Professional Documents

Culture Documents

Eagle Eye Equities: July 15, 2021

Uploaded by

Raja Churchill DassOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eagle Eye Equities: July 15, 2021

Uploaded by

Raja Churchill DassCopyright:

Available Formats

Eagle Eye Equities

July 15, 2021

Index

Punter’s Call

Looking Trendy

Nifty Trader

Smart Charts

Momentum Swing

CTFT (Carry Today For Tomorrow)

Bank Nifty

Bank Nifty Trader

Key Indices

Day Trader’s Hit List

Visit us at www.sharekhan.com

For Private Circulation only

Sharekhan Eagle Eye Equities

Punter’s Call

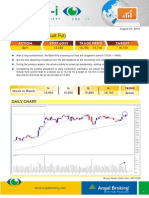

Staring at a hurdle

July 14, 2021 Nifty daily: 15853.95

The Nifty inched higher on July 14. It has recently

broken out from a triangular pattern on the hourly

chart and is witnessing a follow-through on the upside.

For the day, the upside was capped at the hourly and

the daily upper Bollinger Bands. The overall structure

shows that the index is once again staring at the

upper end of the consolidation range i.e. 15900. The

bulls need to cross this barrier on a closing basis in

order to confirm the next leg-up, which will then take

the index to 16400 in the short term. On the flipside,

15800-15750 will act as a cushion in the case of any

60-minute

dip with major support at 15650-15600.

Other technical observations

On the daily chart, the Nifty is above the 20-day

moving average (DMA) and the 40-DEMA of 15761

and 15587, respectively. The momentum indicator is

bearish on the daily chart.

On the hourly chart, the Nifty is above the 20-hour

moving average (HMA) and the 40-HEMA of 15789

and 15787, respectively. The hourly momentum

indicator is bullish. The market breadth was positive

with 1013 advances and 917 declines on the National

Stock Exchange.

Market breadth

BSE NSE

Todays Close 52904.05 15853.95

Advances 1795 1013

Decline 1444 917

Unchanged 139 342

Volume (Rs.) 4,496.92 Cr 58,138.26 Cr

July 15, 2021 2

Sharekhan Eagle Eye Equities

Looking Trendy

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

Nifty 16400 á 15450 15450 / 16400 Nifty 16800 á 15000 15000 / 16800

NOTE: Reversal on closing basis NOTE: Reversal on closing basis

Icon guide

á

á Up Down ßà Sideways Downswing matures Upswing matures

Nifty Trader

Support Resistance

15761 15920

15706 16000

15630 16146

20 DSMA 40 DEMA

15761 15587

Smart Charts

Stop Loss Call Potential %

Buy Price/

Date Scrip Name Action (On closing Closing P/L at Exit/ Target 1 Target 2

Sell Price

Basis) Price/ CMP Current

14 Jul 21 PVR July Fut Buy 1338.00 1408.40 1392.00 -1.16% 1480.00 1565.00

05 Jul 21 IRCTC July Fut Buy 2050.00 2157.00 2268.30 5.16% 2257.00 2400.00

25 Jun 21 Axis Bank July Fut Buy 724.00 756.15 770.80 1.94% 790.00 822.00

22 Jun 21 M & M July Fut Buy 743.00 782.60 779.15 -0.44% 819.00 854.00

NOTE: Kindly note that all stop losses in Smart Charts are on closing basis unless specified.

TPB: Trailing profit booked

Momentum Swing

Call Potential %

Action Stop Loss/ Buy Price/

Scrip Name Action Closing P/L at Exit/ Target 1 Target 2

Date Reversal Sell Price

Price/CMP Current

13 Jul 21 Indigo July Fut Buy 1794.00 1821.00 1821.00 0.00% 1867.00 1887.00

12 Jul 21 Reliance July Fut Buy 2049.00 2101.40 2090.35 -0.53% 2188.00 2230.00

06 Jul 21 Kotak Bank July Fut Buy 1708.00 1739.50 1746.50 0.40% 1775.00 1810.00

NOTE: Kindly note that all stop losses in Momentum swing are on an intra-day basis.

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade.

2) The same will be revised in the TradeTiger terminal every day for the pop-ups.

