Professional Documents

Culture Documents

Capital Market January 01-14 2018@ttalibrary

Uploaded by

vahnitejaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Market January 01-14 2018@ttalibrary

Uploaded by

vahnitejaCopyright:

Available Formats

Taste the thunder

Vol. XXXII/23 2017 hurtled to a nail-biting finale as equities surged

Jan 01 – 14, 2018

www.capitalmarket.com and consumer confidence slipped

......................................................................................................................................

At a point well past half time in 2017, it looked as if there were no clouds with silver

Owner : Capital Market Publishers India Pvt. Ltd.

...................................................................................................................................... linings for the economy. Even as the country was recovering from the frenzy of the

Managing Director : Ruby Anand

...................................................................................................................................... recall of high-value notes late previous year, a torrent of reforms swamped industrial

Editor : Mohan Sule activity. MSP, NPAs, MRP and IBC were the acronyms of the year, arousing pas-

......................................................................................................................................

sionate polarization. Developers were put on leash and sick companies cut off from

Deputy Editor : Yagnesh Thakkar

...................................................................................................................................... the drip of credit. Signs of Cyclone GST triggered a wave of disruption. An umbrella

REGISTERED OFFICE with five different hues of a common tax was barely adequate to shield from the

401, Swastik Chambers, Sion-Trombay Road, Chembur, Mumbai-400 071.

Tel: 91-022-2522-9720 Fax: 91-022-2522-0954 / 2523-0011.

complicated and cumbersome compliance regime. Agrarian distress despite normal

email: info@capitalmarket.com monsoon became the fodder for debate. As a result, growth caught a cold and slipped

into a slumber mid-year. If the 2G scam verdict confounded, the stock-buying frenzy

CAPITALINE DATABASES

Tel: 91-022-2522-1112 / 2522-9720 Fax: 91-022-2522-0954 / 2523-0011 was justified by simple maths: Higher tax base equalled higher government spending

email: info@capitaline.com on infrastructure, a sure-fire demand propeller. Due to the surge in deposits from

ADVERTISING

panicky households fearful of crackdown, banks were swimming in liquidity and did

Tel: 91-022-2528-9297/ 2522-9720 Fax: 91-022-2522-0954 / 2523-0011 not need the raft of higher rates to attract savers. So much was the deluge of cash

email: advt@capitalmarket.com

inflows that some asset management companies had to turn off the subscription tap.

SUBSCRIPTION & DISTRIBUTION Foreign investors making a beeline to make in India bolstered reserves to record high

Tel: 91-022-2526-1046 Fax: 91-022-2522-0954 / 2523-0011 and kept the rupee strong. Benign oil prices due to worldwide slowdown narrowed

email: subscription@capitalmarket.com

the current account deficit. Riding on optimism, equities ran ahead of earnings even as

AHMEDABAD consumer confidence plummeted on pessimism. In an era of low costs, stocks became

312, Sampada Complex, 3rd flr., Rashmi Society, Mithakhali,

Six-Road Junction, Navrangpura, Ahmedabad-380 009. expensive. Issuers rushed into the ring with pricey offerings that ranged from the

Tel: 079-2642 1534 / 35, 2656 4727 Fax: 079-2642 1535. largest share-sale in the history of IPOs to those getting 100 times oversubscribed and

email: cm-ahmd@capitalmarket.com

debuting at 100 times gain on tight supply.

BENGALURU The resolve to shake up a lethargic economy pushed up India to the 100th place in

No.37, 2nd Floor, Dickenson Road, Bengaluru-560 042.

Tel: 080-4151-0674 Fax: 080-4151-0674. the World Bank’s Ease-of-Doing business ranking. The tailwinds turned into a tor-

email: cm-bglr@capitalmarket.com nado, when a global credit rating agency upgraded the outlook to investment grade and

CHENNAI

two others lavished praises while maintaining the status quo. The satisfied purring

No.41, 1 st Flr, Sundareshwarar Street, Mylapore Chennai-600004. emboldened equities to notch new records. The high mast of valuations were powered

Tel: 044-246-12690 / 38, 249-51900 / 01 / 02 Fax: 044-2461-2638

email: cm-chennai@capitalmarket.com by the anticipated discipline in the real estate sector, interest subsidy for first home

and support to low-cost housing. The ripple effect was supposed to spur consump-

DELHI tion across the board. Cheering from the banks would be the lenders, freed from their

601, 6th Floor, Padma Tower - II, 22, Rajendra Place,

New Delhi - 110 008. Tel: 011 - 2581-1255 / 56 / 57 excessive baggage of bad loans courtesy the lifeline thrown by the liquidation law. The

email: cm-delhi@capitalmarket.com

storm in the tea cup was who should bid. The big chill was the realization that there

HYDERABAD might be a slip between the intention to become lean and actually becoming mean

# 3-5-890, Room No-103, Paras Chambers, Himayatnagar, despite supplementary infusion of capital and that private investment will revive

Hyderabad-500 029.

Tel: 040-2326 4384, 32408398. Fax: 040-4007-7098. only when companies shed their fat to become ready to swim. Among those rushing to

email: cm-hyd@capitalmarket.com become slim were conglomerates fattened on a diet of junk consisting of cement,

KOLKATA construction, telecom towers and spectrum, steel, DTH, real estate and retail. The

3A, Shivam building, 3rd Floor, 46E, Rafi Ahmed Kidwai Road, most notable weight-loss exercise was executed by an Indian steel giant, assigning a

Kolkata-700 016. Tel: 033-400 14462. Fax: 033-2227-3120

email: cm-kolkata@capitalmarket.com German guardian for its British offspring.

The rumblings in the corporate corridors were not restricted to the issue of col-

PUNE

C-28, 1st Flr, Shrinath Plaza, Plot no. 559, Bhamburda, Shivaji Nagar, lecting useless trophies. Egos were bruised in bloody battles with successors for

Fergusson College Road, Pune-411 005. Tel: 020-2551-1616 / 17. supremacy. Instances of favourites turning foes were not restricted to the board-

email: cm-pune@capitalmarket.com

...................................................................................................................................... rooms. Regulatory inspections and approvals left pharmaceutical investors spinning.

Cover Price: Rs 75 The volatility extended to a re-look at the elder Ambani sibling-managed RIL in H1

Annual Subscription (26 issues): India Rs 1,460 and the younger one’s RCom in H2. Shunned sectors such as metals and PSU banks

Overseas (Airmail) US$ 210. (Cheque/D.D. drawn on Mumbai

in favour of Capital Market Publishers India Pvt. Ltd.) turned into the flavour of the season. Private-sector banks and the central bank

© 2018 Capital Market Publishers India Pvt. Ltd. clashed on asset recognition. The tense game of thrones in the telecom sector ended

All rights reserved. Reproduction in whole or in part without with just three survivors. Tech players looked poised to leap back to life after a hasty

permission is prohibited. burial as the Federal Reserve signalled that the US economy was on a sound footing.

All possible efforts have been made to present factually correct

data. However, the publication is not responsible, if, despite this, After being down in the dumps for most of the year, oil staged a comeback, spreading

errors may have crept in inadvertently or through oversight. panic as the tamed consumer prices strained to break free. The surest sign that the

Though all care is taken in arriving at the recommendations

given in this publication, readers are cautioned that prices of mood was changing from being politically correct to simply being realistic was the

equity shares and debentures may rise or fall in a manner not

foreseen. Readers are advised to take professional advice

dimming of the ferocity of the winds trying to demolish the unique identity program

before investing. to weed out fakes and the muted protest to the US Federal Communications

Subject only to Mumbai jurisdiction

...................................................................................................................................... Commission’s repeal of net neutrality. 2017 was not for the weak hearted. Capturing

Printed and published by Ruby Anand on behalf of Capital Market the essence of the year was the cliff-hanger in the epic theatre of intrigue staged in the

Publishers India Pvt. Ltd. Printed at Kala Jyothi Process Pvt Ltd home state of the prime minister. If not for the ending, India looked set to turn back in

Plot # W 17 & W18, MIDC, Taloja, Navi Mumbai - 410 208 and

published from 401, Swastik Chambers, Umarshi Bappa Chowk, time to the medieval age of queens and princes.

Sion-Trombay Road, Chembur, Mumbai 400 071.

MOHAN M SULE

Jan 01 – 14, 2018 CAPITAL MARKET 3

ReadersReact

there is hardly any improve- book-building exercise for term on expected demand from

ment in corporate earnings. delisting. Several companies the affordable housing and road

Tanmay Ganod, e-mail prefer to stay put than agree construction segments (Cement:

Problem of bias to the exorbitant demands. ‘One-offs dominate ’, Dec 04–

There is consensus that mass Satyam Vakada, e-mail 17, 2017). Demand is likely to

consumption items require Regaining health recover after monsoon and as

moderate rates. Yet, fuels are The banking sector has exhibited the teething problems associated

heavily taxed both by the improved core operating with the implementation of

Central and state governments performance, with controlled GST and the Real Estate

(Editorial: ‘An uneven field’, slippages of loans, despite a (Regulation and Development)

Dec 04–17, 2017). Despite challenging economic environ- Act, 2016, wears off in the

unanimity on the need for one ment amid implementation of coming months and sand

rate on the same product, the the goods and services tax from availability improves.

