Professional Documents

Culture Documents

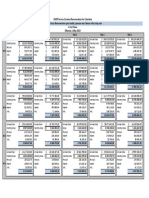

Revised Estimation - FY 2023-24

Uploaded by

Debojyoti MukherjeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revised Estimation - FY 2023-24

Uploaded by

Debojyoti MukherjeeCopyright:

Available Formats

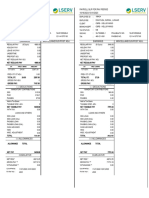

General Monthly Salary Details 2023 - 2024 WEST BENGAL

Basic Salary + DA Income-Tax-Calculation-and-Comparison-2023-24

16667 - SGC

Children Education Allowance * 0

House Rent Allowance - HRA 8334 Children Hostel allowance * 0

Medical Allowance 0 Washing Allowance * 0

Conveyance Allowance 0 Uniform Allowance * 0

Special Allowance 4166 Sum of All Other Reimbursements * 0

Other Allowance 24532 Sum of All Other Allowances 10968

Leave Travel Allowance - LTA 0 Sum of All Annual Perks (If Any) 0

Meal (Voucher) Allowance * 2000 Monthly House Rent Paid 10000

NPS Employer Contribution 0 Select Rent Location Metro City

Total Monthly Gross Salary :- 66667

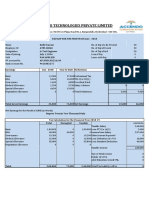

Taxability & Calculation as per old and New Tax Regime Old Regime New Regime

Gross Annual Salary Income (Salary + Allowances + Perks) : 800004 800004

Less: Official and Reimbursement Non Taxable Allowances* : 24000 0

Less: Tax on Employment (Professional Tax) : 2400 -

Less: Standard deduction : 50000 50000

Auto Calculation as per Rent amount Less: HRA Exemption : 100000 -

Amount of LTA Travel Bills (Annually) Less: LTA Exemption : 0 -

Income from Salary : 623604 750004

Less: Loss from House Property u/s(24) : 0 -

Add: Income from House Property : 0 0

Add: Income from Other sources : 0 0

Gross Total Income : 623604 750004

Investments U/S 80C & 80CCC

Current Employer - PF 24000

Pervious Employer - PF 0

Voluntary Provident Fund - VPF 2004

Life Insurance Premiums - LIP 42500

Public Provident Fund - PPF 35000

Children Education Tuition Fees - CEF 0

Pension Funds – Section 80CCC 0

Bank fixed deposits (5-Yr) - FD 0

Unit linked Insurance Plan - ULIP 0

Home Loan Principal Repayment - HLP 0

Equity Linked Savings Scheme - ELSS 0

National Savings Certificate - NSC 0

Stamp Duty and Registration Charges 0

Other Investments E.g. Sukanya Account 0

Total Investments U/S 80C & 80CCC 103504 103504 -

Deduction u/s 80D 23000 -

Deduction u/s 80CCD(1B) 0 -

Deduction u/s 80CCD2 0 0

Deduction u/s 80DD 0 -

Deduction u/s 80DDB 0 -

Deduction u/s 80E 0 -

Deduction u/s 80EE 0 -

Deduction u/s 80EEA 0 -

Deduction u/s 80G 0 -

Deduction u/s 80TTA 0 -

Deduction u/s 80U 0 -

Total Deduction U/C VIA 126504 0

Taxable Income 497100 750004

Income Tax 12355 30000

Less: Rebate 87A 12355 0

Balance Tax Liability 0 30000

Add: Surcharge 0 0

Total Tax 0 30000

Add: Edu. Health Cess 0 1200

Net Annual Tax 0 31200

Save Tax as per New Slab 0

This Utility Prepared by Team, SGC Services Pvt Ltd and download from www.blog.sgcservices.com

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- UntitledDocument45 pagesUntitledWS KNIGHTNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Computation of Total Income: Zenit - A KDK Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software ProductAbhishek SaxenaNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Input To Be Provided in The Cells in YellowDocument2 pagesInput To Be Provided in The Cells in YellowNikhil KautilyaNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- AMRINDER2Document1 pageAMRINDER2amancommercialNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- Pay Slip ExampleDocument1 pagePay Slip ExampleMahmud Morshed100% (1)

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Coi 23-24 Lalu YadavDocument2 pagesCoi 23-24 Lalu Yadavtejpalsinghyadav786No ratings yet

- Faq'S & Guidlines On Income TaxDocument50 pagesFaq'S & Guidlines On Income TaxRavikarthik GurumurthyNo ratings yet

- EstimateDocument1 pageEstimateSrinivasarao ObillaNo ratings yet

- Tax CalculatorDocument1 pageTax CalculatorLovish VatwaniNo ratings yet

- Coi - A.Y. 2017-2018 - Bharti GohilDocument2 pagesCoi - A.Y. 2017-2018 - Bharti GohilSuman jhaNo ratings yet

- Notice of Assessment 2021 03 22 15 36 05 837221Document4 pagesNotice of Assessment 2021 03 22 15 36 05 837221Joseph HudsonNo ratings yet

- Miscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post AdjDocument1 pageMiscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post Adjnicole.dimayuga3No ratings yet

- ITR Computation ABOPD4303LDocument2 pagesITR Computation ABOPD4303LJIGNA NAKARNo ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- EstimateDocument1 pageEstimateshrikrishnapunjabNo ratings yet