CTFT (Carry Today For Tomorrow)

Potential%

Stop Loss/ Buy Price/ Call Closing

Date Scrip Name Action P/L at Exit/ Target 1 Target 2

Reversal Sell Price Price/CMP

Current

13 Jul 21 Hdfc Life July Fut Buy Exit 693.80 691.90 -0.27% 705.00 715.00

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade.

2) The same will be revised in the TradeTiger terminal every day for the pop-ups.

July 15, 2021 3

Sharekhan Eagle Eye Equities

Bank Nifty

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

Bank Nifty 37708 á 33900 33900 / 37708 Bank Nifty 39400 á 32800 32800 / 39400

NOTE: Reversal on closing basis NOTE: Reversal on closing basis

Icon guide

á

á Up Down ßà Sideways Downswing matures Upswing matures

Bank Nifty Trader Bank Nifty Daily

Support Resistance

35340 35811

35080 36000

34852 36648

20 DSMA 40 DEMA

35080 34852

Key Indices

Index Target Trend Reversal Support / Resistance

Nifty Auto 11400 á 10200 10200 / 11400

Nifty Fin. Service 17200 á 16400 16400 / 17200

Nifty FMCG 37000 á 35790 35790 / 37000

Nifty IT 30000 á 28380 28380 / 30000

Nifty Metal 5500 á 5100 5100 / 5500

Nifty Pharma 15000 á 14150 14150 / 15000

Nifty Mid Cap 100 28200 á 27000 27000 / 28200

Nifty Small Cap 100 10550 á 9880 9880 / 10550

July 15, 2021 4

Sharekhan Eagle Eye Equities

Day Trader’s Hit List

For July 15, 2021

Support Levels Close Resistance Levels

Scrip Name Action

S2 S1 (Rs.) R1 R2

Nifty 15700.0 15800.0 15854.00 15915.0 16000.0 Buy Above R1/ Sell Below S1

Bank Nifty 35150.0 35400.0 35668.00 35810.0 36150.0 Buy Above R1/ Sell Below S1

Axis Bank 746.0 760.0 770.10 776.6 799.0 Buy Above R1

Bajaj Finance 5965.0 6053.0 6133.90 6221.0 6343.0 Buy Above R1

HDFC 2470.0 2499.0 2531.10 2561.0 2595.0 Buy Above R1

HDFC Bank 1461.0 1484.0 1499.20 1518.7 1545.5 Buy Above R1

Hindustan Unilever 2375.0 2400.0 2414.90 2432.0 2475.0 Buy Above R1/ Sell Below S1

INFOSYS 1533.0 1558.0 1576.90 1591.0 1615.0 Buy Above R1

ICICI Bank 645.0 653.0 664.40 675.0 685.0 Buy Above R1

ITC 197.6 201.7 204.10 206.3 209.4 Buy Above R1/ Sell Below S1

Kotak Bank 1685.0 1714.9 1748.20 1768.0 1810.0 Buy Above R1

LT 1501.0 1523.0 1544.70 1560.6 1593.0 Buy Above R1

Maruti 7141.0 7233.0 7326.80 7400.0 7530.0 Buy Above R1/ Sell Below S1

Reliance Industries 2041.0 2066.1 2086.00 2107.0 2142.0 Buy Above R1/ Sell Below S1

SBI 421.0 426.1 431.10 436.5 443.0 Buy Above R1

SunPharma 670.0 677.0 686.00 692.4 710.0 Buy Above R1

Tata Steel 1208.5 1223.0 1244.70 1258.5 1284.0 Buy Above R1

TCS 3123.0 3185.0 3214.60 3236.0 3289.0 Buy Above R1/ Sell Below S1

Titan 1665.0 1690.0 1710.40 1728.6 1752.5 Sell Below S1

Zeel 209.5 211.9 214.30 216.6 220.4 Sell Below S1

*Note: Closing price of Nifty futures is last traded price of Nifty futures on NSE

SL=Stoploss

July 15, 2021 5

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he

or his relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or

more in the securities of the company at the end of the month immediately preceding the date of publication of the research report

nor have any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the

company. Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the

company and no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or

views expressed in this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment

banking, merchant banking, brokerage services or any compensation or other benefits from the subject company or from third party

in the past twelve months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway

Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI

(CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN

20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.

com; Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- EagleEye-Aug10 2021Document6 pagesEagleEye-Aug10 2021Abhinav KeshariNo ratings yet

- Eagle Eyes ReportDocument3 pagesEagle Eyes ReportSaketh DahagamNo ratings yet

- Eagle Eye Equities: July 15, 2019Document7 pagesEagle Eye Equities: July 15, 2019Anshuman GuptaNo ratings yet

- Ee 412Document6 pagesEe 412vaibhav vidwansNo ratings yet

- Eagleeye - e APRIL 15 2021Document6 pagesEagleeye - e APRIL 15 2021Mark DavidsonNo ratings yet

- Eagle Eye Equities May 08, 2019 IndexDocument7 pagesEagle Eye Equities May 08, 2019 IndexAnshuman GuptaNo ratings yet

- Ee 502Document6 pagesEe 502vaibhav vidwansNo ratings yet

- Eagle Eye Equities: July 18, 2019Document6 pagesEagle Eye Equities: July 18, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: April 23, 2019Document6 pagesEagle Eye Equities: April 23, 2019Anshuman GuptaNo ratings yet

- 15 May 19Document7 pages15 May 19Anshuman GuptaNo ratings yet

- Eagle Eye Equities: September 22, 2020Document6 pagesEagle Eye Equities: September 22, 2020krishnabtNo ratings yet

- Eagleeye SKhanDocument7 pagesEagleeye SKhanRogerNo ratings yet

- Eagle Eye Equities: July 23, 2019Document7 pagesEagle Eye Equities: July 23, 2019Anshuman GuptaNo ratings yet

- Ee 424Document6 pagesEe 424vaibhav vidwansNo ratings yet

- Eagle Eye Equities: March 26, 2020Document6 pagesEagle Eye Equities: March 26, 2020Anshuman GuptaNo ratings yet

- Eagle Eye Equities: July 05, 2019Document7 pagesEagle Eye Equities: July 05, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Bank Nifty Day Trader OutlookDocument7 pagesBank Nifty Day Trader OutlookAnshuman GuptaNo ratings yet

- Eagle Eye Equities: June 03, 2019Document6 pagesEagle Eye Equities: June 03, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: June 14, 2019Document7 pagesEagle Eye Equities: June 14, 2019Anshuman GuptaNo ratings yet

- 29 May 19Document6 pages29 May 19Anshuman GuptaNo ratings yet

- Eagle Eye Equities November 14 2019 ReportDocument6 pagesEagle Eye Equities November 14 2019 ReportAnshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- EagleEye-Dec18 18 (E) PDFDocument7 pagesEagleEye-Dec18 18 (E) PDFsbvaNo ratings yet

- High Noon: December 17, 2018Document4 pagesHigh Noon: December 17, 2018sbvaNo ratings yet

- Eagle Eye Equities: June 04, 2019Document7 pagesEagle Eye Equities: June 04, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagleeye - 30th April 2019Document7 pagesEagleeye - 30th April 2019RogerNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities Oct 14 - 2019Document7 pagesEagle Eye Equities Oct 14 - 2019RogerNo ratings yet

- Eagleeye - e (11) - 5Document7 pagesEagleeye - e (11) - 5Harry AndersonNo ratings yet

- Eagle Eye Equities: June 11, 2019Document7 pagesEagle Eye Equities: June 11, 2019Anshuman GuptaNo ratings yet

- Eagleeye - e (2) - 7Document7 pagesEagleeye - e (2) - 7Harry AndersonNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye EquitiesDocument6 pagesEagle Eye EquitiesRogerNo ratings yet

- 22 May 19 PDFDocument6 pages22 May 19 PDFAnshuman GuptaNo ratings yet

- Nifty Day Trader March 28, 2019Document7 pagesNifty Day Trader March 28, 2019RogerNo ratings yet

- High Noon: January 03, 2023Document4 pagesHigh Noon: January 03, 2023LakshyaMartianNo ratings yet

