Professional Documents

Culture Documents

QP 1

Uploaded by

Shankar Reddy0 ratings0% found this document useful (0 votes)

94 views7 pagesctp

Original Title

QP-1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentctp

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

94 views7 pagesQP 1

Uploaded by

Shankar Reddyctp

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

Test Series: August, 2018

MOCK TEST PAPER – 1

INTERMEDIATE (IPC) COURSE

PAPER – 4: TAXATION

Time Allowed – 3 Hours Maximum Marks – 100

SECTION – A: INCOME TAX (50 MARKS)

Question No. 1 is compulsory

Attempt any four questions from the remaining five questions

Working Notes should form part of the answer. Wherever necessary, suitable assumptions may be made by

the candidates and disclosed by way of a note.

Your answers should be based on the provisions of Income-tax law as amended

by the Finance Act, 2017. The relevant assessment year is A.Y.2018-19.

1. Dr. Kumar is running a clinic in Delhi. His Income and Expenditure account for the financial year

ended 31-03-2018 is given below:

Expenditure Amount Income Amount

(Rs.) (Rs.)

To Staff salary 4,30,000 By Fee receipts 12,63,600

To Consumables 14,750 By Dividend from an Indian 15,000

Company

To Medicine consumed 3,69,800 By Winning from lotteries (Net 28,000

of TDS)

To Depreciation 91,000 By Income-tax refund 2,750

To Administrative expenses 1,51,000 By Honorarium for lectures at 24,000

seminars

To Rent of clinic 20,000

To Donation to Prime Minister’s 5,000

National Children’s Fund

Children’s Fund

To Excess of income over

expenditure 2,51,800

Total 13,33,350 Total 13,33,350

Other Information:

(1) Depreciation in respect of all assets has been computed at Rs. 50,000 as per Income-tax

Rules, 1962

(2) Medicines consumed include cost of medicine for self and family of Rs. 25,000 and for treating

poor patients of Rs. 24,000 from whom he did not charge any fee either

(3) Salary includes Rs. 15,000 paid in cash to a computer specialist who computerized his

patient’s data in October, 2017.

(4) Donation to Prime Minister’s National Children’s Fund has been made by way of a crossed cheque.

(5) He has paid a sum of Rs. 25,000 for Life Insurance Policy (Sum assured Rs. 2,00,000) of

himself, which was taken on 1-07-2012.

© The Institute of Chartered Accountants of India

(6) He has sold a land in August, 2017 for Rs. 12,00,000, the stamp duty value of which was

Rs. 14,00,000 on that date. The land was acquired by him in May, 2001 for Rs. 4,00,000.

(7) He has paid Rs. 4,000 for purchase of lottery tickets, which has not been debited to Income

and Expenditure account.

(8) He also contributed Rs. 1,20,000 towards Public Provident Fund.

(9) Dr. Kumar also paid interest of Rs. 10,000 on loan taken for higher education of his daughter.

You are required to compute the total income and tax payable by Dr. Kumar for the Assessment

Year 2018-19.

Cost Inflation Index: F.Y. 2001-2002 - 100, F.Y. 2017-18 - 272 (10 Marks)

2. (a) Mr. Shiva purchased a house property on February 15, 1979 for Rs. 3,24,000. In addition, he

has also paid stamp duty value @10% on the stamp duty value of Rs. 3,50,000.

In April, 2007, Mr. Shiva entered into an agreement with Mr. Mohan for sale of such property

for Rs. 14,35,000 and received an amount of Rs. 1,11,000 as advance. However, the sale

consideration did not materialize and Mr. Shiva forfeited the advance. In May 2014, He entered

into an agreement for sale of said house for Rs. 20,25,000 to Ms. Deepshikha and received

Rs. 1,51,000 as advance. However, as Ms. Deepshikha did not pay the balance amount,

Mr. Shiva forfeited the advance. In August, 2014, Mr. Shiva constructed the first floor by

incurring a cost of Rs. 3,90,000.

