Professional Documents

Culture Documents

Address Change Request

Uploaded by

Neelesh JainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Address Change Request

Uploaded by

Neelesh JainCopyright:

Available Formats

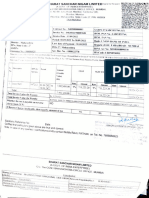

MNVR0A16 BONANZA PORTFOLIO LTD.

SUNIL KUMAR JAIN SARAF

Head Office: 2/2 A First Floor Lakshmi Insurance Building

WARD NO 12/QTR NO 87 Asaf Ali Road New Delhi - 110 002. +91-11-30412600

Corporate Office: Bonanza House Plot no M-2

OPM COLONY

Cama Industriaal Estate Waibhat Road

Compliance Officer Name Manoj Kumar Goel

NEAR PANI TANKI Goregaon East Mumbai - 400 063. +91-22-30863700

Compliance Officer Cont. No. 022-67605507

AMLAI PAPER MILL 484117 Compliance Officer Email mmg@bonanzaonline.com

SEBI Reg. No.(NSE) INB230637836

SEBI Reg. No.(NSEC) INE230637836

SETTLEMENT LETTER - CM SEBI Reg. No.(NSEFO) INF230637836

SEBI Reg. No.(BSE) INB011110237

SEBI Reg. No.(BSEFO) INF011110237

SEBI Reg. No.(MCXC) INE260637836

SEBI Reg. No.(MCXS) INB260637831

SEBI Reg. No.(MCXD) INF260637831

SEBI Reg. No.(USEC) INE270637833

CIN No. U65991DL1993PLC052280

With reference to your consent for quarterly settlement of funds and securities provided at the time of authorizing us for running account maintenance,

please find enclosed herewith your retention statement of funds and securities across the segments.

We would like to bring it in your attention that for the calendar quarter OCT-DEC 2018 your trading account has been settled on 04-10-2018.

In pursuance to SEBI circular no. MIRSD/SE/Cir-19/2009 dated December 3, 2009, your funds/securities have been retained on the basis

of following calculations which are required to meet margin obligations for next 5 trading days, calculated in the manner specified by the exchanges.

In Case your ledger is in debit, we shall hold your stocks equal to ledger debit.

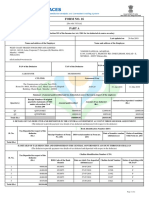

(A) Total value of clients Funds and Securities available prior to settlement

Particulars Amount (Rs.) Amount (Rs.)

Unencumbered balance in client ledger (after reversing value of unsettled bills if any in case of trade

0.00

day billing and margin amount if debited in client ledger.

Unencumbered balance in margin ledgers 0.00

Value of Securities Available on T Day with member (at closing rate of T-1 Day after appropriate Haircut) 0.00

Total Funds and Securities available 0.00

(B) Explanation regarding Retention of Funds and Securities

Capital Market Derivatives Currency Amount

Particulars

NSE BSE MSEI NSE BSE MSEI NSE BSE MSEI (Rs)

Unencumbered Debit balance in client ledger (across segments / exchanges after reversing value of unsettled bills

if any in case of trade day billing and margin amount if debited in client ledger)

476.08

Ledger Debit as on T Day 0.00

T Day Funds Pay in obligation 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

T-1 Day Funds Pay in obligation 0.00 0.00 0.00 0.00

T Day Securities Pay in obligation in CM 0.00 0.00 0.00 0.00

segment

T-1 Day Securities Pay in obligation in CM 0.00 0.00 0.00 0.00

segment

225% of T Day Margin Requirement in 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Derivatives seg

T Day turnover in CM segment 0.00 0.00 0.00 0.00

Maximum Funds and Securities that can be 476.08

retained

(C) Retention of Funds and Securities (Value in Rs.)

Value of Funds received from client - retained 0.00

Value of Securities of client – retained

Scrip Name ISIN Quantity Closing Rate Haircut % Value Cumulative

(T-1 Day) Value

- - 0 0.00 0.00 0.00 0.00

Total Retention 0.00

Statement of Account (Financial Ledger) as on : 04/10/2018

Date Billno Cheue Bank Vallan Exch Debit Credit Cumulative

Balance

30/06/2018 OpnBal 0 2239.62 2239.62 0.00

24/07/2018 B/NM/081/759 1819081 BSE 476.08 0.00 -476.08

Security Register as on : 04/10/2018

Scrip Name ISIN Open Qty Inward Outward Closing Stock

- - 0 0.00 0.00 0.00

(D) Details of Payout to client

Fund Released 0.00

Details of Securities released

Scrip Name ISIN Quantity Closing Rate Haircut % Value

(T-1 Day)

- - 0 0.00 0.00 0.00

Total Funds and Securities released 0.00

(E) Amount not required to be returned

Value of BG's received from client - not required to be returned ( With details of each BG )

Value of FD's received from client - not required to be returned ( With details of each FD )

In case of debit balance, the account is deemed as settled as there is no credit balance in the account. However, the debit position in the account stands as it is. You are

hereby kindly requested to clear the debit on immediate basis.

