Professional Documents

Culture Documents

Decision Tree London Pop Concert Westward Magazine Ines Permatasari Setiawan

Decision Tree London Pop Concert Westward Magazine Ines Permatasari Setiawan

Uploaded by

Luthfi FarhanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Decision Tree London Pop Concert Westward Magazine Ines Permatasari Setiawan

Decision Tree London Pop Concert Westward Magazine Ines Permatasari Setiawan

Uploaded by

Luthfi FarhanaCopyright:

Available Formats

For Evaluation Only

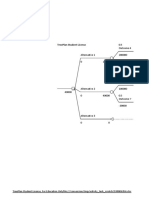

Ines Permatasari Setiawan 0.4

Low

-20

-20 -20

0.5

Option 1 Medium

-20

0 -8 -20 -20

0.1

High

100

100 100

0.1

Low

-60

-60 -60

0.3

Option 2 Medium

2 20

36 0 36 20 20

0.6

High

60

60 60

0.05

Low

-100

-100 -100

0.15

Option 3 Medium

-60

0 2 -60 -60

0.8

High

20

20 20

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

a) Describe the company's decision making

1. What is the problem

An entertainment company which organize a pop concert in London has to decide how much mo

that they should spend on publicizing the event by looking through the demand.

2. What are decision node for the problem

The decision node is how much the company should spend on the publicizing

3. What are SON (State Of Nature) for the problem

1. Advertise only in the music press

2. As option 1 but also advertise in the national press

3. As option 1 and 2 but also advertise on commercial radio

4. What are the company's payoff?

The payoff of the company's is the demand of the ticket. The company will get profit from the tic

b) With information from (a), construct a decision tree

(The decision tree is as seen on the left sides)

c) Determine the option which lead to the highest expected profit

Option 2, publish in the music press and also advertise in the national press. Because option 2 have the highes

Meanwhile, option 1 and option 3 are -8 and 2.

d) Would you have any reservations about recommending this option to the company?

The company could choose the highest profit in the publicizing in the music press and national press.

But the result is relating to other variable factors, such as the date, location, and the guest star of the concert.

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

on has to decide how much money

h the demand.

publicizing

pany will get profit from the ticket sales

cause option 2 have the highest profit which is 36.

ess and national press.

d the guest star of the concert.

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

ID Name Value Prob Pred Kind NS

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

0 TreePlan 0 0 0D 3

1 0 0E 3

2 0 0E 3

3 0 0E 3

4 1T 0

5 1T 0

6 1T 0

7 2T 0

8 2T 0

9 2T 0

10 3T 0

11 3T 0

12 3T 0

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

S1 S2 S3 S4 S5 Row Col Mark

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

1 2 3 0 0 22 1 1

4 5 6 0 0 7 5 1

7 8 9 0 0 22 5 1

10 11 12 0 0 37 5 1

0 0 0 0 0 2 9 1

0 0 0 0 0 7 9 1

0 0 0 0 0 12 9 1

0 0 0 0 0 17 9 1

0 0 0 0 0 22 9 1

0 0 0 0 0 27 9 1

0 0 0 0 0 32 9 1

0 0 0 0 0 37 9 1

0 0 0 0 0 42 9 1

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

Ines Permatasari Setiawan 0.75

High circulation

0.3

Launch before the rival 4000000

0 3250000 0.25

Low circulation

Launch in April 1000000

0 3047000 0.7

High circulation

0.7

Launch after the rival 3800000

0 2960000 0.3

Low circulation

1000000

1

3047000 0.75

High circulation

0.8

Launch before the rival 4000000

0 2750000 0.25

Low circulation

Launch in January 1000000

-500000 2692000 0.7

High circulation

0.2

Launch after the rival 3800000

0 2460000 0.3

Low circulation

1000000

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

High circulation

4000000 1. Draw the decision tree to represent Westward's problem.

4000000 (The decision tree is as seen on the left sides)

2. Assuming that Westward's objective is to maximize expected profit, determine

ow circulation the policy that they should choose.

1000000 Launch in April and before the rival, which will generate the highest

1000000

3. In reality, Westward have little knowledge of the progress which has been mad

by the rival. This means that the probabilities given above for beating the rival

High circulation the launch is, or is not, brought forward) are very rough estimates. How sensiti

3800000 is the policy you identified in (b) to changes in these probabilities?

3800000 There is no changes in the result of the best decision in maximize ex

The policy is not really sensitive to changes in these probabilities.

