipVERONICA ROSARIONo ratings yet

- Revision Notes of IT TAXDocument115 pagesRevision Notes of IT TAXVikki VigneshNo ratings yet

- E&tb23 - Business Pro Migration Promotion For National Day - 01Document1 pageE&tb23 - Business Pro Migration Promotion For National Day - 01leiiding695No ratings yet

- Gis Ev Mining From Excel To PDFDocument25 pagesGis Ev Mining From Excel To PDFStefano SilverioNo ratings yet

- Empanelment Form IIDocument15 pagesEmpanelment Form IIANKESH SHRIVASTAVANo ratings yet

- Basic Business Documents: Unit-IDocument144 pagesBasic Business Documents: Unit-IKalyan Reddy AnuguNo ratings yet

- Application Form For The Registration of Importers & ExportersDocument4 pagesApplication Form For The Registration of Importers & ExportersNilamdeen Mohamed ZamilNo ratings yet

- Accounting BasicsDocument42 pagesAccounting Basicssowmithra4uNo ratings yet

- Form 1065 InstructionsDocument45 pagesForm 1065 InstructionsWilliam BulshtNo ratings yet

- Promotional Offer For Business Pro - 25%-EngDocument1 pagePromotional Offer For Business Pro - 25%-EngAnkita NiravNo ratings yet

- 15 G Form (Blank)Document2 pages15 G Form (Blank)nst27No ratings yet

- Small Businessmen BookletDocument27 pagesSmall Businessmen Bookletstephen_debique9455No ratings yet

- Tendernotice 3Document2 pagesTendernotice 3SangamNo ratings yet

- General Information Sheet (Gis) : For The Year 2016 Stock Corporation General InstructionsDocument9 pagesGeneral Information Sheet (Gis) : For The Year 2016 Stock Corporation General Instructionsedward_199412No ratings yet

- Individual Return IT-Gha (2023) 1Document2 pagesIndividual Return IT-Gha (2023) 1monir7898No ratings yet

- Form 11 Application For Registration of A Firm For The Purposes of The Income-Tax Act, 1961Document1 pageForm 11 Application For Registration of A Firm For The Purposes of The Income-Tax Act, 1961Amit BhatiNo ratings yet

- How To Close A Business in The PhilippinesDocument8 pagesHow To Close A Business in The PhilippinesMark Anthony CasupangNo ratings yet

- Form RCDocument1 pageForm RCKHEM RAJ PANDEYNo ratings yet

- Review ContractDocument2 pagesReview ContractSaint PartNo ratings yet

- Investment Agreement Class ADocument7 pagesInvestment Agreement Class APhilip Wen Argañosa BombitaNo ratings yet

- Century Pacific Food, Inc. 2018 Annual ReportDocument27 pagesCentury Pacific Food, Inc. 2018 Annual ReportRonald MalicdemNo ratings yet

- Form - 1 & 2Document5 pagesForm - 1 & 2Income TaxNo ratings yet

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet

- Starting A Business in DubaiDocument8 pagesStarting A Business in DubaiMazen KhamisNo ratings yet

- Uci 06022018Document23 pagesUci 06022018Chandan kumarNo ratings yet

- Form 101 (See Rule 5) Application For Certificate of RegistrationDocument5 pagesForm 101 (See Rule 5) Application For Certificate of RegistrationLatisha MorrisonNo ratings yet

- Lenskart Appliction FormDocument6 pagesLenskart Appliction FormEr Mayank UppalNo ratings yet

- Refund Guide For Business Visitors - en - 17 09 2019Document21 pagesRefund Guide For Business Visitors - en - 17 09 2019Islam AdelNo ratings yet

- Trade Acc Application v6 PDFDocument5 pagesTrade Acc Application v6 PDFCarneala IlieNo ratings yet

- Form - D Application For The Issue/Renewal/Restoration of Certificate of Practice See Reg. 10 & 14Document4 pagesForm - D Application For The Issue/Renewal/Restoration of Certificate of Practice See Reg. 10 & 14Manoj SivalingamNo ratings yet

- Freelance AgreementDocument2 pagesFreelance AgreementAlankar NarulaNo ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document9 pagesStock Corporation General Instructions:: General Information Sheet (Gis)Vic BarrientosNo ratings yet

- International Commercial Agency Agreement Sample TemplateDocument6 pagesInternational Commercial Agency Agreement Sample Templatemjavan255No ratings yet

- Capital Subsidy DocumentsDocument6 pagesCapital Subsidy Documentsharyana helplineNo ratings yet

- Business Takeover AgreementDocument4 pagesBusiness Takeover AgreementAlankar NarulaNo ratings yet

