Professional Documents

Culture Documents

Eagle Eye Equities: July 05, 2019

Uploaded by

Anshuman GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eagle Eye Equities: July 05, 2019

Uploaded by

Anshuman GuptaCopyright:

Available Formats

Eagle Eye Equities

July 05, 2019

Index

Punter’s Call

Looking Trendy

Nifty Day Trader

Smart Charts

Momentum Swing

CTFT (Carry Today For Tomorrow)

Bank Nifty

Bank Nifty Day Trader

Day Trader’s Hit List

Visit us at www.sharekhan.com

For Private Circulation only

Sharekhan Eagle Eye Equities

Punter’s Call

Scope for a slide

July 04, 2019 Nifty daily: 11,946.75

The Nifty on Thursday inched further towards the

trendline drawn from the swing highs. The index

however faced pressure as it approached the

trendline. In terms of the price patterns, the index

seems to have formed a bearish wedge pattern over

the last couple of weeks. Structurally, the pattern is

about to mature & the pattern implication can be seen

on the downside. This means that the next leg down

could be around the corner. The hourly momentum

indicator that has been showing negative divergence

has triggered a bearish crossover. Key support on the

downside is at 11887 below which steep fall may be

on the cards. Traders can initiate a fresh sell position

below 11887 for the target of 11625 i.e. the June low. 60-minute

On the other hand, 11980-12000 will continue to act

as a crucial resistance zone.

Other technical observations

On the daily chart, the Nifty is above the 20-day

moving average (DMA) and the 40-DEMA, i.e. 11831

and 11764 respectively. The momentum indicator is in

bullish mode on the daily chart.

On the hourly chart, the Nifty is above the 20-hour

moving average (HMA) and the 40-HEMA, i.e. 11911

and 11884 respectively. The hourly momentum

indicator is in bearish mode. The market breadth was

positive with 909 advances and 829 declines on the

National Stock Exchange.

Market breadth

BSE NSE

Todays Close 39,908.06 11,946.75

Advances 1,244 909

Decline 1,199 829

Unchanged 176 351

Volume (Rs.) 2,080.68 cr 29,843.32 cr

July 05, 2019 2

Sharekhan Eagle Eye Equities

Looking Trendy

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

á

Nifty 11200 12104 11200 / 12104 Nifty 12220 á 11107 11107 / 12220

NOTE: Reversal on closing basis NOTE: Reversal on closing basis

Icon guide

á

á

á á

Up Down Sideways Downswing matures Upswing matures

Nifty Day Trader

Support Resistance

11885 11969

11815 12012

11764 12104

20 DSMA 40 DEMA

11831 11764

Smart Charts

Stop Loss Call Potential %

Buy Price/

Date Scrip Name Action (On closing Closing P/L at Exit/ Target 1 Target 2

Sell Price

Basis ) Price/ CMP Current

1-Jul-19 Grasim July Fut Sell 950.00 915.90 946.30 -3.32% 866.00 845.00

28-Jun-19 MFSL July Fut Sell 435.00 414.25 417.30 -0.74% 380.00 350.00

26-Jun-19 Tata Chemical July Fut Sell 638.00 620.05 622.50 -0.40% 552.00 514.00

24-Jun-19 MGL July Fut Sell Exit 839.70 837.75 0.23% 790.00 750.00

NOTE: Kindly note that all stop losses in Smart Charts are on closing basis unless specified.

TPB: Trailing profit booked

Momentum Swing

Call Potential %

Action Stop Loss/ Buy Price/

Scrip Name Action Closing P/L at Exit/ Target 1 Target 2

Date Reversal Sell Price

Price/CMP Current

4-Jul-19 HUL July Fut Buy 1765.00 1800.00 1803.95 0.22% 1832.00 1860.00

4-Jul-19 Havells July Fut Sell 795.50 785.10 783.80 0.17% 770.00 763.00

3-Jul-19 Tata Chemical July Fut Sell 631.00 619.00 622.50 -0.57% 607.00 595.00

3-Jul-19 Cadila HC July Fut Buy 229.40 234.40 234.00 -0.17% 243.80 248.80

NOTE: Kindly note that all stop losses in Momentum swing are on an intra-day basis.

