Professional Documents

Culture Documents

Information Technology Sector Update 19 March 2019

Uploaded by

Abhinav SrivastavaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Information Technology Sector Update 19 March 2019

Uploaded by

Abhinav SrivastavaCopyright:

Available Formats

Institutional Equities

Information Technology Sector

19 March 2019

Rolling Forward Valuation By 6 months Girish Pai

Head of Research

We are changing the target prices on our universe of coverage primarily driven

girish.pai@nirmalbang.com

by the rolling forward of the basis of valuation to FY21 EPS rather than

+91-22-6273 8017

September 2020 EPS that we used previously. Our Target P/E multiples do not

change. This has led to upward revision of target prices (see Exhibit 1 below).

However our ratings on stock remain the same. Wipro’s numbers have also

been adjusted for the recent bonus issue.

Sector Update

Exhibit 1: Changes made to our earnings estimates, target prices and ratings

New New Old Old New Old New Old Chg

CMP New Old

Company Mkt cap FY20E EPS FY21E EPS FY20E EPS FY21E EPS target P/E target P/E TP TP (%)

(Rs) rating rating

(US$bn) (Rs) (Rs) (Rs) (Rs) (x) (x) (Rs) (Rs)

TCS 2,023 110 92.0 97.4 92.0 97.4 16.5 16.5 Sell Sell 1,607 1,607 0

Infosys 710 45 39.5 41.7 39.5 41.7 14.9 14.9 Sell Sell 620 603 2.8

Wipro 258 23 17.8 18.1 23.8 24.2 11.6 11.6 Sell Sell 209 277 -24

HCL Technologies 1,012 20 83.4 87.0 83.4 87.0 12.4 12.4 Acc Acc 1,076 1,054 2.1

Tech Mahindra 789 11 56.2 59.3 56.2 59.3 9.9 9.9 Sell Sell 587 561 4.6

Mindtree 963 2 54.2 56.0 54.2 56.0 9.9 9.9 Sell Sell 554 553 0.2

Persistent Systems 658 1 57.2 59.3 57.2 59.3 8.3 8.3 Sell Sell 489 481 1.7

Source: Bloomberg, Nirmal Bang Institutional Equities Research.

Note 1: Wipro’s EPS has been adjusted for the 1:3 bonus issue that was concluded recently

Note 2: We already moved the Target Price of TCS in the report released on 18 March 2019

Institutional Equities

Exhibit 2: Comparative Valuation

TCS Infosys Wipro HCL Tech Tech Mahindra Mindtree Persistent

Year Ending March March March March March March March

Prices as on 18-Mar-19 2,022.8 710.2 257.6 1,012.0 788.6 962.5 657.9

Currency INR INR INR INR INR INR INR

Market Value (Rsbn) 7,744 3,087 1,272 1,376 695 159 53

(US$mn) 107,562 42,874 17,667 19,116 9,657 2,212 731

Target Price 1,607 620 209 1,076 587 554 489

Upside/(downside) -20.6% -12.7% -18.9% 6.3% -25.6% -42.4% -25.6%

Recommendation Sell Sell Sell Accumulate Sell Sell Sell

FDEPS (Rs)

FY18 67.0 32.5 16.8 62.9 42.8 34.7 40.4

FY19E 82.9 35.7 18.5 74.4 50.1 46.2 44.2

FY20E 92.0 39.5 17.8 83.4 56.2 54.2 57.2

FY21E 97.4 41.7 18.1 87.0 59.3 56.0 59.3

PE (x)

FY18 30.2 21.9 15.3 16.1 18.4 27.8 16.3

FY19E 24.4 19.9 13.9 13.6 15.7 20.8 14.9

FY20E 22.0 18.0 14.5 12.1 14.0 17.8 11.5

FY21E 20.8 17.0 14.2 11.6 13.3 17.2 11.1

EV/EBITDA (x)

FY18 23.7 15.2 13.8 11.2 13.8 20.0 10.7

FY19E 19.1 14.4 11.2 9.2 9.8 13.9 8.7

FY20E 17.4 12.7 9.2 8.2 8.8 11.3 6.8

FY21E 16.8 12.0 8.8 7.7 8.3 10.6 6.1

EV/Sales (x)

FY18 6.2 4.1 2.6 2.5 2.1 2.7 1.7

FY19E 5.3 3.7 2.2 2.1 1.8 2.1 1.5

FY20E 4.7 3.3 1.9 1.9 1.6 1.8 1.2

FY21E 4.5 3.1 1.8 1.8 1.5 1.7 1.1

RoIC (%)

FY18 57.3 44.9 24.5 38.9 25.8 32.9 29.7

FY19E 61.7 47.9 29.2 37.3 36.3 47.6 41.4

FY20E 61.5 51.3 35.4 34.1 38.1 51.3 49.9

FY21E 61.1 50.2 35.8 30.1 38.7 53.2 53.5

Source: Bloomberg, Nirmal Bang Institutional Equities Research

2 Information Technology Sector

Institutional Equities

Exhibit 3: Industry Valuation

Price MCap EPS (Rs) P/E (x) EV/Sales (x) P/B (X)

EPS (Rs) (US$mn) FY19 FY20 FY21 FY19 FY20 FY21 FY19 FY20 FY21 FY19 FY20 FY21

TCS 2,023 110,686 82.9 92.0 97.4 24.4 22.0 20.8 5.3 4.7 4.5 9.0 7.3 6.1

Infosys 710 45,247 35.7 39.5 41.7 19.9 18.0 17.0 3.7 3.3 3.1 5.8 5.1 4.5

Wipro 258 22,666 18.5 17.8 18.1 13.9 14.5 14.2 2.2 1.9 1.8 2.7 2.5 2.3

HCL Tech 1,012 20,015 74.4 83.4 87.0 13.6 12.1 11.6 2.1 1.9 1.8 3.3 3.0 2.8

Tech Mahindra 789 11,308 50.1 56.2 59.3 15.7 14.0 13.3 1.8 1.6 1.5 3.3 2.9 2.5

Persistent 658 767 44.2 57.2 59.3 14.9 11.5 11.1 1.5 1.2 1.1 2.4 2.1 1.8

Mindtree 963 2,305 46.2 54.2 56.0 20.8 17.8 17.2 2.1 1.8 1.7 5.1 4.3 3.7

Cognizant* (US$) 80 41,482 4.5 4.9 5.4 18.0 16.4 14.9 2.1 1.9 1.7 3.5 3.0 2.8

Accenture (US$) 165 106,225 7.2 7.9 8.6 22.8 20.9 19.2 2.4 2.2 2.0 8.0 6.9 5.8

Cap Gemini* (Euro) 115 20,467 6.5 7.2 7.8 17.6 16.0 14.7 1.3 1.2 1.1 2.4 2.2 2.0

Globant (US$) 56 2,604 2.2 2.6 3.3 26.0 21.3 16.9 3.9 3.1 2.5 5.2 4.1 -

Epam (US$) 124 9,181 6.2 7.7 9.6 20.0 16.0 12.9 3.7 2.9 2.2 4.5 3.6 2.9

Luxoft (US$) 37 1,994 2.4 2.9 3.2 15.7 12.7 11.5 2.0 1.8 1.5 2.5 2.2 1.9

Hexaware* 338 1,467 21.4 23.8 26.6 15.8 14.2 12.7 1.7 1.4 1.2 3.7 3.2 2.9

Cyient 659 1,087 39.4 47.8 54.1 16.7 13.8 12.2 1.4 1.2 1.0 2.9 2.6 2.3

Mphasis 969 2,630 56.6 63.9 71.9 17.1 15.2 13.5 2.2 1.9 1.6 3.6 3.2 3.0

eClerx 1,123 634 59.4 70.1 80.0 18.9 16.0 14.0 2.6 2.3 2.1 3.4 3.2 2.9

LTI 1,568 3,966 87.6 98.3 110.3 17.9 16.0 14.2 2.8 2.3 2.0 5.7 4.7 4.0

LTTS 1,491 2,262 69.5 76.9 88.8 21.5 19.4 16.8 3.0 2.5 2.1 6.6 5.4 4.4

#VALU #VALU #VALU #VALU #VALU #VALU #VALU #VALU

KPIT #N/A N/A #N/A N/A 15.6 19.4 23.4 #####

E! E! E! E! E! E! E! E!

NIIT Tech 1,317 1,186 67.5 81.1 92.0 19.5 16.2 14.3 2.0 1.7 1.5 4.0 3.4 3.0

Intellect Design 201 385 8.4 10.6 13.8 24.0 18.9 14.5 1.8 1.5 1.3 2.5 2.3 2.3

OFSS 3,348 4,188 169.5 192.9 213.4 19.8 17.4 15.7 - - - 8.7 8.9 8.9

Just Dial 663 626 27.4 30.7 34.0 24.2 21.6 19.5 3.5 3.4 3.0 4.3 3.6 3.1

Infoedge 1,835 3,268 18.3 30.4 39.4 100.4 60.3 46.6 18.6 15.1 12.6 10.6 9.1 7.8

Makemytrip (US$) 35 2,952 (1.1) (0.5) 0.1 (31.4) (67.1) 249.3 4.0 3.5 3.0 2.6 2.8 2.9

Genpact* 29 6,462 2.0 2.2 2.5 14.7 13.1 11.7 2.1 1.9 - 3.3 2.8 2.4

WNS 52 2,636 2.7 2.8 3.1 19.7 18.9 17.1 3.1 2.8 2.8 4.8 4.0 3.4

EXLS* 58 2,074 3.0 3.3 3.8 19.6 17.8 15.4 2.1 1.8 - 2.9 2.5 -

Source: Bloomberg, Nirmal Bang Institutional Equities Research

3 Information Technology Sector

Institutional Equities

Exhibit 4: Stock Performance

Stock Performance

CY13 CY14 CY15 CY16 CY17 CY18 1QCY17 2QCY17 3QCY17 4QCY17 1QCY18 2QCY18 3QCY18 4QCY18 QTD

(%)

TCS 70.1 17.3 (4.4) (2.8) 11.7 44.4 3.4 (2.9) 3.1 7.8 8.5 29.7 18.2 (13.2) 6.7

Infosys 50.8 12.3 10.5 (8.6) 4.1 27.2 3.0 (8.5) (3.8) 14.8 9.5 15.5 11.7 (10.0) 8.1

Wipro 57.7 0.2 1.0 (15.4) 30.4 7.2 9.2 0.2 8.5 9.9 (8.7) (7.0) 23.9 1.9 4.1

HCL Tech 99.1 27.5 5.8 (2.5) 7.2 9.1 6.8 (2.7) 2.8 0.4 10.3 (4.4) 17.4 (11.9) 5.6

Tech Mahindra 100.6 41.4 (19.6) (8.1) 3.0 43.6 (4.9) (16.8) 19.9 8.6 28.5 2.6 13.7 (4.2) 10.4

