Professional Documents

Culture Documents

Estimate

Uploaded by

Srinivasarao ObillaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estimate

Uploaded by

Srinivasarao ObillaCopyright:

Available Formats

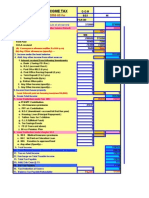

Basic Information

Assessment Year *

2023-24

Taxpayer Category

Individual

Residential Status *

RES (Resident)

Your Age

Below 60 Between 60 -

80 and above

years 79 years

(Super Senior

(Regular (Senior

Citizen)

Citizen) Citizen)

Due Date for Submission of Return *

31-Jul-2023

Actual Date for Submission of Return *

31-Jul-2023

Estimated Tax

View Comparison

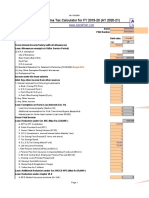

Income Detail

(as p

er old T

ax regime)

Income under the head 2560269

Salaries

Gross Salary 2710013

Exemption claimed 97344

u/s 10

Deduction u/s 16(ia) 50000

Deduction u/s 16(ii) 0

Deduction u/s 16(iii) 2400

Income under the head 0

House Property

a. Income from self 0

occupied house

property

Interest on

Borrowed

Capital

b. Income from Let-

out Property

1. Annual

Letable Value/

Rent Received

or Receivable

2. Less:

Municipal

Taxes Paid

During the Year

3.

Less:Unrealized

Rent

Net Annual Value 0

u/s 23 [1-(2+3)]

Less: Standard 0

Deduction u/s 24(a)

Less: Interest

Payable on

Borrowed Capital

u/s 24(b)

Income under the head 0

Capital Gains

Short Term Capital 0

Gains (Other than

covered under

section 111A) Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Short Term Capital 0

Gains (Covered

under section 111A)

Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Long Term Capital 0

Gains (Charged to

tax @ 20%) Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Long Term Capital 0

Gains (Charged to

tax @ 10%, other

than LTCG u/s 112A)

Total

From 01-Apr to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Long Term Capital 0

Gains u/s

112A(Charged to tax

@ 10%) Total

From 01-Apr-to

15-Jun

From 16-Jun to

15-Sep

From 16-Sep to

15-Dec

From 16-Dec to

15-Mar

From 16-Mar to

31-Mar

Income under the head 0

Business or Profession

Presumptive Income

u/s 44AD,44ADA

Other income from 0

Business or

Profession.

Income under the head 10000

Other Sources

(i) Interest from 10000

Savings bank

account

(ii) Other Interest 0

Income

(iii) Winning from 0

Lottery, crossword

puzzles etc.

(iv) Any other 0

income

Gross Total Income 2570269

Deduction Details

(as p

er old T

ax regime)

ax regime)

Deductions u/s 150000

80C(LIC, PF,

PPF, NSC,

Repayment of

Housing Loan,

etc.)

Deduction u/s 0

80CCC(Payment

in respect

Pension Fund)

Deductions u/s 0

80CCD(1)

(Employees /

Self-employed

contribution

Deductions u/s 0

80CCD (1B)

(Additional

Employees

contribution

towards NPS)

Deductions u/s 44176 44176

80CCD (2)

(Employers

contribution

towards NPS)

Total 194176 44176

Deductions

Deductions u/s

80D(MediClaim

Premium)

Deductions u/s

80G(Donations)

Deductions u/s 0

80E(Interest on

Loan for Higher

Education)

Deductions u/s

80EE(Interest

on Loan taken

for Residential

House)

Deductions u/s 10000

80TTA(Interest

on Savings Bank

Account)

Deductions u/s 0

80TTB(Interest

on Deposits)

Any other 0

deduction

Tax Details

(as p

er old T er new T

ax regime) ax regime)

Taxable Income 2366093 2675837

1. Tax at Normal 522327 540251

Rates

2. Tax at Special 0

Rates (Capital

Gains, Lottery,

etc.)

Short Term 0

Capital Gains

(Covered u/s

111A)

Long Term 0

Capital Gains

(Charged to

Tax @20%)

Long Term 0

Capital Gains

(Charged to

tax @ 10%,

other than

LTCG u/s

112A)

Long Term 0

Capital Gains

u/s

112A(Charged

to tax @ 10%)

Winnings 0

(from Lottery,

Crossword

Puzzles, etc.)

