Professional Documents

Culture Documents

Taxation Trends in The European Union - 2012 193

Taxation Trends in The European Union - 2012 193

Uploaded by

d05register0 ratings0% found this document useful (0 votes)

5 views1 pagep193

Original Title

Taxation Trends in the European Union - 2012 193

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentp193

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageTaxation Trends in The European Union - 2012 193

Taxation Trends in The European Union - 2012 193

Uploaded by

d05registerp193

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Annex A Tables

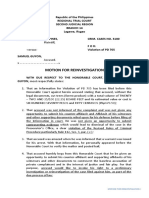

Table 13: Indirect Taxes as % of GDP - Other taxes on production

(2)

Difference(1) Ranking Revenue

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 1995 to 2010 2000 to 2010 2010 2010

BE 1.9 2.0 2.0 2.0 2.0 1.9 1.9 1.8 1.9 1.9 1.8 1.9 1.6 1.8 1.8 1.8 -0.1 -0.1 8 6 471

BG 0.1 0.1 0.0 0.1 0.6 0.5 0.5 0.6 0.7 0.7 0.7 0.6 0.5 0.5 0.6 0.6 0.4 0.0 22 201

CZ 0.8 0.7 0.6 0.5 0.6 0.6 0.5 0.5 0.5 0.5 0.4 0.4 0.4 0.4 0.4 0.4 -0.4 -0.1 25 649

DK 1.6 1.5 1.7 1.8 1.8 1.6 1.8 1.8 1.8 1.8 1.7 1.7 1.8 1.9 2.0 2.1 0.5 0.4 5 4 837

DE 0.6 0.6 0.6 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.0 -0.1 21 15 350

EE 0.6 0.6 0.6 0.6 0.6 0.7 0.8 0.7 0.7 0.6 0.6 0.6 0.6 0.7 0.8 0.7 0.2 0.0 19 104

IE 1.2 1.2 1.0 1.0 0.9 0.8 0.8 0.8 0.9 0.9 0.9 1.0 1.0 1.1 1.3 1.5 0.3 0.7 11 2 308

(3)

EL 0.5 0.7 0.5 0.5 0.6 0.6 0.5 0.3 0.3 0.3 0.3 0.4 0.4 0.4 0.4 0.2 -0.3 -0.3 27 557

ES 1.3 1.2 1.2 1.3 1.3 1.2 1.2 1.2 1.1 1.1 1.1 1.1 1.1 1.1 1.3 1.4 0.1 0.2 12 14 465

FR 4.2 4.4 4.4 4.4 4.3 4.2 4.1 4.1 4.1 4.2 4.3 4.2 4.3 4.3 4.6 4.2 0.1 0.0 2 81 445

IT 1.2 1.2 1.4 3.8 3.3 3.4 3.5 3.5 3.4 3.3 3.5 3.6 3.6 3.2 3.0 3.0 1.8 -0.4 4 46 277

CY 1.2 1.2 1.2 1.9 1.7 1.1 1.0 1.1 1.7 1.9 1.9 2.2 2.9 2.4 2.0 2.1 0.8 0.9 6 355

LV 1.9 1.4 2.0 2.2 2.1 1.4 1.6 1.1 1.1 1.0 0.9 0.8 0.7 0.6 0.8 0.9 -1.0 -0.5 16 168

LT 0.5 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.6 0.5 0.5 0.5 0.4 0.5 0.5 0.0 -0.1 24 132