Persistent 91.7 65.8 (20.7) (3.6) 11.7 (9.6) (4.6) 14.5 (1.8) 4.1 (0.5) 16.9 (2.8) (20.0) 4.3

Mindtree 122.7 59.8 16.4 (26.9) 17.0 41.0 (13.5) 16.8 (12.1) 31.9 25.9 27.8 4.7 (16.4) 11.4

Cognizant 38.4 6.2 14.8 (7.9) 27.1 (11.9) 5.9 11.6 9.2 (1.6) 11.6 (0.9) (2.3) (18.4) 27.3

Accenture 25.0 9.9 17.4 10.5 31.2 (9.0) 2.5 3.2 9.2 13.7 (4.0) 11.0 4.0 (17.8) 6.5

Globant SA - - 150.3 (12.9) 39.7 24.3 11.3 19.3 (7.8) 14.0 11.1 11.9 3.9 (3.7) (9.1)

Epam Systems INC 83.9 37.2 65.8 (18.9) 67.5 5.9 17.5 11.3 4.6 22.5 3.6 11.5 10.8 (17.2) (0.6)

Luxoft Holding INC - 1.7 105.3 (29.4) (0.3) (45.1) 12.0 (2.7) (21.4) 16.5 (26.4) (10.1) 28.5 (35.4) 35.8

Cap Gemini 48.4 - 44.0 (6.2) 22.5 (13.1) 7.2 4.5 9.6 (0.3) 1.8 14.4 (5.9) (20.7) 20.2

Hexaware 56.1 51.2 21.1 (15.1) 65.0 (2.6) 4.7 12.7 11.4 25.5 11.3 21.6 (6.4) (23.1) 2.4

Cyient 88.6 53.3 (8.6) 3.9 18.3 5.8 (4.7) 8.6 0.6 13.7 19.7 10.3 (2.8) (17.5) 7.3

Mphasis 12.2 (13.9) 33.9 13.8 27.9 38.6 2.3 3.4 3.2 17.1 15.6 29.4 8.2 (14.4) (3.5)

NIIT Tech 45.9 (0.1) 63.0 (26.4) 53.1 77.7 2.7 32.6 (6.0) 19.7 33.2 26.9 (0.1) 5.2 14.1

LTI - - - - 61.2 57.9 5.1 10.3 1.3 37.2 22.3 24.7 14.7 (9.7) (9.4)

LTTS - - - - 30.5 66.0 (0.8) (7.9) 9.1 31.0 20.7 (1.4) 42.5 (2.1) (12.2)

Intellect Design - - 258.4 (50.2) 27.9 33.7 (17.6) 7.2 3.2 40.3 (1.1) 17.1 4.9 10.1 (10.3)

OFSS 1.0 1.5 11.5 (17.1) 30.6 (9.9) 22.7 (5.4) 0.7 11.7 (7.8) 8.8 (3.9) (6.5) (8.5)

Ramco Systems 54.2 219.0 71.7 (57.8) 57.3 (47.5) 14.7 (14.8) 16.8 37.9 (32.6) (4.1) (6.1) (13.4) (8.8)

Just Dial (4.9) (36.0) (61.5) 57.4 (4.0) 58.6 (29.5) 0.1 40.7 (15.4) 25.3 (14.0) 5.2 32.0

Infoedge 34.6 81.3 2.4 5.4 44.3 10.8 (11.9) 29.1 6.9 18.7 (10.4) 0.9 20.0 2.2 26.2

Makemytrip 53.9 33.1 (31.2) 32.5 29.9 (21.3) 49.8 (3.0) (14.3) 4.3 10.7 8.9 (24.1) (14.0) 41.9

Index Performance

(%)

Nasdaq 37.0 20.0 8.6 5.7 31.0 (2.4) 10.5 3.9 5.9 7.7 0.3 9.0 8.3 (17.6) 3.9

S&P 500 31.3 13.0 (0.8) 9.0 19.5 (7.5) 5.0 2.6 4.0 6.7 (3.1) 4.4 7.2 (14.7) 5.1

Stox 600 17.3 4.2 7.8 (2.0) 8.1 (13.7) 5.8 (0.5) 2.3 0.4 (5.2) 2.9 0.9 (12.3) 9.3

DAX 25.5 2.7 9.6 6.6 13.4 (18.7) 7.5 0.1 4.1 1.2 (8.0) 3.1 (0.5) (13.8) 13.4

Nikkei 56.7 7.1 9.1 0.6 19.0 (12.2) (1.2) 5.9 1.6 11.9 (7.7) 6.1 8.1 (17.0) 17.5

MSCI EM (5.0) (4.7) (17.1) 8.5 34.4 (16.6) 11.6 5.5 7.0 6.6 0.8 (8.0) (2.0) (8.1) 23.1

Bovespa (15.5) (2.9) (13.3) 38.9 26.9 15.0 7.9 (3.2) 18.1 2.8 9.8 (13.2) 9.0 10.8 (2.1)

HSCEI (5.3) 10.0 (18.4) (3.6) 25.5 (14.5) 10.3 0.9 5.3 7.1 2.7 (7.7) (0.5) (9.3) 16.8

CNX BANK (8.7) 63.9 (9.3) 6.6 41.4 6.4 18.9 8.2 3.6 6.0 (4.8) 8.7 (4.7) 8.0 9.1

CNX IT 57.2 17.4 (0.3) (7.4) 11.7 25.1 4.0 (5.1) 3.2 9.7 8.8 11.8 13.2 (9.2) 6.8

CNX FMCG 11.7 17.8 0.1 1.7 30.5 14.8 15.4 13.6 (8.5) 8.7 (1.8) 10.9 2.7 2.6 (1.2)

CNX AUTO 9.9 57.3 (0.7) 10.5 30.2 (22.2) 8.5 6.7 2.6 9.7 (8.7) (1.0) (10.4) (3.8) (6.5)

CNX ENERGY 0.1 8.4 (0.7) 19.2 40.8 0.6 14.8 (0.4) 10.1 11.9 (7.5) 0.9 17.7 (8.5) 13.7

CNX PHARMA 26.3 42.6 10.3 (15.5) (5.4) (8.0) 2.8 (7.7) (4.5) 4.5 (12.8) 9.8 8.7 (11.6) 4.4

CNX METAL (13.8) 6.2 (31.3) 45.5 49.7 (21.4) 17.1 (3.4) 18.7 11.5 (11.3) (2.1) 1.3 (10.7) (2.7)

CNX INFRA (4.7) 22.5 (8.8) (2.3) 34.1 (11.8) 15.2 3.4 1.4 11.1 (7.7) (6.1) (5.1) 7.1 (0.4)

CNX MIDCAP (5.4) 55.7 7.2 6.5 47.4 (15.2) 20.8 3.1 2.1 15.9 (10.6) (3.1) (5.6) 3.7 0.1

CNX SMALLCAP (8.1) 53.9 7.4 2.2 57.5 (29.0) 22.1 4.7 3.7 18.8 (13.6) (7.9) (14.3) 4.0 2.3

NIFTY 6.5 31.1 (4.3) 2.6 29.3 3.6 13.2 3.8 2.8 7.0 (3.5) 5.9 2.0 (0.6) 5.5

USD/INR 61.8 63.0 66.2 67.4 65.1 68.5 67.0 64.5 `64.3 64.7 65.2 68.5 70.1 72.1 70.7

Source: Bloomberg, Nirmal Bang Institutional Equities Research

4 Information Technology Sector

Institutional Equities

Financials - TCS

Exhibit 5: Income statement Exhibit 6: Cash flow

Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 67.1 64.5 70.0 72.0 74.5 EBIT 303 305 376 423 438

Net Sales (USD mn) 17,575 19,089 20,871 22,673 22,847

(Inc.)/dec. in working capital 6 (20) (77) (36) (10)

-Growth (%) 6.2 8.6 9.3 8.6 0.8

Cash flow from operations 309 285 299 387 429

Net Sales 1,180 1,231 1,459 1,633 1,702

-Growth (%) 8.6 4.4 18.5 11.9 4.3 Other income 42 36 39 35 47

Cost of Sales & Services 669 713 848 950 998 Depreciation & amortisation 20 20 25 20 20

Gross Margin 511 518 612 682 704 Financial expenses - - - - -

% of sales 43.3 42.1 41.9 41.8 41.3 Tax paid (82) (82) (101) (112) (119)

SG& A 208 213 236 260 265 Dividends paid (112) (116) (133) (150) (158)

% of sales 17.6 17.3 16.1 15.9 15.6

Net cash from operations 178 143 130 180 172

EBIT 303 305 376 423 438

Capital expenditure (19) (19) (23) (21) (21)

EBIT Margin (%) 25.7 24.8 25.8 25.9 25.7

Net cash after capex 159 124 107 160 151

Other income (net) 42 36 39 35 47

PBT 345 341 416 458 485 Inc./(dec.) in debt 0 (0) (2) - -

-PBT margin (%) 29.3 27.7 28.5 28.1 28.5 (Inc.)/dec. in investments (192) 60 59 - -

Provision for tax 82 82 101 112 119 Equity issue/(Share Buyback) - (160) (160) - -

Effective tax rate (%) 23.6 24.1 24.2 24.5 24.5 Cash from financial activities (191) (101) (103) - -

Minority Interest 1 1 1 1 1 Others 5 5 (39) (1) 46

Net profit 263 258 314 345 365

Opening cash 67 40 69 35 194

-Growth (%) 8.6 (1.8) 21.6 9.9 5.9

Closing cash 40 69 35 194 391

-Net profit margin (%) 22.3 21.0 21.5 21.1 21.5

Change in cash (28) 29 (35) 159 197

Average Shares outstanding-Basic 3,941 3,829 3,790 3,752 3,752

Source: Company, Nirmal Bang Institutional Equities Research Source: Company, Nirmal Bang Institutional Equities Research

Exhibit 8: Key ratios

Exhibit 7: Balance sheet

Y/E March FY17 FY18 FY19E FY20E FY21E

Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E

Per Share (Rs)

Equity capital 2.0 1.9 3.8 3.8 3.8

EPS 66.7 67.0 82.9 92.0 97.4

Reserves & surplus 885 875 857 1,052 1,260

FDEPS 66.7 67.0 82.9 92.0 97.4

Net worth 887 876 860 1,056 1,264

Dividend Per Share 23.5 25.1 29.1 33.1 34.9

Minority Interest - - - - -

Dividend Yield (%) 1.2 1.2 1.4 1.6 1.7

Other liabilities 21 29 30 34 34

Book Value 231.6 228.9 224.7 275.8 330.1

Total loans 3 2 1 1 1

Dividend Payout Ratio (excl DT) 42.4 37.2 35.1 36.0 35.8

Total liabilities 911 908 891 1,090 1,299

Return ratios (%)

