Professional Documents

Culture Documents

Eagle Eye

Eagle Eye

Uploaded by

RogerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eagle Eye

Eagle Eye

Uploaded by

RogerCopyright:

Available Formats

Eagle Eye Equities

December 24, 2018

Index

Punter’s Call

Looking Trendy

Nifty Day Trader

Smart Charts

Momentum Swing

Momentum Cash Ideas

Bank Nifty

Bank Nifty Day Trader

Day Trader’s Hit List

Visit us at www.sharekhan.com

For Private Circulation only

Sharekhan Eagle Eye Equities

Punter’s Call

Bears back in action

December 21, 2018 Nifty daily: 10754

KST (1.15630) 3

2

1

0

-1

The Nifty opened lower and drifted lower throughout -2

-3

-4

-5

the trading session. After the sharp decline on - NSE50 [NIFTY] (10,944.30, 10,963.70, 10,738.70, 10,754.70, -205.700)

-6

-7

12000

11950

December 21, the index ended in the red for the 100.0%

11900

11850

11800

11750

11700

week. In the near term, the 40-day exponential 11650

11600

11550

11500

11450

moving average (DEMA) of 10726 will be a crucial 11400

11350

11300

11250

11200

support level on the way down. The index can fall to 61.8% 11150

11100

11050

11000

50.0% 10950

10660 – 10582 once the index breaks and sustain 38.2%

10900

10850

10800

10750

10700

below the 40-DEMA. On the way up, 10850 – 10900 23.6%

10650

10600

10550

10500

10450

will act as crucial resistance in the near term. In case 10400

10350

10300

10250

10200

of a pullback, a bounce towards the resistance levels 0.0% 10150

10100

10050

10000

9950

shall be considered as selling opportunity. Overall, 9900

9850

9800

9750

we maintain our bearish on the index for the short

6 13 20 27 3 10 17 24 1 8 15 22 29 5 12 19 26 3 10 17 24 31 7

August September October November December 2019

term with reversal placed at 11140.

60-minute

Other technical observations KST (-1.10759)

2.0

1.5

1.0

0.5

0.0

-0.5

On the daily chart, the Nifty is between the 20-day

-1.0

-1.5

-2.0

-2.5

-3.0

-3.5

- NSE50 [NIFTY] (10,769.95, 10,780.55, 10,738.70, 10,754.70, -15.8994)

moving average (DMA) and the 40-DEMA of 10773 11200

11150

11100

and 10726, respectively. The momentum indicator is 11050

11000

in bullish mode on the daily chart.

10950

10900

10850

10800

10750

On the hourly chart, the Nifty is below the 20-hour 10700

10650

10600

moving average (HMA) and the 40-HEMA of 10898 10550

10500

and 10851, respectively. The hourly momentum

10450

10400

10350

indicator is bearish. Market breadth was negative 10300

10250

10200

with 522 advances and 1176 declines on the National 10150

10100

Stock Exchange. 10050

10000

9950

9900

5 8 9 10 11 12 15 16 17 19 22 23 24 25 26 29 30 31 November 6 7 12 13 14 15 16 19 20 21 22 26 27 28 29 30 December 6 7 10 11 12 13 14 17 18 19 20 21 22 23

Market breadth

BSE NSE

Todays Close 35742.07 10754

Advances 905 522

Decline 1686 1176

Unchanged 152 364

Volume (Rs.) 2874.24 36038

December 24, 2018 2

Sharekhan Eagle Eye Equities

Looking Trendy

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

á á

Nifty 10005 11140 10005 / 11140 Nifty 9700 11400 9700 / 11400

Icon guide

á

á

á á

Up Down Sideways Downswing matures Upswing matures

Nifty Day Trader

Support Resistance

10659 10850

10582 10898

10473 10963

20 DSMA 40 DEMA

10773 10726

Smart Charts

Stop Loss Call Potential%

Buy Price/

Date Scrip Name Action (On closing Closing P/L at Exit/ Target 1 Target 2

Sell Price

Basis ) Price/ CMP Current

21-Dec-18 GSFC Jan Fut Sell 115.00 111.55 111.50 0.04% 103.00 100.00

21-Dec-18 Ktk Bank Jan Fut Sell 113.50 108.25 108.50 -0.23% 99.00 93.00

21-Dec-18 Just Dial Jan Fut Sell 496.00 482.10 481.00 0.23% 391.00 359.00

21-Dec-18 Reliance Ind Jan Fut Sell 1,155.00 1,115.60 1,103.95 1.04% 1,057.00 1,025.00

NOTE: Kindly note that all stop losses in Smart Charts are on closing basis unless specified.

