Professional Documents

Culture Documents

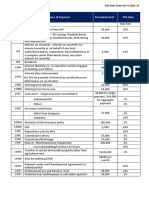

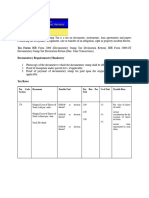

(RA No. 8424) Section Document Taxable Unit Tax Due Per Unit or Fraction % of Unit Taxable Event Primary Taxable Persons

Uploaded by

William AbarcaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(RA No. 8424) Section Document Taxable Unit Tax Due Per Unit or Fraction % of Unit Taxable Event Primary Taxable Persons

Uploaded by

William AbarcaCopyright:

Available Formats

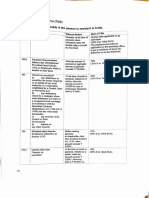

(RA No.

Document Taxable Tax Due % of Taxable Primary

8424) Unit Per Unit Unit Event Taxable

or Persons

Section Fraction

194 Lease and other First 2,000 3.00 1.5% Upon issuance or Lessor/Lessee

Hiring agreements For every 1.00 .1% renewal

of memorandum or P1,000 or

contract for hire, fractional part

use or rent of any thereof in

land or tenements excess of the

or portions thereof first P2,000 for

each year of

the term of the

contract or

agreement

195 Mortgages, First 5,000 20.00 .4% Upon issuance or Banks, Lending

Pledges of lands, on each 10.00 renewal Co., pawnshop

estate, or property P5,000 or

and Deeds of Trust fractional part

thereof in

excess of

P5,000

196 Deed of Sale, First P1,000 15.00 1.5% Upon execution Seller/Buyer

instrument or For each 15.00

writing and additional

P1,000 or

Conveyances of

fractional part

Real Property thereof in excess

(except grants, of P1,000

patents or original

certificate of the

government)

Taxable Base-

Consideration or

FMV whichever is

higher (if gov't. is a

party, basis shall

be the

consideration)

You might also like

- Tax 3 Chapter 14 Documentary Stamp Tax EditedDocument10 pagesTax 3 Chapter 14 Documentary Stamp Tax Editedokay alexNo ratings yet

- TST Les5Document3 pagesTST Les5leomartinqtNo ratings yet

- Important Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDocument1 pageImportant Changes in TDS Chart: Section No. Description Cutoff Rate of TDS ExamplesDaljeet SinghNo ratings yet

- Documentary Stamp TaxDocument120 pagesDocumentary Stamp Taxnegotiator50% (2)

- Documentary Stamps Tax Transaction / Document Rate Tax BaseDocument3 pagesDocumentary Stamps Tax Transaction / Document Rate Tax BaseMark AbraganNo ratings yet

- Tax 3 Chapter 14 Documentary Stamp TaxDocument13 pagesTax 3 Chapter 14 Documentary Stamp Taxokay alexNo ratings yet

- Document Taxable Unit Tax Due Per Unit % of UnitDocument6 pagesDocument Taxable Unit Tax Due Per Unit % of Unitveloxenergy.taxcompspecialistNo ratings yet

- Additional Subscription by Way of Shares of StockDocument3 pagesAdditional Subscription by Way of Shares of Stockregine rose bantilanNo ratings yet

- Other Percentage Taxes Transaction/Entity Tax Rate Tax BaseDocument4 pagesOther Percentage Taxes Transaction/Entity Tax Rate Tax BaseClarissa de VeraNo ratings yet

- Documentary Stamp Tax PDFDocument9 pagesDocumentary Stamp Tax PDFQuinnee VallejosNo ratings yet

- DST & OPT LectureDocument31 pagesDST & OPT LectureJeffrey Fuentes100% (2)

- Documentary Stamp Tax - Bureau of Internal RevenueDocument12 pagesDocumentary Stamp Tax - Bureau of Internal Revenueroy rebosuraNo ratings yet

- IBP Standard Legal FeesDocument4 pagesIBP Standard Legal FeesStewart Paul Torre100% (2)

- TDS RATE CHART FY 2021-22-FinalDocument5 pagesTDS RATE CHART FY 2021-22-FinalLeenaNo ratings yet

- Documentary Stamp Tax: DST DefinedDocument9 pagesDocumentary Stamp Tax: DST DefinedLumingNo ratings yet

- Double Taxation AgreementDocument9 pagesDouble Taxation AgreementAmy Olaes Dulnuan100% (1)

- Documentary Stamp TaxDocument10 pagesDocumentary Stamp TaxDura LexNo ratings yet

- Documentary Stamp TaxDocument6 pagesDocumentary Stamp TaxchrizNo ratings yet

- Taxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orDocument2 pagesTaxation ST 06. Documentary Stamp Tax: 4. Certificates of Profits orFabrienne Kate LiberatoNo ratings yet

- Taxation: 1. Capital Gains TaxDocument9 pagesTaxation: 1. Capital Gains TaxChelsy SantosNo ratings yet

- Tds Rate Chart Fy 2020Document4 pagesTds Rate Chart Fy 2020KAUTUK KOLINo ratings yet