Goodwill 38 39 40 40 40

RoE 32.4 29.3 36.2 36.0 31.5

Net block (incl. CWIP) 117 116 114 115 116

RoCE 33.7 30.7 37.2 37.9 33.1

Investments 3 3 6 6 6

Pre Tax ROIC 60.8 57.3 61.7 61.5 61.1

Deferred tax asset - net 28 34 30 34 34

Tunover Ratios

Other non-current assets 62 76 65 70 71

Asset Turnover Ratio 1.1 1.1 1.3 1.2 1.1

Other current assets 485 427 465 472 474

Debtor Days (incl. unbilled Rev) 87 95 87 87 86

Debtors 280 320 349 390 401

Working Capital Cycle Days 64 63 77 75 74

Cash & bank balance 36 49 52 52 52

Valuation ratios (x)

Bank deposits 4 21 (18) 141 339

PER 30.3 30.2 24.4 22.0 20.8

Total current assets 805 815 849 1,056 1,266

P/BV 8.7 8.8 9.0 7.3 6.1

Total current liabilities 143 176 212 229 234

EV/EBTDA 23.9 23.7 19.2 17.4 16.8

Net current assets 662 639 637 827 1,033

EV/Sales 6.5 6.3 5.3 4.7 4.5

Total assets 911 908 891 1,090 1,299

M-cap/Sales 6.6 6.3 5.3 4.7 4.6

Source: Company, Nirmal Bang Institutional Equities Research

Source: Company, Nirmal Bang Institutional Equities Research

5 Information Technology Sector

Institutional Equities

Financials - Infosys

Exhibit 9: Income statement Exhibit 10: Cash flow

Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 67.1 64.5 69.9 72.0 74.5 EBIT 169 171 191 214 222

Net Sales (USD mn) 10,206 10,940 11,787 12,858 12,819

(Inc.)/dec. in working capital (19) (46) 12 (18) (3)

-Growth (%) 7.4 7.2 7.7 9.1 (0.3)

Cash flow from operations 150 126 203 196 219

Net Sales 685 705 825 926 955

-Growth (%) 9.7 3.0 16.9 12.3 3.1 Other Income 31 32 30 19 25

Direct Costs 433 451 535 601 619 Depreciation & Amortisation 17 19 20 24 25

Gross Margin 252 254 289 325 336 Financial Expenses 0 0 0 0 0

% of sales 36.8 36.0 35.1 35.1 35.2 Tax Paid (56) (57) (61) (65) (69)

SG& A 83 82 99 111 115 Dividends Paid (143) (179) (106) (103) (109)

% of sales 12.2 11.7 11.9 12.0 12.0

Net Cash from Operations (1) (59) 87 71 91

EBIT 169 171 191 214 222

Capital Expenditure (26) (3) (49) (38) (41)

% of sales 24.7 24.3 23.2 23.1 23.2

Net Cash after Capex (26) (63) 38 33 50

Other income (net) 31 32 30 19 25

PBT 200 204 216 233 246 Inc./(Dec.) in Debt - - - - -

-PBT margin (%) 29.1 28.9 26.2 25.2 25.8 (Inc.)/Dec. in Investments (145) 43 (22) 0 0

Provision for tax 56 57 61 65 69 Share Issue/(Share Buyback) (130) (83) 0 0

Effective tax rate (%) 28.1 28.0 28.2 28.0 28.0 Cash from Financial Activities (145) (87) (105) 0 0

Net profit (adjusted) 144 147 155 168 177 Others 71 122 (88) (1)

-Growth (%) 6.4 2.3 5.8 8.1 5.6

Opening Cash 327 226 198 43 75

-Net profit margin (%) 21.0 20.8 18.8 18.1 18.6

Closing Cash 226 198 43 75 125

Shares Outstanding (Basic) 4,594 4,347 4,348 4,244 4,244

Change in Cash (101) (28) (155) 32 50

Source: Company, Nirmal Bang Institutional Equities Research

Source: Company, Nirmal Bang Institutional Equities Research

Exhibit 11: Balance sheet Exhibit 12: Key ratios

Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E Y/E March FY17 FY18 FY19E FY20E FY21E

Equity capital 11.4 10.9 21.8 21.2 21.2 Per Share (Rs)

Reserves & surplus 678 638 511 575 644

EPS-Adjusted 31.2 32.5 35.7 39.6 41.8

Net worth 690 649 532 596 665

FDEPS-Adjusted 31.2 32.5 35.7 39.5 41.7

Deferred tax liability 2 5 5 5 5

Dividend Per Share 25.8 33.5 20.2 20.2 21.3

Other liabilities 2 3 4 4 4

Dividend Yield (%) 3.6 4.7 2.8 2.8 3.0

Total loans - - - - -

Book Value 150 149 122 141 157

Total liabilities and Equity 693 658 542 606 675

Dividend Payout Ratio (incl. DT) 99.3 122.1 68.1 61.5 61.5

Goodwill 37 22 36 36 36

Return ratios (%)

Other intangible assets 8 2 8 8 8

RoE 22.0 21.9 26.3 29.7 28.1

Net block 117 121 131 145 161

RoCE 30.5 30.5 36.6 41.3 39.1

Investments 164 122 144 144 144

Pre Tax ROIC 51.1 44.9 47.9 51.3 50.2

Deferred tax asset - net 5 13 12 12 12

Turnover Ratios

Other non-current assets 65 82 81 88 89

Asset Turnover 0.8 0.9 1.2 1.2 1.1

Unbilled revenue 36 43 48 53 54

Debtor Days (incl. unbilled Rev.) 84 89 85 84 83

Derivative financial instrument 3 0 4 4 4

Working Capital Cycle Days 37 49 38 38 38

Other current assets 49 64 55 62 62

Valuation ratios (x)

Income tax assets-current - - - - -

P/E 22.7 21.9 19.9 18.0 17.0

Debtors 123 131 148 164 166

P/BV 4.7 4.8 5.8 5.1 4.5

Cash & bank balance 226 198 43 75 125

EV/EBITDA 15.4 15.2 14.4 12.7 12.0

Total current assets 437 436 298 358 412

EV/Sales 4.2 4.1 3.7 3.3 3.1

Total current liabilities 140 141 167 184 187

M-cap/Sales 4.5 4.4 3.7 3.3 3.2

Net current assets 297 295 131 174 225

Source: Company, Nirmal Bang Institutional Equities Research

Total assets 693 658 542 606 675

Source: Company, Nirmal Bang Institutional Equities Research

6 Information Technology Sector

Institutional Equities

Financials - Wipro

Exhibit 13: Income statement Exhibit 14: Cash flow

Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 68.6 65.3 70.0 72.0 74.5 EBIT 94 84 99 117 115

Net Sales - IT Services (USDmn) 7,704 8,060 8,191 8,667 8,430

(Inc.)/dec. in working capital 4 (17) 44 (6) 2

-Growth (%) 4.9 4.6 1.6 5.8 (2.7)

Cash flow from operations 97 67 143 111 117

Net Sales - Overall 550 545 585 639 643

-Growth (%) 7.0 (1.0) 7.4 9.3 0.6 Other income 22 24 22 27 31

Cost of Sales & Services 392 386 408 436 440 Depreciation & amortisation 17 17 17 17 18

% of sales 71.1 70.8 69.8 68.1 68.4 Financial expenses (5) (6) (6) (6) (6)

Gross profit 159 159 177 204 203 Tax paid (25) (22) (25) (30) (31)

% of sales 28.9 29.2 30.2 31.9 31.6 Dividends paid (30) (5) (11) (48) (55)

SG& A 73 76 83 87 89

Net cash from operations 76 74 140 71 75

% of sales 13.2 14.0 14.2 13.6 13.8

Capital expenditure (12) 24 (9) (6) (6)

EBIT 94 84 99 117 115

Net cash after capex 64 98 131 65 69

% of sales 17.1 15.5 17.0 18.3 17.8

Interest expenses 5 6 6 6 6 Inc./(dec.) in debt 17 (4) (34) 0 0

Other income (net) 22 24 22 27 31 (Inc.)/dec. in investments (90) 42 37 0 0

PBT 110 102 115 138 140 Equity issue/(buyback) (25) (110) 0 0 0

-PBT margin (%) 20.1 18.8 19.6 21.5 21.8 Cash from financial activities (98) (72) 3 0 0

Provision for tax 25 22 25 30 31 Others (12) (34) (34) - -

Effective tax rate (%) 22.8 21.8 21.8 22.0 22.0

Opening cash 99 53 45 144 209

Minority Interest 0.2 0.0 0.0 0.0 0.0

Closing cash 53 45 145 209 278

Net profit 85 80 90 107 109

Change in cash (46) (8) 100 65 69

-Growth (%) (4.6) (5.7) 11.9 19.7 1.8

-Net profit margin (%) 15.4 14.7 15.3 16.8 17.0 Source: Company, Nirmal Bang Institutional Equities Research

Source: Company, Nirmal Bang Institutional Equities Research

Exhibit 16: Key ratios

Exhibit 15: Balance sheet Y/E March FY17 FY18 FY19E FY20E FY21E

Y/E March (Rsbn) FY17 FY18 FY19E FY20E FY21E Per Share (Rs)

Equity capital 5 9 9 9 9 EPS 17.5 16.8 18.5 17.8 18.1

Reserves & surplus 518 476 561 620 674

FDEPS 17.5 16.8 18.5 17.8 18.1

Net worth 523 485 570 629 683

Dividend Per Share 6.1 1.2 1.8 8.0 9.1

Deferred tax liability, net 4 (4) (5) (5) (5)

Dividend Yield (%) 2.4 0.5 0.7 3.1 3.5

Other liabilities 15 13 13 13 13

Book Value 87 81 95 104 113

Total loans 20 45 50 50 50

Dividend Payout Ratio 35.0 6.7 12.2 45.0 50.0

Total liabilities 561 540 628 687 742

Return ratios (%)

Goodwill 126 118 123 123 123

RoE 17.1 15.9 17.0 17.9 16.6

Other intangible assets 16 18 15 15 15

RoCE 14.4 12.7 14.9 16.3 14.8

Net block 70 64 68 56 44

Pre Tax ROIC 28.8 24.5 29.2 35.4 35.8

Investments 299 258 221 221 221

Tunover Ratios

Other non-current assets 29 34 57 57 57

Asset Turnover Ratio 0.7 0.7 0.7 0.7 0.7

Unbilled revenue 45 42 27 30 29

Debtor Days (incl. unbilled Rev) 95 99 86 87 83

Inventories 4 3 4 4 4

Working Capital Cycle Days 56 68 36 36 34

Other current assets 50 65 51 55 53

Valuation ratios (x)