- ACEPH SEC 17-A (Year End Dec 2019) PDFDocument377 pagesACEPH SEC 17-A (Year End Dec 2019) PDFPeter Paul RecaboNo ratings yet

- Affidavit Cancellation 2v2018Document7 pagesAffidavit Cancellation 2v2018Francis A SalvadorNo ratings yet

- The SolopreneurDocument6 pagesThe Solopreneurjun junNo ratings yet

- Blank Ncda XDocument6 pagesBlank Ncda Xfotogenik saycheeseNo ratings yet

- Contractor's License Application ChecklistDocument11 pagesContractor's License Application ChecklistAngelo Pura0% (1)

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16From EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16No ratings yet

- Ip Camera: H SeriesDocument26 pagesIp Camera: H Series余日中No ratings yet

- Spps Pol-1076Document4 pagesSpps Pol-1076余日中No ratings yet

- TC E p68Document14 pagesTC E p68余日中No ratings yet

- PoliceDocument5 pagesPolice余日中No ratings yet

- Application FormDocument1 pageApplication Form余日中No ratings yet

- 03 NEUTRIK PG E - SpeakON Connectors - 201907-V20Document20 pages03 NEUTRIK PG E - SpeakON Connectors - 201907-V20余日中No ratings yet

- UserManual PO PDFDocument3 pagesUserManual PO PDFVintonius Raffaele PRIMUSNo ratings yet

- How To View and Reply Clarificat Ion: E-Procurement SystemDocument5 pagesHow To View and Reply Clarificat Ion: E-Procurement SystemVintonius Raffaele PRIMUSNo ratings yet

- GF340Document8 pagesGF340余日中No ratings yet

- E-Procurement System User Manual (For Public Works Contractor)Document5 pagesE-Procurement System User Manual (For Public Works Contractor)Vintonius Raffaele PRIMUSNo ratings yet

- UserManual Account ActivationDocument6 pagesUserManual Account Activation余日中No ratings yet

- E-Procurement System User Manual (For Public Works Contractor)Document8 pagesE-Procurement System User Manual (For Public Works Contractor)余日中No ratings yet

- View, submit and track invoices online with e-ProcurementDocument9 pagesView, submit and track invoices online with e-ProcurementVintonius Raffaele PRIMUSNo ratings yet

- UserManual Account ActivationDocument6 pagesUserManual Account Activation余日中No ratings yet

- UserManual Update Company Details and ContactsDocument22 pagesUserManual Update Company Details and ContactsVintonius Raffaele PRIMUSNo ratings yet

- UserManual Update Electronic CatalogueDocument10 pagesUserManual Update Electronic CatalogueVintonius Raffaele PRIMUSNo ratings yet

- CO PY: Camera User GuideDocument0 pagesCO PY: Camera User GuideDiogo MartinhoNo ratings yet

- UserManual View Invitation To QuotationDocument13 pagesUserManual View Invitation To QuotationVintonius Raffaele PRIMUSNo ratings yet

- Stanley Stud Sensor S100Document50 pagesStanley Stud Sensor S100余日中No ratings yet

- UserManual Update Company Details and ContactsDocument22 pagesUserManual Update Company Details and ContactsVintonius Raffaele PRIMUSNo ratings yet

- Repertoire List UpdatedDocument6 pagesRepertoire List Updated余日中No ratings yet

- Siptrunk Addition PressreleaseDocument1 pageSiptrunk Addition Pressrelease余日中No ratings yet

- Product Data Sheet: Power Tools For Trade & IndustryDocument2 pagesProduct Data Sheet: Power Tools For Trade & Industry余日中No ratings yet

- Pro-50 50KDocument1 pagePro-50 50K余日中No ratings yet

- Rechargeable Laptop Battery User ManualDocument1 pageRechargeable Laptop Battery User ManualVintonius Raffaele PRIMUSNo ratings yet

- Siptrunk Addition PressreleaseDocument1 pageSiptrunk Addition Pressrelease余日中No ratings yet

- Product Catalogue: - Professional Fastening Technology - Professional Fastening TechnologyDocument180 pagesProduct Catalogue: - Professional Fastening Technology - Professional Fastening Technology余日中No ratings yet

- Solderpro™: Instruction ManualDocument1 pageSolderpro™: Instruction ManualWinton YUNo ratings yet

- Instruction Manual: Solderpro™Document1 pageInstruction Manual: Solderpro™余日中No ratings yet

- Case NoDocument13 pagesCase NoLaurente JessicaNo ratings yet

- Immigrants and HousingDocument44 pagesImmigrants and HousingMargarita Peña GonzalezNo ratings yet