- Short Term Trend Analysis and Trading Ideas for Bank Nifty and Key IndicesDocument6 pagesShort Term Trend Analysis and Trading Ideas for Bank Nifty and Key IndicesAnshuman GuptaNo ratings yet

- Technical Derivatives 17 02 2023Document5 pagesTechnical Derivatives 17 02 2023rajesh bhosaleNo ratings yet

- Eagleeye - e (10) - 5Document7 pagesEagleeye - e (10) - 5Harry AndersonNo ratings yet

- Eagle Eye Equities: April 12, 2019Document7 pagesEagle Eye Equities: April 12, 2019Anshuman GuptaNo ratings yet

- Eagle Eye SharekhanDocument7 pagesEagle Eye SharekhankochinextNo ratings yet

- Technical Derivatives 21 02 2023Document5 pagesTechnical Derivatives 21 02 2023rajesh bhosaleNo ratings yet

- MTP For NiftyDocument3 pagesMTP For NiftyAnil KumarNo ratings yet

- Eagle Eye Equities: April 03, 2020Document6 pagesEagle Eye Equities: April 03, 2020RogerNo ratings yet

- Show NewsDocument1 pageShow NewsRajashekhar NagalapurNo ratings yet

- Technical Report Summary: Nifty Consolidates Around 17800, Bank Nifty Support At 40600Document5 pagesTechnical Report Summary: Nifty Consolidates Around 17800, Bank Nifty Support At 40600rajesh bhosaleNo ratings yet

- Sensex (38071) / Nifty (11203) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38071) / Nifty (11203) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Man Ho 1103994Document3 pagesMan Ho 1103994car insurance singaporeNo ratings yet

- Daring DerivativesDocument4 pagesDaring DerivativessharmanmruNo ratings yet

- BANK NIFTY (August Fut) : Daily ChartDocument2 pagesBANK NIFTY (August Fut) : Daily ChartTirthajit SinhaNo ratings yet

- Daily Derivative Report - 13072022 - 13-07-2022 - 09Document5 pagesDaily Derivative Report - 13072022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- Market Daily&TechnicalReport Ashika 3.8.2021Document16 pagesMarket Daily&TechnicalReport Ashika 3.8.2021Atish MukherjeeNo ratings yet

- Morning Moves Mar 13, 2019: Research Desk - Stock BrokingDocument5 pagesMorning Moves Mar 13, 2019: Research Desk - Stock BrokingChandrika AnandNo ratings yet

- Sensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Technical & Derivatives Report Highlights Bank Nifty StrengthDocument5 pagesTechnical & Derivatives Report Highlights Bank Nifty StrengthbbaalluuNo ratings yet

- Tech Derivatives DailyReport 200416Document5 pagesTech Derivatives DailyReport 200416xytiseNo ratings yet

- Sensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- 2022 Benefits Book Value High Ded Medical PlanDocument90 pages2022 Benefits Book Value High Ded Medical PlanRaja Churchill DassNo ratings yet

- The Block Research 2022 Digital Asset Outlook.v2Document163 pagesThe Block Research 2022 Digital Asset Outlook.v2Michael Donohue100% (1)

- Global Economic Prospects January 2022Document240 pagesGlobal Economic Prospects January 2022GREEN LEAFNo ratings yet

- 2023.justification - BCI .SGDocument2 pages2023.justification - BCI .SGRaja Churchill DassNo ratings yet

- Big Idea InvestmentDocument132 pagesBig Idea InvestmentHien Minh Nguyen LeNo ratings yet

- Tir2020 enDocument196 pagesTir2020 enĐ̸̢͓͉̣͔̭̜̭͉̰́͌͑͊̇̏̕̚͜͜ͅứ̷̢̛̘̭̤͎̩̣̩̊̆̑̓̽̓͗ͅc̴̟͈̠̤̪͈͍̰̟̤̮̆̄̈́̈̃̏̃̑̊͠͝ä̷̧̰̲̦́̒̐͝ṉ̵̾̀͗̾h̷̥͆͑̍͌͆̋̈́́͒͂̇͘̚ Đ̸̢͓͉̣͔̭̜̭͉̰́͌͑͊̇̏̕̚͜͜ͅứ̷̢̛̘̭̤͎̩̣̩̊̆̑̓̽̓͗ͅc̴̟͈̠̤̪͈͍̰̟̤̮̆̄̈́̈̃̏̃̑̊͠͝ä̷̧̰̲̦́̒̐͝ṉ̵̾̀͗̾h̷̥͆͑̍͌͆̋̈́́͒͂̇͘No ratings yet