- Wa0005Document1 pageWa0005Ravi KumarNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Computation Sheet 2022-11Document4 pagesComputation Sheet 2022-11Harsha KumarNo ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Itdf PDFDocument2 pagesItdf PDFskgaddeNo ratings yet

- EstimateDocument1 pageEstimateAtulPalNo ratings yet

- Tax 2022:23Document3 pagesTax 2022:23tin wongNo ratings yet

- ComputationsDocument2 pagesComputationsJKMSMM BNo ratings yet

- Doc-20230725-Wa0011. (2)Document1 pageDoc-20230725-Wa0011. (2)s0026637No ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Computation 21 22Document1 pageComputation 21 22aarushi singhNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- Case Study 3 SolutionDocument2 pagesCase Study 3 Solutiongaurilakhmani2003No ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Sunil PayslipDocument1 pageSunil PayslipSiyaram MeenaNo ratings yet

- Notice of Reassessment 2021 05 31 09 31 59 847068Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318No ratings yet

- SRL Limited: Payslip For The Month of FEBRUARY 2019Document1 pageSRL Limited: Payslip For The Month of FEBRUARY 2019mkumarsejNo ratings yet

- Tax Return TranscriptDocument2 pagesTax Return TranscripttravisdemitriusNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- ATPL10060 - Kolli Sravani - JUNE - 2018 PDFDocument1 pageATPL10060 - Kolli Sravani - JUNE - 2018 PDFsravani kolliNo ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Computation of Total Incme and Tax Liability Income From Salary Income From House PropertyDocument1 pageComputation of Total Incme and Tax Liability Income From Salary Income From House PropertyshyamiliNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Balwant SinghDocument1 pageBalwant SinghamancommercialNo ratings yet

- Tax DetailsDocument2 pagesTax DetailsRahul AgarwalNo ratings yet

- Chap 006Document9 pagesChap 006dbjnNo ratings yet

- This Is RealDocument17 pagesThis Is RealCheemee LiuNo ratings yet

- Atal Pension Yojana (Apy) - Subscriber Registration FormDocument1 pageAtal Pension Yojana (Apy) - Subscriber Registration FormmurthyksNo ratings yet

- Marketing Report On Fruit Juices - Murree BreweryDocument17 pagesMarketing Report On Fruit Juices - Murree BreweryHumayun100% (9)

- 09 Tolentino v. PALDocument2 pages09 Tolentino v. PALJoshua Ejeil PascualNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- IAS Transfer Notification Date 01-02-2023Document2 pagesIAS Transfer Notification Date 01-02-2023Krupal patelNo ratings yet

- Cash Flow For (Business Name) in (Financial Year) : Cash Flow July August September October November DecemberDocument5 pagesCash Flow For (Business Name) in (Financial Year) : Cash Flow July August September October November DecemberNishit SapatNo ratings yet

- EPF For Construction WorkersDocument10 pagesEPF For Construction WorkersBIJAY KRISHNA DASNo ratings yet

- Multiple Questions PensionsDocument2 pagesMultiple Questions PensionsKawaljeet100% (3)

- Chapter 2 Summary Financial Statement AnalysisDocument5 pagesChapter 2 Summary Financial Statement AnalysisAzlanNo ratings yet

- Gratuity Trust RulesDocument6 pagesGratuity Trust RulesVIKASNo ratings yet

- Hospice Care & Phil. Retirement BenefitsDocument7 pagesHospice Care & Phil. Retirement BenefitsBeverlyNo ratings yet

- Stern Stewart Accounting Is Broken Here Is How To Fix ItDocument32 pagesStern Stewart Accounting Is Broken Here Is How To Fix ItFernando Archila-RuizNo ratings yet

- Introduction To Accounting 2 Current LiabilitiesDocument13 pagesIntroduction To Accounting 2 Current LiabilitiesRhea Mae AmitNo ratings yet

- Benefits @IBMDocument1 pageBenefits @IBMDan ManolacheNo ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- TDS Intrest IncomeDocument3 pagesTDS Intrest Incomekashyap_ajNo ratings yet

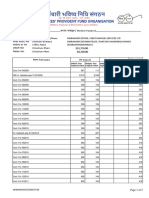

- Passbook PFDocument5 pagesPassbook PFDarshan SarodeNo ratings yet

- IosDocument11 pagesIosDileep ChowdaryNo ratings yet

- Charges Sheet Served On Himadri Shekhar BhattacharjeeDocument42 pagesCharges Sheet Served On Himadri Shekhar Bhattacharjeehimadri_bhattacharjeNo ratings yet

- Company Profile DDDocument71 pagesCompany Profile DDAnonymous H9Qg1iNo ratings yet

- Scala Salaria PnudDocument1 pageScala Salaria PnudAMBIENTAL CJVCNo ratings yet

- Exwel Trust Helps (Power Point Slides)Document76 pagesExwel Trust Helps (Power Point Slides)cm_krish6478No ratings yet

- HR Manual II Award Staff PDFDocument158 pagesHR Manual II Award Staff PDFSri369No ratings yet

- CT5 - Syllabus For 2011Document8 pagesCT5 - Syllabus For 2011Sunil PillaiNo ratings yet

- 7 CPC Information Brochure (English)Document80 pages7 CPC Information Brochure (English)ShounakNo ratings yet

- PBOR Pension BenifitDocument9 pagesPBOR Pension Benifitशिवा यादव सोनूNo ratings yet

- FMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceDocument3 pagesFMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceChristian QuidipNo ratings yet

- Pensionary Benefits Feb 2018Document382 pagesPensionary Benefits Feb 2018karthikNo ratings yet