- Notification Military Engineer Services Mate Electrician Fitter Other PostsDocument21 pagesNotification Military Engineer Services Mate Electrician Fitter Other PostsAnirban DasNo ratings yet

- Ohio Supreme Court House and Senate Map Second RulingDocument65 pagesOhio Supreme Court House and Senate Map Second RulingCincinnatiEnquirerNo ratings yet

- Petition For WritDocument304 pagesPetition For WritLaw&CrimeNo ratings yet

- Industrial Inspectorate Act CapDocument9 pagesIndustrial Inspectorate Act CapOlukunle Fagbayi100% (1)

- Miranda Must Pay Cordial for Delivered Rattan PolesDocument2 pagesMiranda Must Pay Cordial for Delivered Rattan PolesKM SurtidaNo ratings yet

- Persons DigestDocument7 pagesPersons DigestcacacacaNo ratings yet

- Attorney-client privilege and ethical justification for withholding informationDocument4 pagesAttorney-client privilege and ethical justification for withholding informationAlenNo ratings yet

- Cangco V Manila Railroad DigestDocument3 pagesCangco V Manila Railroad DigestJose Ramon Ampil100% (1)

- People of The Philippines vs. Guillermo Manantan G.R. No. 14129 July 31, 1962 Regala, J.: FactsDocument2 pagesPeople of The Philippines vs. Guillermo Manantan G.R. No. 14129 July 31, 1962 Regala, J.: FactsAnsai Calugan100% (1)

- CPA Ownership Dispute Between Association GroupsDocument8 pagesCPA Ownership Dispute Between Association Groupsaljohn pantaleonNo ratings yet

- People V PanidaDocument19 pagesPeople V PanidaJarvy PinonganNo ratings yet

- Power of Supreme Court To Transfer Cases Under CRPC, CPC and Constitution of India"Document11 pagesPower of Supreme Court To Transfer Cases Under CRPC, CPC and Constitution of India"a-468951No ratings yet

- MPDFDocument1 pageMPDFPushpendra YadavNo ratings yet

- Local Government Code Intergovernmental Relations National-Local RelationsDocument8 pagesLocal Government Code Intergovernmental Relations National-Local RelationsSOLIVIO FAYE XYRYLNo ratings yet

- Miller V Bonta OpinionDocument94 pagesMiller V Bonta OpinionAmmoLand Shooting Sports News100% (3)

- Ordinance No Parking and One Way TrafficDocument3 pagesOrdinance No Parking and One Way TrafficRaffy Roncales20% (1)

- Courts Reject Attempt to Overturn Divorce DecreeDocument35 pagesCourts Reject Attempt to Overturn Divorce DecreeKapil KaushikNo ratings yet

- Application Instructions Application Instructions Application Instructions Application InstructionsDocument13 pagesApplication Instructions Application Instructions Application Instructions Application InstructionsJake WuNo ratings yet

- Cases 72 79 TransportationDocument33 pagesCases 72 79 TransportationANNANG, PILITA GLORIANo ratings yet

- City Council Project 11-12-2022Document23 pagesCity Council Project 11-12-2022mary loriNo ratings yet

- Alba v. Deputy Ombudsman 254 SCRA 753Document5 pagesAlba v. Deputy Ombudsman 254 SCRA 753Trebx Sanchez de GuzmanNo ratings yet

- Special Power of Attorney/Deed of Ratification: - Khalid Moued M Althagafi - Erika Joy L MacasuDocument1 pageSpecial Power of Attorney/Deed of Ratification: - Khalid Moued M Althagafi - Erika Joy L MacasuJerico NaypaNo ratings yet

- Stelor Productions v. Silvers, Et Al - Document No. 28Document49 pagesStelor Productions v. Silvers, Et Al - Document No. 28Justia.comNo ratings yet

- Benguet Corp V DenrDocument14 pagesBenguet Corp V DenrRosalie BondNo ratings yet

- Munich AgreementDocument18 pagesMunich Agreementnico-rod1No ratings yet

- Petitioners Vs Vs Respondents Augusto P. Jimenez, Jr. Fred Henry V. MarallagDocument5 pagesPetitioners Vs Vs Respondents Augusto P. Jimenez, Jr. Fred Henry V. MarallagPoPo MillanNo ratings yet

- 444 Cr.P.C. Refund of Surity AmountDocument17 pages444 Cr.P.C. Refund of Surity AmountAnonymous TPVfFif6TONo ratings yet

- B49 Sy CHNG v. Gaw Liu, GR L-29123, 29 March 1972, en Banc, Fernando (J) - MACABALLUGDocument2 pagesB49 Sy CHNG v. Gaw Liu, GR L-29123, 29 March 1972, en Banc, Fernando (J) - MACABALLUGloschudentNo ratings yet