Professional Documents

Culture Documents

Guide Page 1 of 1 (Impairment) : Field A Field B Field C (In Million $)

Guide Page 1 of 1 (Impairment) : Field A Field B Field C (In Million $)

Uploaded by

NicoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Guide Page 1 of 1 (Impairment) : Field A Field B Field C (In Million $)

Guide Page 1 of 1 (Impairment) : Field A Field B Field C (In Million $)

Uploaded by

NicoCopyright:

Available Formats

GUIDE

Page 1 of 1

(Impairment)

CASE STUDY: ACCOUNTING FOR IMPAIRMENT

Assumptions

Proved oil and gas properties and related equipment are grouped on a field basis for

impairment purposes.

The company has 20 proved fields.

During the current reporting period, management made downward revisions in

proved crude oil reserve estimates of three non-operated fields (Fields A, B, and C).

The downward reserve revisions are due to significantly reduced planned

development activities as a result of recent changes in regulations pertaining to the

disposal of produced water for these offshore Louisiana properties.

Field A, B, and C have fair values of $3, $5, and $4 million, respectively (using

expected future cash flows from reserves discounted at the market's current rate of

return).

(in million $)

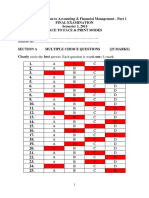

Field A Field B Field C

Capitalized cost of proved properties 5 20 10

Accumulated DD&A (2) (8) (3)

Decommissioning liability 0 (2) (1)

Deferred revenue for volume production

payment on Field C 0 0 (3)

Net book value 3 10 3

Is any of the fields (A, B or C) impaired? Justify your answers.

If there is an impairment, calculate the impairment loss to be recognised.

Prepare the resulting accounting entries.

Field B – 5 mil

Dr Cr

Impairment loss Accumulated depreciation in field B - 5 mil (10 mil NBV– 5 mil FV)

Dr Cr

Different taxes Income taxes - 2 mil

NBV = 16 (sum NBV Field)

FV = 12 (sum FV Field)

<4> diferenta NBV si FV

HANDOUT

Page 2 of 2

(Exploration & Evaluation)

You might also like

- Example 1: Value in Use: Year Cash FlowDocument16 pagesExample 1: Value in Use: Year Cash Flowthuan luong trongNo ratings yet

- Accounting IAS Model Answers Series 2 2010Document17 pagesAccounting IAS Model Answers Series 2 2010Aung Zaw HtweNo ratings yet

- Xii Eco MS Set IiiDocument4 pagesXii Eco MS Set IiiAfiya NazimNo ratings yet

- MS Economics Set-8Document5 pagesMS Economics Set-8Vaidehi BagraNo ratings yet

- Aw - State - Board Answer Key 2024-1 (Final)Document17 pagesAw - State - Board Answer Key 2024-1 (Final)pugazhbhuvaneshrvNo ratings yet

- (193.86KB) Chapter 4 MultiDocument2 pages(193.86KB) Chapter 4 MultigretNo ratings yet

- Recitation 2 PDFDocument3 pagesRecitation 2 PDFiNo ratings yet

- Accountancy, Class XI Com, UT-1 (Periodic)Document4 pagesAccountancy, Class XI Com, UT-1 (Periodic)manoj bhattNo ratings yet

- Answers - Paper5 Financial Accounting Dec 16Document20 pagesAnswers - Paper5 Financial Accounting Dec 16Henil DharodNo ratings yet

- Principles of Accounts 11Document47 pagesPrinciples of Accounts 11Godfrey LwandoNo ratings yet

- 204 Financial Accounting & Costing FY BCOMDocument6 pages204 Financial Accounting & Costing FY BCOMTejas DasnurkarNo ratings yet

- Week4 QuestionpaperDocument8 pagesWeek4 QuestionpaperSouth KoreaNo ratings yet

- Accounting (IAS) Level 3/series 4-2009Document14 pagesAccounting (IAS) Level 3/series 4-2009Hein Linn KyawNo ratings yet

- 516 Past ExamsDocument170 pages516 Past Examslenywarton0% (1)

- Class Xii Pre Board Economics Ms 2023-24Document17 pagesClass Xii Pre Board Economics Ms 2023-24nisharvishwaNo ratings yet

- FA2 - Sem04 ImpairmentDocument5 pagesFA2 - Sem04 Impairmenttitu patriciuNo ratings yet

- Financial Statements Analysis & Reporting Assignment IIIDocument3 pagesFinancial Statements Analysis & Reporting Assignment IIImariyaNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial AccountingDocument17 pagesAnswer To MTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial AccountingMohit SangwanNo ratings yet

- 2 Q For SSC AAO PracticeDocument6 pages2 Q For SSC AAO PracticeAkanksha GargNo ratings yet

- Answers: Effective Preparation Requires Multi-Directional ApproachDocument1 pageAnswers: Effective Preparation Requires Multi-Directional ApproachAravindVRNo ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- Sample Paper 2Document15 pagesSample Paper 2TrostingNo ratings yet