LU 1.4 1.5 1.6 1.8 2.0 2.3 2.2 1.7 1.5 1.7 1.9 2.0 2.0 1.5 1.5 1.7 0.3 -0.7 9 677

HU 0.3 0.4 0.4 0.4 0.5 0.5 0.5 0.5 0.5 0.6 0.6 0.7 0.8 0.8 0.9 1.1 0.8 0.6 14 1 024

MT 0.3 0.2 0.3 0.3 0.3 0.3 0.4 0.4 0.4 0.8 0.6 0.6 0.5 0.5 0.6 0.5 0.3 0.2 23 32

NL 1.1 1.1 1.0 1.0 1.0 1.0 1.1 1.1 1.1 1.1 1.1 1.0 1.0 1.1 1.2 1.2 0.1 0.2 13 7 036

AT 3.3 3.3 3.3 3.3 3.2 3.2 3.3 3.2 3.2 3.1 3.1 3.0 3.0 3.1 3.3 3.2 -0.1 0.0 3 9 223

PL 1.6 1.5 1.5 1.3 1.3 1.3 1.4 1.4 1.3 1.4 1.7 2.0 1.5 1.6 1.6 1.6 0.0 0.3 10 5 539

PT 0.5 0.5 0.5 0.6 0.6 0.6 0.6 0.9 1.3 0.7 0.7 0.7 0.8 0.8 0.9 0.8 0.3 0.2 17 1 442

RO 0.6 0.3 0.2 0.3 0.5 0.5 0.6 0.6 0.6 0.5 0.5 0.6 0.8 0.8 0.7 0.7 0.1 0.2 18 895

SI 0.5 1.0 1.6 1.9 2.0 2.3 2.5 2.5 2.8 2.8 2.9 2.5 2.1 1.6 1.0 1.0 0.5 -1.3 15 362

SK 0.9 1.2 0.8 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.8 0.8 0.8 0.7 0.7 0.7 -0.2 0.0 20 473

FI 0.1 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.3 0.2 0.2 0.2 0.2 0.3 0.3 0.1 0.1 26 474

SE 2.5 3.4 3.8 4.3 5.6 4.0 3.9 4.0 4.1 4.0 3.9 4.3 4.2 5.4 5.6 4.9 2.4 0.9 1 17 003

UK 1.8 1.8 1.8 1.8 1.7 1.8 1.7 1.7 1.6 1.6 1.6 1.6 1.5 1.6 1.7 1.9 0.1 0.1 7 32 627

NO 0.6 0.6 0.6 0.6 0.6 0.5 0.6 0.5 0.5 0.5 0.5 0.6 0.5 0.5 0.6 0.5 0.0 0.0 1 702

IS 2.6 2.6 2.6 2.8 2.8 3.1 2.9 2.7 2.8 2.9 2.9 3.2 3.3 2.9 2.6 2.6 0.0 -0.5 244

EU-27 averages 250 129

weighted 1.7 1.8 1.8 2.1 2.1 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.1 2.0 0.3 0.0

arithmetic 1.2 1.2 1.3 1.5 1.5 1.4 1.4 1.4 1.4 1.4 1.4 1.5 1.5 1.5 1.5 1.5 0.3 0.1

EA-17 averages 187 053

weighted 1.7 1.7 1.8 2.2 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.0 0.4 0.0

arithmetic 1.2 1.3 1.3 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.6 1.6 1.5 1.5 1.5 0.2 0.0

EU-25 averages

weighted 1.7 1.8 1.8 2.1 2.1 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.0 2.1 2.1 0.4 0.0

arithmetic 1.3 1.3 1.4 1.6 1.6 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.6 1.5 0.3 0.1

(1) In percentage points

(2) In millions of euro

(3) Data for Greece is provisional for years 2003-2010

See explanatory notes in Annex B

Source: Eurostat (online data code gov_a_tax_ag)

Date of extraction: 13/01/2012

192 Taxation trends in the European Union

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Professional Responsibility OutlineDocument48 pagesProfessional Responsibility OutlineEli Colmenero100% (5)

- Concept of LeadershipDocument142 pagesConcept of Leadershipv_sasivardhiniNo ratings yet

- 3988 - 3897 - 1 - 1646224208 - Canteen Ordering System ProjectDocument9 pages3988 - 3897 - 1 - 1646224208 - Canteen Ordering System ProjectMohammad AjasNo ratings yet

- Chapter - VII Infrastructure Water SupplyDocument25 pagesChapter - VII Infrastructure Water Supplydreamboy87No ratings yet

- Chapter 4 OjtDocument9 pagesChapter 4 OjtKatz EscañoNo ratings yet

- CEO-Director Data-MumbaiDocument3,019 pagesCEO-Director Data-MumbaiGirish Singh25% (4)

- Motion For ReinvestigationDocument2 pagesMotion For ReinvestigationPj Tigniman80% (5)