On November 15, 2017, Mr. Shiva entered into an agreement with Mr. Manish for sale such

house for Rs. 30,50,000 and received an amount of Rs. 1,50,000 as advance through an

account payee cheque. Mr. Manish paid the balance entire sum and Mr. Shiva transfer the

house to Mr. Manish on February 20, 2018. Mr. Shiva has paid the brokerage @1% of sale

consideration to the broker.

The fair market value of the house property on April 1, 1981 was Rs. 4,00,000. The fair market

value of the house property on April 1, 2001 was Rs. 10,70,000. Valuation as per Stamp duty

Authority of such house on 15 November, 2017 was Rs. 30,00,000 and on 20 February, 2018

was Rs. 32,00,000.

Compute the capital gains in the hands of Mr. Shiva for A.Y.2018-19.

CII for F.Y. 2001-02: 100; F.Y. 2007-08: 129; F.Y. 2014-15: 240; F.Y. 2017-18: 272. (7 Marks)

(b) Explain the difference between Circulars and Notifications in the context to the Income-tax

Act, 1961. (3 Marks)

3. (a) Mr. Shashank is an employee of KML (P) Ltd. drawing a monthly salary of Rs. 30,000. He

provides you the following information for the previous year 2017-18:

(i) He had a fixed deposit of Rs. 4,00,000 with State Bank of India with interest @10%. He

instructed bank to credit such interest on deposit to the saving account of Mr. Ram, his

sister’s son, to help him in his higher education.

(ii) He gifted a flat to Mrs. Kajal (wife of Mr. Shashank) on April 1, 2017. During the previous

year 2017-18, she received a rent of Rs. 20,000 p.m. from letting out the flat.

(iii) He gifted Rs. 10,00,000 to Mrs. Kajal on 1 st April, 2017 which Mrs. Kajal invested in her

business on the same day. Capital in the business before such investment was

Rs. 20,00,000. She earned profits from business for the financial year 2017-18 of

Rs. 9,00,000.

(iv) His minor son Sandeep earned income from company deposit of Rs. 1,50,000.

Mr. Shashank and Mrs. Kajal do not have any other income during the P.Y. 2017-18. Compute

the total income of Mr. Shashank and Mrs. Kajal for A.Y. 2018-19. (6 Marks)

© The Institute of Chartered Accountants of India

(b) Examine the taxability or otherwise of the following independent transactions as per the

provisions of section 56 of the Income-tax Act, 1961 for the Assessment year 2018-19.

(i) Mrs. Meenakshi has received cash gifts aggregating of Rs. 2 lakhs from several friends

and relatives on her birthday. Each cash gift ranges from Rs. 500 to Rs. 1,000.

(ii) Mr. Krishna has received an immovable property, the stamp duty value of which is

Rs. 10 lakhs as per a WILL executed by Mrs. Chandraben on her death.

(iii) Mr. King has received an immovable property at Kilkanur Village from Mr. Prince as a

gift. The stamp duty value of the property is Rs. 75,000

(iv) Mrs. Vijaya has gifted diamonds valued at Rs. 1 lakh to Mrs. Preethi, her sister's

daughter-in-law on her birthday. (4 Marks)

4. Miss Kaira, an American national, got married to Mr. Ramesh of India in USA on 1.03.2017 and

came to India for the first time on 20.03.2017. She left for USA on 20.9.2017. She returned to India

again on 27.03.2018. She has earned the following income during the financial year 2017-18.

Sr. Particulars Amount

No. (Rs.)

1. Dividend from American company, received in America 20,000

2. Profits from a profession in Delhi, but managed directly from America 50,000

3. Long term capital gain on sale of shares of an Indian company, received 60,000

in India

4. Interest on savings bank deposit in SBI, Delhi 17,000

5. Agricultural income from a land situated in Tamilnadu 55,000

6. Rent (computed) from property in America deposit in a Bank there, later 1,00,000

on remitted to India

7. Cash gift received from a friend on her birthday on 16.8.2017 51,000

8. Past foreign untaxed income brought to India 70,000

Determiner her residential status and compute the total income chargeable to tax for the

Assessment Year 2018-19. (10 Marks)

5. (a) The Gross Total Income of Mr. Bharadwaj, a resident, for the year ended 31-03-2018 is

Rs. 15 lakhs. Examine the allowability of the deduction to Mr. Bharadwaj from the following

information.

