Professional Documents

Culture Documents

Input: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020E

Uploaded by

Ram persad0 ratings0% found this document useful (0 votes)

26 views4 pagesValuation model

Original Title

92286 a 338 b 597114

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentValuation model

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views4 pagesInput: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020E

Uploaded by

Ram persadValuation model

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

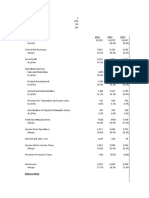

Input

EURmn - Dec y/e 2015A 2016A 2017E 2018E 2019E 2020E

Revenue 20,511 20,792 21,559 22,662 23,673 24,499

% Growth 1.4% 3.7% 5.1% 4.5% 3.5%

EBITDA 4,654 5,042 5,271 5,608 5,915 5,937

% Margin 22.7% 24.2% 24.4% 24.7% 25.0% 24.2%

D&A 1,096 1,502 1,585 1,666 1,701 1,768

% Margin 5.3% 7.2% 7.4% 7.4% 7.2% 7.2%

EBIT 3,558 3,540 3,685 3,942 4,213 4,169

% Margin 17.3% 17.0% 17.1% 17.4% 17.8% 17.0%

Capex 1,638 1,757 1,924 1,880 1,930 1,814

% Margin 8.0% 8.5% 8.9% 8.3% 8.2% 7.4%

Changes in WC 371 80 236 249 260 269

% Margin 1.8% 0.4% 1.1% 1.1% 1.1% 1.1%

Effective Tax Rate 24.6% 27.9% 27.9% 27.5% 27.1% 26.7%

Investments in Associates and JV's 2,166

Other Investments and Receivables 428

Net Debt/ (Net Cash) 11,293

Non-Controlling Interests 1,335

Pension 1,420

Provisions 456

Classified as Held for Sale 40

No of Shares Outstanding 569.7

2021E 2022E 2023E 2024E

25,330 26,163 26,998 27,833

3.4% 3.3% 3.2% 3.1%

6,113 6,288 6,462 6,634

24.1% 24.0% 23.9% 23.8%

1,828 1,888 1,948 2,008

7.2% 7.2% 7.2% 7.2%

4,285 4,400 4,514 4,625

16.9% 16.8% 16.7% 16.6%

1,876 1,937 1,999 2,061

7.4% 7.4% 7.4% 7.4%

278 287 296 305

1.1% 1.1% 1.1% 1.1%

26.3% 25.9% 25.5% 25.1%

FCFF

EURmn - Dec y/e 2017E 2018E 2019E 2020E

EBIT

% Tax Rate

EBIT*Tax Rate

NOPAT 0 0 0 0

Add: D&A

Less: Capex

Add/Less: Changes in WC

Free Cash Flow to Firm (FCFF) 0 0 0 0

Growth #DIV/0! #DIV/0! #DIV/0!

Years Discounted 0.7 1.7 2.7 3.7

Discount Factor 0.9522 0.8874 0.8270 0.7707

Discounted Cash Flow 0 0 0 0

Date of Valuation 21-Apr-17

Fiscal Year End 31-Dec-17

WACC 7.3%

Terminal Growth 2.0%

Normalized FCF 0

Terminal Value 0

Discounted Terminal Value 0

Discounted Cash Flows 0

Enterprise Value (EV) 0

Equity Value

Implied Share Price € 0.0

Terminal Value / EV #DIV/0!

Share Price on Date of Valuation € 81.3

Upside

Implied Exit Multiple #DIV/0!

2021E 2022E 2023E 2024E Norm

0 0 0 0 0

0 0 0 0 0

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

4.7 5.7 6.7 7.7 7.7

0.7183 0.6694 0.6239 0.5814 0.5814

0 0 0 0 0

You might also like

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- EPL LTD Financial Statements - XDocument16 pagesEPL LTD Financial Statements - XAakashNo ratings yet

- Airbus ValoDocument19 pagesAirbus ValobendidisalaheddineNo ratings yet

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- Varma Capitals - Modeling TestDocument6 pagesVarma Capitals - Modeling TestSuper FreakNo ratings yet

- Chapter 3. Exhibits y AnexosDocument24 pagesChapter 3. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Nvidia DCFDocument28 pagesNvidia DCFibs56225No ratings yet

- Kahoot! (Buy TP NOK150) : The Compound Interest Effect With Triple Digit Revenue Growth and +40% FCF Margin Is Massive!Document24 pagesKahoot! (Buy TP NOK150) : The Compound Interest Effect With Triple Digit Revenue Growth and +40% FCF Margin Is Massive!jainantoNo ratings yet

