Professional Documents

Culture Documents

24a PDF

24a PDF

Uploaded by

Fahim Ashab Chowdhury0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

24A.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 page24a PDF

24a PDF

Uploaded by

Fahim Ashab ChowdhuryCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

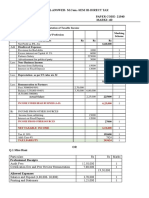

SCHEDULE 24A

Particulars of income from Salaries

Annex this Schedule to the return of income if you have income from Salaries

01 Assessment Year 02 TIN

2 0 -

Particulars Amount Tax exempted Taxable

(A) (B) (C = A-B)

03 Basic pay

04 Special pay

05 Arrear pay (if not included in taxable

income earlier)

06 Dearness allowance

07 House rent allowance

08 Medical allowance

09 Conveyance allowance

10 Festival Allowance

11 Allowance for support staff

12 Leave allowance

13 Honorarium/ Reward/Fee

14 Overtime allowance

15 Bonus / Ex-gratia

16 Other allowances

17 Employer’s contribution to a

recognized provident fund

18 Interest accrued on a recognized

provident fund

19 Deemed income for transport facility

20 Deemed income for free furnished/

unfurnished accommodation

21 Other, if any (give detail)

22 Total

All figures of amount are in taka (৳)

Name Signature & Date

You might also like

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument7 pagesAnnex This Schedule To The Return of Income If You Have Income From Salariesshamim islam limonNo ratings yet

- Tax Implications On Income From EmploymentDocument6 pagesTax Implications On Income From Employmentkoiralan529No ratings yet

- VATReturn All Annexs 3033229Document3 pagesVATReturn All Annexs 3033229Faiza MinhasNo ratings yet

- OfferLetter Riya GuptaDocument2 pagesOfferLetter Riya Guptavermatanishq1610No ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- Computation of Total Income Mitaben Fy 22-23Document2 pagesComputation of Total Income Mitaben Fy 22-23RaviNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Proposed Corrected Return - Muhammad Zai BuildersDocument4 pagesProposed Corrected Return - Muhammad Zai BuildersHaroon ButtNo ratings yet

- 0ol.001.A.01327504881515B1 3Document10 pages0ol.001.A.01327504881515B1 3cwnwwvr5fmNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Act370 Tax Form SowasifDocument16 pagesAct370 Tax Form SowasifAbuboker MahadyNo ratings yet

- Nirmal Todi 2021Document24 pagesNirmal Todi 2021Sujan TripathiNo ratings yet

- 20-21 COMPUTATION (1) Amarjit KaurDocument3 pages20-21 COMPUTATION (1) Amarjit KaurTanvi DhingraNo ratings yet

- Submitted Status:: CNIC in Case of Individual Coy/Aop/Ind Service Category Tax OfficeDocument5 pagesSubmitted Status:: CNIC in Case of Individual Coy/Aop/Ind Service Category Tax OfficeAbbas AliNo ratings yet

- Taxation Nyama AssignmentDocument14 pagesTaxation Nyama AssignmentTakudzwa BenjaminNo ratings yet

- Bnaking Profit and Loss Account 1Document12 pagesBnaking Profit and Loss Account 1madhumathi100% (1)

- IABillDocument2 pagesIABillTalent of PakistanNo ratings yet

- Submitted Status:: Tax Period KNTN Name Submission Date Normal AmendedDocument2 pagesSubmitted Status:: Tax Period KNTN Name Submission Date Normal AmendedEntertaining VideosNo ratings yet

- Solution Tax667 - Jun 2016-1Document8 pagesSolution Tax667 - Jun 2016-1Zahiratul QamarinaNo ratings yet

- Nirima Sahu ComputationDocument2 pagesNirima Sahu Computationbrs consultancyNo ratings yet

- Income From Salary Solution ZDocument3 pagesIncome From Salary Solution ZMuhammad FaisalNo ratings yet

- Notice of Assessment 2021 05 07 05 37 16 132636Document4 pagesNotice of Assessment 2021 05 07 05 37 16 132636bibicolibri1961No ratings yet

- Abdul Hafeez Nadeem JanuaryDocument2 pagesAbdul Hafeez Nadeem Januarymudassir awanNo ratings yet

- VATReturn All Annexs 6402227Document6 pagesVATReturn All Annexs 6402227muhammad saadNo ratings yet