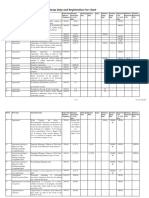

- Stamp Duty and Registration Fee Chart: OptionalDocument14 pagesStamp Duty and Registration Fee Chart: Optionalkalluri raviNo ratings yet

- Tds Rate Chart Fy 2021-22Document3 pagesTds Rate Chart Fy 2021-22Kadambari ShelkeNo ratings yet

- Stamp Duty and Registration Fee Chart: OptionalDocument14 pagesStamp Duty and Registration Fee Chart: OptionalYatish RanjanNo ratings yet

- Sec 180 186Document4 pagesSec 180 186Shaina ObreroNo ratings yet

- Documentary Stamp TaxDocument8 pagesDocumentary Stamp TaxRam DerickNo ratings yet

- Atty. Aranas Lecture Presentation On DST and OPTDocument37 pagesAtty. Aranas Lecture Presentation On DST and OPTEder EpiNo ratings yet

- Proposed IBP RatesDocument6 pagesProposed IBP RatesClutz MacNo ratings yet

- Documentary Stamp Tax - Bureau of Internal RevenueDocument5 pagesDocumentary Stamp Tax - Bureau of Internal RevenueArlene2 ColoradoNo ratings yet

- Quarterly Percentage Tax Rates TableDocument2 pagesQuarterly Percentage Tax Rates TableJoseph MangahasNo ratings yet

- BIR Form 1600WPDocument1 pageBIR Form 1600WPCharmaine MejiaNo ratings yet

- Tax Rates: Coverage Basis Tax RateDocument3 pagesTax Rates: Coverage Basis Tax RateDymphna Ann CalumpianoNo ratings yet

- Documentary StampDocument5 pagesDocumentary Stamppretityn19No ratings yet

- Documentary Stamp TaxDocument5 pagesDocumentary Stamp TaxJustin PaidNo ratings yet

- CHAPTER 5 - Percentage TaxDocument2 pagesCHAPTER 5 - Percentage Taxnewlymade641No ratings yet

- Business TaxationDocument41 pagesBusiness TaxationKim AranasNo ratings yet

- Remittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsDocument1 pageRemittance Return of Percentage Tax On Winnings and Prizes Withheld by Race Track OperatorsShaira Patricia Angelyn NiloNo ratings yet

- Percentage TaxDocument3 pagesPercentage TaxRainNo ratings yet

- TAX - 3 Documentary Stamp Tax RatesDocument2 pagesTAX - 3 Documentary Stamp Tax RatesYamateNo ratings yet

- Taxation Reviewer - Percentage TaxDocument3 pagesTaxation Reviewer - Percentage TaxDaphne BarceNo ratings yet

- Quarterly Percentage Tax Rates Table: Taxable Base Tax RateDocument4 pagesQuarterly Percentage Tax Rates Table: Taxable Base Tax RateKathrine CruzNo ratings yet

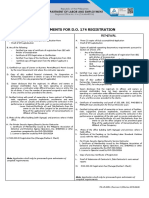

- DOLE - DO 174 ChecklistDocument1 pageDOLE - DO 174 ChecklistDencio Mancilla83% (6)

- Documentary Stamp Tax - BIRDocument11 pagesDocumentary Stamp Tax - BIRBenjamin Hernandez Jr.No ratings yet

- TDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersDocument7 pagesTDS Rate Chart FY 2021-2022: Section Code Nature of Payment Threshold (In RS.) TDS Rate (In %) Indv/HUF OthersRajNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- Documentary Stamp TaxDocument7 pagesDocumentary Stamp TaxJenny KimmeyNo ratings yet

- Chapter 11 Documentary Stamp TaxDocument8 pagesChapter 11 Documentary Stamp TaxRygiem Dela CruzNo ratings yet

- Tax Deducted at Source (TDS) These Rates Are Applicable If The Person Is Resident in LndiDocument5 pagesTax Deducted at Source (TDS) These Rates Are Applicable If The Person Is Resident in Lndirahulmehta1578No ratings yet

- DST OverviewDocument14 pagesDST OverviewMa. Corazon CaramalesNo ratings yet

- Tax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BaseDocument3 pagesTax Rates: Tax Code Section Document Taxable Unit Tax Due Per Unit % of Unit Taxable BasecristinatubleNo ratings yet

- Accounting Treatment For Documentary Stamp TaxDocument22 pagesAccounting Treatment For Documentary Stamp TaxJo CelNo ratings yet

- TDS EntryDocument11 pagesTDS Entryश्रीनाथ राजाराम दातेNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- SEC Memo Circ No. 06-05 - Consolidated Scale of FinesDocument17 pagesSEC Memo Circ No. 06-05 - Consolidated Scale of FinesHailin QuintosNo ratings yet

- Stamp Duty and Registration Fee ChartDocument14 pagesStamp Duty and Registration Fee ChartSujay JadhavNo ratings yet

- Stamp Duty and Registration Fee Chart - MPDocument2 pagesStamp Duty and Registration Fee Chart - MPAkshansh NegiNo ratings yet

- Other Perceentage TaxesDocument9 pagesOther Perceentage TaxesBrian Martin AnupolNo ratings yet

- Index For Documentary Stamp TaxDocument16 pagesIndex For Documentary Stamp TaxWilma P.No ratings yet