Professional Documents

Culture Documents

Ifac Code of Ethics For Professional Accountants: Confidentiality

Uploaded by

JJ Longno0 ratings0% found this document useful (0 votes)

24 views2 pagesThe IFAC Code of Ethics for Professional Accountants outlines standards of ethical conduct for accountants. It establishes five fundamental principles: integrity, objectivity, professional competence and due care, confidentiality, and professional behavior. The code takes a conceptual framework approach, requiring accountants to identify threats to compliance with these principles, evaluate the significance of threats, and apply safeguards to eliminate or reduce threats. It aims to maintain public trust in the accounting profession by ensuring accountants act with integrity and objectivity rather than self-interest.

Original Description:

Original Title

ETHICS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe IFAC Code of Ethics for Professional Accountants outlines standards of ethical conduct for accountants. It establishes five fundamental principles: integrity, objectivity, professional competence and due care, confidentiality, and professional behavior. The code takes a conceptual framework approach, requiring accountants to identify threats to compliance with these principles, evaluate the significance of threats, and apply safeguards to eliminate or reduce threats. It aims to maintain public trust in the accounting profession by ensuring accountants act with integrity and objectivity rather than self-interest.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views2 pagesIfac Code of Ethics For Professional Accountants: Confidentiality

Uploaded by

JJ LongnoThe IFAC Code of Ethics for Professional Accountants outlines standards of ethical conduct for accountants. It establishes five fundamental principles: integrity, objectivity, professional competence and due care, confidentiality, and professional behavior. The code takes a conceptual framework approach, requiring accountants to identify threats to compliance with these principles, evaluate the significance of threats, and apply safeguards to eliminate or reduce threats. It aims to maintain public trust in the accounting profession by ensuring accountants act with integrity and objectivity rather than self-interest.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

IFAC CODE OF ETHICS FOR PROFESSIONAL ACCOUNTANTS

In order to maintain public trust and the advantage of competent professional

confidence in the accountancy profession, service based on up-to-date

professional accountants must adhere to developments in practice, legislation and

standards of ethical conduct standards of conduct techniques.

that embody and demonstrate integrity,

objectivity, and concern for the public rather than

Confidentiality

self-interest. The Code of Ethics for Professional

Accountants in the Philippines is based on the A professional accountant should

IFAC Code of Ethics for Professional respect the confidentiality of information

Accountants. acquired during the course of performing

professional services and should not use

General Application

or disclose any such information without

In acting in the public interest, proper and specific authority or unless

professional accountants have to there is a legal or professional right or

observe a number of prerequisites or duty to disclose.

fundamental principles.

Integrity: Professional Behavior

A professional accountant should be A professional accountant should comply

straightforward and honest in with relevant laws and regulations and

professional and business relationships. refrain from any conduct which might

Integrity implies not merely honesty but it bring discredit to the profession.

requires being brave enough to fight for

what you believe in, Not telling lies is

honesty, but a man of integrity will always Conceptual Framework Approach

be willing to speak out and ask difficult

questions when the circumstances It is impossible to define every situation that

warrant. creates threats to compliance with fundamental

principles. Consequently, the code establishes a

Objectivity:

conceptual framework approach that requires a

The principle of objectivity imposes the professional accountant to:

obligation on all professional

1. Identify threats to compliance with

accountants to be fair, intellectually

fundamental principles

honest and free of conflicts of interest. A

2. Evaluate the significance of threats

professional accountant should be fair

identified; and

and should not allow prejudice or bias,

3. Apply safeguards, when necessary, to

conflict of interest or influence of others

eliminate the threats or reduce them to

to override objectivity.

an acceptable level.

Professional Competence and due Care

This approach is aimed at assisting the

A professional accountant should not professional accountants in complying with

undertake any engagement or accept an ethical requirements and meeting their

employment which he or she cannot responsibility to act in the public interest.

reasonably expect to discharge with

professional competence. A professional

accountant should continually strive to

improve his knowledge and skills to

ensure that a client or employer receives

Threats to Compliance with the Fundamental

Principles

The circumstances in which the professional

accountants operate may create threats to

compliance with fundamental principles. Such

threats fall into one or more of the following

categories:

1 Self-interest;

2. Self-review;

3. Advocacy;

4. Familiarity; and

5. Intimidation.

Safeguards

A professional accountant shall evaluate

any threats to compliance with the

fundamental principles. Both quantitative

and qualitative factors must be

considered in evaluating the significance

of a threat. Once a significant threat has

been identified and evaluated,

appropriate safeguards should be

considered and applied as necessary.

