Professional Documents

Culture Documents

How Banking Sector Is Deteriorated in FY 2017

Uploaded by

Siddhant SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How Banking Sector Is Deteriorated in FY 2017

Uploaded by

Siddhant SinghCopyright:

Available Formats

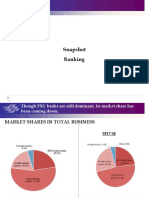

Operations and performance

How banking sector is deteriorated in FY 2017 -18 and how first time after 1993-94 PSB sector registered

losses.

As regulator RBI has taken several steps in order to revive the banking system

Asset quality review (AQRs)

New framework for resolution of stressed assets under IBC

Recapitalization of the PSBs

3) Financial Performance

The financial performance of banks during 2017-18 was burdened by deteriorating asset quality and

treasury losses which impacted non-interest earnings

4) Soundness Indicators

Soundness indicators are barometers of the financial health of the banking sector. During 2017-18 and

2018-19 (up to September 2018), capital adequacy remained above regulatory requirements in spite of

the NPA ratio increasing. Leverage and liquidity coverage ratios (LCR) also witnessed improvement

5) Sectoral Distribution to Bank Credit

During 2017- 18, bank credit to agriculture decelerated, reflecting risk aversion and debt waivers by

various governments, which may have disincentivized lending to the sector.

Increase in credit to NBFC and robust growth of personal loans were also seen in 2017-18

6) Operation of SCBs in th capital market

No issue for PSB this year

Private placements of bonds remained the major long-term source of funding for banks. Also, amount

raised by PVBs was higher than those of PSBs.

Stocks: Nifty bank index outperformed Nifty 50 and Nifty private bank index yielded better returns than

the Nifty PSU bank index

7) Ownership pattern in scheduled commercial banks

During 17-18 govt. ownership in 16 out of 21 PSBs increased due to capital infusion. At the same time

govt. share declined in 5 PSBs as they raised resources through qualified institutional placements (QIPs)

and other capital market Instruments.

You might also like

- Key Trends in Indian BankingDocument8 pagesKey Trends in Indian BankingAswath ChandrasekarNo ratings yet

- Key Trends in Indian BankingDocument3 pagesKey Trends in Indian BankingSonai DasNo ratings yet

- Operations and Performance of Commercial BanksDocument19 pagesOperations and Performance of Commercial Banksneha singhNo ratings yet

- 036 Sbi Contra FundDocument19 pages036 Sbi Contra Fundashwini shuklaNo ratings yet

- Shashank RN Project 2Document76 pagesShashank RN Project 2Nithya RajNo ratings yet

- Rbi Financial Stability Report 2022Document7 pagesRbi Financial Stability Report 2022Sakshi UikeyNo ratings yet

- 103 Sbi Blue Chip FundDocument21 pages103 Sbi Blue Chip FundsagarNo ratings yet

- Vidyadeepam Dec 2019 FinalDocument46 pagesVidyadeepam Dec 2019 FinalAjit kumarNo ratings yet

- In The Fiscal Ended March 2018Document3 pagesIn The Fiscal Ended March 2018vivek guptaNo ratings yet

- Sebibulletinjan2019word PDocument65 pagesSebibulletinjan2019word PShantnu SinghNo ratings yet

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDocument8 pagesBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneNo ratings yet

- Shri Vaishnav Institute of Management, Indore (M.P.)Document14 pagesShri Vaishnav Institute of Management, Indore (M.P.)Vikas_2coolNo ratings yet

- Financial Performance of Non Banking Finance Companies in India Amita S. KantawalaDocument7 pagesFinancial Performance of Non Banking Finance Companies in India Amita S. KantawalajayasundariNo ratings yet

- Ey Private Credit in India v1Document18 pagesEy Private Credit in India v1Naman JainNo ratings yet

- EY Report On Private Credit MarketDocument18 pagesEY Report On Private Credit MarketSaranNo ratings yet

- Performance of Nbfcs A Pre and Post Covi A084d920Document11 pagesPerformance of Nbfcs A Pre and Post Covi A084d920SeetanNo ratings yet

- Jan19 PDFDocument20 pagesJan19 PDFJatin ValechaNo ratings yet

- Vol 45Document101 pagesVol 45Darshan ThummarNo ratings yet

- Finance Report MarketingDocument16 pagesFinance Report MarketingLKNo ratings yet

- Habib Bank Limited: Rating ReportDocument5 pagesHabib Bank Limited: Rating ReportAli AkberNo ratings yet

- UntitledDocument5 pagesUntitledRajendra BambadeNo ratings yet

- 02 IntroductionDocument3 pages02 Introductionmukherjeeprity52No ratings yet

- Snapshot BankingDocument7 pagesSnapshot BankingAmit RajNo ratings yet

- Final Report - Swapnil R. ShendeDocument40 pagesFinal Report - Swapnil R. Shendenitish_735No ratings yet

