Professional Documents

Culture Documents

SBI Indices FactSheet

Uploaded by

Rajiv VermaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SBI Indices FactSheet

Uploaded by

Rajiv VermaCopyright:

Available Formats

SBI Strategy Indices SM

Index Methodology Overview

About the Indices

Strategy Based InvestingSM (SBI) Strategy Indices are benchmarks created specifically to help

investors determine the investment strategy being pursued by active equity managers. The

SBI Strategy Indices are comprised of all open-end active mutual funds pursuing a stated

investment strategy. The Equity Strategies and their definitions are summarized in Figure 1.

More information about AthenaInvest's SBI Methodology can be found on the web at

www.athenainvest.com.

Unlike traditional benchmarks, SBI Strategy Index composition is not determined by an

index committee but by active equity managers' stated investment strategy, which can be

found in the funds' prospectuses. Identifying and categorizing managers by their

investment strategy leads to more meaningful peer groups within the equity universe.

AthenaInvest maintains and publishes 10 SBI US Equity Strategy Indices and 10 SBI

International Equity Strategy Indices.

Index Methodology

CRITERIA FOR INDEX INCLUSION

In order for a mutual fund to be included in a particular SBI Strategy Index, it must be an active open-end

mutual fund with a stated investment strategy. AthenaInvest's Strategy Identification Process excludes

Index Funds, ETF's, Asset Allocation, Life Cycle, and other passively managed or mixed-asset class funds

from the SBI Strategy Indices. More information about AthenaInvest's Strategy Identification Process can

be found at www.athenainvest.com.

The underlying composition of mutual funds in a particular SBI Strategy Index changes when new funds

pursuing that strategy are identified. The equity holdings of the mutual funds change over time, and

AthenaInvest does not control for the composition or characteristics of the securities that make up SBI

Strategy Indices, including sector weighting, market capitalization, or other stock characteristics.

SBI STRATEGY INDICES

CRITERIA FOR INDEX REMOVAL

US Equity Indices

USE - Competitive Position

Once a mutual fund is strategy identified and becomes part of a particular SBI Strategy Index, there are only

USE - Economic Conditions

two reasons for removal: USE - Future Growth

USE - Market Conditions

1) The fund's stated investment strategy changes and as a result it is identified as pursuing a different USE - Opportunity

strategy in which case it will be included going forward in its new strategy, or USE - Profitability

USE - Quantitative

2) The fund closes. USE - Risk

USE - Social Considerations

USE - Valuation

CALCULATION OF INDEX PERFORMANCE

International Equity Indices

Monthly returns for each of the 20 SBI Strategy Indices, 10 US Equity and 10 International Equity, are IE - Competitive Position

IE - Economic Conditions

calculated as a simple average of the monthly across share class fund returns in that strategy. Returns are

IE - Future Growth

net of all automatically deducted fees including management fees, administration fees, 12b1, trading costs, IE - Market Conditions

and other fees. IE - Opportunity

IE - Profitability

The SBI Strategy Indices were launched in May 2009 and cover the time period from January 1980 through IE - Quantitative

the present on a monthly basis. Not all indices start in January 1980 due to the lack of strategy identified IE - Risk

funds in earlier years. The Strategy Identification Process began in 2007, so funds that did not exist then are IE - Social Considerations

excluded from the indices. IE - Valuation

Copyright © 2010 by AthenaInvest, Inc., all rights reserved.

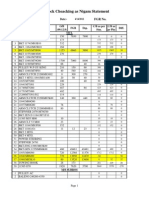

SBI Portfolio Overview - Third Quarter 2008

SBI Strategy Index, Strategy Based Investing, and Diamond Ratings are service marks of AthenaInvest, Inc.

Page 1 of 2

EQUITY STRATEGY DEFINITIONS

SBI PRODUCTS

Currently, there are no SBI Strategy

Index-based investment products COMPETITIVE POSITION

available. However, there are a

Fund managers seek companies with traits such as high-quality management, defensible

number of product offerings that

market position and a track record of innovation.

allow investors to harness the

power of Strategy Based Investing:

ECONOMIC CONDITIONS

SBI STRATEGY INDICES

Fund managers start with a top-down approach and, using macro-economic forecasting,

work their way down to favored industries and stocks.

