Professional Documents

Culture Documents

Assessment

Uploaded by

Vhiena May EstrelladoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessment

Uploaded by

Vhiena May EstrelladoCopyright:

Available Formats

ASSESSMENT #1 ASSESSMENT #3

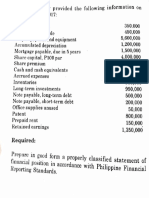

Leo company provided the following information at year end: Purified Company provided the following data on Dec. 31,2019

CASH 300,000 Cash, including Sinking fund of 500,000 P 2,000,000

A/R 1,200,000 N/R 1,200,000

INVENTORY, including expected in the ordinary course N/R discounted 700,000

of operations to be sold beyond 12 mos amounting to 700,000 1,000,000 A/R unassigned 3,000,000

Prepaid expenses 100,000 A/R assigned 800,000

Financial Asset held for trading 200,000 A.D.A 100,000

Equity Investment at FV OCI. 800,000 NCA Equity assignee in A/R –assigned 500,000

Deferred tax asset. PAS 1 & 12 150,000 NCA Inventory, including 600,000 cost of goods in transit

purchased FOB Destination. The goods were receives on

What amount should be reported as total CURRENT ASSET at year end? January 3,2020 2,800,000

2,800,000

Solution : What is the amount of Current asset be reported upon Dec 31,2020

Cash 300,000 Cash 1,500,000

A/R 1,200,000 N/R 1,200,000

INVENTORY, 1,000,000 N/R discounted (700,000)

Prepaid expenses 100,000 A/R unassigned 3,000,000

Financial Asset held for trading 200,000 A/R assigned 800,000

Total Current Assets? 2,800,000 A.D.A (100,000)

Inventory 2,200,000

ASSESSMENT #2 TCA 7,900,000

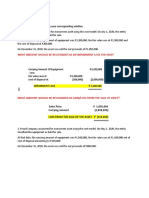

On December 31,2019, IPHONE company reported the following Current Assets:

Cash 700 T

A/R 1.200 T examination of A/R revealed the ff.

Inventory 600T Trade Accounts 930 T

A.D.A (20T)

Claims against shipper for goods lost in transit 30T

Selling Price of unsold goods sent out on

consignment at 130% of cost and not included

in Ending Inventory 260 T

Total A/R 1,200 T

What is the correct amount of total CURRENT ASSET?

Cash 700 T

A/R 930 T

A.D.A (20T)

Claims against shipper for goods lost in transit 30T

Inventory ( 600+ 200) 800 T

Total CA 2440,000

Selling Price of unsold goods sent out on consignment is excluded from A/R but Cogs is included

260,000/ 130%= 200,000

You might also like

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Use The Following Information For Nos. 1 and 2: Classroom Exercise For Financial Reporting in HyperinflationaryDocument3 pagesUse The Following Information For Nos. 1 and 2: Classroom Exercise For Financial Reporting in HyperinflationaryalyssaNo ratings yet

- Ia3 FinalsDocument4 pagesIa3 FinalsGeraldine MayoNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Lecture Notes - Dash 1 Oct 23Document16 pagesLecture Notes - Dash 1 Oct 23だみNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- PacoaDocument12 pagesPacoaSassy GirlNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1LyricVideoNo ratings yet

- Financial Accounting 2022 NeHu Question PaperDocument7 pagesFinancial Accounting 2022 NeHu Question PaperSuraj BoseNo ratings yet

- Statement of Affairs for Sudden Death LtdDocument9 pagesStatement of Affairs for Sudden Death LtdLokesh .cNo ratings yet

- PFA (1st) Dec2017Document3 pagesPFA (1st) Dec2017A RY ANNo ratings yet

- Practice Comptency Exam 124Document3 pagesPractice Comptency Exam 124Ivan Pacificar BioreNo ratings yet

- Cash Flow Statement ProblemDocument2 pagesCash Flow Statement Problemapi-3842194100% (2)

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- PPE Accounting Answers Module 2"TITLE"Property, Plant and Equipment Assessment Answers" TITLE"Module 2 Answer Key on PPE AccountingDocument7 pagesPPE Accounting Answers Module 2"TITLE"Property, Plant and Equipment Assessment Answers" TITLE"Module 2 Answer Key on PPE AccountingLoven BoadoNo ratings yet

- Practical Accounting 1 ValixDocument277 pagesPractical Accounting 1 ValixyzaNo ratings yet

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document7 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Corina Mamaradlo CaragayNo ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- Green Company consignment sales revenue 2021Document8 pagesGreen Company consignment sales revenue 2021jangjangNo ratings yet

