Professional Documents

Culture Documents

Sample Page: Auditing and Attestation

Uploaded by

Admin - At Least Know ThisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Page: Auditing and Attestation

Uploaded by

Admin - At Least Know ThisCopyright:

Available Formats

1.

Introduction and Professional Responsibilities

INTRODUCTION

Audit Attestation Review and Compilation

During engagement with Clarified Statements on Auditing Statements on Standards for Statements on Standards for

nonpublic company, accountant is Standards (SASs) issued by Attestation Engagements Accounting and Review Services

subject to: (SSAEs) issued by (SSARSs) issued by

AICPA Auditing Standards Board. AICPA Auditing Standards Board. AICPA Accounting and Review

Services Committee.

All statements are recorded in the AICPA Professional Standards. SAS sections have identifier AU-C.

SSAE sections have identifier AT-C. SSARS sections have identifier AR-C.

Attestation Audit, review or agreed-upon procedures engagement to report about whether a subject matter or assertion is in conformity with selected

criteria.

Audit Form of attestation in which practitioner obtains reasonable assurance that subject matter is in conformity with applicable financial reporting

framework, where subject matter is a historical financial statement(s).

Objective is to determine if financial statements (FS) are presented fairly.

Determination is based on auditor obtaining reasonable assurance that FS are free from material misstatement, whether due to fraud or error.

Reasonable assurance High level of assurance, but not absolute.

Materiality Total misstatement large enough to influence economic decisions of users on the basis of FS.

Auditor responsibility

Auditor always has general responsibility to conduct audit in accordance with Generally Accepted Auditing Standards. GAAS are made of the

above Clarified Statements on Auditing Standards and recorded in AICPA Professional Standards.

Client responsibilities

To prepare and fairly present FS in accordance with the applicable financial reporting framework.

To maintain internal controls for FS preparation.

To provide the auditor with:

All information, of which management is aware, that is relevant to FS preparation.

Other information at request of auditor.

Unrestricted access to personnel to obtain audit evidence.

Audit for public company Sarbanes-Oxley Act (SOX) of 2002 established the Public Company Accounting Oversight Board (PCAOB). To conduct an

audit of a public company, SOX requires auditor to register with the PCAOB.

During audit with public company, Auditing Standards (AS) issued

accountant is subject to: by

PCAOB with the approval of SEC.

General standards

Adequate technical training, proficiency.

Independence.

Due professional care.

Standards of fieldwork

Adequate planning and supervision.

Sufficient evidence to give reasonable basis for conclusion.

Adequate understanding of internal control (IC).

You might also like

- Audit and Accounting Guide: Property and Liability Insurance Entities 2018From EverandAudit and Accounting Guide: Property and Liability Insurance Entities 2018No ratings yet

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19From EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19No ratings yet

- Reasonable AssuranceDocument12 pagesReasonable AssuranceHossein DavaniNo ratings yet

- Certified Information System Auditor A Complete Guide - 2020 EditionFrom EverandCertified Information System Auditor A Complete Guide - 2020 EditionNo ratings yet

- BEC 1 Outline Corporate Governance and Operations ManagementDocument4 pagesBEC 1 Outline Corporate Governance and Operations ManagementGabriel100% (1)

- IG AT IO N: Audit PlanningDocument19 pagesIG AT IO N: Audit PlanningAmeer ShafiqNo ratings yet

- AU Standards PCAOBDocument49 pagesAU Standards PCAOBAmar GuliNo ratings yet

- REG 3 Text NotesDocument6 pagesREG 3 Text NotesJeffrey WangNo ratings yet

- Reg Flash CardsDocument3,562 pagesReg Flash Cardsmohit2ucNo ratings yet

- Developing Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsDocument24 pagesDeveloping Project Cash Flow Statement: Lecture No. 23 Fundamentals of Engineering EconomicsAyman SobhyNo ratings yet

- In Depth Guide To Public Company AuditingDocument20 pagesIn Depth Guide To Public Company AuditingAhmed Rasool BaigNo ratings yet

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionFrom EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNo ratings yet

- Sole Proprietorship and Joint Venture: BEC - Notes Chapter 1Document9 pagesSole Proprietorship and Joint Venture: BEC - Notes Chapter 1Jack221439No ratings yet