Safeguards fall into two broad categories:

1 Safeguards created by the profession,

legislation of regulation; and

2. Safeguards in the work environment

The firm and the members of the assurance team

should select appropriate safeguards to eliminate

or reduce threats, other than those that are

clearly insignificant, to an acceptable level.

You might also like

- The Code of Ethics For Professional AccountantsDocument2 pagesThe Code of Ethics For Professional Accountantsfely lopezNo ratings yet

- Code of Ethics For Professional AccountantsDocument17 pagesCode of Ethics For Professional AccountantsJay Mark AbellarNo ratings yet

- Chapter 7 Code of Ethics For Professional Accountants in The PhilippinesDocument29 pagesChapter 7 Code of Ethics For Professional Accountants in The PhilippinesJames Diaz100% (3)

- Professional Accountant Ought To Be Straightforward and Honest in Conduct of All Professional Services IntegrityDocument17 pagesProfessional Accountant Ought To Be Straightforward and Honest in Conduct of All Professional Services IntegrityVictorNo ratings yet

- Code of Professional Ethics: The Accountancy Act of 2004Document51 pagesCode of Professional Ethics: The Accountancy Act of 2004Just SomeoneNo ratings yet

- Module 2.2 Code of EthicsDocument29 pagesModule 2.2 Code of EthicsMary Grace Dela CruzNo ratings yet

- EthicsDocument15 pagesEthicsinayathussainjattNo ratings yet

- AuditingDocument12 pagesAuditingMY GODNo ratings yet

- Code of Ethics of Professional AccountantsDocument3 pagesCode of Ethics of Professional AccountantsYamateNo ratings yet

- Code of EthicsDocument78 pagesCode of EthicsNeriza PonceNo ratings yet

- Code of EthicsDocument5 pagesCode of EthicsZeus GamoNo ratings yet

- De - Guzman - Module 12Document8 pagesDe - Guzman - Module 12Ma Ruby II SantosNo ratings yet

- Sheet 1.0 - Code of Ethics For Professional AccountnatsDocument16 pagesSheet 1.0 - Code of Ethics For Professional AccountnatssalviNo ratings yet

- Topic 5 - Code of Ethics For AuditorsDocument39 pagesTopic 5 - Code of Ethics For Auditors黄勇添No ratings yet

- Code of Ethics - EditedDocument76 pagesCode of Ethics - EditedAaron Mañacap100% (1)

- Slides - Lecture 2 - ST VersionDocument17 pagesSlides - Lecture 2 - ST VersionNguyễn Thu UyênNo ratings yet

- Lecture Notes: Auditing Theory AT.0102-Code of Ethics - Part I MAY 2020Document8 pagesLecture Notes: Auditing Theory AT.0102-Code of Ethics - Part I MAY 2020MaeNo ratings yet

- The Code of Professional Ethics of CPA-Tyrelle Garth R. Dela CruzDocument1 pageThe Code of Professional Ethics of CPA-Tyrelle Garth R. Dela CruzTyrelle Dela CruzNo ratings yet

- Code of Etichs of Professional AccountantsDocument40 pagesCode of Etichs of Professional AccountantsYamateNo ratings yet

- Handbook of Bangladesh Standards On Auditing, Assurance, and Ethics PronouncementsDocument37 pagesHandbook of Bangladesh Standards On Auditing, Assurance, and Ethics PronouncementstufanNo ratings yet

- Code of Ethical Principles Published 7 Dec 11 v2 0Document13 pagesCode of Ethical Principles Published 7 Dec 11 v2 0Floch ForsterNo ratings yet

- The Code of Professional EthicsDocument33 pagesThe Code of Professional EthicsPrima FacieNo ratings yet

- 1) Code of Ethics For AuditorsDocument29 pages1) Code of Ethics For Auditorsrajes wari50% (2)

- Bacc307 Assignment 1Document7 pagesBacc307 Assignment 1Denny ChakauyaNo ratings yet

- 08 Code of Ethics For CPAs in The PhilippinesDocument12 pages08 Code of Ethics For CPAs in The PhilippinesBack Up StorageNo ratings yet

- Key Concepts in AccountingDocument9 pagesKey Concepts in AccountingSunday OcheNo ratings yet

- Audit Final Fast Track Book 2Document155 pagesAudit Final Fast Track Book 2ishan ishanNo ratings yet