Total Tax before 522327 540251

Rebate

Less: Tax Rebate 0

u/s 87A

Total Tax before 522327 540251

Rebate

Surcharge 0

Add: Health & 20893

Education Cess

Total Tax on 543220 561861

Income

TDS/TCS 1557850 1557850

Self-Assessment 0

Tax / Advance

Tax

Balance Tax -1014630 -995990

Payable /

Refundable

Add: Interest u/s 0

234A

Add: Interest u/s 0

234B

Add: Interest u/s 0

234C

Add: Fees for 0

late filing of

return u/s 234F

Total Tax and -1014630 -995990

Interest payable

You might also like

- Road Construction EstimateDocument306 pagesRoad Construction EstimateRJ SisonNo ratings yet

- Sample Independent Contractor AgreementDocument5 pagesSample Independent Contractor AgreementRodolfo moo DzulNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Wiring Diagram of Front SAM Control Unit With Fuse and Relay Module (N10 - 1) 2Document5 pagesWiring Diagram of Front SAM Control Unit With Fuse and Relay Module (N10 - 1) 2Сергей АзаренкоNo ratings yet

- Annual Report (Skechers - Amerika) PDFDocument89 pagesAnnual Report (Skechers - Amerika) PDFAndi AgustiawanNo ratings yet

- ACC2001 Lecture 4Document53 pagesACC2001 Lecture 4michael krueseiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Under Water Welding and CuttingDocument7 pagesUnder Water Welding and CuttingVijo JoseNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- The Early Ceramics of The Inca Heartland - Brian S. BauerDocument172 pagesThe Early Ceramics of The Inca Heartland - Brian S. BauerClaudio Rozas0% (1)

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- CivRev - Solidarios V AlampayDocument5 pagesCivRev - Solidarios V AlampayKarla Marie TumulakNo ratings yet

- Technipfmc Company Presentation: April 2020Document38 pagesTechnipfmc Company Presentation: April 2020Fedi M'hallaNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Earth Magnetometer ProjectDocument17 pagesEarth Magnetometer ProjectMario Ariel VesconiNo ratings yet

- EstimateDocument1 pageEstimateAtulPalNo ratings yet

- EstimateDocument1 pageEstimatesandeep sandyNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- CalculateDocument1 pageCalculateanurag tiwariNo ratings yet

- EstimateDocument1 pageEstimateHimali BarmanNo ratings yet

- EstimateDocument1 pageEstimateshrikrishnapunjabNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- EstimateDocument1 pageEstimateikan flyNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2Anonymous Clm40C1No ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Emailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3Document126 pagesEmailing Inter Full Book DT - Youtube - Prof - Aagam Dalal-3chalu account100% (2)

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Directors' Manual 2012Document54 pagesDirectors' Manual 2012harshagarwal5No ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- Old Vs New Income Tax CalculatorDocument14 pagesOld Vs New Income Tax Calculatorsebastianharry49No ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- 031508996Document2 pages031508996Lokesh KumarNo ratings yet

- Revised Estimation - FY 2023-24Document1 pageRevised Estimation - FY 2023-24Debojyoti MukherjeeNo ratings yet

- Computation of Toatal IncomeDocument4 pagesComputation of Toatal IncomePRITAM PATRANo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Income Tax 2019-2020Document49 pagesIncome Tax 2019-2020myjioNo ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Tax Effect Accounting (AASB 1020)Document40 pagesTax Effect Accounting (AASB 1020)Queenlizzie LamSamNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- Auto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesDocument6 pagesAuto Income Tax Calculator: Calculate Your Tax in Just 5 MinutesashutoshbinduNo ratings yet

- QuestionsDocument15 pagesQuestionsSamuelNyaungaNo ratings yet

- Chapter 6 Deferred TaxDocument109 pagesChapter 6 Deferred Taxlindokuhlentuli75No ratings yet

- Double TaxationDocument10 pagesDouble TaxationMintuNo ratings yet

- AutoTax Calculator Version 14.1 FY 2019-20Document17 pagesAutoTax Calculator Version 14.1 FY 2019-20Nihit SandNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Tax & Taxation of BangladeshDocument31 pagesTax & Taxation of BangladeshAl JamiNo ratings yet

- BiyaniSir-Amendments For CAInter Tax - Nov20Document51 pagesBiyaniSir-Amendments For CAInter Tax - Nov20shri jeetNo ratings yet

- Tax Calculator Version 2Document4 pagesTax Calculator Version 2SoikotNo ratings yet

- 5 6170280447000445052 PDFDocument358 pages5 6170280447000445052 PDFmanoj mohanNo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- 4 Chapter VI-ADocument11 pages4 Chapter VI-AVENKATESWARLUMCOMNo ratings yet