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Stocktake IssueDocument2 pagesStocktake IssueMaxamed Geedi CaynaansheNo ratings yet

- Weekly Progress & Evaluation Test 26: D. 2 & 3 OnlyDocument3 pagesWeekly Progress & Evaluation Test 26: D. 2 & 3 OnlyAbhinav GuptaNo ratings yet

- AF310 Chapter 10 Accounting for PPEDocument28 pagesAF310 Chapter 10 Accounting for PPEGe ZhangNo ratings yet

- BEC 3 Outline - 2015 Becker CPA ReviewDocument4 pagesBEC 3 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- Auditing and Assurance Principles: Chapter Two: The Professional StandardsDocument25 pagesAuditing and Assurance Principles: Chapter Two: The Professional StandardsMark Domingo MendozaNo ratings yet

- Project management multiple choice questionsDocument68 pagesProject management multiple choice questionsMohamed Desouky100% (1)

- Sap Fi AP Manual For Common Daily TransactionsDocument72 pagesSap Fi AP Manual For Common Daily TransactionsMehmood Ul HassanNo ratings yet

- BEC Study Guide 4-19-2013Document220 pagesBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- Certified Information Systems Auditor Standard RequirementsFrom EverandCertified Information Systems Auditor Standard RequirementsNo ratings yet

- Guide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?From EverandGuide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?No ratings yet

- Valuation of Fixed AssetsDocument28 pagesValuation of Fixed Assetsmaster53015No ratings yet

- Three Year Rolling Internal Audit PlanDocument5 pagesThree Year Rolling Internal Audit PlanJessmin DacilloNo ratings yet

- Module 4 Islamic Financial Instruments and Contracts For Impact InvestingDocument60 pagesModule 4 Islamic Financial Instruments and Contracts For Impact InvestingMayolla Suci EksaNo ratings yet

- CPA BEC - BudgetingDocument15 pagesCPA BEC - Budgetingpambia2000No ratings yet

- Aud NotesDocument75 pagesAud NotesClaire O'BrienNo ratings yet

- Auditing and Attestation Content Specification OutlineDocument5 pagesAuditing and Attestation Content Specification OutlineLisa GoldmanNo ratings yet

- ISA 610 Using The Work of Internal AuditorsDocument4 pagesISA 610 Using The Work of Internal AuditorsNURUL FAEIZAH BINTI AHMAD ANWAR / UPMNo ratings yet

- Insurance Claim Procedure for ProjectsDocument2 pagesInsurance Claim Procedure for ProjectsAMIT GUPTANo ratings yet

- Corporate Governance FrameworkDocument38 pagesCorporate Governance FrameworksheldonNo ratings yet

- States and Dates: Filing Sales Tax ReturnsDocument10 pagesStates and Dates: Filing Sales Tax ReturnsJonathan ArcherNo ratings yet

- AICPA Released Questions AUD 2015 DifficultDocument26 pagesAICPA Released Questions AUD 2015 DifficultTavan ShethNo ratings yet

- Stocktaking Policy and ProceduresDocument2 pagesStocktaking Policy and Proceduresiftiniazi0% (1)

- ch13 SolDocument17 pagesch13 SolJohn Nigz PayeeNo ratings yet

- Accounts Department S.O.P.Document4 pagesAccounts Department S.O.P.vijay sharmaNo ratings yet

- BEC 4 Outline - 2015 Becker CPA ReviewDocument6 pagesBEC 4 Outline - 2015 Becker CPA ReviewGabrielNo ratings yet

- Audit ReviewDocument12 pagesAudit ReviewAmanda ClaroNo ratings yet

- Bec Flash CardsDocument4,310 pagesBec Flash Cardsmohit2uc100% (1)

- Internal Audit Quality A Polysemous NotionDocument28 pagesInternal Audit Quality A Polysemous NotionalyaniamaliahNo ratings yet

- 1.0 Review of Financial StatementsDocument25 pages1.0 Review of Financial Statementsmujuni brianmjuNo ratings yet

- PMBOK Process Pics ShortcutsDocument72 pagesPMBOK Process Pics Shortcutsgesliop global100% (1)

