Professional Documents

Culture Documents

Maynard Company Balance Sheet and Income Statement

Uploaded by

Tating Bootan Kaayo YangOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maynard Company Balance Sheet and Income Statement

Uploaded by

Tating Bootan Kaayo YangCopyright:

Available Formats

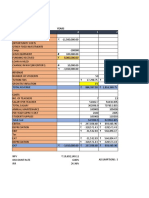

Maynard Company

Balance Sheet

as of June 30

Assets Liabilities and Owner's Equity

Current Assets Current Liabilities

Cash 66,660 Accounts payable 21,315

Accounts Recievable 26,505 Accrued wages payable 2,202

Merchandise Inventory 26,520 Bank notes payable 29,250

Note Recievable, Diane Maynard 0 Taxes Payable 7,224

Supplies on hand 6,630 Total current Liabilities 59,991

Prepaid Insurance 2,826

Total current Assets 129,141

Noncurrent Assets Non Current Liabilities

Building 585,000 Other non current liablities 2,451

Land 89,700

Equipment (at cost) 36,660

Less: Owner's Equity

Accumulated depreciation on Building 157,950

Accumulated depreciation on equipment 5,928 Capital Stock 390,000

Retained Earnings 229,446

Building, Land & Equipment - net 547,482 619,446

Other non current assets 5,265

Total Aset $681,888 Total Liabilities and Owner's Equity $681,888

Maynard Company

Income Statement

For the Month end of June 30

Net Sales 70,925

Cost of Sales 39,345

Gross Margin 31,580

Expenses

Wages paid 5,888

Utilities paid 900

Supplies 600

Insurance 324

Depreciation 2,574

Miscellaneous 135

10,421

Operating Income 21,159

Income Tax Expense 1,524

Net Income $19,635

Dividends 11,700

Increase in retained earnings $7,935

Cash Receipts and Disbursements

Month of June

Cash Receipts Cash Disbursements

Cash Sales $44,420 Equipment purchased $23,400

Credit customers $21,798 Other assets purchased $408.00

Diane Maynard $11,700 Payments on accounts payable $8,517.00

Bank loan $20,865 Cash purchases of merchandise $14,715.00

Total receipts $98,783 Cash purchases of supplies $1,671.00

Dividends $11,700.00

Wages paid $5,600.00

Utilities paid $900.00

Miscellaneous payments $135.00

Total disbursements $67,106

Reconciliation:

Cash balance, June 1 $34,983

Receipts $98,783

Sub Total $133,766

Disbursements $67,106

Cash balance, June 30 $66,660

You might also like

- Maynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income StatementDocument2 pagesMaynard Company Balance Sheets"TITLE "TITLE Maynard Company June Income Statementriya lakhotiaNo ratings yet

- Rajaneesh Company - Cash FlowsDocument3 pagesRajaneesh Company - Cash FlowsAyushi Aggarwal0% (2)

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- Acct Project J Question 1Document12 pagesAcct Project J Question 1graceNo ratings yet

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- Maynard CompanyDocument5 pagesMaynard CompanyNikitha Andrea SaldanhaNo ratings yet

- Accounting Maynard CompanyDocument3 pagesAccounting Maynard CompanyAdit AdityaNo ratings yet

- Maynard Solutions Ch04Document17 pagesMaynard Solutions Ch04Anton VitaliNo ratings yet

- Chemalite Inc - Assignment - AccountingDocument2 pagesChemalite Inc - Assignment - Accountingthi_aar100% (1)

- Question & Answer 28072015 InventoryDocument5 pagesQuestion & Answer 28072015 InventoryGreen StoneNo ratings yet

- Date Details of Transaction Capital Acc. Payable Notes PayableDocument3 pagesDate Details of Transaction Capital Acc. Payable Notes PayablerudypatilNo ratings yet

- Accounting Lecture 10 Annotated 1114Document10 pagesAccounting Lecture 10 Annotated 1114KrisztiNo ratings yet

- Chemalite financial analysisDocument12 pagesChemalite financial analysisAimane Beggar100% (1)

- Case ChemaliteDocument1 pageCase ChemaliteRosario PhillipsNo ratings yet

- CCVODocument2 pagesCCVOAlonzoNo ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- Accounting for Business Combinations and Internal ReconstructionsDocument27 pagesAccounting for Business Combinations and Internal ReconstructionsbinuNo ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- IFRS B.com SH College Model Question Paper 2017 March 2Document2 pagesIFRS B.com SH College Model Question Paper 2017 March 2Rainy GoodwillNo ratings yet

- Stern Corporation Balance Sheet AdjustmentsDocument4 pagesStern Corporation Balance Sheet AdjustmentsYessy KawiNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- Bos 24780 CP 5Document114 pagesBos 24780 CP 5NmNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- Small business cash flow analysisDocument2 pagesSmall business cash flow analysisAgANo ratings yet