(i) He has contributed Rs. 2 lakh towards Clean Ganga Fund set up by the Central

Government

(ii) He has incurred medical expenditure of Rs. 50,000 towards surgery for his grandmother

who is 85 years of age. (No Premium is paid to keep in force an insurance on her health).

(3 Marks)

(b) From the following information of Ms. Kareena, born on 16th

August, 1975, an Indian resident,

you are required to compute total income and tax payable by Ms. Kareena for the Assessment

Year 2018-19.

Particulars Rs.

Long-term capital gains on sale of house 1,50,000

Short-term capital gains on sale of shares in B Pvt. Ltd. 50,000

Loss from house property 3,50,000

© The Institute of Chartered Accountants of India

Interest from saving account in post office 15,000

Prize winning from a T.V. show (Gross) 20,000

Business income 5,50,000

Net agricultural income 1,10,000

LIC premium for self and husband 70,000

Tuition fees to University for full time education of her daughter 50,000

(7 Marks)

6. (a) Pertaining to the following transactions, what is the minimum amount above which quoting

Permanent Account Number is mandatory?

(i) Opening a demat account with a depository

(ii) Purchase of bank draft from a banking company

(iii) Payment for purchase of any foreign currency at any one time.

(iv) Payment to a company for acquiring debentures issued by it.

(v) Payment as life insurance premium to an insurer (5 Marks)

OR

(a) Briefly mention the provisions of the Income-tax Act with regard to the Quoting of Aadhar

Number under section 139AA. (5 Marks)

(b) Examine the applicability of TDS provisions, if any, to be deducted in the following cases:

(i) Payment of fee for professional services of Rs. 20,000 and royalty of Rs. 27,000 to Ms.

Kajal, who is having PAN. (2 Marks)

(ii) Payment of Rs. 1,05,000 made to Mr. Ram for purchase of calendars made according to

specifications of M/s XYZ Ltd. However, no material was supplied for such calendars to

Mr. Ram by M/s XYZ Ltd. (2 Marks)

(iii) Rent paid for plant and machinery Rs. 1,70,000 by a partnership firm having sales

turnover of Rs. 49,00,000 and net loss of Rs. 15,000. (1 Mark)

© The Institute of Chartered Accountants of India

SECTION B - INDIRECT TAXES (50 MARKS)

QUESTIONS

Question no. 1 is compulsory. Attempt any four questions out of the remaining five questions.

(i) Working Notes should form part of the answers.

(ii) Wherever necessary, suitable assumptions may be made by the candidates, and disclosed by way of note.

(iii) All questions should be answered on the basis of the position of GST law as amended up to 30th April, 2018.

(iv) The GST rates for goods and services mentioned in various questions are hypothetical and may not

necessarily be the actual rates leviable on those goods and services. Further, GST compensation cess

should be ignored in all the questions, wherever applicable.

1. (a) Mr. Bholenath, a registered supplier of goods, pays GST under regular scheme and provides the

following information for the month of January, 20XX:

Particulars (Rs.)

(i) Inter-state taxable supply of goods 10,00,000

(ii) Intra state taxable supply of goods 2,00,000

(iii) Intra state purchase of taxable goods 5,00,000

He has the following input tax credit at the beginning of January 20XX:

Nature ITC Amount in (Rs.)

CGST 20,000

SGST 30,000

lGST 25,000

Rate of CGST, SGST and IGST are 9%, 9% and 18% respectively.

Both inward and outward supplies are exclusive of taxes wherever applicable.

All the conditions necessary for availing the ITC have been fulfilled. Compute the net GST payable by

Mr. Bholenath for the month of January, 20XX. (6 Marks)

(b) Shridhar Co. Ltd., a registered supplier, is engaged in the manufacture of heavy machinery. It

procured the following items during the month of March.

S. No. Items GST paid

(Rs.)

