Professional Documents

Culture Documents

P & G and Walmart PDF

Uploaded by

Yavnish GargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P & G and Walmart PDF

Uploaded by

Yavnish GargCopyright:

Available Formats

Two Tough Companies Learn to Dance Together

The word on the street has always been that Procter panies could use information technology to increase

&. Gamhle and Wal-Mart are two tough companies sales and lower costs for both parties.

with whom to do business. Historically, Procter & The result was a sophisticated electronic-data-inter-

Gamble has used its enormous power to dominate the change link, which enables P&G to take responsibil-

trade. P&.G would bring its breathtakingly compre- ity for managing Wal-Mart's inventory, of, say, P&G's

hensive research on consumers to retailers and use it Pampers disposable diapers. P&G receives continuous

to argue for increased shelf space for its brands. Before data by satellite on sales, inventory, and prices for dif-

retailers developed sophisticated point-of-sale sys- ferent sizes of Pampers at individual Wal-Mart stores.

tems, which generate a wealth of information on con- This information allows P&G to anticipate Pampers

sumers, they were unable to dispute P&G's analyses sales at Wal-Mart, determine the number of shelf

and resented P&G's control over the retail trade. Over racks and quantity required, and automatically ship

the years, P&.G built up a reputation for being a "self- the orders - often directly from the factory to individ-

aggrandizing bully of the trade.'" ual stores. Electronic invoicing and electronic transfer

For its part, Wal-Mart was renowned for demanding of funds complete the transaction cycle. Because of

that its supplying manufacturers offer it rock-bottom the speed of the entire order-to-delivery cycle, Wal-

prices, extra service, and preferred credit terms. In Mart pays P&G for the Pampers very shortly after the

1992, it instituted a policy of dealing directly with merchandise is sold to the end consumer.

manufacturers, rendering intermediaries such as bro- This partnership has created great value for con-

kers and manufacturer representatives superfluous. It sumers in the form of lower prices and greater avail-

would do business only with vendors that invested in ability of their favorite P&G items. (Stock-outs have

customized electronic-data-interchange technology been virtually eliminated.) Through cooperation, su-

and put bar codes on their products. However, because perfluous activities related to order processing,

of the volume and growth Wal-Mart delivered, manu- billing, and payment have been eliminated; the sales

facturers had little choice but to fall into line. representatives do not need to visit stores as often; and

Over the last ten years, however, these two giants paperwork and opportunities for errors have been dra-

have developed a partnership that has become the matically reduced. The orderless order system also

benchmark for manufacturer-retailer relationships. It means that P&G produces to demand rather than to

is based on mutual dependence: Wal-Mart needs inventory. Furthermore, Wal-Mart has succeeded in

P&G's brands and P&.G needs Wal-Mart's access to simultaneously reducing the inventory of Pampers

customers. The relationship took time to mature and and the probability of stock-outs, thereby avoiding

has gone through its share of growing pains, but mutu- lost sales for both parties. By working together, the

al trust has been instrumental in the companies' de- two have turned what used to be a win-lose proposi-

velopment of an effective long-term relationship. tion of each striving to lower its own costs regardless

In the bad old days, P&G would dictate to Wal-Mart of the effect on the other's costs into a win-win propo-

how much P&.G would sell, at what prices, and under sition of reduced costs and greater revenues for both

what terms. In turn, Wal-Mart would threaten to drop parties. Wal-Mart is P&G's largest customer, generat-

P&G merchandise or give it poorer shelf locations. ing more than $3 billion in business, which is about

There was no sharing of information, no joint plan- 10% of P&.G's total revenues.

ning, and no systems coordination. Prior to 1987, To unleash the benefits of their partnership, Wal-

Wal-Mart had never been contacted by a corporate of- Mart had to trust P&.G enough to share sales and price

ficer of P&G. As Sam Walton, the founder of Wal- data and to cede control of the order process and in-