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade

2) The same will be revised in the TradeTiger terminal every day for the pop-ups

July 05, 2019 3

Sharekhan Eagle Eye Equities

CTFT (Carry Today For Tomorrow)

Closing Potential

Stop Loss/ Reco

Action date Scrip Name Action Segments Price/ P/L at Target 1 Target 2

Reversal Price

CMP CMP (%)

3-Jul-19 SRF July Fut Sell Fut Stopped Out 3038.15 3080.00 -1.38% 2985.00 2950.00

TPB: Trailing profit booked

1) The stop loss should be placed after 9.17am in order to avoid freak trade

2) The same will be revised in the TradeTiger terminal every day for the pop-ups

July 05, 2019 4

Sharekhan Eagle Eye Equities

Bank Nifty

Short Term Trend Medium Term Trend

Support / Support /

Index Target Trend Reversal Index Target Trend Reversal

Resistance Resistance

á

Bank Nifty 28850 31784 28850 / 31784 Bank Nifty 32300 á 28520 28520 / 32300

NOTE: Reversal on closing basis NOTE: Reversal on closing basis

Icon guide

á

á

á á

Up Down Sideways Downswing matures Upswing matures

Bank Nifty Day Trader Bank Nifty Daily

Support Resistance

31239 31608

30939 31784

30688 32000

20 DSMA 40 DEMA

30939 30688

July 05, 2019 5

Sharekhan Eagle Eye Equities

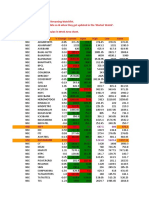

Day Trader’s Hit List

For July 05, 2019

Support Levels Close Resistance Levels

Scrip Name Action

S2 S1 (Rs.) R1 R2

NIFTY Futures 11852.0 11958.0 11977.1 11999.0 12118.0 Buy Above R1/ Sell Below S1

Bank Nifty Futures 31176.0 31414.0 31524.9 31690.0 32000.0 Buy Above R1/ Sell Below S1

Axis Bank 786.0 801.0 807.75 813.2 830.0 Buy Above R1/ Sell Below S1

Bajaj Finance 3689.0 3705.0 3722.40 3750.0 3828.0 Buy Above R1

BHEL 71.5 72.4 73.2 73.8 76.0 Buy Above R1

BPCL 372.0 378.4 379.75 384.0 386.0 Sell Below S1

HDFC 2240.0 2265.0 2278.10 2290.0 2320.0 Buy Above R1/ Sell Below S1

HDFC Bank 2446.0 2472.0 2481.60 2487.0 2543.0 Buy Above R1/ Sell Below S1

Hindustan Unilever 1770.0 1781.0 1794.00 1799.0 1825.0 Buy Above R1

INFOSYS 710.0 728.0 732.50 736.0 741.0 Sell Below S1

ICICI Bank 427.0 433.0 434.5 438.0 444.0 Buy Above R1/ Sell Below S1

LIC Housing 550.0 564.0 568.4 573.1 581.0 Buy Above R1/ Sell Below S1

LNT 1551.0 1560.0 1575.0 1591.0 1607.0 Buy Above R1

Reliance Industries 1270.0 1276.0 1284.0 1291.0 1302.0 Buy Above R1

SBI 360.0 363.0 367.7 371.0 376.0 Buy Above R1

SunPharma 387 391 391.5 395 406 Buy Above R1/ Sell Below S1

Tata Motors 161.0 163.0 165.2 167.8 172.0 Buy Above R1

TISCO 482.0 493.0 494.5 499.0 503.0 Sell Below S1

TCS 2208.0 2230.0 2241.6 2259.0 2290.0 Buy Above R1/ Sell Below S1

Yes Bank 89.8 95.2 96.7 99.0 100.0 Sell Below S1

*Note: Closing price of Nifty futures is last traded price of Nifty futures on NSE

SL=Stoploss

July 05, 2019 6

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Bank Nifty Day Trader OutlookDocument7 pagesBank Nifty Day Trader OutlookAnshuman GuptaNo ratings yet

- Eagle Eye Equities: July 18, 2019Document6 pagesEagle Eye Equities: July 18, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: June 14, 2019Document7 pagesEagle Eye Equities: June 14, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: June 11, 2019Document7 pagesEagle Eye Equities: June 11, 2019Anshuman GuptaNo ratings yet

- Eagleeye SKhanDocument7 pagesEagleeye SKhanRogerNo ratings yet

- Eagle Eye Equities: July 15, 2019Document7 pagesEagle Eye Equities: July 15, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: June 03, 2019Document6 pagesEagle Eye Equities: June 03, 2019Anshuman GuptaNo ratings yet

- 15 May 19Document7 pages15 May 19Anshuman GuptaNo ratings yet

- Eagle Eye Equities: July 23, 2019Document7 pagesEagle Eye Equities: July 23, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities November 14 2019 ReportDocument6 pagesEagle Eye Equities November 14 2019 ReportAnshuman GuptaNo ratings yet

