Professional Documents

Culture Documents

Code of Ethics - A

Uploaded by

Okumura YukioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Code of Ethics - A

Uploaded by

Okumura YukioCopyright:

Available Formats

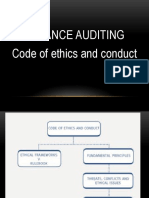

CODE OF ETHICS

PART A - GENERAL APPLICATIONS OF THE CODE

It is the professional’s responsibility to act in the public interest.

To do so, a professional accountant must comply with the following fundamental principles:

Integrity

- being straightforward and honest

- doesn’t tolerate false, misleading, and obscure statements

Objectivity

- professional judgment is not compromised by bias or conflict of interest

- relationships that influence judgment are avoided

Professional Competence and Due Care

- diligent application of the attained and continuing development of professional

standards and knowledge

- providing services that are thorough, careful and timely

- provide services that avoids misinterpretation

Confidentiality

- refrain from disclosure or taking advantage of acquired confidential information

even after the end of the relationship of the client

- What such information slips off the tongue? Be alert that this doesn’t happen and

always consider that the disclosure doesn’t harm any parties, and is relevant

- Only exceptions are when:

(a) permitted by law or authorized by client

(b) required by law (as evidence or use in legal proceedings)

(c) professional duty or right to disclosure

Professional Behavior

- do not soil the good reputation of the profession. How?

(a) adherence to the law and regulations

(b) do not make exaggerated claims or disparaging references to others’ works

What if there are threats to the compliance of the fundamental principles?

- A professional should identify and evaluate these threats then apply appropriate

safeguards and determine the proper course of action.

And what are these safeguards?

- They vary depending on circumstances and professional judgment, which is honed

through education, training, experience, continuing professional development, standards

and regulations, is exercised.

- If that doesn’t work, seek help. And if even then, the conflict is unresolved, detach

from the matter.

You might also like

- Mas Practice Standards and EthicalconsiderationsDocument6 pagesMas Practice Standards and EthicalconsiderationsRolanElumbreNo ratings yet

- 23 Code of Ethics For Professional Accountants: An Ethical Practice Is The Bedrock of An Accountant's SuccessDocument46 pages23 Code of Ethics For Professional Accountants: An Ethical Practice Is The Bedrock of An Accountant's SuccesstrishaNo ratings yet

- Code of Ethics 5th Year Acc. ReviewDocument10 pagesCode of Ethics 5th Year Acc. ReviewCykee Hanna Quizo LumongsodNo ratings yet

- A.2 Usprcp Rec CodeDocument25 pagesA.2 Usprcp Rec Codebhobot riveraNo ratings yet

- Code of EthicsDocument78 pagesCode of EthicsNeriza PonceNo ratings yet

- Code of Ethics For Professional Accountants in The PhilippinesDocument4 pagesCode of Ethics For Professional Accountants in The PhilippinesAlex Ong0% (1)

- Nine Practices of the Successful Security Leader: Research ReportFrom EverandNine Practices of the Successful Security Leader: Research ReportNo ratings yet

- Code of Ethics For Professional AccountantsDocument17 pagesCode of Ethics For Professional AccountantsJay Mark AbellarNo ratings yet

- 1) Code of Ethics For AuditorsDocument29 pages1) Code of Ethics For Auditorsrajes wari50% (2)

- Auditing Theory: CPA ReviewDocument11 pagesAuditing Theory: CPA ReviewAljur SalamedaNo ratings yet

- ISC2 Code of EthicsDocument2 pagesISC2 Code of EthicsUsman Sarwar100% (1)

- Mas Practice Standards and Ethical ConsiderationsACDocument3 pagesMas Practice Standards and Ethical ConsiderationsACLorenz BaguioNo ratings yet

- Code of Ethical Principles Published 7 Dec 11 v2 0Document13 pagesCode of Ethical Principles Published 7 Dec 11 v2 0Floch ForsterNo ratings yet

