Professional Documents

Culture Documents

Cost Accounting Quiz

Uploaded by

Hussain khawaja75%(4)75% found this document useful (4 votes)

583 views2 pagesquiz

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentquiz

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

75%(4)75% found this document useful (4 votes)

583 views2 pagesCost Accounting Quiz

Uploaded by

Hussain khawajaquiz

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

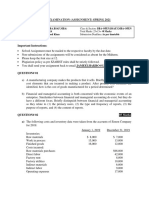

Foxwood Company is a metal- and woodcutting manufacturer, selling

products to the home construction market.

Consider the following data for 2011:

Problem for Self-Study

Sandpaper $ 2,000

Materials-handling costs 70,000

Lubricants and coolants 5,000

Miscellaneous indirect manufacturing labor 40,000

Direct manufacturing labor 300,000

Direct materials inventory Jan. 1, 2011 40,000

Direct materials inventory Dec. 31, 2011 50,000

Finished goods inventory Jan. 1, 2011 100,000

Finished goods inventory Dec. 31, 2011 150,000

Work-in-process inventory Jan. 1, 2011 10,000

Work-in-process inventory Dec. 31, 2011 14,000

Plant-leasing costs 54,000

Depreciation—plant equipment 36,000

Property taxes on plant equipment 4,000

Fire insurance on plant equipment 3,000

Direct materials purchased 460,000

Revenues 1,360,000

Marketing promotions 60,000

Marketing salaries 100,000

Distribution costs 70,000

Customer-service costs 100,000

1. Prepare an income statement with a separate supporting schedule of

cost of goods manufactured. For all manufacturing items, classify costs

as direct costs or indirect costs and indicate by V or F whether each is

basically a variable cost or a fixed cost (when the cost object is a product

unit). If in doubt, decide on the basis of whether the total cost will

change substantially over a wide range of units produced.

2. Suppose that both the direct material costs and the plant-leasing costs

are for the production of 900,000 units. What is the direct material cost

of each unit produced? What is the plant-leasing cost per unit? Assume

that the plant-leasing cost is a fixed cost.

3. Suppose Foxwood Company manufactures 1,000,000 units next year.

Repeat the computation in requirement 2 for direct materials and plant-

leasing costs. Assume the implied cost-behavior patterns persist.

4. As a management consultant, explain concisely to the company

president why the unit cost for direct materials did not change in

requirements 2 and 3 but the unit cost for plant-leasing costs did change

You might also like

- Foxwood Company Income Statement and Cost of Goods ManufacturedDocument3 pagesFoxwood Company Income Statement and Cost of Goods Manufacturedbharteshdas100% (2)

- Maximizing Profits from Running FestivalDocument17 pagesMaximizing Profits from Running FestivalAdnan SiddiquiNo ratings yet

- MBA641 Managerial Accounting Case Study #3Document3 pagesMBA641 Managerial Accounting Case Study #3risvana rahimNo ratings yet

- Ch09 Inventory Costing and Capacity AnalysisDocument13 pagesCh09 Inventory Costing and Capacity AnalysisChaituNo ratings yet

- ACC 311 Exam 3 Review KeyDocument7 pagesACC 311 Exam 3 Review KeySummerNo ratings yet

- Intermediate AccountingDocument60 pagesIntermediate AccountingResky Andika YuswantoNo ratings yet

- Standard Costing Variance AnalysisDocument95 pagesStandard Costing Variance AnalysisErika Villanueva MagallanesNo ratings yet

- Chapter 7 Problems PDFDocument18 pagesChapter 7 Problems PDFArham Sheikh100% (1)

- All Intermediate ChapterDocument278 pagesAll Intermediate ChapterNigus AyeleNo ratings yet

- Chapter 08Document18 pagesChapter 08hana_kimi_91No ratings yet

- MANAGEMENT ACCOUNTING ASSIGNMENTDocument7 pagesMANAGEMENT ACCOUNTING ASSIGNMENTmuhammad Ammar Shamshad100% (2)

- Accounting For Materials 1Document24 pagesAccounting For Materials 1Charles Reginald K. HwangNo ratings yet

- Cost Accounting Systems A. Traditional Cost Accounting TheoriesDocument47 pagesCost Accounting Systems A. Traditional Cost Accounting TheoriesalabwalaNo ratings yet

- 2b. Manufacturing Overhead CR PDFDocument15 pages2b. Manufacturing Overhead CR PDFpoNo ratings yet

- International Business Administration ExamDocument14 pagesInternational Business Administration ExamkipkingleNo ratings yet

- Cost Accounting QUIZDocument4 pagesCost Accounting QUIZMJ YaconNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- June 1, 2007 June 30, 2007Document2 pagesJune 1, 2007 June 30, 2007አረጋዊ ሐይለማርያምNo ratings yet