- Advanced Accounting SolutionsDocument75 pagesAdvanced Accounting SolutionsDipen AdhikariNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- IBF Assign#2Document4 pagesIBF Assign#2Burhan uddin100% (1)

- Accounts Ques Nov06Document48 pagesAccounts Ques Nov06api-3825774No ratings yet

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- NAS 37: Provisions, Contingent Liabilities & Contingent Assets NFRS 3: Business CombinationDocument24 pagesNAS 37: Provisions, Contingent Liabilities & Contingent Assets NFRS 3: Business CombinationSushant MaskeyNo ratings yet

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Solutions To Text Book Exercises: Non-Trading ConcernsDocument12 pagesSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUNo ratings yet

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocument53 pagesAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- The Following Trial Balance of Oakley Co Does Not Balance PDFDocument1 pageThe Following Trial Balance of Oakley Co Does Not Balance PDFAnbu jaromiaNo ratings yet

- Life Insurance:: ST STDocument18 pagesLife Insurance:: ST STBAZINGA100% (1)

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Week 13 SolutionsDocument7 pagesWeek 13 SolutionsStanley RobertNo ratings yet

- ST Clement'S School Case Study: YearsDocument8 pagesST Clement'S School Case Study: YearsTin Bernadette DominicoNo ratings yet

- Profit Prior to Incorporation AccountsDocument7 pagesProfit Prior to Incorporation AccountsParul Bhardwaj VaidyaNo ratings yet

- Problem 5: XY LTDDocument4 pagesProblem 5: XY LTDAF 1 Tejasri PamujulaNo ratings yet

- Unit 5: Death of A PartnerDocument23 pagesUnit 5: Death of A PartnerKARTIK CHADHANo ratings yet

- CTA Level 1 Tax Module 2014 Practice Questions and SolutionsDocument117 pagesCTA Level 1 Tax Module 2014 Practice Questions and SolutionsBernard TynoNo ratings yet

- Unit 3: Trial Balance: Learning OutcomesDocument13 pagesUnit 3: Trial Balance: Learning Outcomesviveo23No ratings yet

- Suggested - Answer - CAP - II - June - 2010 2Document85 pagesSuggested - Answer - CAP - II - June - 2010 2Dipen AdhikariNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Pre-Quali Examination - Level II - Cluster C AccountingDocument12 pagesPre-Quali Examination - Level II - Cluster C AccountingRobert CastilloNo ratings yet

- Maynard Company (A & B)Document9 pagesMaynard Company (A & B)akashnathgarg0% (1)

- Hire Purchase PeqDocument21 pagesHire Purchase PeqRishikaNo ratings yet

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocument13 pagesIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNo ratings yet

- Departmental Accounting ProblemsDocument12 pagesDepartmental Accounting ProblemsRajesh NangaliaNo ratings yet

- Prepare financial statements and cash flow statementDocument4 pagesPrepare financial statements and cash flow statementrishi dhungel100% (1)

- Paper - 1: AccountingDocument18 pagesPaper - 1: AccountingJerry HuffmanNo ratings yet

- Cash Flow Statement for ABC LtdDocument30 pagesCash Flow Statement for ABC LtdNaushad GulNo ratings yet

- Company CaseDocument2 pagesCompany CaseAuramax EnterprisesNo ratings yet

- Maynard Company (A) Balance Sheet Asofjune1 AssetsDocument9 pagesMaynard Company (A) Balance Sheet Asofjune1 AssetsNeoNo ratings yet

- Online Postgraduate Diploma in Management: Financial Accounting Case StudyDocument6 pagesOnline Postgraduate Diploma in Management: Financial Accounting Case StudyStephen dassNo ratings yet

- Case Study: Lone Pine CafeDocument10 pagesCase Study: Lone Pine CafeTating Bootan Kaayo YangNo ratings yet

- Maynard Company Financial AnalysisDocument6 pagesMaynard Company Financial AnalysisTating Bootan Kaayo YangNo ratings yet

- Maynard Company Financial AnalysisDocument6 pagesMaynard Company Financial AnalysisTating Bootan Kaayo YangNo ratings yet

- Maynard Company Financial AnalysisDocument6 pagesMaynard Company Financial AnalysisTating Bootan Kaayo YangNo ratings yet

- Baron Coburg: (A Case Study)Document31 pagesBaron Coburg: (A Case Study)Tating Bootan Kaayo YangNo ratings yet

- Baron Coburg: (A Case Study)Document31 pagesBaron Coburg: (A Case Study)Tating Bootan Kaayo YangNo ratings yet