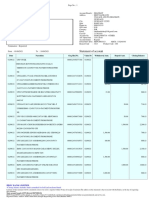

- Acct Statement - XX5710 - 18092021 (4) DeshDocument14 pagesAcct Statement - XX5710 - 18092021 (4) DeshRahul SahaniNo ratings yet

- Control of Cash and Credit: Cash Control - Cash Control Involves All The Transactions Which The Guest Makes inDocument14 pagesControl of Cash and Credit: Cash Control - Cash Control Involves All The Transactions Which The Guest Makes inAryan BishtNo ratings yet

- 1568997886067Iq6YiG0o2YEDSfOe PDFDocument6 pages1568997886067Iq6YiG0o2YEDSfOe PDFalpoNo ratings yet

- SEC577 Cryptography and Security MechanismsDocument18 pagesSEC577 Cryptography and Security MechanismsLuis MercadoNo ratings yet

- Argentina: Iguazu Falls PatagoniaDocument2 pagesArgentina: Iguazu Falls Patagoniamiguel alejandro moreno ruizNo ratings yet

- Freshworks For Startups: Google Slides Presentation TemplateDocument10 pagesFreshworks For Startups: Google Slides Presentation TemplateRajat MittalNo ratings yet

- A Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Document98 pagesA Study On Customer Satisfaction Towards Idbi Fortis Life Insurance Company Ltd.Md MubashirNo ratings yet

- Export Procedure and DocumentationDocument30 pagesExport Procedure and DocumentationSiddhartha NeogNo ratings yet

- Learn About Refunds On Google Play - Google Play HelpDocument9 pagesLearn About Refunds On Google Play - Google Play HelpLemma Tolessa DadiNo ratings yet

- BHB Releases Salary Data Bermuda May 17 2016Document8 pagesBHB Releases Salary Data Bermuda May 17 2016Anonymous UpWci5No ratings yet

- Audit Program - CashDocument2 pagesAudit Program - CashKris Van HalenNo ratings yet

- Ecoplus Power Telesales ScriptDocument2 pagesEcoplus Power Telesales Scriptsales.bellmarketingNo ratings yet

- Cash and Cash EquivalentDocument7 pagesCash and Cash EquivalentAlex VillanuevaNo ratings yet

- Mobicash PptfranchiseeDocument20 pagesMobicash Pptfranchiseeapi-374418427No ratings yet

- Bharatiya Mahila BankDocument5 pagesBharatiya Mahila Bankbharatparyani0% (1)

- eMBMS LTE Usage To Deliver Mobile DataDocument6 pageseMBMS LTE Usage To Deliver Mobile Datasakshi chawlaNo ratings yet

- Control in Logistics Purpose IntegrationDocument23 pagesControl in Logistics Purpose IntegrationRohit shahiNo ratings yet

- Fiber monthly bill summaryDocument4 pagesFiber monthly bill summaryavinash kumarNo ratings yet

- Certificate of EmploymentDocument1 pageCertificate of EmploymentMark Alcera100% (1)

- UntitledDocument7 pagesUntitledMOHD FIRDHAUSNo ratings yet

- E CommerceDocument69 pagesE CommerceAhmed Kadem ArabNo ratings yet

- Ngong Ping PDFDocument2 pagesNgong Ping PDFMorielle Anne De GuzmanNo ratings yet

- Estatement 06082023Document2 pagesEstatement 06082023Dua PutraNo ratings yet

- Indian Banking in Next 5 Years - BCG ReportDocument17 pagesIndian Banking in Next 5 Years - BCG ReportNirav ShahNo ratings yet

- Digital Marketing AssignmentDocument20 pagesDigital Marketing AssignmentHarshit RangaNo ratings yet

- Cs3591cn Unit VDocument134 pagesCs3591cn Unit Vhod cseNo ratings yet

- Matrix Presentation Cosec Cogniface IntegraDocument31 pagesMatrix Presentation Cosec Cogniface IntegraSanket PatelNo ratings yet

- Innovative Services in Banking SectorDocument32 pagesInnovative Services in Banking SectormeghkumawatNo ratings yet

- Week 6Document11 pagesWeek 6Kim Albero CubelNo ratings yet

- Auditing and Assurance Principles ModuleDocument55 pagesAuditing and Assurance Principles ModuleRJ Kristine Daque100% (3)