For example, if we change the probability from 30% to 50%, the resu

ow circulation (0.5(0)+(0.5(0))-0) + (0.75(4000000-0) + (0.25(1000000)

1000000 = 0 + 3000000 + 250000 = 3250000

1000000 The result is same, its means the policy is not sensitive to changes in

High circulation

3500000

3500000

ow circulation

500000

500000

High circulation

3300000

3300000

ow circulation

500000

500000

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

e expected profit, determine

ch will generate the highest profit $3250000

rogress which has been made

n above for beating the rival (if

ough estimates. How sensitive

se probabilities?

best decision in maximize expected profit.

ges in these probabilities.

y from 30% to 50%, the result is

(0.25(1000000)

s not sensitive to changes in these probabilities.

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

ID Name Value Prob Pred Kind NS S1

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

0 TreePlan 0 0 0D 2 1

1 0 0E 2 3

2 0 0E 2 5

3 1E 2 7

4 1E 2 9

5 2E 2 11

6 2E 2 13

7 3T 0 0

8 3T 0 0

9 4T 0 0

10 4T 0 0

11 5T 0 0

12 5T 0 0

13 6T 0 0

14 6T 0 0

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

S2 S3 S4 S5 Row Col Mark

TreePlan Trial, For Evaluation Only www.TreePlan.com

For Evaluation Only

2 0 0 0 19 1 1

4 0 0 0 9 5 1

6 0 0 0 29 5 1

8 0 0 0 4 9 1

10 0 0 0 14 9 1

12 0 0 0 24 9 1

14 0 0 0 34 9 1

0 0 0 0 2 13 1

0 0 0 0 7 13 1

0 0 0 0 12 13 1

0 0 0 0 17 13 1

0 0 0 0 22 13 1

0 0 0 0 27 13 1

0 0 0 0 32 13 1

0 0 0 0 37 13 1

TreePlan Trial, For Evaluation Only www.TreePlan.com

You might also like

- Opportunity Analysis of A Major Food & Beverages ManufacturerDocument12 pagesOpportunity Analysis of A Major Food & Beverages ManufacturerAthiraRavindranNo ratings yet

- NegotiationDocument4 pagesNegotiationinesNo ratings yet

- Covid-19 Case StudyDocument8 pagesCovid-19 Case StudyEvenzx BlackshotNo ratings yet

- Industrial Security Management SyllabusDocument7 pagesIndustrial Security Management SyllabusZefren Botilla100% (2)

- London Pop & Westward M Fiqri Rihyawan 29316056Document1,144 pagesLondon Pop & Westward M Fiqri Rihyawan 29316056FiqriNo ratings yet

- Q# 7 Decision TreeDocument5 pagesQ# 7 Decision TreeMulugeta BezaNo ratings yet

- Thompson Arboles Decisión ResueltosDocument16 pagesThompson Arboles Decisión ResueltosKAREN ESTHELA RAMIREZ TORRESNo ratings yet

- Treeplan Trial Version, For Evaluation OnlyDocument5 pagesTreeplan Trial Version, For Evaluation OnlyJorge Esteban Prada JavierNo ratings yet

- Examen AleatorioDocument19 pagesExamen AleatorioGustavo BlassNo ratings yet

- Treeplan Student License For Education OnlyDocument5 pagesTreeplan Student License For Education OnlyRon TiptonNo ratings yet

- Ejercicios de ClaseDocument6 pagesEjercicios de ClaseCarlos Guevara SánchezNo ratings yet

- WWW - Supersonic.co - Id Result Overlay: Histogram and UndersizeDocument1 pageWWW - Supersonic.co - Id Result Overlay: Histogram and UndersizeWage KarsonoNo ratings yet

- Arbol PurdueDocument36 pagesArbol PurdueKEN ROY LLAJARUNA OLANONo ratings yet

- Arbol de DecisionDocument46 pagesArbol de DecisionAnonymous qxwYgnNo ratings yet

- Topic: Table of SpecificationsDocument5 pagesTopic: Table of Specificationsprincerojas630No ratings yet

- TAPAK e PRESTASI PBPPP TAHUN 2016 PENILAI 1Document23 pagesTAPAK e PRESTASI PBPPP TAHUN 2016 PENILAI 1Zammira RamliNo ratings yet

- VU Calculator Percentage CGPA HelpDocument3 pagesVU Calculator Percentage CGPA HelpMohsin ButtNo ratings yet

- Welcome To The Ge-Mckinsey Nine-Box Matrix BuilderDocument17 pagesWelcome To The Ge-Mckinsey Nine-Box Matrix BuilderSapnaNo ratings yet

- Winery CaseDocument8 pagesWinery CaseMizanNo ratings yet

- Compound Name Impurity Relative Retention Time Relative Response FactorDocument3 pagesCompound Name Impurity Relative Retention Time Relative Response FactorNatalia BaldoniNo ratings yet

- Road 1 UnnamedDocument1 pageRoad 1 UnnamedalutttNo ratings yet

- Asm 1 Opemanaaa 1Document9 pagesAsm 1 Opemanaaa 1Thu NguyenNo ratings yet

- Class Record: Region Division School Name School Id School YearDocument5 pagesClass Record: Region Division School Name School Id School YearSharmaine Nacional AlmodielNo ratings yet