Returns Based Strategy Analysis

Available exclusively through

Zephyr StyleADVISOR®

FUTURE GROWTH

Fund managers search for companies poised to grow rapidly relative to others, but are not

Zephyr StyleADVISOR is a registered limited to stocks that traditionally fall under the “growth” category.

trademark of Zephyr Associates, Inc.

SBI PORTFOLIOS

SM

MARKET CONDITIONS

Fund managers take into consideration a stock’s recent price and volume history relative

Mutual Fund Portfolios

to the market and similar stocks as well as the overall stock market conditions.

SBI US Equity

SBI International Equity

SBI Global Equity

Stock Portfolios

OPPORTUNITY

SBI AlphaIQ 20 US Stock Employing strategies popular with hedge funds, these managers focus on market

SBI AlphaIQ 20 International Stock imbalances that are driven by events such as earnings surprises, mergers and acquisitions,

SBI AlphaIQ 20 Global Stock spin-offs and companies “going private.”

PROFITABILITY

SBI ANALYSIS TOOLS

Fund managers favor companies with impressive gross, operating and net margins and/or

SM return on equity.

SBI SpyGlass

Mutual Fund Lookup Tool

Holdings Based Strategy Analysis

Strategy Peer Group Comparison

Exclusive Diamond Rating System

SM QUANTITATIVE

Fund managers using mathematical and statistical modeling with little or no regard to

company or market fundamentals.

MORE INFORMATION RISK

Fund managers look to control overall risk, with increasing returns as a secondary

Additional information about consideration.

AthenaInvest's products and

Strategy Based Investing can be

found on the web at:

SOCIAL CONSIDERATIONS

www.athenainvest.com Corporate social responsibility, ecological awareness or religious tenets are a factor for

these fund managers when selecting companies. The fund manager may look for these

traits or for a lack of these traits.

VALUATION

Fund managers use financial ratios to determine stock valuations and invest in companies

that are underpriced, but are not limited to stocks that have traditionally been labeled as

“value.”

Figure 1: The Equity Strategies

STRATEGY BASED INVESTING BASICS

AthenaInvest Advisors, LLC

7730 East Belleview Avenue The SBI System identifies US and international open-end equity mutual funds by their stated investment strategy rather than the

Suite AG-12

characteristics of the stocks held. This helps investors understand the process by which securities are analyzed, bought and sold,

Greenwood Village, CO 80111

which leads to the formation of meaningful peer groups, improved performance evaluation, and better investment portfolios. The SBI

877.430.5675 Strategy Identification Process is the result of a five year research effort and is based on more than 45,000 pieces of strategy

www.athenainvest.com information. AthenaInvest provides research tools, investment products, and indices based on the SBI System.

Copyright © 2010 by AthenaInvest, Inc., all rights reserved.

SBI Portfolio Overview - Third Quarter 2008

SBI Strategy Index, Strategy Based Investing, and Diamond Ratings are service marks of AthenaInvest, Inc.

Page 2 of 2

You might also like

- Sale Palnning September 11Document9 pagesSale Palnning September 11Rajiv VermaNo ratings yet

- Stock CHKDocument263 pagesStock CHKRajiv VermaNo ratings yet

- Term Paper OF Strategic Management ON ": SBI vs. Axis BankDocument27 pagesTerm Paper OF Strategic Management ON ": SBI vs. Axis BankRajiv VermaNo ratings yet

- TP of Hr-R1902a17Document17 pagesTP of Hr-R1902a17Rajiv VermaNo ratings yet

- TP of Hr-R1902a17Document17 pagesTP of Hr-R1902a17Rajiv VermaNo ratings yet

- Term PaperDocument12 pagesTerm PaperRajiv VermaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bse and Nasdaq A Comparison Between Two Stock Exchanges.Document16 pagesBse and Nasdaq A Comparison Between Two Stock Exchanges.Poojan Karia100% (2)

- Questions and Answers Capital IQDocument28 pagesQuestions and Answers Capital IQrishifiib08100% (1)