Debtors 99 105 110 122 117

PER 14.8 15.3 13.9 14.5 14.2

Cash & bank balance 53 45 144 209 278

P/BV 3.0 3.2 2.7 2.5 2.3

Total current assets 251 262 336 419 480

EV/EBTDA 12.2 13.8 11.2 9.2 8.8

Total current liabilities 230 214 192 205 199

EV/Sales 2.5 2.6 2.2 1.9 1.8

Net current assets 21 48 144 214 281

M-cap/Sales 2.8 2.8 2.7 2.4 2.4

Total assets 561 540 628 687 742

Source: Company, Nirmal Bang Institutional Equities Research

Source: Company, Nirmal Bang Institutional Equities Research

7 Information Technology Sector

Institutional Equities

Financials - HCL Technologies

Exhibit 17: Income statement Exhibit 18: Cash flow

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 67.0 64.5 69.9 72.0 74.5 EBIT 94,750 99,880 119,553 133,676 141,220

Net Sales (USD mn) 6,975 7,838 8,644 9,767 9,999

(Inc.)/Dec. in Working Capital 9,864 (22,249) (17,603) (9,258) (2,977)

YoY Growth (%) 48.5 12.4 10.3 13.0 2.4

Cash flow from Operations 104,614 77,631 101,950 124,418 138,243

INR Net Sales 467,220 505,700 604,649 703,345 744,950

YoY Growth (%) 50.1 8.2 19.6 16.3 5.9 Other Income 9,190 11,110 8,920 9,904 8,471

Cost of Sales & Services 308,890 332,370 392,031 460,721 482,399 Depreciation & Amortisation 8,340 14,520 21,496 28,069 34,819

Gross Margin 158,330 173,330 212,619 242,624 262,551 Tax Paid (19,520) (23,170) (25,966) (30,152) (31,435)

% of sales 33.9 34.3 35.2 34.5 35.2 Dividends Paid (40,819) (21,952) (13,267) (72,107) (78,662)

SG&A 55,240 58,930 71,570 80,879 86,512 Net Cash from Operations 61,804 58,139 93,133 60,132 71,435

% of sales 11.8 11.7 11.8 11.5 11.6

Capital Expenditure (49,985) (49,354) (62,076) (89,613) (106,131)

EBITDA 103,090 114,400 141,049 161,745 176,038

Net Cash after Capex 11,819 8,785 31,057 (29,480) (34,696)

% of sales 22.1 22.6 23.3 23.0 23.6

Inc./(dec.) in Debt (4,315) (1,046) 34,509 21,000 0

Depreciation and Amortization 8,340 14,520 21,496 28,069 34,819

Depreciation and Amortization 1.8 2.9 3.6 4.0 4.7 (Inc.)/Dec. in Investments (613) 28,503 (26,656) 6,016 33,904

(as

EBIT% of sales) 94,750 99,880 119,553 133,676 141,220 Equity Issue/(Buyback) 0 (35,002) (40,000) 0 0

% of sales 20.3 19.8 19.8 19.0 19.0 Cash from Financial Activities (4,928) (7,545) (32,147) 27,016 33,904

Other income (net) (incl forex gain/loss) 9,190 11,110 8,920 9,904 8,471 Others (1,020) 2,534 6,292 2,464 792

PBT 103,940 110,990 128,473 143,580 149,691 Opening Cash 7,293 13,165 16,939 22,140 22,140

Provision for tax 19,520 23,170 25,966 30,152 31,435

Closing Cash 13,165 16,939 22,140 22,140 22,140

Effective tax rate (%) 18.8 20.9 20.2 21.0 21.0

Change in Cash 5,872 3,774 5,201 (0) (0)

Minority Interest 0 0 0 0 0

Net profit 84,420 87,820 102,507 113,429 118,256 Source: Company, Nirmal Bang Institutional Equities Research

-Growth (%) 49.0 4.0 16.7 10.7 4.3

-Net profit margin (%) 18.1 17.4 17.0 16.1 15.9

Source: Company, Nirmal Bang Institutional Equities Research

Exhibit 20: Key ratios

Exhibit 19: Balance sheet Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Per Share (Rs)

Equity capital 1,400 1,392 1,360 1,360 1,360 EPS 59.8 62.7 74.5 83.4 87.0

Reserves & surplus 333,504 366,776 417,380 458,701 498,294 FDEPS 60.5 62.9 74.4 83.4 87.0

Net worth 334,904 368,168 418,740 460,061 499,654 Dividend Per Share 24.0 13.0 8.0 44.0 48.0

Other liabilities 12,525 12,669 17,630 20,094 20,886 Dividend Yield (%) 2.4 1.3 0.8 4.3 4.7

Total loans 5,417 4,371 38,880 59,880 59,880 Book Value 237 263 304 338 367

Total liabilities 352,846 385,208 475,249 540,035 580,420 Dividend Payout Ratio (excl. DDT) 40.1 20.7 10.7 52.8 55.2

Intangible assets 114,260 144,057 0 0 0 Return ratios (%)

Net block 46,810 51,847 236,484 298,028 369,341 RoE 27.4 25.0 26.1 25.8 24.6

Investments 1,466 5,222 3,900 3,900 3,900 RoCE 28.9 27.1 27.8 26.3 25.2

Other non-Current assets 37,119 37,675 46,478 52,975 55,064 Pre Tax ROIC 46.2 38.9 37.3 34.1 30.1

Debtors 108,026 122,575 147,448 168,058 174,685 Turnover Ratios

Cash & bank balance 13,165 16,939 22,140 22,140 22,140 Asset Turnover Ratio 1.0 1.0 1.0 1.0 1.0

Other Current assets 143,485 106,036 137,398 130,111 95,799 Debtor Days (incl. unbilled Rev.) 84 88 89 87 86

Total Current assets 264,676 245,550 306,986 320,309 292,623 Working Capital Cycle Days 21 35 40 39 38

Total Current liabilities 111,477 99,143 118,599 135,177 140,507 Valuation ratios (x)

Net Current assets 153,199 146,407 188,387 185,132 152,116 P/E 16.7 16.1 13.6 12.1 11.6

Total assets 352,854 385,208 475,249 540,035 580,420 P/BV 4.3 3.9 3.3 3.0 2.8

Source: Company, Nirmal Bang Institutional Equities Research EV/EBITDA 12.2 11.2 9.2 8.2 7.7

EV/Sales 2.7 2.5 2.1 1.9 1.8

M-cap/Sales 2.9 2.7 2.3 2.0 1.8

Source: Company, Nirmal Bang Institutional Equities Research

8 Information Technology Sector

Institutional Equities

Financials - Tech Mahindra

Exhibit 21: Income statement Exhibit 22: Cash flow

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 67.0 64.5 69.8 72.0 74.5 EBIT 32,062 36,321 53,954 58,229 58,554

Net Sales (US$mn) 4,351 4,771 5,002 5,380 5,272 (Inc.)/dec. in working capital (9,120) 8,227 (8,451) (4,082) 267

-Growth (%) 7.8 9.6 4.8 7.6 (2.0) Cash flow from operations 22,942 44,548 45,504 54,147 58,821

Net Sales 291,408 307,730 349,402 387,413 392,662 Other income 7,776 14,093 5,630 9,213 12,141

-Growth (%) 10.0 5.6 13.5 10.9 1.4 Depreciation & amortisation 9,781 10,849 11,596 10,917 10,405

Cost of Sales & Services 205,661 215,299 233,953 263,656 268,015 Financial expenses (1,286) (1,624) (1,384) (1,082) (682)

Gross Profit 85,747 92,431 115,449 123,757 124,647 Tax paid (10,021) (10,925) (13,220) (16,258) (17,153)

% of sales 29.4 30.0 33.0 31.9 31.7 Dividends paid (13,047) (9,048) (14,835) (28,153) (20,939)

SG& A 43,904 45,261 49,899 54,611 55,689 Net cash from operations 16,145 47,893 33,291 28,784 42,592

% of sales 15.1 14.7 14.3 14.1 14.2 Capital expenditure (19,449) (21,142) (5,448) (6,000) (6,000)

EBITDA 41,843 47,170 65,550 69,146 68,959 Net cash after capex (3,304) 26,751 27,843 22,784 36,592

% of sales 14.4 15.3 18.8 17.8 17.6 Inc./(dec.) in debt (145) 3,963 (7,134) (2,000) (2,000)

Depreciation 9,781 10,849 11,596 10,917 10,405 (Inc.)/dec. in investments 18,498 (15,609) (8,773) (2,491) 163

% of sales 3.4 3.5 3.3 2.8 2.6 Equity issue/(buyback) (451) 29 8 - -

EBIT 32,062 36,321 53,954 58,229 58,554 Cash from financial activities 17,903 (11,617) (15,899) (4,491) (1,837)

% of sales 11.0 11.8 15.4 15.0 14.9 Others (638) (4,340) (7,160) 10,457 2,279

Interest expenses 1,286 1,624 1,384 1,082 682 Opening cash 40,138 54,098 64,892 69,675 98,425

Other income (net) 7,776 14,093 5,630 9,213 12,141 Closing cash 54,098 64,892 69,675 98,425 135,459

PBT 38,552 48,790 58,201 66,360 70,013 Change in cash 13,961 10,794 4,783 28,750 37,034

-PBT margin (%) 13.2 15.9 16.7 17.1 17.8

Source: Company, Nirmal Bang Institutional Equities Research

Provision for tax 10,021 10,925 13,220 16,258 17,153

Effective tax rate (%) 26.0 22.4 22.7 24.5 24.5

Minority Interest 389 (136) 98 148 148

Net profit 28,119 38,001 44,400 49,554 52,312

Exhibit 24: Key ratios

-Growth (%) (9.8) 35.1 16.8 11.6 5.6 Y/E March FY17 FY18 FY19E FY20E FY21E

-Net profit margin (%) 9.6 12.3 12.7 12.8 13.3 Per Share (Rs)

Source: Company, Nirmal Bang Institutional Equities Research FDEPS 31.7 42.8 50.1 56.2 59.3

Dividend Per Share 8.5 13.9 26.3 19.6 20.7

Exhibit 23: Balance sheet Dividend Yield (%) 1.1 1.8 3.3 2.5 2.6

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Book Value 184 211 238 274 312

Equity capital 4,388 4,417 4,425 4,425 4,425 Dividend Payout Ratio (%. Incl DDT) 32.2 39.0 63.4 42.3 42.2

Reserves & surplus 159,984 184,011 207,636 240,042 274,241 Return ratios (%)

Net worth 164,372 188,428 212,061 244,467 278,666 RoE 18.3 21.5 22.2 21.7 20.0

Minority Interest 4,641 5,091 5,165 5,165 5,165 RoCE 17.3 17.2 23.1 22.7 20.3

Other liabilities 18,905 18,246 17,889 17,889 17,889 Pre Tax ROIC 26.2 25.8 36.3 38.1 38.7