- Eagle Eye EquitiesDocument6 pagesEagle Eye EquitiesRogerNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: April 23, 2019Document6 pagesEagle Eye Equities: April 23, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities: June 04, 2019Document7 pagesEagle Eye Equities: June 04, 2019Anshuman GuptaNo ratings yet

- Eagle Eye Equities: April 12, 2019Document7 pagesEagle Eye Equities: April 12, 2019Anshuman GuptaNo ratings yet

- Short Term Trend Analysis and Trading Ideas for Bank Nifty and Key IndicesDocument6 pagesShort Term Trend Analysis and Trading Ideas for Bank Nifty and Key IndicesAnshuman GuptaNo ratings yet

- Eagle Eye Equities: IndexDocument6 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Eagle Eye Equities May 08, 2019 IndexDocument7 pagesEagle Eye Equities May 08, 2019 IndexAnshuman GuptaNo ratings yet

- Eagleeye - 30th April 2019Document7 pagesEagleeye - 30th April 2019RogerNo ratings yet

- 29 May 19Document6 pages29 May 19Anshuman GuptaNo ratings yet

- EagleEye-Dec18 18 (E) PDFDocument7 pagesEagleEye-Dec18 18 (E) PDFsbvaNo ratings yet

- Eagle Eye Equities Oct 14 - 2019Document7 pagesEagle Eye Equities Oct 14 - 2019RogerNo ratings yet

- 22 May 19 PDFDocument6 pages22 May 19 PDFAnshuman GuptaNo ratings yet

- Nifty Day Trader March 28, 2019Document7 pagesNifty Day Trader March 28, 2019RogerNo ratings yet

- Eagle Eyes ReportDocument3 pagesEagle Eyes ReportSaketh DahagamNo ratings yet

- Eagleeye - e (11) - 5Document7 pagesEagleeye - e (11) - 5Harry AndersonNo ratings yet

- Eagle Eye Equities: September 22, 2020Document6 pagesEagle Eye Equities: September 22, 2020krishnabtNo ratings yet

- Eagle Eye Equities: March 26, 2020Document6 pagesEagle Eye Equities: March 26, 2020Anshuman GuptaNo ratings yet

- Ee 502Document6 pagesEe 502vaibhav vidwansNo ratings yet

- Ee 412Document6 pagesEe 412vaibhav vidwansNo ratings yet

- High Noon: December 17, 2018Document4 pagesHigh Noon: December 17, 2018sbvaNo ratings yet

- Eagle Eye Equities: July 15, 2021Document6 pagesEagle Eye Equities: July 15, 2021Raja Churchill DassNo ratings yet

- Eagleeye - e (10) - 5Document7 pagesEagleeye - e (10) - 5Harry AndersonNo ratings yet

- Ee 424Document6 pagesEe 424vaibhav vidwansNo ratings yet

- Eagle Eye Equities: April 03, 2020Document6 pagesEagle Eye Equities: April 03, 2020RogerNo ratings yet

- EagleEye-Aug10 2021Document6 pagesEagleEye-Aug10 2021Abhinav KeshariNo ratings yet

- Eagleeye - e (2) - 7Document7 pagesEagleeye - e (2) - 7Harry AndersonNo ratings yet

- Eagleeye - e APRIL 15 2021Document6 pagesEagleeye - e APRIL 15 2021Mark DavidsonNo ratings yet

- High Noon: January 03, 2023Document4 pagesHigh Noon: January 03, 2023LakshyaMartianNo ratings yet

- Eagle Eye SharekhanDocument7 pagesEagle Eye SharekhankochinextNo ratings yet

- Market Strategy: Trading Strategy M&M AUG Fut (Sell at Rs.611-615, Target Rs590, Stop Loss Rs621)Document9 pagesMarket Strategy: Trading Strategy M&M AUG Fut (Sell at Rs.611-615, Target Rs590, Stop Loss Rs621)Ranjan BeheraNo ratings yet

- Highnoon Nov 26Document3 pagesHighnoon Nov 26SITU2412No ratings yet

- Daring DerivativesDocument4 pagesDaring DerivativessharmanmruNo ratings yet

- MTP For NiftyDocument3 pagesMTP For NiftyAnil KumarNo ratings yet

- Show NewsDocument1 pageShow NewsRajashekhar NagalapurNo ratings yet

- Eagleeye eDocument6 pagesEagleeye esuneetaNo ratings yet

- Trading Strategy: Morning NoteDocument6 pagesTrading Strategy: Morning Notenagaraja h iNo ratings yet

- Technical Research Report 20-04-2010Document2 pagesTechnical Research Report 20-04-2010roxsunnyNo ratings yet

