Professional Documents

Culture Documents

Itr-V: Indian Income Tax Return Verification Form - .

Uploaded by

Balkar BhullerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itr-V: Indian Income Tax Return Verification Form - .

Uploaded by

Balkar BhullerCopyright:

Available Formats

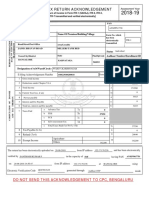

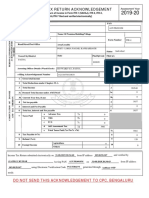

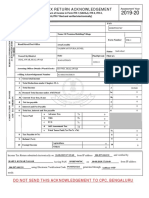

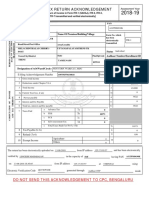

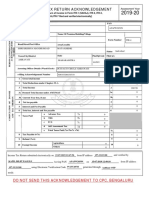

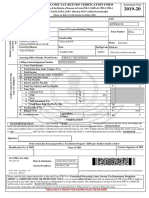

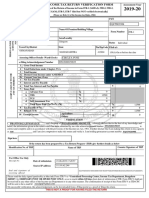

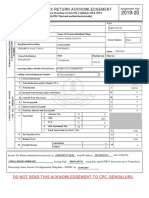

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-2A, ITR-3,

ITR-4S (SUGAM), ITR-4, ITR-5, ITR-7 transmitted electronically without digital signature] . 2016.-17.

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

PARDEEP KUMAR

PERSONAL INFORMATION AND THE

AQZPK5811E

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-4

TRANSMISSION

SON OF SHISH PAL

electronically

transmitted

Road/Street/Post Office Area/Locality

VILLAGE MANGALIA POST OFFICE NANUANA Individual

Status

Town/City/District State Pin Aadhaar Number

TEHSIL RANIA, DISTT SIRSA

HARYANA 125076 XXXX XXXX 8588

Designation of AO (Ward / Circle) WARD-2, SIRSA Original or Revised ORIGINAL

E-filing Acknowledgement Number 357540900060118 Date(DD-MM-YYYY) 06-01-2018

1 Gross Total Income 1 265144

2 Deductions under Chapter-VI-A 2 0

3 Total Income 3 265140

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest Payable 5 0

6 Total Tax and Interest Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 0

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture

10

Others

VERIFICATION

I, PARDEEP KUMAR son/ daughter of SHISH PAL , holding Permanent Account Number AQZPK5811E

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2016-17. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 06-01-2018 Place SIRSA

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 59.98.175.139

Date

Seal and signature of AQZPK5811E043575409000601183B619D11E372849E61A94BB42B81449871928FE5

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address incometr2015@gmail.com

You might also like

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- PDF 383187620040816Document1 pagePDF 383187620040816Ender gamerNo ratings yet

- PDF 708541760280317Document1 pagePDF 708541760280317RISHI PARMARNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSangita AjgaonkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDocument1 page2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDhananjay JaiswalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJayabrata sahooNo ratings yet

- RSM Itrv 2019-20Document1 pageRSM Itrv 2019-20Rajesh KumarNo ratings yet

- Ack VDocument1 pageAck VShantanu MetayNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMithlesh KumarNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- Rahul Nagar MedicalDocument1 pageRahul Nagar Medicalaarna dubeyNo ratings yet

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDocument1 pageMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohit JainNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Itr 18-19Document1 pageItr 18-19aarushi singhNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Karan VetNo ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZIRWA ENTERPRISESNo ratings yet

- Gita Singh IndividualDocument1 pageGita Singh IndividualjccchhhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAshwini oRNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDrsex DrsexNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKishor VibhuteNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ashwani KumarNo ratings yet

- 2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFDocument1 page2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFGanesh DasaraNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSai SanthoshNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)ANSHU KAPOORNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementMadan ChaturvediNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- Bava Bro PDFDocument1 pageBava Bro PDFSomasundara ReddyNo ratings yet

- 2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Document1 page2020 11 22 11 41 29 647 - 1606025489647 - XXXPJ7641X - Itrv 1Ritesh MehtaNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalururambabu peddapalliNo ratings yet

- 2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDocument1 page2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDedaram FulwariyaNo ratings yet

- Ack 18-19Document1 pageAck 18-19tax solutionsNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSandip BakundiNo ratings yet

- Itr 19-20Document1 pageItr 19-20Ruloans VaishaliNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- Managerial. EcoDocument15 pagesManagerial. EcomohitharlaniNo ratings yet

- Canara Bank Deposit RatesDocument3 pagesCanara Bank Deposit RatesvigyaniNo ratings yet

- Project Profile On Bakery Products: Mixing of Ingredients Except Flour in Required Proportion in Paste FormDocument4 pagesProject Profile On Bakery Products: Mixing of Ingredients Except Flour in Required Proportion in Paste FormKomma RameshNo ratings yet

- Company Profile PT BTR 2022 - 220611 - 085254 - 220707 - 113639Document20 pagesCompany Profile PT BTR 2022 - 220611 - 085254 - 220707 - 11363902171513No ratings yet

- 2015 - Civil Services Mentor - MayDocument145 pages2015 - Civil Services Mentor - MayVishnu RoyNo ratings yet

- The Byzantine Empire Followed A Tradition of Caesaropapism in Which The Emperor Himself Was The Highest Religious Authority Thereby Legitimizing Rule Without The Need of Any Formal InstitutionDocument2 pagesThe Byzantine Empire Followed A Tradition of Caesaropapism in Which The Emperor Himself Was The Highest Religious Authority Thereby Legitimizing Rule Without The Need of Any Formal Institutionarindam singhNo ratings yet

- ACP List PDFDocument35 pagesACP List PDFMohammed ShadabNo ratings yet

- EI2 Public Benefit Organisation Written Undertaking External FormDocument1 pageEI2 Public Benefit Organisation Written Undertaking External Formshattar47No ratings yet

- David Robinson Curse On The Land History of The Mozambican Civil WarDocument373 pagesDavid Robinson Curse On The Land History of The Mozambican Civil WarLisboa24100% (2)

- White Paper HealthCare MalaysiaDocument28 pagesWhite Paper HealthCare MalaysiaNamitaNo ratings yet

- FM QuizDocument3 pagesFM QuizSheila Mae AramanNo ratings yet

- RoadsDocument23 pagesRoadsNikhil SharmaNo ratings yet

- Chinese Soft Power Rise and Implications For A Small State by CharuniDocument3 pagesChinese Soft Power Rise and Implications For A Small State by CharuniRaphael Sitor NdourNo ratings yet

- Nghe HSG 4Document3 pagesNghe HSG 4GiangNo ratings yet

- Apm E170Document130 pagesApm E170FigueiredoNo ratings yet

- Philips 3580Document4 pagesPhilips 3580gabymourNo ratings yet

- 1 Croucher S. L.. Globalization and Belonging: The Politics of Identity in A Changing World. Rowman & Littlefield. (2004) - p.10 1Document10 pages1 Croucher S. L.. Globalization and Belonging: The Politics of Identity in A Changing World. Rowman & Littlefield. (2004) - p.10 1Alina-Elena AstalusNo ratings yet

- Bos 63146Document40 pagesBos 63146Piyush GoyalNo ratings yet

- New U LI Cable Support System Catalogue 2019Document185 pagesNew U LI Cable Support System Catalogue 2019muhamad faizNo ratings yet

- Contemporay Economic Issues 2nd EditionDocument176 pagesContemporay Economic Issues 2nd Edition;krvn;kjzdnjvi;No ratings yet

- Status of Solid Waste Management in The Philippines: Alicia L. Castillo " Suehiro Otoma University of Kitakyushu, JapanDocument3 pagesStatus of Solid Waste Management in The Philippines: Alicia L. Castillo " Suehiro Otoma University of Kitakyushu, JapanPrietos KyleNo ratings yet

- The Globe and Mail MCS-February 2004Document1 pageThe Globe and Mail MCS-February 2004ssiweb_adminNo ratings yet

- Emerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHODocument25 pagesEmerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHObuximranNo ratings yet

- Insha Spreadsheet Marketing Contact DataDocument14 pagesInsha Spreadsheet Marketing Contact DataAbhishek SinghNo ratings yet

- Midterm Sample Questions Based On Chapter 2Document3 pagesMidterm Sample Questions Based On Chapter 2Alejandro HerediaNo ratings yet

- An Introduction To The World Trade Organization (WTO)Document9 pagesAn Introduction To The World Trade Organization (WTO)naeemkhan1976No ratings yet

- IS 207 - 1964 Specification For Gate and Shutter Hooks and EyesDocument13 pagesIS 207 - 1964 Specification For Gate and Shutter Hooks and EyesAryansh Rocky RanaNo ratings yet

- ЖасминDocument10 pagesЖасминjasmin nurmamatovaNo ratings yet

- Philippine ZIP CodesDocument22 pagesPhilippine ZIP CodesKenneth Alfonso Manalansan EsturasNo ratings yet