- Accounting and Finance Case Study for Manufacturing CompanyDocument3 pagesAccounting and Finance Case Study for Manufacturing CompanySiraj Mohammed75% (4)

- Process Costing and Hybrid Product-Costing SystemsDocument17 pagesProcess Costing and Hybrid Product-Costing SystemsWailNo ratings yet

- Exercises On Job-Order CostingDocument4 pagesExercises On Job-Order CostinggsdhNo ratings yet

- Application of Marginal Costing in Decision Making-Questions Example 1: Make or BuyDocument3 pagesApplication of Marginal Costing in Decision Making-Questions Example 1: Make or BuyDEVINA GURRIAHNo ratings yet

- Job Costing CADocument13 pagesJob Costing CAmiranti dNo ratings yet

- Breakeven Analysis PDFDocument16 pagesBreakeven Analysis PDFTeja VenkatNo ratings yet

- CSU-Andrews Cost Management Quiz 1Document4 pagesCSU-Andrews Cost Management Quiz 1Wynie AreolaNo ratings yet

- Tarea 4Document2 pagesTarea 4Luisa Martinez Mateos100% (1)

- Chapter 2-Multi-Product CVP AnalysisDocument53 pagesChapter 2-Multi-Product CVP AnalysisAyeNo ratings yet

- Advanced Cost and Management Control CourseDocument4 pagesAdvanced Cost and Management Control CourseGetachew Mulu100% (1)

- ABC Costing Guide for Managerial Accounting ToolsDocument3 pagesABC Costing Guide for Managerial Accounting Toolssouayeh wejdenNo ratings yet

- Latihan Target CostingDocument7 pagesLatihan Target CostingAlvira FajriNo ratings yet

- Differential Analysis Key to Decision MakingDocument18 pagesDifferential Analysis Key to Decision MakingYesaya SetiawanNo ratings yet

- 01 Full CH Cost and Management Accounting Chapter 1 Copy 1Document200 pages01 Full CH Cost and Management Accounting Chapter 1 Copy 1sabit hussenNo ratings yet

- Ch.12 FOH Carter.14thDocument40 pagesCh.12 FOH Carter.14thMuhammad Aijaz KhanNo ratings yet

- Job-Order Costing: Calculating Predetermined Overhead RatesDocument76 pagesJob-Order Costing: Calculating Predetermined Overhead RatesMulugeta GirmaNo ratings yet

- 2nd Revised PC-I For Shahhbaz Sharif General Hospital MultanDocument22 pages2nd Revised PC-I For Shahhbaz Sharif General Hospital Multanafshan arshadNo ratings yet

- Chapter 5 NotesDocument6 pagesChapter 5 NotesXenia MusteataNo ratings yet

- Managerial Accounting AssignmentDocument7 pagesManagerial Accounting AssignmentBedri M Ahmedu100% (1)

- Individual Assignment Cost and Management AccountDocument4 pagesIndividual Assignment Cost and Management AccountSahal Cabdi Axmed100% (1)

- Cost Accounting IIDocument62 pagesCost Accounting IIShakti S SarvadeNo ratings yet

- Miranda, Sweet (FactoryOverhead)Document5 pagesMiranda, Sweet (FactoryOverhead)Sweet Jenesie MirandaNo ratings yet

- 18 x12 ABC ADocument12 pages18 x12 ABC AKM MacatangayNo ratings yet

- Chapter 9 - Inventory Costing and Capacity AnalysisDocument40 pagesChapter 9 - Inventory Costing and Capacity AnalysisBrian SantsNo ratings yet

- Journal Entries for Accounting AdjustmentsDocument18 pagesJournal Entries for Accounting AdjustmentsJavid BalakishiyevNo ratings yet

- 8MAS 08 ABC Balanced Scorecard ModuleDocument4 pages8MAS 08 ABC Balanced Scorecard ModuleKathreen Aya ExcondeNo ratings yet

- Chapter 7 AbcDocument5 pagesChapter 7 AbcAyu FaridYaNo ratings yet

- Chapter 6 Activity Based CostingDocument1 pageChapter 6 Activity Based CostingKaren Cael100% (1)

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- CH 11Document51 pagesCH 11Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- Cost Accounting Techniques Adopted by Manufacturing and Service IndustryDocument14 pagesCost Accounting Techniques Adopted by Manufacturing and Service IndustryDaniel Randolph100% (1)

- TM 7 AklDocument6 pagesTM 7 AklSyam NrNo ratings yet

- Profitability of Products and Relative ProfitabilityDocument5 pagesProfitability of Products and Relative Profitabilityshaun3187No ratings yet