(i) Sweets for consumption of employees working in the factory 50,000

(ii) Raw material 1,00,000

(iii) Trucks used for the transport of raw material 2,00,000

(iv) Electrical transformers to be used in the manufacturing process 4,00,000

Determine the amount of input tax credit available with Shridhar Co. Ltd., for the month of March

by giving necessary explanations for treatment of various items.

Note: All the conditions necessary for availing the input tax credit have been fulfilled. (4 Marks)

2. (a) A manufacturer of machinery supplied a special machine to Modern Furnishers. Following details

are provided in relation to amounts charged:

S. No. Particulars Rs.

(i) Price of machinery excluding taxes (before cash discount) 5,00,000

5

© The Institute of Chartered Accountants of India

Additional charges not included above:-

(ii) Freight 13,000

(iii) Packing charges 10,000

(iv) Charges for designing the machine 17,000

Other information furnished is -

(a) Cash discount @ 2% on price of machinery has been allowed to the customer at the time of

supply and also recorded in invoice.

(b) GST rate – 18%.

Calculate value of supply of the special machine. (5 Marks)

(b) Explain the conditions necessary for obtaining input tax credit? (5 Marks)

3. (a) Examine whether GST is exempted on the following independent supply of services:

(i) Relax & Co, a tour operator, provides services to a foreign tourist for tour conducted in Kerala

and receives a sum of Rs. 1,50,000.

(ii) Ms. Sneha acts as a Coach for Indian Sports League (ISL), a recognised sports body, for a Tennis

tournament organised by Superb retail company and received a remuneration of Rs. 4,00,000.

(6 Marks)

(b) Gupta & Sons, a registered supplier, paying tax under normal scheme is a wholesale supplier of

ready-made garments located in Bandra, Mumbai. On 5th September, 20XX, Mohini, owner of

Charming Boutique located in Dadar, Mumbai, approached Gupta & Sons for supply of a

consignment of customised dresses for ladies and kids.

Gupta & Sons gets the consignment ready by 2nd December, 20XX and informs Mohini about the

same. The invoice for the consignment was issued the next day, 3 rd December, 20XX.

Due to some reasons, Mohini could not collect the consignment immediately. So, she collects the

consignment from the premises of Gupta & Sons on 18th December, 20XX and hands over the

cheque for payment on the same date. The said payment is entered in the accounts on

20th December, 20XX and amount is credited in the bank account on 21st December, 20XX.

You are required to determine the time of supply of the readymade garments supplied by Gupta &

Sons to Mohini elaborating the relevant provisions under the GST law. (4 Marks)

4. (a) When shall the interest be payable by a registered person under section 50 of the CGST Act, 2017

and what is the maximum rate of interest chargeable for the same? (4 Marks)

(b) Who is required to furnish Final Return under CGST Act, 2017 and what is the time limit for the

same? Discuss. (3 Marks)

(c) Does cancellation of registration impose any tax obligations on the person whose registration is so

cancelled? Discuss. (3 Marks)

5. (a) Sangam Ltd., obtains registration for paying taxes under section 9 of CGST Act. He asked his tax

manager to pay taxes on quarterly basis. However, Sangam Ltd.’s tax manager advised the

Company to pay taxes on monthly basis. You are required to examine the validity of the advice

given by tax manager? (4 Marks)

(b) Mr. Akash Malhotra of Gujarat often participates in the jewellery exhibition at Trade Fair in Delhi,

which is organised every year in the month of February. Mr. Akash Malhotra applied for registration

in January. The proper officer demanded an advance deposit of tax in an amount equivalent to the

estimated tax liability of Mr. Akash Malhotra.

© The Institute of Chartered Accountants of India

You are required to examine whether any advance tax is to be paid by Mr. Akash Malhotra at the

time of obtaining registration? (4 Marks)

(c) Discuss any two functions of GSTN. (2 Marks)

6. (a) Examiner whether the following statements are true or false giving brief reasons:

(1) A composition tax payer, who has not rendered any taxable supply during a quarter, is not

required to file any return.

(2) It is mandatory to issue a tax invoice in case a registered person has opted for composition

levy scheme. (2 x 3 = 6 Marks)

(b) Examine whether the following activities would amount to supply under section 7 of the CGST Act:

(i) Shri Ram Charitable Trust, a trust that gets the neuro treatment of underprivileged children

done free of cost, donates clothes and food to children living in slum area.