IF YOU FIND ANY ERROR, YOU ARE REQUESTED TO REPORT IT IN WRITING TO CUSTOMERCARE@BONANZAONLINE.COM WITHIN 10 DAYS FROM THE DATE RECEIPT OF THIS

STATEMENT.

PLEASE NOTE, THROUGH RUNNING ACCOUNT AUTHORISATION YOU WISH TO SETTLE YOUR ACCOUNT ON QUARTERLY BASIS. YOU MAY REVOKE IT BY REQUESTING ITS REVOCATION IN

WRITING TO CUSTOMERCARE@BONANZAONLINE.COM

Note : This is a computer generated statement hence no signature is required.

You might also like

- Final Dawlance Marketing Mangement ProjectDocument32 pagesFinal Dawlance Marketing Mangement ProjectSyed Huzayfah Faisal100% (1)

- Hooks in Odoo OWL FrameworkDocument9 pagesHooks in Odoo OWL FrameworkJohn JackNo ratings yet

- Case Study 3 PDFDocument4 pagesCase Study 3 PDFBetheemae R. Matarlo100% (1)

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Document5 pagesICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Vijaykumar D SNo ratings yet

- ICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Document2 pagesICICI Securities Limited: Annual Global Transaction Statement From 01-Apr-2017 To 31-Mar-2018Lakshmi MuraliNo ratings yet

- TRANEQTYDERServletDocument1 pageTRANEQTYDERServletRahul SharmaNo ratings yet

- RKSV Securities India Pvt. LTD.: Nse-EqDocument2 pagesRKSV Securities India Pvt. LTD.: Nse-EqSachin MalviNo ratings yet

- TRX Equity ReemaDocument51 pagesTRX Equity ReemaKrystle MathisNo ratings yet

- AnnualGlobalTransactionStatement 2018 2019 - SUMMARYDocument2 pagesAnnualGlobalTransactionStatement 2018 2019 - SUMMARYVijaykumar D SNo ratings yet

- Contract NotesDocument2 pagesContract NotesdharmendraNo ratings yet

- Date: 01/04/2020 Mumbai For ICICI Securities Limited. Yours Faithfully, PlaceDocument2 pagesDate: 01/04/2020 Mumbai For ICICI Securities Limited. Yours Faithfully, PlaceVikas KunduNo ratings yet

- Brochure Graphic Design Work InvoiceDocument1 pageBrochure Graphic Design Work InvoicePrabal Pratap SinghNo ratings yet

- Financial Ledger (Nse/Bse/Fo) : Sebi No. (NSE) Sebi No. (BSE) Sebi No. (Cur)Document5 pagesFinancial Ledger (Nse/Bse/Fo) : Sebi No. (NSE) Sebi No. (BSE) Sebi No. (Cur)pooja sharmaNo ratings yet

- Salk1000152223-NoidaDocument5 pagesSalk1000152223-NoidaPratik GosaviNo ratings yet

- Trades - Annual Global StatementDocument8 pagesTrades - Annual Global StatementVenu MadhavNo ratings yet

- Consolidated Report 17022020Document4 pagesConsolidated Report 17022020rashisharma1072007No ratings yet

- Financial Ledger (Nse/Bse/Fo) : Sebi No. (NSE) Sebi No. (BSE) Sebi No. (Cur)Document5 pagesFinancial Ledger (Nse/Bse/Fo) : Sebi No. (NSE) Sebi No. (BSE) Sebi No. (Cur)pooja sharmaNo ratings yet

- Contract NotesDocument3 pagesContract NotesHarshal VaidyaNo ratings yet

- Adobe Scan 15-Apr-2023Document1 pageAdobe Scan 15-Apr-2023VISHAL JANGRANo ratings yet

- I0103s048 13 11 2021 124406Document3 pagesI0103s048 13 11 2021 124406KicajaNo ratings yet

- Jinoy AchDocument5 pagesJinoy Achsinto johnsNo ratings yet

- Municipal Corporation of Greater Mumbai: License Department Projection&Stallboard Renewal ReceiptDocument1 pageMunicipal Corporation of Greater Mumbai: License Department Projection&Stallboard Renewal ReceiptSandeep ShahNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodaymcmeenaNo ratings yet