- Management Accounting Cost Sheet AnalysisDocument3 pagesManagement Accounting Cost Sheet AnalysisRachit SrivastavaNo ratings yet

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Foxwood Company 2014 financial dataDocument2 pagesFoxwood Company 2014 financial dataVermuda VermudaNo ratings yet

- Foxwood Company Data For 2014Document3 pagesFoxwood Company Data For 2014Vermuda VermudaNo ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- BOND-MARKET INDEXES Allocation of MarketDocument38 pagesBOND-MARKET INDEXES Allocation of MarketHussain khawajaNo ratings yet

- Interest Rate Risk ConditionsDocument39 pagesInterest Rate Risk ConditionsHussain khawajaNo ratings yet

- Behavioral Biases in Financial Decision Making: Bachelor Thesis FinanceDocument28 pagesBehavioral Biases in Financial Decision Making: Bachelor Thesis FinanceHussain khawajaNo ratings yet

- Psychological Factors On Irrational Financial Decision MakingDocument22 pagesPsychological Factors On Irrational Financial Decision MakingHussain khawajaNo ratings yet

- Household Financial Management: The Connection Between Knowledge and BehaviorDocument14 pagesHousehold Financial Management: The Connection Between Knowledge and BehaviorAnonymous XhhuYMWNo ratings yet

- Money Market HedgeingDocument19 pagesMoney Market HedgeingHussain khawajaNo ratings yet

- Mentoring Overcoming: Women in Academic Surgery: Institutional Barriers To SuccessDocument4 pagesMentoring Overcoming: Women in Academic Surgery: Institutional Barriers To SuccessHussain khawajaNo ratings yet

- Impactof Financial Literacyand Investment Experienceon RisktoleranceandinvestmentdecisionsDocument7 pagesImpactof Financial Literacyand Investment Experienceon RisktoleranceandinvestmentdecisionsHussain khawajaNo ratings yet

- Research PBM PDFDocument11 pagesResearch PBM PDFHussain khawajaNo ratings yet

- Advance Research SectionDocument5 pagesAdvance Research SectionHussain khawajaNo ratings yet

- Bligh 2011Document38 pagesBligh 2011Hussain khawajaNo ratings yet

- Selfcontrol Bias 2015Document12 pagesSelfcontrol Bias 2015Hussain khawajaNo ratings yet

- Heuristics and Biases in Financial Investment DecisionsDocument20 pagesHeuristics and Biases in Financial Investment DecisionsQamarulArifinNo ratings yet

- Making The Invisible Visible: A Cross-Sector Analysis of Gender-Based Leadership BarriersDocument26 pagesMaking The Invisible Visible: A Cross-Sector Analysis of Gender-Based Leadership BarriersHussain khawajaNo ratings yet

- Does Female Representation in Top Management Improve Firm Performance? A Panel Data InvestigationDocument18 pagesDoes Female Representation in Top Management Improve Firm Performance? A Panel Data InvestigationHussain khawajaNo ratings yet

- BondDocument6 pagesBondHussain khawajaNo ratings yet

- Women'S Union Leadership: Closing The Gender Gap: T J L SDocument17 pagesWomen'S Union Leadership: Closing The Gender Gap: T J L SHussain khawajaNo ratings yet

- Gender differences in the influence of cooperative climate elements on leadership aspirationDocument14 pagesGender differences in the influence of cooperative climate elements on leadership aspirationHussain khawajaNo ratings yet

- What is a Market and its Key CharacteristicsDocument19 pagesWhat is a Market and its Key CharacteristicsHussain khawajaNo ratings yet

- Systematic Analysis of School MGTDocument25 pagesSystematic Analysis of School MGTHussain khawajaNo ratings yet

- Not Yet 50/50' - Barriers To The Progress of Senior Women in The Australian Public ServiceDocument10 pagesNot Yet 50/50' - Barriers To The Progress of Senior Women in The Australian Public ServiceHussain khawajaNo ratings yet

- Add Women, Transform Academe: Barbara A. Baker and Paula BobrowskiDocument3 pagesAdd Women, Transform Academe: Barbara A. Baker and Paula BobrowskiHussain khawajaNo ratings yet

- FRM Lecture 2Document26 pagesFRM Lecture 2Hussain khawajaNo ratings yet

- What is a Market and its Key CharacteristicsDocument19 pagesWhat is a Market and its Key CharacteristicsHussain khawajaNo ratings yet

- Chapter 4 Turning PointDocument30 pagesChapter 4 Turning PointHussain khawajaNo ratings yet

- Merger, Acquisition & Corporate RestructuringDocument23 pagesMerger, Acquisition & Corporate RestructuringHussain khawajaNo ratings yet

- Chapter5 Index NumberDocument19 pagesChapter5 Index NumberHussain khawajaNo ratings yet