Professional Documents

Culture Documents

Esstipallowinfo PDF

Uploaded by

Elena AndriolOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Esstipallowinfo PDF

Uploaded by

Elena AndriolCopyright:

Available Formats

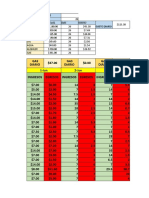

ALLOWABLE TIP CREDIT

A tip credit can only be applied if the employee is

Engaged in an occupation in which the employee customarily and regularly receives more than $30 each month in tips:

· Has been informed by the employer about the provisions of the tip credit section of the Maryland Wage and Hour Law; and,

· has kept all of the tips that the employee received. This does not prohibit the pooling of tips.

Tip Credit calculations for employers subject to the Maryland State Minimum Wage Rate

Effective Date Employer Requirement Tip Credit Allowed Total Hourly Rate Due

7/1/14 $3.63 $3.62 $7.25

1/1/15 $3.63 $4.37 $8.00

7/1/15 $3.63 $4.62 $8.25

7/1/16 $3.63 $5.12 $8.75

7/1/17 $3.63 $5.62 $9.25

7/1/18 $3.63 $6.47 $10.10

Tip Credit calculations for employers subject to the Montgomery County Minimum Wage Rate

Effective Date Employer Requirement Tip Credit Allowed Total Hourly Rate Due

7/1/14 $3.63 $3.62 $7.25

10/1/14 $3.63 $4.77 $8.40

1/1/15 $4.00 $4.40 $8.40

7/1/15 $4.00 $4.40 $8.40

10/1/15 $4.00 $5.55 $9.55

7/1/16 $4.00 $6.75 $10.75

7/1/17 $4.00 $7.50 $11.50

7/1/18 $4.00 $7.50 $11.50

Tip Credit calculation for employers subject to the Prince George’s County Minimum Wage Rate

Effective Date Employer Requirement Tip Credit Allowed Total Hourly Rate Due

7/1/14 $3.63 $3.62 $7.25

10/1/14 $3.63 $4.77 $8.40

10/1/15 $3.63 $5.92 $9.55

10/1/16 $3.63 $7.12 $10.75

10/1/17 $3.63 $7.87 $11.50

Overtime Calculations for Tipped Employees Earning Minimum Wage

In general, overtime is calculated on the basis of each hour over 40 hours that an employee works during one

workweek and an employer shall pay an overtime wage of at least 1.5 times the usual hourly wage.

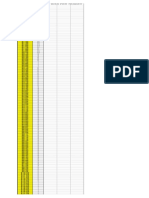

Overtime Tip Credit calculations for employers subject to the Maryland State Minimum Wage Rate

Effective Date Employer Requirement Tip Credit Allowed Total Hourly Rate Due

7/1/14 $7.26 $3.62 $10.88

1/1/15 $7.63 $4.37 $12.00

7/1/15 $7.76 $4.62 $12.38

7/1/16 $8.01 $5.12 $13.13

7/1/17 $8.26 $5.62 $13.88

7/1/18 $8.68 $6.47 $15.15

Overtime Tip Credit calculations for employers subject to the Montgomery County Minimum Wage Rate

Effective Date Employer Requirement Tip Credit Allowed Total Hourly Rate Due

7/1/14 $7.26 $3.62 $10.88

10/1/14 $7.83 $4.77 $12.60

1/1/15 $8.20 $4.40 $12.60

7/1/15 $8.20 $4.40 $12.60

10/1/15 $8.78 $5.55 $14.33

7/1/16 $9.38 $6.75 $16.13

7/1/17 $9.75 $7.50 $17.25

7/1/18 $9.75 $7.50 $17.25

Overtime Tip Credit calculation for employers subject to the Prince George’s County Minimum Wage Rate

Effective Date Employer Requirement Tip Credit Allowed Total Hourly Rate Due

7/1/14 $7.26 $3.62 $10.88

10/1/14 $7.83 $4.77 $12.60

10/1/15 $8.41 $5.92 $14.33

10/1/16 $9.01 $7.12 $16.13

10/1/17 $9.38 $7.87 $17.25

Department of Labor, Licensing and Regulation

Division of Labor and Industry

Employment Standards Service

1100 North Eutaw Street, Room 607

Baltimore, MD 21201

Telephone Number: (410) 767-2357 • Fax Number: (410) 333-7303

E-mail: dldliemploymentstandards-dllr@maryland.gov

Rev: 11/2015

You might also like

- Excel Mortgage CalculatorDocument8 pagesExcel Mortgage Calculatorjmi.secret.anonymousNo ratings yet

- Dowsing for Money - Finding Financial SecurityFrom EverandDowsing for Money - Finding Financial SecurityRating: 5 out of 5 stars5/5 (1)