Total loans 8,818 13,440 6,663 4,663 2,663 Turnover Ratios

Total liabilities 196,736 225,205 241,778 272,184 304,383 Asset Turnover 1.1 1.0 1.1 1.0 1.0

Goodwill 26,279 27,727 28,440 28,440 28,440 Debtor Days 67 77 81 79 78

Net block (incl. CWIP) 42,051 50,896 44,748 39,831 35,427 Working Capital Cycle Days 57 44 47 47 46

Investments 6,802 15,116 20,128 20,128 20,128 Valuation ratios (x)

Deferred tax asset - net 2,674 5,766 5,971 5,971 5,971 P/E 25.2 18.6 15.9 14.2 13.5

Other non-current assets 19,594 23,797 27,353 29,844 29,682 P/BV 4.3 3.7 3.3 2.9 2.5

Other current assets 21,571 19,623 23,635 25,787 25,647 EV/EBITDA 15.7 13.8 9.8 8.8 8.3

Debtors 53,377 64,979 77,268 84,305 83,845 EV/Sales 2.3 2.1 1.8 1.6 1.5

Loans & Advances 33,608 30,917 33,432 36,477 36,278 M-cap/Sales 2.4 2.3 2.0 1.8 1.8

Cash & bank balance 54,098 64,892 69,675 98,425 135,459 Source: Company, Nirmal Bang Institutional Equities Research

Inventory 611 659 638 638 638

Total current assets 163,265 181,070 204,648 245,632 281,866

Total current liabilities 63,929 79,167 89,511 97,663 97,130

Net current assets 99,336 101,903 115,137 147,969 184,736

Total assets 196,736 225,205 241,778 272,184 304,383

Source: Company, Nirmal Bang Institutional Equities Research

9 Information Technology Sector

Institutional Equities

Financials - Mindtree

Exhibit 25: Income statement Exhibit 26: Cash flow

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 67.2 64.5 70.0 72.0 74.5 EBIT 5,327 5,692 9,126 10,981 11,062

Net Sales (USD mn) 780 847 997 1,083 1,066

(Inc.)/dec. in working capital 1,781 (257) (4,435) (1,186) 119

YoY Growth (%) 9.1 8.6 17.8 8.6 (1.6)

Cash flow from operations 7,108 5,435 4,691 9,795 11,181

Net Sales 52,364 54,628 69,876 77,975 79,378

YoY Growth (%) 11.8 4.3 27.9 11.6 1.8 Other income 413 1,900 952 1,387 1,714

Employee benefits expense 34,058 35,641 44,144 49,275 50,231 Depreciation & amortisation 1,858 1,712 1,634 1,733 1,812

% of sales 65.0 65.2 63.2 63.2 63.3 Financial expenses (191) (169) (50) (85) (85)

Gross Margin 18306 18987 25732 28699 29147 Tax paid (1,390) (1,722) (2,423) (3,378) (3,490)

% of sales 35.0 34.8 36.8 36.8 36.7 Dividends paid (1,934) (2,188) (2,766) (3,358) (3,358)

Other expenses 11,121 11,583 14,972 15,985 16,272

Net cash from operations 5,864 4,968 2,038 6,094 7,774

% of sales 21.2 21.2 21.4 20.5 20.5

Capital expenditure 371 629 1,269 1,000 1,000

EBITDA 7,185 7,404 10,759 12,715 12,874

Net cash after capex 5,493 4,339 769 5,094 6,774

% of sales 13.7 13.6 15.4 16.3 16.2

Depreciation & Amortisation 1,858 1,712 1,634 1,733 1,812 Inc./(dec.) in debt (532) (220) 12 - -

EBIT 5,327 5,692 9,126 10,981 11,062 (Inc.)/dec. in investments (4,097) (1,127) (1,912) (4,000) (4,000)

% of sales 10.2 10.4 13.1 14.1 13.9 Equity issue/(buyback) 2 (41) 3 - -

Interest expenses 191 169 50 85 85 Cash from financial activities (4,627) (1,388) (1,897) (4,000) (4,000)

Other income (net) 413 1,900 952 1,387 1,714 Others (690) (2,170) (1,455) 400 400

PBT 5,549 7,423 10,027 12,284 12,691

Opening cash 2,332 2,508 3,289 706 2,200

-PBT margin (%) 10.6 13.6 14.4 15.8 16.0

Closing cash 2,508 3,289 706 2,200 5,374

Provision for tax 1,390 1,722 2,423 3,378 3,490

Change in cash 176 781 (2,583) 1,494 3,174

Effective tax rate (%) 25.0 23.2 24.2 27.5 27.5

Net profit 4,159 5,701 7,605 8,906 9,201 Source: Company, Nirmal Bang Institutional Equities Research

-Growth (%) (29.5) 37.1 33.4 17.1 3.3

-Net profit margin (%) 7.9 10.4 10.9 11.4 11.6

Source: Company, Nirmal Bang Institutional Equities Research

Exhibit 27: Balance sheet Exhibit 28: Key ratios

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Y/E March FY17 FY18 FY19E FY20E FY21E

Equity capital 1,680 1,639 1,642 1,642 1,642 Per Share (Rs)

Reserves & surplus 24,095 25,779 29,290 34,837 40,680 EPS 25.4 34.8 46.4 54.3 56.1

Net worth 25,775 27,418 30,932 36,479 42,322 FDEPS 25.3 34.7 46.2 54.2 56.0

Other liabilities 301 85 101 101 101 Dividend Per Share 9.8 11.1 14.0 17.0 17.0

Total loans 13 9 5 5 5 Book Value 157 167 188 222 257

Total liabilities 26,089 27,512 31,038 36,585 42,428 Dividend Payout Ratio (incl DDT) 47 38 36 38 36

Net block 5,932 5,121 4,692 3,559 2,347 Return ratios (%)

Goodwill 4,470 4,539 4,730 4,730 4,730 RoE 16.7 21.4 26.1 26.4 23.4

Investments 5,927 7,264 8,936 12,936 16,936 RoCE 21.8 21.7 32.5 34.8 30.2

Deferred tax asset - net 624 318 357 357 357 Pre Tax ROIC 27.8 32.9 47.6 51.3 53.2

Other non-current assets 2,202 2,298 2,499 2,499 2,499 Turnover Ratios

Unbilled revenue 1,885 2,791 3,196 3,553 3,518 Asset Turnover 1.5 1.5 1.7 1.7 1.5

Other current assets 1,386 1,590 1,805 2,008 1,987 Debtor Days (incl. unbilled Rev.) 76 86 87 87 85

Debtors 8,962 10,155 13,541 15,057 14,905 Working Capital Cycle Days 37 30 36 45 47

Cash & bank balance 2,508 3,289 706 2,200 5,374 Valuation ratios (x)

Total current assets 14,741 17,825 19,248 22,817 25,784 P/E 38.7 28.0 20.8 17.8 17.2

Total current liabilities 7,807 9,853 9,424 10,313 10,224 P/BV 6.1 5.8 5.1 4.3 3.7

Net current assets 6,934 7,972 9,824 12,504 15,560 EV/EBITDA 20.9 20.0 13.9 11.3 10.6

Total assets 26,089 27,512 31,038 36,585 42,428 EV/Sales 2.9 2.7 2.1 1.8 1.7

Source: Company, Nirmal Bang Institutional Equities Research M-cap/Sales 3.0 2.9 2.3 2.0 2.0

Dividend Yield (%) 1.0 1.2 1.5 1.8 1.8

Source: Company, Nirmal Bang Institutional Equities Research

10 Information Technology Sector

Institutional Equities

Financials - Persistent Systems

Exhibit 29: Income statement Exhibit 30: Cash flow

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E (Y/E March) FY17 FY18 FY19E FY20E FY21E

Average INR/USD 67.1 64.5 69.9 72.0 74.5 EBIT 3,049 3,102 4,202 5,050 4,977

Net Sales (USD mn) 429 471 487 545 532 (Inc.)/dec. in working capital (1,762) (570) (384) (898) 316

YoY Growth (%) 22.0 9.7 3.4 12.0 (2.4) Cash flow from operations 1,287 2,532 3,818 4,152 5,293

Net Sales 28,784 30,337 34,026 39,268 39,613 Other income 958 1,190 725 1,173 1,472

YoY Growth (%) 24.5 5.4 12.2 15.4 0.9 Depreciation & amortisation 1,490 1,585 1,595 1,911 1,989

Cost of Sales & Services 18,518 19,704 21,759 24,957 25,189 Tax paid (992) (1,062) (1,422) (1,816) (1,882)

% of sales 64.3 65.0 63.9 63.6 63.6 Dividends paid (761) (800) (949) (1,305) (1,259)

Gross Margin 10,266 10,633 12,266 14,311 14,424 Net cash from operations 1,982 3,445 3,767 4,114 5,612

% of sales 35.7 35.0 36.1 36.4 36.4 Capital expenditure 1,650 1,027 854 820 854

SG& A 5,727 5,946 6,470 7,350 7,459 Net cash after capex 332 2,419 2,913 3,294 4,759

% of sales 19.9 19.6 19.0 18.7 18.8 Inc./(dec.) in debt 127 (136) 313 - -

EBITDA 4,539 4,687 5,797 6,961 6,965 (Inc.)/dec. in investments 135 (1,145) (2,943) - -

% of sales 15.8 15.4 17.0 17.7 17.6 Equity issue/(buyback) - - (2,250) - -

Depreciation 1,490 1,585 1,595 1,911 1,989 Cash from financial

261 (1,280) (4,880) - -

EBIT 3,049 3,102 4,202 5,050 4,977 activities

% of sales 10.6 10.2 12.3 12.9 12.6 Others (515) (234) (104) -

Other income (net) 958 1,190 725 1,173 1,472 Opening cash 1,432 1,510 2,414 342 3,636

PBT 4,007 4,292 4,927 6,222 6,449 Closing cash 1,510 2,414 342 3,636 8,395

-PBT margin (%) 13.9 14.1 14.5 15.8 16.3 Change in cash 77 904 (2,072) 3,294 4,759

Provision for tax 992 1,062 1,422 1,816 1,882 Source: Company, Nirmal Bang Institutional Equities Research

Effective tax rate (%) 24.8 24.7 28.9 29.2 29.2

Exhibit 32: Key ratios

Net profit 3,015 3,231 3,505 4,406 4,567

-Growth (%) 1.4 7.2 8.5 25.7 3.6 Y/E March FY17 FY18 FY19E FY20E FY21E

-Net profit margin (%) 10.5 10.6 10.3 11.2 11.5 Per Share (Rs)

Source: Company, Nirmal Bang Institutional Equities Research EPS 37.7 40.4 44.2 57.2 59.3