(ii) Simran is a beauty consultant in Mumbai. Her brother who is settled in Paris is a well-known

lawyer. Simran has taken legal advice from him free of cost with regard to her family dispute.

(4 Marks)

© The Institute of Chartered Accountants of India

You might also like

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilNo ratings yet

- Revision Sheet - PP1 - NPO - AkDocument6 pagesRevision Sheet - PP1 - NPO - AkayeshaNo ratings yet

- MTP 1Document7 pagesMTP 1Aman VithlaniNo ratings yet

- 4) TaxationDocument21 pages4) TaxationKrushna MateNo ratings yet

- QP 2 PDFDocument7 pagesQP 2 PDFShankar ReddyNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Document36 pagesCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNo ratings yet

- 16UCO5MC03Document4 pages16UCO5MC03Ñìkíl G KårølNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- Ca Final RTP May 2014 IndiaDocument7 pagesCa Final RTP May 2014 IndiaNIKHILESH9No ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDocument3 pagesBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Assignment 1 For MBA 2020Document10 pagesAssignment 1 For MBA 2020Sichen UpretyNo ratings yet

- Income Tax II Illustration Computation of Total Income PDFDocument7 pagesIncome Tax II Illustration Computation of Total Income PDFSubramanian SenthilNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- Taxation of Individuals QuestionsDocument2 pagesTaxation of Individuals QuestionsPerpetua KamauNo ratings yet

- Term Test 2Document5 pagesTerm Test 2lalshahbaz57No ratings yet

- Edu Ex .: Crack It in First Attempt!!!Document3 pagesEdu Ex .: Crack It in First Attempt!!!umang24No ratings yet

- NullDocument5 pagesNullAshar HammadNo ratings yet

- Aa 498 AssignmentDocument2 pagesAa 498 AssignmentMeena SinghNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- Total Computation QB by CA Pranav ChandakDocument37 pagesTotal Computation QB by CA Pranav ChandakSurajNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Ts Grewal Solutions For Class 11 Account Chapter 16 MinDocument43 pagesTs Grewal Solutions For Class 11 Account Chapter 16 MinSofiya YaseenNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- Test Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingDocument4 pagesTest Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingabhimanyuNo ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Test Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationDocument6 pagesTest Series: October, 2018 Mock Test Paper - 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws & International TaxationRobinxyNo ratings yet

- Grooming Education Academy (Pioneer in Developing Concepts)Document5 pagesGrooming Education Academy (Pioneer in Developing Concepts)dishaNo ratings yet

- Paper 4 Taxation For Nov 2011Document51 pagesPaper 4 Taxation For Nov 2011ACHAL JAINNo ratings yet

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainNo ratings yet

- IPCC Mock Test Taxation - Only Question - 25.09.2018Document5 pagesIPCC Mock Test Taxation - Only Question - 25.09.2018KaustubhNo ratings yet

- Sutlej Public SR Sec School Annual Examination (Session 2021-22) Class Xi Commerce Subject: Accountancy TIME: 2 Hours MM 40Document4 pagesSutlej Public SR Sec School Annual Examination (Session 2021-22) Class Xi Commerce Subject: Accountancy TIME: 2 Hours MM 40mnmehta1990No ratings yet

- Correct AnswerDocument20 pagesCorrect AnswerToji ThomasNo ratings yet

- CS 3Document12 pagesCS 3Mallika VermaNo ratings yet

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- Accounts - First Half TestDocument4 pagesAccounts - First Half TestPeriyanan VNo ratings yet

- 12 Term t2 AccountancyDocument17 pages12 Term t2 AccountancySIFANA ARIMANICHOLA100% (1)

- Taxation Mid Term Paper Fall 2020Document3 pagesTaxation Mid Term Paper Fall 2020umar khanNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- 12 Account SP 01 PDFDocument24 pages12 Account SP 01 PDFJanvi KushwahaNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- BS 6th Taxation Final Term PaperDocument3 pagesBS 6th Taxation Final Term PaperFarjad AliNo ratings yet