The side-effects disagreement on whether there the beginning of the quarter Raman Dev, e-mail

As the goods and services tax should be a single rate has (Banking: ‘Asset quality Season's greetings

(GST) regime stabilized, underscored the fact that tax stabilizing’, Dec 04–17, 2017). The start of the festive season

businesses went for restock- payers have to contend with a It showed better pre-provision- saw good revival of sentiment

ing of finished goods and raw field that is not levelled. ing profit, with the growth (Media and Entertainment: ‘Q2

material inventories and Varun Shorke, e-mail slowly picking up. The banking lacks excitement’, Dec 04–17,

gradually got back on Algo trading gives big-ticket sector’s asset quality is likely 2017). There was good growth

track in the September 2017 investors advantage in placing to have almost touched the in advertisement revenues from

quarter (Q2 of FY 2018: orders. Despite proportionate bottom, with the pace of some specific categories such as

‘Lackluster show’, Dec 04– share allotment, the primary incremental stress addition mobile, consumer electronics, e-

17, 2017). The early festive market is rife with instances showing a sharp decline. commerce, retail and lifestyle.

season acted as trigger for of favouritism. The book is Raman Bujja, e-mail In the print media space, ad

pre-festive stocking. How- run through big investors to Still in the woods spends by e-commerce,

ever, only a few sectors and determine the price range. Despite recent policy measure auto, fashion and apparels

companies benefited. Nearly two-thirds of the issue favoring local capital goods and jewellery brands

Deepak Khakhrechi, e-mail is assigned to institutional players, the investment were noticeable.

While lower GST rate benefits investors. Though the quota climate continues to be Pushakar T, e-mail

had to be passed on fully even for small bidders has increased subdued (Capital Goods: ‘A Favorable environment

on higher-cost pre-GST over the years and a discount double whammy’, Dec 04–17, Festive season sales have been

stocks, it was difficult for is offered on the cut-off price, 2017). The accelerated roll out subdued till now (Automo-

companies to fully and those opting for the lowest of GST, even before the biles: ‘On a steady growth

immediately pass on higher band and minimum quantity economy shrugged off from the path’, Dec 04–17, 2017). But a

GST rates, pulling down the often return empty-handed. impact of demonetization decent monsoon is expected to

profit margins on slower sales. Subham Labadhe, e-mail effected in November 2016, revive rural demand. The

Umesh Kolithad, e-mail Companies have been directed precipitated the slowdown. Central Pay Commission pay-

After a surge in financial to get a majority of the small Thus, domestic capex will outs helped the industry’s

liquidity post the note-ban, shareholders on board for continue to be largely driven by growth a year ago. States’ pay

domestic investors are passing resolutions. The public investment, with little or commission announcements

dumping liquidity in equity problem is not all the no participation from the (around eight states have

market due to unattractive- members of this category hold private sector in the near term. implemented the pay revi-

ness of any other investment equal number of shares. How Ganesh Killan, e-mail sions) are helping demand.

avenue. As a result, indices a dominant section can Sign of hope Manoj Maharathi, e-mail

and select stock prices are subvert the process has been The prospects of the cement Send your feedback to

going through the roof even as displayed during the reverse sector look bright in the long readersreact@capitalmarket.com

Telefolio scrips have a proven Capitaline is an analyst’s delight, yet

record of over 10 years. Still Telefolio Gold easy to be trained upon. Even web Capitaline CSS database gives

young, fresh and fast-growing. Pick right and enjoy extensive data on Commodities,

pages can be called inside the

the full ride Sectors and the related Stocks.

Check out for details at application.

For details contact

http://www.telefolio.com 91-022-25229720 For details contact For details contact

For details see page 85 91-022-25229720 91-022-25229720

4 Jan 01 – 14, 2018 CAPITAL MARKET

Inside

13 | In Focus

Banks

Recognition of divergence

NBFCs

Improved performance

PSU Banks

Buyers’ remorse

Graphite electrodes

Turning around

08 | Cover Story

Stocks: Looking ahead

24 | Over The Counter The performance of companies setting goals for the coming years can be measured,

Buying and Selling helping in evaluating the quality of management

IDBI sells Religare Enterprises

27 | Market Watch 80| Apna Money 90 | Capitalaline Corner

Market Report Securing the girl child Power Mech Projects

Soaring temprature Stake surrender Regaining power

Can sale proceeds from property be

Stocks-Large caps

invested in son’s house?

Movers and shakers

69 | Stock Watch

Visaka Industries

Will remain a star perfomer

32 | Corporate Scoreboard

74 | Sector Spotlight

Real Estate

61 | Consolidated Scoreboard

Home-coming 89 | Commodity Watch 63 | Company Index

Roads & Highways Crude Oil 67 | Bulletin

Dull H1, better outlook Volatility here to stay 68 | Watch List

Track stocks real-time on IPO Ratings FREE

www.capitalmarket.com You can get all IPO ratings on our website.

Due to short lead times, we are not able to

carry some of the IPO ratings in the

‘Hot Pursuit’ captures market action tick by tick FREE

fortnightly magazine. But our web site will

EVERYDAY! give the ratings of every IPO on the day it

opens for subscription.

Sample some of the captions:

SBI gains after board OKs fund raising: 28-Dec-17 (09:39) More... FREE

Keep Your Portfolio Online

Star Cement jumps on receiving capital investment subsidy: 28-Dec-17 (09:49) More... Several investors maintain their portfolios

Kolte-Patil Developers spurts as KKR to invest in Pune township: 28-Dec-17 (10:01) More... online at our site. Premium services

(ApnaMoney) include alerts on all corporate

RCom soars over 50% in two sessions: 28-Dec-17 (10:48) More... actions like board meetings, dividends etc.

Volumes jump at Amul Leasing & Finance counter: 28-Dec-17 (10:52) More... Also ready output statements segregating

short-term and long-term gains.

6 Jan 01 – 14, 2018 CAPITAL MARKET

CoverStory

CoverStory Stocks

Stocks

Looking ahead

The performance of companies setting goals for the coming years can be measured,

helping in evaluating the quality of management

Political stability is one of the biggest as- with CY 2017. Developed countries con-

sets for India’s economy at the moment. The Likely to dissappoint tinue to face economic stagnation. Going

factor is enabling long-pending reforms. In- forward, terrorism and North Korea are

troducing structural changes is essential to Infosys is unlikely to meet the target of likely to remain trouble spots.

achieving revenues of US$ 20 billion by

put the economy on a high-growth trajec- The stock market remained largely buoy-

FY 2020. Consolidated revenues were

tory. The result will be creation of massive around US$ 10.5 billion in FY 2017 ant in CY 2017. The S&P BSE Sensex gained

wealth for investors. 28% in CY 2017 till 26 December. The bench-

Uncertainties stemming from demon- mark index surged and recorded an all-time

Face Value: Rs 5

etization are largely over. Also, the goods high of 34,062 in December 2017. Domestic

and services tax (GST), probably the big- institutional investors, particularly mutual

gest economic reform post Independence, funds, have emerged as major buyers in the

has seen the light of the day and the teeth- market. Mutual funds have received signifi-

ing problems are fading. Industry is stabi- cant inflows from retail investors. However,

lizing as the benefits of a single market are foreign institutional investors (FIIs) turned

becoming visible. net sellers in CY 2017. Domestic institutional

Owing to the ban on high-value cur- investors’ cumulative net investment in equi-

rency notes and implementation of GST, ties stood at Rs 87187 crore in CY 2017 till

CMP Rs 1034 as on 26 December 2017. One-year return: 5.22%

India’s gross domestic product growth S&P BSE Sensex one-year return: 31.79% 15 December. In contrast, FIIs net sold Rs

plunged to 5.7% in the first quarter ended 42774 crore in the period.

June 2017 over a year ago, a 13-quarter meaningful and significant decline in inter- The market in CY 2017 was driven more

low. The GDP subsequently recovered to est rates looks remote, a negative factor for by liquidity than financials. Corporate earn-

expand 6.3% in the second quarter ended the economy and the market. ings remained dismal. Leveraged balance

September 2017. The Reserve Bank of In- Prices of crude oil have jumped in re- sheets of several large- and mid-sized busi-

dia expects the domestic economy to clock cent months reacting to political develop- ness groups proved to be another drag on

a growth of 6.7% in the fiscal year ending ments in Saudi Arabia and an unplanned capital investments.

