Professional Documents

Culture Documents

A Tax PDF

A Tax PDF

Uploaded by

Sasuke UchihaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Tax PDF

A Tax PDF

Uploaded by

Sasuke UchihaCopyright:

Available Formats

A tax (from the Latin taxo) is a compulsory financial charge or some other type of levy imposed

upon a taxpayer (an individual or other legal entity) by a governmental organization in order to

fund various public expenditures.[1] A failure to pay, along with evasion of or resistance to

taxation, is punishable by law. Taxes consist of direct or indirect taxes and may be paid in money

or as its labour equivalent. The first known taxation took place in Ancient Egypt around 3000–

2800 BC.

Most countries have a tax system in place to pay for public, common or agreed national needs

and government functions. Some levy a flat percentage rate of taxation on personal annual

income, but most scale taxes based on annual income amounts. Most countries charge a tax on

individuals income as well as on corporate income. Countries or subunits often also impose

wealth taxes, inheritance taxes, estate taxes, gift taxes, property taxes, sales taxes, payroll taxes

or tariffs.

In economic terms, taxation transfers wealth from households or businesses to the government.

This has effects which can both increase and reduce economic growth and economic welfare.

Consequently, taxation is a highly debated topic.

The legal definition, and the economic definition of taxes differ in some ways such as

economists do not regard many transfers to governments as taxes. For example, some transfers to

the public sector are comparable to prices. Examples include, tuition at public universities, and

fees for utilities provided by local governments. Governments also obtain resources by "creating"

money and coins (for example, by printing bills and by minting coins), through voluntary gifts

(for example, contributions to public universities and museums), by imposing penalties (such as

traffic fines), by borrowing, and also by confiscating wealth. From the view of economists, a tax

is a non-penal, yet compulsory transfer of resources from the private to the public sector, levied

on a basis of predetermined criteria and without reference to specific benefit received.

In modern taxation systems, governments levy taxes in money; but in-kind and corvée taxation

are characteristic of traditional or pre-capitalist states and their functional equivalents. The

method of taxation and the government expenditure of taxes raised is often highly debated in

politics and economics. Tax collection is performed by a government agency such as the Ghana

Revenue Authority, Canada Revenue Agency, the Internal Revenue Service (IRS) in the United

States, Her Majesty's Revenue and Customs (HMRC) in the United Kingdom or Federal Tax

Service in Russia. When taxes are not fully paid, the state may impose civil penalties (such as

fines or forfeiture) or criminal penalties (such as incarceration) on the non-paying entity or

individual.[2]

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Design Coaching 2 PDFDocument12 pagesDesign Coaching 2 PDFandre villanuevaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- $ECTION LAW Reviewer (Atty Flores)Document39 pages$ECTION LAW Reviewer (Atty Flores)warlitoNo ratings yet

- The Shell Company of The Philippine Islands v. National Labor UnionDocument3 pagesThe Shell Company of The Philippine Islands v. National Labor UnionAbegail GaledoNo ratings yet

- ID Task Name Duration Start Finish 1 2 3 4 5 6: Project: Project1 Date: 8:35 PMDocument4 pagesID Task Name Duration Start Finish 1 2 3 4 5 6: Project: Project1 Date: 8:35 PMSasuke UchihaNo ratings yet

- (Axial Stresses) (Bending Stresses) : Partially CompactDocument2 pages(Axial Stresses) (Bending Stresses) : Partially CompactSasuke UchihaNo ratings yet

- A MachineDocument2 pagesA MachineSasuke UchihaNo ratings yet

- Charging For Design Services For Constrcuction ProjectsDocument17 pagesCharging For Design Services For Constrcuction ProjectsSasuke UchihaNo ratings yet

- History of Water Resource Engineering: MaterialsDocument6 pagesHistory of Water Resource Engineering: MaterialsSasuke UchihaNo ratings yet

- Chart TitleDocument4 pagesChart TitleSasuke UchihaNo ratings yet

- Is The Smaller Value of Is The Bigger Value Of: Allowable Bending Stress For Laterally Unbraced BeamsDocument1 pageIs The Smaller Value of Is The Bigger Value Of: Allowable Bending Stress For Laterally Unbraced BeamsSasuke UchihaNo ratings yet

- SadfasdfasdfDocument4 pagesSadfasdfasdfSasuke UchihaNo ratings yet

- A Truss Is An Assembly of Beams or Other Elements That Creates A Rigid StructureDocument1 pageA Truss Is An Assembly of Beams or Other Elements That Creates A Rigid StructureSasuke UchihaNo ratings yet

