Professional Documents

Culture Documents

Post Prior (D New D Old) P

Uploaded by

GandhesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Post Prior (D New D Old) P

Uploaded by

GandhesCopyright:

Available Formats

15-5

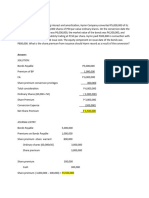

Lee manufacturing’s value of operation is equal to $900 million after a recapitalization ( the firm had

no debt before recap ). It raised $300 million in new debt and used this to buy back stock. Nichols

had no short term investment before or after the recap. After the recap, wd = 1/3 the firm had 30

million share before the recap. What is P ( the stock price after the recap)?

Wd setelah recap = $300/$ 900

= 1/3

Vop = $900

S = (1-Wd)( Vop)

= (1-1/3)*$900

= $600

P ( stock price after the recap ) = price / share

= ( S+ New Debt) / Share number available

= (600 M + 300M )/ 30 M

= 30 M

15-6

Due Trucking raised $ 150 million in new debt and used this to buy back stock. After the recap, Dye’s

stock price is $7.5. if Dye had 60 million share of stock before the recap. How many share does it

have after the recap?

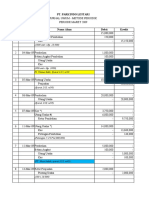

(D new−D old)

npost = nprior −

P

n post = 60 M – (150 M- 0) / 7.5

n post = 60 M – 20M

= 40 M

You might also like

- Fina 3203 HW1Document5 pagesFina 3203 HW1ChiTat LoNo ratings yet

- Corporate Finance - Berk - 4CE - SolutionsDocument4 pagesCorporate Finance - Berk - 4CE - SolutionsZhichang ZhangNo ratings yet

- Classroom Discussion 2 - 04172021Document3 pagesClassroom Discussion 2 - 04172021LLYOD FRANCIS LAYLAY50% (2)

- Chapter 16: Capital Structure: Basic Concepts: Answers To End-of-Chapter Problems BDocument10 pagesChapter 16: Capital Structure: Basic Concepts: Answers To End-of-Chapter Problems BAshish BhallaNo ratings yet

- Q.4-Question and SolutionDocument4 pagesQ.4-Question and SolutionFIROZ KHANNo ratings yet

- Chapter 15Document2 pagesChapter 15Asep KurniaNo ratings yet

- Far160 Debenture NotesDocument9 pagesFar160 Debenture NotesAINUL MARDIYAH MOHD AZMINo ratings yet

- Book 1Document3 pagesBook 1gennalyn goNo ratings yet

- Solution - Hand Out - Problems 9 10 11 12 13 14 15Document16 pagesSolution - Hand Out - Problems 9 10 11 12 13 14 15Anne Clarisse ConsuntoNo ratings yet

- Q.3-Question and SolutionDocument4 pagesQ.3-Question and SolutionFIROZ KHANNo ratings yet

- CFAS - M3P2 AssignmentDocument12 pagesCFAS - M3P2 AssignmentMay OriaNo ratings yet

- Solution Practice 5: Consolidations 2 Consolidation Worksheet, Consolidated Financial StatementsDocument8 pagesSolution Practice 5: Consolidations 2 Consolidation Worksheet, Consolidated Financial StatementsJingwen YangNo ratings yet

- TK1-W3-S4-R3 Deadline 13 Dec 21 12.00Document4 pagesTK1-W3-S4-R3 Deadline 13 Dec 21 12.00khususvpn 67No ratings yet

- Tutorial Week 7-8 PSet 7 SolutionsDocument7 pagesTutorial Week 7-8 PSet 7 SolutionsAshley ChandNo ratings yet

- Answer BE9-2 Explanation:: Calculation of Book Value and Accumulated Depreciation For Each of The AssetsDocument2 pagesAnswer BE9-2 Explanation:: Calculation of Book Value and Accumulated Depreciation For Each of The AssetsYousuf SiyamNo ratings yet

- PROBLEM 1 Audit of Shareholders EquityDocument6 pagesPROBLEM 1 Audit of Shareholders Equityaira nialaNo ratings yet

- Week 8 Tutorial SolutionsDocument21 pagesWeek 8 Tutorial SolutionsKashif Munir IdreesiNo ratings yet

- Accounting For Corporation Reviewer 1 PDFDocument27 pagesAccounting For Corporation Reviewer 1 PDFKrisha SaltaNo ratings yet

- BA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Document6 pagesBA 118.3 (D. Salazar/R. Placido/K. Dela Cruz)Ian De Dios100% (1)

- Corporation Problems-1Document18 pagesCorporation Problems-1Avia Chelsy DeangNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Homework For Debt & EquityDocument6 pagesHomework For Debt & EquityPetra100% (1)

- Assignment No. 2 Group Members M. Sameer Rimsha Shakeel Saniya Khurram Wajeeha SiddiqiDocument31 pagesAssignment No. 2 Group Members M. Sameer Rimsha Shakeel Saniya Khurram Wajeeha SiddiqiSameer AsifNo ratings yet

- Ia2 Ia2 Millan Solution - CompressDocument6 pagesIa2 Ia2 Millan Solution - CompressWynne RamosNo ratings yet