Mart, put it, "We just let our buyers slug it out with ventory management to P&G. P&.G had to trust Wal-

their salesmen."* Mart enough to dedicate a large cross-functional team

It was not until the mid-1980s that this adversarial to the Wal-Mart account, adopt everyday low prices

relationship began to change. A mutual friend (lower standard prices and the elimination of special

arranged a canoe trip for Sam Walton and Lou Pritch- promotions), and invest in a customized information

ett, P&G's vice president for sales. On this trip, the link. Instead of focusing on increasing sales to Wal-

men decided to reexamine the relationship between Mart, the P&.G team concentrates on finding ways to

the two companies. They began the process by assem- increase sales of P&.G products to consumers through

bling the top ten officers of each company for two days Wal-Mart and to maximize both companies' profits.

to develop a collective vision of the future. Within L "Pritchett on Quick Response," Discount Merchandiser, April

three months, a team of 12 people from different func- 1992, p. 64-65.

tions in each company was established to convert that 2. Sam Walton and John Huey, Sam Walton, Made in America: My

vision into an action plan. It examined how the com- Story |New York: Doubleday & Company, 1992), p. 186.

102 HARVARD BUSINESS REVIEW November-December 1996

Harvard Business Review Notice of Use Restrictions, May 2009

Harvard Business Review and Harvard Business Publishing Newsletter content on EBSCOhost is licensed for

the private individual use of authorized EBSCOhost users. It is not intended for use as assigned course material

in academic institutions nor as corporate learning or training materials in businesses. Academic licensees may

not use this content in electronic reserves, electronic course packs, persistent linking from syllabi or by any

other means of incorporating the content into course resources. Business licensees may not host this content on

learning management systems or use persistent linking or other means to incorporate the content into learning

management systems. Harvard Business Publishing will be pleased to grant permission to make this content

available through such means. For rates and permission, contact permissions@harvardbusiness.org.

You might also like

- NTP - Group 6 - Assigment - FIN201Document35 pagesNTP - Group 6 - Assigment - FIN201Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- What Microenvironmental Factors Have Affected Fitbit Since It Opened For Business?Document4 pagesWhat Microenvironmental Factors Have Affected Fitbit Since It Opened For Business?Ubl HrNo ratings yet

- Cocoa PeteDocument6 pagesCocoa Peteapi-456895910No ratings yet

- Procter and Gamble India LimitedDocument68 pagesProcter and Gamble India Limitedten_ishan88No ratings yet

- Ap Di Consumer Products 2020Document17 pagesAp Di Consumer Products 2020Roger federerNo ratings yet

- BCGDocument3 pagesBCGlish1995No ratings yet

- Case-Walmarts Expansion Into Specialty Online RetailingDocument9 pagesCase-Walmarts Expansion Into Specialty Online RetailingSYAHRUL ROBBIANSYAH RAMADHANNo ratings yet

- International BusinessDocument19 pagesInternational BusinessUmesh PanchalNo ratings yet

- INCOTERMS 2020 QUIZ - Chancafe-Reategui-SaenzDocument6 pagesINCOTERMS 2020 QUIZ - Chancafe-Reategui-SaenzJuliana Chancafe IncioNo ratings yet

- Case Chicken of The SeaDocument8 pagesCase Chicken of The SeaLaura HansmanNo ratings yet

- Sbi LifeDocument16 pagesSbi LifesahilNo ratings yet

- Dream Minecraft ReportDocument19 pagesDream Minecraft ReportAiden LimNo ratings yet

- McDonalds and Subway Are Two of The WorldDocument50 pagesMcDonalds and Subway Are Two of The WorldAkshay DevkarNo ratings yet

- The Global Branding of Stella ArtoisDocument8 pagesThe Global Branding of Stella ArtoisBhawna MalhotraNo ratings yet

- 2 New Modes of Trade FinanceDocument3 pages2 New Modes of Trade FinancedesitorontoNo ratings yet

- All You Need To Know About Peer-To-peer LendingDocument4 pagesAll You Need To Know About Peer-To-peer LendingSuryakantNo ratings yet