TPB: Trailing profit booked

Momentum Swing

Poten-

Call

Action Stop Loss/ Buy Price/ tial% P/L

Scrip Name Action Closing Target 1 Target 2

Date Reversal Sell Price at Exit/

Price/CMP

Current

21-Dec-18 Dr Reddy Dec Fut Sell 2,642.00 2,605.00 2,607.60 -0.10% ,544.00 2,525.00

21-Dec-18 DLF Dec Fut Sell 193.50 189.25 187.75 0.79% 183.00 181.00

21-Dec-18 Voltas Dec Fut Sell 585.00 576.10 574.95 0.20% 562.00 555.00

20-Dec-18 Cipla Dec Fut Sell 530.00 520.00 518.30 0.33% 507.00 500.00

20-Dec-18 Mothersumi Dec Fut Sell Stopped Out 169.50 175.20 -3.36% 165.00 162.80

20-Dec-18 Bharat Fin Dec Fut Sell 1,040.00 1,020.80 997.05 2.33% 1,000.00 975.00

19-Dec-18 PEL Dec Fut Buy Exit 2,284.90 2,320.15 1.54% 2,391.00 2,445.00

NOTE: Kindly note that all stop losses in Momentum swing are on an intra-day basis.

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade

2) The same will be revised in the TradeTiger terminal every day for the pop-ups

December 24, 2018 3

Sharekhan Eagle Eye Equities

Momentum Cash Ideas

Call Potential%

Action Stop Loss/ Buy Price/

Scrip Name Action Closing P/L at Exit/ Target 1 Target 2

Date Reversal Sell Price

Price/CMP Current

18-Dec-18 Sterlite Tech Buy Stopped Out 300.00 287.00 -4.33% 319.00 325.00

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade

2) The same will be revised in the TradeTiger terminal every day for the pop-ups

December 24, 2018 4

Sharekhan Eagle Eye Equities

Bank Nifty

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

á á

Bank Nifty 24500 27500 24500 / 27500 Bank Nifty 23600 28390 23600 / 28390

Icon guide

á

á

á á

Up Down Sideways Downswing matures Upswing matures

Bank Nifty Day Trader Bank Nifty Daily

0

Support Resistance

-5

29600

29500

29400

29300

29200

29100

26693 27093

29000

28900

28800

28700

28600

28500

100.0% 28400

28300

28200

26484 27369 28100

28000

27900

27800

27700

27600

78.6% 27500

27400

27300

26275 27500 27200

27100

27000

26900

61.8% 26800

26700

26600

26500

20 DSMA 40 DEMA 50.0%

26400

26300

26200

26100

26000

25900

38.2%

25800

25700

26707 26403

25600

25500

25400

25300

23.6%

25200

25100

25000

24900

24800

24700

24600

24500

24400

0.0% 24300

24200

24100

24000

23900

23800

23700

23600

23500

16 23 30 6 13 20 27 3 10 17 24 1 8 15 22 29 5 12 19 26 3 10 17 24 31 7

August September October November December 2019

December 24, 2018 5

Sharekhan Eagle Eye Equities

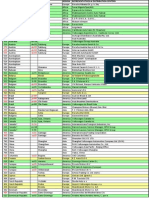

Day Trader’s Hit List

For December 24, 2018

Support Levels Close Resistance Levels

Scrip Name Action

S2 S1 (Rs.) R1 R2

NIFTY Futures 10669.0 10725.0 10769.0 10810.0 10870.0 Go Short Below S1

Bank Nifty Futures 26769.0 26888.0 26971.8 27090.0 27236.0 Go Short Below S1

Axis Bank 609.5 616.0 621.60 626.5 633.0 Go Short Below S1

BHEL 68.1 69.0 69.7 70.4 71.2 Go Short Below S1

BPCL 367.0 371.0 374.60 378.5 383.0 Go Long AboveR1

INFOSYS 634.0 641.0 647.0 653.0 660.0 Go Short Below S1

ICICI Bank 348.0 352.0 355.1 358.5 362.0 Buy Above R1/ Sell Below S1

LIC Housing 462.0 466.0 469.1 472.0 476.0 Go Short Below S1

LNT 1399.0 1410.0 1420.9 1432.0 1443.0 Buy Above R1/ Sell Below S1

Reliance Industries 1076.5 1088.0 1098.0 1108.0 1119.0 Go Short Below S1

SBI 287.0 290.0 292.4 295.0 298.0 Buy Above R1/ Sell Below S1

SunPharma 418.5 422 425.1 428 431 Go Short Below S1

Tata Motors 172.0 173.5 175.5 177.5 179.5 Go Long AboveR1

Yes Bank 178.5 181.5 183.3 185.5 188.0 Go Short Below S1

TISCO 511.6 516.0 520.2 524.5 528.0 Go Short Below S1

TCS 1863.0 1885.0 1905.0 1931.0 1948.0 Buy Above R1/ Sell Below S1

*Note: Closing price of Nifty futures is last traded price of Nifty futures on NSE

SL=Stoploss

December 24, 2018 6

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice. Kindly