FDEPS 37.7 40.4 44.2 57.2 59.3

Exhibit 31: Balance sheet Dividend Per Share 9.0 10.0 10.2 14.1 13.6

Y/E March (Rsmn) FY17 FY18 FY19E FY20E FY21E Book Value 237 266 279 319 362

Equity capital 800 800 770 770 770 Dividend Payout Ratio (%) 25 25 27 30 28

Reserves & surplus 18,193 20,472 20,709 23,810 27,118 Return ratios (%)

Net worth 18,993 21,272 21,479 24,580 27,888 RoE 17.2 15.4 19.7 21.9 19.0

Deferred tax liability 111 - 316 316 316 RoCE 17.1 15.3 19.5 21.6 18.7

Other liabilities 166 160 168 168 168 Pre Tax ROIC 31.1 29.7 41.4 49.9 53.5

Total loans 22 17 13 13 13 Tunover Ratios

Total liabilities 19,291 21,448 21,977 25,078 28,386 Asset Turnover Ratio 1.5 1.4 1.6 1.6 1.4

Goodwill 76 77 82 82 82 Debtor Days (incl. unbilled Rev) 60 58 56 58 54

Net block (incl CWIP) 5,573 5,097 4,357 3,266 2,131 Working Capital Cycle Days 39 51 51 50 52

Investments 6,839 8,797 11,252 11,252 11,252 Valuation ratios (x)

Deferred tax asset 306 372 720 720 720 PER 17.5 16.3 14.9 11.5 11.1

Other non-current assets 994 129 277 277 277 P/BV 2.8 2.5 2.4 2.1 1.8

Other current assets 3,411 4,585 5,381 6,360 6,016 EV/EBTDA 11.3 10.7 8.7 6.8 6.1

Debtors 4,754 4,847 5,211 6,191 5,846 EV/Sales 1.8 1.7 1.5 1.2 1.1

Cash & bank balance 1,510 2,414 342 3,636 8,395 M-cap/Sales 1.8 1.7 1.5 1.3 1.3

Total current assets 9,675 11,846 10,934 16,187 20,257 Dividend Yield 1.4 1.5 1.6 2.1 2.1

Total current liabilities 4,173 4,870 5,645 6,707 6,333

Source: Company, Nirmal Bang Institutional Equities Research

Net current assets 5,502 6,976 5,288 9,480 13,923

Total assets 19,291 21,448 21,977 25,078 28,386

Source: Company, Nirmal Bang Institutional Equities Research

11 Information Technology Sector

Institutional Equities

Rating track - TCS

Date Rating Market price (Rs) Target price (Rs)

13 April 2015 Sell 2,619 2,314

17 April 2015 Sell 2,574 2,325

10 July 2015 Sell 2,529 2,173

9 September 2015 Sell 2,540 2,173

5 October 2015 Sell 2,641 2,217

14 October 2015 Sell 2,599 2,248

8 January 2016 Under Review 2,398 -

13 January 2016 Under Review 2,327 -

14 March 2016 Sell 2,360 2,055

20 April 2016 Sell 2,520 2,089

15 July 2016 Sell 2,521 2,075

14 September 2016 Sell 2,359 2,041

14 October 2016 Sell 2,329 2,073

10 January 2017 Sell 2,304 1,952

13 January 2017 Sell 2,344 1,956

14 February 2017 Sell 2,414 1,983

21 February 2017 Sell 2,502 1,983

2 March 2017 Sell 2,477 1,983

19 April 2017 Sell 2,309 1,996

21 June 2017 Sell 2,443 1,923

14 July 2017 Sell 2,446 1,930

28 September 2017 Sell 2,475 1,908

13 October 2017 Sell 2,548 1,913

26 December 2017 Under Review 2,647 -

12 January 2018 Under Review 2,792 -

17 March 2018 Accumulate 2,829 3,155

20 April 2018 Accumulate 3,191 3,176

26 June 2018* Accumulate 1,818 1,812

11 July 2018 Accumulate 1,876 1,862

05 October 2018 Accumulate 2,063 2,145

12 October 2018 Accumulate 1,980 2,120

27 December 2018 Sell 1,892 1,712

7 January 2019 Sell 1,877 1,533

11 January 2019 Sell 1,883 1,545

18 March 2019 Sell 2,040 1,607

19 March 2019 Sell 2,023 1,607

* Post 1:1 Bonus

12 Information Technology Sector

Institutional Equities

Rating track - Infosys

Date Rating Market price (Rs) Target price (Rs)

13 April 2015 Accumulate 2,229 2,147

27 April 2015 Sell 1,995 1,823

4 June 2015 Sell 2,032 1,823

22 July 2015** Accumulate 1,116 1,189

7 September 2015 Accumulate 1,074 1,189

14 September 2015 Accumulate 1,091 1,189

13 October 2015 Accumulate 1,122 1,194

8 January 2016 Under Review 1,063 -

14 January 2016 Under Review 1,133 -

14 March 2016 Sell 1,141 1,002

15 April 2016 Sell 1,173 1,010

9 June 2016 Sell 1,238 1,010

18 July 2016 Sell 1,072 988

29 August 2016 Sell 1,020 970

17 October 2016 Sell 1,027 964

10 January 2017 Sell 970 920

16 January 2017 Sell 975 910

14 February 2017 Sell 985 926

15 April 2017 Sell 931 887

15 May 2017 Sell 964 887

21 June 2017 Sell 944 844

17 July 2017 Sell 972 846

21 August 2017 Sell 923 794

28 August 2017 Sell 912 836

11 September 2017 Sell 884 836

28 September 2017 Sell 906 833

25 October 2017 Sell 924 873

26 December 2017 Under Review 1,039 -

15 January 2018 Under Review 1,079 -

17 March 2018 Accumulate 1,170 1,154

14 April 2018 Accumulate 1,171 1,157

24 April 2018 Accumulate 1,188 1,157

3 July 2018 Accumulate 1,307 1,314

14 July 2018 Accumulate 1,317 1,328

5 October 2018** Accumulate 711 752

17 October 2018 Accumulate 695 756

27 December 2018 Accumulate 644 688

7 January 2019 Sell 661 620

14 January 2019 Sell 684 603

19 March 2019 Sell 710 620

** Post 1:1 bonus issue of equity shares

13 Information Technology Sector

Institutional Equities

Rating track - Wipro

Date Rating Market price (Rs) Target price (Rs)

13 April 2015 Sell 618 576

22 April 2015 Sell 588 546

24 July 2015 Sell 588 548

30 September 2015 Sell 587 546

23 October 2015 Sell 578 544

8 January 2016 Under Review 556 -

19 January 2016 Under Review 549 -

14 March 2016 Sell 540 498

21 April 2016 Sell 601 489

20 July 2016 Sell 549 478

24 October 2016 Sell 499 436

10 January 2017 Sell 472 410

27 January 2017 Sell 474 413

14 February 2017 Sell 474 427

26 April 2017 Sell 495 437

21 June 2017* Sell 254 197

21 July 2017 Sell 269 235

28 September 2017 Sell 290 228

18 October 2017 Sell 290 244

26 December 2017 Under Review 302 -

22 January 2018 Under Review 329 -

17 March 2018 Accumulate 296 302

26 April 2018 Accumulate 287 303

3 July 2018 Buy 262 335

23 July 2018 Buy 282 323

5 October 2018 Buy 325 377

17 October 2018 Buy 309 364

27 December 2018 Sell 326 297

7 January 2019 Sell 324 268

21 January 2019 Sell 347 277

19 March 2019** Sell 258 209

* Post 1:1 bonus share issue, ** Post 1:3 bonus share issue

14 Information Technology Sector

Institutional Equities

Rating track – HCL Tech

Date Rating Market price (Rs) Target price (Rs)

13 April 2015 Accumulate 959 1,013

22 April 2015 Accumulate 895 1,014

4 August 2015 Accumulate 938 1,008

1 October 2015 Accumulate 982 991

5 October 2015 Accumulate 859 991

20 October 2015 Buy 859 989

8 January 2016 Under Review 828 -

20 January 2016 Under Review 841 -

14 March 2016 Sell 824 737

29 April 2016 Sell 799 719

4 August 2016 Sell 826 745

24 October 2016 Sell 832 718

10 January 2017 Sell 838 712

25 January 2017 Sell 849 718

14 February 2017 Sell 827 740

12 May 2017 Sell 839 743

21 June 2017 Sell 854 713

28 July 2017 Sell 899 764

28 September 2017 Sell 874 744

26 October 2017 Sell 903 763

26 December 2017 Under Review 887 -

22 January 2018 Under Review 958 -

17 March 2018 Accumulate 968 1,048

16 April 2018 Accumulate 991 1,048

3 May 2018 Accumulate 1,001 1,041

3 July 2018 Buy 926 1,131

30 July 2018 Buy 963 1,172

5 October 2018 Buy 1,081 1,281

24 October 2018 Buy 952 1,277

11 December 2018 Buy 942 1,329

27 December 2018 Accumulate 942 1,072

7 January 2019 Accumulate 932 958

30 January 2019 Accumulate 988 1,054

19 March 2019 Accumulate 1,012 1,076

15 Information Technology Sector

Institutional Equities

Rating track - Tech Mahindra

Date Rating Market price (Rs) Target price (Rs)

13 April 2015 Sell 660 593

28 May 2015 Sell 549 511

19 June 2015 Sell 541 470

28 July 2015 Sell 520 470

28 September 2015 Sell 567 474

4 November 2015 Sell 557 472

15 December 2015 Sell 543 471

8 January 2016 Under Review 522 -

2 February 2016 Under Review 497 -

14 March 2016 Sell 459 395

25 May 2016 Sell 480 409

21 June 2016 Sell 544 421

3 August 2016 Sell 499 400

28 October 2016 Sell 414 385

10 January 2017 Sell 473 368

31 January 2017 Sell 472 383

14 February 2017 Sell 500 388

7 March 2017 Sell 501 408

29 May 2017 Sell 429 403

21 June 2017 Sell 395 367

1 August 2017 Sell 385 360

28 September 2017 Sell 447 358

2 November 2017 Sell 478 387

11 December 2017 Sell 496 426

26 December 2017 Under Review 493 -

30 January 2018 Under Review 605 -

17 March 2018 Accumulate 635 608

28 May 2018 Accumulate 703 721

3 July 2018 Accumulate 655 716

31 July 2018 Accumulate 658 718

5 October 2018 Buy 696 845

31 October 2018 Accumulate 685 731

27 November 2018 Accumulate 695 731

27 December 2018 Sell 695 590

7 January 2019 Sell 681 525

6 February 2019 Sell 751 561

19 March 2019 Sell 789 587

16 Information Technology Sector

Institutional Equities

Rating track - Mindtree

Date Rating Market price (Rs) Target price (Rs)