- Illustration InventoriesDocument5 pagesIllustration InventoriesRiyhu DelamercedNo ratings yet

- MODULE 6 - Chapter 8 - ANSWERSDocument3 pagesMODULE 6 - Chapter 8 - ANSWERSArmer MacalintalNo ratings yet

- Exercise5 With SolutionDocument5 pagesExercise5 With SolutionRexmar Christian Bernardo71% (7)

- Cash Flow ActivityDocument1 pageCash Flow Activitycarl fuerzasNo ratings yet

- Financial Statement AnalysisDocument37 pagesFinancial Statement AnalysisAbdulmajed Unda Mimbantas50% (4)

- Cindy Lota - Activity No. 3 - Statement of Financial PositionDocument6 pagesCindy Lota - Activity No. 3 - Statement of Financial PositionCindy LotaNo ratings yet

- Incomplete RecordsDocument27 pagesIncomplete RecordsSteven Raintung0% (1)

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- Qualifying Exam - FAR - 1st YearDocument11 pagesQualifying Exam - FAR - 1st YearKristina Angelina ReyesNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Accounting for Business Combinations RestatementDocument5 pagesAccounting for Business Combinations Restatementeloisa celisNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- Ferna CompanyDocument2 pagesFerna CompanyAngeliePanerioGonzaga100% (1)

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresNo ratings yet

- AccountingDocument8 pagesAccountingktong0121No ratings yet

- AF210 Week 5 Discussion ForumDocument2 pagesAF210 Week 5 Discussion ForumAsh ChandNo ratings yet

- Assignment 2Document1 pageAssignment 2Ha M ZaNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Partnership AppDocument22 pagesPartnership AppPeter AkramNo ratings yet

- Book Value Fair Value Book Value Fair ValueDocument18 pagesBook Value Fair Value Book Value Fair ValueCharla SuanNo ratings yet

- Balance Sheet and Cash Flow Statement AnalysisDocument3 pagesBalance Sheet and Cash Flow Statement AnalysisAmit GodaraNo ratings yet

- Problems On Total IncomeDocument12 pagesProblems On Total IncomedipakNo ratings yet

- ACCOUNTING For SPECIAL TRANSACTIONS - Corporate Liquidation Statement of Realization and LiquidationDocument24 pagesACCOUNTING For SPECIAL TRANSACTIONS - Corporate Liquidation Statement of Realization and LiquidationDewdrop Mae RafananNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- Comprehensive Guide to Miller and Richmond Company FinancialsDocument12 pagesComprehensive Guide to Miller and Richmond Company FinancialsNucke Febriana Putri RZNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Required: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"Document2 pagesRequired: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"АннаNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- Seatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Document4 pagesSeatwork #4: What Amount Should Be Recognized As An Impairment Loss For 2020?Joseph AsisNo ratings yet

- This Study Resource Was: Balance Sheet - ProblemsDocument3 pagesThis Study Resource Was: Balance Sheet - Problemsvenice cambryNo ratings yet

- This Study Resource Was: Income Statement - ProblemsDocument3 pagesThis Study Resource Was: Income Statement - Problemsvenice cambryNo ratings yet

- CashflowDocument8 pagesCashflowShubhankar GuptaNo ratings yet

- Adobe Scan Mar 16, 2023Document20 pagesAdobe Scan Mar 16, 2023Renalyn Ps MewagNo ratings yet

- Ferna Company Financial StatementsDocument2 pagesFerna Company Financial StatementsAngeliePanerioGonzagaNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Period PV of 1 at 10% PV of Ordinary Annuity of 1 at 10%Document1 pagePeriod PV of 1 at 10% PV of Ordinary Annuity of 1 at 10%Vhiena May EstrelladoNo ratings yet

- True or False NotesDocument1 pageTrue or False NotesVhiena May EstrelladoNo ratings yet

- What Is Business OrganizationDocument2 pagesWhat Is Business OrganizationVhiena May EstrelladoNo ratings yet

- Daily Devotional December 9,2018: Bible Reading James 3 English Standard Version (ESV)Document1 pageDaily Devotional December 9,2018: Bible Reading James 3 English Standard Version (ESV)Vhiena May EstrelladoNo ratings yet

- ABC News Anchor's Illegal Dismissal CaseDocument4 pagesABC News Anchor's Illegal Dismissal CaseVhiena May EstrelladoNo ratings yet

- Interpreter Asks The Personal Circumstances of The Witness, Introduces The Witness To The Court, Then Swears in The WitnessDocument3 pagesInterpreter Asks The Personal Circumstances of The Witness, Introduces The Witness To The Court, Then Swears in The WitnessVhiena May EstrelladoNo ratings yet