note that this document is based on technical analysis by studying charts of a stock’s price movement and trading volume, as opposed

to focusing on a company’s fundamentals and as such, may not match with a report on a company’s fundamentals.(Technical specific)

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive

this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN has

not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While we

would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their

directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also, there

may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is prepared

for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients of this

report should also be aware that past performance is not necessarily a guide to future performance and value of investments can go

down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such

investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred

to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of

such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise

you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different

conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he nor his relatives has any

direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of the company nor have any

material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further,

the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved in,

or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000, email id: compliance@sharekhan.com;

For any queries or grievances kindly email: igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway

Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI

(CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN

20669; Research Analyst: INH000006183; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant

exchanges and the T&C on www.sharekhan.com; Investment in securities market are subject to market risks, read all the related

documents carefully before investing.

You might also like

- ABM-BUSINESS FINANCE 12 - Q1 - W1-W2 - Mod1 PDFDocument17 pagesABM-BUSINESS FINANCE 12 - Q1 - W1-W2 - Mod1 PDFKaren Lacuban78% (27)

- VW Dealers Country CodesDocument7 pagesVW Dealers Country Codestzskojevac100% (1)

- Jefferies Vitual London Healthcare Conference Companies 9 18Document22 pagesJefferies Vitual London Healthcare Conference Companies 9 18Steven GaoNo ratings yet

- Eagle Eye Equities: June 11, 2019Document7 pagesEagle Eye Equities: June 11, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: July 05, 2019Document7 pagesEagle Eye Equities: July 05, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: July 04, 2019Document7 pagesEagle Eye Equities: July 04, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: June 03, 2019Document6 pagesEagle Eye Equities: June 03, 2019Anshuman GuptaNo ratings yet

- Eagleeye SKhanDocument7 pagesEagleeye SKhanRogerNo ratings yet

- Eagle Eye Equities: June 04, 2019Document7 pagesEagle Eye Equities: June 04, 2019Anshuman GuptaNo ratings yet

- Eagle Eyes ReportDocument3 pagesEagle Eyes ReportSaketh DahagamNo ratings yet

- Eagle Eye Equities: September 22, 2020Document6 pagesEagle Eye Equities: September 22, 2020krishnabtNo ratings yet

- Eagle Eye Equities: July 18, 2019Document6 pagesEagle Eye Equities: July 18, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: July 23, 2019Document7 pagesEagle Eye Equities: July 23, 2019Anshuman GuptaNo ratings yet

- 15 May 19Document7 pages15 May 19Anshuman GuptaNo ratings yet

- Eagle Eye Equities: June 14, 2019Document7 pagesEagle Eye Equities: June 14, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: July 15, 2019Document7 pagesEagle Eye Equities: July 15, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- 14 Nov 19Document6 pages14 Nov 19Anshuman GuptaNo ratings yet