- Uber Price Strategies & Marketing Communictaions: BE Assignment-II Group 1Document24 pagesUber Price Strategies & Marketing Communictaions: BE Assignment-II Group 1ayushNo ratings yet

- Super Shop (Shwapno & Agora)Document22 pagesSuper Shop (Shwapno & Agora)Chayan SarkerNo ratings yet

- TPS - The Body ShopDocument6 pagesTPS - The Body ShopAashi GargNo ratings yet

- From The Runway To The Racks - A Comparative Analysis of Gucci andDocument32 pagesFrom The Runway To The Racks - A Comparative Analysis of Gucci andThiagoNo ratings yet

- Bài tập trắc nghiệm mớiDocument92 pagesBài tập trắc nghiệm mớiTrang NguyenNo ratings yet

- Presentation On Selling Muffins: Submitted byDocument28 pagesPresentation On Selling Muffins: Submitted byPiyuksha PargalNo ratings yet

- Lecture 4-Channels of DistributionDocument11 pagesLecture 4-Channels of DistributionIsaac OwusuNo ratings yet

- Svedka Vodka: Nisarga C Aman Agarwal - Anvith Prakash - 20071Document10 pagesSvedka Vodka: Nisarga C Aman Agarwal - Anvith Prakash - 20071Tangirala AshwiniNo ratings yet

- Beating The Odds When You Launch A New Venture by Clark G. Gilbert and Matthew J. EyrinDocument5 pagesBeating The Odds When You Launch A New Venture by Clark G. Gilbert and Matthew J. Eyrinvipinkrk-1No ratings yet

- Nestle Maggi - Report of Marketing StrategiesDocument13 pagesNestle Maggi - Report of Marketing StrategiesKeshav SunariaNo ratings yet

- SanMar QA Manual 2022Document226 pagesSanMar QA Manual 2022Ahmed FirozNo ratings yet

- Brand Chapter 7Document38 pagesBrand Chapter 7Sadia PromiNo ratings yet

- 15 Trends Changing The Face of The Beauty Industry in 2020 - CB Insights Research PDFDocument50 pages15 Trends Changing The Face of The Beauty Industry in 2020 - CB Insights Research PDFFranck MauryNo ratings yet

- Case Study 1: The Inexorable Rise of WALMART 1988-2016Document2 pagesCase Study 1: The Inexorable Rise of WALMART 1988-2016neha reddyNo ratings yet

- BPCL Petrol Pump Retail RevolutionDocument11 pagesBPCL Petrol Pump Retail RevolutionAmit JainNo ratings yet

- Mum Term PaperDocument51 pagesMum Term PapermashfikNo ratings yet

- Exam: Semester / Year: Department: Subject Codes: Subject Name: Writing Time: Exam Open: Exam Close: Number of Pages: Instructions To StudentsDocument2 pagesExam: Semester / Year: Department: Subject Codes: Subject Name: Writing Time: Exam Open: Exam Close: Number of Pages: Instructions To StudentsJiya BajajNo ratings yet

- New BcgmatrixDocument21 pagesNew BcgmatrixumergabaNo ratings yet

- Bodega Aurrera Express Format Innovation and In-Fill StrategiesDocument8 pagesBodega Aurrera Express Format Innovation and In-Fill StrategiesAaron ChioNo ratings yet

- Nikitha Assignment 6 CompletedDocument6 pagesNikitha Assignment 6 CompletedNikki JainNo ratings yet

- Big BazaarDocument17 pagesBig BazaarDeepalNo ratings yet

- 02 AddDocument14 pages02 AddHà My NguyễnNo ratings yet

- C11ME - Quality Management: Individual: CourseworkDocument22 pagesC11ME - Quality Management: Individual: CourseworkDiksha RajawatNo ratings yet

- Kantar Worldpanel Dairy Talk Summary - Part 1 - Consumer PulseDocument21 pagesKantar Worldpanel Dairy Talk Summary - Part 1 - Consumer PulseAnonymous 45z6m4eE7pNo ratings yet