- Contract of Sale (Notes)Document14 pagesContract of Sale (Notes)Dael GerongNo ratings yet

- Activity 2.health Factors That Influence Disease TransmissionDocument2 pagesActivity 2.health Factors That Influence Disease TransmissionVhiena May EstrelladoNo ratings yet

- Executive Summary of Teer Soya Bean Oil Supply ChainDocument29 pagesExecutive Summary of Teer Soya Bean Oil Supply ChainAshif Uz ZamanNo ratings yet

- Cost Management For Just-in-Time Environments: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument57 pagesCost Management For Just-in-Time Environments: Financial and Managerial Accounting 8th Edition Warren Reeve FessRETNO KURNIAWANNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Consolidated Financial Statements-Intra-Entity Asset TransactionsDocument185 pagesConsolidated Financial Statements-Intra-Entity Asset TransactionsMarwa HassanNo ratings yet

- Fin 522 Assignment 01Document10 pagesFin 522 Assignment 01Ishrat JahanNo ratings yet

- Summary of Pas 2 Inventories PDFDocument4 pagesSummary of Pas 2 Inventories PDFJimbo Manalastas50% (2)

- ATP and Scheduling KT - KBDDocument5 pagesATP and Scheduling KT - KBDsaibharath8963No ratings yet

- Ratio Analysis TestDocument3 pagesRatio Analysis TestHuma EssaNo ratings yet

- STOCK CONTROL Notesand Stock TakingDocument25 pagesSTOCK CONTROL Notesand Stock TakingEdwine Jeremiah ONo ratings yet

- Caterpillar Tractor Co.: Case AnalysisDocument10 pagesCaterpillar Tractor Co.: Case AnalysisArpita Karmakar100% (1)

- Inventory Management Under UncertaintyDocument6 pagesInventory Management Under Uncertainty강철희No ratings yet

- Operations Module-5Document19 pagesOperations Module-5Jeleetta MathewNo ratings yet

- Chapter 12Document42 pagesChapter 12Jubin VargheseNo ratings yet

- The Mainsail Capital Group MBADocument148 pagesThe Mainsail Capital Group MBANabile AnzNo ratings yet

- PHysical Inventory in SAPDocument16 pagesPHysical Inventory in SAPVishnu Kumar SNo ratings yet

- MBA IInd SEM POM Chapter 09 Inventorysimplified-Independent Demand Inventory SystemsDocument49 pagesMBA IInd SEM POM Chapter 09 Inventorysimplified-Independent Demand Inventory SystemsPravie100% (2)

- StramaDocument59 pagesStramaFranco JavierNo ratings yet

- Baxter announces new IV solution allocation processDocument3 pagesBaxter announces new IV solution allocation processjraz141No ratings yet

- Fabm3 M3Document23 pagesFabm3 M3Jolina GabaynoNo ratings yet

- Industrial EngineeringDocument95 pagesIndustrial EngineeringFarhan AhmadNo ratings yet

- Diego Felipe Murillo H.: Inventory AnalystDocument4 pagesDiego Felipe Murillo H.: Inventory AnalystDIEGO FELIPE MURILLO HINESTRPZANo ratings yet

- Introduction To JIT: Nothing Is Produced Until It Is RequiredDocument10 pagesIntroduction To JIT: Nothing Is Produced Until It Is RequiredSaurabh JadhavNo ratings yet

- GshshahDocument113 pagesGshshahCiarie SalgadoNo ratings yet

- Prakhar Final Project PDFDocument97 pagesPrakhar Final Project PDFPrakhar GuptaNo ratings yet

- Global Sugar Production and Consumption TrendsDocument54 pagesGlobal Sugar Production and Consumption TrendsvishwananthNo ratings yet

- Translation Gains and Losses Under Current and Temporal MethodsDocument10 pagesTranslation Gains and Losses Under Current and Temporal MethodsnahorrNo ratings yet

- Accounting Important Q'sDocument399 pagesAccounting Important Q'sTripti Jindal100% (1)

- Reading 13 Integration of Financial Statement Analysis TechniquesDocument15 pagesReading 13 Integration of Financial Statement Analysis Techniquestaichinhtientien62aNo ratings yet

- Real Estate Development - Accounting ChallengesCADocument35 pagesReal Estate Development - Accounting ChallengesCA891966100% (1)

- Guna FibreDocument21 pagesGuna FibreAirlangga Prima Satria MaruapeyNo ratings yet