- Pag BankDocument24 pagesPag Bankandre.torresNo ratings yet

- Financial Analysis ModelDocument5 pagesFinancial Analysis ModelShanaya JainNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialGaurav KumarNo ratings yet

- Chapter 2. Exhibits y AnexosDocument20 pagesChapter 2. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Y2020 Budget PL-NMDocument1 pageY2020 Budget PL-NMBảo AnNo ratings yet

- SFH Rental AnalysisDocument6 pagesSFH Rental AnalysisA jNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument4 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialtehreemNo ratings yet

- Ultra Tech Cement CreatingDocument7 pagesUltra Tech Cement CreatingvikassinghnirwanNo ratings yet

- Anta Forecast Template STD 2023Document8 pagesAnta Forecast Template STD 2023Ronnie KurtzbardNo ratings yet

- Contoh DCF ValuationDocument17 pagesContoh DCF ValuationArie Yetti NuramiNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- ACC DCF ValuationDocument7 pagesACC DCF ValuationJitesh ThakurNo ratings yet

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument7 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialআসিফহাসানখানNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- JFC - PH Jollibee Foods Corp. Annual Income Statement - WSJDocument1 pageJFC - PH Jollibee Foods Corp. Annual Income Statement - WSJフ卂尺乇ᗪNo ratings yet

- Case 01a Growing Pains SolutionDocument7 pagesCase 01a Growing Pains SolutionUSD 654No ratings yet

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Financial Modelling and Analysis ITCDocument9 pagesFinancial Modelling and Analysis ITCPriyam SarangiNo ratings yet

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- INR (Crores) 2020A 2021A 2022E 2023E 2024E 2025EDocument5 pagesINR (Crores) 2020A 2021A 2022E 2023E 2024E 2025EJatin MittalNo ratings yet

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Document36 pagesUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyNo ratings yet

- Beginner EBay DCFDocument14 pagesBeginner EBay DCFQazi Mohd TahaNo ratings yet

- Axisbank Financial Statements Summary AJ WorksDocument12 pagesAxisbank Financial Statements Summary AJ WorksSoorajKrishnanNo ratings yet

- Book 1Document10 pagesBook 1Sakhwat Hossen 2115202660No ratings yet

- Valuation - NVIDIADocument27 pagesValuation - NVIDIALegends MomentsNo ratings yet

- Task 1 BigTech TemplateDocument5 pagesTask 1 BigTech Templatedaniyalansari.8425No ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessBacarrat BNo ratings yet

- Corporate ValuationDocument32 pagesCorporate ValuationNishant DhakalNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationahmed HOSNYNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument2 pagesThe Discounted Free Cash Flow Model For A Complete BusinessHẬU ĐỖ NGỌCNo ratings yet

- Hasbro Single FEC Outlet FS - 5 YearsDocument7 pagesHasbro Single FEC Outlet FS - 5 YearsC D BNo ratings yet

- DCF TemplateDocument21 pagesDCF TemplateShrikant ShelkeNo ratings yet

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- INR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.0Document7 pagesINR (Crores) 2020A: 2021A 2022E 2023E Income Statement - ITC Revenue 24,750.0 27,225.057 - Lakshita TanwaniNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Financial AnalysisDocument9 pagesFinancial AnalysisSam SumoNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- Tesco Financials - Capital IQDocument48 pagesTesco Financials - Capital IQÑízãr ÑzrNo ratings yet

- Ratio Analysis: Investor Liquidity RatiosDocument11 pagesRatio Analysis: Investor Liquidity RatiosjayRNo ratings yet

- Common Size Income StatementDocument7 pagesCommon Size Income StatementUSD 654No ratings yet

- Induslnd Bank: National Stock Exchange of India Ltd. (Symbol: INDUSINDBK)Document49 pagesInduslnd Bank: National Stock Exchange of India Ltd. (Symbol: INDUSINDBK)Ash SiNghNo ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelMohamedNo ratings yet

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualDocument19 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases Palepu 5th Edition Solutions ManualStephanieParkerexbf100% (43)

- DiviđenDocument12 pagesDiviđenPhan GiápNo ratings yet

- Sections of Companies Act, 2013 Text Public CommentDocument29 pagesSections of Companies Act, 2013 Text Public CommentRam persadNo ratings yet

- 19348sm SFM Finalnew Cp5Document107 pages19348sm SFM Finalnew Cp5Le ProcrastinatorNo ratings yet

- 01 09 Inventory Changes Cash DebtDocument4 pages01 09 Inventory Changes Cash DebtShikharNo ratings yet