- Intellectual CapitalDocument18 pagesIntellectual CapitalAbbas NaqviNo ratings yet

- Airtel Marketing MyopiaDocument36 pagesAirtel Marketing MyopiaBaskar NarayananNo ratings yet

- Gillette and P&GDocument8 pagesGillette and P&GSiddhi MirnaalNo ratings yet

- As1 Sample 1 2 - 133136973699845276Document17 pagesAs1 Sample 1 2 - 133136973699845276Mehwish ArsalNo ratings yet

- Alibaba Case 2022-23Document19 pagesAlibaba Case 2022-23Priyanka GhoshNo ratings yet

- Top 100 Haircare Brands Trending On Instagram October 1668096197Document25 pagesTop 100 Haircare Brands Trending On Instagram October 1668096197Laura Daniela Silva AriasNo ratings yet

- Group 7 - Marketing Management - A05eDocument78 pagesGroup 7 - Marketing Management - A05eKhoa ĐăngNo ratings yet

- MKT460 MID1 by Nafis Faisal Choudhury 1632855030 PDFDocument6 pagesMKT460 MID1 by Nafis Faisal Choudhury 1632855030 PDFFahim HasnatNo ratings yet

- Marico LTD.: ME Final Project PresentationDocument28 pagesMarico LTD.: ME Final Project PresentationSaumitra AmbegaokarNo ratings yet

- End of Course Essay: Integrated Marketing Communications (Imc)Document46 pagesEnd of Course Essay: Integrated Marketing Communications (Imc)Thắng LâmNo ratings yet

- 07.VISSAN Case4study EN (2021)Document12 pages07.VISSAN Case4study EN (2021)Trương M ÁnhNo ratings yet

- Case Studies Prep Material - IgniteDocument8 pagesCase Studies Prep Material - IgniteArnav BhardwajNo ratings yet

- Tag Taste: If You're in Then YouDocument5 pagesTag Taste: If You're in Then YouNIMMI KUMARINo ratings yet

- Fruitazia Case StudyDocument2 pagesFruitazia Case StudyYASEEN AKBARNo ratings yet

- Fba Ga1 Excel ValleyDocument24 pagesFba Ga1 Excel ValleyQuân Nguyễn MinhNo ratings yet

- 1 - Book - T NG H P SP Quý 1Document44 pages1 - Book - T NG H P SP Quý 1Anh Trịnh Thị LanNo ratings yet

- SRI VALS NotesDocument8 pagesSRI VALS NotesVindicatorNo ratings yet

- Soft Drinks Industry: ResearchDocument11 pagesSoft Drinks Industry: ResearchDemoxtraNo ratings yet

- Article Review On Supply Chain of WalmartDocument7 pagesArticle Review On Supply Chain of WalmartNaina AgarwalNo ratings yet

- Mental ModelsDocument46 pagesMental ModelsYavnish Garg100% (1)

- Future of b2bDocument7 pagesFuture of b2bYavnish GargNo ratings yet

- Case XiameterDocument3 pagesCase XiameterYavnish GargNo ratings yet

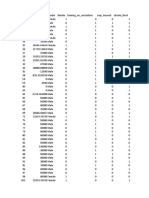

- Insurance Criterion: Non Hierarchical ClusteringDocument2 pagesInsurance Criterion: Non Hierarchical ClusteringYavnish GargNo ratings yet

- GuestFirst Hotel DataDocument35 pagesGuestFirst Hotel DataYavnish GargNo ratings yet

- Jayalaxmi Agro TechDocument92 pagesJayalaxmi Agro TechYavnish GargNo ratings yet

- Four Hour Body Experiment Tracker TemplateDocument4 pagesFour Hour Body Experiment Tracker Templatechanellekristyweaver100% (1)

- XU-CSG Cabinet Minutes of Meeting - April 4Document5 pagesXU-CSG Cabinet Minutes of Meeting - April 4Harold John LaborteNo ratings yet