- Livestock and Poultry: World Markets and Trade: China Meat Supply Continues To GrowDocument16 pagesLivestock and Poultry: World Markets and Trade: China Meat Supply Continues To GrowRaja Churchill DassNo ratings yet

- Global Energy Outlook: Oil Prices Rise as Demand RecoversDocument55 pagesGlobal Energy Outlook: Oil Prices Rise as Demand RecoversRaja Churchill DassNo ratings yet

- Market OutlookDocument42 pagesMarket OutlookajitreddyNo ratings yet

- January 2022 Jobs ReportDocument43 pagesJanuary 2022 Jobs ReportStephen LoiaconiNo ratings yet

- Outlook of Global Airline Industry 2021Document6 pagesOutlook of Global Airline Industry 2021Raja Churchill DassNo ratings yet

- Momentum PicksDocument21 pagesMomentum PicksRaja Churchill DassNo ratings yet

- Advance Monthly Sales For Retail and Food Services, December 2021Document7 pagesAdvance Monthly Sales For Retail and Food Services, December 2021Raja Churchill DassNo ratings yet

- WEF The Global Risks Report 2022Document117 pagesWEF The Global Risks Report 2022Jamie WhiteNo ratings yet

- Ie Aviation Industry Leaders Report Route To RecoveryDocument68 pagesIe Aviation Industry Leaders Report Route To RecoveryRajendra KumarNo ratings yet

- Glo DGF Ocean Market UpdateDocument19 pagesGlo DGF Ocean Market UpdateRaja Churchill DassNo ratings yet

- JETNET Iq Pulse - April 8 2021Document12 pagesJETNET Iq Pulse - April 8 2021Raja Churchill DassNo ratings yet

- Iata Future Airline IndustryDocument64 pagesIata Future Airline Industrypranzali gupta100% (2)

- Economic Performance of The Airline Industry: Key PointsDocument5 pagesEconomic Performance of The Airline Industry: Key PointsAlex SanchoNo ratings yet

- Impacts of The COVID - 19 On EU Industries (ENG)Document86 pagesImpacts of The COVID - 19 On EU Industries (ENG)Clara GarvizNo ratings yet

- GLO Air-Market-UpdateDocument15 pagesGLO Air-Market-UpdateRaja Churchill DassNo ratings yet

- Aviation Industry Leaders Report 2022Document62 pagesAviation Industry Leaders Report 2022Raja Churchill DassNo ratings yet

- Aea 2021 Master Final2Document51 pagesAea 2021 Master Final2api-548139140No ratings yet

- IDirect Monthly AutoVolumes Sep21Document5 pagesIDirect Monthly AutoVolumes Sep21Raja Churchill DassNo ratings yet

- IDirect GladiatorStocks PNCInfra Sep21Document10 pagesIDirect GladiatorStocks PNCInfra Sep21Raja Churchill DassNo ratings yet

- PayrollDocument41 pagesPayrollRafa BorgesNo ratings yet

- Beto Sust Aviation Fuel Sep 2020Document81 pagesBeto Sust Aviation Fuel Sep 2020Raja Churchill Dass100% (1)

- The Method and Role of Comparative LawDocument37 pagesThe Method and Role of Comparative LawRaja Churchill DassNo ratings yet

- Momentum Picks Under 40 CharactersDocument28 pagesMomentum Picks Under 40 CharactersRaja Churchill DassNo ratings yet

- 3-in-1 Stylus Business PlanDocument24 pages3-in-1 Stylus Business Planalliahdane valenciaNo ratings yet

- Final Executive SummaryDocument19 pagesFinal Executive Summarydas_s13No ratings yet

- SITXCOM005 Assessment 2 Observations - ReachDocument11 pagesSITXCOM005 Assessment 2 Observations - ReachAnzel AnzelNo ratings yet

- Tax credit claim form guideDocument2 pagesTax credit claim form guideVivian KongNo ratings yet