March 2018 (FY 2018). India reported eco- closure of the pipeline that carries crude The scenario is unlikely to change in CY

nomic growth of 7.1% in FY 2017. In inter- oil from the North Sea to a processing ter- 2018 as well. At the current level of 34,011,

national comparison, this is a good num- minal in Scotland. Brent crude touched US$ the Sensex is expensive at a price to earnings

ber. However, the country needs to grow 63.3 per barrel mid-December 2017, a two- (P/E) multiple of 24.8 as against the long-

close to double digits to lift its large popu- year high. term average of around 18. The index is com-

lation from poverty. India is largely dependent on imports manding a price to book value (P/BV) of

In a major morale boost, international for its crude oil requirement. As such, it will 3.05 times and dividend yield of 1.16%. Simi-

rating agency Moody’s Investors Service in be a matter of concern if oil moves to a higher larly, the Nifty is available at P/E of 26.5,

November 2017 upgraded India’s sovereign trajectory and remains at an elevated level. P/BV of 3.5 times and dividend yield of 1.1%.

bonds rating for the first time in nearly 14 There will be a spike in inflation that will Dismal corporate earnings have resulted

years by one notch to Baa2 from Baa3, cit- put the financials of the Central government in expensive valuations. The surge by the

ing continued progress on economic and in- under stress. The result could be economic equity market is purely on account of ex-

stitutional reform. The agency changed its slowdown, thereby impairing the Central pansion in P/E, a worrying trend. Corporate

rating outlook to stable from positive. Be- government’s ability to spend liberally to earnings are expected to be better in FY 2019

sides, in October 2017, India ranking in the lift the economy. and beyond. But the improvement is un-

World Bank’s 2017-18 Ease of Doing Busi- Besides, the Central government might likely to be dramatic to moderate the valua-

ness survey improved 30 places to 100. resort to populism in the near future as less tions. Invariably, the market will have to

Over the last one year, interest rates have than one-and-a-half years remain for the depend on liquidity to report gain in share-

declined substantially, offering a cushion to general election. Any adventurism will have holders’ wealth.

India Inc at a time when many big compa- an adverse effect on the fiscal deficit. The CY 2017 has proved to be an excellent

nies are struggling with over-leveraged bal- reform process might take a backseat. year for initial public offerings (IPOs). Sev-

ance sheets. Interest rates are likely to re- The global scenario is unlikely to change eral companies took advantage of buoyancy

main stable. But, from here on, a further in the calendar year (CY) 2018 compared in the secondary market, driven by liquid-

8 Jan 01 – 14, 2018 CAPITAL MARKET

CoverStory Stocks

ity. Around Rs 68000 crore were garnered Titan Company expects to clock rev-

from the primary market in CY 2017. Off target enue of US$ 5 billion by FY 2025 as against

The CY 2018 begins with a mixture of US$ 2 billion in FY 2017. Investment is

optimism and pessimism. One way to ex- Welspun India in April 2016 had shared being earmarked to ensure growth.

Vision 2020. Due to macroeconomic

plore equities is to focus on companies that Broadly, the joint venture between the

and other challenges, the vision has

have set goals for coming years. The best been deferred by two years Tata Group and the Tamil Nadu Industrial

part of the investment strategy is that the Development Corporation operates in

performance of companies is measurable three business segments of watches (rev-

Face Value: Re 1

compared with the targets that have been enue contribution of 16% in FY 2017),

set, thereby helping in evaluating perfor- jewelry (81%) and eye-wear (3%).

mance of the management and promoters. As many as 1,415 stores are operational

Moreover, guidance offers some visibility on aggregate retail space of 1.8 million square

to investors and builds a scenario for fu- feet spread across 266 towns. Also, prod-

ture valuations. ucts are sold through over 11,000 multi-brand

Companies do have their internal tar- retail outlets. There is presence in 32 coun-

gets for one or two years. It is integral part tries with aggregate of 2,264 outlets. Key

of corporate budgeting and planning. Com- brands include Titan (watches and accesso-

CMP Rs 76 as on 26 December 2017. One-year return: 23.27%

panies sharing their objectives make the S&P BSE Mid cap index one-year return: 58.28% ries), Sonata (largest selling watch brand in

whole process transparent for investors. India), Fastrack (largest youth brand),

Also, the exercise lends accountability, owing to allegation of corporate governance Tanishq (India’s leading jewelry brand) and

largely missing in India Inc unlike in the issues and disconnect between management Raga (exclusive women’s watch brand).

west, where non-performance results in un- and erstwhile promoters on sabbatical. Luxury brands include Zoya (diamond col-

ceremonious exits. Also, companies postponing deadlines lection) and Favre-Leuba (watches), while

There is a conflict of interest that should are not uncommon. Welspun India in April premium brands include Xylys (watches)

be kept in mind. Companies obviously want 2016 had shared Vision 2020 with the share- and Nebula (watches).

to keep their market value high. In this en- holders detailing certain targets. Due to mac- Indian ethnic wear has been identified as

deavour, the management has no option but roeconomic and other challenges, the vision a new product category. Products such as

to make optimistic statements. The factor has been deferred by two years. sarees, lehengas, yardages, stoles and dupattas

needs to be discounted while assessing com- Polymer manufacturer Bhansali Engi- are priced from Rs 2000 to Rs 2.5 lakh under

panies for investment. In the context, inves- neering Polymers has talked about multiple the Taneira brand. The segment can become

tors can assess the past performance of goals in the annual report for FY 2017. The Titan’s fourth lifestyle vertical in future.

management of delivering results. aim is to be the lowest costs well as to be the Auto component maker Motherson

Companies can be seen talking about largest producer of acrylonitrile butadiene Sumi Systems is known for carving out

future revenues, market share, product port- styrene (ABS) in India by FY 2019. The tar- five-year plans. The practice of providing

folio, distribution or geographical reach, debt get is to achieve over 90% capacity utiliza- five-year targets was started in FY 2000.

reduction, divestment of non-core assets and tion from FY 2018 and generate sufficient Importantly, the targets set over the last one-

return on equity. internal accrual to fund future expansion and-a-half decade have been achieved. IP

Capital Market scanned various sources projects without relying on borrowings. modules, door trims and bumpers for pas-

of information to compile a list of compa- ABS manufacturing capacity is to be senger cars in Europe and India contribute

nies to have disclosed their medium- to long- ramped up to 137 kilotonnes per annum around 51% to the top line. Wiring harnesses

term goals. Data was collected from annual (ktpa) from the current 80 ktpa by Decem- for passenger cars in India and for commer-

reports, presentations, corporate announce- ber 2018. The expansion will be financed cial vehicles globally accounts for 27% of

ments, news reports, press releases and through internal accruals. There are plans the consolidated revenues. Rear-view mir-

media interviews. In certain cases, vision to establish a port-based greenfield project rors comprise 22% of the total sales.

statements of companies have provided in- of minimum 200 ktpa of ABS capacity by The target is to achieve revenues of US$

formation about future plans. Largely, com- March 2022. This facility will be located 18 billion and returns on capital employed

panies offering concrete future plans have in Gujarat. (RoCE) (consolidated) of 40% by FY 2020.

been selected. Those making generic state- ABS and styrene acrylonitrile resins are Further, the aim is to pay 40% of consoli-

ments were removed. Companies that have classified as of highly specialized engineering dated profit as dividend. As per the busi-

gone for IPOs in the recent times were ig- thermoplastics. Their manufacturing facilities ness strategy, 3CX15, no country or cus-

nored because they tend to talk big to jus- are located at Abu Road, Rajasthan, and tomer of components should account for

tify their rich valuations. Satnoor, Madhya Pradesh. Key customers more than 15% of the total revenues. Turn-

Country’s second largest software com- include HMSI, Maruti Suzuki, Whirlpool, over was around US$ 7.4 billion in FY 2017.

pany Infosys is unlikely to meet the target Samsung, LG, Toyota, M&M, Bajaj Auto and The goal is not only to pursue growth but

of achieving revenues of US$ 20 billion by Godrej group among others. A significant also improve RoCE.

FY 2020. Consolidated revenues were portion of the raw materials are required to Among the leading companies by mar-

around US$ 10.5 billion in FY 2017. The be imported. Thus, there is risk of price and ket value, ITC’s aspiration is to clock rev-

company has witnessed a churn at the top currency fluctuations. enues of Rs 1 lakh crore from the new

Jan 01 – 14, 2018 CAPITAL MARKET 9

CoverStory Stocks

FMCG businesses. Revenues from the new tels and information technology. British and small enterprises (12%) accounted for

FMCG businesses were Rs 14000 crore in American Tobacco held 30% equity stake 60% of the loan book end March 2017.