- Recipe Master TemplateDocument439 pagesRecipe Master TemplatechefkalomoiropoulosNo ratings yet

- Financial Management Predictive ModelingDocument15 pagesFinancial Management Predictive ModelingShankaran RamanNo ratings yet

- Operation Analytics 22ndsepDocument9 pagesOperation Analytics 22ndsepMohit TiwaryNo ratings yet

- SPSS FileDocument21 pagesSPSS Filevansham malikNo ratings yet

- CALIBRATION OF HM PlantDocument3 pagesCALIBRATION OF HM PlantDeven PatleNo ratings yet

- Adidas Group Supplier Adidas Group Supplier Adidas Group SupplierDocument6 pagesAdidas Group Supplier Adidas Group Supplier Adidas Group SupplierahmaduggokiNo ratings yet

- ImbalanceDocument14 pagesImbalanceSlash2xNo ratings yet

- Analisis PAS Ganjil Kelas 5 TP. 2021Document23 pagesAnalisis PAS Ganjil Kelas 5 TP. 2021harsono30No ratings yet

- Tapak Lama 2Document9 pagesTapak Lama 2wakazizNo ratings yet

- Modified Item Analysis Form New 2 1Document1 pageModified Item Analysis Form New 2 1leejiyoung019No ratings yet

- Programacion DinamicaDocument19 pagesProgramacion DinamicaJesusNo ratings yet

- Objective and Scope of StudyDocument13 pagesObjective and Scope of StudyZunair AmeerNo ratings yet

- Element EL4KAMZ5517 (Amazon Fire TV Edition) CNET Review Calibration ResultsDocument3 pagesElement EL4KAMZ5517 (Amazon Fire TV Edition) CNET Review Calibration ResultsDavid KatzmaierNo ratings yet

- BD20022 OprDocument12 pagesBD20022 OprDeepNo ratings yet

- Optoma UHD60 CNET Review Calibration ResultsDocument3 pagesOptoma UHD60 CNET Review Calibration ResultsDavid Katzmaier0% (1)

- Sample TOS TemplateDocument2 pagesSample TOS TemplateMars CabanaNo ratings yet

- Making Use of Reliability Statistics - ConversionDocument46 pagesMaking Use of Reliability Statistics - ConversionKasinathan Muniandi100% (1)

- Kerice 2022Document16 pagesKerice 2022A. HawaNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones Alumnosjose perezNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones Alumnosjose perezNo ratings yet

- Strain Rosette ReganganDocument16 pagesStrain Rosette ReganganAnnisa Arifandita MifshellaNo ratings yet

- Material Properties: % PassingDocument1 pageMaterial Properties: % PassingBIPL REPORTNo ratings yet

- AAG Tolerances GBDocument2 pagesAAG Tolerances GBJayantNo ratings yet

- Book 1Document9 pagesBook 1lalit.cNo ratings yet

- Grelha de Avaliação - A - : N.º Nome 5% 5% 50%Document6 pagesGrelha de Avaliação - A - : N.º Nome 5% 5% 50%Paulo MenezesNo ratings yet

- Philippine Rural Development Project I-REAP Enterprise OperationsDocument30 pagesPhilippine Rural Development Project I-REAP Enterprise OperationsEdna ArnocoNo ratings yet

- Chapter 4 Revised and Final Copy IPsDocument50 pagesChapter 4 Revised and Final Copy IPsmilrosebatilo2012No ratings yet

- Perno 2Document2 pagesPerno 2franklin.barrosNo ratings yet

- LDM Form 4P - Summary of LDM Practicum Portfolio Completers (School LAC Leaders)Document1,448 pagesLDM Form 4P - Summary of LDM Practicum Portfolio Completers (School LAC Leaders)oranisouth100% (1)

- TCL 65R716 CNET Review Calibration ResultsDocument3 pagesTCL 65R716 CNET Review Calibration ResultsDavid KatzmaierNo ratings yet

- GAP (Sizes and Sieve Passing)Document7 pagesGAP (Sizes and Sieve Passing)MacNo ratings yet

- Ver PlantillaDocument8 pagesVer PlantillaGESTORHSEQ VIA9No ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones Alumnosguillermo pinedaNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones AlumnosSamantha DamEspNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones AlumnosDime FefoNo ratings yet

- Plantilla Excel Calificaciones AlumnosDocument8 pagesPlantilla Excel Calificaciones AlumnosVinke Gop SalazarNo ratings yet

- Assign 1 ChanDocument3 pagesAssign 1 ChanAnnisatul FadlilahNo ratings yet

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- Validity: Case Processing SummaryDocument1 pageValidity: Case Processing SummaryinesNo ratings yet