- Sensex (37736) / Nifty (11102) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37736) / Nifty (11102) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Technical & Derivatives Report Highlights Bank Nifty StrengthDocument5 pagesTechnical & Derivatives Report Highlights Bank Nifty StrengthbbaalluuNo ratings yet

- Market Mantra 27022023Document8 pagesMarket Mantra 27022023KkxNo ratings yet

- Sensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Technical Report Highlights Midcap Rally and Dollar Index ReboundDocument5 pagesTechnical Report Highlights Midcap Rally and Dollar Index ReboundbbaalluuNo ratings yet

- 14th October, 2021 Equity 360: Nifty LevelDocument6 pages14th October, 2021 Equity 360: Nifty LevelMohan KrishnaNo ratings yet

- Sensex (37935) / Nifty (11132) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37935) / Nifty (11132) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Moving Average GuideDocument16 pagesMoving Average Guidesuisuifx538795% (63)

- Health Payout PDFDocument9 pagesHealth Payout PDFAnshuman GuptaNo ratings yet

- Health Payout PDFDocument9 pagesHealth Payout PDFAnshuman GuptaNo ratings yet

- DD No - Date - Jan 19 BankDocument3 pagesDD No - Date - Jan 19 BankAnshuman GuptaNo ratings yet

- DAY TRADING Sand RDocument6 pagesDAY TRADING Sand RAnshuman Gupta100% (1)

- Using 12-24 Minute Moving Averages for Intra-Day Trading ProfitsDocument3 pagesUsing 12-24 Minute Moving Averages for Intra-Day Trading ProfitsAnshuman Gupta100% (1)

- 3 Simple Ways to Trade the 52-Week RangeDocument9 pages3 Simple Ways to Trade the 52-Week RangeAnshuman GuptaNo ratings yet

- Accumulation Distribution Uses Volume To Confirm Price Trends or Warn of Weak Movements That Could Result in A Price ReversalDocument2 pagesAccumulation Distribution Uses Volume To Confirm Price Trends or Warn of Weak Movements That Could Result in A Price ReversalAnshuman GuptaNo ratings yet

- How To Day Trade Morning GapsDocument9 pagesHow To Day Trade Morning GapsAnshuman GuptaNo ratings yet

- Candlestick ChartsDocument8 pagesCandlestick ChartsAnshuman GuptaNo ratings yet

- Moving Average GuideDocument16 pagesMoving Average Guidesuisuifx538795% (63)

- 2 4 Multiple Time Frames PDFDocument13 pages2 4 Multiple Time Frames PDFZul AtfiNo ratings yet

- Volume - 4 Simple Trading Strategies Using Chart Pattterns: Why Is Volume Important?Document20 pagesVolume - 4 Simple Trading Strategies Using Chart Pattterns: Why Is Volume Important?Anshuman Gupta100% (1)

- Grow Your Trading Account Up To 266x: Recent ArticlesDocument11 pagesGrow Your Trading Account Up To 266x: Recent ArticlesAnshuman GuptaNo ratings yet

- Tambola SongsDocument3 pagesTambola SongsAnshuman GuptaNo ratings yet

- Save TigersDocument1 pageSave TigersAnshuman GuptaNo ratings yet

- Tambola Tickets (Sanggeta Sureeli)Document18 pagesTambola Tickets (Sanggeta Sureeli)Anshuman GuptaNo ratings yet

- Geography (Question & Answer)Document3 pagesGeography (Question & Answer)Anshuman GuptaNo ratings yet

- Power SharingDocument3 pagesPower SharingMudit Garg0% (1)

- FederalismDocument4 pagesFederalismbblue1980100% (1)

- Date Open High LOW Close H-O O-L: Instrument Name: NseniftyDocument28 pagesDate Open High LOW Close H-O O-L: Instrument Name: NseniftyAnshuman GuptaNo ratings yet

- NiftyDocument14 pagesNiftyAnshuman GuptaNo ratings yet

- How To Trade With The ADXDocument26 pagesHow To Trade With The ADXAnshuman GuptaNo ratings yet

- Save PlantsDocument2 pagesSave PlantsAnshuman GuptaNo ratings yet

- Dily Gainers and LosersDocument10 pagesDily Gainers and LosersAnshuman GuptaNo ratings yet

- Strategy Overview:: Trading Range Breakout On Daily Timeframe: Excel SheetDocument2 pagesStrategy Overview:: Trading Range Breakout On Daily Timeframe: Excel SheetAnshuman GuptaNo ratings yet

- 12 PM Call Generation: Morning ORB 15 Minutes CandleDocument5 pages12 PM Call Generation: Morning ORB 15 Minutes CandleAnshuman GuptaNo ratings yet