- Final Que 7Document25 pagesFinal Que 7Adhira VenkatNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Strengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceFrom EverandStrengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceNo ratings yet

- Emerging Trends in Digital MarketingDocument18 pagesEmerging Trends in Digital MarketingShankar ReddyNo ratings yet

- 3056 - Government First Grade College, Halebeedu Internal Marks - Dec 2019Document11 pages3056 - Government First Grade College, Halebeedu Internal Marks - Dec 2019Shankar ReddyNo ratings yet

- BRM - SyllabusDocument1 pageBRM - SyllabusShankar ReddyNo ratings yet

- 2019-20 FB Report and APDocument18 pages2019-20 FB Report and APShankar ReddyNo ratings yet

- Concept of Indirect Tax in IndiaDocument16 pagesConcept of Indirect Tax in IndiaShankar ReddyNo ratings yet

- National Corporate Governance PolicyDocument25 pagesNational Corporate Governance PolicyNandan MaluNo ratings yet

- 2018-19 Feedback ReportsDocument3 pages2018-19 Feedback ReportsShankar ReddyNo ratings yet

- Ifm - TheoremsDocument7 pagesIfm - TheoremsShankar ReddyNo ratings yet

- GST - Practice Pointer IssuesDocument58 pagesGST - Practice Pointer IssuesShankar ReddyNo ratings yet

- InsuranceDocument58 pagesInsuranceShankar ReddyNo ratings yet

- CTP-5 Ans PDFDocument54 pagesCTP-5 Ans PDFShankar ReddyNo ratings yet

- Designing A Global Financing StrategyDocument23 pagesDesigning A Global Financing StrategyShankar ReddyNo ratings yet

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyNo ratings yet

- List of Chapters: SL No Chapters NumbersDocument4 pagesList of Chapters: SL No Chapters NumbersShankar ReddyNo ratings yet

- Calender of EventsDocument89 pagesCalender of EventsShankar ReddyNo ratings yet

- Present Value TablesDocument2 pagesPresent Value TablesFreelansir100% (1)

- Capital StructureDocument14 pagesCapital StructureShankar ReddyNo ratings yet

- Benefits of GST To The Indian EconomyDocument6 pagesBenefits of GST To The Indian EconomyShankar ReddyNo ratings yet

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyNo ratings yet

- NPV Versus IrrDocument5 pagesNPV Versus IrrAmitNo ratings yet

- Syll 2015-16Document40 pagesSyll 2015-16yathishaNo ratings yet

- Calender of EventsDocument89 pagesCalender of EventsShankar ReddyNo ratings yet

- BBM Course Curriculum and Syllabus-2014!11!1Document23 pagesBBM Course Curriculum and Syllabus-2014!11!1darshanNo ratings yet

- 01Document126 pages01Shankar ReddyNo ratings yet

- HrmsDocument1 pageHrmsShankar ReddyNo ratings yet

- MIS006: Form KFC 62 B: Hosakote 2016-2017 01 - Government FebruaryDocument2 pagesMIS006: Form KFC 62 B: Hosakote 2016-2017 01 - Government FebruaryShankar ReddyNo ratings yet

- First Case Law On GSTDocument4 pagesFirst Case Law On GSTShankar ReddyNo ratings yet

- Analysis and Interpretation: Table 4.1 Comparative Income Statement For March Ending 2011 and March Ending 2012Document32 pagesAnalysis and Interpretation: Table 4.1 Comparative Income Statement For March Ending 2011 and March Ending 2012Shankar ReddyNo ratings yet

- Hays County Tax Ceiling For Age 65 Plus and Disabled ResidentsDocument1 pageHays County Tax Ceiling For Age 65 Plus and Disabled ResidentsCrit John KennedyNo ratings yet

- 68 BALAGTAS Quezon City vs. BayantelDocument2 pages68 BALAGTAS Quezon City vs. BayantelEins BalagtasNo ratings yet

- W TCRL 2 Di 4 N 1 MujbzDocument10 pagesW TCRL 2 Di 4 N 1 MujbzKiran KumarNo ratings yet