- CODE OF ETHICS For Professional Accountants in TheDocument61 pagesCODE OF ETHICS For Professional Accountants in TheDiana Rose BassigNo ratings yet

- WV&PE Lesson 3Document14 pagesWV&PE Lesson 3Daniel S. GonzalesNo ratings yet

- The Code of Ethics For Cpas in The Philippines: Chapter SixDocument24 pagesThe Code of Ethics For Cpas in The Philippines: Chapter SixQueenie QuisidoNo ratings yet

- Auditing I CH 2Document36 pagesAuditing I CH 2Hussien AdemNo ratings yet

- Code of Ethics For Professional Accountants in The PhilippinesDocument3 pagesCode of Ethics For Professional Accountants in The Philippinesmac mercadoNo ratings yet

- Professional Ethics P2Document19 pagesProfessional Ethics P2chandrsenNo ratings yet

- Code of Professional EthicsDocument2 pagesCode of Professional EthicsJohn Lexter MacalberNo ratings yet

- Chapter 5 MarlouDocument7 pagesChapter 5 MarlouCarla ZanteNo ratings yet

- Acca Code of Ethics (Notes)Document16 pagesAcca Code of Ethics (Notes)nurmaisarahnurazim1No ratings yet

- COE. Act. 9298Document8 pagesCOE. Act. 9298Mark Kenneth ParagasNo ratings yet

- Code of EthicsDocument37 pagesCode of EthicsDawn Rei Dangkiw100% (1)

- Roque CPA Reviewer Auditing ch3 Final PDFDocument87 pagesRoque CPA Reviewer Auditing ch3 Final PDFSherene Faith Carampatan67% (3)

- Chapter 2Document21 pagesChapter 2Danish NabilNo ratings yet

- Chapter Three: Professional Ethics and Legal Liability of AuditorsDocument35 pagesChapter Three: Professional Ethics and Legal Liability of Auditorseferem100% (1)

- The Code of Ethics For Professional Accountants in The PhilippinesDocument4 pagesThe Code of Ethics For Professional Accountants in The PhilippinesKimberly LimNo ratings yet

- Topic 1 MIA by LawsDocument70 pagesTopic 1 MIA by LawsHanis ZahiraNo ratings yet

- Audit 2: Puan Roslina Binti IdrisDocument12 pagesAudit 2: Puan Roslina Binti Idrishakim azmiNo ratings yet

- 02 - Code of Ethics of ProfessionalDocument22 pages02 - Code of Ethics of ProfessionalYamateNo ratings yet

- Revised Code of Ethics For CPA's: BackgroundDocument6 pagesRevised Code of Ethics For CPA's: BackgroundMaria Lucy MendozaNo ratings yet

- Chapter 3Document56 pagesChapter 3Michael AnthonyNo ratings yet

- Summary of Code of EthicsDocument30 pagesSummary of Code of EthicsMJNo ratings yet

- Audit Chapter 20 PDFDocument45 pagesAudit Chapter 20 PDFÑïkêţ BäûðhåNo ratings yet

- Code of Ethics - ADocument2 pagesCode of Ethics - AOkumura YukioNo ratings yet

- Code of Ethics 2010 Fatal Flaw ReviewDocument6 pagesCode of Ethics 2010 Fatal Flaw ReviewGabriela Lourdes SandovalNo ratings yet

- Additional Ethics SlidesDocument5 pagesAdditional Ethics Slidesathirah jamaludinNo ratings yet

- 23 Code of Ethics For Professional Accountants: An Ethical Practice Is The Bedrock of An Accountant's SuccessDocument46 pages23 Code of Ethics For Professional Accountants: An Ethical Practice Is The Bedrock of An Accountant's SuccesstrishaNo ratings yet

- Lecture Notes: Auditing & Assurance Principles AT.112-Code of Ethics - Part I Nu Sports Academy LagunaDocument8 pagesLecture Notes: Auditing & Assurance Principles AT.112-Code of Ethics - Part I Nu Sports Academy LagunaPatrickMendozaNo ratings yet

- Unit 2 Regulation of The Practice of Public Accountancy and Within The Accounting FirmDocument136 pagesUnit 2 Regulation of The Practice of Public Accountancy and Within The Accounting FirmDia Mae Ablao GenerosoNo ratings yet

- Code of Ethiics GovDocument3 pagesCode of Ethiics GovJames Dayagbil IINo ratings yet