FY 2017. The FMCG business includes and. mutual funds 4.73% in the debt-free The ongoing merger of micro finance

branded packaged foods, personal care company end September 2017. Bonus company Bharat Financial Inclusion (BFIL)

products, education and stationery prod- shares were issued in the ratio of 1:2 in FY is expected to provide a big boost to the

ucts, lifestyle retailing, incense sticks and 2017 and 1:1 in FY 2011. business base. The shareholders of BFIL will

safety matches. There is presence in 40 IndusInd Bank has devised a growth receive 639 shares of IndusInd for every

FMCG categories, with aggregate 10,000 strategy for FY 2017 to FY 2020, called 4D. 1,000 shares of BFIL. BFIL’s business con-

stock-keeping units. As many as two mil- The vision envisages doubling the client base, sists of 1408 offices, 6.8 million customers,

lion outlets are served directly. loans and profit. The loan growth target has 15284 employees, a loan book of Rs 9631

Aggressive investment is being made in been set at 25-30% and revenues growth crore and total assets of Rs 10170 crore end

manufacturing and logistics facilities to grow aimed at higher than the balance-sheet June 2017. The merger is expected to be

the FMCG business. A third company- growth. The current-account-savings-ac- completed by mid-CY 2018.

owned manufacturing unit was commis- count ratio should reach 40% and the branch Nilkamal is focusing on growing its

sioned to cater to the foods and personal- network touch 2,000 by FY 2020 from 1,250 mattress business. The plan is to scale up

care products segments. Further, a decision branches at present. The aim is to double revenues of the vertical to nearly Rs 200

has been made foray into fruits, vegetables the customer base to 20 million. The objec- crore within the next three years from Rs 48

and other perishables segment. The primary tive is to report return on asset of 2.4% as crore in FY 2017. FY 2017 saw efforts to

focus is on growing the non-cigarette busi- against 1.86% in FY 2017. improve the reach, enhance the product of-

nesses. The non-cigarette segments contrib- The advances base stood at Rs 123181 ferings and increase awareness of the

uted 58% to the revenues in FY 2017. crore and deposits at Rs 141441 crore end Nilkamal Mattress brand to assist the chan-

The largest cigarette maker in the coun- September 2017. The capital adequacy ra- nel partners in achieving the twin objectives

try also operates in the sectors of tio was 15.63% end September 2017. Large of top-line growth and retailer appointment.

paperboards and packaging, agriculture, ho- firms (29%), mid-sized companies (19%) Two mattress manufacturing units, one

Opening up the window

Companies do have their internal targets for one or two years and, by sharing their objectives, make the whole process

transparent for investors. Also, the exercise lends accountability

COMPANY CMP MCAP 52-WEEK MF D-E TTM NET SALES TTM APAT P/E P/BV DY

(Rs) (Rs cr) HIGH (Rs) LOW (Rs) (%) RATIO (Rs cr) CHG(%) (Rs cr) CHG(%) RATIO (%)

APL Apollo Tubes 1969.4 4673.4 2027.8 876.0 14.43 0.97 4887.8 24.2 150.4 10.7 31.08 6.06 0.61

Bhansali Engineering Polymers 174.0 2886.8 199.9 21.4 0.22 0.11 787.8 35.3 60.1 204.0 85.11 18.37 0.11

Biocon 539.7 32379.0 548.1 294.0 2.1 0.54 3843.8 5.3 448.9 -13.9 72.13 6.83 0.19

IndusInd Bank 1648.9 98887.4 1818.0 1045.2 12.06 0 15873.2 21.3 3218.9 25.4 34.52 4.88 0

ITC 263.4 321035.7 353.2 222.1 4.73 0 40350.7 6.1 10516.5 7.7 36.23 6.92 2.13

Marico 317.0 40917.5 347.8 238.6 1.55 0.13 5946.3 -1.0 783.5 -0.9 52.22 14.92 1.1

Motherson Sumi Systems 376.2 79190.5 395.0 201.8 6.8 1.3 47918.8 21.9 2349.3 21.5 33.71 9.07 0.35

Nilkamal 1836.1 2739.4 2274.9 1225.0 9.62 0.14 1979.7 7.0 110.7 -0.4 22.43 3.71 0.22

Supreme Industries 1225.3 15564.6 1250.0 844.0 5.34 0.23 4606.8 8.1 398.2 3.1 39.09 9.39 0.24

Titan Company 856.1 76003.4 871.9 307.0 2.74 0.01 14954.6 34.3 935.9 18.8 81.21 17.12 0.3

Adani Transmission 235.6 25911.5 247.8 51.1 0.08 3.13 2920.1 17.8 345.0 -13.1 75.11 8.65 0

Britannia Industries 4744.9 56966.3 4963.7 2776.0 6.39 0.05 9256.2 6.1 908.4 5.7 62.71 19.81 0.46

CCL Products (India) 302.6 4025.4 371.8 250.0 2.23 0.31 1126.7 29.3 141.7 22.2 28.42 6.1 0.83

Finolex Industries 641.0 7954.2 752.8 425.0 8.18 0.08 2981.5 10.4 305.5 11.6 22.78 3.44 1.79

Hatsun Agro Product 841.0 12797.4 970.0 347.8 0.3 2.75 4395.2 16.9 145.5 131.1 87.97 36.65 0.48

Mahanagar Gas 1118.5 11047.8 1345.0 751.3 4.93 0 2094.3 3.3 447.6 25.9 24.68 5.64 1.87

Orient Cement 166.8 3417.7 182.0 115.8 20.77 1.29 2144.2 34.3 53.9 LP 63.42 3.33 0.3

TTK Prestige 7964.4 9199.8 8399.0 5272.2 6.58 0.07 1793.7 15.9 162.8 34.8 56.5 9.92 0.34

Vidhi Specialty Food Ingredients 112.1 559.6 115.9 49.1 0 0.93 219.8 36.3 15.3 -1.5 36.62 7.72 0.71

Welspun India 76.1 7646.0 99.6 60.0 1.37 1.5 5954.7 0.9 515.8 -44.2 14.82 3.07 0.85

CMP (current market price) is closing as on 22 December 2017. Consolidated financials considered wherever available. MF (mutual fund) holding as of September 2017. Debt-to-equity ratio is as of FY 2017.

LP : Loss to profit. P/E : Price to earnings. P/BV : Price to book value. DY : Dividend yield. TTM net sales and TTM APAT (trailing 12-month adjusted profit after tax) is for the period ended September 2017.

Variation in TTM net sales and APAT is over the corresponding previous period. Source: Capitaline Databases

10 Jan 01 – 14, 2018 CAPITAL MARKET

CoverStory Stocks

With some caution

Guidance offers some visibility to investors and builds a scenario for future valuations. But there is a conflict of interest

as management makes optimistic statements. The factor needs to be discounted

COMPANY HIGHLIGHTS

Welspun India One of the world’s leading home textile manufacturers with a diversified brand portfolio and global distribution network has set

multiple goals as part of Vision 2022. The aim is to achieve revenues of US$ 2 billion and emerge debt-free by FY 2022. The

objective is to ensure half of the revenues from branded products as against 16% in FY 2017 and at least 20% revenues from

the domestic market as against mere 5% in FY 2017. Mutual funds held 1.37% stake end September 2017.

Hatsun Agro Product The milk segment, constituting 68% of the revenues in FY 2017, has been notching 18% CAGR over the last five years.

Growth is anticipated at similar levels in the next three financial years owing to deeper penetration into new markets.

Expansion is planned to commensurate with the increased milk-handling facilities. Capacity is to be enhanced by March 2018

with the proposed addition of one milk processing unit at Dharapuram in Tamil Nadu and another in Andhra Pradesh.

TTK Prestige With a range of cookware and kitchen appliances, the plan is to launch 100 new stock-keeping units in FY 2018. Lately, forays

have been into newer product segments adjacent to kitchen appliances such as cleaning solutions, irons, lanterns and water

filters. The clean-home division, launched in April 2016, is expected to contribute 8-10% to the revenues over the next three

years. Growth will be driven new product launches. The country’s first electric mop and a new range of water purifiers were

launched in December 2017. The division reported sales of Rs 13 crore in FY 2017.

Vidhi Specialty Food Ingred The manufacturer of superior synthetic and natural food grade colors aims to achieve turnover of Rs 500 crore by FY 2020

along with improved operating profit margins. Concrete capital expenditure plans include enhancement of existing product lines

and diversification into new products along with backward integration to manufacture two major raw materials. These

investments are expected to boost revenues and the profit margins.

Orient Cement The CK Birla group company aims to achieve cement capacity of 15 million tonnes (mt) by FY 2020. Organic and

inorganic growth opportunities are being explored. The current cement capacity stood at eight mt. A 74% stake was

acquired in CY 2016 in Bhilai Jaypee Cement, with integrated capacity of 2.2 mt and a separate grinding unit in Nigrie, with

capacity of two mt. Thus, the aggregate cement manufacturing capacity is set to increase to 12.2 mt along with entry into

the central and eastern markets of the country.

Mahanagar Gas Plans to add over 656 kilometers of steel and PE pipeline and 96 CNG filling stations over the next five years, involving

substantial investment. The sole authorized distributor of CNG and PNG in Mumbai, its adjoining areas and Raigad has over

21 years of track record in Mumbai. Infrastructure includes 4,838 kilometers of pipeline and 203 CNG filling stations. The aim

is to participate in bidding process to achieve geographical expansion.

Britannia Industries The leading biscuit maker is focusing on increasing the share of premium products, reducing cost and improving distribution

reach. The thrust continues on rural expansion through the rural-preferred dealers program. The program aims to strengthen

and expand the sales and distribution network. In the last three years, direct reach improved 2.3 times. To reduce cost, the

objective is to reduce the distance to market.