- RFLR Artificial Intelligence in Asset ManagementDocument100 pagesRFLR Artificial Intelligence in Asset ManagementJason MilesNo ratings yet

- BrillyBrown CH 11 2019Document31 pagesBrillyBrown CH 11 2019Aaron HoardNo ratings yet

- Fast Stocks Fast Money PDFDocument433 pagesFast Stocks Fast Money PDFPrateek Dubey100% (1)

- FMEP Interactive Handbook GoldDocument5 pagesFMEP Interactive Handbook GoldNavi Fis0% (1)

- Best Smallcap IT Stocks For The Long Term. Here Are 5 To Watch Out ForDocument5 pagesBest Smallcap IT Stocks For The Long Term. Here Are 5 To Watch Out ForPGM5HNo ratings yet

- C S M L M S P P: Omparative Tudy of Achine Earning Odels For Tock Rice RedictionDocument6 pagesC S M L M S P P: Omparative Tudy of Achine Earning Odels For Tock Rice RedictionsamsamerNo ratings yet

- Isgpore PDFDocument16 pagesIsgpore PDFGabriel La MottaNo ratings yet

- Nepse207172 PDFDocument80 pagesNepse207172 PDFNirakarJhaNo ratings yet

- MBA Finance Project - Analysis of Indian Financial System Post Liberalization - PDF Report DoDocument92 pagesMBA Finance Project - Analysis of Indian Financial System Post Liberalization - PDF Report DoRam PNo ratings yet

- 2014 CFA Level 3 Mock Exam AfternoonDocument30 pages2014 CFA Level 3 Mock Exam AfternoonElsiiieNo ratings yet

- Internship Report - Federal BankDocument55 pagesInternship Report - Federal Bankpooja100% (1)

- Market Pulse 130619Document5 pagesMarket Pulse 130619ventriaNo ratings yet

- Sample IPSDocument21 pagesSample IPSMohamed ZulhilmiNo ratings yet

- CFA PresentationDocument47 pagesCFA PresentationBen Carlson100% (8)

- Stock Market HistoryDocument10 pagesStock Market HistoryAdinanoorNo ratings yet

- Goldman Funds SicavDocument658 pagesGoldman Funds SicavThanh NguyenNo ratings yet

- Quarter 2 - Module 10 GENERAL MATHEMATICSDocument7 pagesQuarter 2 - Module 10 GENERAL MATHEMATICSKristine AlcordoNo ratings yet

- Impact of COVID - 19 Pandemic and Its Impact On Financial MarketsDocument6 pagesImpact of COVID - 19 Pandemic and Its Impact On Financial MarketsEditor IJTSRDNo ratings yet

- Volatility and Co-Movement Models A Literature Review and SynthesisDocument25 pagesVolatility and Co-Movement Models A Literature Review and SynthesisarcherselevatorsNo ratings yet

- 2009 May04 No368 Ca TheedgesporeDocument19 pages2009 May04 No368 Ca TheedgesporeThe Edge SingaporeNo ratings yet

- Definations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007Document24 pagesDefinations of Every Word Used in Stock Market To Be Known.............. Must READ - December 9th, 2007rimolahaNo ratings yet

- Capital Markets1Document2 pagesCapital Markets1komal desaiNo ratings yet

- The Efficient Market HypothesisDocument31 pagesThe Efficient Market HypothesisKoon Sing ChanNo ratings yet

- UTI MF Common Application FormDocument32 pagesUTI MF Common Application Formrkdgr87880100% (1)

- Brinson Fachler 1985 Multi Currency PADocument4 pagesBrinson Fachler 1985 Multi Currency PAGeorgi MitovNo ratings yet

- Ind Nifty Financial ServicesDocument2 pagesInd Nifty Financial ServicesPrashant DalviNo ratings yet

- Royce Semi Annual ReportDocument168 pagesRoyce Semi Annual ReportSpencer GantsoudesNo ratings yet

- Dow Jones Industrial Average (DJIA) DefinitionDocument9 pagesDow Jones Industrial Average (DJIA) Definitionselozok1No ratings yet