- Mas Practice Standards and Ethical Considerations MAS Practice Standards Personal CharacteristicsDocument4 pagesMas Practice Standards and Ethical Considerations MAS Practice Standards Personal CharacteristicsRoderick RonidelNo ratings yet

- Industrial Security Operations Book One: The Security Officers HandbookFrom EverandIndustrial Security Operations Book One: The Security Officers HandbookNo ratings yet

- Certified Risk and Compliance ProfessionalFrom EverandCertified Risk and Compliance ProfessionalRating: 5 out of 5 stars5/5 (3)

- Public Acceptability of A Sugar Sweetened Beverage Tax and Its Associated Factors in The NetherlandsDocument11 pagesPublic Acceptability of A Sugar Sweetened Beverage Tax and Its Associated Factors in The NetherlandsJJ LongnoNo ratings yet

- Sustainability 09 02262 PDFDocument14 pagesSustainability 09 02262 PDFsara6anneNo ratings yet

- Online Tourism and Travel-Analyzing Trends From Marketing PerspectiveDocument25 pagesOnline Tourism and Travel-Analyzing Trends From Marketing PerspectiveJJ LongnoNo ratings yet

- Nutrients 12 00817Document17 pagesNutrients 12 00817JJ LongnoNo ratings yet

- Online Tourism Information and Tourist Behavior: A Structural Equation Modeling Analysis Based On A Self-Administered SurveyDocument15 pagesOnline Tourism Information and Tourist Behavior: A Structural Equation Modeling Analysis Based On A Self-Administered SurveyJJ LongnoNo ratings yet

- The Commitment-Trust Theory of Relationship MarketingDocument21 pagesThe Commitment-Trust Theory of Relationship MarketingJJ LongnoNo ratings yet

- International Journal of Hospitality Management: Gomaa Agag, Ahmed A. El-MasryDocument16 pagesInternational Journal of Hospitality Management: Gomaa Agag, Ahmed A. El-MasryMai NguyenNo ratings yet

- Sample Draft Research ProposalDocument15 pagesSample Draft Research ProposalJJ LongnoNo ratings yet

- The Effect of Perceived Trust On Electronic Commerce: Shopping Online For Tourism Products and Services in South KoreaDocument12 pagesThe Effect of Perceived Trust On Electronic Commerce: Shopping Online For Tourism Products and Services in South KoreaJJ LongnoNo ratings yet

- PSA200Document1 pagePSA200JJ LongnoNo ratings yet

- Psa 610 Using The Work of Internal Auditors: RequirementsDocument2 pagesPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoNo ratings yet

- How Far Have We Gone?Document2 pagesHow Far Have We Gone?JJ LongnoNo ratings yet

- PAPS 1000 Inter-Bank Confirmation ProceduresDocument1 pagePAPS 1000 Inter-Bank Confirmation ProceduresJJ LongnoNo ratings yet

- Macro Chapter 2 Lesson 1-2 PDFDocument20 pagesMacro Chapter 2 Lesson 1-2 PDFJJ LongnoNo ratings yet

- 20200930010129Document1 page20200930010129JJ LongnoNo ratings yet

- 1ST ActivityDocument22 pages1ST ActivityJJ LongnoNo ratings yet

- 20200930010043Document1 page20200930010043JJ LongnoNo ratings yet

- 3RD Activity - ComprehensiveDocument19 pages3RD Activity - ComprehensiveJJ Longno100% (2)

- 20200930010043Document1 page20200930010043JJ LongnoNo ratings yet

- 2ND ActivityDocument9 pages2ND ActivityJJ LongnoNo ratings yet

- Answer The Following Questions Substantially.: Chapter ActivityDocument3 pagesAnswer The Following Questions Substantially.: Chapter ActivityJJ LongnoNo ratings yet

- 3RD Activity FinalDocument22 pages3RD Activity FinalJJ LongnoNo ratings yet

- Ang Pag-Aalsa Sa Cavite (Facebook Post)Document1 pageAng Pag-Aalsa Sa Cavite (Facebook Post)JJ LongnoNo ratings yet

- Reflection & DocumentationDocument2 pagesReflection & DocumentationJJ LongnoNo ratings yet

- Letter From Archbishop GregorioDocument2 pagesLetter From Archbishop GregorioJJ LongnoNo ratings yet

- Cavite Mutiny - Toward A Definitive HistoryDocument13 pagesCavite Mutiny - Toward A Definitive HistoryJJ LongnoNo ratings yet

- Transfer06 Essa03 PDFDocument10 pagesTransfer06 Essa03 PDFJJ LongnoNo ratings yet