Adani Transmission Based on organic and inorganic initiatives, the power distributor wants achieve capacity of 22,000 circuit kilometers (ckm) of

transmission line and asset value of Rs 40000 crore by CY 2022. As much as 2,369 ckm of transmission lines are being

constructed in Rajasthan, Chhattisgarh, Madhya Pradesh, Maharashtra, Bihar and Jharkhand. The GMR group’s transmission

assets in Rajasthan were acquired in FY 2017. Post completion of these initiatives, the network is expected to increase to

10,425 ckm so as to help in achieving the target of 13,000 ckm by CY 2020. High debt, with a debt-to-equity ratio of 3.1 times

and borrowings of Rs 8,974.8 crore end March 2017, is a matter of concern.

Finolex Industries The target is to achieve revenues of US$ 1 billion and double capacity by CY 2020. Among the leading supplier of PVC pipes

and fittings for the agriculture and non-agricultural sectors is expanding the distribution network in the northern and eastern

regions. The current network consists of 18,000 retail touch points. The capacity of PVC pipes and fittings will be increased to

capture expected increase in demand. Also, brand promotion will be undertaken.

CCL Products The established player in the international markets in the traditional spray-dried instant coffee segment has also entered the

freeze-dried coffee segment. A foray was made into the domestic market in FY 2016 to rapidly expand market share. In the

last couple of years, volumes grew 15-20%. In the current fiscal, the volume growth is likely to be around 20-30%. As similar

growth in volumes is expected till FY 2020.

Source: Companies.

at Barjora in West Bengal (eastern market) stream, there is presence in all the four re- market for the vertical. A dealer-distribution

and the other at Bhiwandi in Maharashtra gions of the country. The bubble guard busi- network is being set up.

(western market), commenced operations in ness began in the June 2017 quarter. The The leading maker of molded furniture

October 2017. With these units going on aim is to develop a business-to-business and material handling products has a diver-

Jan 01 – 14, 2018 CAPITAL MARKET 11

CoverStory Stocks

sified product profile across various seg- The current plastic processing capacity is

ments. The customer base comprises house- To re-invent around 3.50 lakh tonnes. Apart from increas-

holds, industrials and retail buyers. Also, ing revenue contribution of value-added

there is presence in the retail business of APL Apollo Tubes is augmenting products and deepening of the distribution

capacity of steel tubes to 2.5 mt

lifestyle furniture, furnishings and acces- by FY 2020 from the existing 1.3 mt

network, the focus will be on technological

sories under brand @home and Nilkamal by adopting latest technology innovation and enhancing the product port-

Mattresses. Overall capital expenditure folio. At present, products are distributed

was Rs 48 crore in the first half of FY 2018 through 2,950 channel partners. The targets

Face Value: Rs 10

and another Rs 50 crore will be incurred in are CAGR of 12-15% by volumes till FY

the second half. 2021 and maintain the OPM of 15-15.5%.

In a significant morale boost for Biocon, By FY2022, Marico aspires to be a lead-

the US Food and Drug Administration ap- ing emerging market multinational company,

proved co-developer Mylan’s Ogivri with leadership position in two core catego-

(trastuzmab-dkst) in December 2017. The ries of nourishment and male grooming in five

cancer product is the first FDA approved xxxxx chosen markets in Asia and Africa. The aim is

bio-similar to Herceptin in the US. The busi- to achieve volume growth of 8-10% through

ness opportunity runs into millions of dol- investment in core portfolio, new product

CMP Rs 2008 as on 26 December 2017. One-year return: 128.0%

lars and also provides a stamp of approval S&P BSE Mid cap index one-year return: 58.28% launches, distribution expansion, pricing and

to the research capabilities. In aggregate, the cost management. In the process, revenues

two partners are exploring business oppor- tube manufactures in the world. are expected to double that of FY 2017 (Rs

tunities worth about US$ 44 billion in the The distribution network consists of 5918 crore). There is presence in 25 coun-

developed markets in the bio-similars and 625 dealers and 40,000 retailers serving cus- tries across emerging markets of Asia and

bio-logics space. tomers across 300 towns. To strengthen lo- Africa. Around 30% of the revenues are gen-

Among the country’s largest bio-pharma- cal presence, two warehouses were added in erated from international markets.

ceutical companies serves clients across 120 H1 of FY 2018, taking the total warehouse The operator in the beauty and wellness

countries. A range of novel biologics, bio- count to 28. There is pan India presence, space is among the country’s leading con-

similars, differentiated small molecules and with units located at Sikandarabad (three sumer products provider, with flagship

affordable recombinant human insulin and ana- units) in Uttar Pradesh, in Bangalore in brands comprising Parachute, Parachute

logs has been developed and marketed. Key Karnataka, at Raipur in Chattisgarh, at Advansed, Saffola, Hair & Care, Nihar, Nihar

brands include Insugen, Basalog, Canmab, Hosur in Tamil Nadu and at Murbad in Naturals, Livon, Set Wet, Mediker and Re-

Biomab-Egfr, Krabeva and Alzumab. Maharashtra. The product offering includes vive across product categories of hair and skin

The aim is for revenue of US$ 1 bil- over 400 varieties of MS black pipes, galva- care, edible oils, health foods, male grooming

lion by FY 2019. Turnover was Rs 3891 nized tubes, pre-galvanized tubes, structural and fabric care. International brands are lo-

crore in FY 2017. Broadly, the operations ERW steel tubes and hollow sections. calized considering lifestyle needs.

span four segments of small molecules (ac- Supreme Industries processes poly- The dense domestic distribution net-

tive pharmaceutical ingredients and generic mers and resins into finished plastic prod- work reaches all towns with population of

formulations), biologics (bio-similars and ucts. The product portfolio is divided into over 10,000. The moderately leveraged com-

novel biologics), branded formulations (for- five categories of plastic piping (pipes and pany had a debt-to-equity ratio of 0.13 times

mulations business in India and the UAE) fittings), consumer products (plastic end FY 2017.

and research services (contract research molded furniture), packaging products

and manufacturing). (specialty films, protective packaging Conclusion

APL Apollo Tubes has formulated a products and cross laminated films), in- Companies that have disclosed targets are

long-term growth strategy to meet poten- dustrial products (industrial components answerable to investors. The accountability

tial demand by augmenting capacity of steel and material handling) and composite might put pressure on the management to

tubes to 2.5 million tonnes (mt) by FY 2020 products (LPG cylinders). perform. Some companies might want to

from the existing 1.3 mt. To achieve the The market share in key product port- adopt unethical ways to achieve the ambi-

vision, latest technology will be adopted folio is plastic pipes (8.4%), plastic molded tions. At the same time, having a plan makes

and existing production lines modernized furniture (10.5%), material handling prod- companies transparent and attract more in-

to improve the operating profit margins ucts (13.5%) and protective packaging prod- vestors, thereby giving a boost to valuations.

(OPM). Also, the target is to become debt- ucts (ranging between 17% and 53% depend- The stock market is at historic peaks.

free and reduce the working capital cycle ing on products). There is strategic equity As such, investors should pay attention to

by FY 2020. The debt-to-equity ratio stood stake of 29.99% in Supreme Petrochem, the discounting. Besides, the economic en-

at 0.97 times end March 2017. Two new commanding a 2% market share in the global vironment should be conducive for compa-

direct-forming-technology lines were com- polystrene market and 60% of domestic in- nies to reach their objectives. Investors

missioned in H1 of FY 2018. The remain- stalled capacity. should also focus on the promoters’ track

ing four lines will be established by March The existing capacity is to be enhanced record in meeting goals, balance sheet and

2018. Post complete commissioning will to seven lakh tonnes by FY 2021, involving industry prospects.

see the emergence as one of the largest steel capital expenditure of Rs 1200 to 1300 crore. — Venkatesh S

12 Jan 01 – 14, 2018 CAPITAL MARKET

InFocus

InFocus

Banks Among the 15 PSBs disclosing figures

Recognition of divergence

for divergence, only five PSBs showed gross

NPA divergence above the regulatory

threshold level of 15% in FY2016. However,

PSBs sharply surpassed the threshold level

About 75% of the overall annual slippages happened in of 15% for provision divergence to Pat. More

importantly, large PSBs such as State Bank

H2 of FY 2016, after the RBI undertook an asset quality review of India, Bank of Baroda, Bank of India,

The banking sector fresh slippages of loans Indian Bank, Uco Bank and Union Bank

jumped more than two times, with public You, too? indicated that neither additional provisioning

sector bank (PSBs) reporting voluminous Yes Bank showed gross NPA requirements assessed by the RBI nor the

fresh non-performing asset (NPA) additions divergence of four-times, additional gross NPAs identified by RBI

of Rs 3.63 trillion and private sector banks Axis Bank at 131% and exceeded 15% of the published Pat and

(PVBs) posting NPA addition of Rs 0.47 Indusind Bank 66% in FY 2016 incremental gross NPAs, respectively,

trillion in the financial year ending March 160 allowing them to escape from disclosing

IndusInd Bank

2016 (FY 2016). 140 related data.