- A Bridge Is A Structure Built To Span A Physical ObstacleDocument1 pageA Bridge Is A Structure Built To Span A Physical ObstacleSasuke UchihaNo ratings yet

- History of Water Resources EnggDocument4 pagesHistory of Water Resources EnggSasuke UchihaNo ratings yet

- Portfolio (Cie 065-Ojt) : John Lenard G. SantillanDocument6 pagesPortfolio (Cie 065-Ojt) : John Lenard G. SantillanSasuke UchihaNo ratings yet

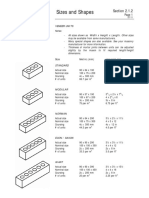

- Sizes and Shapes: Section 2.1.2Document3 pagesSizes and Shapes: Section 2.1.2Sasuke UchihaNo ratings yet

- Community Service Bid 1112Document24 pagesCommunity Service Bid 1112Glenn William AlcalaNo ratings yet

- Defence of Insanity Under Indian Legal System An AnalysisDocument7 pagesDefence of Insanity Under Indian Legal System An AnalysisHimanshu UpadhyayNo ratings yet

- JIL Vs Gaurav GoyalDocument7 pagesJIL Vs Gaurav GoyalkaranNo ratings yet

- Professional Misconduct of Lawyers in IndiaDocument19 pagesProfessional Misconduct of Lawyers in Indiayashc09100% (2)

- Garcia, Et Al. v. People - 318 SCRA 434Document5 pagesGarcia, Et Al. v. People - 318 SCRA 434Khenz MistalNo ratings yet

- Shree CSR PolicyDocument2 pagesShree CSR PolicyAshwin Hemant LawanghareNo ratings yet

- Dismissal VS DischargeDocument13 pagesDismissal VS DischargeDebasish RauloNo ratings yet

- Criminal Report 2009 ADocument8 pagesCriminal Report 2009 AdaneelNo ratings yet

- Tio Vs Videogram Regulatory BoardDocument2 pagesTio Vs Videogram Regulatory BoardAngeli CampanerNo ratings yet

- Public Relations ManagementDocument22 pagesPublic Relations ManagementNatashaNo ratings yet

- Group WorkDocument2 pagesGroup WorkCarolyne OkwembaNo ratings yet

- Consti SeuzuresDocument32 pagesConsti SeuzurespatrixiaNo ratings yet

- Eo 292 - Administrative Code of 1987 - Book V - Title 1 - CSCDocument21 pagesEo 292 - Administrative Code of 1987 - Book V - Title 1 - CSCYan Rodriguez DasalNo ratings yet

- City Limits Magazine, September/October 1998 IssueDocument40 pagesCity Limits Magazine, September/October 1998 IssueCity Limits (New York)No ratings yet

- Weissmann Sealed DocumentsDocument102 pagesWeissmann Sealed DocumentsThe Federalist91% (11)

- People v. MacabalangDocument11 pagesPeople v. MacabalangReal TaberneroNo ratings yet

- Criminal Law Memory AidDocument95 pagesCriminal Law Memory AidJeffy EmanoNo ratings yet

- People Vs EchegarayDocument16 pagesPeople Vs EchegarayJomar Teneza100% (1)

- 4Document2 pages4rishiNo ratings yet

- Civil ProcedureDocument6 pagesCivil ProcedureAya BeltranNo ratings yet

- Caveat: Important NoteDocument2 pagesCaveat: Important NoteChris BSomethingNo ratings yet

- Civil Procedure Lecture Notes 206 UZDocument72 pagesCivil Procedure Lecture Notes 206 UZIsabel T MaunganidzeNo ratings yet

- Aguirre vs. RanaDocument9 pagesAguirre vs. RanaGlyds D. UrbanoNo ratings yet

- Power of Eminent DomainDocument8 pagesPower of Eminent DomainMary Pascua Abella100% (1)

- Chapter 5 - Political PartiesDocument37 pagesChapter 5 - Political PartiesHasdanNo ratings yet

- People v. VictoriaDocument2 pagesPeople v. VictoriaNelle Dominique DeximoNo ratings yet

- Central Bank Employees Association v. BSP DigestDocument3 pagesCentral Bank Employees Association v. BSP DigestDonn LinNo ratings yet

- Harrison v. Laffin Et Al - Document No. 4Document21 pagesHarrison v. Laffin Et Al - Document No. 4Justia.comNo ratings yet