- ACCT 304 Auditing: Session 4 - Fundamental Principles of AuditingDocument22 pagesACCT 304 Auditing: Session 4 - Fundamental Principles of Auditingjeff bansNo ratings yet

- De - Guzman - Module 12Document8 pagesDe - Guzman - Module 12Ma Ruby II SantosNo ratings yet

- Code of Ethics For Professional Accountants in The PhilippinesDocument3 pagesCode of Ethics For Professional Accountants in The Philippinesmac mercadoNo ratings yet

- Apd 3 NotesDocument6 pagesApd 3 NotesHelios HexNo ratings yet

- AA - Spring 2021 11 Professional EthicsDocument13 pagesAA - Spring 2021 11 Professional EthicsSarim AhmadNo ratings yet

- AA - 2023 11 Professional EthicsDocument13 pagesAA - 2023 11 Professional EthicstahreemNo ratings yet

- Code of Ethics Summary - P 1 & 2Document9 pagesCode of Ethics Summary - P 1 & 2RafayAliNo ratings yet

- Auditing I CH 2Document36 pagesAuditing I CH 2Hussien AdemNo ratings yet

- Statement of Ethical Professional PracticeDocument13 pagesStatement of Ethical Professional PracticeKristine Dianne BoquirenNo ratings yet

- Additional Ethics SlidesDocument5 pagesAdditional Ethics Slidesathirah jamaludinNo ratings yet

- Code of Professional EthicsDocument42 pagesCode of Professional EthicsMariella CatacutanNo ratings yet

- Standard 1: Professionalism: Standard's Name DescriptionDocument7 pagesStandard 1: Professionalism: Standard's Name Descriptionkush kushalNo ratings yet

- Code of Professional EthicsDocument2 pagesCode of Professional EthicsJohn Lexter MacalberNo ratings yet

- Slides - Lecture 2 - ST VersionDocument17 pagesSlides - Lecture 2 - ST VersionNguyễn Thu UyênNo ratings yet

- Topic 5 - Code of Ethics For AuditorsDocument39 pagesTopic 5 - Code of Ethics For Auditors黄勇添No ratings yet

- Audit 2: Puan Roslina Binti IdrisDocument12 pagesAudit 2: Puan Roslina Binti Idrishakim azmiNo ratings yet

- The Code of Ethics For Professional AccountantsDocument2 pagesThe Code of Ethics For Professional Accountantsfely lopezNo ratings yet

- Ima Sepp PDFDocument3 pagesIma Sepp PDFchocoNo ratings yet

- Code of EthicsDocument35 pagesCode of EthicsJamsankin PersianNo ratings yet

- Lecture Notes - Code of EthicsDocument5 pagesLecture Notes - Code of EthicsHalim Matuan MaamorNo ratings yet

- Group 3 Module 10Document20 pagesGroup 3 Module 10romerosa.roman.d.jrNo ratings yet

- Chapter 3Document56 pagesChapter 3Michael AnthonyNo ratings yet

- Professional Ethics: Elaine Capili Christine TeodoroDocument65 pagesProfessional Ethics: Elaine Capili Christine TeodoroJoyce Anne GarduqueNo ratings yet

- Redondo, Marc Eric B.: MAS Practice Standards and Code of Professional EthicsDocument6 pagesRedondo, Marc Eric B.: MAS Practice Standards and Code of Professional EthicsjhouvanNo ratings yet

- 08 Code of Ethics For CPAs in The PhilippinesDocument12 pages08 Code of Ethics For CPAs in The PhilippinesBack Up StorageNo ratings yet

- Ifac Code of Ethics For Professional Accountants: ConfidentialityDocument2 pagesIfac Code of Ethics For Professional Accountants: ConfidentialityJJ LongnoNo ratings yet

- Code of Ethics - EditedDocument76 pagesCode of Ethics - EditedAaron Mañacap100% (1)