More importantly, about 75% of the The gross NPA divergence of 15 PSBs

120

overall annual slippages happened in the Yes Bank stood at Rs 21136 crore and the net NPA

second half of FY 2016, after the Reserve 100 divergence at Rs 14470 crore for FY2016 as

bank of India (RBI) undertook the asset 80

against the reported NPAs. The NPA

Axis Bank

quality review (AQR) of the banking system divergence led to provisioning divergence of

60 l

in Q3 of FY 2016 and advised banks to S

l

O

l

N

l l

D J'17 F

l l

M

l

A

l

M

l

J

l

J

l

A

l

S

l

O

l

N

l

D

l

Rs 7750 crore. Thus, these 15 PSBs

classify certain weak accounts as bad loans Base = 100 as on 1 September 2016. underestimated its net losses at Rs 17364 crore

and make provisions. About 55-65% of the for FY 2016 against the RBI assessment of

total slippages in the second half of FY 2016 provisioning (IRACP) as part of its net losses of Rs 24124 crore adjusting for

owed to the implementation of RBI’s AQR. supervisory processes. There have been additional provision requirement on account

The corporate lenders mainly faced the brunt instances of material divergences in banks’ of NPA divergence.

of asset quality woes in FY 2016. Retail asset classification and provisioning from The gross NPA divergence among PSBs

PVBs were better off with lower exposure the RBI norms, thereby leading to the was the highest at 53% or Rs 3034 crore of

to leveraged corporate accounts. published financial statements not depicting reported incremental slippages for Bank of

The fresh slippages of loan remained a true and fair view of the financial position Maharashtra in FY 2016. IDBI Bank also

elevated at Rs 2.59 trillion for PSBs, while of the bank. To ensure greater transparency showed higher NPA divergence of 36% or Rs

those of PVBs jumped to Rs 0.78 trillion in and promote better discipline of 6817 crore, followed by Punjab & Sind Bank

FY2017. The slippages continue to be compliance with IRACP norms, as per the 27% or Rs 539 crore, Corporation Bank 18%

elevated at Rs 1.48 trillion for PSBs and Rs April 2017 circular, the RBI has decided or Rs 1954 crore, and United Bank of India

0.37 trillion for PVBs in the first half for FY that banks shall make suitable disclosures 17% or Rs 840 crore. Apart from these five

2018. The subsequent AQRs from the RBI, when either the additional provisioning PSBs, the gross NPA divergence of the

continuous slippages of restructured loans, requirements assessed by the RBI exceed remaining 15 PSBs was below 15% of

balance sheet clean-up from banks, 15% of the published net profits after tax incremental slippages for FY2016. Thus, the

demonetization, government’s loan waivers for the reference period or the additional overall gross NPA divergence for 15 PSBs

for certain segments etc caused further gross non-performing assets (NPAs) together at 11% was below RBI 15%

slippages of loan in FY 2017 and FY 2018. identified by the RBI exceed 15% of the threshold level for FY2016.

Meanwhile, the bank-wise risk-based published incremental gross NPAs for the However, these 15 PSBs sharply

supervision (RBS) from the RBI, assessing reference period, or both. underestimated net losses by 39% for FY

certain retrospective divergence in the bank’s As many as 24 banks of the 38 listed 2016 due to higher provisioning divergence.

asset classification and provisioning relating banks reported gross NPA divergence of Rs Bank of Maharashtra and Oriental Bank of

to FY2016 caused pressure on banks’ asset 43546 crore for FY2016. The divergence has Commerce actually dipped into net losses

quality and profitability in FY2017. The been adjusted in their financial statements of Rs 405 crore and 238 crore for FY2016

RBS for couple of PVBs is completed for for FY 2017. The net NPA divergence for on account of additional provisioning required

FY 2017, significantly denting their asset these banks was Rs 31536 in FY2016. for NPA divergence as compared with

quality in the first half of FY2018. However, Further, the reported provision divergence reported Pat of Rs 101 crore and Rs 156

the RBS for many PVBs as well as PSBs is was Rs 13200 crore, while the reported crore. The losses for Corporation Bank and

yet to be completed and may have bearings profit after tax (Pat) at Rs 7466 crore was United Bank doubled from reported level

on their performance in the first half as well overestimated to the extent of Rs 10522 crore for FY2016. Further, Central Bank, IDBI

as second half of FY2018. (notional) for FY 2016. The remaining 14 Bank, Allahabad Bank, Syndicate Bank,

The RBI assesses compliance by banks banks have not disclosed the divergence as Indian Overseas Bank, Punjab National

with extant prudential norms on income it is below the 15% threshold level of the Bank, and Canara Bank also showed 20-50%

recognition, asset classification and RBI on both NPA as well as provisioning. higher losses adjusting for additional

Jan 01 – 14, 2018 CAPITAL MARKET 13

InFocus

Reporting v review

15 PSBs underestimated their net losses at Rs 17364 crore and nine PVBs showed higher gross NPA divergence

of Rs 22410 crore for FY 2016

GNPA (Rs cr) NNPA (Rs cr) PAT (Rs cr) FRESH SLIPPAGES (Rs cr) DIVERGENCE FOR FY2016 (Rs cr)

FY C16 FY 2017 FY 2016 FY 2017 FY 2016 FY 2017 FY 2016 FY 2017 GROSS NPA NET NPA PROVISION ADJ. *PAT

Public Sector

Allahabad Bank 15385 20688 10293 13434 -743 -314 12925 11417 973 715 258 -1001

Andhra Bank 11444 17670 6036 10355 540 174 6332 9410 877 693 184 420

Bank of Maharashtra 10386 17189 6832 11230 101 -1373 5724 9119 3034 3034 505 -405

Canara Bank 31638 34202 20833 21649 -2813 1122 24724 11652 507 30 537 -3350

Central Bank 22721 27251 13242 14218 -1418 -2439 15145 10487 2097 1403 695 -2113

Corporation Bank 14544 17045 9160 11692 -506 561 10582 7762 1954 1246 708 -1024

Dena Bank 8560 12619 5230 7735 -935 -864 6098 6767 311 299 56 -991

IDBI Bank 24875 44753 14643 25206 -3665 -5158 19087 27595 6817 4756 2061 -5013

Indian Overseas Bank 30049 35098 19213 19749 -2897 -3417 20998 13004 818 280 537 -3462

Oriental Bank 14702 22859 9932 14118 156 -1094 10371 12222 1350 1350 394 -238

Punjab & Sind Bank 4229 6298 2949 4375 336 201 1960 2900 539 305 234 102

Punjab National Bank 55818 55370 35423 32702 -3974 1325 42252 22415 138 -623 761 -4735

Syndicate Bank 13832 17609 9015 10411 -1643 359 12201 8138 654 227 427 -2070

United Bank 9471 10952 6111 6592 -282 220 5011 3533 840 590 249 -531

Vijaya Bank 6027 6382 4277 4118 382 750 5836 2893 229 166 145 287

State Bank of India 98173 112343 55807 58277 9951 10484 64198 39071 # # # #

Bank of Baroda 40521 42719 19406 18080 -5396 1383 27828 13312 # # # #

UCO Bank 20908 22541 11444 10703 -2799 -1851 14942 9909 # # # #

Union Bank 24171 33712 14026 18832 1352 555 12953 13244 # # # #

Bank of India 49879 52045 27996 25305 -6089 -1558 38606 20321 # # # #

Indian Bank 8827 9865 5419 5607 711 1406 5712 3331 # # # #

Private Sector

Axis Bank 6088 21280 2522 8627 8224 3679 7241 19858 9478 7163 2315 6688

City Union Bank 512 682 323 408 445 503 429 480 83 67 16 429

ICICI Bank 26721 42552 13297 25451 9726 9801 16711 33547 5105 4034 1071 9026

IndusInd Bank 777 1055 322 439 2286 2868 849 1429 560 316 244 2137

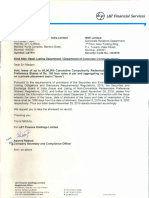

J & K Bank 4369 6000 2164 2425 416 -1632 2383 3278 1884 1366 517 -101

Karur Vysya Bank 511 1484 216 1033 568 606 1133 1331 220 220 106 496

RBL Bank 208 357 124 190 292 446 200 533 339 202 137 203

South Indian Bank 1562 1149 1185 675 333 393 1610 1698 565 379 186 212

Yes Bank 749 2019 284 1072 2539 3330 911 2632 4177 3319 858 1978

Kotak Mahindra Bank 2838 3579 1262 1718 2090 3412 2866 1797 $ $ $ $

HDFC Bank 4393 5886 1320 1844 12296 14550 5713 7126 $ $ $ $

Lakshmi Vilas Bank 391 640 232 418 180 256 197 597 # # # #

Federal Bank 1668 1727 950 941 476 831 1895 1075 # # # #

Dhanlaxmi Bank 459 316 193 166 -209 12 251 155 # # # #

Karnataka Bank 1180 1582 795 975 415 452 1125 1348 # # # #

DCB Bank 197 254 97 124 195 200 225 262 # # # #

IDFC Bank 3058 1542 1139 576 467 1020 3425 981 # # # #

$ No divergence observed. # Figures not disclosed as divergence within threshold limits *Adjusted notional PAT. Source: Capitaline Databases and banks annual reports 2016-17

provisioning compared with reported losses FY2016. These PVBs have overestimated Pat 2016. Among the small PVBs, gross NPA

for FY2016. at Rs 24830 crore reported for FY 2016 as divergence for RBL Bank was a huge 170%