- Eagle Eye EquitiesDocument6 pagesEagle Eye EquitiesRogerNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: November 25, 2019Document6 pagesEagle Eye Equities: November 25, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: April 12, 2019Document7 pagesEagle Eye Equities: April 12, 2019Anshuman GuptaNo ratings yet

- High Noon: December 17, 2018Document4 pagesHigh Noon: December 17, 2018sbvaNo ratings yet

- 29 May 19Document6 pages29 May 19Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagleeye - e March 28 2019Document7 pagesEagleeye - e March 28 2019RogerNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: April 23, 2019Document6 pagesEagle Eye Equities: April 23, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: March 26, 2020Document6 pagesEagle Eye Equities: March 26, 2020Anshuman GuptaNo ratings yet

- Ee 412Document6 pagesEe 412vaibhav vidwansNo ratings yet

- Eagle Eye Equities Oct 14 - 2019Document7 pagesEagle Eye Equities Oct 14 - 2019RogerNo ratings yet

- Eagleeye - 30th April 2019Document7 pagesEagleeye - 30th April 2019RogerNo ratings yet

- Eagle Eye Equities: July 15, 2021Document6 pagesEagle Eye Equities: July 15, 2021Raja Churchill DassNo ratings yet

- Eagle Eye Equities: April 03, 2020Document6 pagesEagle Eye Equities: April 03, 2020RogerNo ratings yet

- 22 May 19 PDFDocument6 pages22 May 19 PDFAnshuman GuptaNo ratings yet

- Ee 502Document6 pagesEe 502vaibhav vidwansNo ratings yet

- Ee 424Document6 pagesEe 424vaibhav vidwansNo ratings yet

- EagleEye-Aug10 2021Document6 pagesEagleEye-Aug10 2021Abhinav KeshariNo ratings yet

- High Noon: January 03, 2023Document4 pagesHigh Noon: January 03, 2023LakshyaMartianNo ratings yet

- Eagleeye - e APRIL 15 2021Document6 pagesEagleeye - e APRIL 15 2021Mark DavidsonNo ratings yet

- Momentum PicksDocument25 pagesMomentum PicksGopal KambeNo ratings yet

- 14th October, 2021 Equity 360: Nifty LevelDocument6 pages14th October, 2021 Equity 360: Nifty LevelMohan KrishnaNo ratings yet

- Sensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (37736) / Nifty (11102) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37736) / Nifty (11102) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38407) / Nifty (11323) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38407) / Nifty (11323) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Market Mantra 27022023Document8 pagesMarket Mantra 27022023KkxNo ratings yet

- Sensex (37935) / Nifty (11132) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37935) / Nifty (11132) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Daring DerivativesDocument4 pagesDaring DerivativessharmanmruNo ratings yet

- 17th August, 2018: Nifty Outlook Nifty ChartDocument5 pages17th August, 2018: Nifty Outlook Nifty ChartRohan UpadhyayNo ratings yet

- Sensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (35430) / Nifty (10471) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (35430) / Nifty (10471) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38140) / Nifty (11215) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38140) / Nifty (11215) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Ordinary People, Extraordinary Profits: How to Make a Living as an Independent Stock, Options, and Futures TraderFrom EverandOrdinary People, Extraordinary Profits: How to Make a Living as an Independent Stock, Options, and Futures TraderNo ratings yet

- Long Term SIP Picks Jan 23Document15 pagesLong Term SIP Picks Jan 23sbvaNo ratings yet

- High Noon: December 17, 2018Document4 pagesHigh Noon: December 17, 2018sbvaNo ratings yet

- ValidationDocument HarmonicAnalysis IEEEStd399 1997Document3 pagesValidationDocument HarmonicAnalysis IEEEStd399 1997sbvaNo ratings yet

- Maharashtra Energy AuditorsDocument2 pagesMaharashtra Energy AuditorssbvaNo ratings yet

- Transformer Replacement DecisionsDocument23 pagesTransformer Replacement DecisionssbvaNo ratings yet