- Exam 1 Practice - Solutions To CLV Sample ProblemsDocument66 pagesExam 1 Practice - Solutions To CLV Sample ProblemsVNR CNo ratings yet

- BOIS Re-Entry Income CalculatorDocument246 pagesBOIS Re-Entry Income CalculatorJohn BoydNo ratings yet

- Spectralis Touch Panel Upgrade GuideDocument10 pagesSpectralis Touch Panel Upgrade GuideMohamed AbdulaalNo ratings yet

- Insta Forex Money Management Spreadsheet Tracks Daily Profits Over 20 DaysDocument26 pagesInsta Forex Money Management Spreadsheet Tracks Daily Profits Over 20 DaysFrancisco Deny S.No ratings yet

- Principle of Economics Consolidated Assignements-2 - 10th February 22Document27 pagesPrinciple of Economics Consolidated Assignements-2 - 10th February 22Mani Bhushan SinghNo ratings yet

- Win Bet Record Keeper Beta #5.2M Excel 2010Document481 pagesWin Bet Record Keeper Beta #5.2M Excel 2010Eric HackettNo ratings yet

- HANDOUT - Cell Transport Review WorksheetDocument4 pagesHANDOUT - Cell Transport Review WorksheetDenis Martinez100% (1)

- Sheath CurrentsDocument5 pagesSheath Currentsscribdkkk100% (1)

- Pi̇sa Edu Türki̇ye Geneli̇ Imat Denemesi̇Document31 pagesPi̇sa Edu Türki̇ye Geneli̇ Imat Denemesi̇Efe Tunç AkyürekNo ratings yet

- Benjamin W. Tatler, Clare Kirtley, Ross G Macdonald, Katy M. a Mitchell (Auth.), Mike Horsley, Matt Eliot, Bruce Allen Knight, Ronan Reilly (Eds.)-Current Trends in Eye Tracking Research-Springer InteDocument339 pagesBenjamin W. Tatler, Clare Kirtley, Ross G Macdonald, Katy M. a Mitchell (Auth.), Mike Horsley, Matt Eliot, Bruce Allen Knight, Ronan Reilly (Eds.)-Current Trends in Eye Tracking Research-Springer InteElena AndriolNo ratings yet

- Problems of Elder AbuseDocument13 pagesProblems of Elder AbuseNeha Jayaraman100% (3)

- Hospital Acquired Infections-IIDocument52 pagesHospital Acquired Infections-IIFATHIMA ANo ratings yet

- GastosDocument1 pageGastosGıø AlønsøNo ratings yet

- StockDelver CalculatorDocument11 pagesStockDelver CalculatorAhtsham AhmadNo ratings yet

- MAMATEODocument20 pagesMAMATEOJeffry BuendiaNo ratings yet

- Kel691 XLS EngDocument10 pagesKel691 XLS EngSuyash DeepNo ratings yet

- IBM Cash DividendsDocument12 pagesIBM Cash DividendsЖека ПономаренкоNo ratings yet

- Member Date Buy Sell Par Amount ValueDocument42 pagesMember Date Buy Sell Par Amount ValuecrapshooterNo ratings yet

- HouseDocument14 pagesHouseapi-435614969No ratings yet

- Icecream Data SetDocument16 pagesIcecream Data SetMohammed Areeb MuneerNo ratings yet

- Car Loan EMI CalculatorDocument4 pagesCar Loan EMI CalculatorKamarul IMtiyazNo ratings yet

- Car Usage Claims Form Reimbursement Rate $0.55 Odometer Reimbursed Reading at 0.55 CENTS Daily Date Start Stop Mileage Per Mile Fuel Parking TotalsDocument1 pageCar Usage Claims Form Reimbursement Rate $0.55 Odometer Reimbursed Reading at 0.55 CENTS Daily Date Start Stop Mileage Per Mile Fuel Parking TotalsGeorge KariukiNo ratings yet

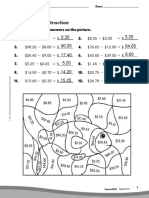

- Practice 4 Subtraction: Subtract. Color The Answers On The Picture. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12Document5 pagesPractice 4 Subtraction: Subtract. Color The Answers On The Picture. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12Mareeswari BalasubramaniamNo ratings yet

- Projeto 0,5Document11 pagesProjeto 0,5Thiago LimaNo ratings yet

- GDOL UI Stats (Jan. 2, 2021)Document1 pageGDOL UI Stats (Jan. 2, 2021)ABC15 News100% (1)

- Inventory As Money NewDocument11 pagesInventory As Money New।। SultanNo ratings yet

- Loan AmortizationDocument8 pagesLoan AmortizationRobertFWainblatIIINo ratings yet