- Chap 3Document4 pagesChap 3Uyên Thư TrầnNo ratings yet

- Assignmnet Chapter 13Document12 pagesAssignmnet Chapter 13Nicolas ErnestoNo ratings yet

- Investment Accounts Practice QuestionsDocument10 pagesInvestment Accounts Practice QuestionsJanhvi AroraNo ratings yet

- Corporation PDFDocument28 pagesCorporation PDFJorufel PapasinNo ratings yet

- Chapter 16 EditedDocument5 pagesChapter 16 Editedomar_geryesNo ratings yet

- Solution Practice 5 Consolidations 2Document7 pagesSolution Practice 5 Consolidations 2Mya Hmuu KhinNo ratings yet

- Kuis AklDocument6 pagesKuis AklArista Yuliana SariNo ratings yet

- Problem Set 1Document8 pagesProblem Set 1Carol VarelaNo ratings yet

- Soal - Intermediate Accounting2Document3 pagesSoal - Intermediate Accounting2WiryawanNuryusufNo ratings yet

- PARTNERSHIP AND CORPORATION Answers For pp.226-227 Exercises 1,2, 3 and 8Document5 pagesPARTNERSHIP AND CORPORATION Answers For pp.226-227 Exercises 1,2, 3 and 8MALICDEM, CharizNo ratings yet

- Template Tuto Group ProjectDocument6 pagesTemplate Tuto Group ProjectNur Athirah Binti MahdirNo ratings yet

- Module 2: Assignment: PROBLEM 9 - Treasury SharesDocument8 pagesModule 2: Assignment: PROBLEM 9 - Treasury SharesYvonne DuyaoNo ratings yet

- Kelompok 6 Latihan Soal EquityDocument7 pagesKelompok 6 Latihan Soal EquityTria SalzanabillaNo ratings yet

- Particulars Calculation WNDocument4 pagesParticulars Calculation WNVansh KansaraNo ratings yet

- CH 15Document8 pagesCH 15Ansley0% (1)

- PPE Tuto 7Document3 pagesPPE Tuto 7LAVINNYA NAIR A P PARBAKARANNo ratings yet

- MATH 15 Lesson 5Document13 pagesMATH 15 Lesson 5Adelfa LibanonNo ratings yet

- Transaction Analysis (2424)Document17 pagesTransaction Analysis (2424)AirForce ManNo ratings yet

- New Rev Financial Acc1Document22 pagesNew Rev Financial Acc1ahmedfaiyaz917No ratings yet

- Latihan - Ch.11Document16 pagesLatihan - Ch.11DiditNo ratings yet

- Payout Policy: Fundamentals of Corporate FinanceDocument24 pagesPayout Policy: Fundamentals of Corporate FinanceMuh BilalNo ratings yet

- Q1Document18 pagesQ1Hilario, Jana Rizzette C.No ratings yet

- AnnuityDocument22 pagesAnnuityDr Thushar Rai NNo ratings yet

- Cost Solution (Sir Jawad)Document11 pagesCost Solution (Sir Jawad)Tooba MaqboolNo ratings yet

- Brealey. Myers. Allen Chapter 22 SolutionDocument8 pagesBrealey. Myers. Allen Chapter 22 SolutionPulkit Aggarwal100% (1)

- Quarter 2 - Week 1Document42 pagesQuarter 2 - Week 1Ma Joy E BarradasNo ratings yet

- Share-Based Sample ProblemsDocument4 pagesShare-Based Sample ProblemsEmma Mariz Garcia100% (1)

- AnnuitiesDocument8 pagesAnnuitiesNasserNo ratings yet

- Capital Structure 2Document10 pagesCapital Structure 2chelseaNo ratings yet

- Dave Chapter 9Document11 pagesDave Chapter 9Mark Dave SambranoNo ratings yet

- FNCE370 Assignment 5: Question 1: Raising Capital - DividendsDocument11 pagesFNCE370 Assignment 5: Question 1: Raising Capital - DividendssmaNo ratings yet

- Local Media6407818735901173272Document1 pageLocal Media6407818735901173272KRISTINE JEAN BUNA GERUNDANo ratings yet

- Intercompany Profit Transaction - Bonds (Revised) - Part 1Document27 pagesIntercompany Profit Transaction - Bonds (Revised) - Part 1Raihan YonaldiiNo ratings yet

- Adv Acc 2 Module 1 Topic 1.1Document4 pagesAdv Acc 2 Module 1 Topic 1.1James CantorneNo ratings yet

- Formulating Long-Term Objectives and Grand StrategiesDocument40 pagesFormulating Long-Term Objectives and Grand StrategiesGandhesNo ratings yet

- Chap015 Marketing Strategy Implementation and ControlDocument41 pagesChap015 Marketing Strategy Implementation and ControlGandhes100% (1)

- Business Strategy: Mcgraw-Hill/Irwin Strategic Management, 10/EDocument30 pagesBusiness Strategy: Mcgraw-Hill/Irwin Strategic Management, 10/EGandhesNo ratings yet

- Analisis Keuangan Sistem DupontDocument29 pagesAnalisis Keuangan Sistem DupontGandhesNo ratings yet

- Here's How Prince Harry and Meghan Markle's Cake Differs From Other Royal CakesDocument2 pagesHere's How Prince Harry and Meghan Markle's Cake Differs From Other Royal CakesGandhesNo ratings yet