- Reliability of High Voltage EquipmentDocument8 pagesReliability of High Voltage EquipmentsbvaNo ratings yet

- Investigation of Earth Potential Rise On A Typical Single Phase HV NetworkDocument57 pagesInvestigation of Earth Potential Rise On A Typical Single Phase HV NetworksbvaNo ratings yet

- P111EDocument1 pageP111EsbvaNo ratings yet

- Reduction of Flashovers On 220 KV Double-Circuits LineDocument6 pagesReduction of Flashovers On 220 KV Double-Circuits LinesbvaNo ratings yet

- A Verified Wireless Safety Critical Hard Real-Time DesignDocument9 pagesA Verified Wireless Safety Critical Hard Real-Time DesignsbvaNo ratings yet

- Bv2018 Revised Conceptual FrameworkDocument18 pagesBv2018 Revised Conceptual FrameworkTeneswari RadhaNo ratings yet

- Dividend PolicyDocument36 pagesDividend Policyarun1qNo ratings yet

- OECD (2009), Guide On Fighting Abusive Related Party TransactionsDocument67 pagesOECD (2009), Guide On Fighting Abusive Related Party TransactionsMeru DityaNo ratings yet

- Corporation Law SyllabusDocument7 pagesCorporation Law SyllabusSamNo ratings yet

- Satyam ScamDocument30 pagesSatyam Scamvikrant9147No ratings yet

- Company LawDocument20 pagesCompany LawZahid SafdarNo ratings yet

- Investment Banking Scorecard 07 28 22Document5 pagesInvestment Banking Scorecard 07 28 22AlfredNo ratings yet

- DRHP 20190221140816Document436 pagesDRHP 20190221140816SubscriptionNo ratings yet

- Jurnal Enron 3Document10 pagesJurnal Enron 3Mochamad RisnandaNo ratings yet

- Buy Back of SharesDocument71 pagesBuy Back of Sharesmastionline121No ratings yet

- Demutualisation & Corporatization of Stock ExchangesDocument29 pagesDemutualisation & Corporatization of Stock ExchangesMayank Jain100% (10)

- Business Sole ProprietorshipDocument2 pagesBusiness Sole ProprietorshipLaurence Bande Del RosarioNo ratings yet

- Allocating Cash Dividends Between Preferred and Co PDFDocument3 pagesAllocating Cash Dividends Between Preferred and Co PDFrockerNo ratings yet

- Luckin Coffee Scandal: Compiled By: Dr. Megha ShahDocument11 pagesLuckin Coffee Scandal: Compiled By: Dr. Megha ShahPrey100% (2)

- S No. Name of Bank User Id Remarks: (7 Characters)Document4 pagesS No. Name of Bank User Id Remarks: (7 Characters)Sudeepa SudeepaNo ratings yet

- Nse 20121010Document33 pagesNse 20121010Dhawan SandeepNo ratings yet

- Bus - Law PAA CompilationDocument10 pagesBus - Law PAA CompilationMs AJNo ratings yet

- Amalgmation - August 2020 - Arihant Capital Shree Renuka Sugars LTDDocument10 pagesAmalgmation - August 2020 - Arihant Capital Shree Renuka Sugars LTDBhavin SagarNo ratings yet

- Book Value Per Share Problem 1Document3 pagesBook Value Per Share Problem 1XXXXXXXXXXXXXXXXXXNo ratings yet

- Broker Name Address SegmentDocument8 pagesBroker Name Address Segmentsoniya_dps2006No ratings yet

- Act2 1Document6 pagesAct2 1Kath LeynesNo ratings yet

- Vijay Kumar: GuptaDocument63 pagesVijay Kumar: GuptaContra Value BetsNo ratings yet

- Final VersionDocument26 pagesFinal VersionRahul MoreNo ratings yet

- Ab InbevDocument12 pagesAb Inbevkhlsth100No ratings yet

- Exam - SHE, RE & Share Based CompensationDocument4 pagesExam - SHE, RE & Share Based CompensationJohnAllenMarilla100% (2)

- Free Float Requirements at Indonesian Stock ExchangeDocument3 pagesFree Float Requirements at Indonesian Stock ExchangeIndra Tri JunialdiNo ratings yet