- Hoja de Cálculo de Rendimiento de La Inversión en Trading WavesDocument7 pagesHoja de Cálculo de Rendimiento de La Inversión en Trading WavesHurtado TorresNo ratings yet

- CUSTODocument1 pageCUSTOwaldexsantos6466No ratings yet

- Untitled Spreadsheet - Sheet1Document1 pageUntitled Spreadsheet - Sheet1api-430438622No ratings yet

- Binarias Gestion de CapitalDocument3 pagesBinarias Gestion de CapitalAdalid Alfredo Zeballos TejerinaNo ratings yet

- Davor Coin Strategy SpreadsheetDocument27 pagesDavor Coin Strategy SpreadsheetShakur ShadydsNo ratings yet

- Normal Economy Crop Yields and ProfitsDocument3 pagesNormal Economy Crop Yields and ProfitsJoão FonsecaNo ratings yet

- Book 1Document2 pagesBook 1AbhayNo ratings yet

- Stock TableDocument3 pagesStock TableDaniel Christian-Grafton HutchinsonNo ratings yet

- Accounts PayableDocument1 pageAccounts PayableM Monjur MobinNo ratings yet

- 2-15-17 FBETA 7 - Projections PDFDocument29 pages2-15-17 FBETA 7 - Projections PDFmohammedNo ratings yet

- Cuenta NoviembreDocument2 pagesCuenta Noviembrefcalagu77No ratings yet

- Quilo Met Rage MDocument9 pagesQuilo Met Rage MAndre OliveiraNo ratings yet

- Soal1 EfaDocument8 pagesSoal1 EfaWiani yuliaNo ratings yet

- December-Staff Database: Id No. Name Date HiredDocument11 pagesDecember-Staff Database: Id No. Name Date HiredwelpNo ratings yet

- Loan Amortization Schedule Template: Lender NameDocument4 pagesLoan Amortization Schedule Template: Lender NamerayyanNo ratings yet

- Loan Amortization Schedule4Document9 pagesLoan Amortization Schedule4devanand bhawNo ratings yet

- Loan Amortization Schedule6Document9 pagesLoan Amortization Schedule6devanand bhawNo ratings yet

- Math ReflectionDocument3 pagesMath Reflectionapi-611523283No ratings yet

- Loan Amortization Schedule5Document9 pagesLoan Amortization Schedule5devanand bhawNo ratings yet

- Loan Amortization Schedule2Document9 pagesLoan Amortization Schedule2devanand bhawNo ratings yet

- Loan Amortization Schedule3Document9 pagesLoan Amortization Schedule3devanand bhawNo ratings yet

- Interes Magico Vs DolarDocument3 pagesInteres Magico Vs Dolarfernando.pagnottaNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableDanhilson VivoNo ratings yet

- Bill Paying WorksheetDocument1 pageBill Paying WorksheetDenis SherNo ratings yet

- Daftar Operasional (Upah) Pekerja Pembangunan Masjid Al - Muttaqin Lembah 12 S/D 15 SEPTEMBER 2018Document5 pagesDaftar Operasional (Upah) Pekerja Pembangunan Masjid Al - Muttaqin Lembah 12 S/D 15 SEPTEMBER 2018ariezkyNo ratings yet

- Kelompok 5 DK - SSDocument2 pagesKelompok 5 DK - SSFebriati RusydaNo ratings yet

- Commish (Medicare) (ComDocument13 pagesCommish (Medicare) (Comcebusgod619No ratings yet

- Healthcare UsageDocument81 pagesHealthcare UsageglasscityjungleNo ratings yet

- Graph 1: Light Bulb Final Cost Comparison (Base Price of Light Bulb+ Cost Based On KWH Usage For 5 Hours Per Day)Document6 pagesGraph 1: Light Bulb Final Cost Comparison (Base Price of Light Bulb+ Cost Based On KWH Usage For 5 Hours Per Day)aggieNo ratings yet

- Planejamento CapacityDocument13 pagesPlanejamento Capacitydaniellucas677No ratings yet

- Micro-Econ Signature Assignment - Gavin WestDocument4 pagesMicro-Econ Signature Assignment - Gavin Westapi-531246385No ratings yet

- Gerenciamento de RiscoDocument3 pagesGerenciamento de RiscoRafael SantosNo ratings yet

- Mini Data SetDocument4 pagesMini Data SetT ReyNo ratings yet

- Práctica 9 - GonzaloDocument1 pagePráctica 9 - GonzaloJehu SantiagoNo ratings yet

- Professional Guide To Dealing and Playing Blackjack: Written for players, dealers, surveillance and for anyone who works in or wants to work in a casino.From EverandProfessional Guide To Dealing and Playing Blackjack: Written for players, dealers, surveillance and for anyone who works in or wants to work in a casino.No ratings yet