- Outlook of Bank Industry in PakistanDocument3 pagesOutlook of Bank Industry in PakistanghazalaNo ratings yet

- Private Banks Rein in NPAsDocument8 pagesPrivate Banks Rein in NPAsanayatbakshNo ratings yet

- Team - Finacs - Mergers & Acquisition Document in Banking IndustryDocument21 pagesTeam - Finacs - Mergers & Acquisition Document in Banking IndustryankurchorariaNo ratings yet

- Magnitude of Npas in Public Sector BanksDocument10 pagesMagnitude of Npas in Public Sector BanksMahesh PandeyNo ratings yet

- IEA Report 28th FebruaryDocument34 pagesIEA Report 28th FebruarynarnoliaNo ratings yet

- A Study On Home Loans - SbiDocument69 pagesA Study On Home Loans - SbiRajesh BathulaNo ratings yet

- Analysis of Financial Performance of SbiDocument5 pagesAnalysis of Financial Performance of SbiMAYANK GOYALNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- RR24112023Document10 pagesRR24112023Vinay TescoNo ratings yet

- Insolvency and Bankruptcy Code 2016Document14 pagesInsolvency and Bankruptcy Code 2016Parth SharmaNo ratings yet

- Banking Industry AnalysisDocument17 pagesBanking Industry AnalysisChirag ParakhNo ratings yet

- Finacial Performance of NBFC I IdiaDocument12 pagesFinacial Performance of NBFC I IdiaKutub UdaipurwalaNo ratings yet

- AlmDocument5 pagesAlmNitish JoshiNo ratings yet

- Unit 1Document83 pagesUnit 1Bothuka ShoheNo ratings yet

- A Comparative Study of NBFC in IndiaDocument28 pagesA Comparative Study of NBFC in IndiaGuru Prasad0% (1)

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- ICRA Research MFIDocument8 pagesICRA Research MFIJaiganesh M SNo ratings yet

- 6 Banking and Financial ServicesDocument5 pages6 Banking and Financial ServicesSatish MehtaNo ratings yet

- N BP Annual Report 2021Document406 pagesN BP Annual Report 2021ProNo ratings yet

- Future of Indian Banking IndustryDocument8 pagesFuture of Indian Banking IndustrymbashriksNo ratings yet

- Goal - A Process of Continuous Improvement - Eliyahu Goldratt (Qwerty80)Document43 pagesGoal - A Process of Continuous Improvement - Eliyahu Goldratt (Qwerty80)Girish GaykawadNo ratings yet

- Financial Performance Analysis of Banking Sector in IndiaDocument7 pagesFinancial Performance Analysis of Banking Sector in IndiaEditor IJTSRDNo ratings yet

- Industry Profile: Excellence in Indian Banking', India's Gross Domestic Product (GDP) Growth Will Make TheDocument27 pagesIndustry Profile: Excellence in Indian Banking', India's Gross Domestic Product (GDP) Growth Will Make TheNekta PinchaNo ratings yet

- Equitas SFBDocument23 pagesEquitas SFBSanjeedeep Mishra , 315No ratings yet

- B Company FavoritesDocument9 pagesB Company FavoritesmangapitalbertiiNo ratings yet

- Industry Note Report On: Individual AssignmentDocument6 pagesIndustry Note Report On: Individual AssignmentLaveenAdvaniNo ratings yet

- Feel Left Out? Join The Midcap Party With These10 Stocks: City Union BankDocument4 pagesFeel Left Out? Join The Midcap Party With These10 Stocks: City Union BankDynamic LevelsNo ratings yet

- Effect of Bond Issuance On Financial Performance of Firms Listed On Nairobi Securities ExchangeDocument10 pagesEffect of Bond Issuance On Financial Performance of Firms Listed On Nairobi Securities ExchangeNelsiez OchiezNo ratings yet

- IDirect RBIAction Dec21Document4 pagesIDirect RBIAction Dec21PavankopNo ratings yet

- Profitability Improves in Q2-FY10 Over The Previous Quarter Aided by Revival in Capital Market SentimentsDocument8 pagesProfitability Improves in Q2-FY10 Over The Previous Quarter Aided by Revival in Capital Market SentimentsAnuj VohraNo ratings yet

- Banking IndustryDocument122 pagesBanking IndustryRitesh BhansaliNo ratings yet

- Format-Ijhss - An Analytical Study of Nbfcs and Its Impact On Financial Growth of The Nation - 1Document10 pagesFormat-Ijhss - An Analytical Study of Nbfcs and Its Impact On Financial Growth of The Nation - 1Impact JournalsNo ratings yet

- 2631IIBF Vision January 2013Document8 pages2631IIBF Vision January 2013Sukanta DasNo ratings yet

- Case Studies Financial ServicesDocument12 pagesCase Studies Financial ServicesHemant JainNo ratings yet

- Group 05Document18 pagesGroup 05Shifat ShahriarNo ratings yet