- Grow Your Trading Account Up To 266x: Recent ArticlesDocument11 pagesGrow Your Trading Account Up To 266x: Recent ArticlesAnshuman GuptaNo ratings yet

- Stock Trading Excel SheetDocument3 pagesStock Trading Excel SheetAnshuman GuptaNo ratings yet

- A. DO NOT Make Any Changes in Streaming WatchlistDocument12 pagesA. DO NOT Make Any Changes in Streaming WatchlistAnshuman GuptaNo ratings yet

- Dec 2018 VI Program - Participant Profile BookDocument24 pagesDec 2018 VI Program - Participant Profile BookJBNo ratings yet

- Centre For Global Finance Working Paper Series (ISSN 2041-1596) Paper Number: 02/12Document19 pagesCentre For Global Finance Working Paper Series (ISSN 2041-1596) Paper Number: 02/12Horace ChoiNo ratings yet

- Industry and Company AnalysisDocument4 pagesIndustry and Company AnalysisAchirangshu MukhopadhyayNo ratings yet

- C4 - Financial Statement AnalysisDocument13 pagesC4 - Financial Statement Analysisjose danny literatoNo ratings yet

- Financial Crime Cover LetterDocument6 pagesFinancial Crime Cover Letterfqh4d8zf100% (1)

- BHARATH SfinalDocument66 pagesBHARATH Sfinalaurorashiva1No ratings yet

- Financial Advisor ResumeDocument8 pagesFinancial Advisor Resumef675ztsf100% (2)

- Financial Statement and AnalysisDocument10 pagesFinancial Statement and Analysisjiao0001No ratings yet

- Lesson 2A - Financial RatiosDocument4 pagesLesson 2A - Financial RatiosButchoy ButchukoyNo ratings yet

- Responsibility Accounting - Types, Features, Prerequisites & ExamplesDocument8 pagesResponsibility Accounting - Types, Features, Prerequisites & Examplesprakashzodpe2013No ratings yet

- CIMB Strategy Note 2 Aug 2023 2Q23, Mixed Results, Large Banks AheadDocument10 pagesCIMB Strategy Note 2 Aug 2023 2Q23, Mixed Results, Large Banks Aheadbotoy26No ratings yet

- Resume 8.7.2012Document1 pageResume 8.7.2012Cole FunNo ratings yet

- H R M M P:: Uman Esource Anagement INI RojectDocument12 pagesH R M M P:: Uman Esource Anagement INI RojectAmazing VideosNo ratings yet

- Equity Research - Banking SectorDocument89 pagesEquity Research - Banking Sectorsnfrh2188% (33)

- JPM Equity Strategy 2021-03-15 - 3677865Document31 pagesJPM Equity Strategy 2021-03-15 - 3677865gustavomorgadoNo ratings yet

- International Credit Rating AgenciesDocument6 pagesInternational Credit Rating AgenciesShubhit GaurNo ratings yet

- Investment Consulting Business PlanDocument9 pagesInvestment Consulting Business Planbe_supercoolNo ratings yet

- JPM Software Outlook SummaryDocument4 pagesJPM Software Outlook SummaryAvid HikerNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- 11 Chapter-5Document155 pages11 Chapter-5Shazaf KhanNo ratings yet

- Financial Analysts Chapter QuestionsDocument50 pagesFinancial Analysts Chapter QuestionsVK ACCANo ratings yet

- Credit Analyst ResumeDocument6 pagesCredit Analyst Resumezpxjybifg100% (2)

- Social Force at WorkDocument15 pagesSocial Force at WorkRudi San100% (2)

- Special Situations Tracker - 020723 - OthersDocument11 pagesSpecial Situations Tracker - 020723 - OthersKushal AkbariNo ratings yet

- Abba Ali Habib EquityDocument2 pagesAbba Ali Habib Equityali ahmadNo ratings yet

- Corporate Credit Analysis Chapter IIIDocument14 pagesCorporate Credit Analysis Chapter IIIdewi wahyuNo ratings yet

- IMD MBA Class ProfilesDocument16 pagesIMD MBA Class Profilessameer3105No ratings yet

- Bikaji Foods International Limited - IPO Note 104P India BikajiDocument4 pagesBikaji Foods International Limited - IPO Note 104P India BikajiAmit kumarNo ratings yet

- Daily Derivatives SnapshotDocument3 pagesDaily Derivatives SnapshotGauriGanNo ratings yet

- Future Leaders and Influencers through Leadership, Networking and Financial EconomicsDocument11 pagesFuture Leaders and Influencers through Leadership, Networking and Financial EconomicsHelen Nguyễn100% (5)