- Golf For Money: Earn Income From Golfing: Beginner's Introduction Guide: Earn MoneyFrom EverandGolf For Money: Earn Income From Golfing: Beginner's Introduction Guide: Earn MoneyNo ratings yet

- Event Statistics - Trial SummaryDocument10 pagesEvent Statistics - Trial SummaryElena AndriolNo ratings yet

- Eyetracking DataDocument1 pageEyetracking DataElena AndriolNo ratings yet

- B2B 122 PDFDocument24 pagesB2B 122 PDFElena AndriolNo ratings yet

- MP Maxat Pernebayev Tanvi Singh Karthick SundararajanDocument117 pagesMP Maxat Pernebayev Tanvi Singh Karthick SundararajansadiaNo ratings yet

- Bonding BB1Document3 pagesBonding BB1DeveshNo ratings yet

- Aos Ce 15400Document4 pagesAos Ce 15400Jovenal TuplanoNo ratings yet

- SG Salary Guide 2021-22Document66 pagesSG Salary Guide 2021-22Gilbert ChiaNo ratings yet

- WHO Guidelines For Drinking Water: Parameters Standard Limits As Per WHO Guidelines (MG/L)Document3 pagesWHO Guidelines For Drinking Water: Parameters Standard Limits As Per WHO Guidelines (MG/L)114912No ratings yet

- Piston Water MeterDocument2 pagesPiston Water MeterMark PamularNo ratings yet

- EVBAT00100 Batterij ModuleDocument1 pageEVBAT00100 Batterij ModuleSaptCahbaguzNo ratings yet

- Managing Hypertension and Insomnia Through Family Nursing Care PlansDocument4 pagesManaging Hypertension and Insomnia Through Family Nursing Care PlansChristian UmosoNo ratings yet

- English Form 2 Mod23042022001Document10 pagesEnglish Form 2 Mod23042022001Qiash JontezNo ratings yet

- Take Test - Final Exam - INDE8900-34-R-2020FDocument2 pagesTake Test - Final Exam - INDE8900-34-R-2020FAbhiNo ratings yet

- Action On Agricultural. Calculating Agricultural EmissionsDocument27 pagesAction On Agricultural. Calculating Agricultural EmissionsXoel UrriagaNo ratings yet

- PT. Citilink Indonesia N P W P: 0 2 - 8 2 7 - 5 9 7 - 2 - 0 9 3 - 0 0 0 Jl. Raya Juanda Sawotratap Gedangan SidoarjoDocument2 pagesPT. Citilink Indonesia N P W P: 0 2 - 8 2 7 - 5 9 7 - 2 - 0 9 3 - 0 0 0 Jl. Raya Juanda Sawotratap Gedangan SidoarjoZemNo ratings yet

- Physical ExaminationDocument7 pagesPhysical ExaminationCha CulveraNo ratings yet

- Proposed Plan For Increasing The Entrepreneurial Skills of Students in Food PreservationDocument13 pagesProposed Plan For Increasing The Entrepreneurial Skills of Students in Food PreservationAnonymous B0hmWBTNo ratings yet

- Welfare Schemes in TelanganaDocument46 pagesWelfare Schemes in TelanganaNare ChallagondlaNo ratings yet

- Letter From Springfield Mayor Sarno To License Commission Re: Late Night Hours.Document12 pagesLetter From Springfield Mayor Sarno To License Commission Re: Late Night Hours.Patrick JohnsonNo ratings yet

- 2017 Aso Security TrainingDocument60 pages2017 Aso Security TrainingTanzila SiddiquiNo ratings yet

- ProVent - MANN + HUMMEL ProVent - Oil Separator For Open and Closed Crankcase Ventilation SystemsDocument29 pagesProVent - MANN + HUMMEL ProVent - Oil Separator For Open and Closed Crankcase Ventilation SystemsJosephNo ratings yet

- Chapter 1Document52 pagesChapter 1MD NAYM MIANo ratings yet

- Literature Review of ZnoDocument7 pagesLiterature Review of Znoea6mkqw2100% (1)

- Altivar 71 - ATV71H037M3Document13 pagesAltivar 71 - ATV71H037M3Mite TodorovNo ratings yet

- SPE/IADC-189336-MS Pioneering The First Hydraulic Fracturing in Iraq's Complex ReservoirDocument12 pagesSPE/IADC-189336-MS Pioneering The First Hydraulic Fracturing in Iraq's Complex ReservoirKarar AliNo ratings yet

- Restraint Prevalence and Perceived Coercion Among Psychiatric Inpatientsfrom South IndiaDocument7 pagesRestraint Prevalence and Perceived Coercion Among Psychiatric Inpatientsfrom South IndiaEdson HilárioNo ratings yet