- Assessment On The Influence of Tax Education On Tax Compliance The Case Study of Tanzania Revenue Authority - Keko Bora Temeke BranchDocument33 pagesAssessment On The Influence of Tax Education On Tax Compliance The Case Study of Tanzania Revenue Authority - Keko Bora Temeke BranchSikudhani MmbagaNo ratings yet

- Financial Literacy Levels of Small Businesses Owners and It Correlation With Firms' Operating PerformanceDocument72 pagesFinancial Literacy Levels of Small Businesses Owners and It Correlation With Firms' Operating PerformanceRod SisonNo ratings yet

- Cbse Cost Accounting NotesDocument154 pagesCbse Cost Accounting NotesMANDHAPALLY MANISHANo ratings yet

- Adv 1 - 6 - Intercompany Profit Transactions - Plant Assets - Handout #1Document12 pagesAdv 1 - 6 - Intercompany Profit Transactions - Plant Assets - Handout #1ria fransiscaieNo ratings yet

- 50 MCQ SETS on JOB ANALYSISDocument14 pages50 MCQ SETS on JOB ANALYSISChaudhary AdeelNo ratings yet

- TQM in Graduate Teacher EducationDocument38 pagesTQM in Graduate Teacher Educationjuditha b. PaunillanNo ratings yet

- Natlonalaerospace8%Andabd: Aiainas N A S 5 6 0Document2 pagesNatlonalaerospace8%Andabd: Aiainas N A S 5 6 0Glenn CHOU100% (1)

- Ijcs 127281Document34 pagesIjcs 127281Faten bakloutiNo ratings yet

- Technical Appraisal: Unit 5Document16 pagesTechnical Appraisal: Unit 5DIPAKNo ratings yet

- Supply Chain Management in Big BazaarDocument25 pagesSupply Chain Management in Big Bazaarabhijit05582% (11)

- Barangay transparency monitoring form titleDocument1 pageBarangay transparency monitoring form titleOmar Dizon100% (1)

- CARGO Establishment ListDocument3 pagesCARGO Establishment ListRanjith PNo ratings yet

- UK-eCommerce ListDocument16 pagesUK-eCommerce ListSheel ThakkarNo ratings yet

- Education System Thesis StatementDocument6 pagesEducation System Thesis Statementanneryssanchezpaterson100% (2)

- Upper Intermediate Unit Test 5: Grammar VocabularyDocument2 pagesUpper Intermediate Unit Test 5: Grammar VocabularyAléxia DinizNo ratings yet

- Payment of Wages Act 1936 Key ProvisionsDocument12 pagesPayment of Wages Act 1936 Key ProvisionsRinu VargheseNo ratings yet

- Hyper Launch BrochureDocument22 pagesHyper Launch BrochureQuintin McDonaldNo ratings yet

- Technical Letter StructureDocument33 pagesTechnical Letter Structuresayed Tamir janNo ratings yet

- Critical Challenges Facing Small Business Enterprises in Nigeria A Literature ReviewDocument14 pagesCritical Challenges Facing Small Business Enterprises in Nigeria A Literature ReviewMuhammadNo ratings yet

- Grade 9 TLE LCPDocument8 pagesGrade 9 TLE LCPMJ Andrade67% (3)

- MICE - A New Paradigm For TourismDocument69 pagesMICE - A New Paradigm For TourismRoy Cabarles100% (1)

- Macroeconomics Encapsulated in Three Models (Recovered)Document33 pagesMacroeconomics Encapsulated in Three Models (Recovered)Katherine Asis NatinoNo ratings yet

- Accounting Postulates, Concepts and PrinciplesDocument4 pagesAccounting Postulates, Concepts and PrinciplesKkaran ShethNo ratings yet

- Befa Question BankDocument9 pagesBefa Question Bank20bd1a6655No ratings yet

- What Does ATEX Mean?: Quality - Reliability - EfficiencyDocument4 pagesWhat Does ATEX Mean?: Quality - Reliability - EfficiencyNayyar SkNo ratings yet

- BP B1P Tests U2 LCCIDocument1 pageBP B1P Tests U2 LCCIHải NguyễnNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet