Professional Documents

Culture Documents

DM Case 1 2

DM Case 1 2

Uploaded by

Luthfi FarhanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DM Case 1 2

DM Case 1 2

Uploaded by

Luthfi FarhanaCopyright:

Available Formats

For Evaluation Only

0.4

Low

-20

-20 -20

0.5

Option 1 Medium

-20

0 -8 -20 -20

0.1

High

100

100 100

0.1

Low

-60

-60 -60

0.3

Option 2 Medium

2 20

36 0 36 20 20

0.6

High

60

60 60

0.05

Low

-100

-100 -100

0.15

Option 3 Medium

-60

0 2 -60 -60

0.8

High

20

20 20

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

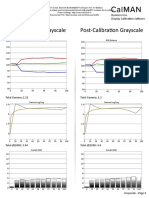

a) Describe the company's decision making

1. What is the problem

An entertainment company which organize a pop concert in London has to decide how much mo

that they should spend on publicizing the event by looking through the demand.

2. What are decision node for the problem

The decision node is how much the company should spend on the publicizing

3. What are SON (State Of Nature) for the problem

1. Advertise only in the music press

2. As option 1 but also advertise in the national press

3. As option 1 and 2 but also advertise on commercial radio

4. What are the company's payoff?

The payoff of the company's is the demand of the ticket. The company will get profit from the tic

b) With information from (a), construct a decision tree

(The decision tree is as seen on the left sides)

c) Determine the option which lead to the highest expected profit

Option 2, publish in the music press and also advertise in the national press. Because option 2 have the highes

Meanwhile, option 1 and option 3 are -8 and 2.

d) Would you have any reservations about recommending this option to the company?

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

on has to decide how much money

h the demand.

publicizing

pany will get profit from the ticket sales

cause option 2 have the highest profit which is 36.

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

ID Name Value Prob Pred Kind NS

0 TreePlan 0 0 0D 3

1 0 0E 3

2 0 0E 3

3 0 0E 3

4 1T 0

5 1T 0

6 1T 0

7 2T 0

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

8 2T 0

9 2T 0

10 3T 0

11 3T 0

12 3T 0

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

S1 S2 S3 S4 S5 Row Col Mark

1 2 3 0 0 22 1 1

4 5 6 0 0 7 5 1

7 8 9 0 0 22 5 1

10 11 12 0 0 37 5 1

0 0 0 0 0 2 9 1

0 0 0 0 0 7 9 1

0 0 0 0 0 12 9 1

0 0 0 0 0 17 9 1

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

0 0 0 0 0 22 9 1

0 0 0 0 0 27 9 1

0 0 0 0 0 32 9 1

0 0 0 0 0 37 9 1

0 0 0 0 0 42 9 1

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

0.75

High circulation

0.3

Launch before the rival 4000000

0 3250000 0.25

Low circulation

Launch in April 1000000

0 3047000 0.7

High circulation

0.7

Launch after the rival 3800000

0 2960000 0.3

Low circulation

1000000

1

3047000 0.75

High circulation

0.8

Launch before the rival 4000000

0 2750000 0.25

Low circulation

Launch in January 1000000

-500000 2692000 0.7

High circulation

0.2

Launch after the rival 3800000

0 2460000 0.3

Low circulation

1000000

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

High circulation

4000000 1. Draw the decision tree to represent Westward's problem.

4000000 (The decision tree is as seen on the left sides)

2. Assuming that Westward's objective is to maximize expected profit, determine

ow circulation the policy that they should choose.

1000000 Launch in April and before the rival

1000000

3. In reality, Westward have little knowledge of the progress which has been mad

by the rival. This means that the probabilities given above for beating the rival

High circulation the launch is, or is not, brought forward) are very rough estimates. How sensiti

3800000 is the policy you identified in (b) to changes in these probabilities?

3800000 There is no changes in the result of the best decision in maximize ex

The policy is not really sensitive to changes in these probabilities.

ow circulation

1000000

1000000

High circulation

3500000

3500000

ow circulation

500000

500000

High circulation

3300000

3300000

ow circulation

500000

500000

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

e expected profit, determine

rogress which has been made

n above for beating the rival (if

ough estimates. How sensitive

se probabilities?

best decision in maximize expected profit.

ges in these probabilities.

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

ID Name Value Prob Pred Kind NS S1

0 TreePlan 0 0 0D 2 1

1 0 0E 2 3

2 0 0E 2 5

3 1E 2 7

4 1E 2 9

5 2E 2 11

6 2E 2 13

7 3T 0 0

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

8 3T 0 0

9 4T 0 0

10 4T 0 0

11 5T 0 0

12 5T 0 0

13 6T 0 0

14 6T 0 0

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

S2 S3 S4 S5 Row Col Mark

2 0 0 0 19 1 1

4 0 0 0 9 5 1

6 0 0 0 29 5 1

8 0 0 0 4 9 1

10 0 0 0 14 9 1

12 0 0 0 24 9 1

14 0 0 0 34 9 1

0 0 0 0 2 13 1

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

0 0 0 0 7 13 1

0 0 0 0 12 13 1

0 0 0 0 17 13 1

0 0 0 0 22 13 1

0 0 0 0 27 13 1

0 0 0 0 32 13 1

0 0 0 0 37 13 1

TreePlan Trial, For Evaluation Only www.TreePlan.com

You might also like

- Opportunity Analysis of A Major Food & Beverages ManufacturerDocument12 pagesOpportunity Analysis of A Major Food & Beverages ManufacturerAthiraRavindranNo ratings yet

- NegotiationDocument4 pagesNegotiationinesNo ratings yet

- TMH-6 - ST3Document4 pagesTMH-6 - ST3ATHOLSCHWARZNo ratings yet

- London Pop & Westward M Fiqri Rihyawan 29316056Document1,144 pagesLondon Pop & Westward M Fiqri Rihyawan 29316056FiqriNo ratings yet

- Q# 7 Decision TreeDocument5 pagesQ# 7 Decision TreeMulugeta BezaNo ratings yet

- Thompson Arboles Decisión ResueltosDocument16 pagesThompson Arboles Decisión ResueltosKAREN ESTHELA RAMIREZ TORRESNo ratings yet

- Treeplan Trial Version, For Evaluation OnlyDocument5 pagesTreeplan Trial Version, For Evaluation OnlyJorge Esteban Prada JavierNo ratings yet

- Examen AleatorioDocument19 pagesExamen AleatorioGustavo BlassNo ratings yet

- Treeplan Student License For Education OnlyDocument5 pagesTreeplan Student License For Education OnlyRon TiptonNo ratings yet

- Ejercicios de ClaseDocument6 pagesEjercicios de ClaseCarlos Guevara SánchezNo ratings yet

- WWW - Supersonic.co - Id Result Overlay: Histogram and UndersizeDocument1 pageWWW - Supersonic.co - Id Result Overlay: Histogram and UndersizeWage KarsonoNo ratings yet

- Arbol PurdueDocument36 pagesArbol PurdueKEN ROY LLAJARUNA OLANONo ratings yet

- Arbol de DecisionDocument46 pagesArbol de DecisionAnonymous qxwYgnNo ratings yet

- Topic: Table of SpecificationsDocument5 pagesTopic: Table of Specificationsprincerojas630No ratings yet

- TAPAK e PRESTASI PBPPP TAHUN 2016 PENILAI 1Document23 pagesTAPAK e PRESTASI PBPPP TAHUN 2016 PENILAI 1Zammira RamliNo ratings yet

- VU Calculator Percentage CGPA HelpDocument3 pagesVU Calculator Percentage CGPA HelpMohsin ButtNo ratings yet

- Welcome To The Ge-Mckinsey Nine-Box Matrix BuilderDocument17 pagesWelcome To The Ge-Mckinsey Nine-Box Matrix BuilderSapnaNo ratings yet

- Winery CaseDocument8 pagesWinery CaseMizanNo ratings yet

- Compound Name Impurity Relative Retention Time Relative Response FactorDocument3 pagesCompound Name Impurity Relative Retention Time Relative Response FactorNatalia BaldoniNo ratings yet

- Road 1 UnnamedDocument1 pageRoad 1 UnnamedalutttNo ratings yet

- Asm 1 Opemanaaa 1Document9 pagesAsm 1 Opemanaaa 1Thu NguyenNo ratings yet

- Class Record: Region Division School Name School Id School YearDocument5 pagesClass Record: Region Division School Name School Id School YearSharmaine Nacional AlmodielNo ratings yet

- Recipe Master TemplateDocument439 pagesRecipe Master TemplatechefkalomoiropoulosNo ratings yet

- Financial Management Predictive ModelingDocument15 pagesFinancial Management Predictive ModelingShankaran RamanNo ratings yet

- Operation Analytics 22ndsepDocument9 pagesOperation Analytics 22ndsepMohit TiwaryNo ratings yet

- SPSS FileDocument21 pagesSPSS Filevansham malikNo ratings yet

- CALIBRATION OF HM PlantDocument3 pagesCALIBRATION OF HM PlantDeven PatleNo ratings yet

- Adidas Group Supplier Adidas Group Supplier Adidas Group SupplierDocument6 pagesAdidas Group Supplier Adidas Group Supplier Adidas Group SupplierahmaduggokiNo ratings yet

- ImbalanceDocument14 pagesImbalanceSlash2xNo ratings yet

- Analisis PAS Ganjil Kelas 5 TP. 2021Document23 pagesAnalisis PAS Ganjil Kelas 5 TP. 2021harsono30No ratings yet

- Tapak Lama 2Document9 pagesTapak Lama 2wakazizNo ratings yet

- Modified Item Analysis Form New 2 1Document1 pageModified Item Analysis Form New 2 1leejiyoung019No ratings yet

- Programacion DinamicaDocument19 pagesProgramacion DinamicaJesusNo ratings yet

- Objective and Scope of StudyDocument13 pagesObjective and Scope of StudyZunair AmeerNo ratings yet

- Element EL4KAMZ5517 (Amazon Fire TV Edition) CNET Review Calibration ResultsDocument3 pagesElement EL4KAMZ5517 (Amazon Fire TV Edition) CNET Review Calibration ResultsDavid KatzmaierNo ratings yet

- BD20022 OprDocument12 pagesBD20022 OprDeepNo ratings yet

- Optoma UHD60 CNET Review Calibration ResultsDocument3 pagesOptoma UHD60 CNET Review Calibration ResultsDavid Katzmaier0% (1)

- Sample TOS TemplateDocument2 pagesSample TOS TemplateMars CabanaNo ratings yet

- Making Use of Reliability Statistics - ConversionDocument46 pagesMaking Use of Reliability Statistics - ConversionKasinathan Muniandi100% (1)

- Kerice 2022Document16 pagesKerice 2022A. HawaNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones Alumnosjose perezNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones Alumnosjose perezNo ratings yet

- Material Properties: % PassingDocument1 pageMaterial Properties: % PassingBIPL REPORTNo ratings yet

- Strain Rosette ReganganDocument16 pagesStrain Rosette ReganganAnnisa Arifandita MifshellaNo ratings yet

- AAG Tolerances GBDocument2 pagesAAG Tolerances GBJayantNo ratings yet

- Book 1Document9 pagesBook 1lalit.cNo ratings yet

- Grelha de Avaliação - A - : N.º Nome 5% 5% 50%Document6 pagesGrelha de Avaliação - A - : N.º Nome 5% 5% 50%Paulo MenezesNo ratings yet

- Philippine Rural Development Project I-REAP Enterprise OperationsDocument30 pagesPhilippine Rural Development Project I-REAP Enterprise OperationsEdna ArnocoNo ratings yet

- Chapter 4 Revised and Final Copy IPsDocument50 pagesChapter 4 Revised and Final Copy IPsmilrosebatilo2012No ratings yet

- Perno 2Document2 pagesPerno 2franklin.barrosNo ratings yet

- LDM Form 4P - Summary of LDM Practicum Portfolio Completers (School LAC Leaders)Document1,448 pagesLDM Form 4P - Summary of LDM Practicum Portfolio Completers (School LAC Leaders)oranisouth100% (1)

- GAP (Sizes and Sieve Passing)Document7 pagesGAP (Sizes and Sieve Passing)MacNo ratings yet

- TCL 65R716 CNET Review Calibration ResultsDocument3 pagesTCL 65R716 CNET Review Calibration ResultsDavid KatzmaierNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones AlumnosVinke Gop SalazarNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones AlumnosSamantha DamEspNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones Alumnosguillermo pinedaNo ratings yet

- Assign 1 ChanDocument3 pagesAssign 1 ChanAnnisatul FadlilahNo ratings yet

- Ver PlantillaDocument8 pagesVer PlantillaGESTORHSEQ VIA9No ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones AlumnosDime FefoNo ratings yet

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- Validity: Case Processing SummaryDocument1 pageValidity: Case Processing SummaryinesNo ratings yet

- Decision Tree - Ines Permatasari SetiawanDocument14 pagesDecision Tree - Ines Permatasari Setiawanines100% (1)

- Decision Tree - Ines Permatasari SetiawanDocument14 pagesDecision Tree - Ines Permatasari Setiawanines100% (1)

- GM - Project Time ManagementDocument35 pagesGM - Project Time ManagementinesNo ratings yet

- STP Framework SegmentationDocument1 pageSTP Framework SegmentationinesNo ratings yet

- Neodur Level Au: Underlayment CT-C30-F5Document1 pageNeodur Level Au: Underlayment CT-C30-F5Oğuzhan OdbayNo ratings yet

- C633 617621-1 PDFDocument8 pagesC633 617621-1 PDFAmy BurnsNo ratings yet

- Skyblivion Architecture GuidelinesDocument11 pagesSkyblivion Architecture GuidelinesBrody EvensonNo ratings yet

- Interferometry, Screw Thread & Gear MeasurementsDocument55 pagesInterferometry, Screw Thread & Gear MeasurementsManvendra Pratap Singh BishtNo ratings yet

- User Manual: V737 V737W V747 V747WDocument19 pagesUser Manual: V737 V737W V747 V747WMihai MargineanuNo ratings yet

- ISOM2500 Regression Practice SolutionsDocument3 pagesISOM2500 Regression Practice Solutions3456123No ratings yet

- Programas de Intervencion en CoparentalidadDocument17 pagesProgramas de Intervencion en CoparentalidadAri CornejoNo ratings yet

- Module 7 - On The Move - StudentDocument14 pagesModule 7 - On The Move - StudentTrương Tố DiNo ratings yet

- Case Study On Different Go Kart Engine Transmission Systems: IOP Conference Series: Materials Science and EngineeringDocument9 pagesCase Study On Different Go Kart Engine Transmission Systems: IOP Conference Series: Materials Science and EngineeringRohitNo ratings yet

- MODULE 3 - Subject & Content of ArtsDocument30 pagesMODULE 3 - Subject & Content of ArtsJomari FalibleNo ratings yet

- The Development of Science and Technology During The Spanish RegimeDocument3 pagesThe Development of Science and Technology During The Spanish RegimeLady of the Light100% (2)

- StarCraft - TBG - Resurrection - v1.1 ExpansionDocument38 pagesStarCraft - TBG - Resurrection - v1.1 ExpansionJacomoNo ratings yet

- Annex 3.3.2 Technical Proposal For Radio Network 20141119Document40 pagesAnnex 3.3.2 Technical Proposal For Radio Network 20141119Hoàng NguyễnNo ratings yet

- (BS en ISO 6245-2002) - Methods of Test For Petroleum and Its Products. BS 2000-4 - Determination of Ash.Document16 pages(BS en ISO 6245-2002) - Methods of Test For Petroleum and Its Products. BS 2000-4 - Determination of Ash.CHOUCHENE ELYES100% (2)

- High PH RO Membrane Cleaner: Product Information SheetDocument2 pagesHigh PH RO Membrane Cleaner: Product Information SheetAjay PatelNo ratings yet

- Overview of Polymer Flooding (EOR) in North Africa Fields - Elements of Designing A New Polymer/Surfactant Flood Offshore (Case Study)Document12 pagesOverview of Polymer Flooding (EOR) in North Africa Fields - Elements of Designing A New Polymer/Surfactant Flood Offshore (Case Study)abdulsalam alssafi94No ratings yet

- Simple PendulumDocument3 pagesSimple Pendulumhittaf_05100% (1)

- Vba ExcelDocument5 pagesVba ExcelsergioNo ratings yet

- Impact and Challenges of Using Virtual Reality & Artificial Intelligence in BusinessesDocument4 pagesImpact and Challenges of Using Virtual Reality & Artificial Intelligence in BusinessesAfif LotfiNo ratings yet

- 1 s2.0 S1472648321004296 MainDocument10 pages1 s2.0 S1472648321004296 MainOrero roeoNo ratings yet

- Powder Metallurgy (ISE)Document107 pagesPowder Metallurgy (ISE)likydo100% (1)

- 894-Hydrolic Power UnitDocument3 pages894-Hydrolic Power UnitAhmed HamdyNo ratings yet

- Ariel JGE JGH JGK JGT Manual - 231029 - 233805Document203 pagesAriel JGE JGH JGK JGT Manual - 231029 - 233805Daniel LatorreNo ratings yet

- Micrologix Lab 1Document28 pagesMicrologix Lab 1Fernando Jaime Alonso MartínezNo ratings yet

- Greed Vs GrievanceDocument6 pagesGreed Vs GrievanceAlᎥyⱥภNo ratings yet

- GeomagicWrap Whats New PDFDocument7 pagesGeomagicWrap Whats New PDFDiego Fernando ÑauñayNo ratings yet

- RefractoriesDocument24 pagesRefractoriesArnulfo PerezNo ratings yet

- Onestop Qamaker: Extract Question-Answer Pairs From Text in A One-Stop ApproachDocument8 pagesOnestop Qamaker: Extract Question-Answer Pairs From Text in A One-Stop ApproachSV PRNo ratings yet

- Configuring MPLS VPNs - Troubleshooting Any Transport Over MPLS Based VPNsDocument19 pagesConfiguring MPLS VPNs - Troubleshooting Any Transport Over MPLS Based VPNsAnonymous 6PurzyegfXNo ratings yet