- 1 5152522306228060242Document107 pages1 5152522306228060242Ram persadNo ratings yet

- Astromantra ComDocument12 pagesAstromantra ComRam persadNo ratings yet

- 1703 10449 PDFDocument10 pages1703 10449 PDFRam persadNo ratings yet

- Micro PPT FinalDocument39 pagesMicro PPT FinalRyan Christopher PascualNo ratings yet

- Strategy Output Activity (Ppa) : Activities (Ppas) For The Social Sector Activities (Ppas) For The Education Sub-SectorDocument3 pagesStrategy Output Activity (Ppa) : Activities (Ppas) For The Social Sector Activities (Ppas) For The Education Sub-Sectorstella marizNo ratings yet

- Unit-4 Sewer Appurtenances - Only Introduction (4 Hours) R2Document13 pagesUnit-4 Sewer Appurtenances - Only Introduction (4 Hours) R2Girman RanaNo ratings yet

- Profile - Sudip SahaDocument2 pagesProfile - Sudip Sahasudipsinthee1No ratings yet

- Literature - Short Stories Test 2Document22 pagesLiterature - Short Stories Test 2cosme.fulanitaNo ratings yet

- Patrick Svitek - Resume 2012Document1 pagePatrick Svitek - Resume 2012Patrick SvitekNo ratings yet

- Construction ManagementDocument191 pagesConstruction ManagementYu Oscar KpariongoNo ratings yet

- Public Perceptionon Print MediaDocument8 pagesPublic Perceptionon Print MediaSeyram MayvisNo ratings yet

- Rule: Airworthiness Directives: Hartzell Propeller Inc.Document3 pagesRule: Airworthiness Directives: Hartzell Propeller Inc.Justia.comNo ratings yet

- English (202) Tutor Marked Assignment: NoteDocument3 pagesEnglish (202) Tutor Marked Assignment: NoteLubabath IsmailNo ratings yet

- Learning CompetenciesDocument44 pagesLearning CompetenciesJeson GalgoNo ratings yet

- COWASH Federal Admin Manual v11 PDFDocument26 pagesCOWASH Federal Admin Manual v11 PDFmaleriNo ratings yet

- Baby MangDocument8 pagesBaby MangffNo ratings yet

- Intermarket AnaDocument7 pagesIntermarket Anamanjunathaug3No ratings yet

- Term Paper General Principle in The Construction of StatutesDocument8 pagesTerm Paper General Principle in The Construction of StatutesRonald DalidaNo ratings yet

- STS Learning Plan 1Document9 pagesSTS Learning Plan 1Lienol Pestañas Borreo0% (1)

- Sample DLL Catch Up FridayDocument11 pagesSample DLL Catch Up Fridayalice mapanaoNo ratings yet

- Change Your Life PDF FreeDocument51 pagesChange Your Life PDF FreeJochebed MukandaNo ratings yet

- MCQ Chapter 1Document9 pagesMCQ Chapter 1K57 TRAN THI MINH NGOCNo ratings yet

- Ruhr OelDocument9 pagesRuhr OelJunghietu DorinNo ratings yet

- Marudur,+6 +nikaDocument12 pagesMarudur,+6 +nikaResandi MuhamadNo ratings yet

- The Peace Report: Walking Together For Peace (Issue No. 2)Document26 pagesThe Peace Report: Walking Together For Peace (Issue No. 2)Our MoveNo ratings yet

- Toms River Fair Share Housing AgreementDocument120 pagesToms River Fair Share Housing AgreementRise Up Ocean CountyNo ratings yet

- Microsoft Logo Third Party Usage Guidance: June 2021Document7 pagesMicrosoft Logo Third Party Usage Guidance: June 2021Teo HocqNo ratings yet

- Keto SureDocument3 pagesKeto SureNicolette Gozun HipolitoNo ratings yet

- Rhonda Taube - Sexuality Meso FigurinesDocument5 pagesRhonda Taube - Sexuality Meso FigurinesSneshko SnegicNo ratings yet

- PMP Mock Exams 1, 200 Q&ADocument29 pagesPMP Mock Exams 1, 200 Q&Asfdfdf dfdfdf100% (1)

- MA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCDocument105 pagesMA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCPrisca RaniNo ratings yet

- Zlodjela Bolesnog UmaDocument106 pagesZlodjela Bolesnog UmaDZENAN SARACNo ratings yet

- Summary (SDL: Continuing The Evolution)Document2 pagesSummary (SDL: Continuing The Evolution)ahsanlone100% (2)