7 June 2017 Sell 547 424

21 June 2017 Sell 519 382

20 July 2017 Sell 506 382

22 August 2017 Sell 461 382

28 September 2017 Sell 471 396

26 October 2017 Sell 507 426

26 December 2017 Under Review 600 -

18 January 2018 Under Review 622 -

17 March 2018 Sell 812 574

26 October 2017 Sell 867 -

26 December 2017 Under Review 600 -

18 January 2018 Under Review 622 -

17 March 2018 Sell 812 574

19 April 2018 Sell 867 577

3 July 2018 Sell 986 716

19 July 2018 Sell 1,062 803

4 September 2018 Sell 1,100 803

5 October 2018 Sell 1,063 986

19 October 2018 Sell 978 778

27 December 2018 Sell 855 631

7 January 2019 Sell 815 552

17 January 2019 Sell 835 553

19 March 2019 Sell 963 554

17 Information Technology Sector

Institutional Equities

Rating track - Persistent Systems

Date Rating Market price (Rs) Target price (Rs)

21 September 2015 Sell 685 562

27 October 2015 Sell 669 553

7 December 2015 Sell 663 544

8 January 2016 Under Review 630 -

27 January 2016 Under Review 609 -

14 March 2016 Sell 599 522

22 March 2016 Sell 741 555

26 April 2016 Sell 719 558

22 June 2016 Sell 697 558

26 July 2016 Sell 665 562

26 October 2016 Sell 660 573

19 December 2016 Sell 613 573

10 January 2017 Sell 636 557

24 January 2017 Sell 612 548

14 February 2017 Sell 624 574

27 April 2017 Sell 568 534

21 June 2017 Sell 681 516

24 July 2017 Sell 659 526

28 September 2017 Sell 651 540

17 October 2017 Sell 663 566

04 December 2017 Sell 654 566

26 December 2017 Under Review 650 -

30 January 2018 Under Review 788 -

17 March 2018 Sell 816 698

25 April 2018 Accumulate 726 717

3 July 2018 Accumulate 811 847

31 July 2018 Accumulate 828 867

5 October 2018 Buy 718 909

23 October 2018 Accumulate 560 622

12 December 2018 Accumulate 611 622

27 December 2018 Sell 630 504

7 January 2019 Sell 577 455

29 January 2019 Sell 567 481

19 March 2019 Sell 658 489

18 Information Technology Sector

Institutional Equities

DISCLOSURES

This Report is published by Nirmal Bang Equities Private Limited (hereinafter referred to as “NBEPL”) for private circulation. NBEPL is a

registered Research Analyst under SEBI (Research Analyst) Regulations, 2014 having Registration no. INH000001436. NBEPL is also

a registered Stock Broker with National Stock Exchange of India Limited and BSE Limited in cash and derivatives segments.

NBEPL has other business divisions with independent research teams separated by Chinese walls, and therefore may, at times, have

different or contrary views on stocks and markets.

NBEPL or its associates have not been debarred / suspended by SEBI or any other regulatory authority for accessing / dealing in

securities Market. NBEPL, its associates or analyst or his relatives do not hold any financial interest in the subject company. NBEPL or

its associates or Analyst do not have any conflict or material conflict of interest at the time of publication of the research report with the

subject company. NBEPL or its associates or Analyst or his relatives do not hold beneficial ownership of 1% or more in the subject

company at the end of the month immediately preceding the date of publication of this research report.

NBEPL or its associates / analyst has not received any compensation / managed or co-managed public offering of securities of the

company covered by Analyst during the past twelve months. NBEPL or its associates have not received any compensation or other

benefits from the company covered by Analyst or third party in connection with the research report. Analyst has not served as an

officer, director or employee of Subject Company and NBEPL / analyst has not been engaged in market making activity of the subject

company.

Analyst Certification: I, Girish Pai, research analyst and the author of this report, hereby certify that the views expressed in this

research report accurately reflects my personal views about the subject securities, issuers, products, sectors or industries. It is also

certified that no part of the compensation of the analyst was, is, or will be directly or indirectly related to the inclusion of specific

recommendations or views in this research. The analyst is principally responsible for the preparation of this research report and has

taken reasonable care to achieve and maintain independence and objectivity in making any recommendations.

19 Information Technology Sector

Institutional Equities

Disclaimer

Stock Ratings Absolute Returns

BUY > 15%

ACCUMULATE -5% to15%

SELL < -5%

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. NBEPL is not

soliciting any action based upon it. Nothing in this research shall be construed as a solicitation to buy or sell any security or product, or to engage in or refrain

from engaging in any such transaction. In preparing this research, we did not take into account the investment objectives, financial situation and particular needs

of the reader.

This research has been prepared for the general use of the clients of NBEPL and must not be copied, either in whole or in part, or distributed or redistributed to

any other person in any form. If you are not the intended recipient you must not use or disclose the information in this research in any way. Though disseminated

to all the customers simultaneously, not all customers may receive this report at the same time. NBEPL will not treat recipients as customers by virtue of their

receiving this report. This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where

such distribution, publication, availability or use would be contrary to law, regulation or which would subject NBEPL & its group companies to registration or

licensing requirements within such jurisdictions.

The report is based on the information obtained from sources believed to be reliable, but we do not make any representation or warranty that it is accurate,

complete or up-to-date and it should not be relied upon as such. We accept no obligation to correct or update the information or opinions in it. NBEPL or any of its

affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained

in this report. NBEPL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to

this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report

should rely on their own investigations.

This information is subject to change without any prior notice. NBEPL reserves its absolute discretion and right to make or refrain from making modifications and

alterations to this statement from time to time. Nevertheless, NBEPL is committed to providing independent and transparent recommendations to its clients, and

would be happy to provide information in response to specific client queries.

Before making an investment decision on the basis of this research, the reader needs to consider, with or without the assistance of an adviser, whether the advice

is appropriate in light of their particular investment needs, objectives and financial circumstances. There are risks involved in securities trading. The price of

securities can and does fluctuate, and an individual security may even become valueless. International investors are reminded of the additional risks inherent in

international investments, such as currency fluctuations and international stock market or economic conditions, which may adversely affect the value of the

investment. Opinions expressed are subject to change without any notice. Neither the company nor the director or the employees of NBEPL accept any liability

whatsoever for any direct, indirect, consequential or other loss arising from any use of this research and/or further communication in relation to this research. Here it

may be noted that neither NBEPL, nor its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special

or consequential including lost revenue or lost profit that may arise from or in connection with the use of the information contained in this report.

Copyright of this document vests exclusively with NBEPL.

Our reports are also available on our website www.nirmalbang.com

Access all our reports on Bloomberg, Thomson Reuters and Factset.

Team Details:

Name Email Id Direct Line

Rahul Arora CEO rahul.arora@nirmalbang.com -

Girish Pai Head of Research girish.pai@nirmalbang.com +91 22 6273 8017 / 18

Dealing

Ravi Jagtiani Dealing Desk ravi.jagtiani@nirmalbang.com +91 22 6273 8230, +91 22 6636 8833

Pradeep Kasat Dealing Desk pradeep.kasat@nirmalbang.com +91 22 6273 8100/8101, +91 22 6636 8831

Michael Pillai Dealing Desk michael.pillai@nirmalbang.com +91 22 6273 8102/8103, +91 22 6636 8830

Nirmal Bang Equities Pvt. Ltd.

Correspondence Address

B-2, 301/302, Marathon Innova,

Nr. Peninsula Corporate Park,

Lower Parel (W), Mumbai-400013.

Board No. : 91 22 6273 8000/1; Fax. : 022 6273 8010

20 Information Technology Sector

You might also like

- Jamna Auto Jamna Auto: India I EquitiesDocument16 pagesJamna Auto Jamna Auto: India I Equitiesrishab agarwalNo ratings yet

- Kotak Mahindra Bank Limited Consolidated Financials FY18Document60 pagesKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNo ratings yet

- MD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeDocument4 pagesMD & Ceo CFO CRO CIO: Note For Investment Operation CommitteeAyushi somaniNo ratings yet

- ITC Analyst Meet Key TakeawaysDocument19 pagesITC Analyst Meet Key TakeawaysTatsam VipulNo ratings yet

- Eicher Motors: Whethering The StormDocument11 pagesEicher Motors: Whethering The StormAnonymous y3hYf50mTNo ratings yet

- Trent 10 08 2023 IscDocument7 pagesTrent 10 08 2023 Iscaghosh704No ratings yet

- Shanthi Gears PDFDocument10 pagesShanthi Gears PDFGurnam SinghNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- ICICI Securities Initiating Coverage On Nazara Technologies WithDocument27 pagesICICI Securities Initiating Coverage On Nazara Technologies Withagarwal.deepak6688No ratings yet

- NSE India - Nov22 - EUDocument9 pagesNSE India - Nov22 - EUpremalgandhi10No ratings yet

- Dam Capital Initiating Coverage Report On JK Tyre Rating BUY TargetDocument18 pagesDam Capital Initiating Coverage Report On JK Tyre Rating BUY TargetНикита МузафаровNo ratings yet

- DMART - RR - 17102022 - Retail 17 October 2022 104478400Document13 pagesDMART - RR - 17102022 - Retail 17 October 2022 104478400Dhruval KabariyaNo ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- Canara Rob Emerging Equitties FundDocument1 pageCanara Rob Emerging Equitties Fundjaspreet AnandNo ratings yet

- Microsoft Corp. $260.36 Rating: Neutral Neutral NeutralDocument3 pagesMicrosoft Corp. $260.36 Rating: Neutral Neutral Neutralphysicallen1791No ratings yet

- Q3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedDocument10 pagesQ3FY22 Result Update Indo Count Industries LTD: Steady Numbers FY22E Volume Guidance ReducedbradburywillsNo ratings yet

- Q2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsDocument10 pagesQ2FY22 Result Update Indo Count Industries LTD: Higher Realization Aids FinancialsbradburywillsNo ratings yet

- Our TopicDocument17 pagesOur Topicadil siddiqyuiNo ratings yet

- RR Jubilant FoodworksDocument26 pagesRR Jubilant FoodworkssantoshpesitNo ratings yet

- Q4FY22 Result Review: Margin performance commendable; upgrade to BUYDocument10 pagesQ4FY22 Result Review: Margin performance commendable; upgrade to BUYTai TranNo ratings yet

- Hero MotoCorp 1QFY18 Results Update: GST compensation, RM hurt margin; Volume guidance slightly loweredDocument12 pagesHero MotoCorp 1QFY18 Results Update: GST compensation, RM hurt margin; Volume guidance slightly loweredSAHIL SHARMANo ratings yet

- Note For Investment Operation CommitteeDocument4 pagesNote For Investment Operation CommitteeAyushi somaniNo ratings yet

- Delta Corp 1QFY20 Results Update | Sector: OthersDocument6 pagesDelta Corp 1QFY20 Results Update | Sector: OthersJatin SoniNo ratings yet

- Strategiuc MGMT Session 1 MaterialDocument14 pagesStrategiuc MGMT Session 1 MaterialAPOORVA BALAKRISHNANNo ratings yet