Surprisingly, the nine PVBs showed higher against Rs 21068 crore after adjusting for or Rs 339 crore, Indusind Bank’s was 66%

gross NPA divergence of Rs 22410 crore for additional provisioning. or Rs 560 crore and South Indian Bank 35%

FY2016 compared with the divergence of Rs Among PVBs, Yes Bank surprised by or Rs 565 crore for FY2016. The gross NPA

21136 crore reported by 15 PSBs. The showing gross NPA divergence of four times divergence of these nine PVBs together was

adjustment of NPA divergence in the FY 2017 or Rs 4177 crore compared with its reported enormous at 71% of reported incremental

financial statements substantially affected the fresh slippages of Rs 911 crore for FY 2016. slippages in FY2016. Eight other PVBs did

performance of PVBs in FY 2017. These nine Further, the NPA divergence was sharply not disclose any divergence figures, being

PVBs reported higher net NPA divergence of higher for Axis Bank at 131% or Rs 9478 comfortably below the RBI threshold limits.

Rs 17066 crore, while the provisioning crore, J&K Bank 79% or Rs 1884 crore and More importantly, HDFC Bank and Kotak

divergence was lower at Rs 5450 crore for ICICI Bank 31% or Rs 5105 crore for FY Mahindra Bank indicated that the RBI had

14 Jan 01 – 14, 2018 CAPITAL MARKET

InFocus

in the asset classification and provisioning

Under severe stress for FY2017 for a couple of PVBs mostly

The gross NPA ratio of all SCBs might increase from 10.2% in September 2017 to operating in the corporate loan segment.

10.8% by March 2018 and further to 11.1% by September 2018 Yes Bank showed a surge in gross NPA

divergence to Rs 6355.2 crore worth of loans

As per the financial stability report of amounts accounted for 15.5% of credit and additional provision requirement of Rs

the Reserve Bank of India published in and 25% of gross NPAs of SCBs. 1535.9 crore for FY2017. The bank absorbed

December 2017, the gross non- All PSBs and some PVBs had a the full impact of the divergence in Q2 of

performing advances (NPA) ratio as a negative provisioning gap assuming FY2018. Of the NPA divergence, about 81%

percentage of total net advances of benchmark provision coverage at 50%. or Rs 5135.8 of the exposure has been repaid

scheduled commercial banks (SCBs) Negative returns on the assets of under- (Rs 1690.4 crore) or resolved (sold to Asset

increased from 9.6% to 10.2%, and the provisioned PSBs might hinder their Reconstruction Companies for Rs 461.5 crore)

net NPAs from 5.5% to 5.7%, whereas ability to further build-up their loss and classified as standard (Rs 2983.9 crore)

their restructured standard advances absorption capacity. on account of their satisfactory conduct. The

ratio declined from 2.5% to 2% between Under the baseline scenario, the bank classified the balance 19% or Rs 1219.4-

March and September 2017. The gross NPA ratio of all SCBs might crore exposure as NPAs mainly contributing

stressed advances ratio rose marginally increase from 10.2% in September 2017 to the overall slippages of Rs 1988 crore in

from 12.1% to 12.2%. Public sector to 10.8% by March 2018 and further to Q2 of FY2018. As per the bank, the 82-basis-

bank (PSBs) recorded a distinctly higher 11.1% by September 2018. point (bp) increase in the gross NPA ratio

net NPA ratio of 7.9%. Under the assumed baseline macro and 52-bps spurt in the net NPA in Q2 of

The gross NPA ratio of large scenario, six banks have CRAR below FY2018 was mainly on account of divergence

borrowers increased from 14.6% to the minimum regulatory level of 9% by of NPAs after RBI’s assessment.

15.5%. It was up for both PSBs and September 2018. Under the severe Axis Bank also disclosed elevated gross

private sector bank (PVBs), but stress scenario, the system-level CRAR NPA divergence of Rs 5633 crore and

declined for foreign banks. The top 100 declines from 13.5% in September 2017 provisioning divergence of Rs 1316 crore,

large borrowers by outstanding funded to 11.5% by September 2018. causing 24% decline in its Pat to Rs 2794

crore from reported Pat of Rs 3679 crore for

not observed any divergence in their asset regulations and decisions taken by the joint FY2017. The bank has duly recorded the

quality classification. lenders’ forum. impact of divergence for FY2017 in the results

The NPA divergence hurt J&K Bank The RBI has started to issue bank-wise for the quarter ended September 2017. The

sharply as it has moved into net losses of Rs RBS reports for FY2017. It has again pointed RBI asked reclassification of nine consortium

101 crore after adjusting for additional out at certain large retrospective divergence loan accounts with the bank worth Rs 4867

provisioning from Pat of Rs 416 crore reported Sector line-up crore as NPAs. The divergence related

for FY 2016. Pat of South Indian Bank dipped accounts will consume 40 bps of credit costs

a sharp 36% to Rs 212 crore and RBL Bank Total stressed advances of large borrowers

for FY2018. It raised the credit-cost guidance

by 31% to Rs 203 crore. Despite the steep increased 2.4% and advances to large

to 220-260 bps for FY2018.

NPA divergence, Yes Bank showed only 22% special mention accounts 56.5% between

decline in its Pat to Rs 1978 crore for FY March and September 2017

Conclusion

2016. Further, Pat of Axis Bank fell 13% to CREDIT STRESSED The disclosure on RBI’s assessment of banks

Rs 6688 crore and Karur Vysya Bank 13% to SHARE ASSET RATIO* divergence on asset quality classification by

Rs 496 crore. Notional Pat of ICICI Bank, Agriculture 13.8 6.9 Yes Bank and Axis Bank raises concerns for

Indusind Bank and City Union Bank declined Industries 36.6 23.9 asset quality pressure on their performance

in the range of 4-7% for FY2016 after Mining and quarrying 1.2 27.1 for FY 2018. The NPA divergence has been

adjusting for additional provisions. Food processing 5.7 24.9 mainly large for PVBs. It will put additional

As for the reason for divergence, the Textiles 7.3 23.7 pressure on their performance for FY2018.

banks have indicated that the classification Paper and paper products 1.2 23.6 Among big PVBs, ICICI Bank is yet to dis-

of NPAs and provisions were appropriately Chemical and chemical prod 6.2 8.1 close its divergence for FY2017, but has

done as per the accounting policy and the Rubber, plastic and their prod 1.5 5.1 provided relief indicating that NPA additions

relevant guidelines based on the relevant facts Cement and cement products 2 12.8

for FY2018 will be significantly lower than

available at the time of finalisation of the Basic metals and metal prod 14.4 44.5

FY2017. As for PSBs, the NPA divergence

financial statements of FY 2016. However, Engineering 5.8 31

is not significant. The PSBs have improved

Vehicles, parts & transport equi 2.9 21

the risk-based assessment of the RBI was their provision coverage ratio to protect them

Gems and Jewellery 2.9 11.7

carried out in the middle of FY 2017 and the against any large provisioning divergence.

Construction 3.8 26.7

divergence was possibly due to the The banking sector showed higher

Infrastructure 34.1 19.6

availability of data subsequent to the slippages in Q1 and Q2 of FY2018. So the

Services 24.6 6.4

finalisation of financial statements, data of Retail 24.3 2.1 surprise slippages relating to RBI assessment

other banks in the consortium available to Figures in percentage. * Stressed assets is net NPA plus standard may have already been taken care.

the RBI and certain interpretations of the restructured loans of banks

— Vijay Ghutukade

Jan 01 – 14, 2018 CAPITAL MARKET 15

The most innovative companies trust us

with their financial market data requirement

We power Indian leaders like SEBI, Motilal Oswal Financial Services, J M Financial,

IDBI, Angel, HDFC Securities, India Infoline, Geojit BNP Paribas, Cholamandalam

Investment and Finance Company and many more…

Stocks Get Quotes

Stock Price Ticker

Commodities Live Commentary

Live News

(BSE / NSE) Online Price Analysis (Gainers/Losers) (MCX / NCDEX) Commodity Quotes

Price Chart: Intraday & EOD (Online Prices) Gainers & Losers

(Equity & Derivatives) Volume/Value Toppers, Advances & Declines

52-week High/Low, etc. Charts

Corporate Announcements Volume/Value Toppers

Advances & Declines

CM Live Market Commentary

(Pre-, Mid-, and End Session) Others World Indices/ADR Prices

Forex Market

News Stock Alert

Hot Pursuit

FII/MF Invesments

Market Beat

Corporate News

Economy News

Other Market News

Web Thumbnail/Auto Grow Chart

Portfolio Module

Result Announcements Tools Financial Planning Tools

Customised Applications

Foreign Markets

Fund Ranking

MF-SIP/Return Calculator

Fundamental Company Synopsis

Board of Directors

Quarterly Results

Balance Sheet

Profit & Loss You’ve put up a website.