- Decision Tree - Ines Permatasari SetiawanDocument14 pagesDecision Tree - Ines Permatasari Setiawanines100% (1)

- Decision Tree - Ines Permatasari SetiawanDocument14 pagesDecision Tree - Ines Permatasari Setiawanines100% (1)

- GM - Project Time ManagementDocument35 pagesGM - Project Time ManagementinesNo ratings yet

- STP Framework SegmentationDocument1 pageSTP Framework SegmentationinesNo ratings yet

- Mobile Commerce: Imran Matola, BA, MSCDocument31 pagesMobile Commerce: Imran Matola, BA, MSCimranmatolaNo ratings yet

- The New Fluke 317: Technical DataDocument2 pagesThe New Fluke 317: Technical Datachristianh_mNo ratings yet

- Single-Phase T-Type Inverter Performance Benchmark Using Si IGBTs SiC MOSFETs and GaN HEMTsDocument14 pagesSingle-Phase T-Type Inverter Performance Benchmark Using Si IGBTs SiC MOSFETs and GaN HEMTsnikunjNo ratings yet

- Dealer Price List 14.06.2016 EnkiDocument6 pagesDealer Price List 14.06.2016 EnkiNicolae IsacNo ratings yet

- Flat Notes 1Document212 pagesFlat Notes 1varshitapericherla24No ratings yet

- Online Quiz Portal ProjectDocument55 pagesOnline Quiz Portal ProjectAnonymous fc1OJnbNo ratings yet

- IBM RDX Solutions: Smart, Simple and Secure Removable Hard Drive SolutionDocument2 pagesIBM RDX Solutions: Smart, Simple and Secure Removable Hard Drive Solutionouss860No ratings yet

- MP&MC LabDocument241 pagesMP&MC LabSandeepNo ratings yet

- Revpi Connect-Plus Flyer enDocument8 pagesRevpi Connect-Plus Flyer ennugroho_budiNo ratings yet

- ITL PVBX Systems - Sample QuotesDocument2 pagesITL PVBX Systems - Sample QuotesKevin LathamNo ratings yet

- An Investigation of IBM Quantum Computing Device Performance On Combinatorial Optimisation ProblemsDocument16 pagesAn Investigation of IBM Quantum Computing Device Performance On Combinatorial Optimisation Problems1032220018No ratings yet

- Hemant Kumar: ObjectiveDocument2 pagesHemant Kumar: ObjectiveChandan PandeyNo ratings yet

- Mainstream ETCO2 Module CM2200 Technical SpecificationDocument13 pagesMainstream ETCO2 Module CM2200 Technical SpecificationEmilio CánepaNo ratings yet

- Fibrain FOC 2017 EN PDFDocument107 pagesFibrain FOC 2017 EN PDFalaroNo ratings yet

- Arbor APS STT - Unit 12 - Arbor APS Administration - 25jan2018pptx PDFDocument83 pagesArbor APS STT - Unit 12 - Arbor APS Administration - 25jan2018pptx PDFmasterlinh2008No ratings yet

- For 4th YearDocument113 pagesFor 4th YearNabin OliyaNo ratings yet

- Spanning Tree ProtocolDocument52 pagesSpanning Tree ProtocolchelohuhuNo ratings yet

- Chapter 15 W AnswerDocument2 pagesChapter 15 W AnswerjessdoriaNo ratings yet

- Clustered Data ONTAP 82 Network Management GuideDocument109 pagesClustered Data ONTAP 82 Network Management GuideKamlesh SinghNo ratings yet

- Synopsis of Password ProtectorDocument3 pagesSynopsis of Password ProtectorAnonymous QrLiISmpFNo ratings yet

- Ph802 User GuideDocument14 pagesPh802 User GuidenicdutaNo ratings yet

- Erpnext Introduction: Enterprise Resource Planning ToolDocument9 pagesErpnext Introduction: Enterprise Resource Planning ToolRST timedoctoNo ratings yet

- Fuzzy RelationsDocument23 pagesFuzzy RelationsdinkarbhombeNo ratings yet

- Emerging TechnologiesDocument11 pagesEmerging TechnologiesZeina AbdelnabyNo ratings yet

- Enterprise Resource PlanningDocument5 pagesEnterprise Resource PlanningNiño Rey Lopez100% (1)

- Simplifying Rational Expressions: Algebra 2 9.1 NameDocument6 pagesSimplifying Rational Expressions: Algebra 2 9.1 Namedjvaughan01No ratings yet

- SGC Map Down LoaderDocument141 pagesSGC Map Down LoaderRaden WisnugrohoNo ratings yet

- DIGICO SD7 BrochureDocument40 pagesDIGICO SD7 BrochureDave Ruiz HernandezNo ratings yet