Professional Documents

Culture Documents

Annex D - Certificate of Availment

Uploaded by

MELLICENT LIANZA0 ratings0% found this document useful (0 votes)

241 views1 pageEstate Tax Amnesty

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEstate Tax Amnesty

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

241 views1 pageAnnex D - Certificate of Availment

Uploaded by

MELLICENT LIANZAEstate Tax Amnesty

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

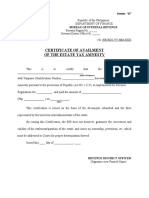

Annex“D”

Republic of the Philippines

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Revenue Region No. ______

Revenue District Office No. ______

No.(RR-RDO-YY-MM-XXX)

CERTIFICATE OF AVAILMENT

OF THE ESTATE TAX AMNESTY

This is to certify that the Estate of

_____________________________________________

(name of taxpayer)

with Taxpayer Identification Number ______________________has availed of the Estate Tax

Amnesty pursuant to the provisions of Republic Act No. 11213,as implemented by Revenue

Regulations No. __________,and paid the amount of ___________________________

(Php______________) on _____________.

(date)

This certification is issued on the basis of the documents submitted and the facts

represented by the heirs/executor/administrator of the estate.

By issuing this Certification, the BIR does not however, guarantee the correctness and

validity of the settlement/partition of the estate, and issues on ownership, preterition, etc. which

must be addressed to Courts for proper determination thereof.

Issued this ____ day of _____________, ____.

REVENUE DISTRICT OFFICER

(Signature over Printed Name)

You might also like

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joeanna100% (13)

- Affidavit - BIR For EcarDocument1 pageAffidavit - BIR For EcarlittleredtigerNo ratings yet

- RA 7641 retirement guidelinesDocument11 pagesRA 7641 retirement guidelinesAllan Bacaron100% (1)

- Q & A - Solo Parent's Welfare Act and Parental LeaveDocument6 pagesQ & A - Solo Parent's Welfare Act and Parental Leaveelvie_arugay100% (1)

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- Tax Amnesty CertificateDocument1 pageTax Amnesty CertificateJewelyn C. Espares-CioconNo ratings yet

- Estate Tax Amnesty CertificateDocument2 pagesEstate Tax Amnesty CertificateIsaac Dominic MacaranasNo ratings yet

- Annex B - RMC 103-2019Document2 pagesAnnex B - RMC 103-2019Ra JeNo ratings yet

- Certificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2Document1 pageCertificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2PaulNo ratings yet

- RMC No. 102-2020 Annex ADocument2 pagesRMC No. 102-2020 Annex AHerzl Hali V. HermosaNo ratings yet

- Annex B - Delinquency Verification Certificate 1 CorrectedDocument2 pagesAnnex B - Delinquency Verification Certificate 1 CorrectedKirk Yngwie EnriquezNo ratings yet

- Annex A NOD Tax DiscrepancyDocument2 pagesAnnex A NOD Tax DiscrepancyJoanna AbañoNo ratings yet

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- BIR Abatement FormDocument1 pageBIR Abatement FormJecky Delos ReyesNo ratings yet

- Application For Tax Compliance Verification Certificate Individual TaxpayersDocument1 pageApplication For Tax Compliance Verification Certificate Individual TaxpayerslynmarieloverNo ratings yet

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23No ratings yet

- BIR cancellation notice availment withholding taxDocument1 pageBIR cancellation notice availment withholding taxJoyNo ratings yet

- BIR Form Notice Cancellation Substituted Filing Percentage Tax VAT ReturnDocument1 pageBIR Form Notice Cancellation Substituted Filing Percentage Tax VAT ReturnWarlie Zambales DiazNo ratings yet

- Bureau of Internal Revenue: Annex "E"Document1 pageBureau of Internal Revenue: Annex "E"Yna YnaNo ratings yet

- Philippine BIR Notice of DiscrepancyDocument2 pagesPhilippine BIR Notice of DiscrepancyFo LetNo ratings yet

- Annex A - Certificate of AvailmentDocument1 pageAnnex A - Certificate of AvailmentJoel SyNo ratings yet

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDocument5 pagesRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNo ratings yet

- BIR Form Notice of Availing Percentage Tax Withholding OptionDocument2 pagesBIR Form Notice of Availing Percentage Tax Withholding OptionChristian Sadia0% (1)

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNo ratings yet

- Application Form For Tax Compliance Verification Certificate (Individual Taxpayers)Document1 pageApplication Form For Tax Compliance Verification Certificate (Individual Taxpayers)abmbookkeepingofficeNo ratings yet

- Application For Tax Compliance Verification Certificate Non-Individual TaxpayersDocument1 pageApplication For Tax Compliance Verification Certificate Non-Individual TaxpayersanabuaNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Non-Individual TaxpayerscharmedbytinnieNo ratings yet

- SF-GOOD-10 OkDocument1 pageSF-GOOD-10 OksteelyannNo ratings yet

- Philippine Economic Zone Authority: Republic of The PhilippinesDocument2 pagesPhilippine Economic Zone Authority: Republic of The PhilippinesPaul GeorgeNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes - EdrDocument2 pagesSworn Application For Tax Clearance For Bidding Purposes - Edranabua0% (1)

- Annex E RR14 - 2003Document1 pageAnnex E RR14 - 2003Jomar Teneza100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Renz Lorenz100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Kisu ShuteNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018ehhmehhfNo ratings yet

- Certification of Qualified EmployeesDocument1 pageCertification of Qualified EmployeesJeZkYNo ratings yet

- Annex RR 11-2018Document1 pageAnnex RR 11-2018jayNo ratings yet

- Annex FDocument1 pageAnnex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Gerynes Mae Bacarra100% (1)

- Certification of Qualified EmployeesDocument1 pageCertification of Qualified Employees유니스No ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joyce CabatanNo ratings yet

- BIR Sworn Declaration Annex FDocument1 pageBIR Sworn Declaration Annex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018___wena100% (2)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Erica MailigNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018grecelyn bianesNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018julieta m. timoganNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018reneth davidNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Pfda Camaligan Fish PortNo ratings yet

- Ertificat E of D FN Resident For Indone T Withh F R - DGT 2: C O Micile O ON SIA AX Oldin G O M)Document2 pagesErtificat E of D FN Resident For Indone T Withh F R - DGT 2: C O Micile O ON SIA AX Oldin G O M)Reviansyah Machfudin YusufNo ratings yet

- Declaration of No ImprovementDocument1 pageDeclaration of No ImprovementKat Kat100% (1)

- Sworn Declaration of No Improvement On Real Property: (Date of Sale/donation/death of Decedent)Document1 pageSworn Declaration of No Improvement On Real Property: (Date of Sale/donation/death of Decedent)Kat KatNo ratings yet

- 5 PDFDocument1 page5 PDFNic NalpenNo ratings yet

- Cortt FormDocument3 pagesCortt FormJude ItutudNo ratings yet

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax ClearanceJoy Mangale AmidaoNo ratings yet

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocument2 pagesNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNo ratings yet

- Annex B - Cortt FormDocument3 pagesAnnex B - Cortt FormJaniceNo ratings yet

- Annex F - Authority To Issue VAT RefundDocument1 pageAnnex F - Authority To Issue VAT RefundCzarPaguioNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- Tax FormDocument1 pageTax FormChriestal SorianoNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Intellectual Property CodeDocument6 pagesIntellectual Property CodeKate Alyssa CatonNo ratings yet

- PrimerDocument4 pagesPrimerMELLICENT LIANZANo ratings yet

- Q & A On Batas Kasambahay (RA No 10361) PDFDocument8 pagesQ & A On Batas Kasambahay (RA No 10361) PDFchristimyvNo ratings yet

- Magna Carta of Women Q&ADocument4 pagesMagna Carta of Women Q&ASj EclipseNo ratings yet

- Anti-Red Tape ActDocument5 pagesAnti-Red Tape ActMELLICENT LIANZANo ratings yet

- Arta IrrDocument13 pagesArta Irrapi-234555728No ratings yet

- AdvisoryDocument1 pageAdvisoryMELLICENT LIANZANo ratings yet

- Presentation 1Document11 pagesPresentation 1MELLICENT LIANZANo ratings yet

- Ra 9710 Magna Carta For Women With Implementing Rules (Irr)Document133 pagesRa 9710 Magna Carta For Women With Implementing Rules (Irr)alm27ph57% (7)

- R A 8371Document4 pagesR A 8371MELLICENT LIANZANo ratings yet

- Salient PointsDocument5 pagesSalient PointsMELLICENT LIANZANo ratings yet

- Ra 9262Document3 pagesRa 9262divine venturaNo ratings yet

- Philhealth Act - Irr Ra 9241Document58 pagesPhilhealth Act - Irr Ra 9241Linda Himoldang Marcaida100% (1)

- Anti-VAWC Act ExplainedDocument3 pagesAnti-VAWC Act ExplainedMELLICENT LIANZANo ratings yet

- FAQDocument16 pagesFAQMELLICENT LIANZANo ratings yet

- Indigenous Peoples Rights Act protects land rightsDocument5 pagesIndigenous Peoples Rights Act protects land rightsmizzeloNo ratings yet

- PrimerDocument4 pagesPrimerMELLICENT LIANZANo ratings yet

- Moral Damages in Cases of Illegal DismissalDocument2 pagesMoral Damages in Cases of Illegal DismissalMELLICENT LIANZANo ratings yet

- Salient PointsDocument5 pagesSalient PointsMELLICENT LIANZANo ratings yet

- Primer On Parental Leave and Solo Parent ActDocument5 pagesPrimer On Parental Leave and Solo Parent ActRavenFoxNo ratings yet

- Primer On Parental Leave and Solo Parent ActDocument5 pagesPrimer On Parental Leave and Solo Parent ActRavenFoxNo ratings yet

- PrimerDocument3 pagesPrimerMELLICENT LIANZANo ratings yet

- Holiday PayDocument1 pageHoliday PayAnonymous s07JFlrNo ratings yet

- Annex C 0621-EADocument1 pageAnnex C 0621-EAMELLICENT LIANZANo ratings yet

- Facts On Labor LAwDocument13 pagesFacts On Labor LAwMELLICENT LIANZANo ratings yet

- REPUBLIC ACT 8972 (Solo Parents' Welfare Act of 2000)Document5 pagesREPUBLIC ACT 8972 (Solo Parents' Welfare Act of 2000)Wilchie Dane OlayresNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentMELLICENT LIANZANo ratings yet

- Ra 9504Document5 pagesRa 9504MRose SerranoNo ratings yet