Share Price/Chart

(Monthly High/Low/Close) Content is obvious...Demanding

Key Financial Ratio and challenging. Turn to us.

Forthcoming IPO

IPO Open Issues

Outsource content from a one-stop, reliable

Closed Issues

New Listing supplier like us. It is the easiest way out, rather

Basis of Allotment than knitting bits and pieces of information

Draft Prospectus yourself. Your end-users gain a single-point access

New Issue Monitor to a wider range of up-to-date content for making

smarter investment decisions.

F&O Gainers & Losers

Advances & Declines in OI

Highest/Lowest OI Ready content is served. Get the look and feel

customised to your need — delivered and

Mutual Fund/Scheme Profile

Daily NAV

activated in 48 hours.

MF Synopsis

Fund Historical NAV

MF News & MF Activities

Dividend Details

Ask our 300 plus clients

Top 10 Holdings Horizontal & vertical portals, financial

NFO institutions, and online traders.

Dividend Announcements

www.gwcindia.in www.geojit.com www.adityabirlamoney.com www.esselfinance.com

Two decades of credibility record in the finance industry

Use our domain expertise to drive

your digital transformation strategy

CMOTS EKYC Wealth Management System (WMS)

C-MOTS e-KYC is an end-to-end online WMS is a web-based tool that allows users,

solution for financial institutions to capture, RMs and channel partners to track investments

store and process details of their applicant and integrate with backoffice software. Actions

clients (individuals, non-individuals or NRIs) that can be tracked are transactions in the cash

while opening a demat, trading, banking or and F&O equity markets, mutual fund schemes,

mutual fund account for KYC compliance. commodity derivatives, real estate, bullion,

bank and company FDS and payment of

C-MOTS e-KYC portal offers an easy process insurance premium.

to complete the KYC formalities. The

applicants need to provide only a few details. WMS stores the actual buys and sells and

The remaining information is populated provides online report of current holdings by

automatically through backend integration integrating with the backoffice software.

with the CVL KRA database.

API Datafeed

C-MOTS e-KYC minimizes paper work in the (http://www.apidatafeed.com)

KYC process and helps save time required for

manual verifications, making the process fast The information resource tool designed to help

and reliable. to get more from your investments

API DataFeed provides financial market APIs in

Features easy-to-use data formats on a single interactive

Available across platforms such as desktops, website. Data analytics can save time and effort

smart phones and tablets. in delivering live data to websites and apps.

Suitable for all financial intermediaries

including brokers, banks and AMCs to ease Financial data include APIs for equity and

the KYC- compliant procedure for their clients. mutual funds, company announcements,

commodity information, currency movements,

Integrated with CVL KRA to instantly capture

economic news, other market data, IPOs in the

information and verification.

market and derivatives trades with different

Digitized KYC and IPV with system-controlled frequency options such as delayed, historical

processes. and end of the day.

C-MOTS INTERNET TECHNOLOGIES PVT. LTD.

ISO 9001 : 2015

certified

“Database & Content Management, Content Integration, Technology Integrator,

Mobile Solutions, Design & Development through Desktop Application, Web Solutions,

Internet Solutions, Knowledge Management, Testing, Hosting and Maintenance”

E-mail: info@cmots.com

Sourcing, Syndicating and Technology Integrator:

C-MOTS Internet Technologies Pvt Ltd

www.cmots.com

InFocus

InFocus

NBFCs Gruh Finance maintained robust

Improved performance

earnings performance. Pat increased 25%

to Rs 77.77 crore in Q2 of FY 2018 over a

year ago. The loan book continued to

expand at healthy pace of 18% end

Better margins, strong loan growth and stable asset September 2017. Disbursements improved

quality in the September 2017 quarter 28% to Rs 1283 crore. The net interest

margins were stable at 4.49%.

Increase in revenue growth led by better mar- LIC Housing Finance’s Pat slipped

gins along with stable credit cost supported Looking up 1% to Rs 489.11 crore as the margins

the earnings of non-banking financial compa- Manappuram Finance’s consolidated narrowed to 2.38% amid weakening of

nies (NBFCs) in the quarter ended Septem- AUM was up 3% end September 2017 corporate loan book asset quality. The

ber 2017 of the financial year ending March over end June 2017, after decline in the margins were affected by reduction in lending

2018 (FY 2018). Profit after tax (Pat) of 71 previous three straight quarters rates. The decline in the cost of funds going

NBFCs increased at a double-digit pace of 125 ahead is expected to support the margins.

10% to Rs 11806 crore over Q2 of FY 2017, 110

The gross NPA ratio rose to 0.8% end

snapping a decline of the last two straight September 2017 from 0.72% end June 2017,

95

quarters. The asset quality improved, reflect- contributed mainly by increase in non-retail

ing the waning impact of demonetization and 80 NPAs. The loan portfolio increased at a

Manappuram Fin.

the rollout of the goods and service tax (GST). 65

healthy pace of 16% to Rs 151417 crore, as

NBFCs catering to the auto sector individual loan book increased 14% to Rs

50

reported better margins on higher collections l l

J'17

l

F

l

M

l

A

l

M

l

J

l

J

l

A

l

S

l

O

l

N

l

D

l

145486 crore. An overall disbursement

and lower cost of borrowings. Microfinance Price on BSE in Rs. growth of around 15% is expected in FY

institutions (MFIs) recorded a jump in 2018 and better margins in H2 of FY 2018.

collection, but high provisioning continued The net interest margins (NIMs) were Gold finance companies registered

to hit their bottom lines. strong at 3.05% and these are likely to healthy earnings, but showed moderation in

All housing finance companies (HFCs) sustain in the 3-3.05% range. loan growth. Manappuram Finance’s

have recorded strong earnings growth in Q2 Indiabulls Housing Finance continued consolidated AUM was up 3% to Rs 13723.2

of FY2018. Despite a stable performance, to exhibit strong earnings performance, with crore end September 2017 over end June

marginal pressure continued on asset quality. Pat spurting 26% to Rs 861.06 crore due to 2017, after consistent decline in the previous

Disbursements spurted and loan growth rose improved asset quality, margins and loans three straight quarters due to demonetization.

to 22% end September 2017 over September growth. Spreads increased to 3.25% in H1 A 20% growth in consolidated AUM is

2016. Their margins remained stable, of FY 2018 from 3.20% in H1 of FY 2017 expected over the next three years, with gold

supported by moderation in borrowing as the cost of funds eased to 8.11% from loan growth of 15%. The gold loan book

costs. However, increasing competition from 9.05%. The loan portfolio expanded at a expanded 3% to Rs 10761 crore end

banks is putting pressure on the margins. robust pace of 33% to Rs 100257 crore over September 2017 over end June 2017. Gold

HDFC’s Pat jumped 11% to Rs 2101.12 September 2016. The target is 30% growth holdings rose a marginal 0.7% to 59.8 tonnes

crore in Q2 of FY2018 over a year ago, driven in AUM in FY 2018. The AUM is expected over the June 2017 quarter. The gross NPA

by improved revenue growth and lower tax to touch Rs 2 lakh crore by FY 2020. The ratio inclined to 1.2% end September 2017

provisions. The gross non-performing asset share of mortgage loans stood at 78% and from 1.1% end June 2017. The non-gold loan

(NPA) level was steady at 1.14% end corporate mortgage at 22%. The gross NPA book’s share increased to 21.7% of the

September 2017. NPAs of the individual ratio improved to 0.78% from 0.83% at end overall loans end September 2017 from

portfolio were stable at 0.65% and those of September 2016. The provision coverage 19.8% end June 2017.

non-individual portfolio stood at 2.18%. Net ratio was strong at 157%. Muthoot Finance’s Pat surged 53% to

loans grew 18% to Rs 324077 crore. The Repco Home Finance’s Pat improved Rs 454.16 crore, driven by 51% jump in net

margins were broadly stable at 3.9% in the 22% to Rs 55.87 crore in Q2 of FY2018, interest income (NII) and steep 13%

half year ended September 2017. recovering out of one-off impacts in the percentage point improvement in the cost-

Dewan Housing Finance previous quarter. The loan book expanded to-income ratio in Q2 of FY 2018 over Q2 of

Corporation’s Pat spurted 26% to Rs 10% to Rs 9321 crore from Rs 8469 crore FY 2017. The NIMs substantially improved

293.30 crore, driven by improved margins, end September 2016. With expectation of Rs to 16.55% from 12.29% in Q1 of FY 2018.

cost-to-income ratio and loan book growth. 1800-crore disbursements in H2 of FY2018, However, the asset quality worsened and the

The loan portfolio surged 25% to Rs 81390 there is hope of achieving 20% loan growth loan growth moderated to a mere 1% at Rs

crore as loan disbursements surged 51% to in the current fiscal. Spreads are expected to 27608 crore end September 2017 over end