- Taxation Exam: MidtermDocument33 pagesTaxation Exam: MidtermSim BelsondraNo ratings yet

- NPS Contribution Instruction Slip (NCIS)Document1 pageNPS Contribution Instruction Slip (NCIS)Vijaya Krishna PondalaNo ratings yet

- Tax 1 Cases On Allowable DeductionsDocument45 pagesTax 1 Cases On Allowable DeductionsREJFREEFALLNo ratings yet

- Case 3 - Andy 2015Document14 pagesCase 3 - Andy 2015api-306226330No ratings yet

- Michael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa ArimaDocument2 pagesMichael Nedd/ Theophilus Nedd 4 Bayleaf Court Santa Rosa Arimamichael neddNo ratings yet

- 6) CaliforniaALL 2008 Tax ReturnDocument21 pages6) CaliforniaALL 2008 Tax ReturnCaliforniaALLExposedNo ratings yet

- Graphic Is Ed Cheque - FINALDocument2 pagesGraphic Is Ed Cheque - FINALdennismyoNo ratings yet

- CAM-Accounting For Income Taxes - Nike 2020 10KDocument1 pageCAM-Accounting For Income Taxes - Nike 2020 10KnofeNo ratings yet

- MC WhitePaper GlobalPaymentsPlaybook 201801 v3 ReducedDocument16 pagesMC WhitePaper GlobalPaymentsPlaybook 201801 v3 ReducedKeshav JhaNo ratings yet

- 700 Vocab PDF Antonym and Synonym 86Document4 pages700 Vocab PDF Antonym and Synonym 86Bhola KumarNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- Dpsnorth FeeDocument1 pageDpsnorth FeeJanaki KrishnanNo ratings yet

- Chapter1-Taxes and DefinitionsDocument37 pagesChapter1-Taxes and DefinitionsSohael Adel AliNo ratings yet

- Taxation Law Bar Questions 06-14Document49 pagesTaxation Law Bar Questions 06-14CarmeloNo ratings yet

- China Banking Corporation Vs - Cir GR NO. 172509Document12 pagesChina Banking Corporation Vs - Cir GR NO. 172509Lyka Dennese SalazarNo ratings yet

- RMC No. 13-2024 - Accounting and Tax Treatment of Retirement Benefits ExpenseDocument10 pagesRMC No. 13-2024 - Accounting and Tax Treatment of Retirement Benefits ExpenseAnostasia NemusNo ratings yet

- Cash DiscountsDocument9 pagesCash DiscountsRahul JainNo ratings yet

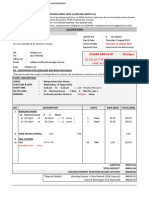

- Gmak Engg Proforma InvoiceDocument1 pageGmak Engg Proforma Invoicegmak tvNo ratings yet

- MdaseDocument4 pagesMdasenovelNo ratings yet

- Bill Overview: Jlb9Fcydzw7Gxfivcivc Ykpfivk8Ukywlvxmxsygrvcaxgajk7FDocument5 pagesBill Overview: Jlb9Fcydzw7Gxfivcivc Ykpfivk8Ukywlvxmxsygrvcaxgajk7FEugene TayNo ratings yet

- HD - Smart Payslips July2020 PDFDocument1 pageHD - Smart Payslips July2020 PDFAmar AliNo ratings yet

- OU 166 QuoDocument2 pagesOU 166 QuoLincon AsrtraxNo ratings yet

- Car Parking Sticker 2024Document1 pageCar Parking Sticker 2024Ahmed SiddiquiNo ratings yet

- Appraisal of Bank Verification Number (BVN) in Nigeria Banking SystemDocument37 pagesAppraisal of Bank Verification Number (BVN) in Nigeria Banking SystemABDULRAZAQNo ratings yet

- Gcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceDocument3 pagesGcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceJessica CraveNo ratings yet

- Vat Form 100Document10 pagesVat Form 100Shoaib4804174No ratings yet

- Check Out Procedure and Account SettlementDocument61 pagesCheck Out Procedure and Account SettlementNitin GuptaNo ratings yet