- Ayub Traders Nov-23 Return PSTDocument4 pagesAyub Traders Nov-23 Return PSTABBAS KHANNo ratings yet

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- Salary Slip (70015409 February, 2023)Document1 pageSalary Slip (70015409 February, 2023)حامدولیNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- Payslip 10105020 12-2021 2022-01-28 20 36 58 61f4069221c44Document1 pagePayslip 10105020 12-2021 2022-01-28 20 36 58 61f4069221c44ginizoneNo ratings yet

- Sonali Securities WTR (Jan'22-June'22) 75ADocument8 pagesSonali Securities WTR (Jan'22-June'22) 75Alimon islamNo ratings yet

- Abdul Hafeez Nadeem FebruaryDocument2 pagesAbdul Hafeez Nadeem Februarymudassir awanNo ratings yet

- 2022 23 Sample Return MaleDocument28 pages2022 23 Sample Return Malepk ghosh100% (1)

- Mbotela Taxable IncomeDocument1 pageMbotela Taxable IncomeMohamed AhmedNo ratings yet

- Sales Tax Return Sept 10Document6 pagesSales Tax Return Sept 10Raheel BaigNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19sky2flyboy@gmail.comNo ratings yet

- Salary Slip (10511035 December, 2016)Document1 pageSalary Slip (10511035 December, 2016)Syed Tabish Ali100% (1)

- Judicial Reforms in IndiDocument1 pageJudicial Reforms in IndiArsalan KhanNo ratings yet

- Zaib - Altaf - Naik - Payslip - July - 2022 (1) NewDocument2 pagesZaib - Altaf - Naik - Payslip - July - 2022 (1) Newzuber shaikhNo ratings yet

- Case - Final Project - Micro Tiles-blank-Feb 25 2024Document45 pagesCase - Final Project - Micro Tiles-blank-Feb 25 2024Aimee ChantengcoNo ratings yet

- W201977 - Naveenkumar Duraisamysalary SlipDocument3 pagesW201977 - Naveenkumar Duraisamysalary SlipSRV MOTORSSNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- Payslip For The Month of April 2022: Earnings DeductionsDocument2 pagesPayslip For The Month of April 2022: Earnings DeductionsPrateek KwatraNo ratings yet

- Payslips 5Document1 pagePayslips 5Tech stackNo ratings yet

- OfferLetter 225107Document2 pagesOfferLetter 225107NIKHIL RANANo ratings yet

- Assignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionDocument2 pagesAssignment No 02 Business Law and Taxation: Tauraira Arshad 16320 SolutionSYEDA -No ratings yet

- Withholding Tax Return Excell FormatDocument18 pagesWithholding Tax Return Excell FormatMohammad Shah Alam ChowdhuryNo ratings yet

- 0ol 001 A 00688151985931 PDFDocument12 pages0ol 001 A 00688151985931 PDFChristopher ApadNo ratings yet

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument18 pagesAnnex This Schedule To The Return of Income If You Have Income From SalariessajedulNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAbhinaba SahaNo ratings yet

- Computation of Taxable Income Marking Scheme Particulars Rs Rs Rs 6,60,000Document8 pagesComputation of Taxable Income Marking Scheme Particulars Rs Rs Rs 6,60,000LAKHAN TRIVEDINo ratings yet

- Deepak ComputationDocument3 pagesDeepak ComputationRavi YadavNo ratings yet

- Spice Deals MemoDocument2 pagesSpice Deals MemoSelma IilongaNo ratings yet

- 2 - Australian Taxation OfficeDocument2 pages2 - Australian Taxation Officelakshmi.bodduluruNo ratings yet

- ComputationDocument2 pagesComputationnsispatna1No ratings yet

- Revised Estimation - FY 2023-24Document1 pageRevised Estimation - FY 2023-24Debojyoti MukherjeeNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- CCM Handbook 2021Document41 pagesCCM Handbook 2021gawtomNo ratings yet

- K2P1 01 M FM 02Document1 pageK2P1 01 M FM 02gawtomNo ratings yet

- Intake Flowmeter ChamberDocument1 pageIntake Flowmeter ChambergawtomNo ratings yet

- BSEN2876Document30 pagesBSEN2876gawtom100% (1)

- Temporary Pipeline - Sludge From Existing Clarifier & PSBDocument2 pagesTemporary Pipeline - Sludge From Existing Clarifier & PSBgawtomNo ratings yet