- 3241 - Demand Letter PDFDocument2 pages3241 - Demand Letter PDFvarshaNo ratings yet

- Soa ME701869 28-FEB-2023Document2 pagesSoa ME701869 28-FEB-2023JAYAKUMAR JAYAKUMARNo ratings yet

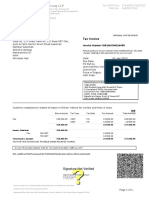

- Tax Invoice: Datum TechnologiesDocument1 pageTax Invoice: Datum Technologiesraj rajNo ratings yet

- CW 131007 20161026 Bse 27232 CommonDocument2 pagesCW 131007 20161026 Bse 27232 CommonDebapriyo SinhaNo ratings yet

- 5paisa Capital Limited: Contract Note No. 0004658086Document2 pages5paisa Capital Limited: Contract Note No. 0004658086Bs20mscph013No ratings yet

- Fy2018-19 Part A PDFDocument2 pagesFy2018-19 Part A PDFVoot VootNo ratings yet

- Maruti Suzuki India Limited: Standard Draft Purchase Order Msil Gurgaon Plant Page No.: 1 of 1Document1 pageMaruti Suzuki India Limited: Standard Draft Purchase Order Msil Gurgaon Plant Page No.: 1 of 1Abhilash SinghNo ratings yet

- ReportDocument2 pagesReportvikas batraNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodaymcmeenaNo ratings yet

- Financial Ledger (Nse/Bse/Fo)Document5 pagesFinancial Ledger (Nse/Bse/Fo)pooja sharmaNo ratings yet

- ICICI Securities Limited: Signature Not VerifiedDocument3 pagesICICI Securities Limited: Signature Not VerifiedmskhandelwalNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument3 pagesCash Segment - Trade Summary Cum Bill Report For TodaySimul MondalNo ratings yet

- Master Capital Services LTD.: 31/07/2019 Trade Date 65433 Contract Note NoDocument3 pagesMaster Capital Services LTD.: 31/07/2019 Trade Date 65433 Contract Note NoVenu MadhavNo ratings yet

- Computation 23-24 Buta Singh.Document2 pagesComputation 23-24 Buta Singh.Sharn RamgarhiaNo ratings yet

- Inv No - 6554 PDFDocument1 pageInv No - 6554 PDFSunil PatelNo ratings yet

- Alice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeDocument2 pagesAlice Blue Financial Services (P) LTD: Name of The Client: UCC & Client CodeKulasekara PandianNo ratings yet

- ICICI Securities Limited: Signature Not VerifiedDocument2 pagesICICI Securities Limited: Signature Not VerifiedKKNo ratings yet

- Account Statement: Sip/Stp/SwpDocument2 pagesAccount Statement: Sip/Stp/SwpGanesh PoojatyNo ratings yet

- EY Invoice - ORG - IN91MH3M016459Document1 pageEY Invoice - ORG - IN91MH3M016459AltafNo ratings yet

- Usshar Pi (Ra-23) AdvanceDocument2 pagesUsshar Pi (Ra-23) Advancesmn.ussharNo ratings yet

- Part A 4883020Document2 pagesPart A 4883020AkchikaNo ratings yet

- Acctstmt P 11713974Document1 pageAcctstmt P 11713974nisha goyalNo ratings yet

- Financial Ledger (Nse/Bse/Fo)Document5 pagesFinancial Ledger (Nse/Bse/Fo)pooja sharmaNo ratings yet

- Agcpa9205b 2019-20Document2 pagesAgcpa9205b 2019-20HRNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Branch:Juhu Tara Road - Mumbai: Clarifications, KindlyDocument2 pagesBranch:Juhu Tara Road - Mumbai: Clarifications, Kindlyremo.pathakNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document1 pageIncome Tax Department: Computerized Payment Receipt (CPR - It)naeem1990No ratings yet

- Subhani Engineering: QuotationDocument7 pagesSubhani Engineering: QuotationJaseem Khan KhanNo ratings yet

- mr-0000400Document1 pagemr-0000400videologfebNo ratings yet

- Sbi STATEMENTDocument7 pagesSbi STATEMENTlalitNo ratings yet

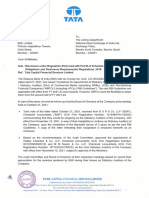

- TCFSL-BSE-NSE-Auditors IntimationsDocument3 pagesTCFSL-BSE-NSE-Auditors Intimationsvighnarthaagency2255No ratings yet

- ZerodhaDocument46 pagesZerodhaanicket kabeerNo ratings yet

- SN Engineers: Tax InvoiceDocument1 pageSN Engineers: Tax InvoiceShaikh TausifNo ratings yet