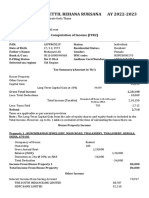

- AY2022-23 KALLA PUTHIYAVEETTIL REHANA RUKSANA-ASFPR0552F-ComputationDocument3 pagesAY2022-23 KALLA PUTHIYAVEETTIL REHANA RUKSANA-ASFPR0552F-ComputationSourabh PunshiNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Reimbursements (1) 1 8Document8 pagesReimbursements (1) 1 8Srinivasarao ObillaNo ratings yet

- Reimbursements (1) 1 8 2Document1 pageReimbursements (1) 1 8 2Srinivasarao ObillaNo ratings yet

- Srinivasa Rao RPA DeveloperDocument4 pagesSrinivasa Rao RPA DeveloperSrinivasarao ObillaNo ratings yet

- Srikanth ResumeDocument3 pagesSrikanth ResumeSrinivasarao ObillaNo ratings yet

- Broadband Over Power Line and Amateur RadioDocument53 pagesBroadband Over Power Line and Amateur RadioSrinivasarao ObillaNo ratings yet

- မြန်မာ - datastructures&algorithmsDocument114 pagesမြန်မာ - datastructures&algorithmsAlex SnowNo ratings yet

- 001 Agabin, Pacifico A., Mestizo - The Story of The Philippine Legal System, Chapter 7Document49 pages001 Agabin, Pacifico A., Mestizo - The Story of The Philippine Legal System, Chapter 7Isabella EncarnacionNo ratings yet

- Hyundai Led4 InstruccionesDocument5 pagesHyundai Led4 InstruccionesEncep ZaenalNo ratings yet

- Print Server Scalability and Sizing Technical Overview WhiteDocument14 pagesPrint Server Scalability and Sizing Technical Overview Whiteapi-3734769No ratings yet

- mt4 GuideDocument24 pagesmt4 GuideGeorge PruteanuNo ratings yet

- Cryogenic Reactor Cooling Spec SheetDocument2 pagesCryogenic Reactor Cooling Spec SheetLibinNo ratings yet

- How Entrepreneurs Craft (HBR) (Lalit Nainani)Document15 pagesHow Entrepreneurs Craft (HBR) (Lalit Nainani)virtual17No ratings yet

- Modeling and Simulation of EHV (402034MJ) : Unit 4: Electric Vehicle ConfigurationDocument90 pagesModeling and Simulation of EHV (402034MJ) : Unit 4: Electric Vehicle Configurationsagar kordeNo ratings yet

- Abelardo Rodríguez, Ann Kendall (2001)Document14 pagesAbelardo Rodríguez, Ann Kendall (2001)Alexander J. SicosNo ratings yet

- Emily Bekele - Practicing Diplomacy Abroad - Reporting Cable #2Document4 pagesEmily Bekele - Practicing Diplomacy Abroad - Reporting Cable #2Emily BekeleNo ratings yet

- McDonald's Generic Strategy & Intensive Growth Strategies - Panmore InstituteDocument3 pagesMcDonald's Generic Strategy & Intensive Growth Strategies - Panmore InstituteLayyinahNo ratings yet

- Product Bulletin: PB NO. 116 REV. 0 Subject: Elliott Turbocharger Conversions For Cooper ET-11 and ET-13 Series TurbosDocument1 pageProduct Bulletin: PB NO. 116 REV. 0 Subject: Elliott Turbocharger Conversions For Cooper ET-11 and ET-13 Series TurbosOreolNo ratings yet

- TracebackDocument2 pagesTracebackTim HinderkottNo ratings yet

- SQL Server (Transact-SQL) - CREATE LOGIN StatementDocument4 pagesSQL Server (Transact-SQL) - CREATE LOGIN StatementEL Ghazouany MedNo ratings yet

- Zirconium in The Nuclear IndustryDocument680 pagesZirconium in The Nuclear IndustryWeb devNo ratings yet

- John Ortolano ResumeDocument7 pagesJohn Ortolano ResumeWEAR ABC 3No ratings yet

- Wallstreetjournaleurope 20170307 The Wall Street Journal EuropeDocument20 pagesWallstreetjournaleurope 20170307 The Wall Street Journal EuropestefanoNo ratings yet

- Introduction of Civic IssueDocument2 pagesIntroduction of Civic IssueFaisalKhan0% (1)

- Hotel. How May I Help You?Document2 pagesHotel. How May I Help You?putu kasparinataNo ratings yet

- Fishbone Diagram PresentationDocument47 pagesFishbone Diagram PresentationSangram KendreNo ratings yet

- JCPenney Coupons & Promo CodesDocument1 pageJCPenney Coupons & Promo CodesGenesis Veronica ColonNo ratings yet