- GgwpxxfvvjfssedDocument13 pagesGgwpxxfvvjfssedJJ LongnoNo ratings yet

- Ais Company StudyDocument55 pagesAis Company StudyJJ LongnoNo ratings yet

- Industrial Motor Control Part IDocument38 pagesIndustrial Motor Control Part Ikibrom atsbha100% (2)

- Class InsectaDocument4 pagesClass InsectaLittle Miss CeeNo ratings yet

- Lord of The Flies - Chapter Comprehension QuestionsDocument19 pagesLord of The Flies - Chapter Comprehension Questionsjosh johnsyNo ratings yet

- Some Studies On Structure and Properties of Wrapped Jute (Parafil) YarnsDocument5 pagesSome Studies On Structure and Properties of Wrapped Jute (Parafil) YarnsVedant MahajanNo ratings yet

- RS2 Stress Analysis Verification Manual - Part 1Document166 pagesRS2 Stress Analysis Verification Manual - Part 1Jordana Furman100% (1)

- Evan Lagueux - H Argument EssayDocument7 pagesEvan Lagueux - H Argument Essayapi-692561087No ratings yet

- An Introduction To Routine and Special StainingDocument13 pagesAn Introduction To Routine and Special StainingBadiu ElenaNo ratings yet

- Performance Task 2Document3 pagesPerformance Task 2Edrose WycocoNo ratings yet

- Random Questions From Various IIM InterviewsDocument4 pagesRandom Questions From Various IIM InterviewsPrachi GuptaNo ratings yet

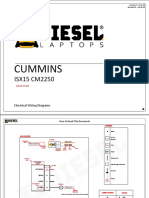

- Cummins: ISX15 CM2250Document17 pagesCummins: ISX15 CM2250haroun100% (4)

- Sistemas de Mando CST Cat (Ing)Document12 pagesSistemas de Mando CST Cat (Ing)Carlos Alfredo LauraNo ratings yet

- SANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabDocument2 pagesSANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabsantonuNo ratings yet

- PV Power To Methane: Draft Assignment 2Document13 pagesPV Power To Methane: Draft Assignment 2Ardiansyah ARNo ratings yet

- Ec 0301Document25 pagesEc 0301Silvio RomanNo ratings yet

- Effects of Corneal Scars and Their Treatment With Rigid Contact Lenses On Quality of VisionDocument5 pagesEffects of Corneal Scars and Their Treatment With Rigid Contact Lenses On Quality of VisionJasmine EffendiNo ratings yet

- Nationalism, Feminism, and Modernity in PalestineDocument26 pagesNationalism, Feminism, and Modernity in PalestinebobandjoerockNo ratings yet

- DADTCO Presentation PDFDocument34 pagesDADTCO Presentation PDFIngeniería Industrias Alimentarias Itsm100% (1)

- Swiss Army Triplet 1Document2 pagesSwiss Army Triplet 1johnpwayNo ratings yet

- DOT RequirementsDocument372 pagesDOT RequirementsMuhammadShabbirNo ratings yet

- God Reproducing Himself in UsDocument6 pagesGod Reproducing Himself in UsLisa100% (1)

- Collins Ks3 Science Homework Book 3Document5 pagesCollins Ks3 Science Homework Book 3g3pz0n5h100% (1)

- Panera Bread Case StudyDocument28 pagesPanera Bread Case Studyapi-459978037No ratings yet

- ANTINEOPLASTICSDocument21 pagesANTINEOPLASTICSGunjan KalyaniNo ratings yet

- Embedded Software Development ProcessDocument34 pagesEmbedded Software Development ProcessAmmar YounasNo ratings yet

- Zillah P. Curato: ObjectiveDocument1 pageZillah P. Curato: ObjectiveZillah CuratoNo ratings yet

- Review Course 2 (Review On Professional Education Courses)Document8 pagesReview Course 2 (Review On Professional Education Courses)Regie MarcosNo ratings yet

- Setting and Plot: Old YellerDocument8 pagesSetting and Plot: Old YellerWalid AhmedNo ratings yet

- Shelly Cashman Series Microsoft Office 365 Excel 2016 Comprehensive 1st Edition Freund Solutions ManualDocument5 pagesShelly Cashman Series Microsoft Office 365 Excel 2016 Comprehensive 1st Edition Freund Solutions Manualjuanlucerofdqegwntai100% (10)

- 한국항만 (영문)Document38 pages한국항만 (영문)hiyeonNo ratings yet