- Taxation Trends in The European Union - 2012 224Document1 pageTaxation Trends in The European Union - 2012 224d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 216Document1 pageTaxation Trends in The European Union - 2012 216d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 220Document1 pageTaxation Trends in The European Union - 2012 220d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 218Document1 pageTaxation Trends in The European Union - 2012 218d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 204Document1 pageTaxation Trends in The European Union - 2012 204d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 192Document1 pageTaxation Trends in The European Union - 2012 192d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 210Document1 pageTaxation Trends in The European Union - 2012 210d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 196Document1 pageTaxation Trends in The European Union - 2012 196d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 190Document1 pageTaxation Trends in The European Union - 2012 190d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 188Document1 pageTaxation Trends in The European Union - 2012 188d05registerNo ratings yet

- Taxation Trends in The European Union - 2012 186Document1 pageTaxation Trends in The European Union - 2012 186d05registerNo ratings yet

- Harmonic and Random Vibration DurabilityDocument238 pagesHarmonic and Random Vibration Durabilityviluk100% (1)

- Moratorium AgreementDocument4 pagesMoratorium AgreementMANU OKAYNo ratings yet

- Saudi Aramco Test Report: External Tank Bottom Testing 24-Jul-18 CP-SATR-X-3204Document7 pagesSaudi Aramco Test Report: External Tank Bottom Testing 24-Jul-18 CP-SATR-X-3204nadeem shaikhNo ratings yet

- Building A Smarter, Faster Business With Modern ApplicationsDocument36 pagesBuilding A Smarter, Faster Business With Modern ApplicationsSy CoNo ratings yet

- 2nd EBT Webinar - Lufthansa Grading System 28.09.2021Document11 pages2nd EBT Webinar - Lufthansa Grading System 28.09.2021Alireza Ghasemi moghadamNo ratings yet

- Ashley Bush-Hardy ResumeDocument2 pagesAshley Bush-Hardy ResumeashleybushhardyNo ratings yet

- PDA Interim Guidelines On Infection Prevention During The Covid-19 PandemicDocument42 pagesPDA Interim Guidelines On Infection Prevention During The Covid-19 Pandemicbaron nissanNo ratings yet

- A Review On Indoor Optical Wireless SystemsDocument36 pagesA Review On Indoor Optical Wireless SystemsDenySidiqMulyonoChtNo ratings yet

- Iso Series DVLDocument8 pagesIso Series DVLclintNo ratings yet

- LalruDocument98 pagesLalruAbhinav KumarNo ratings yet

- Dynamic Testing: White Box Testing Techniques: © Oxford University Press 2011. All Rights ReservedDocument33 pagesDynamic Testing: White Box Testing Techniques: © Oxford University Press 2011. All Rights ReservedShaurya KumarNo ratings yet

- Request For Advisory Evalution of Foreign Credentials Personal InformationDocument4 pagesRequest For Advisory Evalution of Foreign Credentials Personal InformationqeulkiteNo ratings yet

- Risk Register FormatDocument26 pagesRisk Register FormatDemewez AsfawNo ratings yet

- SBI Associates Clerks Previous Paper Completely SolvedDocument49 pagesSBI Associates Clerks Previous Paper Completely Solvedradhika1991No ratings yet

- Application WindowDocument2 pagesApplication Windowpatriciomaryrose557No ratings yet

- PROJECTSDocument9 pagesPROJECTSM A N J I LNo ratings yet

- Economics Today The Macro View 18th Edition Miller Solutions ManualDocument15 pagesEconomics Today The Macro View 18th Edition Miller Solutions Manualletitiamelanienhz100% (31)

- 7.4 - Equations and Graphs of Trigonometric FunctionsDocument16 pages7.4 - Equations and Graphs of Trigonometric FunctionsJoven IsNo ratings yet

- Plastmix GDocument2 pagesPlastmix Gmohab hakimNo ratings yet

- 01 Project Shakti HULDocument3 pages01 Project Shakti HULAjaySharmaNo ratings yet

- Weekly Current Affairs May 2023 Week 01 - CompressedDocument31 pagesWeekly Current Affairs May 2023 Week 01 - Compressedsailesh singhNo ratings yet

- 2012 Jay Feather Ultra Lite Owners ManualDocument101 pages2012 Jay Feather Ultra Lite Owners ManualRachel Naiman WilsonNo ratings yet

- ENTP. Per TOPICDocument13 pagesENTP. Per TOPICeffendyNo ratings yet