- Grasa LO 915Document2 pagesGrasa LO 915Angelo Carrillo VelozoNo ratings yet

- Windows Intrusion Detection ChecklistDocument10 pagesWindows Intrusion Detection ChecklistJosé Tomás García CáceresNo ratings yet

- Rocker ScientificDocument10 pagesRocker ScientificRody JHNo ratings yet

- JBF Winter2010-CPFR IssueDocument52 pagesJBF Winter2010-CPFR IssueakashkrsnaNo ratings yet

- Jones Et - Al.1994Document6 pagesJones Et - Al.1994Sukanya MajumderNo ratings yet

- Design Practical Eden Swithenbank Graded PeDocument7 pagesDesign Practical Eden Swithenbank Graded Peapi-429329398No ratings yet

- Lecture 12 Health Management Information SystemDocument14 pagesLecture 12 Health Management Information SystemKamran SheikhNo ratings yet

- Process Industry Practices Insulation: PIP INEG2000 Guidelines For Use of Insulation PracticesDocument15 pagesProcess Industry Practices Insulation: PIP INEG2000 Guidelines For Use of Insulation PracticesZubair RaoofNo ratings yet

- Qualitrol 900 910Document6 pagesQualitrol 900 910chennupati999No ratings yet

- AppcDocument71 pagesAppcTomy lee youngNo ratings yet

- Smart Plug Installation GuideDocument9 pagesSmart Plug Installation GuideFrancisco GuerreroNo ratings yet

- Bustax Midtem Quiz 1 Answer Key Problem SolvingDocument2 pagesBustax Midtem Quiz 1 Answer Key Problem Solvingralph anthony macahiligNo ratings yet

- Friday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDocument3 pagesFriday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDONI ARTANo ratings yet

- Generator ControllerDocument21 pagesGenerator ControllerBrianHazeNo ratings yet

- Fear of God-3Document50 pagesFear of God-3Duy LêNo ratings yet

- MiddleWare Technology - Lab Manual JWFILESDocument171 pagesMiddleWare Technology - Lab Manual JWFILESSangeetha BajanthriNo ratings yet

- ISO-3046-4-2009 (Gobernador de Velocidad)Document8 pagesISO-3046-4-2009 (Gobernador de Velocidad)David GastelumNo ratings yet

- VerificationManual en PDFDocument621 pagesVerificationManual en PDFurdanetanpNo ratings yet

- Using Visual Rating To Diagnose DementiaDocument10 pagesUsing Visual Rating To Diagnose DementiaImágenes Rosendo GarcíaNo ratings yet

- Auditory Evoked Potentials - AEPs - Underlying PrinciplesDocument19 pagesAuditory Evoked Potentials - AEPs - Underlying PrinciplesMansi SinghNo ratings yet

- Individual Daily Log and Accomplishment Report: Date and Actual Time Logs Actual AccomplishmentsDocument3 pagesIndividual Daily Log and Accomplishment Report: Date and Actual Time Logs Actual AccomplishmentsMarian SalazarNo ratings yet

- Marieb ch3dDocument20 pagesMarieb ch3dapi-229554503No ratings yet

- Abbas Ali Mandviwala 200640147: Ba1530: Information Systems and Organization StudiesDocument11 pagesAbbas Ali Mandviwala 200640147: Ba1530: Information Systems and Organization Studiesshayan sohailNo ratings yet

- Principles To Action (Short)Document6 pagesPrinciples To Action (Short)nsadie34276No ratings yet

- AMO Exercise 1Document2 pagesAMO Exercise 1Jonell Chan Xin RuNo ratings yet

- Annex To ED Decision 2013-015-RDocument18 pagesAnnex To ED Decision 2013-015-RBurse LeeNo ratings yet

- Hydraulics and PneumaticsDocument6 pagesHydraulics and PneumaticsRyo TevezNo ratings yet

- Assignment-For-Final of-Supply-Chain - Management of Courses PSC 545 & 565 PDFDocument18 pagesAssignment-For-Final of-Supply-Chain - Management of Courses PSC 545 & 565 PDFRAKIB HOWLADERNo ratings yet