- Alice Blue Financial Services (P) LTD: Name of The ClientDocument4 pagesAlice Blue Financial Services (P) LTD: Name of The ClientPabitra Kumar PrustyNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument3 pagesCash Segment - Trade Summary Cum Bill Report For TodaySanu Moni BorahNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Tax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Document2 pagesTax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Rinku Singh RinkuNo ratings yet

- 090 PDFDocument1 page090 PDFAMIT SYSTEMNo ratings yet

- NDTL JLN STADIUM - Sept'23Document1 pageNDTL JLN STADIUM - Sept'23vineet.tpsNo ratings yet

- International Business 1st Edition Ebook PDFDocument41 pagesInternational Business 1st Edition Ebook PDFmilagros.ehrhardt872100% (35)

- LM Business Math - Q1 W6 - MELC3 Module 8Document15 pagesLM Business Math - Q1 W6 - MELC3 Module 8Cristina C MarianoNo ratings yet

- Core Abap Notes PDFDocument38 pagesCore Abap Notes PDFAneesh ShamsudeenNo ratings yet

- Ksorteberg 472 Karen Sorteberg ResumeDocument2 pagesKsorteberg 472 Karen Sorteberg Resumeapi-30051750No ratings yet

- HandbookDocument31 pagesHandbookfrkmrd7955No ratings yet

- Random Walk Model of ConsumptionDocument22 pagesRandom Walk Model of Consumptionshahid_hussain_41100% (1)

- New Dodge Chrysler Jeep Airbag Squib Spiral Cable Clock Spring 56046533ae 3 Plug EbayDocument1 pageNew Dodge Chrysler Jeep Airbag Squib Spiral Cable Clock Spring 56046533ae 3 Plug EbayJohan LorenzoNo ratings yet

- 4EC0ec 01 Que 20110606Document24 pages4EC0ec 01 Que 20110606Arif AbdullahNo ratings yet

- Innovation in Credit Card and Debit Card Business by Indian BanksDocument21 pagesInnovation in Credit Card and Debit Card Business by Indian BanksProf S P GargNo ratings yet

- Ret Walmart TiffanyDocument6 pagesRet Walmart TiffanySachinSamrajNo ratings yet

- General Cover Letter For Job FairDocument4 pagesGeneral Cover Letter For Job Fairnub0vomygun2100% (2)

- Eliciting RequirementsDocument20 pagesEliciting RequirementsVijaya AlukapellyNo ratings yet

- The Military Simulation, Modelling, and Virtual Training Market 2013-2023Document28 pagesThe Military Simulation, Modelling, and Virtual Training Market 2013-2023VisiongainGlobal100% (1)

- How To Become A Shoe DesignerDocument6 pagesHow To Become A Shoe DesignerVishnu TejaNo ratings yet

- Test Bank For Cornerstones of Managerial Accounting 5th EditionDocument24 pagesTest Bank For Cornerstones of Managerial Accounting 5th EditionDebraWrighterbis100% (47)

- Memorandum of Association OF Rehbar FoundationDocument14 pagesMemorandum of Association OF Rehbar FoundationAyaz ManiNo ratings yet

- Designing Sustainable Process Excellence: Marc GrayDocument27 pagesDesigning Sustainable Process Excellence: Marc GraychrysobergiNo ratings yet

- Company Law: Difference Between Share Holder and Debenture HolderDocument7 pagesCompany Law: Difference Between Share Holder and Debenture HolderNesanithi PariNo ratings yet

- Solution Ch05Document14 pagesSolution Ch05sovuthyNo ratings yet

- Answer of Case StudyDocument85 pagesAnswer of Case StudyAyesha KhanNo ratings yet

- FC Digital Marketing Course NewDocument28 pagesFC Digital Marketing Course Newchangerflow19No ratings yet

- Aws Security Best PracticesDocument7 pagesAws Security Best PracticesSantiago MuñozNo ratings yet

- Nube VS PemaDocument2 pagesNube VS PemaNina Grace G. ArañasNo ratings yet

- COSRECI Annual Account 2019Document21 pagesCOSRECI Annual Account 2019Tony OrtegaNo ratings yet

- Literature Review Promotional StrategiesDocument6 pagesLiterature Review Promotional Strategiesea884b2k100% (1)

- Itp For Fabn. & Erection of Structural WorksDocument4 pagesItp For Fabn. & Erection of Structural Workscrm 2No ratings yet

- Microsoft Dynamics 365 For Finance and Operations, Business EditionDocument13 pagesMicrosoft Dynamics 365 For Finance and Operations, Business EditionjoseNo ratings yet