- ICICI Bank, Reliance Industries, Infosys among top large-cap stock picks for upside of up to 32Document25 pagesICICI Bank, Reliance Industries, Infosys among top large-cap stock picks for upside of up to 32Prachi PatwariNo ratings yet

- Tata Motors Dupont and Altman Z-Score AnalysisDocument4 pagesTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDINo ratings yet

- A Report ON Valuation of Satyam Computers Services LimitedDocument15 pagesA Report ON Valuation of Satyam Computers Services LimitedAshmita DeNo ratings yet

- Campus Activewear Limited IPO: NeutralDocument7 pagesCampus Activewear Limited IPO: NeutralAkash PawarNo ratings yet

- Castrol India stock update and buy callDocument4 pagesCastrol India stock update and buy callSAM SAMNo ratings yet

- Q3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleDocument12 pagesQ3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleSAGAR VAZIRANINo ratings yet

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Persistent Systems Buy Case Target Price Rs.1025 19.2% UpsideDocument3 pagesPersistent Systems Buy Case Target Price Rs.1025 19.2% UpsideKishor KrNo ratings yet

- 11.24.23 Nividia Report FORD ResearchDocument3 pages11.24.23 Nividia Report FORD Researchphysicallen1791No ratings yet

- IDBI Capital Century Plyboards Q1FY23 Result ReviewDocument10 pagesIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranNo ratings yet

- ICRA - Stock Update - 070322Document10 pagesICRA - Stock Update - 070322arunNo ratings yet

- TCS - 1QFY20 - HDFC Sec-201907100816499656445Document15 pagesTCS - 1QFY20 - HDFC Sec-201907100816499656445Sandip HaseNo ratings yet

- DiwaliPicks2022 131022Document22 pagesDiwaliPicks2022 131022tranganathanNo ratings yet

- HSL - IT PAck Report - 2021-202108182348354902869Document9 pagesHSL - IT PAck Report - 2021-202108182348354902869SHAIK AHMEDNo ratings yet

- KPIT Income Statement Analysis and ForecastingDocument13 pagesKPIT Income Statement Analysis and ForecastingAnonymous Fr37v90cqNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- ITC 21 08 2023 EmkayDocument15 pagesITC 21 08 2023 Emkayvikram112in20002445No ratings yet

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- Brokerage Report Jan 24Document6 pagesBrokerage Report Jan 24arnabdeb83No ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- Butterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1Document12 pagesButterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1sundar iyerNo ratings yet

- ICICI Securities Sees 34% UPSIDE in Info Edge Green Shoots VisibleDocument6 pagesICICI Securities Sees 34% UPSIDE in Info Edge Green Shoots Visiblemanitjainm21No ratings yet

- Safari Industries BUY: Growth Momentum To Continue.Document20 pagesSafari Industries BUY: Growth Momentum To Continue.dcoolsamNo ratings yet

- Bhansali Engineering Polymers - 34 AGM HighlightsDocument4 pagesBhansali Engineering Polymers - 34 AGM HighlightsAbhinav SrivastavaNo ratings yet

- Nazara Technologies - Prabhu - 14022022140222Document8 pagesNazara Technologies - Prabhu - 14022022140222saurabht11293No ratings yet

- Shriram Pistons Initiating Coverage - 140324 - Others-054537Document29 pagesShriram Pistons Initiating Coverage - 140324 - Others-054537long-shortNo ratings yet

- Infosys LTD 20361 - Research and Analysis Report - ICICIdirectDocument6 pagesInfosys LTD 20361 - Research and Analysis Report - ICICIdirectVivek GuptaNo ratings yet

- Airtel AnalysisDocument15 pagesAirtel AnalysisPriyanshi JainNo ratings yet

- Alibaba Group Holding Limited: Strong BuyDocument9 pagesAlibaba Group Holding Limited: Strong BuyAnonymous P73cUg73L100% (1)

- Triveni Turbine's Margins Surprise, Revenue FlatDocument9 pagesTriveni Turbine's Margins Surprise, Revenue FlatjaimaaganNo ratings yet

- Steady Outlook With Focus On Execution: InfosysDocument10 pagesSteady Outlook With Focus On Execution: Infosyssaran21No ratings yet

- Maruti Suzuki India 030522 KRDocument6 pagesMaruti Suzuki India 030522 KRVala UttamNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- NikeDocument6 pagesNikeAbhinav SrivastavaNo ratings yet

- CAT 2007 Question Paper With SolutionsDocument59 pagesCAT 2007 Question Paper With SolutionsdheerajajwaniNo ratings yet

- Alkem Laboratories: CMP: INR1,772 FY19 An Aberration, But Outlook Remains PromisingDocument16 pagesAlkem Laboratories: CMP: INR1,772 FY19 An Aberration, But Outlook Remains PromisingAbhinav SrivastavaNo ratings yet

- Indian Hotels Company - Initiating Coverage-25 March 2019Document34 pagesIndian Hotels Company - Initiating Coverage-25 March 2019Abhinav SrivastavaNo ratings yet

- Pick of The Week - Axis Direct - 25032019-1 - 25-03-2019 - 08Document7 pagesPick of The Week - Axis Direct - 25032019-1 - 25-03-2019 - 08Abhinav SrivastavaNo ratings yet

- Maruti Suzuki - Update - Mar19 - HDFC Sec-201903251402449570067Document8 pagesMaruti Suzuki - Update - Mar19 - HDFC Sec-201903251402449570067Abhinav SrivastavaNo ratings yet

- Financial Statement AnalysisDocument79 pagesFinancial Statement AnalysisAbdi Rahman Bariise100% (2)

- Annual report analysisDocument22 pagesAnnual report analysisAbhinav SrivastavaNo ratings yet

- Bhansali Engineering Polymers - 34 AGM HighlightsDocument4 pagesBhansali Engineering Polymers - 34 AGM HighlightsAbhinav SrivastavaNo ratings yet

- Ashok Leyland Company Update - 180319Document15 pagesAshok Leyland Company Update - 180319Abhinav SrivastavaNo ratings yet

- Power: Power Tariff Regulation (2019-24) NotifiedDocument5 pagesPower: Power Tariff Regulation (2019-24) NotifiedAbhinav SrivastavaNo ratings yet

- Zee Learn LTD Research ReportDocument10 pagesZee Learn LTD Research ReportAbhinav SrivastavaNo ratings yet

- Mangalam Organics - StudyDocument17 pagesMangalam Organics - StudyAbhinav SrivastavaNo ratings yet

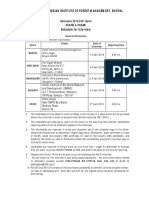

- Indian Institute of Forest Management, Bhopal: General Information Venue Date of Interview Reporting TimeDocument11 pagesIndian Institute of Forest Management, Bhopal: General Information Venue Date of Interview Reporting TimeAbhinav SrivastavaNo ratings yet

- Krispy Kreme DoughnutsDocument31 pagesKrispy Kreme DoughnutsAnkit MishraNo ratings yet

- Esop FinalDocument31 pagesEsop Finalansh384100% (2)

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- DSIJ3119Document76 pagesDSIJ3119Navin ChandarNo ratings yet

- CFA Level I Study Guide TopicsDocument6 pagesCFA Level I Study Guide TopicsVaibhav SarinNo ratings yet

- PT NUSA RAYA CIPTA Tbk Interim Financial ReportsDocument89 pagesPT NUSA RAYA CIPTA Tbk Interim Financial ReportsZaelul AlfinNo ratings yet

- Accounting Theory: Case StudyDocument5 pagesAccounting Theory: Case StudyLutfiana Hermawati67% (3)

- Accrual vs. Cash AccountingDocument33 pagesAccrual vs. Cash AccountingAbhishek ShetyeNo ratings yet

- 4ca62security Analysis & PortfolioDocument1 page4ca62security Analysis & PortfolioAkhil VijayNo ratings yet

- Patient Capital - A Study On The Outperformance of Infrequent TradersDocument72 pagesPatient Capital - A Study On The Outperformance of Infrequent TradersCanadianValueNo ratings yet

- Characteristics, Covariances, and Average Returns 1929-1997 Fama FrenchDocument24 pagesCharacteristics, Covariances, and Average Returns 1929-1997 Fama Frenchkrg09No ratings yet

- Asset Allocation & Portfolio Management Process - Lecture 2 - 2011Document45 pagesAsset Allocation & Portfolio Management Process - Lecture 2 - 2011phanquang144No ratings yet

- Forex Scaling Out Is Crucial For Money ManagementDocument4 pagesForex Scaling Out Is Crucial For Money ManagementThomas SteinNo ratings yet

- Tata Coffee - Financial AnalysisDocument10 pagesTata Coffee - Financial AnalysisAnkush KunzruNo ratings yet

- Soal Kuis Ch.11Document3 pagesSoal Kuis Ch.11Siti Robi'ahNo ratings yet

- Chapter 1 Investment EnvironmentDocument5 pagesChapter 1 Investment Environmentcrc520% (1)

- Chapter 4 SolutionsDocument80 pagesChapter 4 SolutionssurpluslemonNo ratings yet

- CDBLDocument5 pagesCDBLsmg_dreamNo ratings yet

- Forming and Operating Hedge Fund PDFDocument44 pagesForming and Operating Hedge Fund PDFMary Samsung Mendoza100% (2)

- Toll Road Financial Model v1-0Document52 pagesToll Road Financial Model v1-0siby13172100% (3)

- 17 PHD Directory F LRDocument16 pages17 PHD Directory F LRchetanaNo ratings yet

- Derivative Question and AnswerDocument15 pagesDerivative Question and AnswerPriyadarshini Sahoo65% (23)

- Fitting The Yield Curve and Cubic Spline InterpolationDocument36 pagesFitting The Yield Curve and Cubic Spline InterpolationLeonardo MorenoNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 4 and 5Document14 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 4 and 5NiizamUddinBhuiyan100% (1)

- Pilot Pen CompanyDocument3 pagesPilot Pen CompanyvishalastronomyNo ratings yet

- American Economic Review-Top 20 ArticlesDocument8 pagesAmerican Economic Review-Top 20 ArticlesClub de Finanzas Economía-UCV100% (1)

- Kotak Mahindra Bank balance sheet and profit & loss data for 5 yearsDocument24 pagesKotak Mahindra Bank balance sheet and profit & loss data for 5 yearsSandip PatelNo ratings yet

- Objective of IAS 34Document3 pagesObjective of IAS 34Prince KaharianNo ratings yet

- Derivatives DocumentationDocument89 pagesDerivatives DocumentationJonathan Ching100% (1)

- Persimmon PLC: A Valuation Based Financial AnalysisDocument14 pagesPersimmon PLC: A Valuation Based Financial AnalysisUsmanNo ratings yet