- Chapter 4 Audit f8 - 2.3Document43 pagesChapter 4 Audit f8 - 2.3JosephineMicheal17No ratings yet

- Code of Conduct and EthicsDocument4 pagesCode of Conduct and EthicsJames ChintengoNo ratings yet

- Audit Notes Midsems FinDocument14 pagesAudit Notes Midsems FinAaditya ManojNo ratings yet

- Code of Ethics For Professional Accountants - Nov 2018 COEDocument11 pagesCode of Ethics For Professional Accountants - Nov 2018 COEChung CFNo ratings yet

- Topic 2 MIA by LawDocument32 pagesTopic 2 MIA by LawNUR IMAN SHAHIDAH BINTI SHAHRUL RIZALNo ratings yet

- Chapter 2 Part 2 Code of EthicsDocument10 pagesChapter 2 Part 2 Code of EthicsCharles MasenyaNo ratings yet

- 08 JournalDocument6 pages08 Journalits me keiNo ratings yet

- Chapter 5 MarlouDocument7 pagesChapter 5 MarlouCarla ZanteNo ratings yet

- Chapter 2Document21 pagesChapter 2Danish NabilNo ratings yet

- Code of Ethics For Professional Accountants HandoutDocument25 pagesCode of Ethics For Professional Accountants Handoutsaidkhatib368No ratings yet

- W2 Professional Ethics Revised 29 Mac 2021Document33 pagesW2 Professional Ethics Revised 29 Mac 2021YalliniNo ratings yet

- MAS Practice Standards Personal CharacteristicsDocument5 pagesMAS Practice Standards Personal CharacteristicsPatrickNo ratings yet

- Code of Ethics of Professional AccountantsDocument3 pagesCode of Ethics of Professional AccountantsYamateNo ratings yet

- The Code of Ethics For Professional Accountants in The PhilippinesDocument4 pagesThe Code of Ethics For Professional Accountants in The PhilippinesKimberly LimNo ratings yet

- At.1304 - Code of EthicsDocument29 pagesAt.1304 - Code of EthicsSheila Mae PlanciaNo ratings yet

- Accounting Ethics: Lect. Victor-Octavian Müller, PH.DDocument7 pagesAccounting Ethics: Lect. Victor-Octavian Müller, PH.DavalentinNo ratings yet

- Professional Accountant Ought To Be Straightforward and Honest in Conduct of All Professional Services IntegrityDocument17 pagesProfessional Accountant Ought To Be Straightforward and Honest in Conduct of All Professional Services IntegrityVictorNo ratings yet

- Ethics and AcceptanceDocument41 pagesEthics and AcceptanceTaimur ShahidNo ratings yet

- AT 02.03 - AT 02.07: Code of Ethics For Professional AccountantsDocument8 pagesAT 02.03 - AT 02.07: Code of Ethics For Professional AccountantscasmortelleNo ratings yet

- Industrial Security Operations Book One: The Security Officers HandbookFrom EverandIndustrial Security Operations Book One: The Security Officers HandbookNo ratings yet

- Failure of Native Writing Part 2Document7 pagesFailure of Native Writing Part 2Okumura YukioNo ratings yet

- Detailed Presentationo On ArchitectureDocument26 pagesDetailed Presentationo On ArchitectureOkumura YukioNo ratings yet

- USC Cebu Accounting OJT CoverletterDocument2 pagesUSC Cebu Accounting OJT CoverletterOkumura YukioNo ratings yet

- HUMN Medieval ArtDocument4 pagesHUMN Medieval ArtOkumura YukioNo ratings yet

- HUMN Medieval ArtDocument4 pagesHUMN Medieval ArtOkumura YukioNo ratings yet

- A Study On The Relationship of Unemployment and Crime RatesDocument1 pageA Study On The Relationship of Unemployment and Crime RatesOkumura YukioNo ratings yet