- Baron Coburg: (A Case Study)Document31 pagesBaron Coburg: (A Case Study)Tating Bootan Kaayo YangNo ratings yet

- America The Story of US Episode 1Document2 pagesAmerica The Story of US Episode 1Ray KasperNo ratings yet

- Wong Keng Liang The Lizard King CaseDocument11 pagesWong Keng Liang The Lizard King CaseaishahNo ratings yet

- Invoice PO4275090671-350 PDFDocument1 pageInvoice PO4275090671-350 PDFsameeraNo ratings yet

- Foreign CapitalDocument15 pagesForeign Capitaldranita@yahoo.comNo ratings yet

- EcoWorld Malaysia - Proposed Land AcquisitionDocument9 pagesEcoWorld Malaysia - Proposed Land AcquisitiondaveleyconsNo ratings yet

- Court Rules Arrest of Vessel a Covered RiskDocument3 pagesCourt Rules Arrest of Vessel a Covered Riskretep69phNo ratings yet

- Feleke Firewall Note 2023Document21 pagesFeleke Firewall Note 2023Abni booNo ratings yet

- Notice: Arms Export Control Act: Persons Violating or Conspiring To Violate Section 38 Statutory DebarmentDocument2 pagesNotice: Arms Export Control Act: Persons Violating or Conspiring To Violate Section 38 Statutory DebarmentJustia.com100% (1)

- Assignment 2 Answer KeyDocument2 pagesAssignment 2 Answer KeyAbdulakbar Ganzon BrigoleNo ratings yet

- The Union Legislature Q-AnsDocument2 pagesThe Union Legislature Q-Ansconnect.amairaNo ratings yet

- Profibus DP Master Protocol APIDocument336 pagesProfibus DP Master Protocol APImail87523100% (2)

- Financial Statements and Ratio Analysis: All Rights ReservedDocument55 pagesFinancial Statements and Ratio Analysis: All Rights ReservedZidan ZaifNo ratings yet

- 10 Demerits of Caste System in IndiaDocument7 pages10 Demerits of Caste System in Indiarabiya altafNo ratings yet

- Mayank Ahuja 19021321063 IbfsDocument4 pagesMayank Ahuja 19021321063 IbfsMayank AhujaNo ratings yet

- Modules 13, 14 and 15Document11 pagesModules 13, 14 and 15George EvangelistaNo ratings yet

- Concentration TermsDocument6 pagesConcentration Termsallure25No ratings yet

- Pronunciation Extra: Pre-Intermediate Unit 10Document1 pagePronunciation Extra: Pre-Intermediate Unit 10olhaNo ratings yet

- Canoreco v. Torres GR 127249 2-27-1998Document10 pagesCanoreco v. Torres GR 127249 2-27-1998HjktdmhmNo ratings yet

- Young Feminists Want System Change: A Global Advocacy Toolkit, For The Beijing+25 Process and BeyondDocument28 pagesYoung Feminists Want System Change: A Global Advocacy Toolkit, For The Beijing+25 Process and BeyondRanda MoNo ratings yet

- Authority of Solemnizing Officer Beso V DagumanDocument5 pagesAuthority of Solemnizing Officer Beso V DagumanRojas Law OfficeNo ratings yet

- FSA Midterm Exam FormattedDocument8 pagesFSA Midterm Exam Formattedkarthikmaddula007_66No ratings yet

- Letter of Authorization: To Whom It May ConcernDocument2 pagesLetter of Authorization: To Whom It May ConcernAvinash NandaNo ratings yet

- Current at The End of The Reporting Period. Comparative Figures For Prior Period(s) Shall Also Be RestatedDocument3 pagesCurrent at The End of The Reporting Period. Comparative Figures For Prior Period(s) Shall Also Be RestatedJustine VeralloNo ratings yet

- Tax Filing Basics For Stock Plan TransactionsDocument8 pagesTax Filing Basics For Stock Plan Transactionshananahmad114No ratings yet

- Citigroup, Inc., v. Citistate Savings Bank, Inc.Document1 pageCitigroup, Inc., v. Citistate Savings Bank, Inc.Samantha MakayanNo ratings yet

- Spare Part List: Breaker TE 705 120V USADocument7 pagesSpare Part List: Breaker TE 705 120V USAJoseLuisCarrilloMenaNo ratings yet

- Medical Malpractice and Negligence StandardsDocument2 pagesMedical Malpractice and Negligence StandardsRuthy SegoviaNo ratings yet

- Case Study of EBay IncDocument3 pagesCase Study of EBay IncyibungoNo ratings yet

- Intermediate Accounting 1 - InventoriesDocument9 pagesIntermediate Accounting 1 - InventoriesLien LaurethNo ratings yet