- US Internal Revenue Service: f1041sk1 - 1996Document2 pagesUS Internal Revenue Service: f1041sk1 - 1996IRSNo ratings yet

- English - DPP Haor Risk Management Main PartDocument10 pagesEnglish - DPP Haor Risk Management Main PartShadman ShakibNo ratings yet

- Acc Xi See QP With BP, Ms-17-30Document15 pagesAcc Xi See QP With BP, Ms-17-30AmiraNo ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- CMA Intermediate Paper 5Document16 pagesCMA Intermediate Paper 5ramesh devarajuNo ratings yet

- 2015 Final Exam SolutionsDocument8 pages2015 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- MCQs On Cash Book & Ledgers PDFDocument11 pagesMCQs On Cash Book & Ledgers PDFHaroon Akhtar100% (1)

- MS Paper 2Document10 pagesMS Paper 2Abdul MoizNo ratings yet

- KV MS PP 1-3Document18 pagesKV MS PP 1-3AADHYA KHANNANo ratings yet

- MS Practice PapersDocument98 pagesMS Practice Papersdakshparashar973No ratings yet

- Navneet Model Practice-2Document7 pagesNavneet Model Practice-2Rudra ShahNo ratings yet

- Ifrs December 2020 Key WebDocument10 pagesIfrs December 2020 Key Webjad NasserNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)Document4 pagesNanyang Business School AB1201 Financial Management Tutorial 8: The Basics of Capital Budgeting (Common Questions)asdsadsaNo ratings yet

- Xi Account MSDocument5 pagesXi Account MSrohanjithesh2525No ratings yet

- XII Accountancy MorningDocument18 pagesXII Accountancy Morningarihant jainNo ratings yet

- 12th BK Question Paper 2023Document11 pages12th BK Question Paper 2023yashashreebhurke333100% (1)

- Finance Quantitative Worksheets - Profitability and Liquidity RatiosDocument3 pagesFinance Quantitative Worksheets - Profitability and Liquidity Ratiosrebeccapegoraro06No ratings yet

- XI Half Yrly2023 24 - MSDocument2 pagesXI Half Yrly2023 24 - MS꧁༺Bhavishya Gaur༻꧂No ratings yet

- CA Inter FMEF Suggested Answers For May 2019Document19 pagesCA Inter FMEF Suggested Answers For May 2019Sayyamee BedmuthaNo ratings yet

- Poa Multiple Choice Questions 6-10Document11 pagesPoa Multiple Choice Questions 6-10AsishMohapatra100% (1)

- Sample Paper-8 ANSWER KEYDocument4 pagesSample Paper-8 ANSWER KEYbalajayalakshmi96No ratings yet

- Cambridge International AS & A Level: Subject 9706/31 October/November 2020Document9 pagesCambridge International AS & A Level: Subject 9706/31 October/November 2020djgq2xn5wmNo ratings yet

- Revision II (Ratio Analysis)Document6 pagesRevision II (Ratio Analysis)Allwin GanaduraiNo ratings yet

- Accounts Notes Grade 11Document47 pagesAccounts Notes Grade 11Jordan Mulenga100% (1)

- Target 2024 by Eco BabaDocument101 pagesTarget 2024 by Eco BabaAritra DasNo ratings yet

- Marking Scheme 2022 - 2023Document4 pagesMarking Scheme 2022 - 2023Adil MasudNo ratings yet

- Economics XII KVS SQP-3 MS by CUET & CBSE CoterieDocument3 pagesEconomics XII KVS SQP-3 MS by CUET & CBSE CoterieTanishkaNo ratings yet

- F3 Mock2 AnsDocument14 pagesF3 Mock2 AnsKiran BatoolNo ratings yet

- CPT Question Paper December 2016 With Answer Key PDFDocument28 pagesCPT Question Paper December 2016 With Answer Key PDFSarthak LakhaniNo ratings yet

- Examination Question and Answers, Set B (Problem Solving), Chapter 2 - Analyzing TransactionsDocument4 pagesExamination Question and Answers, Set B (Problem Solving), Chapter 2 - Analyzing TransactionsJohn Carlos DoringoNo ratings yet

- Financial Managemnet 3B LAO 2020 FinalDocument11 pagesFinancial Managemnet 3B LAO 2020 Finalsabelo.j.nkosi.5No ratings yet

- Chapter 6-Working PapersDocument38 pagesChapter 6-Working PapersJohnNo ratings yet

- The Balance of Payments and International Economic LinkagesDocument28 pagesThe Balance of Payments and International Economic LinkagesRajnikant PatelNo ratings yet

- CH 11Document6 pagesCH 11Saleh RaoufNo ratings yet

- Ms 4 Xii EconomicsDocument6 pagesMs 4 Xii Economicsbalajayalakshmi96No ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Increasing Resilience to Climate Change in the Agricultural Sector of the Middle East: The Cases of Jordan and LebanonFrom EverandIncreasing Resilience to Climate Change in the Agricultural Sector of the Middle East: The Cases of Jordan and LebanonNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet